|

|

市場調査レポート

商品コード

1293837

再生熱酸化装置(RTO)市場- 成長、将来展望、競合分析、2023年~2031年Regenerative Thermal Oxidizer (RTO) Market - Growth, Future Prospects and Competitive Analysis, 2023 - 2031 |

||||||

|

|||||||

| 再生熱酸化装置(RTO)市場- 成長、将来展望、競合分析、2023年~2031年 |

|

出版日: 2023年05月30日

発行: Acute Market Reports

ページ情報: 英文 119 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

再生熱酸化装置(RTO)市場は、2023年から2031年の予測期間において、CAGR4.5%以上で大きな成長を遂げると予測されています。RTOは、産業プロセスから排出される揮発性有機化合物(VOC)や有害大気汚染物質(HAP)を削減するために用いられる大気汚染防止技術の一種です。高温で排ガス中の汚染物質を酸化させ、二酸化炭素と水蒸気に変換することで機能します。大気汚染に関する懸念の高まりと、大気汚染を抑制するために世界各国の政府が課す厳しい規制が、RTOシステムの需要を押し上げています。また、医薬品、飲食品、化学など様々な最終用途産業の成長も、RTO市場の成長に寄与しています。さらに、中国、インド、ブラジルなどの新興国におけるRTOシステムの採用が増加しており、市場関係者にとって有利な機会を生み出すと期待されています。さらに、RTOシステムの技術的進歩は、予測期間中の市場成長を促進すると期待されています。人工知能(AI)、モノのインターネット(IoT)、自動化などの先進技術の統合が、RTOシステムの効率と性能を向上させています。例えば、RTOシステムにおけるAI対応センサーの使用は、排出ガスのリアルタイムモニタリングやシステムの性能の最適化に役立っています。

政府規制と環境に関する懸念の高まり

大気汚染に関する懸念の高まりと、産業プロセスからの揮発性有機化合物(VOC)や有害大気汚染物質(HAP)の排出を抑制するために世界各国の政府が課す厳しい規制が、再生熱酸化装置(RTO)の需要を押し上げています。例えば、米国では、環境保護庁(EPA)が、さまざまな産業からのVOCやHAPの排出について厳しい基準を設けています。同様に、欧州連合(EU)は、産業活動からの排出を削減することを目的とした産業排出指令(IED)を実施しています。これらの規制は、化学、医薬品、飲食品などさまざまな産業におけるRTOシステムの需要を促進しています。

さまざまな最終用途産業の成長

化学、医薬品、飲食品など、さまざまな最終用途産業の成長が、RTO市場の成長に寄与しています。これらの産業では、製造工程で大量のVOCやHAPが排出されますが、RTOシステムの使用により、これらの排出を削減することができます。例えば、製薬業界は環境規制を厳守する必要があるため、RTOシステムの最大のエンドユーザーの1つとなっています。

技術的な進歩

人工知能(AI)、モノのインターネット(IoT)、自動化などの先進技術の統合は、RTOシステムの効率と性能を向上させています。例えば、RTOシステムのAI対応センサーは、排出ガスのリアルタイム監視やシステムの性能の最適化に役立ちます。同様に、IoT技術の統合は、RTOシステムの遠隔監視と制御に役立ちます。これらの技術的進歩は、予測期間中のRTO市場の成長を促進すると予想されます。

高い資本コストとメンテナンスコスト

再生熱酸化装置(RTO)市場の主な抑制要因の1つは、これらのシステムに関連する高い資本コストとメンテナンスコストです。RTOシステムには多額の先行投資が必要であり、これらのシステムの設置や試運転には時間とコストがかかることがあります。さらに、これらのシステムは、効率的な運用を確保するために定期的なメンテナンスとクリーニングが必要であり、運用コストをさらに増加させる可能性があります。さらに、これらのシステムは複雑であるため、操作やメンテナンスには高度な技術を要します。これらの要因により、特に予算が限られている中小企業では、RTOシステムの導入が制限される可能性があります。例えば、環境保護庁(EPA)の調査によると、一般的なRTOシステムの資本コストは、システムの規模や複雑さにもよりますが、エアフロー1立方フィート/分(cfm)あたり1万米ドルから5万米ドルに及ぶと推定されます。さらに、これらのシステムのメンテナンス費用は、メンテナンスの頻度や使用する機器の種類にもよりますが、年間1万米ドルから10万米ドルにも及びます。このような高いコストは、特に資源が限られている発展途上国において、RTOシステムの導入の大きな障壁となり得ます。

