|

|

市場調査レポート

商品コード

1421545

ガラス包装:世界市場の展望・予測 (2023-2028年)Glass Packaging Market - Global Outlook & Forecast 2023-2028 |

||||||

|

|||||||

| ガラス包装:世界市場の展望・予測 (2023-2028年) |

|

出版日: 2024年02月06日

発行: Arizton Advisory & Intelligence

ページ情報: 英文 278 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のガラス包装の市場規模は、2022年から2028年にかけてCAGR 4.73%で成長すると予測されています。

市場動向と機会

Z世代とミレニアル世代:持続可能な包装に大きな影響を受ける

Z世代とミレニアル世代は、環境意識が高まる時代に育ってきました。彼らは気候変動、プラスチック汚染、天然資源の減少がもたらす結果を目の当たりにしており、環境へのフットプリントをより意識するようになり、持続可能な代替手段を求めるようになりました。リサイクル可能で環境に優しい素材であるガラスは、ゴミを減らし地球を守るというZ世代やミレニアル世代の価値観に合致しています。また、これらの世代は以前の世代よりも健康志向が強いです。ガラスは、一部のプラスチックのように有害な化学物質を含まないため、食品・飲料を包装するための、より安全な選択肢と考えられています。

医薬品・化粧品包装の需要増加

近年、ガラス包装の市場は医薬品・化粧品業界において顕著な需要の急増を経験しています。このような需要の高まりは、ガラス固有の特性、消費者の嗜好の変化、規制への配慮など、さまざまな要因が絡み合っていると考えられます。これらの分野でのガラス包装の採用は、製品の保存と安全性に関する厳しい要件を満たすだけでなく、ブランドの差別化と持続可能な実践の道を開き、最終的に市場の成長を促進しています。

当レポートでは、世界のガラス包装の市場を調査し、市場の定義と概要、市場機会・市場動向、市場影響因子の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 調査手法

第2章 調査の目的

第3章 調査プロセス

第4章 調査対象・調査範囲

第5章 レポートの前提・注記

第6章 重要考察

第7章 市場の概要

第8章 イントロダクション

第9章 市場機会と動向

- 持続可能包装の影響を受けるZ世代とミレニアル世代

- 代替包装に傾いている企業

- 革新的な技術の採用の増加

第10章 市場成長の実現要因

- パッケージのプレミアム化の向上

- 医薬品および化粧品の包装の需要の高まり

- アルコール消費量の増加

第11章 市場抑制要因

- 原材料の価格感度

- ガラス包装に関するサプライチェーンの問題

- 代替包装ソリューション

第12章 市場情勢

- 市場概要

- ベンダー分析

- 需要に関する洞察

- 市場規模・予測

- ファイブフォース分析

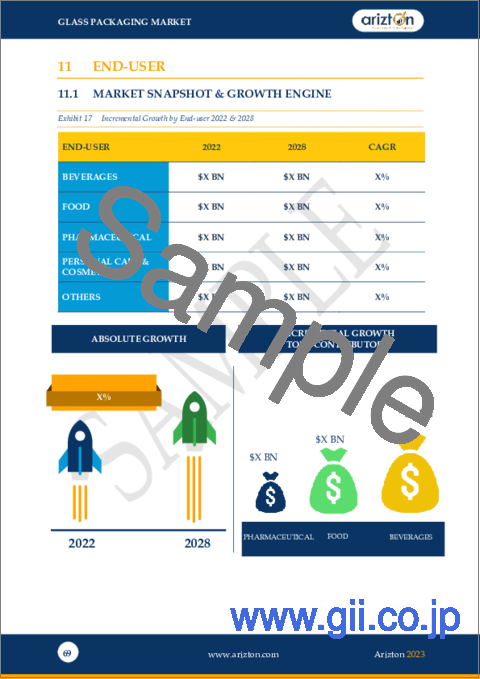

第13章 エンドユーザー

- 市場のスナップショットと成長促進要因

- 市場概要

- 飲料

- 食品

- 医薬品

- パーソナルケア・化粧品

- その他

- 市場概要

- 市場規模・予測

- 地域別市場

第14章 製品

- 市場のスナップショットと成長促進要因

- 市場概要

- ボトル

- 瓶・容器

- アンプル、バイアル、その他

- 市場概要

- 市場規模・予測

- 地域別市場

第15章 地域

- 市場スナップショット・成長促進要因

- 地域概要

第16章 アジア太平洋

第17章 欧州

第18章 北米

第19章 ラテンアメリカ

第20章 中東・アフリカ

第21章 競合情勢

第22章 主要企業プロファイル

- ARDAGH GROUP

- AMCOR

- APTARGROUP

- BERLIN PACKAGING

- GERRESHEIMER

- HEINZ-GLAS

- NIHON YAMAMURA GLASS

- O-I GLASS

- PIRAMAL

- VERALLIA

- VIDRALA

第23章 他の主要ベンダー

- AAPL

- AGI GLASPAC

- BA GLASS

- BEATSON CLARK

- BORMIOLI LUIGI

- GROUPE POCHET

- HINDUSTAN NATIONAL GLASS & INDUSTRIES LIMITED

- KOA GLASS

- MIDDLE EAST GLASS

- NIPRO

- SAVERGLASS

- SCHOTT

- SHANDONG PROVINCE MEDICINAL GLASS

- SISECAM

- SGD PHARMA

- STOELZLE GLASS GROUP

- TOYO SEIKAN GROUP HOLDINGS

- VETROPACK

- VITRO, S.A.B. DE C.V.

