|

|

市場調査レポート

商品コード

1271368

自動車用ステアリングシステムの市場規模、市場シェア、アプリケーション分析、地域展望、成長動向、主要企業、競合戦略、予測、2023年~2031年Automotive Steering Systems Market Size, Market Share, Application Analysis, Regional Outlook, Growth Trends, Key Players, Competitive Strategies and Forecasts, 2023 To 2031 |

||||||

| 自動車用ステアリングシステムの市場規模、市場シェア、アプリケーション分析、地域展望、成長動向、主要企業、競合戦略、予測、2023年~2031年 |

|

出版日: 2023年04月24日

発行: Acute Market Reports

ページ情報: 英文 118 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

自動車用ステアリングシステムの世界市場規模は、2021年から2031年の予測期間中にCAGR 5.5%で増加すると予測されています。自動車用ステアリングシステムは、車両の進行経路を調整するために連携して機能するコンポーネントの集合です。自動車のステアリングシステムのうち、手動で操作するコンポーネントには、ステアリングコラム、ユニバーサルジョイント、ラック&ピニオン機構、および手で駆動するステアリングホイールが含まれます。この改良の結果、ステアリングシステムは手動操舵からパワーアシストステアリングシステムに変更されました。自動車のステアリングシステムは、自動車の効率的な制御を維持するために不可欠であり、交換が不可能なことから、必須部品とされています。このように、ステアリングシステムはすべての自動車に搭載されているため、自動車用ステアリングシステムの市場には大きな需要があります。環境に優しく、運転しやすい自動車への要望が高まっていることが、市場拡大の主な要因となっています。車両用ステアリングシステムの市場は、2026年末までに米国で250億米ドルを超えると予想されています。市場拡大の原動力となっているのは、製品の再設計による自動車用ステアリングシステムの簡素化です。また、燃料の使用効率を高めることも、自動車用ステアリングシステムの市場拡大に大きく寄与しています。

市場成長を促進する技術革新への注力

ステアリングシステムの絶え間ない進歩は、手動ステアリングシステムからパワーアシストによるステアリングシステムへの移行など、大きな変化をもたらしています。自動車用ステアリングシステム市場の拡大は、世界の自動車需要の高まりによって直接的に推進されています。多くのメーカーが、ステアリングシステムに関する最先端のソリューションの開発に取り組んでいます。現代の自動車のステアリングシステムは、制御技術やSbW(Steer by Wire)システムなど、さまざまな技術の統合が進んでいます。ステア・バイ・ワイヤー(SbW)」と呼ばれる技術は、自動車の総合的な性能と安全性に対して多くの利点を提供します。 促進要因の手にあるホイールと道路上のホイールとの間の従来の機械的なステアリングリンクの代わりに、SbW技術によってエレクトロニクス、アルゴリズム、アクチュエーターが使用されています。より正確で素早いステアリング反応を実現するだけでなく、路面から伝わる振動から 促進要因を隔離することで、振動抑制の役割も果たします。さらに、車両重量の軽減、車両メンテナンス費用の削減、自律走行車の設計のしやすさなど、さまざまなメリットがあります。例えば、日産自動車のサブブランドで高級車を扱うインフィニティブランドは、Q50モデルバージョンにSteer by Wire(SbW)技術を採用しています。

市場成長に有利な人口統計学的パラメータ

業界の拡大は、主に顧客の裁量所得の増加に伴う自動車需要の増加によってもたらされます。また、自動車におけるパワーステアリングの普及が、この産業の拡大の原動力となっています。自動車全体の燃費向上は、自動車のステアリングシステムの性能向上に起因しています。その結果、低燃費車の市場拡大の直接的な結果として、ステアリングシステムの需要が急増しています。さらに、消費者は自動車に快適な乗り心地を求めており、これには楽に運転できること、簡単に操作できることなどが含まれます。このような運転しやすさの好みは、あらゆるタイプの自動車に当てはまります。快適な運転は、効率的なステアリングシステムの利用によって達成されるため、ステアリングシステムの需要が増加し、この市場の拡大に寄与しています。

新興国市場における自動車生産への注目の高まりが市場を促進する

自動車用ステアリングシステム市場の拡大には、中国やインドなどの新興国における自動車生産の増加などが寄与すると予想されます。新興国では、原材料や労働力が安価に入手できるため、自動車メーカーの生産台数が増加し、ステアリングシステムの需要も増加するものと思われます。インドや中国など新興国では、人々の平均可処分所得が増加し、自動車を購入する人が増えているはずです。その結果、自動車用ステアリングシステムの市場も拡大することが予想されます。その結果、自動車用ステアリングシステムの世界市場は、本予測期間中、増加傾向にあることが予想されます。

低燃費車への需要が市場成長を促進する

今後、ガソリン消費量が少なく、効率的なステアリングシステムを搭載した自動車への需要の高まりが、市場の拡大を牽引すると予想されます。自動車用ステアリングシステム市場の最も重要な動向の一つは、自動車の燃費に関する政府機関による厳しい勧告の数が増加していることです。また、快適なドライビング体験に対するニーズが高まっており、自動車用ステアリングシステム市場の成長を促進すると予測されています。さらに、インドや中国などの新興国市場におけるハイテク技術の需要の高まりも、予測期間中の市場の成長を後押ししています。この需要は、市場拡大の大きな要因となることが予想されます。

電動油圧式パワーステアリングシステムを採用する自動車の増加

電気油圧式パワーステアリングは、油圧と電子パワーの利点を融合させたものであり、自動車用ステアリングシステム市場においてますます人気が高まっています。電子制御パワーステアリングは、燃費と使い勝手の両面で有利なシステムです。電子制御パワーステアリングは、乗用車やシティカーなど、最近の自動車に標準装備されています。このシステムの駆動源となるのは電気モーターです。エンジンとは別に、必要なときにだけ動くモーターです。油圧パワーステアリングは、ステアリングシステムの中で最もシンプルで複雑な設計になっています。ステアリング機構に油圧を供給することで、 促進要因の操作を補助し、操舵を容易にします。そのため、 促進要因はハンドルに力を入れるだけでよく、あとは油圧システムで操作することになります。ステアリングシステムの研究開発には膨大な資金が必要であり、これが業界の最大の関心事となっています。このため、自動車用ステアリングシステムの価格は大きく上昇します。

市場拡大を制約するコスト問題

パワーステアリングシステムに関連する高コストが、ステアリングシステムの市場拡大の障壁になると予測されています。今後、ドライブ・バイ・ワイヤなどの技術が自動車に採用されることが予想され、遠くない将来に市場拡大に寄与すると思われます。

