|

|

市場調査レポート

商品コード

1372013

機能性食品・飲料の世界市場、2030年までの市場予測:タイプ別、成分別、用途別、流通チャネル別、地域別の世界分析Functional Food and Beverages Market Forecasts to 2030 - Global Analysis By Type, By Ingredient, Application, Distribution Channel and By Geography |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 機能性食品・飲料の世界市場、2030年までの市場予測:タイプ別、成分別、用途別、流通チャネル別、地域別の世界分析 |

|

出版日: 2023年10月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の機能性食品・飲料市場は2023年に3,587億4,000万米ドルを占め、2030年には7,686億2,000万米ドルに達すると予測され、予測期間中にCAGR 11.5%で成長する見込みです。

特定の栄養素や成分で強化され、さらなる健康上のメリットを提供する食品・飲料は、機能性食品・飲料と呼ばれます。これらの製品は多くの場合、特定の健康上の懸念に対処したり、特定の身体機能をサポートしたり、生活の質を向上させたりするために作られます。機能性食品や飲料には、腸の健康のためのプロバイオティクス・ヨーグルトや、ビタミンやミネラルを添加した強化シリアルなど、幅広い商品が含まれます。

国連食糧農業機関(FAO)によると、2050年には、特に栄養価の高い食品に対する世界の需要は2013年の2倍になります。

栄養豊富で健康的な食生活への需要の高まり

健康的で栄養豊富な食生活に対する需要の増加は、機能性食品・飲料市場の重要な促進要因です。消費者の健康意識が高まるにつれて、基本的な栄養補給だけでなく特定の健康上のメリットも提供する製品を求めるようになります。この需要に拍車をかけているのは、病気の予防や活力の向上など、食生活と全般的な健康の関連性に対する意識の高まりです。さらに、ビタミン、ミネラル、抗酸化物質、およびプロバイオティクスやオメガ 3脂肪酸のような有益な成分を豊富に含む機能性食品・飲料は、こうした消費者の嗜好に応えるものであり、積極的な健康管理と予防的栄養摂取を目指す広範な動向と一致しています。

高い製品コスト

高い製品コストが機能性食品・飲料市場を制限すると予想されます。機能性製品の開発、製剤化、生産には特殊な原料や工程が必要とされることが多く、標準的な飲食品よりも高価になります。消費者はこうした高価格の商品への投資をためらい、潜在的な市場の限界につながる可能性があります。さらに、価格の障壁は一部の人口集団にとって市場へのアクセスを妨げ、健康に焦点を当てた製品を食生活に取り入れる能力に影響を与える可能性があります。

成長を支える新製品開発とイノベーション

健康と栄養に関する理解が日進月歩で進む中、特定の健康上の懸念に対応し、変化する消費者の嗜好に応える、科学的裏付けのある斬新な製品を生み出す余地があります。パーソナライズされた栄養や機能性スーパーフードなど、革新的な成分、製剤、供給方法に対する需要は拡大し続けています。さらに、独創的なマーケティングとともに研究開発に投資する企業は、ユニークで魅力的な機能性製品を提供することでこの機会を活用し、食生活の選択を通じてより良い健康を求める消費者の欲求の高まりに応え、市場拡大を促進することができます。

高い規制基準

厳しい規制要件は、機能性食品・飲料市場に大きな脅威をもたらします。健康強調表示、ラベリング、安全基準の複雑で進化する性質は、新製品を発売しようとするメーカーにハードルをもたらす可能性があります。こうした規制の遵守には時間とコストがかかり、技術革新や製品開発を阻害する可能性があります。また、製品の主張や効能について消費者が懐疑的になる可能性もあります。さらに、これらの規制を乗り切るには、調査、試験、法的専門知識への多大な投資が必要となるため、中小企業の参入を妨げ、市場参入を制限し、最終的に業界の成長と競争力を阻害する可能性があります。

COVID-19の影響

機能性食品・飲料市場は、COVID-19の大流行によって大きな影響を受けました。COVID-19の流行は消費者の健康とウェルネスに対する意識を高め、防衛機構、一般的な健康、ウェルビーイングを高める商品への需要を煽っています。免疫系を強化する抗酸化物質やビタミンを含む機能性食品の人気が高まっています。さらに、体力増進を促す機能性成分を含む食品や飲料の需要が一時的に減少しました。こうした課題にもかかわらず、この分野は消費者の嗜好の変化や市場力学の変化に適応することで回復力を示しました。

