|

|

市場調査レポート

商品コード

1260062

歯のホワイトニング製品市場- 成長、将来展望、競合分析、2023年~2031年Teeth Whitening Products Market - Growth, Future Prospects and Competitive Analysis, 2023 - 2031 |

||||||

| 歯のホワイトニング製品市場- 成長、将来展望、競合分析、2023年~2031年 |

|

出版日: 2023年04月13日

発行: Acute Market Reports

ページ情報: 英文 119 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の歯のホワイトニング製品市場は、予測期間2023年から2031年にかけてCAGR5.0%で成長すると予測されています。この業界は、歯の審美性を高めることを選択する個人の数が増加したため、大きな発展を遂げました。新興国市場では可処分所得が大幅に増加しており、これが市場拡大の主な理由となっています。一般的に高齢者人口は、加齢に伴う歯の問題を通じて、この産業の拡大に寄与しています。市場促進要因としては、審美歯科の人気の高まり、歯科医療観光の進化、公衆口腔衛生のための複数の政府イニシアチブの導入などが挙げられます。

米国審美歯科学会が実施した調査によると、93%の患者が友人や家族からの勧めをきっかけに審美歯科治療を選択しました。また、これらの人の75%は、オンラインで審美歯科に関する情報を入手できるようになったことがきっかけで、施術を選択したとのことです。2018年に英国で実施された調査によると、自尊心、生活満足度、自己関連の身体的魅力などの動機づけ要因により、審美的な処置を選ぶ女性が増えています。これらの女性には、メディアへの露出が多いという共通の特徴がありました。このような要因から、人々は歯のホワイトニングなどの美容・修復処置を選ぶようになり、市場の成長を促進する可能性があります。

ソーシャルメディアの影響による歯のホワイトニング製品の市場拡大

ラカウンターによると、アメリカの成人の67%が、歯科医やプロのホワイトニング技術、あるいは歯磨き粉やストリップの助けを借りて、何らかの方法で歯を白くしようとしたことがあるそうです。家庭用ホワイトニングジェルに含まれる過酸化水素のFDA承認濃度はおよそ3%です。歯のホワイトニングは米国で最も人気のある歯科治療で、オフィスでの診療の32%を占めています。これは、99.7%のアメリカ人が自分の笑顔を最も価値のある社会的資産とみなしていることに起因しています。そのため、歯のホワイトニングは、現在最も要望の多い歯科処置の一つとなっています。自宅での歯のホワイトニング施術を促進する上で、ソーシャルメディアだけが果たす役割は極めて重要です。White Dental Beautyが報じたように、ロンドンの歯科外科による2016年の調査では、矯正治療を求める大人やセレブの増加により、回答者の84%が完璧な笑顔を持つことにプレッシャーを感じていることが明らかになりました。2019年のフォーブスの記事によると、製品やサービスを推奨する5%のインフルエンサーが社会的影響力の45%を担っており、これにより歯のホワイトニング市場はさらに強化されるでしょう。

可処分所得の増加が歯のホワイトニング製品市場の世界の需要を促進する

多くの国で可処分所得が増加し、市場拡大の原動力となっています。より多くの人々がこれらの製品を購入できるようになり、所得の増加が需要の原動力となっています。さらに、消費者はより高価な製品や専門的な歯のホワイトニングサービスにお金を払うことを厭わないです。

審美歯科治療に対する消費者の需要は高まっている

消費者は、歯の見た目を改善するために、歯のホワイトニングなどの審美歯科治療を求めるようになってきています。さらに、若々しさを保つために審美歯科治療を選択することもあります。歯のホワイトニングは、比較的簡単で安価な処置であり、笑顔の全体的な外観を改善し、より若々しい外観に貢献することができます。