EPSは荷重に耐える能力が限られています。

EPSシステムは、燃費の向上や操縦性の向上などのメリットがあるため、乗用車市場で採用が進んでいます。しかし、商用車分野では耐荷重が低いため、需要は極めて限定的であり、徐々にHPSに置き換わってきています。ピニオンアシスト電動パワーステアリング(P-EPS)のような従来の電動ステアリングシステムは、平均して10kN(キロニュートン)のステアリングラック力をアシストする能力を持っています。しかし、大型商用車では、15kN以上のステアリングラック力をアシストするステアリングシステムが必要とされています。そこで、多くの企業がステアリングラックの力に耐えられる電動パワーステアリングの研究開発に力を注いでいます。例えば、Nexteer Automotive社は、大型商用車市場に対応するため、12.5kNのステアリングラック力を管理できるデュアルピニオン電動ピニオンシステムと12Vラックアシスト電動パワーステアリング・システムを設計しました。これらのシステムは、いずれも12ボルトで駆動します。

自動車産業における革新と需要増が大きなチャンスをもたらす

自動車用ステアリングシステムの需要の高まりは、直接的には、乗用車や小型商用車の人気の高まりに起因しています。技術の進歩により、自動車のステアリングシステムにモノのインターネットを取り入れる新たな可能性が出てきています。また、電力システムの高耐久化により、商用車への搭載が可能になる可能性もあります。さらに、信用が得られやすくなったこと、特に疫病が流行した時期に安全性が求められたことなども、車両用ステアリングシステムの売上を増加させる要因となっています。特殊用途車(SUV)の操縦性が向上し、より美しいデザインになったことも、自動車用ステアリングシステムの普及の主な要因となっています。また、燃費の良い車や快適な運転ができる車へのニーズが高まっていることも、この業界の売上を押し上げる要因になっていると考えられます。また、乗用車や商用車の販売・生産台数が増加していることも、自動車用ステアリングシステム部品の需要を押し上げると予想されます。これは、今後数年間の需要を促進する要因になると思われます。自動車メーカー各社は、自動車のエレクトロニクス化の進展に対応するため、安全システムや電気システムの統合に多額の投資を余儀なくされています。相当数の自動車メーカーが、自動車用ステアリングホイールの設計に関連する技術的進歩に投資すると予想されます。

予測期間中、センサーの使用が増加し、市場の可能性が広がる

ステアリングコラムに設置されたセンサーは、トルク(操舵力)、ステアリングホイールの速度と位置という2つの主要な 促進要因入力を測定する役割を担っています。その結果、このようなシステムで利用されるセンサーは3種類に分けられます。トルクセンサー、ステアリングホイールスピードセンサー、ポジションセンサーです。これらのセンサーは、ECUに信号を送り、ECUはステアリングシステムに適切な出力を送り、アクションを起こします。ほとんどの場合、トルクセンサーは非接触型のセンシングデバイスです。このセンサーは、 促進要因がステアリングホイールに与えている力の大きさを記録し、電動ステアリングアシストをより微妙に管理することを可能にします。物理的な接触を必要としない磁気的な測定原理を利用して機能します。マグネットユニット、フラックスチューブユニット、センサーユニットが含まれています。トルクセンサー自体は、2つの別々のワイヤーコイルが巻かれて構成されています。右に曲がる場合は一方のコイルで、左に曲がる場合はもう一方のコイルで曲がる方向を決定します。その後、信号は電動パワーステアリング(EPS)モジュールから関連するコイルに送信され、その後、 促進要因に車の操縦を支援します。自動車業界では、急速な技術革新に対応するため、より高度で信頼性の高いセンサーデバイスを開発するための研究開発に継続的に投資しています。予測期間中、自動車メーカーはEPSシステムにより高度なセンサー製品を採用し続けると予想されます。これは、センサー製品の採用が進んでいるためと思われます。

EPSステアリングは引き続き市場を独占する

2021年の自動車用ステアリングシステム市場は、電動パワーステアリング部門が数量・売上高ともに圧倒的に多かっています。運転中の快適性を求める消費者動向の高まりから、電動パワーステアリング・システムの需要は増加すると考えられます。自動車の電動化は、補助動力としての燃料への依存度を下げ、結果的に自動車の総合的な燃費を向上させることになります。このことが、乗用車のパワーアシストステアリングシステム、特に電動アシストパワーステアリングシステム(EPS)の需要増加の主な要因となっています。EPSの採用は、自動車の軽量化とそのエネルギー効率の向上というニーズによって推進されています。電子パワーステアリング(EPS)システムは、他のシステムよりも部品点数が少ないため、車両システムへの搭載がよりシンプルになります。2025年には、新車販売の4%近く、世界の自動車保有台数の7%が電気自動車になると予想されています。電気自動車の販売拡大に伴い、軽量ステアリングシステム(電動パワーステアリング(EPS)など)の展開率は、予測期間中に潜在的な需要を目の当たりにすることになりそうです。EPSは排出ガスを削減するだけでなく、漏れの可能性がないため、環境に対するリスクも低減することができます。電動パワーステアリングの売上は、これらすべての要因によって大きく左右されます。電動パワーステアリングの世界市場は、予測期間中に5.7%以上のCAGRで成長する見込みです。

乗用車が収益と成長のリーダーであり続ける

2021年、自動車用ステアリングシステムの世界市場は、乗用車セグメントによって支配されています。これは、車両の種類によって決定されたものです。また、世界中で乗用車の販売台数が増加することで、市場が促進されると予想されます。全世界の消費者の購買力の向上が自動車の販売台数の増加につながり、自動車用ステアリングシステムの世界市場の成長を促進すると予測されます。2021年から2031年の予測期間において、自動車用ステアリングシステム市場の乗用車サブマーケットは、車種別で最大のセグメントを占めると予測されています。世界中で休暇やその他のレジャー活動が増えていることに加え、お金や信用が簡単に手に入るようになったことが、自動車用ステアリングシステム部品のニーズを高め、それが乗用車の販売台数を増加させています。また、SUV(Special Utility Vehicle)の需要が高いことも、市場の成長を後押ししています。SUVは、操縦性の向上、スタイリッシュなデザイン、低価格が支持されています。

APACは世界リーダーであり続ける

APACには、中国、インド、日本など、世界で最も重要な自動車製造の中心地があります。この地域における自動車用ステアリングシステムの産業の拡大は、中国の日立オートモティブシステムズ、現代モービス、インフィニオンテクノロジーズ、ジェイテクト、NSKステアリングシステム、日立アステモ、バワイ工場、ボッシュ華友といった企業によって推進されています。両地域は、世界の総需要の3分の1以上を占める可能性を持っています。この10年間で、この地域の人口が大幅に増加し、一人当たりの所得や生活水準も向上したことは、いずれもこの地域の自動車産業の拡大に寄与しています。低燃費車や快適装備への需要の高まりにより、特に乗用車セグメントにおいて、油圧式パワーステアリングに代わる電動パワーステアリング(EPS)の搭載が加速すると予想されます。このシフトは、燃費の良い車や快適な機能に対する需要の高まりによってもたらされるでしょう。EPSの採用は、車両の軽量化やエネルギー効率の向上により、さらに推進されます。

