|

|

市場調査レポート

商品コード

1788520

自動車テレマティクスの世界市場:サービス別、接続性別、車両タイプ別、形式別、提供別、EVタイプ別、アフターマーケット別、地域別 - 予測(~2032年)Automotive Telematics Market by Service (E-call, Remote Diagnostics, IRA, SVA), Connectivity (Cellular, Satellite), Vehicle Type (PC, LCV, Bus, Truck), Form Type, Offering, EV Type, Aftermarket, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 自動車テレマティクスの世界市場:サービス別、接続性別、車両タイプ別、形式別、提供別、EVタイプ別、アフターマーケット別、地域別 - 予測(~2032年) |

|

出版日: 2025年08月07日

発行: MarketsandMarkets

ページ情報: 英文 367 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

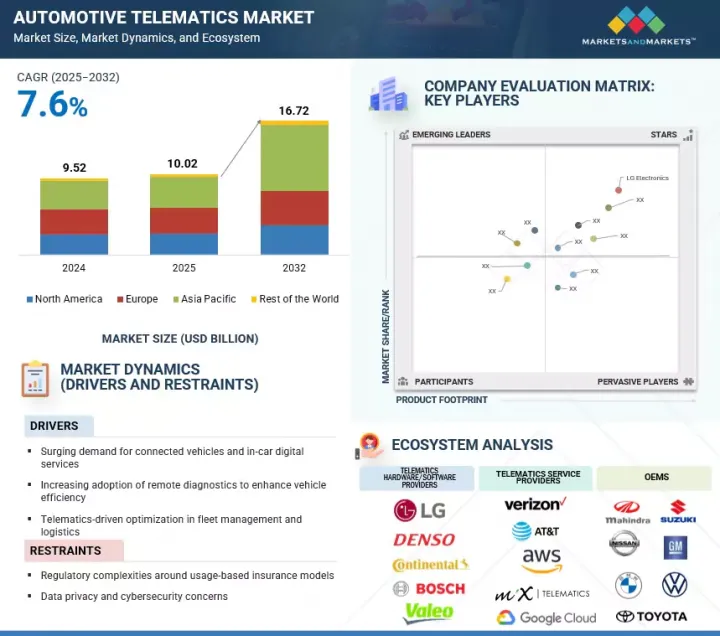

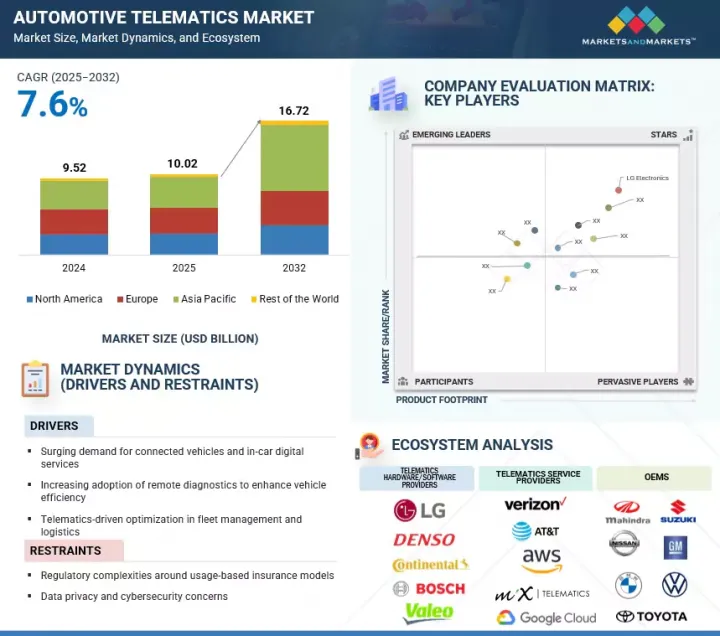

世界の自動車テレマティクスの市場規模は、2025年の100億2,000万米ドルから2032年までに167億2,000万米ドルに達すると予測され、CAGRで7.6%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | サービス、車両タイプ、形式、フリート管理サービス、提供、車両タイプ(アフターマーケット)、EVサービス、EVタイプ、接続性、地域 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

5Gネットワークの展開は、自動運転とインテリジェント交通システムに不可欠な要素であるV2X通信に不可欠な、より高速で低遅延な接続を可能にすることで、自動車システムを大幅に進化させています。この強化された接続性により、テレマティクスプラットフォームは、危険警告、協調運転、スマート交通調整などの機能に利用するリアルタイムデータ交換をサポートすることができます。テレマティクスシステムにエッジコンピューティングを採用することで、さらに重要な車両データをオンボードで直接リアルタイム処理できるようになり、安全性とナビゲーション機能の応答性が向上します。AIと機械学習がテレマティクスプラットフォームにますます統合され、ルートの最適化、ドライバーの行動の分析、事故の早期発見などの予測的考察が可能になります。また、センサーの統合やCANバスなどの通信プロトコルの改良により、より正確なデータ収集が可能になる一方、サイバーセキュリティへの注目が高まることで、コネクテッド化が進む車両における脅威からのより強力な保護が確保されています。

組み込みテレマティクスが予測期間に自動車テレマティクス市場で圧倒的なシェアを占める見込みです。

組み込みテレマティクスは自動車のシステムに直接組み込まれ、OEMは工場自体に接続された機能を提供することができるため、自動車テレマティクス市場で最大のシェアを占めると予測されます。欧州と中国の規制も、エネルギー使用と車両の安全性をモニターするために、工場で搭載されるテレマティクスを要求しています。中国では、NEV-NMP(New Energy Vehicle National Monitoring Platform)により、すべての電気自動車・ハイブリッド車に対して、バッテリーの状態、車両の位置情報、アラートなどのデータを政府の集中プラットフォームにリアルタイムで送信することが義務付けられているため、組み込みテレマティクスはコンプライアンス上不可欠となっています。さらに、組み込みテレマティクスは、自動車メーカーがサブスクリプションベースのサービスを提供し、車両データを新たな収益機会に活用するクローズドなエコシステムを構築するのに役立ちます。EVやADAS(先進運転支援システム)搭載車への需要の高まりは、統合されたソフトウェアベースのテレマティクスへのニーズを高めています。OEMはまた、組み込みテレマティクスをクラウドやエッジコンピューティングと組み合わせ、リアルタイムのデータ処理やより優れたサービス提供をサポートするハイブリッドシステムへと移行しています。GMのOnStar、HyundaiのBlueLink、Toyotaのi-Connectはいずれも、リアルタイムナビゲーション、遠隔診断、OTAアップデートなどの機能を提供しています。例えば、Volkswagen Group(ドイツ)は2024年11月、CARIADと共同でフリートインターフェースデータソリューションを展開し、Volkswagen、Audi、Skoda、Cupraなどのブランドのフリート顧客に組み込みテレマティクスを提供しています。このプラットフォームは、テレマティクスハードウェアを追加することなく、走行距離、残走行距離、警告信号、今後のサービスの必要性などをほぼリアルタイムで把握することができます。これらの要因は、組み込みテレマティクスシステムの成長を大きく後押しすると予測されます。

ハードウェアセグメントが予測期間に自動車テレマティクス市場を主導する見込みです。

ハードウェアが自動車テレマティクス市場で圧倒的なシェアを占めると予測されます。テレマティクスコントロールユニット(TCU)、センサー、アンテナ、CANバス、通信モジュール、エレクトロニックコントロールユニット(ECU)などの主要コンポーネントは、車両の接続性とデータ交換を可能にする上で不可欠です。車両のソフトウェアデファインド化が進むにつれて、OTAアップデート、組み込みサイバーセキュリティ、高速データ処理に対応できる強力で柔軟なハードウェアに対するニーズが高まっています。

当レポートでは、世界の自動車テレマティクス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 自動車テレマティクス市場の企業にとって魅力的な機会