- WIEGAND-GLAS

- ZIGNAGO VETRO

第24章 レポートサマリー

- 重要ポイント

- 戦略的推奨事項

第25章 定量的サマリー

- 地域別市場

- 製品別市場

- エンドユーザー別市場

- 北米

- ラテンアメリカ

- アジア太平洋

- 欧州

- 中東・アフリカ

第26章 付録

List Of Exhibits

LIST OF EXHIBITS

- EXHIBIT 1 SEGMENTATION OF GLOBAL GLASS PACKAGING MARKET

- EXHIBIT 2 MARKET SIZE CALCULATION APPROACH 2022

- EXHIBIT 3 INCREMENTAL GROWTH OF GLASS PACKAGING

- EXHIBIT 4 MEGA TRENDS IN THE GLASS PACKAGING

- EXHIBIT 5 RISK FACTORS

- EXHIBIT 6 VALUE CHAIN ANALYSIS OF GLASS PACKAGING

- EXHIBIT 7 IMPACT OF GEN Z AND MILLENNIALS INFLUENCED BY SUSTAINABLE PACKAGING

- EXHIBIT 8 SUSTAINABILITY DEMAND BY GENERATIONS IN US 2022

- EXHIBIT 9 TOP F&B ITEMS PREFERRED BY GEN Z IN GLASS PACKAGING IN UK 2022

- EXHIBIT 10 US TOTAL POPULATION IN 2023 (%)

- EXHIBIT 12 IMPACT OF COMPANIES LEANING TOWARD ALTERNATIVE PACKAGING

- EXHIBIT 13 IMPACT OF RISING ADOPTION OF INNOVATIVE TECHNOLOGIES

- EXHIBIT 14 IMPACT OF INCREASING PREMIUMIZATION IN PACKAGING

- EXHIBIT 15 URBANIZATION EXPANDS AUDIENCE FOR PREMIUMIZATION 2019-2030 (GLOBAL URBAN AND RURAL HOUSEHOLDS MILLION)

- EXHIBIT 16 RISING DEMAND FOR PREMIUMIZATION AGE WISE IN SOME COUNTRIES: 2020 (%)

- EXHIBIT 17 IMPACT OF RISING DEMAND FOR PHARMACEUTICALS AND COSMETICS PACKAGING

- EXHIBIT 18 TYPES OF SMART PACKAGING IN THE PHARMACEUTICAL INDUSTRY

- EXHIBIT 19 IMPACT OF INCREASED ALCOHOL CONSUMPTION

- EXHIBIT 20 VINEYARD SURFACE AREA & WINE PRODUCTION IN GLOBAL AND EUROPE: 2022

- EXHIBIT 21 WINE PRODUCTION IN EUROPE: 2022 (MILLION HECTOLITERS)

- EXHIBIT 22 WINE CONSUMPTION HIGHLIGHTS: 2022 (MHL)

- EXHIBIT 23 IMPACT OF PRICE SENSITIVITY OF RAW MATERIALS

- EXHIBIT 24 IMPORT PRICE OF SILICA SAND IN INDIA: 2012-2022 ($ PER TON)

- EXHIBIT 25 LOWEST AND HIGHEST PRICE OF SILICA SAND: 2022

- EXHIBIT 26 PRODUCTION OF SODA ASH IN THE US 2017-2021 (MILLION TONS)

- EXHIBIT 27 IMPACT OF SUPPLY CHAIN ISSUES WITH GLASS PACKAGING

- EXHIBIT 28 US GLASS CONTAINER SHIPMENTS MARKET SHARE BY CATEGORY 2022 (%)

- EXHIBIT 29 IMPACT OF ALTERNATE PACKAGING SOLUTIONS

- EXHIBIT 30 PLASTIC KEY STATICS

- EXHIBIT 31 ALUMINUM PRODUCTION IN CHINA, RUSSIA AND INDIA: 2020

- EXHIBIT 32 GLOBAL PRIMARY ALUMINUM PRODUCTION IN JULY 2023 (THOUSAND METRIC TONS OF ALUMINUM)

- EXHIBIT 33 FACTORS DRIVING DEMAND FOR GLASS PACKAGING

- EXHIBIT 34 CAGR ACROSS GEOGRAPHY

- EXHIBIT 35 KEY STRATEGIES ADOPTED BY GLASS PACKAGING VENDORS

- EXHIBIT 36 GLOBAL GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 37 FIVE FORCES ANALYSIS 2022

- EXHIBIT 38 INCREMENTAL GROWTH BY END-USER 2022 & 2028

- EXHIBIT 39 GLOBAL BEER CONSUMPTION BY REGION: 2021 (MILLION KL)

- EXHIBIT 40 GLOBAL BEER CONSUMPTION BY DIFFERENT COUNTRIES: 2021 (MILLION KL)

- EXHIBIT 41 GLOBAL BEVERAGES GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 42 FOOD PACKAGING TRENDS: 2022

- EXHIBIT 43 GLOBAL FOOD GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 44 GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 45 EXPORT DESTINATIONS FOR BEAUTY COSMETICS AND SKINCARE PRODUCTS BY COUNTRIES: 2022 ($ BILLION)

- EXHIBIT 46 GLOBAL PERSONAL CARE AND COSMETICS GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 47 CHEMICALS THAT ONLY REQUIRE GLASS PACKAGING

- EXHIBIT 48 CHEMICAL SALES BY SELECTED COUNTRIES 2021 ($ BILLION)

- EXHIBIT 49 GLOBAL OTHER GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 50 INCREMENTAL GROWTH BY PRODUCT 2022 & 2028

- EXHIBIT 51 GLOBAL GLASS PACKAGING MARKET SEGMENTATION BY PRODUCTS

- EXHIBIT 52 GLOBAL PACKAGING MARKET BY PRODUCT 2022 & 2028 (% MARKET SHARE)

- EXHIBIT 53 TOP BEER PRODUCER COUNTRIES IN THE EUROPE UNION: 2022 (BILLION LITERS)

- EXHIBIT 54 GLOBAL BOTTLES GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 55 GLOBAL JARS & CONTAINERS GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 56 GLOBAL AMPULES, VIALS & OTHERS GLASS PACKAGING MARKET 2022-2028 ($ BILLION)