戦略的提携と地理的拡大が引き続き重要な競合要因に

市場は、多数のプレーヤーが存在するため、断片化され、企業は、競争力を持つことができるように、新しい革新的な技術でビジネスを拡大してきました。これらのトップクラスの企業は、より広範な地域的プレゼンスを有し、一貫して研究開発を行い、その結果、規制機関からの確実な承認を得ています。OEM(相手先ブランド製造)による自動車用ステアリングホイールの需要は、自動車生産台数の増加に正比例しています。今後数年間、多くの著名な自動車メーカーがOEMと長期契約を結ぶと予想されます。また、一部のメーカーは、優れた品質の自動車用製品を生産するために、OEMと買収や合弁事業を行うことが予想されます。

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象読者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者別レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

- 市場スナップショット:世界の自動車用ステアリングシステムの市場

- テクノロジー別の世界の自動車用ステアリングシステムの市場 2022

- 車両別の世界の自動車用ステアリングシステムの市場 2022

- 販売チャネル別の世界の自動車用ステアリングシステムの市場 2022

- コンポーネント別の世界の自動車用ステアリングシステムの市場 2022

- 地域別の世界の自動車用ステアリングシステムの市場 2022

- 魅力的な投資提案:地域別 2022

- 主な購入基準

- 主要なケースレポート

- シナリオ分析

- 市場プロファイリング

- 販売およびマーケティング計画

- 市場における重要な結論

- 戦略的な推奨事項

第3章 自動車用ステアリングシステムの市場:競合分析

- 主要ベンダーの市場での位置付け

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2022 vs 2031

第4章 自動車用ステアリングシステムの市場:マクロ分析と市場力学

- イントロダクション

- 世界の自動車用ステアリングシステムの市場価値 2021-2031

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- サプライヤーパワー

- バイヤーパワー

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- PESTEL分析

- 政治的情勢

- 経済情勢

- テクノロジーの情勢

- 法的情勢

- 社会的情勢

- Heptalysis分析

- 5つの根本原因分析と関連ソリューションによるビジネス上の問題の重要な調査

第5章 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 電子ステアリング

- H-EPS

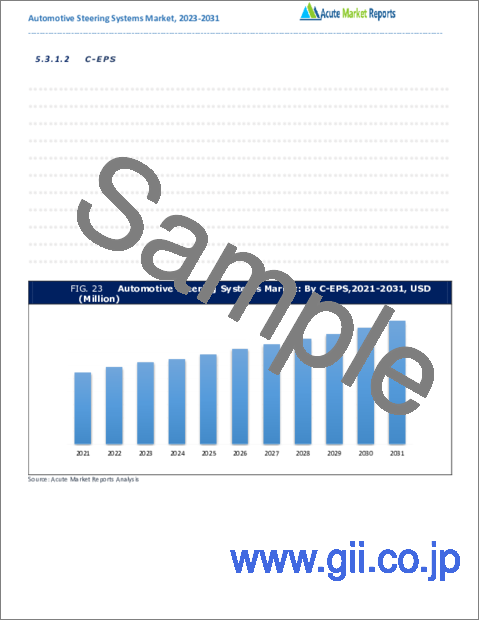

- C-EPS

- P-EPS

- R-EPS

- 油圧ステアリング

- マニュアルステアリング

- 電気油圧ステアリング

- 電子ステアリング

第6章 自動車用ステアリングシステムの車両別市場 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 乗用車

- コンパクト

- 中規模

- プレミアム

- SUV

- 小型商用車

- 大型商用車

- 乗用車

第7章 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- OEM

- アフターマーケット

第8章 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 油圧ポンプ

- ステアリング/コラム/ラック

- センサー

- 電気モーター

- その他のコンポーネント

第9章 地域分析

- 市場概要

- マクロ要因と市場への影響:ダッシュボード 2022

- 地域をまたいだポーターズファイブフォースモデル: ダッシュボード 2022

- 地域にわたるPESTEL要因の影響:ダッシュボード 2022

第10章 北米自動車用ステアリングシステムの市場 2021-2031

- 市場概要

- 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 自動車用ステアリングシステムの車両別市場 2021-2031

- 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 自動車用ステアリングシステムの地域別市場 2021-2031

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第11章 英国および欧州連合自動車用ステアリングシステムの市場 2021-2031

- 市場概要

- 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 自動車用ステアリングシステムの車両別市場 2021-2031

- 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 自動車用ステアリングシステムの地域別市場 2021-2031

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第12章 アジア太平洋自動車用ステアリングシステムの市場 2021-2031

- 市場概要

- 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 自動車用ステアリングシステムの車両別市場 2021-2031

- 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 自動車用ステアリングシステムの地域別市場 2021-2031

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋

第13章 ラテンアメリカ自動車用ステアリングシステムの市場 2021-2031

- 市場概要

- 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 自動車用ステアリングシステムの車両別市場 2021-2031

- 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 自動車用ステアリングシステムの地域別市場 2021-2031

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第14章 中東およびアフリカ自動車用ステアリングシステムの市場 2021-2031

- 市場概要

- 自動車用ステアリングシステムのテクノロジー別市場 2021-2031

- 自動車用ステアリングシステムの車両別市場 2021-2031

- 自動車用ステアリングシステムの販売チャネル別市場 2021-2031

- 自動車用ステアリングシステムのコンポーネント別市場 2021-2031

- 自動車用ステアリングシステムの地域別市場 2021-2031

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第15章 企業プロファイル

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- JTEKT Corporation

- Nexteer Automotive Corporation

- NSK Ltd

- Showa Corporation

- その他

List of Tables

- TABLE 1 Global Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 2 Global Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 3 Global Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 4 Global Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 5 Global Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 6 Global Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 7 North America Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 8 North America Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 9 North America Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 10 North America Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 11 North America Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 12 North America Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 13 U.S. Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 14 U.S. Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 15 U.S. Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 16 U.S. Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 17 U.S. Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 18 U.S. Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 19 Canada Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 20 Canada Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 21 Canada Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 22 Canada Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 23 Canada Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 24 Canada Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 25 Rest of North America Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 26 Rest of North America Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 27 Rest of North America Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 28 Rest of North America Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 29 Rest of North America Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 30 Rest of North America Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 31 UK and European Union Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 32 UK and European Union Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 33 UK and European Union Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 34 UK and European Union Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 35 UK and European Union Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 36 UK and European Union Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 37 UK Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 38 UK Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 39 UK Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 40 UK Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 41 UK Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 42 UK Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 43 Germany Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 44 Germany Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 45 Germany Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 46 Germany Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 47 Germany Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 48 Germany Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 49 Spain Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 50 Spain Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 51 Spain Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 52 Spain Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 53 Spain Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 54 Spain Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 55 Italy Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 56 Italy Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 57 Italy Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 58 Italy Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 59 Italy Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 60 Italy Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 61 France Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 62 France Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 63 France Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 64 France Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 65 France Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 66 France Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 67 Rest of Europe Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 68 Rest of Europe Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 69 Rest of Europe Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 70 Rest of Europe Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 71 Rest of Europe Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 72 Rest of Europe Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 73 Asia Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 74 Asia Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 75 Asia Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 76 Asia Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 77 Asia Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 78 Asia Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 79 China Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 80 China Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 81 China Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 82 China Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 83 China Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 84 China Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 85 Japan Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 86 Japan Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 87 Japan Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 88 Japan Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 89 Japan Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 90 Japan Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 91 India Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 92 India Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 93 India Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 94 India Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 95 India Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 96 India Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 97 Australia Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 98 Australia Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 99 Australia Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 100 Australia Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 101 Australia Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 102 Australia Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 103 South Korea Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 104 South Korea Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 105 South Korea Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 106 South Korea Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 107 South Korea Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 108 South Korea Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 109 Latin America Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 110 Latin America Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 111 Latin America Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 112 Latin America Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 113 Latin America Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 114 Latin America Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 115 Brazil Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 116 Brazil Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 117 Brazil Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 118 Brazil Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 119 Brazil Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 120 Brazil Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 121 Mexico Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 122 Mexico Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 123 Mexico Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 124 Mexico Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 125 Mexico Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 126 Mexico Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 127 Rest of Latin America Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 128 Rest of Latin America Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 129 Rest of Latin America Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 130 Rest of Latin America Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 131 Rest of Latin America Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 132 Rest of Latin America Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 133 Middle East and Africa Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 134 Middle East and Africa Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 135 Middle East and Africa Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 136 Middle East and Africa Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 137 Middle East and Africa Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 138 Middle East and Africa Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 139 GCC Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 140 GCC Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 141 GCC Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 142 GCC Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 143 GCC Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 144 GCC Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 145 Africa Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 146 Africa Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 147 Africa Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 148 Africa Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 149 Africa Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 150 Africa Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