- 自動車テレマティクス市場:サービス別

- 自動車テレマティクス市場:形式別

- 自動車テレマティクス市場:提供別

- 電気自動車・ハイブリッド車テレマティクス市場:車両タイプ別

- 電気自動車・ハイブリッド車テレマティクス市場:サービス別

- 自動車テレマティクス市場:車両タイプ別

- 自動車テレマティクス市場:接続性別

- 自動車テレマティクスアフターマーケット:車両タイプ別

- 自動車テレマティクス市場:フリート管理サービス別

- 自動車テレマティクス市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 市場力学の影響の分析

- 価格設定の分析

- テレマティクスコントロールユニットの参考価格:主要企業別(2024年)

- テレマティクスコントロールユニットの平均販売価格:地域別(2022年~2024年)

- エコシステム分析

- OEM

- テレマティクスハードウェア/ソフトウェアサプライヤー

- クラウドサービスプロバイダー

- 衛星ナビゲーションプロバイダー

- 通信サービスプロバイダー

- VAS企業

- サプライチェーン分析

- ケーススタディ分析

- UFFIZIO、廃棄物収集からロジスティクスまで、各クライアントタイプに合わせてダッシュボード、ユーザーロール、ワークフローを構成するフリート追跡プラットフォームを提供

- ITRIANGLEのVFOTA搭載テレマティクスソリューションによる、車両のメンテナンスと性能の革新

- ITRIANGLE、シームレスインテリジェント診断ソリューションとしてOBD IIデバイスを導入

- ITRIANGLE、OEMトラックプラットフォームへの統合向けにカスタマイズされた堅牢なTCUを展開

- ITRIANGLE、IOCLの要件に合わせた堅牢かつ拡張性の高いテレマティクスソリューションを実装

- VODAFONE、リアルタイムのエンジン診断、運転時間、燃料データ、位置情報を取得するデバイスを搭載し、フリートアナリティクスソリューションを展開

- Vodafone、自社のフリートアナリティクスプラットフォームをProgetti del cuoreのフリート全体に展開

- ATWELL、GEOTABのフリート管理プラットフォームを採用し、フリートの安全性を高め、車両利用率を向上

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- イントロダクション

- 主要技術

- 補完技術

- 隣接技術

- サプライヤー分析

- 各OEMのテレマティクスデータプラン:地域別

- 北米

- 欧州

- HSコード

- 輸入シナリオ

- 輸出シナリオ

- 関税と規制情勢

- 関税データ

- 規制機関、政府機関、その他の組織

- 主な規制

- 主な会議とイベント(2025年~2026年)

- 主なステークホルダーと購入基準

- カスタマービジネスに影響を与える動向/混乱

- 生成AIの影響

- フリート管理テレマティクスにおけるAI

- 保険テレマティクスにおけるAI

- コネクテッドカーサービスにおけるAI

- インドの自動車テレマティクス市場の動向に関するMNMの知見

- IoT統合

- AIと機械学習

- 5G接続

- クラウドコンピューティングとデータプラットフォーム

- 車車間通信(V2X)

- テレマティクスデータ向けブロックチェーン

- ビデオストリーミングとテレマティクスカメラ

- 先進運転支援(ADAS)

- 自動道路支援(ARAS)

- サイバーセキュリティ

- 自動車テレマティクスアーキテクチャに関するMNMの知見

- 二輪車

- 四輪車

第6章 自動車テレマティクス市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- バス

- トラック

- 重要な知見

第7章 自動車テレマティクス市場:形式別

- イントロダクション

- 組み込み

- 統合

- 重要な知見

第8章 自動車テレマティクス市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- 重要な知見

第9章 自動車テレマティクス市場:接続性別

- イントロダクション

- 衛星

- セルラー

- 5G

- 4G

- 2G/3G

- 重要な知見

第10章 自動車テレマティクス市場:フリート管理サービス別

- イントロダクション

- 運用管理

- 車両のメンテナンス、診断

- フリートアナリティクス、報告

- その他

- 重要な知見

第11章 自動車テレマティクス市場:サービス別

- イントロダクション

- 緊急通報

- 路上支援

- 遠隔診断

- 保険リスク評価

- 盗難車両支援

- その他

- 重要な知見

第12章 電気自動車・ハイブリッド車テレマティクス市場:車両タイプ別

- イントロダクション

- バッテリー電気自動車(BEV)

- 燃料電池電気自動車(FCEV)

- プラグインハイブリッド電気自動車(PHEV)

- 重要な知見

第13章 電気自動車・ハイブリッド車テレマティクス市場:サービス別

- イントロダクション

- 緊急通報

- 路上支援

- 遠隔診断

- 保険リスク評価

- 盗難車両支援

- その他

- 重要な知見

第14章 自動車テレマティクスアフターマーケット:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 重要な知見

第15章 自動車テレマティクス市場:地域別

- イントロダクション

- アジア太平洋

- マクロ経済の見通し

- 中国

- インド

- 日本

- 韓国

- タイ

- その他のアジア太平洋

- 欧州

- ミクロ経済の見通し

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- 英国

- その他の欧州

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- メキシコ

- その他の地域

- マクロ経済の見通し

- ブラジル

- 南アフリカ

- イラン

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 世界のテレマティクスコントロールユニットプロバイダーの市場シェア分析(2024年)

- インドのテレマティクスコントロールユニットプロバイダーの市場シェア分析(2024年)

- 上場企業/上場企業の収益分析(2024年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第17章 企業プロファイル

- 主要企業

- LG ELECTRONICS

- HARMAN INTERNATIONAL

- DENSO CORPORATION

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- APTIV

- VISTEON CORPORATION

- MARELLI HOLDINGS CO., LTD.

- VALEO

- INFINEON TECHNOLOGIES AG

- FICOSA INTERNACIONAL SA

- AT&T INTELLECTUAL PROPERTY

- VERIZON

- BRIDGESTONE MOBILITY SOLUTIONS B.V.

- インドの主要企業

- ITRIANGLE INFOTECH PVT LTD

- CE INFO SYSTEMS LTD

- ATLANTA SYSTEMS PVT. LTD.

- BLACKBOX GPS TECHNOLOGY

- ROSMERTA

- その他の企業

- ADDSECURE

- PANASONIC CORPORATION

- GARMIN LTD.

- POWERFLEET

- TRIMBLE INC.

- CALAMP

- THE DESCARTES SYSTEMS GROUP INC.

- QUALCOMM TECHNOLOGIES, INC.

- AIRIQ INC.

- ACTSOFT, INC.

- TELETRAC NAVMAN US LTD.

- MICHELIN

- OCTO GROUP S.P.A.

第18章 MARKETSANDMARKETSによる提言

- 工場で搭載される組み込みソリューションを通じた世界のテレマティクス採用の加速

- 統合アナリティクスによる運転行動ベースの保険料

- インテリジェントテレマティクスの統合による電気自動車運用の最適化

- 結論

第19章 付録

List of Tables

- TABLE 1 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY SERVICE

- TABLE 2 ELECTRIC & HYBRID VEHICLE MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE

- TABLE 3 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY FORM TYPE

- TABLE 4 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY FLEET MANAGEMENT SERVICE

- TABLE 6 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY OFFERING

- TABLE 7 AUTOMOTIVE TELEMATICS AFTERMARKET MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 8 AUTOMOTIVE TELEMATICS MARKET DEFINITION, BY CONNECTIVITY

- TABLE 9 INCLUSIONS AND EXCLUSIONS

- TABLE 10 CURRENCY EXCHANGE RATES (PER USD), 2019-2024

- TABLE 11 RISK ASSESSMENT

- TABLE 12 CONNECTED VEHICLE PLATFORMS, BY OEM

- TABLE 13 OEMS OFFERING REMOTE DIAGNOSTICS SERVICES

- TABLE 14 DATA SPECIFIC REGULATIONS/LAWS, BY COUNTRY/REGION

- TABLE 15 KEY REGULATIONS AND COMPLIANCE RULES, BY COUNTRY/REGION

- TABLE 16 INDICATIVE PRICING OF TELEMATICS CONTROL UNITS BY KEY PLAYERS, 2024 (USD)

