|

|

市場調査レポート

商品コード

1880370

ゲノミクスの世界市場 (~2030年):製品 (試薬・キット・機器)・サービス (ゲノムプロファイリング・バイオインフォマティクス)・技術 (シーケンシング・PCR・ISH・フローサイトメトリー)・研究タイプ (エピゲノミクス)・用途 (創薬・診断・農業) 別Genomics Market by Product (Reagents, Kits, Instruments), Services (Genome Profiling, Bioinformatics), Technology (Sequencing, PCR, ISH, Flow Cytometry), Study Type (Epigenomics), Application (Drug Discovery, Diagnostics, Agri) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ゲノミクスの世界市場 (~2030年):製品 (試薬・キット・機器)・サービス (ゲノムプロファイリング・バイオインフォマティクス)・技術 (シーケンシング・PCR・ISH・フローサイトメトリー)・研究タイプ (エピゲノミクス)・用途 (創薬・診断・農業) 別 |

|

出版日: 2025年11月20日

発行: MarketsandMarkets

ページ情報: 英文 589 Pages

納期: 即納可能

|

概要

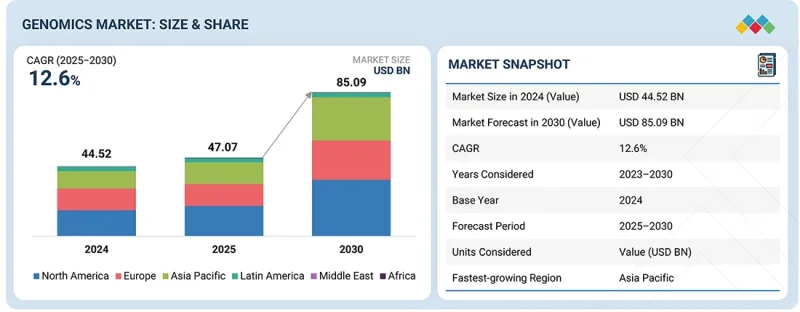

世界のゲノミクスの市場規模は、2025年の470億7,000万米ドルから、2025年から2030年にかけての予測期間中はCAGR 12.6%で成長し、2030年には850億9,000万米ドルに達すると予測されています。

ゲノミクス市場は、政府資金の増加、ウイルス性疾患および遺伝性疾患の有病率の上昇、次世代シーケンシング (NGS) 技術の継続的な進歩に牽引され、力強い成長を遂げています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分、製品、サービス、技術、用途、研究タイプ |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

遺伝性疾患の特定や創薬における従来の応用分野に加え、ゲノミクスは農業、獣医学、法医学の分野でも注目を集めています。法医学分野では、次世代シーケンシング (NGS) の導入によりDNA分析が革新されました。従来のDNAフィンガープリンティング手法は、包括的なゲノム再構築に取って代わられ、より精密な身元確認が可能となっています。NGSは現場での分析も容易にし、微量または劣化したDNAサンプルから詳細な遺伝情報を抽出することを可能にすることで、法医学調査の精度と範囲を向上させています。

"製品タイプ別では、試薬・キット・消耗品の部門が予測期間中に最大のCAGRを記録する見込み"

製品タイプ別では、試薬・キット・消耗品の部門が最大のシェアを占めました。試薬およびキットは、DNA・RNA抽出、増幅、シーケンシング、解析を含むほぼ全てのゲノムワークフローに不可欠です。これらは研究用途と臨床用途の両方で極めて重要です。診断、個別化医療、創薬分野におけるゲノム実験の増加が、これらの製品需要を牽引しています。各ワークフローでは、正確かつ信頼性の高いゲノムデータ生成を確保するため、高品質な試薬・キットの安定供給が求められています。

さらに、次世代シーケンシング (NGS) やポリメラーゼ連鎖反応 (PCR) といった先進技術の急速な普及により、用途特化型の試薬・消耗品の需要はさらに高まっています。医療、研究、バイオテクノロジーなどのゲノミクス分野における継続的な成長は、消耗品からの収益を拡大させ、その市場における主導的地位を確固たるものにしています。

"エンドユーザー別では、病院・診断ラボ・診療所の部門が2024年に最大のシェアに"

このエンドユーザー部門の大きなシェアは、市民科学イニシアチブにより患者のゲノム研究への参加が拡大したことに起因します。これらの取り組みは、データ収集の民主化と希少疾患・個別化医療における発見の加速を目指しています。また、エンドユーザー別では、製薬・バイオテクノロジー企業が第2位のシェアを占めています。

"北米市場では、米国が2024年の市場を主導"

米国は世界最大のバイオ医薬品市場であり、バイオ医薬品研究・投資のリーダー的存在です。先進的な研究エコシステム、強力な資金支援、Illumina、Thermo Fisher Scientific、Agilent Technologies、Danaherといった主要な業界リーダーの存在により、今後数年間でゲノム製品およびサービスへの需要は拡大すると予想されています。米国は、NIHやAll of Usイニシアチブを含む精密医療および集団ゲノム解析プログラムへの政府および民間からの多大な投資の恩恵を受けています。臨床および研究環境におけるNGSおよびバイオインフォマティクスプラットフォームの高い採用率も市場の主導的立場をさらに支えています。さらに、確立された規制の枠組み、強固な医療インフラ、活発な官民連携が、米国におけるゲノム技術の継続的な革新と商業化を促進しています。

当レポートでは、世界のゲノミクスの製品およびサービスの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 関連市場・異業種との分野横断的機会

