|

|

市場調査レポート

商品コード

1858530

アクセス制御の世界市場:提供別、ACaaS別、業界別、地域別 - 予測(~2030年)Access Control Market by Offering (Hardware - Card-based, Biometric & Multi-technology Readers, Electronics Locks, Controllers; Software; Services), ACaaS (Hosted, Managed, Hybrid), Vertical and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| アクセス制御の世界市場:提供別、ACaaS別、業界別、地域別 - 予測(~2030年) |

|

出版日: 2025年10月04日

発行: MarketsandMarkets

ページ情報: 英文 263 Pages

納期: 即納可能

|

概要

世界のアクセス制御の市場規模は、2025年に推定106億2,000万米ドルであり、2030年までに158億米ドルに達すると予測され、CAGRで8.3%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル |

| セグメント | 提供、業界、ACaaS、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

学校、病院、ショッピングモール、企業などの新しいインフラにはより強固なセキュリティが必要であるため、新興経済圏における急速な都市化が先進のアクセス制御ソリューションの需要を促進しています。この急増は、住宅部門と商業部門での生体認証システムやスマートロックの採用に拍車をかけています。同時に、ACaaS(Access Control as a Service)に対する選好の高まりは、費用対効果が高く柔軟で拡張可能なセキュリティモデルを提供し、企業がダイナミックな都市環境に適応しながら業務を合理化することを可能にしています。

「カードリーダーセグメントが2030年に最大の市場シェアを占めると推定されます。」

カードリーダーは、その広範な採用、費用対効果、業界を問わない汎用性から、2030年までアクセス制御市場全体で最大のシェアを占めると予測されています。カードは、本人確認に用いるもっとも一般的で便利な認証情報として機能し、組織が事前に定義された権利に基づいてアクセスを許可または制限することを可能にします。このセグメントでは、非接触型スマートカードへの選好の高まりに後押しされ、スマートカードリーダーが支配的な技術として台頭しています。これらのカードは、磁気ストライプカードや近接カードに比べ、信頼性が高く、セキュリティが強化され、メンテナンスが大幅に少なく済みます。従業員の行動をモニターし記録するためにスマートカードが使用されるようになったことで、企業における需要がさらに高まり、セキュリティと従業員管理の両方の利点が提供されています。加えて、スマートカードリーダーはマルチテクノロジーソリューションとの互換性があるため、バイオメトリクスやモバイル認証情報とのスムーズな統合が可能で、ハイブリッドセキュリティインフラにおける関連性が高まっています。その採用は、商業、BFSI、医療、政府、エンターテインメント、メディアといった幅広い業界に及んでおり、最新のアクセスシステムに不可欠なものとなっています。コスト効率、信頼性、適応性の組み合わせにより、カードリーダーは2030年まで最大の市場シェアを維持します。

「アジア太平洋が予測期間にアクセス制御市場でもっとも高いCAGRを記録する見込みです。」

アジア太平洋は、急速な都市化、インフラ開発、スマートシティ構想により、予測期間にアクセス制御市場でもっとも高いCAGRで成長する見込みです。中国、インド、日本、韓国などの国々は、都市インフラ、交通システム、商業施設の近代化に多額の投資を行っており、先進のセキュリティソリューションに対する強い需要を生み出しています。新興経済圏における工業化と製造拠点の急増も、資産と労働者を保護するための電子ロック、カードリーダー、生体認証システムの採用を推進しています。犯罪率、データセキュリティ、職場の安全性に対する懸念の高まりは、住宅、商業、政府部門全体で信頼性の高いアクセス制御システムへのニーズを加速させています。加えて、この地域で急成長を示しているBFSI、医療、小売産業では、ID管理を強化するバイオメトリックリーダーやマルチテクノロジーリーダーの導入が進んでいます。クラウドコンピューティングとIoTベースのセキュリティシステムの普及は、企業がACaaS(Access Control as a Service)のようなスケーラブルで費用対効果の高いソリューションを求める中、さらなる機会をもたらしています。人口が多く、可処分所得が増加し、スマートインフラを推進する政府の政策が支持されているアジア太平洋は、計り知れない成長可能性を秘めています。これらの要因により、世界のアクセス制御市場におけるこの地域の急速な拡大が促進されます。

当レポートでは、世界のアクセス制御市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- アクセス制御市場の企業にとって魅力的な機会