市場売上高をリードするトリプルベッド再生熱酸化装置セグメント

再生熱酸化装置(RTO)市場は、タイプ別にシングルベッド再生熱酸化器、ダブルベッド再生熱酸化器、トリプルベッド再生熱酸化器に分類することができます。これらのうち、ダブルベッド再生熱酸化器セグメントは、2023年から2031年の予測期間中に最も高いCAGRを示すと予想されます。これは、シングルベッドRTOシステムと比較して、ダブルベッドRTOシステムの効率が高く、運用コストが低いことに起因しています。ダブルベッドRTOシステムは、セラミックメディアのベッドを2つ使用し、入口と出口の空気の流れを交互に変えて、酸化プロセス中に発生する熱エネルギーを回収して再利用します。その結果、シングルベッドRTOシステムと比較して、熱効率が高く、燃料消費量が少なくなります。収益面では、トリプルベッド再生熱酸化装置セグメントが2022年に最大のシェアを占めました。これは、化学、石油化学、医薬品など、高いレベルの大気汚染防止を必要とする産業で、これらのシステムが高く採用されていることに起因していると考えられます。トリプルベッドRTOシステムは、セラミックメディアを3層使用し、シングルベッドやダブルベッドRTOシステムと比較して、高い熱効率と高いVOC破壊能力を提供します。また、大風量・高濃度での処理が可能なため、大量のVOCが発生する用途に最適なシステムです。

製品セグメント別では、回転再生式熱酸化装置が市場を席巻

再生熱酸化装置(RTO)市場は、製品タイプ別にも、回転式再生熱酸化器とコンパクト型再生熱酸化器に分類することができます。これらのうち、コンパクトタイプの再生熱酸化器セグメントは、2023年から2031年の予測期間中に最も高いCAGRを記録すると予想されます。これは、これらのシステムのコンパクトなサイズとモジュール設計が、中小規模の産業での使用に理想的であることに起因していると考えられます。コンパクトなRTOシステムは、床面積を最小限に抑えながら高いVOC破壊効率と省エネを実現するため、スペースが限られている用途に適しています。収益面では、2022年に回転式再生熱酸化装置セグメントが市場で最大のシェアを占めています。これは、化学産業や石油化学産業など、大量のVOCが発生する大規模な産業用途で、これらのシステムの採用率が高いことに起因しています。ロータリーRTOシステムは、セラミックメディアを充填した円筒形のドラムを使用し、入口と出口の空気流の間で回転させ、酸化プロセス中に発生する熱エネルギーを回収して再利用します。その結果、他のタイプのRTOシステムと比較して、高い熱効率と低い運転コストを実現しています。

北米が収益のリーダーであり続ける一方、APACは成長のリーダーとして台頭する

アジア太平洋地域は、2023年から2031年の予測期間中、最も高いCAGRを示すと予想されます。これは、中国、インド、東南アジア諸国などの新興国における工業化の進展が、大気汚染防止システムの需要増につながったことに起因しています。また、同地域では、特に都市部における大気汚染の軽減を目的とした政府の取り組みが顕著であり、これがRTOシステムの需要をさらに押し上げています。北米は、厳しい環境規制と化学、石油化学、製薬など様々な産業におけるRTOシステムの高い採用により、2022年の市場において最大の収益シェアを占めています。また、同地域では、エネルギー効率が高く、費用対効果の高い大気汚染防止ソリューションへのシフトが見られ、これがRTOシステムの需要をさらに高めています。さらに、同地域には同市場の主要プレーヤーが複数存在し、同地域の市場成長に寄与しています。