- TABLE 17 AVERAGE SELLING PRICE OF TELEMATICS CONTROL UNITS, BY REGION, 2022-2024 (USD)

- TABLE 18 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 19 LIST OF FUNDING, 2022-2025

- TABLE 20 PATENT REGISTRATIONS, 2022-2024

- TABLE 21 SUPPLIERS OF TELEMATICS HARDWARE, BY OEM

- TABLE 22 TELEMATICS DATA PLANS IN NORTH AMERICA, 2024

- TABLE 23 TELEMATICS DATA PLANS IN EUROPE, 2024

- TABLE 24 IMPORT DATA FOR HS CODE 901480-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 25 EXPORT DATA FOR HS CODE 901480-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 26 IMPORT TARIFFS ON TELEMATICS COMPONENTS

- TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 REGULATIONS MANDATING TELEMATICS SERVICES, BY COUNTRY/REGION

- TABLE 31 VEHICLE SAFETY STANDARDS, BY COUNTRY/REGION

- TABLE 32 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE (%)

- TABLE 34 KEY BUYING CRITERIA FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE

- TABLE 35 OEM-WISE CONNECTED FEATURE OFFERINGS IN INDIA

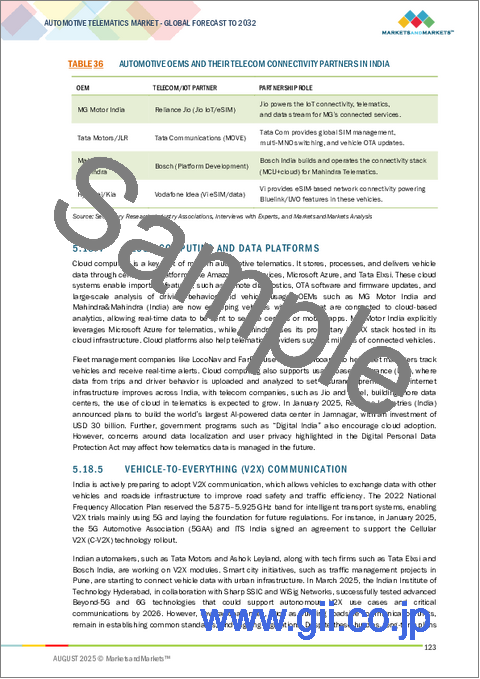

- TABLE 36 AUTOMOTIVE OEMS AND THEIR TELECOM CONNECTIVITY PARTNERS IN INDIA

- TABLE 37 OEM-WISE TELEMATICS OFFERINGS FOR TWO-WHEELERS

- TABLE 38 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 39 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 40 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 41 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 42 PASSENGER CAR: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 43 PASSENGER CAR: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 44 PASSENGER CAR: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 PASSENGER CAR: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 46 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 47 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 48 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 50 BUS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 51 BUS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 52 BUS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 BUS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 TRUCK: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 TRUCK: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 56 TRUCK: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 TRUCK: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 58 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 59 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 60 EMBEDDED AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 61 EMBEDDED AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 62 INTEGRATED AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 63 INTEGRATED AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 64 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 65 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 66 AUTOMOTIVE TELEMATICS HARDWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 AUTOMOTIVE TELEMATICS HARDWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 AUTOMOTIVE TELEMATICS SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 AUTOMOTIVE TELEMATICS SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY, 2021-2024 (THOUSAND UNITS)

- TABLE 71 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY, 2025-2032 (THOUSAND UNITS)

- TABLE 72 AUTOMOTIVE SATELLITE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 73 AUTOMOTIVE SATELLITE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 74 AUTOMOTIVE CELLULAR TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 75 AUTOMOTIVE CELLULAR TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 76 AUTOMOTIVE 5G TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 77 AUTOMOTIVE 5G TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 78 AUTOMOTIVE 4G TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 79 AUTOMOTIVE 4G TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 80 AUTOMOTIVE 2G/3G TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 81 AUTOMOTIVE 2G/3G TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 82 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE, 2021-2024 (USD MILLION)

- TABLE 83 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE, 2025-2032 (USD MILLION)

- TABLE 84 OPERATIONS MANAGEMENT: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 OPERATIONS MANAGEMENT: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 86 VEHICLE MAINTENANCE AND DIAGNOSTICS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 VEHICLE MAINTENANCE AND DIAGNOSTICS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 88 FLEET ANALYTICS AND REPORTING: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 FLEET ANALYTICS AND REPORTING: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 90 OTHERS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 OTHERS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 92 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 93 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 94 EMERGENCY CALLING: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 EMERGENCY CALLING: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 96 ON-ROAD ASSISTANCE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 ON-ROAD ASSISTANCE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 98 REMOTE DIAGNOSTICS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 99 REMOTE DIAGNOSTICS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 100 INSURANCE RISK ASSESSMENT: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 101 INSURANCE RISK ASSESSMENT: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 102 STOLEN VEHICLE ASSISTANCE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 STOLEN VEHICLE ASSISTANCE: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 104 OTHERS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 OTHERS: AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 106 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 107 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 108 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 109 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 110 BATTERY ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 111 BATTERY ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 112 BATTERY ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 BATTERY ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 114 FUEL CELL ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 115 FUEL CELL ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 116 FUEL-CELL ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 FUEL CELL ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 118 PLUG-IN HYBRID ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 119 PLUG-IN HYBRID ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 120 PLUG-IN HYBRID ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 PLUG-IN HYBRID ELECTRIC VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 122 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 123 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 124 EMERGENCY CALLING: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 EMERGENCY CALLING: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 126 ON-ROAD ASSISTANCE: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 ON-ROAD ASSISTANCE: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 128 REMOTE DIAGNOSTICS: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 129 REMOTE DIAGNOSTICS: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 130 INSURANCE RISK ASSESSMENT: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 131 INSURANCE RISK ASSESSMENT: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 132 STOLEN VEHICLE ASSISTANCE: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 133 STOLEN VEHICLE ASSISTANCE: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 134 OTHERS: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 135 OTHERS: ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 136 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 137 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 138 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 139 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 140 PASSENGER CAR: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 141 PASSENGER CAR: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 142 PASSENGER CAR: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 143 PASSENGER CAR: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 144 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 145 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 146 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 147 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 148 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 149 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 150 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 151 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE TELEMATICS AFTERMARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 152 AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 153 AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 156 CHINA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 157 CHINA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 158 INDIA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 159 INDIA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 160 INDIA: AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 161 INDIA: AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 162 JAPAN: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 163 JAPAN: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 164 SOUTH KOREA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 165 SOUTH KOREA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 166 THAILAND: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 167 THAILAND: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 170 EUROPE: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 EUROPE: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 172 GERMANY: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 173 GERMANY: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 174 FRANCE: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 175 FRANCE: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 176 ITALY: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 177 ITALY: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 178 SPAIN: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 179 SPAIN: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 180 RUSSIA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 181 RUSSIA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 182 UK: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 183 UK: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 184 REST OF EUROPE: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 185 REST OF EUROPE: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 186 NORTH AMERICA: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 187 NORTH AMERICA: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 188 US: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 189 US: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 190 CANADA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 191 CANADA: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 192 MEXICO: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 193 MEXICO: AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 194 ROW: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 195 ROW: AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 196 BRAZIL: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 197 BRAZIL: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 198 SOUTH AFRICA: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 199 SOUTH AFRICA: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 200 IRAN: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 201 IRAN: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 202 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-JUNE 2025