予測期間中、健康・ウェルネス分野が最大となる見込み

予測期間中、健康・ウェルネス分野が最大の市場シェアを占めると予想されます。この優位性は主に、消費者の健康への関心の高まり、予防医学、バランスの取れた食生活の追求によってもたらされます。必要な栄養素、抗酸化物質、健康成分で強化された機能性食品と飲食品は、この動向に完全に適合しています。こうした要因の結果、この分野は拡大しつつあり、健康を重視した食生活の選択へと大きくシフトしていることを示しています。

機能性飲料分野は予測期間中に最も高いCAGRが見込まれる

機能性飲料分野は、予測期間中、機能性食品・飲料市場で最も高い成長率を示すとみられます。この急成長の背景には、便利で健康志向の飲料オプションに対する消費者の嗜好の変化があります。機能性飲料は、水分補給から、エネルギー強化、体重管理、精神的健康といった特定の健康改善まで、幅広いメリットを提供します。さらに、市場では製品の配合、フレーバー、パッケージングに革新が見られ、こうした飲料の魅力がますます高まっています。加えて、機能性飲料の利便性と携帯性は現代のライフスタイルにマッチしており、市場の成長軌道においてその優位性が予測される一因となっています。

最大のシェアを占める地域

健康を気遣う消費者が栄養価の高い機能性成分を含む食品を選ぶ傾向が強まっていることから、北米地域が最大の市場シェアを占めると予想されます。この地域の食品市場は、バランスの取れた食生活を通じて身体的、精神的、および全体的な健康を維持することを重視する消費者の増加の結果として拡大しています。さらに、この地域には、機能性食品と飲料の分野で積極的に可能性を追求しているタイソンフーズ、ゼネラル・ミルズ、その他の活動を含む大手食品企業が存在するため、今後数年間の地域市場の成長をさらに後押しすることができます。

CAGRが最も高い地域

アジア太平洋の機能性食品・飲料市場は、同地域の多様な文化や人口が多種多様な料理の伝統や食の嗜好につながっているため、急速に拡大しています。近年では、欧米スタイルの食生活、簡便食品、加工食品や機能性食品の消費増加へのシフトが顕著です。健康的で自然な製品に対する需要が急増し、有機食品や植物由来の代替食品といった分野の成長を牽引しています。さらに、急増する中産階級人口と都市化が食品小売と流通の形を変えつつあり、これが市場の成長を後押ししています。

無料のカスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査源

- 1次調査源

- 2次調査源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- アプリケーション分析

- 新興市場

- 新型コロナウイルス感染症(COVID-19)の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の機能性食品・飲料市場:タイプ別

- 機能性食品

- ベーカリー製品

- 菓子類製品

- 乳製品

- 幼児用食品

- おやつ

- 全粒穀物

- その他の機能性食品

- 機能性飲料

- 抗酸化ドリンク

- 乳製品飲料

- エネルギー・ドリンク

- 強化ジュース

- スポーツドリンク

- その他の機能性飲料

第6章 世界の機能性食品・飲料市場:成分別

- カロテノイド

- アミノ酸

- 食物繊維

- 電解質

- 脂肪酸

- ミネラル

- プロバイオティクス

- その他の成分

第7章 世界の機能性食品・飲料市場:用途別

- 健康・ウェルネス

- 心臓の健康

- 臨床栄養学

- 消化器の健康

- 免疫

- スポーツ栄養学

- 体重管理

- その他の用途

第8章 世界の機能性食品・飲料市場:流通チャネル別

- スーパーマーケットとハイパーマーケット

- コンビニエンスストア

- eコマース

- その他の流通チャネル

第9章 世界の機能性食品・飲料市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他のアジア太平洋

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他の中東・アフリカ

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイル

- Arla Foods

- Celsius Holding, Inc.

- Danone S.A.

- Fonterra Co-operative Group Limited

- General Mills Inc.

- Glanbia Plc

- Hearthside Food Solutions LLC

- Kraft Heinz Company

- Nestle S.A

- PepsiCo Inc.