予測期間中、市場は極めて高い競争力を保つ

世界の再生熱酸化装置(RTO)市場は非常に競争が激しく、複数の主要プレーヤーが存在することが特徴です。これらのプレーヤーは、市場での地位を強化し、市場シェアを拡大するために、製品革新、パートナーシップ、買収など、さまざまな戦略に注力しています。市場のトッププレイヤーには、CECO Environmental、Babcock &Wilcox Enterprises, Inc.、Eisenmann SE、Durr AG、Anguil Environmental Systems, Inc.、TANN Corporation、Honeywell International Inc.、Air Clear LLC、The CMM Group、 Ship &Shore Environmental, Inc.これらのプレイヤーは、より良いエネルギー効率、より高い性能、より低いメンテナンスコストを提供する高度なRTOシステムの開発に注力しています。近年では、コンパクトでモジュール化されたRTOシステムを開発する傾向が強まっています。市場のプレーヤーは、既存の産業プロセスに容易に統合できる、より小型で効率的なRTOシステムの開発に投資しています。例えば、2021年にBabcock &Wilcox Enterprises, Inc.は、小さな設置面積で高い熱効率と低い運転コストを実現するコンパクトなRTOシステムを発表しています。さらに、プレーヤーは市場でのプレゼンスを拡大し、製品提供を改善するために、パートナーシップや買収にも力を入れています。例えば、2020年、CECO Environmental社は、大気汚染防止システムの設計と設置を専門とするカナダのEnvironmental Integrated Solutions Limited社を買収し、製品ポートフォリオの拡大とカナダ市場での存在感の向上を図りました。

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象読者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者別レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

第3章 再生熱酸化装置(RTO)市場:競合分析

- 主要ベンダーの市場での位置付け

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2022 vs 2031

第4章 再生熱酸化装置(RTO)市場:マクロ分析と市場力学

- イントロダクション

- 世界の再生熱酸化装置(RTO)市場金額

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

第5章 再生熱酸化装置(RTO)市場:タイプ別

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- シングルベッド再生型熱酸化装置

- ダブルベッド再生熱酸化装置

- トリプルベッド再生熱酸化装置

第6章 再生熱酸化装置(RTO)市場:製品別

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 回転式蓄熱酸化装置

- コンパクトタイプ蓄冷式熱酸化装置

第7章 再生熱酸化装置(RTO)市場:最終用途産業別

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 自動車

- 化学

- 医薬品

- 石油ガス

- 塗料とコーティング

- マイニング

- 飲食品

- 電気・電子

- 耐火物および鋳物工場

- コーティングと塗装

- その他

第8章 北米の再生熱酸化装置(RTO)市場

- 市場概要

- 再生熱酸化装置(RTO)市場:タイプ別

- 再生熱酸化装置(RTO)市場:製品別

- 再生熱酸化装置(RTO)市場:最終用途産業別

- 再生熱酸化装置(RTO)市場:地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第9章 英国と欧州連合の再生熱酸化装置(RTO)市場

- 市場概要

- 再生熱酸化装置(RTO)市場:タイプ別

- 再生熱酸化装置(RTO)市場:製品別

- 再生熱酸化装置(RTO)市場:最終用途産業別

- 再生熱酸化装置(RTO)市場:地域別

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第10章 アジア太平洋の再生熱酸化装置(RTO)市場

- 市場概要

- 再生熱酸化装置(RTO)市場:タイプ別

- 再生熱酸化装置(RTO)市場:製品別

- 再生熱酸化装置(RTO)市場:最終用途産業別

- 再生熱酸化装置(RTO)市場:地域別

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋

第11章 ラテンアメリカの再生熱酸化装置(RTO)市場

- 市場概要

- 再生熱酸化装置(RTO)市場:タイプ別

- 再生熱酸化装置(RTO)市場:製品別

- 再生熱酸化装置(RTO)市場:最終用途産業別

- 再生熱酸化装置(RTO)市場:地域別

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第12章 中東・アフリカの再生熱酸化装置(RTO)市場

- 市場概要

- 再生熱酸化装置(RTO)市場:タイプ別

- 再生熱酸化装置(RTO)市場:製品別

- 再生熱酸化装置(RTO)市場:最終用途産業別

- 再生熱酸化装置(RTO)市場:地域別

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第13章 企業プロファイル

- CECO Environmental

- Babcock & Wilcox Enterprises Inc.

- Eisenmann SE

- Durr AG

- Anguil Environmental Systems Inc.

- TANN Corporation

- Honeywell International Inc.

- Air Clear LLC

- The CMM Group

- Ship & Shore Environmental Inc.