- TABLE 203 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS, 2024

- TABLE 204 MARKET SHARE ANALYSIS OF TOP 5 INDIAN PLAYERS, 2024

- TABLE 205 AUTOMOTIVE TELEMATICS MARKET: REGION FOOTPRINT, 2024

- TABLE 206 AUTOMOTIVE TELEMATICS MARKET: FORM TYPE FOOTPRINT, 2024

- TABLE 207 AUTOMOTIVE TELEMATICS MARKET: OFFERING FOOTPRINT, 2024

- TABLE 208 AUTOMOTIVE TELEMATICS MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 209 AUTOMOTIVE TELEMATICS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 210 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 211 AUTOMOTIVE TELEMATICS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 212 AUTOMOTIVE TELEMATICS MARKET: DEALS, JANUARY 2021-JUNE 2025

- TABLE 213 AUTOMOTIVE TELEMATICS MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 214 AUTOMOTIVE TELEMATICS MARKET: OTHER DEVELOPMENTS, JANUARY 2021-JUNE 2025

- TABLE 215 LG ELECTRONICS: COMPANY OVERVIEW

- TABLE 216 LG ELECTRONICS: STANDALONE TYPE TCU SPECIFICATION

- TABLE 217 LG ELECTRONICS: INTEGRATED-ANTENNA TYPE TCU SPECIFICATION

- TABLE 218 LG ELECTRONICS: SUPPLIER ANALYSIS

- TABLE 219 LG ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 LG ELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 221 LG ELECTRONICS: DEALS

- TABLE 222 LG ELECTRONICS: EXPANSIONS

- TABLE 223 LG ELECTRONICS: OTHER DEVELOPMENTS

- TABLE 224 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- TABLE 225 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 HARMAN INTERNATIONAL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 227 HARMAN INTERNATIONAL: DEALS

- TABLE 228 HARMAN INTERNATIONAL: OTHER DEVELOPMENTS

- TABLE 229 DENSO CORPORATION: COMPANY OVERVIEW

- TABLE 230 DENSO CORPORATION: SUPPLIER ANALYSIS

- TABLE 231 DENSO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 233 CONTINENTAL AG: SUPPLIER ANALYSIS

- TABLE 234 CONTINENTAL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 CONTINENTAL AG: DEALS

- TABLE 236 CONTINENTAL AG: EXPANSIONS

- TABLE 237 CONTINENTAL AG: OTHER DEVELOPMENTS

- TABLE 238 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 239 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 241 ROBERT BOSCH GMBH: DEALS

- TABLE 242 ROBERT BOSCH GMBH: OTHER DEVELOPMENTS

- TABLE 243 APTIV: COMPANY OVERVIEW

- TABLE 244 APTIV: SUPPLIER ANALYSIS

- TABLE 245 APTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 APTIV: OTHER DEVELOPMENTS

- TABLE 247 VISTEON CORPORATION: COMPANY OVERVIEW

- TABLE 248 VISTEON CORPORATION: SUPPLIER ANALYSIS

- TABLE 249 VISTEON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 VISTEON CORPORATION: DEALS

- TABLE 251 VISTEON CORPORATION: EXPANSIONS

- TABLE 252 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 253 MARELLI HOLDINGS CO., LTD.: SUPPLIER ANALYSIS

- TABLE 254 MARELLI HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 MARELLI HOLDINGS CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 256 MARELLI HOLDINGS CO., LTD.: DEALS

- TABLE 257 VALEO: COMPANY OVERVIEW

- TABLE 258 VALEO: SUPPLIER ANALYSIS

- TABLE 259 VALEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 261 VALEO: DEALS

- TABLE 262 VALEO: OTHER DEVELOPMENTS

- TABLE 263 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 264 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 FICOSA INTERNACIONAL SA: COMPANY OVERVIEW

- TABLE 266 FICOSA INTERNACIONAL SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 AT&T INTELLECTUAL PROPERTY: COMPANY OVERVIEW

- TABLE 268 AT&T INTELLECTUAL PROPERTY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 AT&T INTELLECTUAL PROPERTY: DEALS

- TABLE 270 VERIZON: COMPANY OVERVIEW

- TABLE 271 VERIZON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 VERIZON: DEALS

- TABLE 273 BRIDGESTONE MOBILITY SOLUTIONS B.V.: COMPANY OVERVIEW

- TABLE 274 BRIDGESTONE MOBILITY SOLUTIONS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 BRIDGESTONE MOBILITY SOLUTIONS B.V.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 276 BRIDGESTONE MOBILITY SOLUTIONS B.V.: DEALS

- TABLE 277 ITRIANGLE INFOTECH PVT LTD: COMPANY OVERVIEW

- TABLE 278 ITRIANGLE INFOTECH PVT LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 ITRIANGLE INFOTECH PVT LTD: DEALS

- TABLE 280 ITRIANGLE INFOTECH PVT LTD: EXPANSIONS

- TABLE 281 ITRIANGLE INFOTECH PVT LTD: OTHER DEVELOPMENTS

- TABLE 282 CE INFO SYSTEMS LTD: COMPANY OVERVIEW

- TABLE 283 CE INFO SYSTEMS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 CE INFO SYSTEMS LTD: DEALS

- TABLE 285 CE INFO SYSTEMS LTD: OTHER DEVELOPMENTS

- TABLE 286 ATLANTA SYSTEMS PVT. LTD.: COMPANY OVERVIEW

- TABLE 287 ATLANTA SYSTEMS PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 BLACKBOX GPS TECHNOLOGY: COMPANY OVERVIEW

- TABLE 289 BLACKBOX GPS TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 ROSMERTA: COMPANY OVERVIEW

- TABLE 291 ROSMERTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 ADDSECURE: COMPANY OVERVIEW

- TABLE 293 PANASONIC CORPORATION: COMPANY OVERVIEW

- TABLE 294 GARMIN LTD.: COMPANY OVERVIEW

- TABLE 295 POWERFLEET: COMPANY OVERVIEW

- TABLE 296 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 297 CALAMP: COMPANY OVERVIEW

- TABLE 298 THE DESCARTES SYSTEMS GROUP INC.: COMPANY OVERVIEW

- TABLE 299 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 300 AIRIQ INC.: COMPANY OVERVIEW

- TABLE 301 ACTSOFT, INC.: COMPANY OVERVIEW

- TABLE 302 TELETRAC NAVMAN US LTD.: COMPANY OVERVIEW

- TABLE 303 MICHELIN: COMPANY OVERVIEW

- TABLE 304 OCTO GROUP S.P.A.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 MARKET ESTIMATION METHODOLOGY

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 MARKET ESTIMATION NOTES

- FIGURE 10 DATA TRIANGULATION

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS

- FIGURE 12 AUTOMOTIVE TELEMATICS MARKET OVERVIEW

- FIGURE 13 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 ON-ROAD ASSISTANCE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 KEY PLAYERS IN AUTOMOTIVE TELEMATICS MARKET

- FIGURE 17 INCREASING DEMAND FOR CONNECTED VEHICLE SOLUTIONS TO DRIVE MARKET

- FIGURE 18 ON-ROAD ASSISTANCE TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 19 EMBEDDED SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 20 HARDWARE SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 21 BEV SEGMENT TO LEAD MARKET IN 2032

- FIGURE 22 ON-ROAD ASSISTANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 PASSENGER CAR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 24 CELLULAR CONNECTIVITY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 25 PASSENGER CAR SEGMENT TO DOMINATE AFTERMARKET DURING FORECAST PERIOD

- FIGURE 26 OPERATIONS MANAGEMENT SEGMENT TO HOLD SECOND-LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 28 INTEGRATED TELEMATICS ARCHITECTURE IN CONNECTED VEHICLES

- FIGURE 29 AUTOMOTIVE TELEMATICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 30 PRIVACY CONCERNS FROM CONSUMERS AND BUSINESSES

