|

|

年間契約型情報サービス

商品コード

1225792

ポリプロピレン(PP)の世界市場:工場生産能力、生産量、プロセス、技術、稼働率、需要と供給、最終用途、海外貿易、販売チャネル、地域需要、企業シェア(2015年~2030年)Global Polypropylene (PP) Market Analysis: Plant Capacity, Production, Process, Technology, Operating Efficiency, Demand & Supply, End-Use, Foreign Trade, Sales Channel, Regional Demand, Company Share, 2015-2030 |

||||||

|

|||||||

| ポリプロピレン(PP)の世界市場:工場生産能力、生産量、プロセス、技術、稼働率、需要と供給、最終用途、海外貿易、販売チャネル、地域需要、企業シェア(2015年~2030年) |

|

出版日: 年間契約型情報サービス

発行: ChemAnalyst

ページ情報: 英文

|

全表示

- 概要

- 目次

世界のポリプロピレン(PP)の市場規模は、2021年に約7,000万トンに達し、2030年までに5.48%のCAGRで成長すると予測されています。自動車産業による需要増、電気自動車やハイブリッド車(EV/HEV)の需要の大幅な高まり、建築・建設業界や電気・電子業界での断熱材としての需要の高まりは、市場の成長を促進しています。

当データベースでは、世界のポリプロピレン(PP)市場について調査分析し、生産能力、需要分析、国別輸出入など、体系的な情報を提供しています。

オンラインデータベースをPDFまたはExcelとしてダウンロード可能です。データ内のテキスト等のコピー&ペースト及び、データの印刷は可能です。データは四半期ごとに更新されます。

目次

第1章 生産能力:企業別

当社のオンラインプラットフォームでは、ポリプロピレン(PP)の重要なメーカーとその現在および将来の生産能力について、ほぼリアルタイムで最新情報を入手できます。

第2章 生産能力:場所別

製造業者の場所ベースの生産能力を分析することにより、ポリプロピレン(PP)の地域供給を説明しています。

第3章 生産能力:プロセス別

各プロセスの将来の成長を見ながら、さまざまな方法の需要とその能力を評価します。

第4章 生産能力:技術別

さまざまな技術の製造能力をより適切に評価し、どの技術がより需要があるかを説明しています。

第5章 生産量:企業別

主要企業によるポリプロピレン(PP)の過去の年間生産量を調査し、今後数年間でポリプロピレン(PP)がどのように成長するかを予測します。

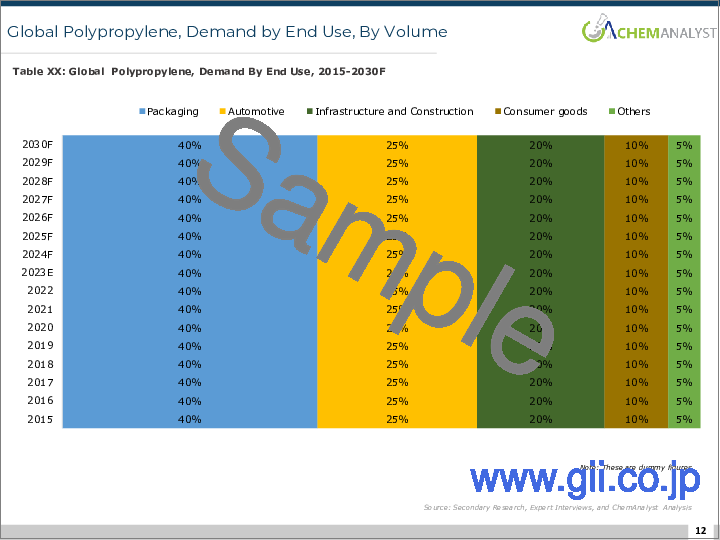

第6章 需要:最終用途別

どのエンドユーザー業界(パッケージング、自動車、インフラストラクチャおよび建設、消費財、その他)が市場を生み出しているか、およびポリプロピレン(PP)市場の成長予測を説明しています。