- Red Bull GmbH

- Suntory Holdings Ltd

- The Bountiful Company

- The Coca-Cola Company

- The Hain Celestial Group

- Tyson Foods Inc.

- Universal Nutrition

List of Tables

- Table 1 Global Functional Food and Beverages Market Outlook, By Region (2021-2030) ($MN)

- Table 2 Global Functional Food and Beverages Market Outlook, By Type (2021-2030) ($MN)

- Table 3 Global Functional Food and Beverages Market Outlook, By Functional Foods (2021-2030) ($MN)

- Table 4 Global Functional Food and Beverages Market Outlook, By Bakery Products (2021-2030) ($MN)

- Table 5 Global Functional Food and Beverages Market Outlook, By Confectionery Products (2021-2030) ($MN)

- Table 6 Global Functional Food and Beverages Market Outlook, By Dairy Products (2021-2030) ($MN)

- Table 7 Global Functional Food and Beverages Market Outlook, By Infant Food Products (2021-2030) ($MN)

- Table 8 Global Functional Food and Beverages Market Outlook, By Snacks (2021-2030) ($MN)

- Table 9 Global Functional Food and Beverages Market Outlook, By Whole Grains (2021-2030) ($MN)

- Table 10 Global Functional Food and Beverages Market Outlook, By Other Functional Foods (2021-2030) ($MN)

- Table 11 Global Functional Food and Beverages Market Outlook, By Functional Beverages (2021-2030) ($MN)

- Table 12 Global Functional Food and Beverages Market Outlook, By Antioxidant Drinks (2021-2030) ($MN)

- Table 13 Global Functional Food and Beverages Market Outlook, By Dairy-based Beverages (2021-2030) ($MN)

- Table 14 Global Functional Food and Beverages Market Outlook, By Energy Drinks (2021-2030) ($MN)

- Table 15 Global Functional Food and Beverages Market Outlook, By Fortified Juices (2021-2030) ($MN)

- Table 16 Global Functional Food and Beverages Market Outlook, By Sports Drinks (2021-2030) ($MN)

- Table 17 Global Functional Food and Beverages Market Outlook, By Other Functional Beverages (2021-2030) ($MN)

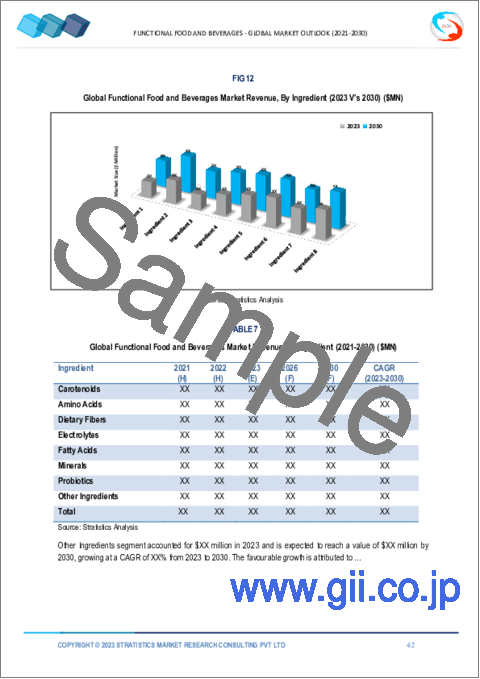

- Table 18 Global Functional Food and Beverages Market Outlook, By Ingredient (2021-2030) ($MN)

- Table 19 Global Functional Food and Beverages Market Outlook, By Carotenoids (2021-2030) ($MN)

- Table 20 Global Functional Food and Beverages Market Outlook, By Amino Acids (2021-2030) ($MN)

- Table 21 Global Functional Food and Beverages Market Outlook, By Dietary Fibers (2021-2030) ($MN)

- Table 22 Global Functional Food and Beverages Market Outlook, By Electrolytes (2021-2030) ($MN)

- Table 23 Global Functional Food and Beverages Market Outlook, By Fatty Acids (2021-2030) ($MN)

- Table 24 Global Functional Food and Beverages Market Outlook, By Minerals (2021-2030) ($MN)

- Table 25 Global Functional Food and Beverages Market Outlook, By Probiotics (2021-2030) ($MN)

- Table 26 Global Functional Food and Beverages Market Outlook, By Other Ingredients (2021-2030) ($MN)