- TABLE 151 Rest of Middle East and Africa Automotive Steering Systems Market By Technology, 2021-2031, USD (Million)

- TABLE 152 Rest of Middle East and Africa Automotive Steering Systems Market By Electronic Steering, 2021-2031, USD (Million)

- TABLE 153 Rest of Middle East and Africa Automotive Steering Systems Market By Vehicle, 2021-2031, USD (Million)

- TABLE 154 Rest of Middle East and Africa Automotive Steering Systems Market By Passenger Cars, 2021-2031, USD (Million)

- TABLE 155 Rest of Middle East and Africa Automotive Steering Systems Market By Sales Channel, 2021-2031, USD (Million)

- TABLE 156 Rest of Middle East and Africa Automotive Steering Systems Market By Component, 2021-2031, USD (Million)

List of Figures

- FIG. 1 Global Automotive Steering Systems Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Automotive Steering Systems Market: Quality Assurance

- FIG. 5 Global Automotive Steering Systems Market, By Technology, 2022

- FIG. 6 Global Automotive Steering Systems Market, By Vehicle, 2022

- FIG. 7 Global Automotive Steering Systems Market, By Sales Channel, 2022

- FIG. 8 Global Automotive Steering Systems Market, By Component, 2022

- FIG. 9 Global Automotive Steering Systems Market, By Geography, 2022

- FIG. 10 Market Geographical Opportunity Matrix - Global Automotive Steering Systems Market, 2022

- FIG. 11 Market Positioning of Key Automotive Steering Systems Market Players, 2022

- FIG. 12 Global Automotive Steering Systems Market - Tier Analysis - Percentage of Revenues by Tier Level, 2022 Versus 2031

- FIG. 13 Porters Five Force Model - Current, Midterm and Long Term Perspective

- FIG. 14 See Saw Analysis

- FIG. 15 PETEL Analysis

- FIG. 16 Key Buying Criteria: Current and Long-Term Perspective

- FIG. 17 Global Automotive Steering Systems Market, Scenario Analysis, 2021 to 2031 (US$ Million)

- FIG. 18 Heptalysis Analysis: Global Automotive Steering Systems Market

- FIG. 19 Five Whys Analysis

- FIG. 20 Global Automotive Steering Systems Market, By Technology, 2022 Vs 2031, %

- FIG. 21 Global Automotive Steering Systems Market, By Vehicle, 2022 Vs 2031, %

- FIG. 22 Global Automotive Steering Systems Market, By Sales Channel, 2022 Vs 2031, %

- FIG. 23 Global Automotive Steering Systems Market, By Component, 2022 Vs 2031, %

- FIG. 24 U.S. Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 25 Canada Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 26 Rest of North America Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 27 UK Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 28 Germany Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 29 Spain Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 30 Italy Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 31 France Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 32 Rest of Europe Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 33 China Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 34 Japan Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 35 India Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 36 Australia Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 37 South Korea Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 38 Rest of Asia Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 39 Brazil Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 40 Mexico Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 41 Rest of Latin America Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 42 GCC Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 43 Africa Automotive Steering Systems Market (US$ Million), 2021 - 2031

- FIG. 44 Rest of Middle East and Africa Automotive Steering Systems Market (US$ Million), 2021 - 2031

The value of the global automotive steering system market is expected to increase at a CAGR of 5.5% during the forecast period of 2021 to 2031. An automotive steering system is a collection of components that work together to regulate the path that a vehicle is going in while also assisting the driver in manoeuvring the vehicle in the desired manner. The component of the vehicle steering system that is operated manually includes the steering column, the universal joints, the rack and pinion mechanism, and the hand-driven steering wheel. As a result of this improvement, the steering system has been converted from manual steering to a power assist steering system. Because it is essential for maintaining efficient control of the vehicle and because it is not replaceable, the steering system in automobiles is regarded as an essential component. Due to the fact that steering systems are required in all automobiles, there is a significant demand in the market for automotive steering systems. The rising desire for vehicles that are both better for the environment and more comfortable to drive is the primary factor propelling the expansion of this market. The market for vehicle steering systems is expected to cross US $25 billion by the end of 2026. The expansion of the market is being driven by the simplification of automobile steering systems through product redesign. Achieving more efficiency in the use of fuel is another factor that plays a significant part in the growing market for automobile steering systems.

Focus on Technological Innovation to Propel the Market Growth

The constant advancement of the steering system has resulted in significant modifications, such as the transition from a manual steering system to one that uses power assistance for steering. The expansion of the automotive steering system market has been directly propelled forward by the rising demand for vehicles around the world. A number of different manufacturers are hard at work developing cutting-edge solutions for the steering system. The steering system of modern automobiles is undergoing integration of a number of different technologies, including control technology and the Steer by Wire (SbW) system. The technology known as "Steer by Wire" (SbW) offers a number of advantages for the overall performance and safety of the vehicle. Electronics, algorithms, and actuators are used in place of the traditional mechanical steering link between the wheel in the driver's hands and the wheel on the road by means of the SbW technology. In addition to providing a more precise and quicker steering reaction, it also works as a vibration restraint by isolating the driver from the vibrations that are transmitted from the road. In addition to this, it results in a reduction in overall vehicle weight, reduced expenses associated with vehicle maintenance, and facilitates an easier design process for autonomous vehicles. For instance, the Infiniti brand of luxury automobiles, which is a sub-brand of the Nissan carmaker and focuses on high-end automobiles, has used the Steer by Wire (SbW) technology in its Q50 model version.