ホワイトニング用歯磨き粉が最大のシェアを占める

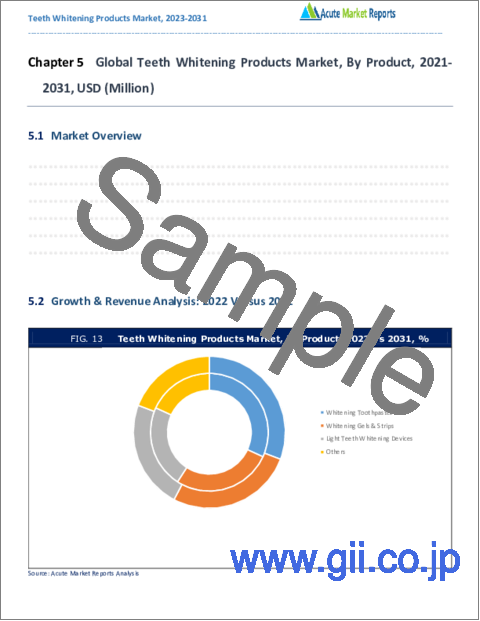

2022年の市場シェアは、ホワイトニング歯磨き粉が35%と最も高いシェアを占めています。業界は製品別に、ホワイトニング歯磨き粉、ホワイトニングジェル、ストリップ、光による歯のホワイトニング機器、その他の製品に分類されます。ホワイトニング歯磨き粉は、その手頃な価格とP&GやColgate Palmoliveといった主要プレイヤーの存在により、最大の市場シェアを占めています。さらに、活性炭歯磨き粉は吸着性が高く、歯の汚れを落とすのに効果的です。しかし、ホワイトニング歯磨き粉は過酸化水素の濃度が低いため、2階調しか歯を白くすることができません。歯のホワイトニングジェルとデバイスは、最も成長率の高い製品分野です。なぜなら、歯のホワイトニングジェルは、変色を除去するのに有効で、顕著な結果をもたらすからです。光デバイスは、歯の汚れを除去する化学反応を促進するため、歯を白くするジェルとLEDホワイトニングデバイスの組み合わせが効果的であることが証明されています。その結果、この分野は急速に拡大しています。

オフラインの販売チャネルが市場収益の60%以上を占める

2022年、歯のホワイトニング市場のオフライン流通セグメントは、60%の収益シェアを占めています。ホワイトニング用歯磨き粉やストリップなどの製品は、主に小売店などのオフラインチャネルで販売されるため、大きな市場シェアを占めています。セマンティクスによると、歯磨き粉のオフライン販売は世界売上の95%を占めています。

北米が世界リーダーを維持し、APACが成長リーダーである

北米は、技術の進歩や歯のホワイトニング施術を選ぶ個人の増加により、2022年には約35%の収益シェアを獲得し、市場をリードしています。同地域は口腔衛生に対する意識が高く、美容整形を選択する人が増えています。米国は、審美歯科の人気が高まっていることから、歯のホワイトニングの市場を独占すると予想されます。歯の審美意識の高まりに伴い、今後数年間はこれらの製品の採用が増加すると思われます。米国国勢調査およびシモンズ国民消費者調査(NHCS)のデータによると、2020年に歯磨き粉を使用した米国人は3億717万人で、この数は2024年には3億1,603万人に増加すると予測されています。米国歯科医師会(ADA)健康政策研究所が実施した調査では、回答した歯科医師の97%が、2020年には、自分の医院では救急患者しか診ないか、全く診ないようになると回答しています。また、高齢者人口の増加やアルコール、ソーダ、タバコ、ジャンクフード、カフェイン摂取などの不健康な食習慣は、歯の変色を増加させる要因となっており、米国市場の成長に好影響を与える可能性があります。また、多数の企業が歯を白くする製品を継続的に発売しており、これも市場の推進力の一つとなっています。例えば、2020年には、Procter &Gamble社の子会社であるCrest社が、家庭用歯のホワイトニングに該当するCrest 3DWhitestripsを発売しています。前述の要因の結果、北米の歯のホワイトニング市場は、予測期間中に大きく拡大すると予想されます。

市場シェアを拡大する鍵はイノベーションにあり

市場は適度に統合されており、現在、一握りの企業が世界市場を独占しています。市場シェアの大半は、一握りのマーケットリーダーによって獲得されています。コルゲート・パルモリーブ、ユニリーバ、プロクター・アンド・ギャンブル、グラクソ・スミスクラインは、市場を独占している企業の一部です。これらの競合他社は、市場シェアを拡大するために、革新的な製品の開発や戦略的提携による製品ポートフォリオの拡充に注力しています。2020年2月、Procter &Gamble Companyが、歯の表面の汚れを除去するペン型の歯のホワイトニングアプリケーターを発売しました。

本レポートで回答した主な質問

歯のホワイトニング製品市場の成長に影響を与える主要なミクロおよびマクロ環境要因は何か?