- FIGURE 31 SOLUTION ARCHITECTURE TO GET PREDICTIVE INSIGHTS USING VEHICLE TELEMATICS DATA

- FIGURE 32 AVERAGE SELLING PRICE OF TELEMATICS CONTROL UNITS, BY REGION, 2022-2024 (USD)

- FIGURE 33 ECOSYSTEM MAPPING

- FIGURE 34 SUPPLY CHAIN ANALYSIS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO, 2022-2025

- FIGURE 36 PATENT ANALYSIS, 2015-2024

- FIGURE 37 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 38 ESINET INFRASTRUCTURE WITH E-CALL AND NG E-CALL FLOWS

- FIGURE 39 FLEET MANAGEMENT SYSTEM BASED ON GPS SATELLITES AND GSM CELLULAR NETWORK

- FIGURE 40 5G FEATURES OF FUTURE TELEMATICS

- FIGURE 41 IMPORT DATA FOR HS CODE 901480-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 42 EXPORT DATA FOR HS CODE 901480-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 43 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE

- FIGURE 44 KEY BUYING CRITERIA FOR TELEMATICS SYSTEMS, BY VEHICLE TYPE

- FIGURE 45 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN AUTOMOTIVE TELEMATICS MARKET

- FIGURE 46 TELEMATICS FEATURES IN TWO-WHEELERS

- FIGURE 47 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 48 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE, 2025-2032 (THOUSAND UNITS)

- FIGURE 49 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- FIGURE 50 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY, 2025-2032 (THOUSAND UNITS)

- FIGURE 51 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE, 2025-2032 (USD MILLION)

- FIGURE 52 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- FIGURE 53 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 54 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- FIGURE 55 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- FIGURE 56 AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 57 ASIA PACIFIC: AUTOMOTIVE TELEMATICS MARKET SNAPSHOT

- FIGURE 58 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 59 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 60 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 61 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 62 EUROPE: AUTOMOTIVE TELEMATICS MARKET, 2025 VS. 2032

- FIGURE 63 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 64 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 65 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 66 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 67 NORTH AMERICA: AUTOMOTIVE TELEMATICS MARKET SNAPSHOT

- FIGURE 68 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 69 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 70 NORTH AMERICA: CPI INFLATION RATE, BY COUNTRY, 2024-2026

- FIGURE 71 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 72 ROW: AUTOMOTIVE TELEMATICS MARKET, 2025 VS. 2035 (USD MILLION)

- FIGURE 73 ROW: REAL GDP ANNUAL PERCENTAGE CHANGE, 2024-2026

- FIGURE 74 ROW: GDP PER CAPITA, 2024-2026

- FIGURE 75 ROW: AVERAGE CPI INFLATION RATE, 2024-2026

- FIGURE 76 ROW: MANUFACTURING INDUSTRY'S VALUE (AS PART OF GDP), 2024

- FIGURE 77 MARKET SHARE ANALYSIS OF TOP TELEMATICS CONTROL UNIT PROVIDERS, 2024

- FIGURE 78 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2020-2024

- FIGURE 79 COMPANY VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 80 FINANCIAL METRICS OF KEY PLAYERS, 2025

- FIGURE 81 BRAND COMPARISON OF TOP 5 PLAYERS

- FIGURE 82 AUTOMOTIVE TELEMATICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 83 AUTOMOTIVE TELEMATICS MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 84 AUTOMOTIVE TELEMATICS MARKET: STARTUP/SME EVALUATION MATRIX, (STARTUPS/SMES), 2024

- FIGURE 85 LG ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 86 LG ELECTRONICS: AUTOMOTIVE TELEMATICS AND ANTENNA TECHNOLOGY ROADMAP

- FIGURE 87 HARMAN INTERNATIONAL: COMPANY SNAPSHOT

- FIGURE 88 DENSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 89 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 90 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 91 APTIV: COMPANY SNAPSHOT

- FIGURE 92 VISTEON CORPORATION: COMPANY SNAPSHOT

- FIGURE 93 VISTEON CORPORATION: TELEMATICS SOLUTIONS

- FIGURE 94 MARELLI HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 95 VALEO: COMPANY SNAPSHOT

- FIGURE 96 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 97 FICOSA INTERNACIONAL SA: COMPANY SNAPSHOT

- FIGURE 98 AT&T INTELLECTUAL PROPERTY: COMPANY SNAPSHOT

- FIGURE 99 VERIZON: COMPANY SNAPSHOT

- FIGURE 100 ITRIANGLE INFOTECH PVT LTD: VEHICLE FIRMWARE OVER-THE-AIR (VFOTA)

- FIGURE 101 CE INFO SYSTEMS LTD: COMPANY SNAPSHOT

- FIGURE 102 CE INFO SYSTEMS LTD: AUTOMOTIVE OFFERINGS

The automotive telematics market is projected to grow from USD 10.02 billion in 2025 to USD 16.72 billion by 2032 at a CAGR of 7.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By service, vehicle type, form type, fleet management service, offering, aftermarket based on vehicle type, EV service, EV type, connectivity, and region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The rollout of 5G networks is significantly advancing the automotive systems by enabling faster, low-latency connectivity crucial for V2X communication, an essential component for autonomous driving and intelligent transportation systems. This enhanced connectivity allows telematics platforms to support real-time data exchange for functions like hazard alerts, cooperative driving, and smart traffic coordination. The adoption of edge computing within telematics systems further enables real-time processing of critical vehicle data directly onboard, improving responsiveness for safety and navigation functions. AI and machine learning are increasingly integrated into telematics platforms to enable predictive insights such as route optimization, driver behavior analysis, and early incident detection. In addition, improved sensor integration and communication protocols such as CAN bus are enabling more precise data collection, while growing attention to cybersecurity is ensuring stronger protection against threats in increasingly connected vehicles.

Embedded telematics is expected to hold the dominant share of the automotive telematics market during the forecast period.

Embedded telematics is expected to hold the largest share of the automotive telematics market, as it is built directly into the vehicle's system, allowing OEMs to offer features connected to the factory itself. Regulations in Europe and China also require factory-installed telematics to monitor energy use and vehicle safety. In China, the New Energy Vehicle National Monitoring Platform (NEV-NMP) mandates that all electric and hybrid vehicles transmit real-time data, such as battery status, vehicle location, and alerts to a centralized government platform, making embedded telematics essential for compliance. Additionally, embedded telematics helps automakers create a closed ecosystem for offering subscription-based services and using vehicle data for new revenue opportunities. The growing demand for EVs and vehicles with advanced driver assistance systems (ADAS) is increasing the need for integrated, software-based telematics. OEMs are also moving toward hybrid systems that combine embedded telematics with cloud and edge computing to support real-time data processing and better service delivery. GM's OnStar, Hyundai's BlueLink, and Toyota's i-Connect all offer features such as real-time navigation, remote diagnostics, and OTA updates. For instance, in November 2024, Volkswagen Group (Germany) rolled out its Fleet Interface Data solution in collaboration with CARIAD, offering embedded telematics to fleet customers across brands such as Volkswagen, Audi, Skoda, and Cupra. This platform provides near real-time insights into mileage, remaining range, warning signals, and upcoming service needs, all without additional telematics hardware. These factors are expected to support the growth of embedded telematics systems significantly.

The hardware segment is projected to lead the automotive telematics market during the forecast period.

Hardware is expected to hold the dominant share of the automotive telematics market. Key components such as telematics control units (TCUs), sensors, antennas, CAN Bus, communication modules, and electronic control units (ECUs) are essential for enabling vehicle connectivity and data exchange. With vehicles becoming more software-defined, there is a growing need for powerful and flexible hardware that can support OTA updates, built-in cybersecurity, and fast data processing. OEMs are increasingly favoring embedded, factory-fitted hardware to ensure consistent deployment across vehicle models. Hardware manufacturers are integrating 4G/5G connectivity, edge computing, and satellite communication into TCUs to improve performance and service reliability. Modern TCUs also include hardware security modules (HSMs), secure boot, encryption, and intrusion detection to protect against cyber threats and ensure safe software updates. Additionally, there is growing interest in modular hardware designs that can support future upgrades and V2X features. Companies such as LG Electronics (South Korea), Denso Corporation (Japan), and HARMAN International offer advanced TCUs with 4G/5G, GNSS, and cybersecurity capabilities, which are widely used by leading OEMs such as Toyota and Volkswagen. For instance, Visteon Corporation provided a TCU to Ford for its 2025 Mustang and Mustang Mach-E vehicle models.