Demographic Parameters Favouring the Market Growth

The expansion of the industry is primarily driven by an increase in demand for automobiles as a result of an increase in the amount of discretionary income available to customers. In addition, the increasing prevalence of power steering systems in motor vehicles is a driving force behind the expansion of this industry. Increases in the vehicle's overall fuel efficiency can be attributed to the improved performance of the vehicle's steering system. As a result, there has been a surge in demand for steering systems as a direct consequence of the growing market for fuel-efficient vehicles. Additionally, consumers like driving comfort in their automobiles, which includes effortless driving and the vehicle's capacity to be manoeuvred easily. This preference for driving comfort applies to all types of vehicles. Driving comfort can be accomplished through the utilisation of an efficient steering system, which has led to an increase in the demand for steering systems and contributed to the expansion of this market.

Demand For Powered Steering Systems to Increase as A Result of Stringent Regulations.

Several nations' administrations on different continents have brought into effect rigorous emission and fuel economy regulations for automobiles. Fleet-level requirements have been adopted by regulatory authorities such as the National Highway Traffic and Safety Administration (NHTSA) in the United States, the International Council on Clean Transportation (ICCT) in Europe, and other associations. These regulations establish an average emission level that original equipment manufacturers (OEMs) of automobiles are obligated to uphold. Because of these rules, original equipment manufacturers (OEMs) in the car industry have been forced to improve their fuel-efficient steering systems, such as electronic power steering. Traditional hydraulic steering systems are heavier in weight and more complicated in structure, while electrically assisted power steering systems are lighter in weight and less complex in structure. In addition, because they do not require the use of fuel, the upkeep for these vehicles is much simpler for their owners. According to the data provided by the Department of Energy (DOE) in the United States, EPS systems have the potential to improve fuel efficiency by 2% to 4%, cut fuel consumption by up to 6%, and cut CO2 emissions by 8g/km in ideal conditions. Since 1999, it is estimated that EPS systems have contributed to the savings of roughly 3 billion gallons of gasoline (Source: Nexteer Automotive). In contrast to hydraulic systems, which continue to pump fluid even when the engine is shut off, these systems do not consume power unless the wheels are in motion. This directly leads to improved efficiency in terms of fuel use. The market share of electrically assisted power steering is most prevalent in the European region, followed by the North American market, and then the Asia Oceania market in that order.

Increasing Focus on Automobiles Production Among Developing Countries to Propel Market

The expansion of the automotive steering system market is anticipated to be driven by factors such as the increased manufacturing of automobiles in emerging nations such as China and India throughout the course of the forecast period. It is probable that the abundant availability of raw materials, as well as labour at lower costs in emerging countries, will assist in driving the rise of the production rate of vehicle manufacturers, which, in turn, would simultaneously enhance the demand for the steering systems. A rise in the average disposable income of people in emerging nations like India and China should lead to an increase in the number of people purchasing automobiles in such countries. This should, in turn, lead to an expansion of the market for automotive steering systems. As a result, it is anticipated that the global market for automotive steering systems will see a growth rate that is on the rise over the period covered by the forecast.

In some nations in the Asia Pacific, the production of electric cars and the introduction of these vehicles to the market are relatively recent. For instance, both domestic and foreign companies are mulling over the possibility of establishing electric vehicle production facilities. In addition, APAC is the home to major centres of automobile manufacturing, such as China and Japan. In addition, the expansion of the market can be attributed to factors such as a sizable population, an increase in income per person, and improvements in the general quality of living. Consumers in the Asia Pacific region have shown a preference for automobiles that combine low fuel consumption with high levels of comfort. It is anticipated that the installation of electric power steering (EPS) will accelerate the installation of hydraulic power steering, particularly in the passenger car market. As a consequence of this, the market for vehicle steering systems is expanding at a healthy rate.

Demand for Fuel-Efficient Vehicles to Drive Market Growth

Over the course of the forthcoming time period, the expansion of the market is anticipated to be driven by the rising demand for automobiles that consume less gasoline and feature efficient steering systems. One of the most important trends in the automotive steering system market is the increasing number of stringent recommendations issued by government bodies regarding the fuel efficiency of automobiles. The rising need for a driving experience that is unruffled and exceptionally comfortable is projected to catapult the growth of the automotive steering system market. In addition to this, the growing demand for high-tech automotive steering systems in developing nations like India and China is also fuelling the growth of the market over the forecast period. This demand is expected to be a major factor in the expansion of the market.

Increasing Number of Automobiles Using Electro-Hydraulic Power Steering Systems

The electro-hydraulic power steering is becoming increasingly popular in the automotive steering system market as a result of the advantages that it converges, which are those of hydraulic power and electronic power. Electronic power steering systems are advantageous in both their fuel economy and their usability. Electronic power steering is standard equipment in modern automobiles, including both passenger cars and city cars. An electric motor serves as the driving force behind this system. This motor is separate from the primary engine and works only when it is required to do so. Hydraulic power steering systems have the simplest and least complicated design of all the different types of steering systems. By supplying hydraulic assistance to the steering mechanism, the steering system lends a helping hand to the driver, making it easier for them to manoeuvre the vehicle. Therefore, drivers only need to provide a moderate amount of effort to the steering wheel, as the hydraulic system will handle the remainder of the work. The vast amount of cash that is necessary for research and development of the steering system is the primary issue that the industry is concerned about. This causes the price of the automotive steering system to climb significantly.

Cost Issues to Constraint the Market Expansion

It is projected that the high cost associated with power steering systems will act as a barrier to the expansion of the market for steering systems. It is anticipated that technologies such as drive-by-wire will be adopted in forthcoming automobiles; this will contribute to the expansion of the market in the not-too-distant future.

The EPS systems only have a limited capacity to bear loads

EPS systems are seeing increased use in the passenger automobile market as a result of the benefits they provide, which include an improvement in the vehicle's fuel efficiency and ease of manoeuvrability. However, because of their low load-bearing capability, their demand in the commercial vehicle category is extremely limited, and they are gradually being replaced by HPS systems. Different types of conventional electric steering systems, such as pinion assist electric power steering (P-EPS), have the ability to assist 10 kN (kilo-Newtons) of steering rack force on average. However, heavy commercial vehicles require steering systems that can assist 15 kN or more of steering rack force. Numerous businesses are putting research and development efforts into the creation of electric power steering systems that are capable of withstanding strong steering rack forces. For instance, in order to serve the market for heavy commercial vehicles, Nexteer Automotive designed a dual-pinion electric pinion system that is capable of managing 12.5 kN of steering rack force and a 12-Volt rack assist electric power steering system. Both of these systems are powered by 12 volts.