- その他の注目選手

List of Tables

- TABLE 1 Global Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 2 Global Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 3 Global Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 4 North America Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 5 North America Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 6 North America Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 7 U.S. Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 8 U.S. Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 9 U.S. Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 10 Canada Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 11 Canada Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 12 Canada Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 13 Rest of North America Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 14 Rest of North America Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 15 Rest of North America Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 16 UK and European Union Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 17 UK and European Union Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 18 UK and European Union Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 19 UK Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 20 UK Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 21 UK Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 22 Germany Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 23 Germany Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 24 Germany Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 25 Spain Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 26 Spain Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 27 Spain Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 28 Italy Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 29 Italy Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 30 Italy Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 31 France Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 32 France Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 33 France Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 34 Rest of Europe Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 35 Rest of Europe Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 36 Rest of Europe Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 37 Asia Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 38 Asia Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 39 Asia Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 40 China Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 41 China Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 42 China Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 43 Japan Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 44 Japan Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 45 Japan Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 46 India Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 47 India Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 48 India Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 49 Australia Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 50 Australia Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 51 Australia Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 52 South Korea Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 53 South Korea Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 54 South Korea Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 55 Latin America Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 56 Latin America Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 57 Latin America Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 58 Brazil Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 59 Brazil Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 60 Brazil Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 61 Mexico Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 62 Mexico Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 63 Mexico Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 64 Rest of Latin America Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 65 Rest of Latin America Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 66 Rest of Latin America Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 67 Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 68 Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 69 Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 70 GCC Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 71 GCC Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 72 GCC Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 73 Africa Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 74 Africa Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 75 Africa Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

- TABLE 76 Rest of Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By Type, 2021-2031, USD (Million)

- TABLE 77 Rest of Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By Product, 2021-2031, USD (Million)

- TABLE 78 Rest of Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market By End Use Industry, 2021-2031, USD (Million)

List of Figures

- FIG. 1 Global Regenerative Thermal Oxidizer (RTO) Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Regenerative Thermal Oxidizer (RTO) Market: Quality Assurance

- FIG. 5 Global Regenerative Thermal Oxidizer (RTO) Market, By Type, 2022

- FIG. 6 Global Regenerative Thermal Oxidizer (RTO) Market, By Product, 2022

- FIG. 7 Global Regenerative Thermal Oxidizer (RTO) Market, By End Use Industry, 2022

- FIG. 8 Global Regenerative Thermal Oxidizer (RTO) Market, By Geography, 2022

- FIG. 9 Market Geographical Opportunity Matrix - Global Regenerative Thermal Oxidizer (RTO) Market, 2022

- FIG. 10 Market Positioning of Key Regenerative Thermal Oxidizer (RTO) Market Players, 2022

- FIG. 11 Global Regenerative Thermal Oxidizer (RTO) Market - Tier Analysis - Percentage of Revenues by Tier Level, 2022 Versus 2031

- FIG. 12 Global Regenerative Thermal Oxidizer (RTO) Market, By Type, 2022 Vs 2031, %

- FIG. 13 Global Regenerative Thermal Oxidizer (RTO) Market, By Product, 2022 Vs 2031, %

- FIG. 14 Global Regenerative Thermal Oxidizer (RTO) Market, By End Use Industry, 2022 Vs 2031, %

- FIG. 15 U.S. Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 16 Canada Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 17 Rest of North America Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 18 UK Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 19 Germany Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 20 Spain Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 21 Italy Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 22 France Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 23 Rest of Europe Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 24 China Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 25 Japan Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 26 India Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 27 Australia Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 28 South Korea Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 29 Rest of Asia Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 30 Brazil Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 31 Mexico Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 32 Rest of Latin America Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 33 GCC Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 34 Africa Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

- FIG. 35 Rest of Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market (US$ Million), 2021 - 2031

The regenerative thermal oxidizer (RTO) market is projected to witness significant growth during the forecast period of 2023-2031, with a compound annual growth rate (CAGR) of over 4.5%. RTO is a type of air pollution control technology used to reduce emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) from industrial processes. It works by using high temperatures to oxidize pollutants in the exhaust gas stream, converting them into carbon dioxide and water vapor. The increasing concerns regarding air pollution and the strict regulations imposed by governments across the world to control air pollution are driving the demand for RTO systems. The growth of various end-use industries, such as pharmaceuticals, food and beverage, and chemicals, is also contributing to the growth of the RTO market. In addition, the rising adoption of RTO systems in emerging economies, such as China, India, and Brazil, is expected to create lucrative opportunities for market players. Furthermore, the technological advancements in RTO systems are expected to fuel market growth during the forecast period. The integration of advanced technologies, such as artificial intelligence (AI), the Internet of Things (IoT), and automation, is improving the efficiency and performance of RTO systems. For instance, the use of AI-enabled sensors in RTO systems is helping in real-time monitoring of emissions and optimizing the performance of the system.