- EXHIBIT 57 INCREMENTAL GROWTH BY GEOGRAPHY 2022 & 2028

- EXHIBIT 58 CAGR AND MARKET SHARE IN 2022

- EXHIBIT 59 GLASS PACKAGING MARKET IN APAC 2022-2028 ($ BILLION)

- EXHIBIT 60 INCREMENTAL GROWTH IN APAC 2022 & 2028

- EXHIBIT 61 SOME FOOD & BEVERAGES MANUFACTURERS IN CHINA

- EXHIBIT 62 GLASS PACKAGING MARKET IN CHINA 2022-2028 ($ BILLION)

- EXHIBIT 63 SOME FOOD & BEVERAGES MANUFACTURERS IN INDIA

- EXHIBIT 64 CHEMICAL INVESTMENT GOVERNMENT 2023

- EXHIBIT 65 GLASS PACKAGING MARKET IN INDIA 2022-2028 ($ BILLION)

- EXHIBIT 66 FOOD & BEVERAGES MANUFACTURING COMPANIES IN JAPAN

- EXHIBIT 67 COSMETICS EXPORT SHIPMENT BY JAPAN ACROSS THE GLOBE 2022(%)

- EXHIBIT 68 GLASS PACKAGING MARKET IN JAPAN 2022-2028 ($ BILLION)

- EXHIBIT 69 SOME FOOD & BEVERAGES MANUFACTURER IN SOUTH KOREA

- EXHIBIT 70 GLASS PACKAGING MARKET IN SOUTH KOREA 2022-2028 ($ BILLION)

- EXHIBIT 71 SHARE OF MONTHLY HOUSEHOLD CONSUMPTION FOR PACKAGED FOOD IN INDONESIA, 2011-2022, IN % (AS PER MARCH OF EACH YEAR)

- EXHIBIT 72 GLASS PACKAGING MARKET IN INDONESIA 2022-2028 ($ BILLION)

- EXHIBIT 73 AUSTRALIAN'S 2025 NATIONAL PACKAGING TARGETS

- EXHIBIT 74 GLASS PACKAGING MARKET IN AUSTRALIA 2022-2028 ($ BILLION)

- EXHIBIT 75 GLASS PACKAGING MARKET IN EUROPE 2022 & 2028 (% MARKET SHARE)

- EXHIBIT 76 GLASS PACKAGING MARKET IN EUROPE 2022-2028 ($ BILLION)

- EXHIBIT 77 INCREMENTAL GROWTH IN EUROPE 2022 & 2028

- EXHIBIT 78 SUSTAINABLE PACKAGING INITIATIVES IN FRANCE

- EXHIBIT 79 GLASS PACKAGING MARKET IN FRANCE 2022-2028 ($ BILLION)

- EXHIBIT 80 R&D BUDGET OF GERMAN CHEMICAL INDUSTRY: 2017 & 2050 (%)

- EXHIBIT 81 GLASS PACKAGING MARKET IN GERMANY 2022-2028 ($ BILLION)

- EXHIBIT 82 SOME BEVERAGE MANUFACTURING COMPANIES IN ITALY

- EXHIBIT 83 GLASS PACKAGING MARKET IN ITALY 2022-2028 ($ BILLION)

- EXHIBIT 84 SOME FOOD AND BEVERAGE MANUFACTURING COMPANIES IN THE UK

- EXHIBIT 85 GLASS PACKAGING MARKET IN UK 2022-2028 ($ BILLION)

- EXHIBIT 86 SOME SUSTAINABLE PACKAGING INITIATIVES IN SPAIN

- EXHIBIT 87 GLASS PACKAGING MARKET IN SPAIN 2022-2028 ($ BILLION)

- EXHIBIT 88 GLASS PACKAGING MARKET IN NORTH AMERICA 2022-2028 ($ BILLION)

- EXHIBIT 89 INCREMENTAL GROWTH IN NORTH AMERICA 2022 & 2028

- EXHIBIT 90 TOP PHARMACEUTICAL AND MEDICINE EXPORTING STATES: 2022 ($ BILLION)

- EXHIBIT 91 GLASS PACKAGING MARKET IN US 2022-2028 ($ BILLION)

- EXHIBIT 92 GLASS PACKAGING MARKET IN CANADA 2022-2028 ($ BILLION)

- EXHIBIT 93 GLASS PACKAGING MARKET IN LATIN AMERICA 2022-2028 ($ BILLION)

- EXHIBIT 94 INCREMENTAL GROWTH IN LATIN AMERICA 2022 & 2028

- EXHIBIT 95 SALES OF SPIRIT IN MEXICO: 2020-2024 ($ MILLION)

- EXHIBIT 96 SALES OF BEER IN MEXICO: 2020-2024 ($ BILLION)

- EXHIBIT 97 GLASS PACKAGING MARKET IN MEXICO 2022-2028 ($ BILLION)

- EXHIBIT 98 TOTAL VOLUME OF WINE SOLD IN BRAZIL 2006-2020 (MILLION LITER)

- EXHIBIT 99 GLASS PACKAGING MARKET IN BRAZIL 2022-2028 ($ BILLION)

- EXHIBIT 100 EXPORT BY ARGENTINA TO OTHER COUNTRIES 2021 (% SHARE)

- EXHIBIT 101 FACTORS DRIVING THE MARKET IN ARGENTINA

- EXHIBIT 102 GLASS PACKAGING MARKET IN REST OF LATIN AMERICA 2022-2028 ($ BILLION)

- EXHIBIT 103 MIDDLE EAST GLASS PACKAGING MARKET 2022 & 2028 (% MARKET SHARE)

- EXHIBIT 104 GLASS PACKAGING MARKET IN MIDDLE EAST AND AFRICA 2022-2028 ($ BILLION)