Innovation and Increasing Demand in Automotive Industry to Open Significant Opportunities

The rising demand for automotive steering systems can be directly attributed to the rising popularity of passenger automobiles and light commercial vehicles. New possibilities for incorporating the internet of things into vehicle steering systems are becoming available as a result of advances in technology. In addition, there is the possibility that electric power systems may be able to achieve a higher load-bearing capacity and become integrated into commercial vehicles. Additionally, the ease of gaining access to credit together with the requirement for safety, particularly during the period of the epidemic, all contributed to an increase in sales of vehicle steering systems. The increased manoeuvrability of Special-Purpose-Utility-Vehicles (SUVs), in conjunction with their more aesthetically pleasing designs, is a major factor in the proliferation of automobile steering systems. It is projected that rising demand for cars that use less fuel and an urgent need for vehicles that provide a more comfortable driving experience would push sales in the industry. Another aspect that is expected to boost the demand for car steering system parts in the years to come is the rising sales and production of both passenger cars and commercial vehicles. This will be a driver for the demand in the coming years. Car manufacturers are being forced to invest large sums of money in the integration of safety and electrical systems in response to the growing trend of integrating electronics in autos. It is anticipated that a significant number of automobile manufacturers will invest in technological advancements related to the design of steering wheels for automobiles.

Increasing Use of Sensors to Widen Market Potential During Forecast Period

The sensor that is situated in the steering column is responsible for measuring two key driver inputs, namely torque (also known as steering effort) and the speed and position of the steering wheel. As a result, there are three varieties of sensors that are utilised in such systems. These sensors are referred to as the torque sensor, the steering wheel speed sensor, and the position sensor. These steering system sensors send the signals to an ECU in the form of inputs, and the ECU then sends the appropriate output to the steering system so that an action can be taken. In most cases, torque sensors are contactless sensing devices. The sensor keeps track of the amount of force that is being given to the steering wheel by the driver, which allows for more nuanced management of the electric steering assistance. It functions using a magnetic measurement principle that does not require physical contact. It contains a magnet unit, a flux-tube unit, and a sensor unit. The torque sensor itself consists of two separate wire coils wound together. If the turn is to the right, the direction of the turn is determined by one of the coils, and if the turn is to the left, the direction of the turn is determined by the other coil. After that, the signal is transmitted from the electric power steering (EPS) module to the relevant coil, which subsequently provides assistance to the driver in steering the car. The automobile industry is continuously investing in research and development to create more advanced and reliable sensor devices in response to the rapid pace of technological improvement. During the forecast period, it is anticipated that automakers will continue to embrace more advanced sensor products for the EPS system. This is likely to continue due to the fact that such goods have seen rising adoption.

EPS Steering Continue to Dominate the Market

The electric power steering segment dominated the automotive steering system market, in terms of volume and revenue, in 2021. It is likely that the demand for electric power steering systems will increase as a result of the growing consumer trend toward comfort while driving. Electrifying a vehicle lessens its reliance on fuels for auxiliary power, which ultimately results in the vehicle having a higher overall fuel efficiency. This reason is a primary force behind the rise in demand for power-assisted steering systems in passenger cars, particularly electric-assisted power steering systems (EPS). The adoption of EPS is being driven by the need for lighter vehicles and increased energy efficiency in those vehicles. The Electronic Power Steering (EPS) system has fewer components than other systems, which makes its installation in the vehicle system simpler. By the year 2025, it is anticipated that nearly 4% of new car sales and 7% of the global car fleet will be electric vehicles. With the expanding electric vehicle sales, the deployment rate of lightweight steering systems (such as electric power steering (EPS)) is likely to witness a potential demand during the forecast period. Not only does the EPS system cut down on emissions, but it also lessens the risks to the environment because there is no possibility of leaks occurring. The sales of electric power steering systems are being driven in large part by all of these factors. The global market for electric power steering systems will grow at a compound annual growth rate (CAGR) of over 5.7% during the forecast period.

Within the EPS segment, it is anticipated that the R-EPS market would have the greatest CAGR during the forecast period of 2021 to 2031. This is due to the fact that R-EPS is able to steer a diverse range of vehicles, from little cars to large trucks. The shifting preferences of consumers away from passenger cars and toward compact SUVs and higher-end vehicles is another factor that is anticipated to contribute to the expansion of the R-EPS market. R-EPS not only frees up valuable space in engine compartments but also has the ability to be easily integrated into a variety of vehicle platforms. According to Nexteer Automotive Group Limited, a leading manufacturer of steering systems in North America, R-EPS currently holds a market share of more than 90 % in the North American full-size truck industry. High demand for powerful light commercial vehicles in the US is likely to further boost the growth of the R-EPS segment.

In terms of revenue, the segment that dealt with hydraulic power steering also held a significant share of the market in the year 2021. It is anticipated that during the period under consideration, it will develop significantly. Because of its widespread application in commercial vehicles, the market for hydraulic power steering is anticipated to experience a favourable development rate over the period covered by the projection. Due to the low load-bearing capability of commercial vehicles, the electric power steering does not function well in these vehicles. In addition to this, hydraulic power steering has the ability to dampen the impact of road shocks.

Passenger Vehicle to Remain the Revenue and Growth Leader

In 2021, the global market for automotive steering systems was dominated by the passenger vehicle segment. This was determined by the kind of vehicle. It is also anticipated that an increase in the sales of passenger vehicles across the world will propel the market. It is anticipated that an increase in the purchasing power of consumers located all over the world will lead to an increase in the sale of vehicles, which is then anticipated to fuel the growth of the global market for automotive steering systems. During the forecast period of 2021 to 2031, it is anticipated that the passenger car submarket of the automotive steering system market would represent the largest segment by vehicle type. The increasing number of vacations and other types of leisure activities around the world, in addition to the ease with which money and credit can be obtained, are driving up the need for automobile steering system parts, which in turn is driving up the sales of passenger vehicles. A further reason that is fuelling growth in the market is the high demand for Special Utility Vehicles (SUVs), which are supported by their improved manoeuvrability, stylish design, and low cost.

In addition, it is anticipated that the segment of light commercial vehicles will show splendid growth in the market. Vehicles classified as light commercial are the most common users of the hydraulic power steering system. A further factor that is predicted to promote the expansion of this sector of the market is the rising need for logistical operations related to commercial activities. As a result of lower sales and manufacturing in the volume of commercial vehicles in comparison to passenger automobiles, it is anticipated that the heavy commercial vehicle segment would display consistent growth in the market in the near future.

APAC Remains as the Global Leader

APAC is home to some of the world's most important centres for automobile manufacturing, including China, India and Japan. The expansion of the automotive steering systems industry in the region is being propelled by the likes of Hitachi Automotive systems, Hyundai Mobis, and Infineon Technologies in China, JTEKT Corporation and NSK steering systems, and Hitachi Astemo, Bawai Plant, and Bosch Huayu. Both regions have the potential to account for more than a third of the total demand in the world. Over the course of the last decade, the significant increase in the region's population, as well as its per-capita income and living standards, have all contributed to the expansion of the region's automotive industry. It is anticipated that the growing demand for fuel-efficient vehicles and comfort features will accelerate the installation of electric power steering (EPS) over hydraulic power steering, particularly in the passenger car segment. This shift will be driven by the increasing demand for fuel-efficient vehicles and comfort features. The adoption of EPS is being driven further by the reduction in the weight of vehicles as well as the enhancement of their energy efficiency.