Increasing Government Regulations and Environmental Concerns

The increasing concerns regarding air pollution and the stringent regulations imposed by governments across the world to control emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) from industrial processes are driving the demand for regenerative thermal oxidizers (RTOs). For instance, in the United States, the Environmental Protection Agency (EPA) has set strict standards for VOC and HAP emissions from various industries. Similarly, the European Union has implemented the Industrial Emissions Directive (IED), which aims to reduce emissions from industrial activities. These regulations are driving the demand for RTO systems in various industries, including chemicals, pharmaceuticals, and food and beverage.

Growth of Various End-Use Industries

The growth of various end-use industries, such as chemicals, pharmaceuticals, and food and beverage, is contributing to the growth of the RTO market. These industries generate a large amount of VOC and HAP emissions during their manufacturing processes, and the use of RTO systems helps to reduce these emissions. For instance, the pharmaceutical industry is one of the largest end-users of RTO systems, as it requires strict adherence to environmental regulations.

Technological Advancements

The integration of advanced technologies, such as artificial intelligence (AI), the Internet of Things (IoT), and automation, is improving the efficiency and performance of RTO systems. For instance, AI-enabled sensors in RTO systems can help in real-time monitoring of emissions and optimizing the performance of the system. Similarly, the integration of IoT technology can help in remote monitoring and control of RTO systems. These technological advancements are expected to drive the growth of the RTO market during the forecast period.

High Capital and Maintenance Costs

One of the major restraints of the regenerative thermal oxidizer (RTO) market is the high capital and maintenance costs associated with these systems. RTO systems require significant upfront investments, and the installation and commissioning of these systems can be time-consuming and expensive. Additionally, these systems require regular maintenance and cleaning to ensure their efficient operation, which can further increase operational costs. Furthermore, the complexity of these systems requires highly skilled technicians to operate and maintain them. These factors can limit the adoption of RTO systems, especially among small and medium-sized enterprises with limited budgets. For instance, a study by the Environmental Protection Agency (EPA) estimated that the capital cost for a typical RTO system can range from $10,000 to $50,000 per cubic feet per minute (cfm) of airflow, depending on the size and complexity of the system. Moreover, the maintenance costs for these systems can range from $10,000 to $100,000 per year, depending on the frequency of maintenance and the type of equipment used. These high costs can be a significant barrier to the adoption of RTO systems, especially in developing countries with limited resources.

Triple Bed Regenerative Thermal Oxidizer Segment Leading the Market Revenues

The regenerative thermal oxidizer (RTO) market can be segmented by type into single-bed regenerative thermal oxidizer, double-bed regenerative thermal oxidizer, and triple-bed regenerative thermal oxidizer. Among these, the double bed regenerative thermal oxidizer segment is expected to witness the highest CAGR during the forecast period of 2023 to 2031. This can be attributed to the higher efficiency and lower operating costs of double-bed RTO systems compared to single-bed RTO systems. Double-bed RTO systems use two beds of ceramic media, which alternate between the inlet and outlet air streams to recover and reuse the thermal energy generated during the oxidation process. This results in higher thermal efficiency and lower fuel consumption compared to single-bed RTO systems. In terms of revenue, the triple-bed regenerative thermal oxidizer segment held the largest share of in 2022. This can be attributed to the high adoption of these systems in industries such as chemicals, petrochemicals, and pharmaceuticals, which require high levels of air pollution control. Triple-bed RTO systems use three beds of ceramic media, which provide a higher level of thermal efficiency and greater VOC destruction capabilities compared to single and double-bed RTO systems. These systems can also handle higher air flows and pollutant concentrations, making them ideal for applications where large volumes of VOCs are generated.