現在および予測期間中の製品セグメントおよび地域に関する主要な投資ポケットは何か?

2031年までの推定推計・市場予測

予測期間中に最も速いCAGRを占めるのはどのセグメントか?

より大きな市場シェアを持つ市場セグメントとその理由は?

低・中所得国は歯のホワイトニング製品市場に投資しているか?

歯のホワイトニング製品市場の地域別市場規模が最も大きいのはどこか?

アジア太平洋、ラテンアメリカ、中東・アフリカなどの新興市場における市場動向と力学は?

歯のホワイトニング製品市場の成長を促進する主要動向は何か?

世界の歯のホワイトニング製品市場で存在感を高めるための主要な競合企業とその主要戦略は何か?

目次

第1章 序文

- レポート内容

- 報告書の目的

- 対象読者

- 主な提供商品

- 市場セグメンテーション

- 調査手法

- フェーズⅠ-二次調査

- フェーズⅡ-一次調査

- フェーズⅢ-有識者別レビュー

- 前提条件

- 採用したアプローチ

第2章 エグゼクティブサマリー

- 市場のスナップショット:世界の歯のホワイトニング製品市場

- 世界の歯のホワイトニング製品市場:製品別 2022

- 世界の歯のホワイトニング製品市場:治療オプション別 2022

- 世界の歯のホワイトニング製品市場:流通チャネル別 2022

- 世界の歯のホワイトニング製品市場:地域別 2022

- 魅力的な投資提案:地域別 2022

第3章 歯のホワイトニング製品市場:競合分析

- 主要ベンダーの市場ポジショニング

- ベンダーが採用する戦略

- 主要な産業戦略

- ティア分析:2022 vs 2031

第4章 歯のホワイトニング製品市場:マクロ分析と市場力学

- イントロダクション

- 世界の歯のホワイトニング製品市場金額 2021-2031

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因と抑制要因の影響分析

- シーソー分析

第5章 歯のホワイトニング製品市場:製品別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- ホワイトニング歯磨き粉

- ホワイトニングジェル&ストリップ

- 光の歯のホワイトニングデバイス

- その他

第6章 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- プロフェッショナルオフィス内

- 歯科医監修の在宅

- 店頭

第7章 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 市場概要

- 成長・収益分析:2022 vs 2031

- 市場セグメンテーション

- 小売店

- 小売店と病院の薬局

- 直販・eコマース

第8章 北米の歯のホワイトニング製品市場 2021-2031

- 市場概要

- 歯のホワイトニング製品市場:製品別 2021-2031

- 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 歯のホワイトニング製品市場:地域別 2021-2031

- 北米

- 米国

- カナダ

- その他北米地域

- 北米

第9章 英国と欧州連合の歯のホワイトニング製品市場 2021-2031

- 市場概要

- 歯のホワイトニング製品市場:製品別 2021-2031

- 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 歯のホワイトニング製品市場:地域別 2021-2031

- 英国と欧州連合

- 英国

- ドイツ

- スペイン

- イタリア

- フランス

- その他欧州地域

- 英国と欧州連合

第10章 アジア太平洋の歯のホワイトニング製品市場 2021-2031

- 市場概要

- 歯のホワイトニング製品市場:製品別 2021-2031

- 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 歯のホワイトニング製品市場:地域別 2021-2031

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- アジア太平洋

第11章 ラテンアメリカの歯のホワイトニング製品市場 2021-2031

- 市場概要

- 歯のホワイトニング製品市場:製品別 2021-2031

- 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 歯のホワイトニング製品市場:地域別 2021-2031

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ地域

- ラテンアメリカ

第12章 中東・アフリカの歯のホワイトニング製品市場 2021-2031

- 市場概要

- 歯のホワイトニング製品市場:製品別 2021-2031

- 歯のホワイトニング製品市場:治療オプション別 2021-2031

- 歯のホワイトニング製品市場:流通チャネル別 2021-2031

- 歯のホワイトニング製品市場:地域別 2021-2031

- 中東・アフリカ

- GCC

- アフリカ

- その他中東・アフリカ地域

- 中東・アフリカ

第13章 企業プロファイル

- Colgate Palmolive

- GlaxoSmithKline Plc

- Johnson & Johnson

- Procter & Gamble

- Brodie & Stone

- Unilever

- Church & Dwight Co.