North American manufacturers are finding lucrative new growth prospects by focusing on increasing their market share through the formation of partnerships, joint ventures, and mergers and acquisitions. The growing purchasing power and easy access to credit to customers in North America is also fuelling the demand for vehicle steering systems. Furthermore, increasing levels of vehicle manufacturing throughout all of North America's regions are having an impact on the demand for the automotive steering system market. North America is expected to grow at a CAGR of 4% during the forecast period of 2021 to 2031.

During the period covered by this forecast, it is anticipated that Europe will not only display significant growth in the market but will also hold the position of second-largest position in the market. In this part of the world, strict regulations imposed by the government regarding the efficiency of fuel have led to an increase in the number of people purchasing fuel-efficient vehicles that are also outfitted with an efficient steering system. For example, the sales of electric vehicles in Europe increased by 37% in 2018, compared to the sales of electric vehicles in 2017. Additionally, different governments across the world have established various regulations, incentives, and programmes to boost the usage of electric vehicles.

Strategic Collaboration and Geographic Expansion Remain the Key Competitive Factor

The market is fragmented due to the presence of a significant number of market players. Several companies, including Robert Bosch GmbH, ZF Friedrichshafen AG, JTEKT Corporation, Nexteer Automotive Corporation, NSK Ltd, Showa Corporation and Other Notable Players, currently hold the majority of the market share in the automotive steering market. These companies have been expanding their business with new innovative technologies so that they can have a competitive edge. These top-tier companies have a more extensive geographic presence and have been consistently conducting R&D, which has resulted in secure approvals from regulatory bodies. The demand for steering wheels for automobiles among Original Equipment Manufacturers (OEMs) is directly proportional to the rising volume of automobile production. Many prominent automotive manufacturers are expected to sign long-term contracts with OEMs in the forthcoming years. It is anticipated that some of the manufacturers will engage in acquisitions and joint ventures with OEMs in order to produce products for automobiles that are of an exceptional level of quality.

The primary aim of the leading companies currently functioning in the worldwide automotive steering system market is to increase their market share through the formation of new partnerships, joint ventures, as well as mergers and acquisitions. Key players in the automotive steering system are focusing on providing comfort and safety to people. Also, companies are constantly integrating the latest technological advancements that would reduce the chances of vehicle failures. For instance, in July 2021, Hyundai Mobis developed the world's first brainwaves based on ADAS technology. With the help of this technology, the brainwaves can measure the driving state and notify to avert accidents.

Leading businesses participating in the global automotive steering system market are releasing cutting-edge products to cater to the growing demand from customers. A few of the other multinational corporations have the goal of expanding their business through the acquisition of local vehicle power steering system producers that are either small or medium in size. They want to have a competitive advantage in the market as a result of these acquisitions that they have made. For example, In January 2022, IMUZAK, a major producer of moulding technology-based products located in Japan, introduced a 3D floating display for driverless vehicles at CES 2022. It can project visual driver notifications from behind the steering wheel. The unique technique incorporates a proprietary microlens system for producing free-standing messages that notify drivers of many highway characteristics, important distances, and upcoming problems.

Historical & Forecast Period

This study report represents analysis of each segment from 2021 to 2031 considering 2022 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2022 to 2031.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Steering Systems market are as follows:

- Research and development budgets of manufacturers and government spending

- Revenues of key companies in the market segment

- Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report

Micro and macro environment factors that are currently influencing the Automotive Steering Systems market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

Market Segmentation

Technology

- Electronic Steering

- H-EPS

- C-EPS

- P-EPS

- R-EPS

- Hydraulic Steering

- Manual Steering

- Electro-hydraulic Steering

Vehicle

- Passenger Cars

- Compact

- Mid-size

- Premium

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Sales Channel

- OEM

- After Market

- Component

- Hydraulic Pump

- Steering/Coloumn/Rack

- Sensors

- Electric Motor

- Other Components

Region Segment (2021-2031; US$ Million)

- North America

- U.S.

- Canada

- Rest of North America

- UK and European Union

- UK

- Germany

- Spain

- Italy

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Africa

- Rest of Middle East and Africa

Key questions answered in this report

- What are the key micro and macro environmental factors that are impacting the growth of Automotive Steering Systems market?

- What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

- Estimated forecast and market projections up to 2031.

- Which segment accounts for the fastest CAGR during the forecast period?

- Which market segment holds a larger market share and why?

- Are low and middle-income economies investing in the Automotive Steering Systems market?

- Which is the largest regional market for Automotive Steering Systems market?

- What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

- Which are the key trends driving Automotive Steering Systems market growth?

- Who are the key competitors and what are their key strategies to enhance their market presence in the Automotive Steering Systems market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Automotive Steering Systems Market

- 2.2. Global Automotive Steering Systems Market, By Technology, 2022 (US$ Million)

- 2.3. Global Automotive Steering Systems Market, By Vehicle, 2022 (US$ Million)

- 2.4. Global Automotive Steering Systems Market, By Sales Channel, 2022 (US$ Million)

- 2.5. Global Automotive Steering Systems Market, By Component, 2022 (US$ Million)

- 2.6. Global Automotive Steering Systems Market, By Geography, 2022 (US$ Million)

- 2.7. Attractive Investment Proposition by Geography, 2022

- 2.8. Key Buying Criteria

- 2.9. Key Case Reports

- 2.10. Scenario Analysis

- 2.10.1. Optimistic estimates and analysis

- 2.10.2. Realistic estimates and analysis

- 2.10.3. Pessimistic estimates and analysis

- 2.11. Market Profiling

- 2.12. Sales and Marketing Plan

- 2.13. Top Market Conclusions

- 2.14. Strategic Recommendations

3. Automotive Steering Systems Market: Competitive Analysis

- 3.1. Market Positioning of Key Automotive Steering Systems Market Vendors

- 3.2. Strategies Adopted by Automotive Steering Systems Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2022 Versus 2031

4. Automotive Steering Systems Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Automotive Steering Systems Market Value, 2021 - 2031, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

- 4.6. Porter's Five Force Model

- 4.6.1. Supplier Power

- 4.6.2. Buyer Power

- 4.6.3. Threat Of Substitutes

- 4.6.4. Threat Of New Entrants

- 4.6.5. Competitive Rivalry

- 4.7. PESTEL Analysis

- 4.7.1. Political Landscape

- 4.7.2. Economic Landscape

- 4.7.3. Technology Landscape

- 4.7.4. Legal Landscape

- 4.7.5. Social Landscape

- 4.8. Heptalysis Analysis

- 4.9. Critical Investigation of Business Problems Through Five Whys Root Cause Analysis & Relevant Solutions

5. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2022 Versus 2031

- 5.3. Market Segmentation

- 5.3.1. Electronic Steering

- 5.3.1.1. H-EPS

- 5.3.1.2. C-EPS

- 5.3.1.3. P-EPS

- 5.3.1.4. R-EPS

- 5.3.2. Hydraulic Steering

- 5.3.3. Manual Steering

- 5.3.4. Electro-hydraulic Steering

- 5.3.1. Electronic Steering

6. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2022 Versus 2031

- 6.3. Market Segmentation

- 6.3.1. Passenger Cars

- 6.3.1.1. Compact

- 6.3.1.2. Mid-size

- 6.3.1.3. Premium

- 6.3.1.4. SUVs

- 6.3.2. Light Commercial Vehicles

- 6.3.3. Heavy Commercial Vehicles

- 6.3.1. Passenger Cars

7. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2022 Versus 2031

- 7.3. Market Segmentation

- 7.3.1. OEM

- 7.3.2. After Market

8. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 8.1. Market Overview

- 8.2. Growth & Revenue Analysis: 2022 Versus 2031

- 8.3. Market Segmentation

- 8.3.1. Hydraulic Pump

- 8.3.2. Steering/Coloumn/Rack

- 8.3.3. Sensors

- 8.3.4. Electric Motor

- 8.3.5. Other Components

9. Geographic Analysis

- 9.1. Market Overview

- 9.2.Macro Factors versus Market Impact: Dashboard, 2022

- 9.3. Porters Five Force Model Across Geography: Dashboard, 2022

- 9.4. Impact of PESTEL factors Across Geography: Dashboard, 2022

10. North America Automotive Steering Systems Market, 2021-2031, USD (Million)

- 10.1. Market Overview

- 10.2. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 10.3. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 10.4. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 10.5. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 10.6.Automotive Steering Systems Market: By Region, 2021-2031, USD (Million)

- 10.6.1.North America

- 10.6.1.1. U.S.

- 10.6.1.1.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 10.6.1.1.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 10.6.1.1.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 10.6.1.1.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 10.6.1.2. Canada

- 10.6.1.2.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 10.6.1.2.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 10.6.1.2.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 10.6.1.2.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 10.6.1.3. Rest of North America

- 10.6.1.3.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 10.6.1.3.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 10.6.1.3.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 10.6.1.3.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 10.6.1.1. U.S.

- 10.6.1.North America

11. UK and European Union Automotive Steering Systems Market, 2021-2031, USD (Million)

- 11.1. Market Overview

- 11.2. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.3. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.4. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.5. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.Automotive Steering Systems Market: By Region, 2021-2031, USD (Million)

- 11.6.1.UK and European Union

- 11.6.1.1. UK

- 11.6.1.1.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.1.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.1.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.1.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.2. Germany

- 11.6.1.2.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.2.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.2.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.2.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.3. Spain

- 11.6.1.3.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.3.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.3.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.3.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.4. Italy

- 11.6.1.4.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.4.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.4.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.4.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.5. France

- 11.6.1.5.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.5.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.5.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.5.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.6. Rest of Europe

- 11.6.1.6.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 11.6.1.6.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 11.6.1.6.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 11.6.1.6.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 11.6.1.1. UK

- 11.6.1.UK and European Union

12. Asia Pacific Automotive Steering Systems Market, 2021-2031, USD (Million)

- 12.1. Market Overview

- 12.2. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.3. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.4. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.5. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.Automotive Steering Systems Market: By Region, 2021-2031, USD (Million)

- 12.6.1.Asia Pacific

- 12.6.1.1. China

- 12.6.1.1.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.1.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.1.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.1.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.2. Japan

- 12.6.1.2.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.2.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.2.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.2.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.3. India

- 12.6.1.3.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.3.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.3.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.3.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.4. Australia

- 12.6.1.4.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.4.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.4.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.4.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.5. South Korea

- 12.6.1.5.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.5.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.5.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.5.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.6. Rest of Asia Pacific

- 12.6.1.6.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 12.6.1.6.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 12.6.1.6.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 12.6.1.6.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 12.6.1.1. China

- 12.6.1.Asia Pacific

13. Latin America Automotive Steering Systems Market, 2021-2031, USD (Million)

- 13.1. Market Overview

- 13.2. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 13.3. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 13.4. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 13.5. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 13.6.Automotive Steering Systems Market: By Region, 2021-2031, USD (Million)

- 13.6.1.Latin America

- 13.6.1.1. Brazil

- 13.6.1.1.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 13.6.1.1.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 13.6.1.1.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 13.6.1.1.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 13.6.1.2. Mexico

- 13.6.1.2.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 13.6.1.2.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 13.6.1.2.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 13.6.1.2.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 13.6.1.3. Rest of Latin America

- 13.6.1.3.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 13.6.1.3.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 13.6.1.3.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 13.6.1.3.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 13.6.1.1. Brazil

- 13.6.1.Latin America

14. Middle East and Africa Automotive Steering Systems Market, 2021-2031, USD (Million)

- 14.1. Market Overview

- 14.2. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 14.3. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 14.4. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 14.5. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 14.6.Automotive Steering Systems Market: By Region, 2021-2031, USD (Million)

- 14.6.1.Middle East and Africa

- 14.6.1.1. GCC

- 14.6.1.1.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 14.6.1.1.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 14.6.1.1.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 14.6.1.1.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 14.6.1.2. Africa

- 14.6.1.2.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 14.6.1.2.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 14.6.1.2.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 14.6.1.2.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 14.6.1.3. Rest of Middle East and Africa

- 14.6.1.3.1. Automotive Steering Systems Market: By Technology, 2021-2031, USD (Million)

- 14.6.1.3.2. Automotive Steering Systems Market: By Vehicle, 2021-2031, USD (Million)

- 14.6.1.3.3. Automotive Steering Systems Market: By Sales Channel, 2021-2031, USD (Million)

- 14.6.1.3.4. Automotive Steering Systems Market: By Component, 2021-2031, USD (Million)

- 14.6.1.1. GCC

- 14.6.1.Middle East and Africa

15. Company Profile

- 15.1. Robert Bosch GmbH

- 15.1.1. Company Overview

- 15.1.2. Financial Performance

- 15.1.3. Product Portfolio

- 15.1.4. Strategic Initiatives

- 15.2. ZF Friedrichshafen AG

- 15.2.1. Company Overview

- 15.2.2. Financial Performance

- 15.2.3. Product Portfolio

- 15.2.4. Strategic Initiatives

- 15.3. JTEKT Corporation

- 15.3.1. Company Overview

- 15.3.2. Financial Performance

- 15.3.3. Product Portfolio

- 15.3.4. Strategic Initiatives

- 15.4. Nexteer Automotive Corporation

- 15.4.1. Company Overview

- 15.4.2. Financial Performance

- 15.4.3. Product Portfolio

- 15.4.4. Strategic Initiatives

- 15.5. NSK Ltd

- 15.5.1. Company Overview

- 15.5.2. Financial Performance

- 15.5.3. Product Portfolio

- 15.5.4. Strategic Initiatives

- 15.6. Showa Corporation

- 15.6.1. Company Overview

- 15.6.2. Financial Performance

- 15.6.3. Product Portfolio

- 15.6.4. Strategic Initiatives

- 15.7. Other Notable Players

- 15.7.1. Company Overview

- 15.7.2. Financial Performance

- 15.7.3. Product Portfolio

- 15.7.4. Strategic Initiatives