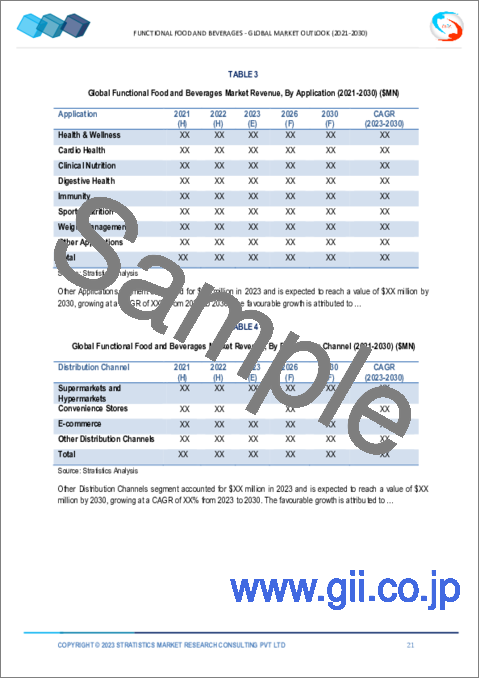

- Table 27 Global Functional Food and Beverages Market Outlook, By Application (2021-2030) ($MN)

- Table 28 Global Functional Food and Beverages Market Outlook, By Health & Wellness (2021-2030) ($MN)

- Table 29 Global Functional Food and Beverages Market Outlook, By Cardio Health (2021-2030) ($MN)

- Table 30 Global Functional Food and Beverages Market Outlook, By Clinical Nutrition (2021-2030) ($MN)

- Table 31 Global Functional Food and Beverages Market Outlook, By Digestive Health (2021-2030) ($MN)

- Table 32 Global Functional Food and Beverages Market Outlook, By Immunity (2021-2030) ($MN)

- Table 33 Global Functional Food and Beverages Market Outlook, By Sports Nutrition (2021-2030) ($MN)

- Table 34 Global Functional Food and Beverages Market Outlook, By Weight Management (2021-2030) ($MN)

- Table 35 Global Functional Food and Beverages Market Outlook, By Other Applications (2021-2030) ($MN)

- Table 36 Global Functional Food and Beverages Market Outlook, By Distribution Channel (2021-2030) ($MN)

- Table 37 Global Functional Food and Beverages Market Outlook, By Supermarkets and Hypermarkets (2021-2030) ($MN)

- Table 38 Global Functional Food and Beverages Market Outlook, By Convenience Stores (2021-2030) ($MN)

- Table 39 Global Functional Food and Beverages Market Outlook, By E-commerce (2021-2030) ($MN)

- Table 40 Global Functional Food and Beverages Market Outlook, By Other Distribution Channels (2021-2030) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Functional Food and Beverages Market is accounted for $358.74 billion in 2023 and is expected to reach $768.62 billion by 2030 growing at a CAGR of 11.5% during the forecast period. Foods and drinks that have been enhanced with particular nutrients or ingredients to offer additional health benefits are referred to as functional foods and beverages. These products are often created to address particular health concerns, support specific bodily functions, or improve the quality of life. Functional foods and beverages can include a wide range of items, such as probiotic yogurt for gut health and fortified cereals with added vitamins and minerals.

According to the Food and Agriculture Organization (FAO), in 2050, the global demand for food, particularly nutrient-rich, will be twice as compared to 2013.

Market Dynamics:

Driver:

Increasing demand for nutrition-rich and healthy diets

The increasing demand for healthy and nutrition-rich diets is a significant driver in the functional food and beverages market. As consumers become more health-conscious, they seek products that not only provide basic sustenance but also offer specific health benefits. This demand is fueled by a growing awareness of the link between diet and overall well-being, including disease prevention and improved vitality. Moreover, functional foods and beverages, enriched with vitamins, minerals, antioxidants, and beneficial ingredients like probiotics or omega-3 fatty acids, cater to these consumer preferences, aligning with a broader trend towards proactive health management and preventive nutrition.

Restraint:

High Product costs

High product costs are expected to limit the functional food and beverages market. The development, formulation, and production of functional products often require specialized ingredients and processes, making them more expensive than standard foods and beverages. Consumers may be hesitant to invest in these higher-priced items, leading to potential market limitations. Additionally, the price barrier can hinder the market's accessibility for some demographic groups, impacting their ability to incorporate health-focused products into their diets.