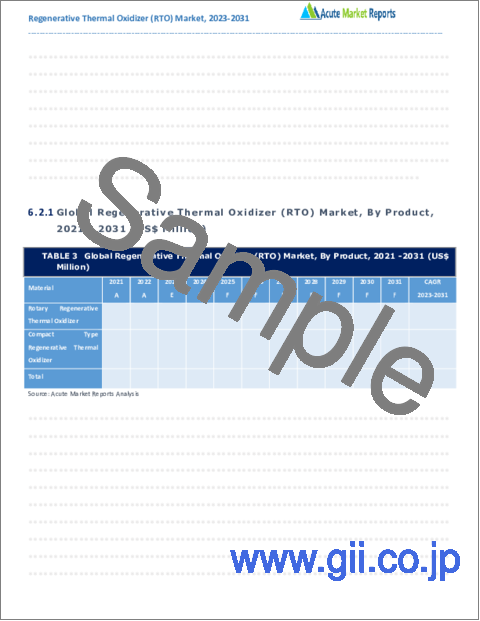

Rotary Regenerative Thermal Oxidizer Dominates the Market by Product Segment

The regenerative thermal oxidizer (RTO) market can also be segmented by product type into rotary regenerative thermal oxidizer and compact type regenerative thermal oxidizer. Among these, the compact-type regenerative thermal oxidizer segment is expected to witness the highest CAGR during the forecast period of 2023 to 2031. This can be attributed to the compact size and modular design of these systems, which make them ideal for use in small to medium-sized industries. Compact RTO systems offer high VOC destruction efficiencies and energy savings while taking up minimal floor space, making them suitable for applications where space is limited. In terms of revenue, the rotary regenerative thermal oxidizer segment held the largest share of the market in 2022. This can be attributed to the high adoption of these systems in large industrial applications, such as the chemical and petrochemical industries, where large volumes of VOCs are generated. Rotary RTO systems use a cylindrical drum filled with ceramic media that rotates between the inlet and outlet air streams to recover and reuse the thermal energy generated during the oxidation process. This results in high thermal efficiency and low operating costs compared to other types of RTO systems.

North America Remains the Revenue Leader While APAC emerges as the Growth Leader

The Asia-Pacific region is expected to exhibit the highest CAGR during the forecast period of 2023 to 2031. This can be attributed to the growing industrialization in emerging economies such as China, India, and Southeast Asian countries, which has led to an increase in the demand for air pollution control systems. The region has also witnessed significant government initiatives aimed at reducing air pollution, particularly in urban areas, which has further boosted the demand for RTO systems. North America held the largest revenue share of the market in 2022, owing to the stringent environmental regulations and high adoption of RTO systems in various industries, such as chemical, petrochemical, and pharmaceutical. The region has also witnessed a shift towards energy-efficient and cost-effective air pollution control solutions, which has further boosted the demand for RTO systems. In addition, the region is home to several key players in the market, which has contributed to the growth of the market in the region.

Market to Remain Extremely Competitive During the Forecast Period

The global regenerative thermal oxidizer (RTO) market is highly competitive and is characterized by the presence of several key players. These players are focusing on various strategies, such as product innovation, partnerships, and acquisitions, to strengthen their market position and increase their market share. Some of the top players in the market include CECO Environmental, Babcock & Wilcox Enterprises, Inc., Eisenmann SE, Durr AG, Anguil Environmental Systems, Inc., TANN Corporation, Honeywell International Inc., Air Clear LLC, The CMM Group, Ship & Shore Environmental, Inc. These players are focusing on developing advanced RTO systems that offer better energy efficiency, higher performance, and lower maintenance costs. In recent years, there has been a growing trend toward the development of compact and modular RTO systems. Players in the market are investing in the development of smaller, more efficient RTO systems that can be easily integrated into existing industrial processes. For instance, in 2021, Babcock & Wilcox Enterprises, Inc. introduced a compact RTO system that is designed to provide high thermal efficiency and low operating costs while occupying a small footprint. In addition, players are also focusing on partnerships and acquisitions to expand their market presence and improve their product offerings. For instance, in 2020, CECO Environmental acquired Environmental Integrated Solutions Limited, a Canadian-based company specializing in the design and installation of air pollution control systems, to expand its product portfolio and increase its presence in the Canadian market.

Historical & Forecast Period

This study report represents analysis of each segment from 2021 to 2031 considering 2022 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2022 to 2031.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends, and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. A key data point that enables the estimation of the Regenerative Thermal Oxidizer (RTO) market are as follows:

- Research and development budgets of manufacturers and government spending

- Revenues of key companies in the market segment

- Number of end users and consumption volume, price, and value.

Geographical revenues generate by countries considered in the report:

Micro and macro environment factors that are currently influencing the Regenerative Thermal Oxidizer (RTO) market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top-down and bottom-up approaches for validation of market estimation assures logical, methodical, and mathematical consistency of the quantitative data.

Market Segmentation

Type

- Single Bed Regenerative Thermal Oxidizer

- Double Bed Regenerative Thermal Oxidizer

- Triple Bed Regenerative Thermal Oxidizer

Product

- Rotary Regenerative Thermal Oxidizer

- Compact Type Regenerative Thermal Oxidizer

End Use Industry

- Automotive

- Chemical

- Pharmaceutical

- Oil & Gas

- Paints & Coatings

- Mining

- Food & Beverage

- Electrical & Electronics

- Refractories & Foundries

- Coating & Painting

- Others

Region Segment (2021-2031; US$ Million)

- North America

- U.S.