- アクセス制御市場:提供別

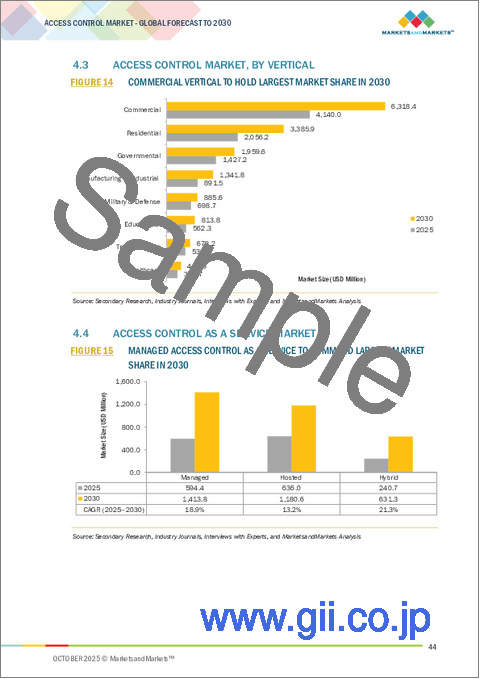

- アクセス制御市場:業界別

- ACaaS市場

- アクセス制御市場:地域別

- アクセス制御市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 市場企業のビジネスに影響を与える動向/混乱

- エコシステム/市場マップ

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ(HSコード847190)

- 輸出シナリオ

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 政府規制

- 規制機関、政府機関、その他の組織

- 標準

- 価格設定の分析

- ACaaSの平均販売価格:主要企業別

- 平均販売価格:地域別

- AIの影響

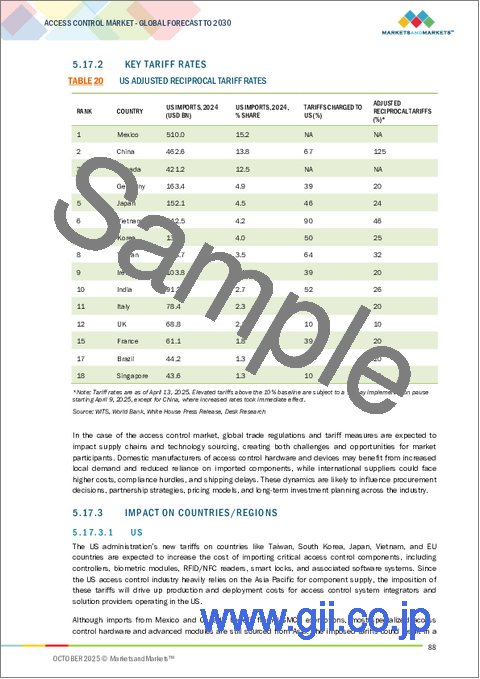

- 2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 国/地域への影響

- 業界への影響

第6章 アクセス制御システムのタイプ

- イントロダクション

- 物理アクセス制御システム

- 論理アクセス制御システム

- モバイルアクセス制御システム

第7章 アクセス制御モデル

- イントロダクション

- 裁量アクセス制御モデル

- 必須アクセス制御モデル

- ロールベースアクセス制御モデル

- ルールベースアクセス制御モデル

- 属性ベースアクセス制御モデル

- リスク適応型アクセス制御モデル

- IDベースアクセス制御モデル

第8章 アクセス制御市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第9章 ACaaS市場

- イントロダクション

- ACaaS

- ホスト

- マネージド

- ハイブリッド

第10章 アクセス制御市場:業界別

- イントロダクション

- 商業

- 軍事・防衛

- 政府

- 住宅

- 教育

- 医療

- 製造・工業

- 輸送

第11章 アクセス制御市場:地域別

- イントロダクション

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済の見通し

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- マクロ経済の見通し

- 中東・アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析(2024年)

- 主要企業の収益分析(2022年~2024年)

- 企業の評価と財務指標(2025年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業

- 企業の評価マトリクス:スタートアップ企業/中小企業

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ASSA ABLOY

- DORMAKABA GROUP

- JOHNSON CONTROLS

- ALLEGION PLC

- HONEYWELL INTERNATIONAL INC.

- HIRSCH SECURE, INC.

- NEDAP N.V.

- SUPREMA INC.

- KEENFINITY

- THALES

- その他の主要企業

- AMAG

- AXIS COMMUNICATIONS AB

- GUNNEBO SAFE STORAGE AB

- NEC CORPORATION

- GALLAGHER GROUP LIMITED

- BRIVO SYSTEMS, LLC

- SALTO SYSTEMS, S.L.

- IDEMIA

- VANDERBILT INDUSTRIES

- CANSEC SYSTEMS LTD.

- SECURITAS TECHNOLOGY

- DATAWATCH SYSTEMS

- TELCRED

- FORCEFIELD SECURITY

- KISI INC.