- EXHIBIT 105 INCREMENTAL GROWTH IN MIDDLE EAST AND AFRICA 2022 & 2028

- EXHIBIT 106 CHEMICAL PRODUCTION: 2016-2021 (APPROXIMATELY $ BILLION)

- EXHIBIT 107 GLASS PACKAGING MARKET IN TURKEY 2022-2028 ($ BILLION)

- EXHIBIT 108 EXPORTS OF MEDICINES, SERUMS, VACCINES & PHARMACEUTICALS ($ MILLION)

- EXHIBIT 109 GLASS PACKAGING MARKET IN EGYPT 2022-2028 ($ BILLION)

- EXHIBIT 110 GLASS PACKAGING MARKET IN SAUDI ARABIA 2022-2028 ($ BILLION)

- EXHIBIT 111 GLASS PACKAGING MARKET IN REST OF MIDDLE EAST AND AFRICA 2022-2028 ($ BILLION)

List Of Tables

LIST OF TABLES

- TABLE 1 KEY CAVEATS

- TABLE 2 CURRENCY CONVERSION 2015-2022

- TABLE 3 GLOBAL BEVERAGES GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 4 LIST OF SOME COMPANIES OFFERING GLASS JARS AND BOTTLES FOR FOOD PACKAGING

- TABLE 5 GLOBAL FOOD GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 6 GLOBAL PHARMACEUTICAL GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 7 GLOBAL PERSONAL CARE AND COSMETICS GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 8 GLOBAL OTHER GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 9 GLOBAL BOTTLES GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 10 GLOBAL JARS & CONTAINERS GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 11 GLOBAL AMPULES, VIALS & OTHERS GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 12 APAC GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 13 APAC GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 14 EUROPE GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 15 EUROPE GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 16 SOME PHARMACEUTICAL, FOOD & BEVERAGES MANUFACTURING COMPANIES IN SPAIN

- TABLE 17 NORTH AMERICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 18 NORTH AMERICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 19 SOME MANUFACTURING COMPANIES IN FOOD & BEVERAGE SEGMENT IN THE US

- TABLE 20 SOME PHARMACEUTICAL AND FOOD & BEVERAGE MANUFACTURERS IN CANADA

- TABLE 21 LATIN AMERICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 22 LATIN AMERICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 23 MIDDLE EAST AND AFRICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 24 MIDDLE EAST AND AFRICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 25 SOME FOOD & BEVERAGE MANUFACTURERS IN THE COUNTRY

- TABLE 26 ARDAGH GROUP: MAJOR PRODUCT OFFERINGS

- TABLE 27 AMCOR: MAJOR PRODUCT OFFERINGS

- TABLE 28 APTARGROUP: MAJOR PRODUCT OFFERINGS

- TABLE 29 BERLIN PACKAGING: MAJOR PRODUCT OFFERINGS

- TABLE 30 GERRESHEIMER: MAJOR PRODUCT OFFERINGS

- TABLE 31 HEINZ-GLAS: MAJOR PRODUCT OFFERINGS

- TABLE 32 NIHON YAMAMURA GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 33 O-I GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 34 PGP GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 35 VERALLIA: MAJOR PRODUCT OFFERINGS

- TABLE 36 VIDRALA: MAJOR PRODUCT OFFERINGS

- TABLE 37 AAPL SOLUTIONS: MAJOR PRODUCT OFFERINGS

- TABLE 38 AGI GLASPAC: MAJOR PRODUCT OFFERINGS

- TABLE 39 BA GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 40 BEATSON CLARK: MAJOR PRODUCT OFFERINGS

- TABLE 41 BORMIOLI LUIGI: MAJOR PRODUCT OFFERINGS

- TABLE 42 GROUPE POCHET: MAJOR PRODUCT OFFERINGS

- TABLE 43 HINDUSTAN NATIONAL GLASS & INDUSTRIES LIMITED: MAJOR PRODUCT OFFERINGS

- TABLE 44 KOA GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 45 MIDDLE EAST GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 46 NIPRO: MAJOR PRODUCT OFFERINGS

- TABLE 47 SAVERGLASS: MAJOR PRODUCT OFFERINGS

- TABLE 48 SCHOTT: MAJOR PRODUCT OFFERINGS

- TABLE 49 SHANDONG PROVINCE MEDICINAL GLASS: MAJOR PRODUCT OFFERINGS

- TABLE 50 SISECAM: MAJOR PRODUCT OFFERINGS

- TABLE 51 SGD PHARMA: MAJOR PRODUCT OFFERINGS

- TABLE 52 STOELZLE GLASS GROUP: MAJOR PRODUCT OFFERINGS

- TABLE 53 TOYO SEIKAN GROUP HOLDINGS: MAJOR PRODUCT OFFERINGS

- TABLE 54 VETROPACK: MAJOR PRODUCT OFFERINGS

- TABLE 55 VITRO, S.A.B. DE C.V.: MAJOR PRODUCT OFFERINGS

- TABLE 56 WIEGAND-GLAS: MAJOR PRODUCT OFFERINGS

- TABLE 57 ZIGNAGO VETRO: MAJOR PRODUCT OFFERINGS

- TABLE 58 GLOBAL GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 ($ BILLION)

- TABLE 59 GLOBAL GLASS PACKAGING MARKET BY GEOGRAPHY 2022-2028 (%)

- TABLE 60 GLOBAL GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 61 GLOBAL GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 62 NORTH AMERICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 63 NORTH AMERICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 64 LATIN AMERICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 65 LATIN AMERICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 66 APAC GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 67 APAC GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 68 EUROPE GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 69 EUROPE GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

- TABLE 70 MIDDLE EAST AND AFRICA GLASS PACKAGING MARKET BY PRODUCT 2022-2028 ($ BILLION)

- TABLE 71 MIDDLE EAST AND AFRICA GLASS PACKAGING MARKET BY END-USER 2022-2028 ($ BILLION)

The global glass packaging market is expected to grow at a CAGR of 4.73% from 2022-2028.