- Canada

- Rest of North America

- UK and European Union

- UK

- Germany

- Spain

- Italy

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Africa

- Rest of Middle East and Africa

Key questions answered in this report:

- What are the key micro and macro environmental factors that are impacting the growth of Regenerative Thermal Oxidizer (RTO) market?

- What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

- Estimated forecast and market projections up to 2031.

- Which segment accounts for the fastest CAGR during the forecast period?

- Which market segment holds a larger market share and why?

- Are low and middle-income economies investing in the Regenerative Thermal Oxidizer (RTO) market?

- Which is the largest regional market for Regenerative Thermal Oxidizer (RTO) market?

- What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

- Which are the key trends driving Regenerative Thermal Oxidizer (RTO) market growth?

- Who are the key competitors and what are their key strategies to enhance their market presence in the Regenerative Thermal Oxidizer (RTO) market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Regenerative Thermal Oxidizer (RTO) Market

- 2.2. Global Regenerative Thermal Oxidizer (RTO) Market, By Type, 2022 (US$ Million)

- 2.3. Global Regenerative Thermal Oxidizer (RTO) Market, By Product, 2022 (US$ Million)

- 2.4. Global Regenerative Thermal Oxidizer (RTO) Market, By End Use Industry, 2022 (US$ Million)

- 2.5. Global Regenerative Thermal Oxidizer (RTO) Market, By Geography, 2022 (US$ Million)

- 2.6. Attractive Investment Proposition by Geography, 2022

3. Regenerative Thermal Oxidizer (RTO) Market: Competitive Analysis

- 3.1. Market Positioning of Key Regenerative Thermal Oxidizer (RTO) Market Vendors

- 3.2. Strategies Adopted by Regenerative Thermal Oxidizer (RTO) Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2022 Versus 2031

4. Regenerative Thermal Oxidizer (RTO) Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Regenerative Thermal Oxidizer (RTO) Market Value, 2021 - 2031, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

5. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2022 Versus 2031

- 5.3. Market Segmentation

- 5.3.1. Single Bed Regenerative Thermal Oxidizer

- 5.3.2. Double Bed Regenerative Thermal Oxidizer

- 5.3.3. Triple Bed Regenerative Thermal Oxidizer

6. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2022 Versus 2031

- 6.3. Market Segmentation

- 6.3.1. Rotary Regenerative Thermal Oxidizer

- 6.3.2. Compact Type Regenerative Thermal Oxidizer

7. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2022 Versus 2031

- 7.3. Market Segmentation

- 7.3.1. Automotive

- 7.3.2. Chemical

- 7.3.3. Pharmaceutical

- 7.3.4. Oil & Gas

- 7.3.5. Paints & Coatings

- 7.3.6. Mining

- 7.3.7. Food & Beverage

- 7.3.8. Electrical & Electronics

- 7.3.9. Refractories & Foundries

- 7.3.10. Coating & Painting

- 7.3.11. Others

8. North America Regenerative Thermal Oxidizer (RTO) Market, 2021-2031, USD (Million)

- 8.1. Market Overview

- 8.2. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 8.3. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 8.4. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 8.5.Regenerative Thermal Oxidizer (RTO) Market: By Region, 2021-2031, USD (Million)

- 8.5.1.North America

- 8.5.1.1. U.S.

- 8.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 8.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 8.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 8.5.1.2. Canada

- 8.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 8.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 8.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 8.5.1.3. Rest of North America

- 8.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 8.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 8.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 8.5.1.1. U.S.

- 8.5.1.North America

9. UK and European Union Regenerative Thermal Oxidizer (RTO) Market, 2021-2031, USD (Million)

- 9.1. Market Overview

- 9.2. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.3. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.4. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.Regenerative Thermal Oxidizer (RTO) Market: By Region, 2021-2031, USD (Million)

- 9.5.1.UK and European Union

- 9.5.1.1. UK

- 9.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.2. Germany

- 9.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.3. Spain

- 9.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.4. Italy

- 9.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.5. France

- 9.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.6. Rest of Europe

- 9.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 9.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 9.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 9.5.1.1. UK