Europe is expected to have the second-largest share of the automotive telematics market during the forecast period.

Europe is expected to hold the second-largest share of the automotive telematics market during the forecast period. The European automotive telematics market is led by advanced OEM-integrated systems, shaped by strict regulations and varying regional needs. Unlike regions where third-party providers dominate, European automakers offer built-in telematics platforms such as Volkswagen's We Connect, BMW's ConnectedDrive, Mercedes-Benz Me Connect, Renault's EASY CONNECT, and Stellantis's Uconnect. These systems commonly include OTA updates, remote diagnostics, digital services like parking and charging, and links to insurance products. The E-Call mandate is the key regulatory driver for the automotive telematics market in the European region. It requires all new cars and light vans sold in the EU since April 2018 to be equipped with an emergency call (eCall) system. This system automatically contacts emergency services in the event of a serious accident, transmitting the vehicle's location and other key data to speed up rescue response. Other regulations, such as the General Safety Regulation and EU Data Act, are pushing manufacturers to improve data privacy, user data ownership, and system compatibility. Usage-based insurance is also growing, supported by GDPR-compliant platforms, with insurers such as AXA, Allianz, Admiral, and UNIQA partnering with automakers and tech providers to offer customized premiums based on driving behavior. The continued expansion of advanced 5G networks is further enabling real-time features such as predictive maintenance, vehicle-to-grid connectivity, and in-car digital services, positioning Europe as a highly regulated and innovation-driven telematics market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 8%, Tier II - 56%, and Tier III - 36%

- By Designation: CXOs - 36%, Managers - 51%, and Executives - 13%

- By Region: North America - 24%, Europe - 38%, Asia Pacific - 30%, and RoW - 8%

The automotive telematics market is dominated by major players, including LG Electronics (South Korea), Harman International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany). These companies offer comprehensive telematics solutions encompassing telematics control units (TCUs), cloud-based connectivity platforms, cybersecurity features, OTA update systems, and integrated infotainment services. They also provide customized hardware-software integration, enabling OEMs to deliver connected services across vehicle segments and global markets.

Leading telematics service providers, such as AT&T Intellectual Property (US), Geotab (Canada), Samsara (US), Verizon Connect (US), and Powerfleet (US), offer bundled and innovative telematics services tailored for fleets, OEMs, and mobility operators. These companies provide comprehensive service platforms that integrate real-time vehicle tracking, driver behavior monitoring, AI-enabled video telematics, maintenance diagnostics, EV analytics, and workflow automation.

Research Coverage:

The report covers the automotive telematics market in terms of service, form type, offering, vehicle type, connectivity, EV type, aftermarket, EV by service, and region. It covers the competitive landscape and company profiles of the major automotive telematics market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive telematics market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report also provides insights into automotive telematics architecture in two-wheelers and four-wheelers, as well as automotive telematics market trends in India.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the automotive telematics market.

The report provides insights into the following pointers:

- Analysis of key drivers (surging demand for connected vehicles and in-car digital services, increasing adoption of remote diagnostics to enhance vehicle efficiency, telematics-driven optimization in fleet management and logistics), restraints (regulatory complexities around usage-based insurance models, data privacy and cybersecurity concerns), opportunities (expansion of IoT and next-gen connectivity technologies, convergence of advanced analytics, generative AI, and smart city integration, heightened emphasis on vehicle safety and security through mandates), and challenges (limited user acceptance and behavioral resistance, absence of industry-wide standardization).

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the automotive telematics market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the automotive telematics market across varied regions)

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the automotive telematics market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players such as LG Electronics (South Korea), HARMAN International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany) in the automotive telematics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews-demand and supply sides

- 2.1.2.2 Key industry insights and breakdown of primary interviews

- 2.1.2.3 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE TELEMATICS MARKET

- 4.2 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE

- 4.3 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE

- 4.4 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING

- 4.5 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE

- 4.6 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE

- 4.7 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE

- 4.8 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY

- 4.9 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE

- 4.10 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE

- 4.11 AUTOMOTIVE TELEMATICS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for connected vehicles and in-car digital services

- 5.2.1.2 Increasing adoption of remote diagnostics to enhance vehicle efficiency

- 5.2.1.3 Telematics-driven optimization in fleet management and logistics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory complexities around usage-based insurance models

- 5.2.2.2 Data privacy and cybersecurity concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of IoT and next-gen connectivity technologies

- 5.2.3.2 Convergence of advanced analytics, GenAI, and smart city integration

- 5.2.3.3 Emphasis on vehicle safety and security through mandates

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited user acceptance and behavioral resistance

- 5.2.4.2 Absence of industry-wide standardization

- 5.2.5 IMPACT ANALYSIS OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE PRICING OF TELEMATICS CONTROL UNITS BY KEY PLAYERS, 2024

- 5.3.2 AVERAGE SELLING PRICE OF TELEMATICS CONTROL UNITS, BY REGION, 2022-2024

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 OEMS

- 5.4.2 TELEMATICS HARDWARE/SOFTWARE SUPPLIERS

- 5.4.3 CLOUD SERVICE PROVIDERS

- 5.4.4 SATELLITE NAVIGATION PROVIDERS

- 5.4.5 TELECOM SERVICE PROVIDERS

- 5.4.6 VAS PLAYERS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 UFFIZIO OFFERED FLEET TRACKING PLATFORM TO CONFIGURE DASHBOARDS, USER ROLES, AND WORKFLOWS FOR EACH CLIENT TYPE, FROM WASTE COLLECTION TO LOGISTICS

- 5.6.2 REVOLUTIONIZING FLEET MAINTENANCE AND PERFORMANCE WITH ITRIANGLE'S VFOTA-POWERED TELEMATICS SOLUTION

- 5.6.3 ITRIANGLE INTRODUCED OBD II DEVICE AS SEAMLESS AND INTELLIGENT DIAGNOSTIC SOLUTION

- 5.6.4 ITRIANGLE DEPLOYED ROBUST TCU, TAILORED FOR INTEGRATION INTO OEM TRUCK PLATFORMS

- 5.6.5 ITRIANGLE IMPLEMENTED ROBUST AND SCALABLE TELEMATICS SOLUTION TAILORED TO IOCL'S REQUIREMENTS

- 5.6.6 VODAFONE DEPLOYED ITS FLEET ANALYTICS SOLUTION, INSTALLING DEVICES THAT CAPTURE REAL-TIME ENGINE DIAGNOSTICS, DRIVER HOURS, FUEL DATA, AND LOCATION INFORMATION

- 5.6.7 VODAFONE IMPLEMENTED ITS FLEET ANALYTICS PLATFORM ACROSS PROGETTI DEL CUORE'S FLEET

- 5.6.8 ATWELL ADOPTED GEOTAB'S FLEET MANAGEMENT PLATFORM TO ENHANCE FLEET SAFETY AND IMPROVE VEHICLE UTILIZATION

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PATENT ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 KEY TECHNOLOGIES

- 5.9.2.1 Next generation eCall (NGeCall)