- その他の注目選手

List of Tables

- TABLE 1 Global Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 2 Global Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 3 Global Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 4 North America Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 5 North America Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 6 North America Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 7 U.S. Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 8 U.S. Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 9 U.S. Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 10 Canada Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 11 Canada Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 12 Canada Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 13 Rest of North America Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 14 Rest of North America Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 15 Rest of North America Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 16 UK and European Union Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 17 UK and European Union Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 18 UK and European Union Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 19 UK Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 20 UK Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 21 UK Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 22 Germany Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 23 Germany Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 24 Germany Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 25 Spain Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 26 Spain Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 27 Spain Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 28 Italy Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 29 Italy Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 30 Italy Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 31 France Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 32 France Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 33 France Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 34 Rest of Europe Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 35 Rest of Europe Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 36 Rest of Europe Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 37 Asia Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 38 Asia Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 39 Asia Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 40 China Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 41 China Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 42 China Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 43 Japan Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 44 Japan Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 45 Japan Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 46 India Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 47 India Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 48 India Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 49 Australia Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 50 Australia Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 51 Australia Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 52 South Korea Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 53 South Korea Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 54 South Korea Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 55 Latin America Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 56 Latin America Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 57 Latin America Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 58 Brazil Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 59 Brazil Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 60 Brazil Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 61 Mexico Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 62 Mexico Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 63 Mexico Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 64 Rest of Latin America Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 65 Rest of Latin America Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 66 Rest of Latin America Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 67 Middle East and Africa Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 68 Middle East and Africa Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 69 Middle East and Africa Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 70 GCC Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 71 GCC Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 72 GCC Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 73 Africa Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 74 Africa Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 75 Africa Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

- TABLE 76 Rest of Middle East and Africa Teeth Whitening Products Market By Product, 2021-2031, USD (Million)

- TABLE 77 Rest of Middle East and Africa Teeth Whitening Products Market By Treatment Option, 2021-2031, USD (Million)

- TABLE 78 Rest of Middle East and Africa Teeth Whitening Products Market By Distribution Channel, 2021-2031, USD (Million)

List of Figures

- FIG. 1 Global Teeth Whitening Products Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Teeth Whitening Products Market: Quality Assurance

- FIG. 5 Global Teeth Whitening Products Market, By Product, 2022

- FIG. 6 Global Teeth Whitening Products Market, By Treatment Option, 2022

- FIG. 7 Global Teeth Whitening Products Market, By Distribution Channel, 2022

- FIG. 8 Global Teeth Whitening Products Market, By Geography, 2022

- FIG. 9 Market Geographical Opportunity Matrix - Global Teeth Whitening Products Market, 2022

- FIG. 10 Market Positioning of Key Teeth Whitening Products Market Players, 2022

- FIG. 11 Global Teeth Whitening Products Market - Tier Analysis - Percentage of Revenues by Tier Level, 2022 Versus 2031

- FIG. 12 Global Teeth Whitening Products Market, By Product, 2022 Vs 2031, %

- FIG. 13 Global Teeth Whitening Products Market, By Treatment Option, 2022 Vs 2031, %

- FIG. 14 Global Teeth Whitening Products Market, By Distribution Channel, 2022 Vs 2031, %

- FIG. 15 U.S. Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 16 Canada Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 17 Rest of North America Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 18 UK Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 19 Germany Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 20 Spain Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 21 Italy Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 22 France Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 23 Rest of Europe Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 24 China Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 25 Japan Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 26 India Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 27 Australia Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 28 South Korea Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 29 Rest of Asia Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 30 Brazil Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 31 Mexico Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 32 Rest of Latin America Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 33 GCC Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 34 Africa Teeth Whitening Products Market (US$ Million), 2021 - 2031

- FIG. 35 Rest of Middle East and Africa Teeth Whitening Products Market (US$ Million), 2021 - 2031

The global teeth whitening products market is anticipated to grow at a CAGR of 5.0% during the forecast period 2023 to 2031. This industry has undergone significant development as the number of individuals opting to enhance dental aesthetics has increased. Developing nations have generated a substantial amount of disposable income, which is the primary reason for the market's expansion. The elderly population, in general, has contributed to the expansion of this industry through age-related tooth problems. A few market growth drivers include the increasing popularity of cosmetic dentistry, the evolution of dental medical tourism, and the introduction of multiple government initiatives for public oral health care.

According to a survey conducted by the American Academy of Cosmetic Dentistry, 93% of patients opted for cosmetic dentistry procedures as a result of positive recommendations from friends and family. In addition, 75% of these individuals opted for the procedure due to the increasing availability of information about cosmetic dentistry online. According to a survey conducted in the UK in 2018, an increasing number of women opt for aesthetic procedures due to motivational factors such as self-esteem, life satisfaction, and self-related physical attractiveness. All of these women shared a common characteristic: they had extensive media exposure. People have opted for cosmetic and restorative procedures such as teeth whitening as a result of these factors, which is likely to propel the market's growth.

Impact of Social Media is Boosting the Market for Teeth Whitening Products

67% of American adults, according to Racounter, have attempted to whiten their teeth in some way, either through dentists and professional whitening techniques or with the help of toothpaste and strips. The FDA-approved concentration of hydrogen peroxide in at-home whitening gels is roughly 3%. Teeth whitening is the most popular dental procedure in the U.S., accounting for 32% of in-office practice. This is due to the fact that 99.7% of Americans consider their smile to be their most valuable social asset. This is why teeth whitening is one of the most requested dental procedures today. The role of social media alone in promoting at-home teeth whitening procedures is crucial. A 2016 survey by a London dental surgery revealed that 84% of respondents felt more pressure to have a perfect smile due to the increase in adults and celebrities seeking orthodontic treatment, as reported by White Dental Beauty. According to a 2019 Forbes article, 5% of influencers who recommend products or services are responsible for 45% of social influence; this will further strengthen the teeth whitening market.

Increasing Disposable Income Drives Global Demand for Teeth Whitening Products Market

Increases in disposable income in a number of nations are driving market expansion. As more people are able to afford these products, a rise in income drives their demand. In addition, consumers are willing to pay for more expensive products and professional teeth-whitening services.

Consumer Demand for Cosmetic Dental Procedures Is Growing

Consumers are increasingly seeking out cosmetic dental procedures, such as teeth whitening, to improve the appearance of their teeth. Additionally, they choose cosmetic dental procedures to preserve their youthful appearance. Teeth whitening is a relatively simple and inexpensive procedure that can help improve the overall appearance of the smile, contributing to a more youthful appearance.

In the United States, for instance, the demand for cosmetic dentistry procedures has increased; the demand for teeth whitening has risen steadily over the past decade. The number of teeth whitening procedures performed in the United States increased by 27% between 2010 and 2019, according to the American Academy of Cosmetic Dentistry. In the coming years, more consumers are anticipated to seek out cosmetic dental procedures to enhance the appearance of their teeth.

Whitening Toothpaste Held the Largest Share

In 2022, whitening toothpaste held the largest market share at 35%. The industry is segmented by product into whitening toothpaste, whitening gels, and strips, light teeth whitening devices, and other products. Whitening toothpaste held the largest market share due to its affordability and the presence of key players such as P&G and Colgate Palmolive. Additionally, active charcoal toothpaste is highly absorbent and effective at removing dental stains. However, whitening toothpaste contains a lower concentration of hydrogen peroxide and therefore only whitens teeth by two shades. Teeth whitening gels and devices are the product segment with the highest rate of growth. Because teeth whitening gels are effective at removing discoloration and produce remarkable results. As light devices accelerate the chemical reactions that remove stains from teeth, the combination of teeth-whitening gel and LED whitening devices is proving effective. Consequently, this segment is experiencing rapid expansion.

In April 2020, OralgenNuPearl launched its new Oralgen Probiotic Oral Care Whitening Toothpaste, which is clinically proven to balance healthy bacteria in the mouth and brighten smiles with a fluoride-free, gentler formula.

In addition, in February 2020, Wellness, a manufacturer of personal care products, released its new all-natural whitening toothpaste, which is free of glycerin and fluoride and contains calcium carbonate, peppermint, stevia leaf, and green tea leaf extract.

As a result of the effective benefits of whitening toothpaste and the increasing number of new product launches, the whitening toothpaste segment is anticipated to experience significant growth over the forecast period.