- 9.5.1.UK and European Union

10. Asia Pacific Regenerative Thermal Oxidizer (RTO) Market, 2021-2031, USD (Million)

- 10.1. Market Overview

- 10.2. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.3. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.4. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.Regenerative Thermal Oxidizer (RTO) Market: By Region, 2021-2031, USD (Million)

- 10.5.1.Asia Pacific

- 10.5.1.1. China

- 10.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.2. Japan

- 10.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.3. India

- 10.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.4. Australia

- 10.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.4.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.5. South Korea

- 10.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.5.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.6. Rest of Asia Pacific

- 10.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 10.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 10.5.1.6.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 10.5.1.1. China

- 10.5.1.Asia Pacific

11. Latin America Regenerative Thermal Oxidizer (RTO) Market, 2021-2031, USD (Million)

- 11.1. Market Overview

- 11.2. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 11.3. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 11.4. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 11.5.Regenerative Thermal Oxidizer (RTO) Market: By Region, 2021-2031, USD (Million)

- 11.5.1.Latin America

- 11.5.1.1. Brazil

- 11.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 11.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 11.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 11.5.1.2. Mexico

- 11.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 11.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 11.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 11.5.1.3. Rest of Latin America

- 11.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 11.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 11.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 11.5.1.1. Brazil

- 11.5.1.Latin America

12. Middle East and Africa Regenerative Thermal Oxidizer (RTO) Market, 2021-2031, USD (Million)

- 12.1. Market Overview

- 12.2. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 12.3. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 12.4. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 12.5.Regenerative Thermal Oxidizer (RTO) Market: By Region, 2021-2031, USD (Million)

- 12.5.1.Middle East and Africa

- 12.5.1.1. GCC

- 12.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 12.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 12.5.1.1.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 12.5.1.2. Africa

- 12.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 12.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 12.5.1.2.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 12.5.1.3. Rest of Middle East and Africa

- 12.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Type, 2021-2031, USD (Million)

- 12.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By Product, 2021-2031, USD (Million)

- 12.5.1.3.1. Regenerative Thermal Oxidizer (RTO) Market: By End Use Industry, 2021-2031, USD (Million)

- 12.5.1.1. GCC

- 12.5.1.Middle East and Africa

13. Company Profile

- 13.1. CECO Environmental

- 13.1.1. Company Overview

- 13.1.2. Financial Performance

- 13.1.3. Product Portfolio

- 13.1.4. Strategic Initiatives

- 13.2. Babcock & Wilcox Enterprises, Inc.

- 13.2.1. Company Overview

- 13.2.2. Financial Performance

- 13.2.3. Product Portfolio

- 13.2.4. Strategic Initiatives

- 13.3. Eisenmann SE

- 13.3.1. Company Overview

- 13.3.2. Financial Performance

- 13.3.3. Product Portfolio

- 13.3.4. Strategic Initiatives

- 13.4. Durr AG

- 13.4.1. Company Overview

- 13.4.2. Financial Performance

- 13.4.3. Product Portfolio

- 13.4.4. Strategic Initiatives

- 13.5. Anguil Environmental Systems, Inc.

- 13.5.1. Company Overview

- 13.5.2. Financial Performance

- 13.5.3. Product Portfolio

- 13.5.4. Strategic Initiatives

- 13.6. TANN Corporation

- 13.6.1. Company Overview

- 13.6.2. Financial Performance

- 13.6.3. Product Portfolio

- 13.6.4. Strategic Initiatives

- 13.7. Honeywell International Inc.

- 13.7.1. Company Overview

- 13.7.2. Financial Performance

- 13.7.3. Product Portfolio

- 13.7.4. Strategic Initiatives

- 13.8. Air Clear LLC

- 13.8.1. Company Overview

- 13.8.2. Financial Performance

- 13.8.3. Product Portfolio

- 13.8.4. Strategic Initiatives

- 13.9. The CMM Group

- 13.9.1. Company Overview

- 13.9.2. Financial Performance

- 13.9.3. Product Portfolio

- 13.9.4. Strategic Initiatives

- 13.10. Ship & Shore Environmental, Inc.

- 13.10.1. Company Overview

- 13.10.2. Financial Performance

- 13.10.3. Product Portfolio

- 13.10.4. Strategic Initiatives

- 13.11. Other Notable Players

- 13.11.1. Company Overview

- 13.11.2. Financial Performance

- 13.11.3. Product Portfolio

- 13.11.4. Strategic Initiatives