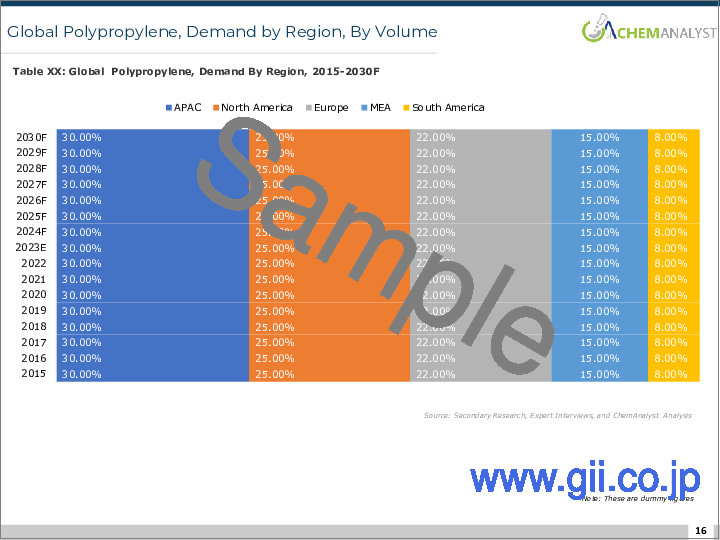

第7章 需要:地域別

さまざまな地域、つまり北米、欧州、アジア太平洋、中東およびアフリカ、南米でのポリプロピレン(PP)の需要の変化を分析し、地域の需要のマッピングを説明しています。

第8章 需要:販売チャネル別(直接および間接)

ポリプロピレン(PP)の販売には、複数のチャネルが使用されています。当社の販売チャネルは、業界の販売の大部分を代理店やディーラー、または直接販売が占めているかどうかを分析するのに役立ちます。

第9章 需給ギャップ

ポリプロピレン(PP)の貿易上での余剰や不足に関する情報を得るため、需給ギャップを説明しています。

第10章 企業シェア

現在、ポリプロピレン(PP)の市場シェアのうち、世界中の主要企業が占める割合を説明しています。

第11章 国別輸出

主要国のポリプロピレン(PP)の輸出量に関する詳細を説明しています。

第12章 国別輸入

主要国のポリプロピレン(PP)の輸入量に関する詳細を説明しています。

The global Polypropylene (PP) market stood at approximately 70 million tonnes in 2021 and is expected to grow at a healthy CAGR of 5.48% during the forecast period until 2030. Recently, Nayara Energy laid the foundation of a new petrochemical project at Vadinar, Gujarat, India. This Polypropylene plant which will have an annual capacity of 450 thousand tonnes of polypropylene is estimated to be finished in 2023.

The packaging industry dominates the Polypropylene market and is the most widely used plastic for packaging and largely used in food packaging applications. The increasing demand for Polypropylene by the automotive industry is expected to boost the Polypropylene market in the forecast period. As polypropylene is a low-cost material with excellent mechanical properties, more than half of the plastic is used in the automotive sector for bumpers, instrumental panels, door trims, etc. Exponentially rising demand for electric and hybrid electric vehicles (EV/HEV) is further propelling the demand for Polypropylene and is likely to augment the market growth in the future. The surging demand for Polypropylene from building & construction and electricals & electronics industries for insulation purposes is expected to accelerate the Polypropylene market over the next few years. The global Polypropylene (PP) market is anticipated to reach approximately 110 million tonnes by 2030.

Polypropylene (PP), also known as Polypropene, is a thermoplastic 'addition' polymer, produced from the polymerization of propylene monomers. Polypropylene belongs to the group of Polyolefins and is rigid, tough, crystalline, and non-polar in nature. After Polyethylene, Polypropylene is the second-most produced plastic. Polypropylene can be easily copolymerized with other polymers like polyethylene, which changes the material properties significantly, allowing for more robust applications and making it an ideal material for various end-use industries. Polypropylene possesses versatile properties such as high chemical resistance, fatigue resistance, high insulation, high elasticity and toughness, and high transmissivity.

The two major types of Polypropylene available in the market include Homopolymers (PPH) and Copolymers (PPC), which are widely utilized in packaging, healthcare, textiles, pipes, automotive, electrical, and other applications. Polypropylene is an important chemical commodity used in numerous industrial and household applications like the packaging of consumer products and manufacturing of plastic parts for end-user industries. It is extensively used in the manufacturing of plastic moldings, ropes, carpets, rugs, ropes, roofing membranes, electrical insulators, etc. one of the most common applications for PP is as biaxially oriented polypropylene (BOPP), which are used to make a wide variety of materials including clear bags.

Asia Pacific is the dominating the Polypropylene (PP) market all across the globe. is anticipated to maintain its dominance in the forecast period until 2030. Growing demand for Polypropylene from the packaging and automotive industry, especially in emerging countries such as China, India, and Japan, is anticipated to drive the market in the Asia Pacific region. The rising demand for Polypropylene by the food and beverage industry in countries like U.S., Canada, and Mexico, will boost the Polypropylene market in North America.

Based on the end-user industry, the Polypropylene (PP) market is segmented into sectors like Packaging, Automotive, Infrastructure and Construction, Consumer goods, and Others. Among these, Packaging industry is leading segment and accounted more than 45% of the share of total Polypropylene (PP) demand in 2021. This industry is anticipated to dominate the global Polypropylene (PP) market owing to the growing demand of ready-to-eat food items in the forthcoming years.