MARKET TRENDS & OPPORTUNITIES

Gen Z and Millennials Highly Influenced by Sustainable Packaging

Gen Z and Millennials have grown up in an era of increased environmental awareness. They've witnessed the consequences of climate change, plastic pollution, and dwindling natural resources. As a result, they are more conscious of their environmental footprint and seek sustainable alternatives. Being a recyclable and eco-friendly material, glass aligns with Gen Z and millennials' values of reducing waste and protecting the planet. These generations are also more health-conscious than previous ones. Glass is considered a safer option for packaging food and beverages because it doesn't contain harmful chemicals like some plastics can (e.g., BPA). The perception of glass as a healthier choice drives the glass packaging market, especially for products consumed directly from the packaging.

Rising Demand for Pharmaceutical And Cosmetics Packaging

In recent years, the glass packaging market has experienced a notable surge in demand within the pharmaceutical and cosmetics industries. This upswing can be attributed to a convergence of factors, including the inherent properties of glass, changing consumer preferences, and regulatory considerations. The adoption of glass packaging within these sectors has not only met the stringent requirements for product preservation and safety but has also opened avenues for brand differentiation and sustainable practices, ultimately driving market growth.

INDUSTRY RESTRAINTS

Price Sensitivity of Raw Material

The price sensitivity of raw materials used in glass packaging can directly and significantly impact market demand. Glass production relies on specific raw materials like sand, soda ash, and limestone, and any price fluctuations can influence the overall cost of producing glass containers. This, in turn, can affect producers and consumers in the following ways.

Moreover, when the cost of these raw materials rises, it directly increases the production cost in the glass packaging market. Manufacturers might absorb some of these costs, but eventually, they are likely to pass the expenses on to consumers. This increases prices for products packaged in glass containers, making them less price-competitive than alternatives. Price-conscious consumers may shift their preferences to products with lower-priced packaging, potentially decreasing demand for goods in glass containers.

SEGMENTATION INSIGHTS

INSIGHT BY END-USER

The beverage end-user dominated the global glass packaging market in 2022. This uptick is primarily driven by increased consumption of beverages such as beer, wine, spirits, juice, flavored water, and more. Glass packaging is favored for these products, primarily due to its qualities that preserve the taste and quality of the beverages, making it the preferred choice for producers and consumers.

Furthermore, lightweight glass packaging is more environmentally friendly as it reduces the energy and resources required for production and transportation. This aligns with the growing consumer and industry emphasis on sustainability, which can drive increased demand for glass packaging. For instance, in 2021, drinks and brewing company AB InBev designed a 150g 330 ml beer bottle (a 17% reduction from the previous design), which increased the consumer base and compliance with regulations.

Segmentation by End-user

- Beverages

- Food

- Pharmaceutical

- Personal Care and Cosmetics

- Others

INSIGHTS BY PRODUCT

The global glass packaging market by product is segmented into bottles, jars & containers, and ampules, vials & others. The bottle segment dominated the product market, accounting for over 48% share in 2022. The demand for glass bottles has been rising due to several factors, including companies expanding their operations, a growing emphasis on eco-friendliness, collaborations among beverage companies, and other related trends. This trend reflects a shift towards more sustainable packaging solutions, as glass bottles are often perceived as a more environmentally friendly option. Additionally, the collaborative efforts among beverage companies have facilitated innovative product offerings and marketing strategies, further driving the demand for the bottles segment in the glass packaging market.

Segmentation by Product

- Bottles

- Jars & Containers

- Ampules & Vials & Others

GEOGRAPHICAL ANALYSIS

The global glass packaging market is mainly driven by increased disposable income, urbanization, and rising consumption of food & beverages. Moreover, with the increasing focus on personalization & customization, the demand for glass packaging is expected to rise in various regions. APAC is the leading region in growing consumer awareness of health & safety, rising disposable income, and advanced glass manufacturing technology of glass packaging in the market. Moreover, APAC is expected to witness the highest CAGR of around 5-6% during the forecast period. In 2022, North America was the third revenue contributor to the global glass packaging market. During the forecast period, Latin America is expected to witness the second-highest CAGR due to increased focus on sustainability and rising demand for food & beverages.

Segmentation by Geography

- APAC

- China

- India

- Japan

- South Korea

- Indonesia

- Australia

- Europe

- France

- Germany

- Italy

- UK

- Spain

- North America

- US

- Canada

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East and Africa

- Turkey

- Egypt

- Saudi Arabia

- Rest of Middle East and Africa

COMPETITIVE LANDSCAPE

The global glass packaging market is characterized by a dynamic interplay of various factors that shape the market. Glass packaging has long been favored for its exceptional qualities, such as purity, recyclability, and preservation of product integrity. However, several key players and trends have emerged to influence the industry's dynamics. First and foremost, significant manufacturers in the global glass packaging market, such as O-I Glass, Ardagh Group, Gerresheimer, Verallia, and others, dominate the sector. These industry giants have established extensive production capabilities and distribution networks, enabling them to cater to various sectors, including food and beverages, cosmetics, pharmaceuticals, and more. Their vast resources and technological advancements give them a competitive edge in product innovation, quality control, and cost efficiency.

Key Company Profiles

- Ardagh Group

- Amcor

- AptarGroup

- Berlin Packaging

- Gerresheimer

- HEINZ-GLAS

- Nihon Yamamura Glass

- O-I Glass

- Piramal

- Verallia

- Vidrala

Other Prominent Vendors

- AAPL Solutions

- AGI glaspac

- BA Glass

- Beatson Clark

- Bormioli Luigi

- Groupe Pochet

- Hindustan National Glass & Industries Limited

- koa glass

- Middle East Glass

- Nipro

- Saverglass

- SCHOTT

- Shandong Province Medicinal Glass

- Sisecam

- SGD Pharma

- STOELZLE GLASS GROUP

- Toyo Seikan Group Holdings

- Vetropack

- Vitro, S.A.B. de C.V.