Offline Distribution Channel Captured over 60% of Market Revenues

In 2022, the offline distribution segment of the teeth whitening market held a 60% revenue share. Products such as whitening toothpaste and strips are primarily sold through offline channels, such as retail stores, and thus hold a significant market share. Offline sales of toothpaste account for 95% of global sales, according to semantics.

However, sales through the online network are growing six times faster and at a tremendous rate. Companies such as Colgate and Procter & Gamble have observed an increase in online sales of whitening products. Globally, Colgate's eCommerce sales grew by 26% in 2019, led by robust growth in North America. In addition, online channels offer a variety of products at reasonable prices. As a result, their popularity is growing. In addition, to strengthen its online channel, Colgate opened its first Online Acceleration center in the United Kingdom in 2019 to create digital content for the company.

North America Remains the Global Leader and APAC is the Growth Leader

North America led the market with a revenue share of approximately 35% in 2022, as a result of technological advancements and an increase in the number of individuals opting for teeth whitening procedures. The region has a high level of oral health awareness, and the number of people opting for cosmetic procedures has increased. The United States is expected to dominate the market for teeth whitening due to the rising popularity of cosmetic dentistry. The adoption of these products is likely to increase over the next few years as dental aesthetics awareness grows. According to data from the United States Census and the Simmons National Consumer Survey (NHCS), 307.17 million Americans used toothpaste in 2020, and this number is projected to rise to 316.03 million by 2024. In a survey conducted by the American Dental Association (ADA) Health Policy Institute, 97% of responding dentists indicated that, in 2020, their offices would only see emergency patients or no patients at all. In addition, the increasing geriatric population and unhealthy food habits, including alcohol, soda, tobacco, junk food, and caffeine consumption, contribute to an increase in tooth discoloration, which may have a positive effect on the growth of the US market. In addition, numerous companies are continuously launching teeth-whitening products, which is also one of the market's driving forces. For instance, in 2020, Crest, a subsidiary of Procter & Gamble, introduced Crest 3DWhitestrips, which fall under the category of at-home teeth whitening. As a result of the aforementioned factors, the market for teeth whitening in North America is anticipated to expand significantly over the forecast period.

Asia-Pacific is projected to experience the highest CAGR over the forecast period. This is primarily due to the increasing disposable income generated in developing nations such as India and China. With such a large population in this region, many individuals are interested in improving their dental health for aesthetic purposes. Moreover, the high prevalence of dental conditions such as periodontitis, which contribute to tooth discoloration, is compelling people to choose teeth whitening procedures and expanding the market share of the industry.

Innovation Remains as the Key to Enhance Market Share

The market is moderately consolidated, with a handful of companies currently dominating the global market. The majority of the market share has been acquired by a handful of market leaders. Colgate-Palmolive, Unilever, Procter & Gamble, and GlaxoSmithKline are some of the market's most dominant companies. These competitors are concentrating on developing innovative products and forming strategic alliances to expand their product portfolios in order to increase their market share. In February 2020, Procter & Gamble Company released a pen-shaped teeth-whitening applicator that removes surface stains from teeth.

In February 2020, P&G introduced two types of Crest Whitening Emulsions: one with a built-in applicator for on-the-go use and another with a whitening wand containing five times more active hydrogen peroxide. It also introduced a pen-shaped teeth-whitening applicator that works to remove surface stains from teeth and contains ingredients such as hydrogen peroxide, sodium hydroxide, and disodium pyrophosphate, which is an anti-tartar agent. The market for teeth whitening is dominated by companies such as Colgate Palmolive, GlaxoSmithKline Plc, Johnson & Johnson, Procter & Gamble, Brodie & Stone, Unilever, and Church & Dwight Co.

Historical & Forecast Period

This study report represents analysis of each segment from 2021 to 2031 considering 2022 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2022 to 2031.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Teeth Whitening Products market are as follows:

Research and development budgets of manufacturers and government spending

Revenues of key companies in the market segment

Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report

Micro and macro environment factors that are currently influencing the Teeth Whitening Products market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

Market Segmentation

Product

Whitening Toothpastes

Whitening Gels & Strips

Light Teeth Whitening Devices

Others

Treatment Option

Professional In-office

Dentist-supervised At-home

Over-the-counter

Distribution Channel

Retail Stores

Retail & Hospital Pharmacies

Direct Sales & E-commerce

Region Segment (2021-2031; US$ Million)

North America

U.S.