Opportunity:

New product developments and innovation to support growth

With an ever-evolving understanding of health and nutrition, there is room for creating novel, science-backed products that address specific health concerns and cater to changing consumer preferences. The demand for innovative ingredients, formulations, and delivery methods, such as personalized nutrition and functional superfoods, continues to grow. Furthermore, companies that invest in research and development, along with creative marketing, can tap into this opportunity by offering unique and appealing functional products, meeting the increasing consumer appetite for better health through dietary choices, and thus driving market expansion.

Threat:

High regulation standards

Stringent regulatory requirements pose a significant threat to the functional food and beverages market. The complex and evolving nature of health claims, labeling, and safety standards can create hurdles for manufacturers seeking to launch new products. Compliance with these regulations is time-consuming and costly, potentially stifling innovation and product development. It may also lead to consumer skepticism regarding product claims and efficacy. In addition, navigating these requirements demands a substantial investment in research, testing, and legal expertise, which can deter smaller players and limit market access, ultimately hampering the industry's growth and competitiveness.

COVID-19 Impact:

The functional food and beverage market was greatly impacted by the COVID-19 pandemic. It increased consumer awareness of health and wellness, which fueled demand for goods boosting defense mechanisms, general health, and wellbeing. Products that function and contain antioxidants and vitamins to strengthen the immune system have grown in popularity. In addition, there was a brief decline in demand for foods and drinks with functional ingredients that promote physical fitness. In spite of these challenges, the sector showed resiliency by adapting to shifting consumer preferences and market dynamics.

The health and wellness segment is expected to be the largest during the forecast period

In the anticipated timeframe, it is anticipated that the health and wellness segment will hold the largest market share. This dominance is mainly driven by consumers' growing attention to their health, preventive medicine, and pursuit of a balanced diet. Functional foods and beverages that are enhanced with necessary nutrients, antioxidants, and healthy ingredients fit in perfectly with this trend. As a result of these factors, this segment is expanding, signaling a significant shift towards dietary choices that are focused on health.

The functional beverages segment is expected to have the highest CAGR during the forecast period

The functional beverages segment is poised to experience the highest growth rate in the functional food and beverages market during the forecast period. This surge is driven by shifting consumer preferences towards convenient and health-conscious drink options. Functional beverages offer a wide range of benefits, from hydration to specific health improvements such as enhanced energy, weight management, and mental well-being. Additionally, the market has seen innovations in product formulations, flavors, and packaging, making these beverages increasingly appealing. In addition, the convenience and portability of functional drinks align well with modern lifestyles, contributing to their projected prominence in the market's growth trajectory.

Region with largest share:

The North American region is expected to witness the largest market share owing to growing numbers of consumers concerned about their health choosing foods that are high in nutritive and functional ingredients. The region's food market is expanding as a result of consumers' growing emphasis on maintaining good physical, mental, and overall health through a balanced diet. Additionally, the presence of major food corporations in the area, including Tyson Foods, General Mills, and others, who are actively pursuing their potential in the functional food and beverage space, can further support regional market growth in the upcoming years.

Region with highest CAGR:

The functional food and beverages market in Asia Pacific is expanding rapidly due to the region's diverse cultures and populations, which have led to a wide variety of culinary traditions and dietary preferences. In recent years, there has been a notable shift towards Western-style diets, convenience foods, and increased consumption of processed and functional foods. Demand for healthy and natural products has surged, driving growth in segments like organic foods and plant-based alternatives. Moreover, the burgeoning middle-class population and urbanization are reshaping food retail and distribution, which is propelling market growth.

Key players in the market:

Some of the key players in Functional Food and Beverages market: Arla Foods, Celsius Holding, Inc., Danone S.A., Fonterra Co-operative Group Limited, General Mills Inc., Glanbia Plc, Hearthside Food Solutions LLC, Kraft Heinz Company, Nestle S.A, PepsiCo Inc., Red Bull GmbH, Suntory Holdings Ltd, The Bountiful Company, The Coca-Cola Company, The Hain Celestial Group, Tyson Foods Inc. and Universal Nutrition.