- Wiegand-Glas

- Zignago Vetro

KEY QUESTIONS ANSWERED:

1. How big is the glass packaging market?

2. What is the growth rate of the global glass packaging market?

3. Which region dominates the global glass packaging market share?

4. What are the significant trends in the glass packaging industry?

5. Who are the key players in the global glass packaging market?

TABLE OF CONTENTS

1 RESEARCH METHODOLOGY

2 RESEARCH OBJECTIVES

3 RESEARCH PROCESS

4 SCOPE & COVERAGE

- 4.1 MARKET DEFINITION

- 4.1.1 INCLUSIONS

- 4.1.2 EXCLUSIONS

- 4.1.3 MARKET ESTIMATION CAVEATS

- 4.2 BASE YEAR

- 4.3 SCOPE OF THE STUDY

- 4.3.1 MARKET SEGMENTATION BY GEOGRAPHY

- 4.3.2 MARKET SEGMENTATION BY END-USER

- 4.3.3 MARKET SEGMENTATION BY PRODUCT

5 REPORT ASSUMPTIONS & CAVEATS

- 5.1 KEY CAVEATS

- 5.2 CURRENCY CONVERSION

- 5.3 MARKET DERIVATION

6 PREMIUM INSIGHTS

- 6.1 REPORT OVERVIEW

- 6.2 OPPORTUNITIES & CHALLENGE ANALYSIS

- 6.3 SEGMENT ANALYSIS

- 6.4 REGIONAL ANALYSIS

- 6.5 COMPETITIVE LANDSCAPE

7 MARKET AT A GLANCE

8 INTRODUCTION

- 8.1 OVERVIEW

- 8.1.1 SUSTAINABILITY IN GLASS PACKAGING

- 8.1.2 PACKAGING INDUSTRY HIGHLIGHTS

- 8.1.3 MEGA TRENDS

- 8.2 KEY INSIGHTS

- 8.2.1 RAW MATERIALS

- 8.2.2 PRICING

- 8.3 RISK FACTORS IN THE MARKET

- 8.4 VALUE CHAIN

- 8.4.1 MATERIAL SUPPLIERS

- 8.4.2 MANUFACTURERS

- 8.4.3 DISTRIBUTORS

- 8.4.4 APPLICATION

9 MARKET OPPORTUNITIES & TRENDS

- 9.1 GEN Z AND MILLENNIALS INFLUENCED BY SUSTAINABLE PACKAGING

- 9.2 COMPANIES LEANING TOWARD ALTERNATIVE PACKAGING

- 9.3 RISING ADOPTION OF INNOVATIVE TECHNOLOGIES

10 MARKET GROWTH ENABLERS

- 10.1 INCREASING PREMIUMIZATION IN PACKAGING

- 10.2 RISING DEMAND FOR PHARMACEUTICAL AND COSMETICS PACKAGING

- 10.3 INCREASED ALCOHOL CONSUMPTION

11 MARKET RESTRAINTS

- 11.1 PRICE SENSITIVITY OF RAW MATERIALS

- 11.2 SUPPLY CHAIN ISSUES WITH GLASS PACKAGING

- 11.3 ALTERNATE PACKAGING SOLUTIONS

12 MARKET LANDSCAPE

- 12.1 MARKET OVERVIEW

- 12.2 VENDOR ANALYSIS

- 12.3 DEMAND INSIGHTS

- 12.4 MARKET SIZE & FORECAST

- 12.5 FIVE FORCES ANALYSIS

- 12.5.1 THREAT OF NEW ENTRANTS

- 12.5.2 BARGAINING POWER OF SUPPLIERS

- 12.5.3 BARGAINING POWER OF BUYERS

- 12.5.4 THREAT OF SUBSTITUTES

- 12.5.5 COMPETITIVE RIVALRY

13 END-USER

- 13.1 MARKET SNAPSHOT & GROWTH ENGINE

- 13.2 MARKET OVERVIEW

- 13.3 BEVERAGES

- 13.3.1 MARKET OVERVIEW

- 13.3.2 ALCOHOL BEVERAGES

- 13.3.3 NON-ALCOHOL BEVERAGES

- 13.3.4 MARKET SIZE & FORECAST

- 13.3.5 MARKET BY GEOGRAPHY

- 13.4 FOOD

- 13.4.1 MARKET OVERVIEW

- 13.4.2 MARKET SIZE & FORECAST

- 13.4.3 MARKET BY GEOGRAPHY

- 13.5 PHARMACEUTICAL

- 13.5.1 MARKET OVERVIEW

- 13.5.2 MARKET SIZE & FORECAST

- 13.5.3 MARKET BY GEOGRAPHY

- 13.6 PERSONAL CARE AND COSMETICS

- 13.6.1 MARKET OVERVIEW

- 13.6.2 MARKET SIZE & FORECAST

- 13.6.3 MARKET BY GEOGRAPHY

- 13.7 OTHERS

- 13.7.1 MARKET OVERVIEW

- 13.7.2 MARKET SIZE & FORECAST

- 13.7.3 MARKET BY GEOGRAPHY

14 PRODUCT

- 14.1 MARKET SNAPSHOT & GROWTH ENGINE

- 14.2 MARKET OVERVIEW

- 14.3 BOTTLES

- 14.3.1 MARKET OVERVIEW

- 14.3.2 MARKET SIZE & FORECAST

- 14.3.3 MARKET BY GEOGRAPHY

- 14.4 JARS & CONTAINERS

- 14.4.1 MARKET OVERVIEW

- 14.4.2 MARKET SIZE & FORECAST