- ティア1/2/3企業の戦略的動き

第6章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

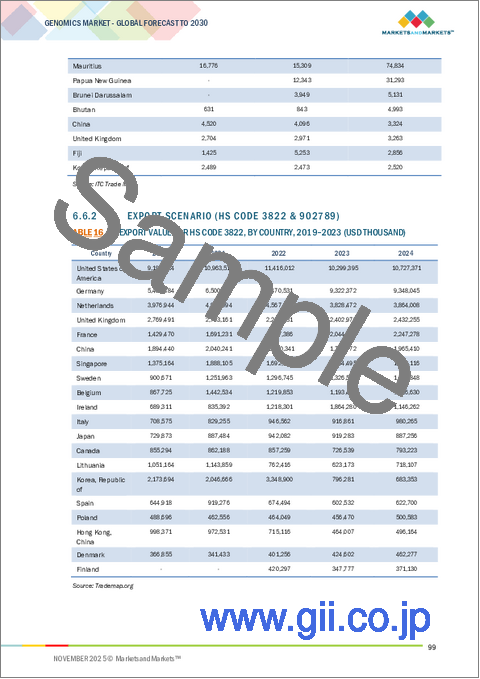

- 貿易分析

- 2026年の主な会議とイベント

- 顧客の事業に影響を与える動向/ディスラプション

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響

第7章 技術の進歩、AI別影響、特許、イノベーション

- 技術分析

- 主要な新興技術

- 補完的技術

- 隣接技術

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

- AI/生成AIがゲノミクス市場に与える影響

第8章 持続可能性と規制状況

- 地域の規制とコンプライアンス

- 持続可能性への取り組み

- 持続可能性への影響と規制政策の取り組み

- 認証、ラベル、環境基準

第9章 顧客情勢と購買行動

- 意思決定プロセス

- 購入者の利害関係者と購入評価基準

- 採用障壁と内部課題

- さまざまな最終用途産業からの満たされていないニーズ

- 市場収益性

第10章 ゲノミクス市場:提供区分別

- 製品

- サービス

第11章 ゲノミクス製品市場:タイプ別

- 試薬・キット・消耗品

- 機器

- バイオインフォマティクスツール

第12章 ゲノミクス製品市場:技術別

- シーケンシング

- PCR

- 遺伝子編集

- フローサイトメトリー

- マイクロアレイ

- インサイチューハイブリダイゼーション

- その他

第13章 ゲノミクス製品市場:エンドユーザー別

- 病院・診断ラボ・診療所

- 学術研究機関

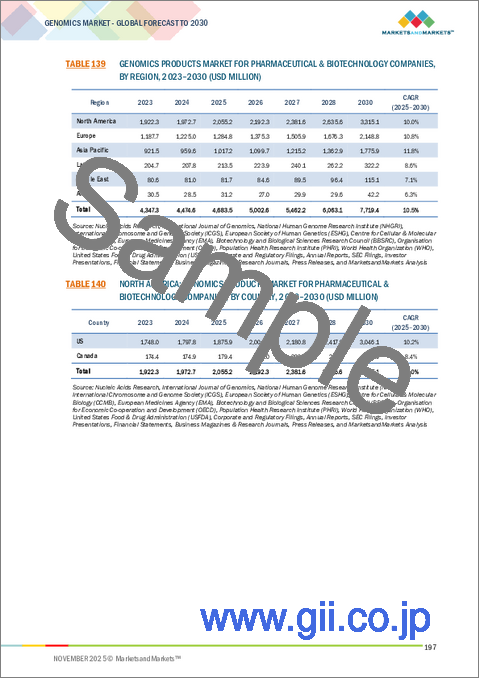

- 製薬・バイオテクノロジー企業

- CRO

- その他

第14章 ゲノミクスサービス市場:タイプ別

- ゲノムプロファイリングおよびシーケンシングサービス

- サンプル調製およびライブラリ調製サービス

- バイオインフォマティクスサービス

第15章 ゲノミクスサービス市場:エンドユーザー別

- 病院・診断ラボ・診療所

- 学術研究機関

- 製薬・バイオテクノロジー企業

- その他

第16章 ゲノミクス市場:用途別

- 医薬品の発見と開発

- 診断

- がん診断

- 感染症

- 生殖保健

- その他

- 農業と動物調査

- その他

第17章 ゲノミクス市場:研究タイプ別

- 機能ゲノミクス

- バイオマーカーの発見

- パスウェイ分析

- エピゲノミクス

- その他

第18章 ゲノミクス市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東

- マクロ経済見通し

- GCC諸国

- その他

- アフリカ

- マクロ経済見通し

第19章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業評価と財務指標

- 競合シナリオ

第20章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- ILLUMINA, INC.

- DANAHER CORPORATION

- F. HOFFMANN-LA ROCHE LTD.

- AGILENT TECHNOLOGIES, INC.

- QIAGEN

- REVVITY

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- IQVIA INC.

- CHARLES RIVER LABORATORIES

- BIO-RAD LABORATORIES, INC.

- EUROFINS SCIENTIFIC

- PACBIO

- OXFORD NANOPORE TECHNOLOGIES PLC.

- TAKARA BIO INC.

- BGI GROUP

- EPPENDORF SE

- MERCK KGAA

- BD

- ABBOTT

- 10X GENOMICS

- NEW ENGLAND BIOLABS

- PROMEGA CORPORATION

- その他の企業

- CREATIVE BIOGENE

- NOVOGENE CO., LTD.

- HELIX, INC.

- PHALANX BIOTECH GROUP

- POLARIS GENOMICS