- 5.9.2.2 Satellite-enabled telematics

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 5G connectivity

- 5.9.3.2 Cloud telematics platforms

- 5.9.4 ADJACENT TECHNOLOGIES

- 5.9.4.1 Vehicle-to-cloud

- 5.9.4.2 Vehicle-to-pedestrian

- 5.9.4.3 Vehicle-to-infrastructure

- 5.9.4.4 Vehicle-to-vehicle

- 5.9.4.5 Cellular V2X

- 5.9.4.5.1 LTE-V2X

- 5.9.4.5.2 5G-V2X

- 5.10 SUPPLIER ANALYSIS

- 5.11 OEM-WISE TELEMATICS DATA PLANS, BY REGION

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.12 HS CODES

- 5.12.1 IMPORT SCENARIO

- 5.12.2 EXPORT SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 IMPACT OF GENERATIVE AI

- 5.17.1 AI IN FLEET MANAGEMENT TELEMATICS

- 5.17.2 AI IN INSURANCE TELEMATICS

- 5.17.3 AI IN CONNECTED VEHICLE SERVICES

- 5.18 MNM INSIGHTS INTO INDIAN AUTOMOTIVE TELEMATICS MARKET TRENDS

- 5.18.1 IOT INTEGRATION

- 5.18.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.18.3 5G CONNECTIVITY

- 5.18.4 CLOUD COMPUTING AND DATA PLATFORMS

- 5.18.5 VEHICLE-TO-EVERYTHING (V2X) COMMUNICATION

- 5.18.6 BLOCKCHAIN FOR TELEMATICS DATA

- 5.18.7 VIDEO STREAMING AND TELEMATICS CAMERAS

- 5.18.8 ADVANCED DRIVER ASSISTANCE (ADAS)

- 5.18.9 AUTOMATED ROAD ASSISTANCE (ARAS)

- 5.18.10 CYBERSECURITY

- 5.19 MNM INSIGHTS INTO AUTOMOTIVE TELEMATICS ARCHITECTURE

- 5.19.1 TWO-WHEELERS

- 5.19.2 FOUR-WHEELERS

6 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CAR

- 6.2.1 GROWING TELEMATICS PENETRATION IN MID-PRICED VEHICLE SEGMENTS TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLE

- 6.3.1 NEED FOR ROUTE OPTIMIZATION TO MEET TIGHT DELIVERY WINDOWS TO DRIVE MARKET

- 6.4 BUS

- 6.4.1 GROWING SAFETY AWARENESS IN PUBLIC TRANSPORT TO DRIVE MARKET

- 6.5 TRUCK

- 6.5.1 RISING DEMAND FOR SAFER AND OPTIMIZED LOGISTICS TO DRIVE MARKET

- 6.6 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE

- 7.1 INTRODUCTION

- 7.2 EMBEDDED

- 7.2.1 EXPANDING CONNECTED CAR ECOSYSTEM TO DRIVE MARKET

- 7.3 INTEGRATED

- 7.3.1 INCREASING TELEMATICS DEPLOYMENT IN FLEET MANAGEMENT TO DRIVE MARKET

- 7.4 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 GROWING DEMAND FOR EMBEDDED TELEMATICS BOXES TO DRIVE MARKET

- 8.2.2 TELEMATICS CONTROL UNIT

- 8.2.3 COMMUNICATION DEVICES

- 8.2.4 CONTROLLER AREA NETWORK (CAN) BUS

- 8.2.5 AUDIO/VIDEO INTERFACE

- 8.3 SOFTWARE

- 8.3.1 SHIFT TOWARD SOFTWARE-DEFINED VEHICLES TO TRANSFORM TELEMATICS LANDSCAPE

- 8.3.2 REAL-TIME NAVIGATION

- 8.3.3 REMOTE DIAGNOSTICS

- 8.3.4 OVER-THE-AIR (OTA) UPDATES

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY

- 9.1 INTRODUCTION

- 9.2 SATELLITE

- 9.2.1 DEMAND FOR GLOBAL VEHICLE VISIBILITY AND RELIABILITY ACROSS GEOGRAPHIES TO DRIVE MARKET

- 9.3 CELLULAR

- 9.4 5G

- 9.4.1 HIGH DATA TRANSFER SPEED, AND ABILITY TO SUPPORT MASSIVE IOT AND REAL-TIME APPLICATIONS TO DRIVE MARKET

- 9.5 4G

- 9.5.1 INCREASING 4G INTEGRATION IN MASS-MARKET VEHICLES TO DRIVE MARKET

- 9.6 2G/3G

- 9.6.1 SUSTAINED 2G/3G CONNECTIVITY DEMAND IN EMERGING ECONOMIES TO DRIVE MARKET

- 9.7 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE

- 10.1 INTRODUCTION

- 10.2 OPERATIONS MANAGEMENT

- 10.2.1 OPERATIONAL EFFICIENCY IMPERATIVES TO ACCELERATE TELEMATICS ADOPTION

- 10.3 VEHICLE MAINTENANCE AND DIAGNOSTICS

- 10.3.1 GROWING FOCUS ON PREVENTIVE MAINTENANCE TO ENHANCE FLEET PERFORMANCE TO DRIVE MARKET

- 10.4 FLEET ANALYTICS AND REPORTING

- 10.4.1 RISING NEED FOR FLEET PERFORMANCE TRANSPARENCY TO DRIVE MARKET

- 10.5 OTHERS

- 10.6 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE

- 11.1 INTRODUCTION

- 11.2 EMERGENCY CALLING

- 11.2.1 GOVERNMENT MANDATES FOR E-CALL SYSTEMS TO ENHANCE OCCUPANT SAFETY TO DRIVE MARKET

- 11.3 ON-ROAD ASSISTANCE

- 11.3.1 GROWING NEED FOR REAL-TIME BREAKDOWN ASSISTANCE TO DRIVE MARKET

- 11.4 REMOTE DIAGNOSTICS

- 11.4.1 GROWING NEED FOR VEHICLE HEALTH MONITORING AND PREDICTIVE MAINTENANCE TO DRIVE MARKET

- 11.5 INSURANCE RISK ASSESSMENT

- 11.5.1 GROWING DEMAND FOR PERSONALIZED, DATA-DRIVEN POLICIES TO DRIVE MARKET

- 11.6 STOLEN VEHICLE ASSISTANCE

- 11.6.1 RISING VEHICLE THEFT INCIDENTS TO DRIVE MARKET

- 11.7 OTHERS

- 11.8 KEY PRIMARY INSIGHTS

12 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.2 BATTERY ELECTRIC VEHICLE (BEV)

- 12.2.1 OEMS PRIORITIZING CONNECTED SERVICES TO ENHANCE USER EXPERIENCE TO DRIVE MARKET

- 12.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 12.3.1 GOVERNMENT INVESTMENTS IN HYDROGEN INFRASTRUCTURE TO ACCELERATE TELEMATICS ADOPTION

- 12.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 12.4.1 OEMS' EMPHASIS ON INTEGRATING CONNECTED FEATURES IN PHEVS TO DRIVE MARKET

- 12.5 PRIMARY INSIGHTS

13 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE

- 13.1 INTRODUCTION

- 13.2 EMERGENCY CALLING

- 13.2.1 REGULATORY PUSH FOR MANDATORY ECALL SYSTEMS TO ACCELERATE TELEMATICS ADOPTION

- 13.3 ON-ROAD ASSISTANCE

- 13.3.1 GROWING DEMAND FOR REAL-TIME SUPPORT DURING BREAKDOWNS TO DRIVE MARKET

- 13.4 REMOTE DIAGNOSTICS

- 13.4.1 PROACTIVE DIAGNOSTICS AND MAINTENANCE OPTIMIZATION TO PROPEL TELEMATICS ADOPTION

- 13.5 INSURANCE RISK ASSESSMENT

- 13.5.1 GOVERNMENT SUPPORT FOR USAGE-BASED INSURANCE POLICIES TO DRIVE MARKET

- 13.6 STOLEN VEHICLE ASSISTANCE

- 13.6.1 RISING ADOPTION OF STOLEN VEHICLE ASSISTANCE AS STANDARD FEATURE IN ELECTRIC VEHICLES TO DRIVE MARKET

- 13.7 OTHERS

- 13.8 KEY PRIMARY INSIGHTS

14 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE

- 14.1 INTRODUCTION

- 14.2 PASSENGER CAR

- 14.2.1 GROWTH OF RIDE-HAILING AND SHARED MOBILITY SERVICES TO FUEL TELEMATICS ADOPTION

- 14.3 LIGHT COMMERCIAL VEHICLE

- 14.3.1 RISING LAST-MILE DELIVERY DEMAND TO ACCELERATE AFTERMARKET TELEMATICS ADOPTION

- 14.4 HEAVY COMMERCIAL VEHICLE

- 14.4.1 OPERATIONAL EFFICIENCY AND DOWNTIME REDUCTION TO ACCELERATE TELEMATICS ADOPTION

- 14.5 KEY PRIMARY INSIGHTS

15 AUTOMOTIVE TELEMATICS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Government's focus on vehicle data standardization and intelligent transportation systems to drive market