- 14.4.3 MARKET BY GEOGRAPHY

- 14.5 AMPULES, VIALS, & OTHERS

- 14.5.1 MARKET OVERVIEW

- 14.5.2 MARKET SIZE & FORECAST

- 14.5.3 MARKET BY GEOGRAPHY

15 GEOGRAPHY

- 15.1 MARKET SNAPSHOT & GROWTH ENGINE

- 15.2 GEOGRAPHIC OVERVIEW

16 APAC

- 16.1 MARKET OVERVIEW

- 16.2 MARKET SIZE & FORECAST

- 16.3 END-USER

- 16.3.1 MARKET SIZE & FORECAST

- 16.4 PRODUCT

- 16.4.1 MARKET SIZE & FORECAST

- 16.5 KEY COUNTRIES

- 16.6 CHINA: MARKET SIZE & FORECAST

- 16.7 INDIA: MARKET SIZE & FORECAST

- 16.8 JAPAN: MARKET SIZE & FORECAST

- 16.9 SOUTH KOREA: MARKET SIZE & FORECAST

- 16.10 INDONESIA: MARKET SIZE & FORECAST

- 16.11 AUSTRALIA: MARKET SIZE & FORECAST

17 EUROPE

- 17.1 MARKET OVERVIEW

- 17.2 MARKET SIZE & FORECAST

- 17.3 END-USER

- 17.3.1 MARKET SIZE & FORECAST

- 17.4 PRODUCT

- 17.4.1 MARKET SIZE & FORECAST

- 17.5 KEY COUNTRIES

- 17.6 FRANCE: MARKET SIZE & FORECAST

- 17.7 GERMANY: MARKET SIZE & FORECAST

- 17.8 ITALY: MARKET SIZE & FORECAST

- 17.9 UK: MARKET SIZE & FORECAST

- 17.10 SPAIN: MARKET SIZE & FORECAST

18 NORTH AMERICA

- 18.1 MARKET OVERVIEW

- 18.2 MARKET SIZE & FORECAST

- 18.3 END-USER

- 18.3.1 MARKET SIZE & FORECAST

- 18.4 PRODUCT

- 18.4.1 MARKET SIZE & FORECAST

- 18.5 KEY COUNTRIES

- 18.6 US: MARKET SIZE & FORECAST

- 18.7 CANADA: MARKET SIZE & FORECAST

19 LATIN AMERICA

- 19.1 MARKET OVERVIEW

- 19.2 MARKET SIZE & FORECAST

- 19.3 END-USER

- 19.3.1 MARKET SIZE & FORECAST

- 19.4 PRODUCT

- 19.4.1 MARKET SIZE & FORECAST

- 19.5 KEY COUNTRIES

- 19.6 MEXICO: MARKET SIZE & FORECAST

- 19.7 BRAZIL: MARKET SIZE & FORECAST

- 19.8 REST OF LATIN AMERICA: MARKET SIZE & FORECAST

20 MIDDLE EAST AND AFRICA

- 20.1 MARKET OVERVIEW

- 20.2 MARKET SIZE & FORECAST

- 20.3 END-USER

- 20.3.1 MARKET SIZE & FORECAST

- 20.4 PRODUCT

- 20.4.1 MARKET SIZE & FORECAST

- 20.5 KEY COUNTRIES

- 20.6 TURKEY: MARKET SIZE & FORECAST

- 20.7 EGYPT: MARKET SIZE & FORECAST

- 20.8 SAUDI ARABIA: MARKET SIZE & FORECAST

- 20.9 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE & FORECAST

21 COMPETITIVE LANDSCAPE

- 21.1 COMPETITION OVERVIEW

22 KEY COMPANY PROFILES

- 22.1 ARDAGH GROUP

- 22.1.1 BUSINESS OVERVIEW

- 22.1.2 PRODUCT OFFERINGS

- 22.1.3 KEY STRATEGIES

- 22.1.4 KEY STRENGTHS

- 22.1.5 KEY OPPORTUNITY

- 22.2 AMCOR

- 22.2.1 BUSINESS OVERVIEW

- 22.2.2 PRODUCT OFFERINGS

- 22.2.3 KEY STRATEGIES

- 22.2.4 KEY STRENGTHS

- 22.2.5 KEY OPPORTUNITIES

- 22.3 APTARGROUP

- 22.3.1 BUSINESS OVERVIEW

- 22.3.2 PRODUCT OFFERINGS

- 22.3.3 KEY STRATEGIES

- 22.3.4 KEY STRENGTHS

- 22.3.5 KEY OPPORTUNITY

- 22.4 BERLIN PACKAGING

- 22.4.1 BUSINESS OVERVIEW

- 22.4.2 PRODUCT OFFERINGS

- 22.4.3 KEY STRATEGIES

- 22.4.4 KEY STRENGTHS

- 22.4.5 KEY OPPORTUNITY

- 22.5 GERRESHEIMER

- 22.5.1 BUSINESS OVERVIEW

- 22.5.2 PRODUCT OFFERINGS

- 22.5.3 KEY STRATEGIES

- 22.5.4 KEY STRENGTHS

- 22.5.5 KEY OPPORTUNITY

- 22.6 HEINZ-GLAS

- 22.6.1 BUSINESS OVERVIEW

- 22.6.2 PRODUCT OFFERINGS

- 22.6.3 KEY STRATEGIES

- 22.6.4 KEY STRENGTHS

- 22.6.5 KEY OPPORTUNITY

- 22.7 NIHON YAMAMURA GLASS

- 22.7.1 BUSINESS OVERVIEW

- 22.7.2 PRODUCT OFFERINGS

- 22.7.3 KEY STRATEGIES

- 22.7.4 KEY STRENGTHS