Significant companies for Global Polypropylene (PP) market are Braskem, Reliance Industries Limited, ExxonMobil Chemical, LyondellBasell, Borouge, Shenhua Ningxia Coal Industry, Total Petrochemicals, Prime Polymer Co., Ltd., Indian Oil Corporation Limited, SABIC Europe, Zhejiang Petrochemical, Sinopec KPC PC JV, INEOS, Japan Polypropylene Corporation, Saudi Polyolefins, and Petrochina Dushanzi Petrochemical.

Years considered for this report:

Historical Period: 2015- 2021

Base Year: 2021

Estimated Year: 2022

Forecast Period: 2023-2030

The objective of the Study:

- To assess the demand-supply scenario of Polypropylene (PP), which covers the production, demand, and supply of Polypropylene (PP) around the globe.

- To analyze and forecast the market size of Polypropylene (PP).

- To classify and forecast the Global Polypropylene (PP) market based on end-use and regional distribution.

- To examine global competitive developments such as new capacity expansions, mergers & acquisitions, etc., of the Polypropylene (PP) market.

To extract data for the Global Polypropylene (PP) market, primary research surveys were conducted with Polypropylene (PP) manufacturers, suppliers, distributors, wholesalers, and Traders. While interviewing, the respondents were also inquired about their competitors. Through this technique, ChemAnalyst was able to include manufacturers that could not be identified due to the limitations of secondary research. Moreover, ChemAnalyst analyzed various segments and projected a positive outlook for the Global Polypropylene (PP) market over the coming years.

ChemAnalyst calculated Polypropylene (PP) demand in the globe by analyzing the historical data and demand forecast which was carried out considering the historical extraction and supply and demand of Polypropylene (PP) across the globe. ChemAnalyst sourced these values from industry experts, and company representatives and externally validated through analyzing historical sales data of respective manufacturers to arrive at the overall market size. Various secondary sources such as company websites, association reports, annual reports, etc., were also studied by ChemAnalyst.

Key Target Audience:

- Polypropylene (PP) manufacturers and other stakeholders

- Organizations, forums and alliances related to Polypropylene (PP) distribution

- Government bodies such as regulating authorities and policy makers

- Market research organizations and consulting companies

The study is useful in providing answers to several critical questions that are important for industry stakeholders such as Polypropylene (PP) manufacturers, customers and policy makers. The study would also help them to target the growing segments over the coming years, thereby aiding the stakeholders in taking investment decisions and facilitating their expansion.

Report Scope:

In this report, Global Polypropylene (PP) market has been segmented into following categories, in addition to the industry trends which have also been detailed below:

- Market, by End Use: Packaging, Automotive, Infrastructure and Construction, Consumer goods, and Others.

- Market, by Sales Channel: Direct Sale and Indirect Sale

- Market, by Region: North America, Europe, Asia Pacific, Middle East and Africa, and South America.

Available Customizations:

With the given market data, ChemAnalyst offers customizations according to a company's specific needs.

Table of Contents

Table of Content

1. Capacity By Company

On our online platform, you can stay up to date with essential manufacturers and their current and future operation capacity on a practically real-time basis for Polypropylene (PP).

2. Capacity By Location

To better understand the regional supply of Polypropylene (PP) by analyzing its manufacturers' location-based capacity.

3. Capacity By Process

To evaluate the demand of various methods and their capacities while looking for the future growth of each process.

4. Capacity By Technology

To better assess the manufacturing capacities with different technologies as well as understand which technology is more in demand.

5. Production By Company

Study the historical annual production of Polypropylene (PP) by the leading players and forecast how it will grow in the coming years.

6. Demand by End- Use

Discover which end-user industry (Packaging, Automotive, Infrastructure and Construction, Consumer goods, and Others) are creating a market and the forecast for the growth of the Polypropylene (PP) market.

7. Demand by Region

Analyzing the change in demand of Polypropylene (PP) in different regions, i.e., North America, Europe, Asia Pacific, Middle East and Africa, and South America, that can direct you in mapping the regional demand.

8. Demand by Sales Channel (Direct and Indirect)

Multiple channels are used to sell Polypropylene (PP). Our sales channel will help in analyzing whether distributors and dealers or direct sales make up most of the industry's sales.

9. Demand-Supply Gap

Determine the supply-demand gap to gain information about the trade surplus or deficiency of Polypropylene (PP).

10. Company Share

Figure out what proportion of the market share of Polypropylene (PP) is currently held by leading players across the globe.

11. Country-wise Export

Get details about quantity of Polypropylene (PP) exported by major countries.

12. Country-wise Import

Get details about quantity of Polypropylene (PP) imported by major countries.