Canada

Rest of North America

UK and European Union

UK

Germany

Spain

Italy

France

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East and Africa

GCC

Africa

Rest of Middle East and Africa

Key questions answered in this report

What are the key micro and macro environmental factors that are impacting the growth of Teeth Whitening Products market?

What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

Estimated forecast and market projections up to 2031.

Which segment accounts for the fastest CAGR during the forecast period?

Which market segment holds a larger market share and why?

Are low and middle-income economies investing in the Teeth Whitening Products market?

Which is the largest regional market for Teeth Whitening Products market?

What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

Which are the key trends driving Teeth Whitening Products market growth?

Who are the key competitors and what are their key strategies to enhance their market presence in the Teeth Whitening Products market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Teeth Whitening Products Market

- 2.2. Global Teeth Whitening Products Market, By Product, 2022 (US$ Million)

- 2.3. Global Teeth Whitening Products Market, By Treatment Option, 2022 (US$ Million)

- 2.4. Global Teeth Whitening Products Market, By Distribution Channel, 2022 (US$ Million)

- 2.5. Global Teeth Whitening Products Market, By Geography, 2022 (US$ Million)

- 2.6. Attractive Investment Proposition by Geography, 2022

3. Teeth Whitening Products Market: Competitive Analysis

- 3.1. Market Positioning of Key Teeth Whitening Products Market Vendors

- 3.2. Strategies Adopted by Teeth Whitening Products Market Vendors

- 3.3. Key Industry Strategies

- 3.4. Tier Analysis 2022 Versus 2031

4. Teeth Whitening Products Market: Macro Analysis & Market Dynamics

- 4.1. Introduction

- 4.2. Global Teeth Whitening Products Market Value, 2021 - 2031, (US$ Million)

- 4.3. Market Dynamics

- 4.3.1. Market Drivers

- 4.3.2. Market Restraints

- 4.3.3. Key Challenges

- 4.3.4. Key Opportunities

- 4.4. Impact Analysis of Drivers and Restraints

- 4.5. See-Saw Analysis

5. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2022 Versus 2031

- 5.3. Market Segmentation

- 5.3.1. Whitening Toothpastes

- 5.3.2. Whitening Gels & Strips

- 5.3.3. Light Teeth Whitening Devices

- 5.3.4. Others

6. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2022 Versus 2031

- 6.3. Market Segmentation

- 6.3.1. Professional In-office

- 6.3.2. Dentist-supervised At-home

- 6.3.3. Over-the-counter

7. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2022 Versus 2031

- 7.3. Market Segmentation

- 7.3.1. Retail Stores

- 7.3.2. Retail & Hospital Pharmacies

- 7.3.3. Direct Sales & E-commerce

8. North America Teeth Whitening Products Market, 2021-2031, USD (Million)

- 8.1. Market Overview

- 8.2. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 8.3. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 8.4. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 8.5.Teeth Whitening Products Market: By Region, 2021-2031, USD (Million)

- 8.5.1.North America

- 8.5.1.1. U.S.

- 8.5.1.1.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 8.5.1.1.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 8.5.1.1.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 8.5.1.2. Canada

- 8.5.1.2.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 8.5.1.2.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 8.5.1.2.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 8.5.1.3. Rest of North America

- 8.5.1.3.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 8.5.1.3.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 8.5.1.3.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 8.5.1.1. U.S.

- 8.5.1.North America

9. UK and European Union Teeth Whitening Products Market, 2021-2031, USD (Million)

- 9.1. Market Overview

- 9.2. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.3. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.4. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.Teeth Whitening Products Market: By Region, 2021-2031, USD (Million)

- 9.5.1.UK and European Union

- 9.5.1.1. UK

- 9.5.1.1.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.1.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.1.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.2. Germany

- 9.5.1.2.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.2.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.2.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.3. Spain

- 9.5.1.3.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.3.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.3.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.4. Italy

- 9.5.1.4.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.4.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.4.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.5. France

- 9.5.1.5.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.5.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.5.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.6. Rest of Europe

- 9.5.1.6.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 9.5.1.6.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 9.5.1.6.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 9.5.1.1. UK

- 9.5.1.UK and European Union

10. Asia Pacific Teeth Whitening Products Market, 2021-2031, USD (Million)

- 10.1. Market Overview

- 10.2. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.3. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.4. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.Teeth Whitening Products Market: By Region, 2021-2031, USD (Million)

- 10.5.1.Asia Pacific

- 10.5.1.1. China

- 10.5.1.1.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.1.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.1.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.2. Japan

- 10.5.1.2.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.2.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.2.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.3. India

- 10.5.1.3.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.3.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.3.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.4. Australia

- 10.5.1.4.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.4.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.4.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.5. South Korea

- 10.5.1.5.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.5.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.5.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.6. Rest of Asia Pacific

- 10.5.1.6.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 10.5.1.6.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 10.5.1.6.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 10.5.1.1. China

- 10.5.1.Asia Pacific

11. Latin America Teeth Whitening Products Market, 2021-2031, USD (Million)

- 11.1. Market Overview

- 11.2. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 11.3. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 11.4. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.5.Teeth Whitening Products Market: By Region, 2021-2031, USD (Million)

- 11.5.1.Latin America

- 11.5.1.1. Brazil

- 11.5.1.1.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 11.5.1.1.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 11.5.1.1.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.5.1.2. Mexico

- 11.5.1.2.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 11.5.1.2.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 11.5.1.2.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.5.1.3. Rest of Latin America

- 11.5.1.3.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 11.5.1.3.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 11.5.1.3.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 11.5.1.1. Brazil

- 11.5.1.Latin America

12. Middle East and Africa Teeth Whitening Products Market, 2021-2031, USD (Million)

- 12.1. Market Overview

- 12.2. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 12.3. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 12.4. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.5.Teeth Whitening Products Market: By Region, 2021-2031, USD (Million)

- 12.5.1.Middle East and Africa

- 12.5.1.1. GCC

- 12.5.1.1.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 12.5.1.1.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 12.5.1.1.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.5.1.2. Africa

- 12.5.1.2.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 12.5.1.2.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 12.5.1.2.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.5.1.3. Rest of Middle East and Africa

- 12.5.1.3.1. Teeth Whitening Products Market: By Product, 2021-2031, USD (Million)

- 12.5.1.3.1. Teeth Whitening Products Market: By Treatment Option, 2021-2031, USD (Million)

- 12.5.1.3.1. Teeth Whitening Products Market: By Distribution Channel, 2021-2031, USD (Million)

- 12.5.1.1. GCC

- 12.5.1.Middle East and Africa

13. Company Profile

- 13.1. Colgate Palmolive

- 13.1.1. Company Overview

- 13.1.2. Financial Performance

- 13.1.3. Product Portfolio

- 13.1.4. Strategic Initiatives

- 13.2. GlaxoSmithKline Plc

- 13.2.1. Company Overview

- 13.2.2. Financial Performance

- 13.2.3. Product Portfolio

- 13.2.4. Strategic Initiatives

- 13.3. Johnson & Johnson

- 13.3.1. Company Overview

- 13.3.2. Financial Performance

- 13.3.3. Product Portfolio

- 13.3.4. Strategic Initiatives

- 13.4. Procter & Gamble

- 13.4.1. Company Overview

- 13.4.2. Financial Performance

- 13.4.3. Product Portfolio

- 13.4.4. Strategic Initiatives

- 13.5. Brodie & Stone

- 13.5.1. Company Overview

- 13.5.2. Financial Performance

- 13.5.3. Product Portfolio

- 13.5.4. Strategic Initiatives

- 13.6. Unilever

- 13.6.1. Company Overview

- 13.6.2. Financial Performance

- 13.6.3. Product Portfolio

- 13.6.4. Strategic Initiatives

- 13.7. Church & Dwight Co.

- 13.7.1. Company Overview

- 13.7.2. Financial Performance

- 13.7.3. Product Portfolio

- 13.7.4. Strategic Initiatives

- 13.8. Other notable players

- 13.8.1. Company Overview

- 13.8.2. Financial Performance

- 13.8.3. Product Portfolio

- 13.8.4. Strategic Initiatives