- 22.7.5 KEY OPPORTUNITIES

- 22.8 O-I GLASS

- 22.8.1 BUSINESS OVERVIEW

- 22.8.2 PRODUCT OFFERINGS

- 22.8.3 KEY STRATEGIES

- 22.8.4 KEY STRENGTHS

- 22.8.5 KEY OPPORTUNITY

- 22.9 PIRAMAL

- 22.9.1 BUSINESS OVERVIEW

- 22.9.2 PRODUCT OFFERINGS

- 22.9.3 KEY STRATEGIES

- 22.9.4 KEY STRENGTHS

- 22.9.5 KEY OPPORTUNITIES

- 22.10 VERALLIA

- 22.10.1 BUSINESS OVERVIEW

- 22.10.2 PRODUCT OFFERINGS

- 22.10.3 KEY STRATEGIES

- 22.10.4 KEY STRENGTHS

- 22.10.5 KEY OPPORTUNITIES

- 22.11 VIDRALA

- 22.11.1 BUSINESS OVERVIEW

- 22.11.2 PRODUCT OFFERINGS

- 22.11.3 KEY STRATEGIES

- 22.11.4 KEY STRENGTHS

- 22.11.5 KEY OPPORTUNITY

23 OTHER PROMINENT VENDORS

- 23.1 AAPL

- 23.1.1 BUSINESS OVERVIEW

- 23.1.2 PRODUCT OFFERINGS

- 23.2 AGI GLASPAC

- 23.2.1 BUSINESS OVERVIEW

- 23.2.2 PRODUCT OFFERINGS

- 23.3 BA GLASS

- 23.3.1 BUSINESS OVERVIEW

- 23.3.2 PRODUCT OFFERINGS

- 23.4 BEATSON CLARK

- 23.4.1 BUSINESS OVERVIEW

- 23.4.2 PRODUCT OFFERINGS

- 23.5 BORMIOLI LUIGI

- 23.5.1 BUSINESS OVERVIEW

- 23.5.2 PRODUCT OFFERINGS

- 23.6 GROUPE POCHET

- 23.6.1 BUSINESS OVERVIEW

- 23.6.2 PRODUCT OFFERINGS

- 23.7 HINDUSTAN NATIONAL GLASS & INDUSTRIES LIMITED

- 23.7.1 BUSINESS OVERVIEW

- 23.7.2 PRODUCT OFFERINGS

- 23.8 KOA GLASS

- 23.8.1 BUSINESS OVERVIEW

- 23.8.2 PRODUCT OFFERINGS

- 23.9 MIDDLE EAST GLASS

- 23.9.1 BUSINESS OVERVIEW

- 23.9.2 PRODUCT OFFERINGS

- 23.10 NIPRO

- 23.10.1 BUSINESS OVERVIEW

- 23.10.2 PRODUCT OFFERINGS

- 23.11 SAVERGLASS

- 23.11.1 BUSINESS OVERVIEW

- 23.11.2 PRODUCT OFFERINGS

- 23.12 SCHOTT

- 23.12.1 BUSINESS OVERVIEW

- 23.12.2 PRODUCT OFFERINGS

- 23.13 SHANDONG PROVINCE MEDICINAL GLASS

- 23.13.1 BUSINESS OVERVIEW

- 23.13.2 PRODUCT OFFERINGS

- 23.14 SISECAM

- 23.14.1 BUSINESS OVERVIEW

- 23.14.2 PRODUCT OFFERINGS

- 23.15 SGD PHARMA

- 23.15.1 BUSINESS OVERVIEW

- 23.15.2 PRODUCT OFFERINGS

- 23.16 STOELZLE GLASS GROUP

- 23.16.1 BUSINESS OVERVIEW

- 23.16.2 PRODUCT OFFERINGS

- 23.17 TOYO SEIKAN GROUP HOLDINGS

- 23.17.1 BUSINESS OVERVIEW

- 23.17.2 PRODUCT OFFERINGS

- 23.18 VETROPACK

- 23.18.1 BUSINESS OVERVIEW

- 23.18.2 PRODUCT OFFERINGS

- 23.19 VITRO, S.A.B. DE C.V.

- 23.19.1 BUSINESS OVERVIEW

- 23.19.2 PRODUCT OFFERINGS

- 23.20 WIEGAND-GLAS

- 23.20.1 BUSINESS OVERVIEW

- 23.20.2 PRODUCT OFFERINGS

- 23.21 ZIGNAGO VETRO

- 23.21.1 BUSINESS OVERVIEW

- 23.21.2 PRODUCT OFFERINGS

24 REPORT SUMMARY

- 24.1 KEY TAKEAWAYS

- 24.2 STRATEGIC RECOMMENDATIONS

25 QUANTITATIVE SUMMARY

- 25.1 MARKET BY GEOGRAPHY

- 25.2 MARKET BY PRODUCT

- 25.2.1 MARKET SIZE & FORECAST

- 25.3 MARKET BY END-USER

- 25.3.1 MARKET SIZE & FORECAST

- 25.4 NORTH AMERICA

- 25.4.1 PRODUCT: MARKET SIZE & FORECAST

- 25.4.2 END-USER: MARKET SIZE & FORECAST

- 25.5 LATIN AMERICA

- 25.5.1 PRODUCT: MARKET SIZE & FORECAST

- 25.5.2 END-USER: MARKET SIZE & FORECAST

- 25.6 APAC

- 25.6.1 PRODUCT: MARKET SIZE & FORECAST

- 25.6.2 END-USER: MARKET SIZE & FORECAST

- 25.7 EUROPE

- 25.7.1 PRODUCT: MARKET SIZE & FORECAST

- 25.7.2 END-USER: MARKET SIZE & FORECAST

- 25.8 MIDDLE EAST AND AFRICA

- 25.8.1 PRODUCT: MARKET SIZE & FORECAST

- 25.8.2 END-USER: MARKET SIZE & FORECAST

26 APPENDIX

- 26.1 ABBREVIATIONS