Key Developments:

In May 2023, Kirin Holdings has partnered with Kellogg Japan to introduce a new addition to Kellogg's All-Bran portfolio, as it aims to support immune system health. According to Kirin, the new product can be enjoyed as a daily meal. In addition, the company highlights that this is the first 'meal'-type product containing L. lactis strain Plasma as a functional food, as opposed to a snack or side dish.

In May 2023, Functional frozen food manufacturer Blender Bites Ltd. is launching a line of frozen coffee-based beverages. The brand's 1-Step Frappes are designed to offer a nutritious and convenient beverage option for health-conscious consumers. Formulated from organic, dairy-free, gluten-free and functional ingredients, like collagen and lion's mane, each serving of the blended iced coffee includes 90 mg of caffeine and a combination of 12 vitamins and minerals.

In February 2023, Biotechnology company Kyowa Hakko USA and sparkling beverage company Centr debuted Centr Enhanced, a sparkling water that features a blend of nootropic and adaptogenic ingredients. The launch of Centr Enhanced marks the first time Centr is stepping outside of the CBD-related category. Centr Enhanced sparkling water includes Kyowa Hakko's Cognizin citicoline, which is a nutrient that supports "comprehensive brain health," according to the company. The product claims to elevate mood, to reduce stress, and to improve focus, mental clarity, memory and energy.

Types Covered:

- Functional Foods

- Functional Beverages

Ingredients Covered:

- Carotenoids

- Amino Acids

- Dietary Fibers

- Electrolytes

- Fatty Acids

- Minerals

- Probiotics

- Other Ingredients

Applications Covered:

- Health & Wellness

- Cardio Health

- Clinical Nutrition

- Digestive Health

- Immunity

- Sports Nutrition

- Weight Management

- Other Applications

Distribution Channels Covered:

- Supermarkets and Hypermarkets

- Convenience Stores

- E-commerce

- Other Distribution Channels

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Application Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Functional Food and Beverages Market, By Type

- 5.1 Introduction

- 5.2 Functional Foods

- 5.2.1 Bakery Products

- 5.2.2 Confectionery Products

- 5.2.3 Dairy Products

- 5.2.4 Infant Food Products

- 5.2.5 Snacks

- 5.2.6 Whole Grains

- 5.2.7 Other Functional Foods

- 5.3 Functional Beverages

- 5.3.1 Antioxidant Drinks

- 5.3.2 Dairy-based Beverages

- 5.3.3 Energy Drinks

- 5.3.4 Fortified Juices

- 5.3.5 Sports Drinks

- 5.3.6 Other Functional Beverages

6 Global Functional Food and Beverages Market, By Ingredient

- 6.1 Introduction

- 6.2 Carotenoids

- 6.3 Amino Acids

- 6.4 Dietary Fibers

- 6.5 Electrolytes

- 6.6 Fatty Acids

- 6.7 Minerals

- 6.8 Probiotics

- 6.9 Other Ingredients

7 Global Functional Food and Beverages Market, By Application

- 7.1 Introduction

- 7.2 Health & Wellness

- 7.3 Cardio Health

- 7.4 Clinical Nutrition

- 7.5 Digestive Health

- 7.6 Immunity

- 7.7 Sports Nutrition

- 7.8 Weight Management

- 7.9 Other Applications

8 Global Functional Food and Beverages Market, By Distribution Channel

- 8.1 Introduction

- 8.2 Supermarkets and Hypermarkets

- 8.3 Convenience Stores

- 8.4 E-commerce

- 8.5 Other Distribution Channels

9 Global Functional Food and Beverages Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 Arla Foods

- 11.2 Celsius Holding, Inc.

- 11.3 Danone S.A.

- 11.4 Fonterra Co-operative Group Limited

- 11.5 General Mills Inc.

- 11.6 Glanbia Plc

- 11.7 Hearthside Food Solutions LLC

- 11.8 Kraft Heinz Company

- 11.9 Nestle S.A

- 11.10 PepsiCo Inc.

- 11.11 Red Bull GmbH

- 11.12 Suntory Holdings Ltd

- 11.13 The Bountiful Company

- 11.14 The Coca-Cola Company

- 11.15 The Hain Celestial Group

- 11.16 Tyson Foods Inc.

- 11.17 Universal Nutrition