- 15.2.3 INDIA

- 15.2.3.1 Mandatory inclusion of GPS tracking and emergency response features in public service vehicles to drive market

- 15.2.3.2 Indian automotive telematics market, by offering

- 15.2.3.2.1 Hardware

- 15.2.3.2.1.1 Telematics control unit (TCU)

- 15.2.3.2.1.2 Audio/Video interface

- 15.2.3.2.1.3 CAN Bus

- 15.2.3.2.1.4 Communications modules

- 15.2.3.2.2 Software

- 15.2.3.2.2.1 Real-time navigation

- 15.2.3.2.2.2 Remote diagnostics

- 15.2.3.2.2.3 Over-the-air (OTA) updates

- 15.2.3.2.1 Hardware

- 15.2.4 JAPAN

- 15.2.4.1 Strong integration of safety, infrastructure, and mobility innovations to drive market

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Strong convergence of automotive, telecom, and electronics sectors to drive market

- 15.2.6 THAILAND

- 15.2.6.1 Government mandates to include telematics features in commercial vehicles to drive market

- 15.2.7 REST OF ASIA PACIFIC

- 15.3 EUROPE

- 15.3.1 MICROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Increasing sales of connected vehicles equipped with advanced telematics features to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Mandating safety requirements to drive market

- 15.3.4 ITALY

- 15.3.4.1 Innovation in automobile industry to drive market

- 15.3.5 SPAIN

- 15.3.5.1 Legislative support for autonomous vehicle development and trials to drive market

- 15.3.6 RUSSIA

- 15.3.6.1 Increasing integration of advanced safety features in new vehicle models to drive market

- 15.3.7 UK

- 15.3.7.1 Rising inclusion of telematics features in mid-tier automobiles to drive market

- 15.3.8 REST OF EUROPE

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Substantial investments by OEMs in connected services and autonomous driving to drive market

- 15.4.3 CANADA

- 15.4.3.1 Growth of fleet telematics and rise of UBI programs to drive market

- 15.4.4 MEXICO

- 15.4.4.1 Rising adoption of telematics in commercial fleets to drive market

- 15.5 REST OF THE WORLD

- 15.5.1 MACROECONOMIC OUTLOOK

- 15.5.2 BRAZIL

- 15.5.2.1 Growing demand for vehicle tracking and safety features to drive market

- 15.5.3 SOUTH AFRICA

- 15.5.3.1 Rising telematics adoption in commercial vehicles to drive market

- 15.5.4 IRAN

- 15.5.4.1 Escalating telematics demand in fleets and commercial vehicles to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS FOR GLOBAL TELEMATICS CONTROL UNIT PROVIDERS, 2024

- 16.4 MARKET SHARE ANALYSIS FOR INDIAN TELEMATICS CONTROL UNIT PROVIDERS, 2024

- 16.5 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2024

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6.1 COMPANY VALUATION

- 16.6.2 FINANCIAL METRICS

- 16.7 BRAND/ PRODUCT COMPARISON

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Region footprint

- 16.8.5.3 Form type footprint

- 16.8.5.4 Offering footprint

- 16.8.5.5 Vehicle type footprint

- 16.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.9.1 PROGRESSIVE COMPANIES

- 16.9.2 RESPONSIVE COMPANIES

- 16.9.3 DYNAMIC COMPANIES

- 16.9.4 STARTING BLOCKS

- 16.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.9.5.1 List of startups/SMEs

- 16.9.5.2 Competitive benchmarking of startups/SMEs

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.10.2 DEALS

- 16.10.3 EXPANSIONS

- 16.10.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 LG ELECTRONICS

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.3.4 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HARMAN INTERNATIONAL

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 DENSO CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 CONTINENTAL AG

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Deals

- 17.1.4.3.2 Expansions

- 17.1.4.3.3 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 ROBERT BOSCH GMBH

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 APTIV

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Other developments

- 17.1.7 VISTEON CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.3.2 Expansions

- 17.1.8 MARELLI HOLDINGS CO., LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.9 VALEO

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Other developments

- 17.1.10 INFINEON TECHNOLOGIES AG

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 FICOSA INTERNACIONAL SA

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 AT&T INTELLECTUAL PROPERTY

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Deals

- 17.1.13 VERIZON

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Deals

- 17.1.14 BRIDGESTONE MOBILITY SOLUTIONS B.V.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.1 LG ELECTRONICS

- 17.2 INDIAN KEY PLAYERS

- 17.2.1 ITRIANGLE INFOTECH PVT LTD

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Deals

- 17.2.1.3.2 Expansions

- 17.2.1.3.3 Other developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 CE INFO SYSTEMS LTD

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Deals

- 17.2.2.3.2 Other developments

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 ATLANTA SYSTEMS PVT. LTD.

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 MnM view

- 17.2.3.3.1 Key strengths

- 17.2.3.3.2 Strategic choices

- 17.2.3.3.3 Weaknesses and competitive threats

- 17.2.4 BLACKBOX GPS TECHNOLOGY

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Solutions/Services offered

- 17.2.4.3 MnM view

- 17.2.4.3.1 Key strengths

- 17.2.4.3.2 Strategic choices

- 17.2.4.3.3 Weaknesses and competitive threats

- 17.2.5 ROSMERTA

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Solutions/Services offered

- 17.2.5.3 MnM view

- 17.2.5.3.1 Key strengths

- 17.2.5.3.2 Strategic choices

- 17.2.5.3.3 Weaknesses and competitive threats

- 17.2.1 ITRIANGLE INFOTECH PVT LTD

- 17.3 OTHER PLAYERS

- 17.3.1 ADDSECURE

- 17.3.2 PANASONIC CORPORATION

- 17.3.3 GARMIN LTD.

- 17.3.4 POWERFLEET

- 17.3.5 TRIMBLE INC.

- 17.3.6 CALAMP

- 17.3.7 THE DESCARTES SYSTEMS GROUP INC.

- 17.3.8 QUALCOMM TECHNOLOGIES, INC.

- 17.3.9 AIRIQ INC.

- 17.3.10 ACTSOFT, INC.

- 17.3.11 TELETRAC NAVMAN US LTD.

- 17.3.12 MICHELIN

- 17.3.13 OCTO GROUP S.P.A.

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ACCELERATING GLOBAL TELEMATICS ADOPTION THROUGH FACTORY-FITTED EMBEDDED SOLUTIONS

- 18.2 DRIVING BEHAVIOR-BASED INSURANCE PREMIUMS WITH INTEGRATED ANALYTICS

- 18.3 OPTIMIZING ELECTRIC VEHICLE OPERATIONS WITH INTELLIGENT TELEMATICS INTEGRATION

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, AT COUNTRY LEVEL

- 19.4.2 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 19.4.3 COMPANY INFORMATION

- 19.4.3.1 Profiling of additional market players (up to five)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS