|

|

市場調査レポート

商品コード

1648508

Wi-Fiの世界市場:提供別、展開別、技術別、用途別、地域別 - 予測(~2029年)Wi-Fi Market by Offering (Hardware, Software, and Services), Deployment (indoor, outdoor), Technology (Wi-Fi 5, Wi-Fi 6, Wi-Fi 7), Application (Residential, industry 4.0, Smart Healthcare) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| Wi-Fiの世界市場:提供別、展開別、技術別、用途別、地域別 - 予測(~2029年) |

|

出版日: 2025年01月29日

発行: MarketsandMarkets

ページ情報: 英文 312 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のWi-Fiの市場規模は、2024年に220億6,000万米ドル、2029年までに451億2,000万米ドルに達すると推定され、CAGRで15.4%の成長が見込まれます。

Wi-Fiは、都市におけるほとんどの用途に信頼性の高い接続性を提供する、スマートシティ構想の中核をなすコンポーネントです。Wi-Fiは多数のIoTデバイスを同時にサポートし、電気や水などのユーティリティを均等に分散化してこれらの資源の無駄を省きます。スマート監視や緊急通信などの公共安全システムも、リアルタイムのデータ伝送を通じて強化されます。交通機関では、Wi-Fiを利用することで、コネクテッド交通管理や公共交通機関の追跡が可能になり、乗り換えが改善されます。Wi-Fiとそのスケーラブルで費用対効果の高いソリューションの採用により、都市はインテリジェントで効率的な住みやすい空間へと変わりつつあります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 提供、展開、技術、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「展開別では、屋内セグメントが予測期間に大きな市場規模を維持します。」

屋内Wi-Fi展開は、高速接続を必要とする家庭、オフィス、ショッピングモール、病院、教育機関などの閉鎖空間向けに調整されています。このような屋内環境では、壁などの障害物からの干渉を最小化し、もっとも効果的なカバー範囲を達成するためにアクセスポイントを戦略的に配置します。ビームフォーミングやMU-MIMOなどの機能により、オープンプランのオフィスや教室などの高密度環境でも最適なパフォーマンスを実現します。シームレスローミングにより、構内のユーザーの位置に関係なく、デバイスの接続性を維持することができます。企業環境におけるセキュリティは、WPA3などの新しい規格によって確保されます。一元化されたネットワーク管理により、リアルタイムモニタリングや問題のトラブルシューティングが可能になります。屋内Wi-Fiは、スマートビルディングシステム、ビデオ会議、IoTデバイスのほか、現代のコネクテッド屋内空間に必要な広帯域アプリケーションをサポートします。

「高密度Wi-Fiセグメントが予測期間にもっとも速い成長率を記録します。」

高密度Wi-Fiネットワークは、多数のデバイスが存在する環境で信頼性の高い接続性を提供するように設計されています。これらはさまざまな用途でシームレスなインターネットアクセスを実現します。また、Wi-Fi 6やWi-Fi 7などの先進技術を採用し、スマートフォン、ノートパソコン、IoTなどの幅広いデバイスからの高い需要に対応しています。最適なアクセスポイントや信号強度を含むインテリジェントなネットワーク設計により、高密度Wi-Fiは、もっとも密集したスペースであっても、あらゆるエリアでの一貫性を保証します。ロードバランシングやバンドステアリングなどの技術も、トラフィックパターンをより適切に再分配することで混雑を緩和し、より強固な接続性を実現します。堅牢な暗号化、強化されたモニタリング機能、きめ細かなアクセス制御により、安全で信頼性の高い接続を実現します。予知的なキャパシティプランニングと継続的なパフォーマンスモニタリングにより、高密度Wi-Fiネットワークは、利用がピークに達する時間帯でも、安定した安全で高性能な体験を保証します。

当レポートでは、世界のWi-Fi市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- Wi-Fi市場における主要企業の機会

- Wi-Fi市場:提供別

- Wi-Fi市場:ハードウェア別

- Wi-Fi市場:ソフトウェア別

- Wi-Fi市場:サービス別

- Wi-Fi市場:プロフェッショナルサービス別

- Wi-Fi市場:用途別

- Wi-Fi市場:展開別

- Wi-Fi市場:技術別

- Wi-Fi市場:密度別

- 北米のWi-Fi市場:提供別、展開別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- Wi-Fiの進化

- 2009年

- 2014年

- 2019年

- 2024年

- エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 関税と規制情勢

- 音声、画像その他のデータを受信、変換、送信又は再生するための機器(スイッチング機器及びルーティング機器を含む)に関連する関税

- 規制機関、政府機関、その他の組織

- 主な規制:Wi-Fi

- 価格分析

- 主要企業の平均販売価格の動向:ハードウェア別

- 主要企業の参考価格分析:展開タイプ別(2024年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- ポーターのファイブフォース分析

- 顧客ビジネスに影響を与える動向/混乱

- 主なステークホルダーと購入基準

- 主な会議とイベント(2025年~2026年)

- Wi-Fi市場の技術ロードマップ

- 短期ロードマップ(2023年~2025年)

- 中期ロードマップ(2026年~2028年)

- 長期ロードマップ(2029年~2030年)

- Wi-Fi市場におけるベストプラクティス

- 現在のビジネスモデルと新たなビジネスモデル

- Wi-Fi市場:ツール、フレームワーク、技法

- 貿易分析

- Wi-Fiデバイスの輸出シナリオ

- Wi-Fiデバイスの輸入シナリオ

- 投資と資金調達のシナリオ

- Wi-Fi市場に対するAI/生成AIの影響

- Wi-Fiに対するAI/生成AIの影響

- Wi-Fiにおける生成AIのユースケース

第6章 Wi-Fi市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 Wi-Fi市場:密度別

- イントロダクション

- 高密度Wi-Fi

- 中密度Wi-Fi

- 低密度Wi-Fi

第8章 Wi-Fi市場:展開タイプ別

- イントロダクション

- 屋内

- 屋外

第9章 Wi-Fi市場:技術別

- イントロダクション

- Wi-Fi 5(802.11AC)

- Wi-Fi 6(802.11AX)/6E

- Wi-Fi 7(802.11 BE)

- その他の技術

第10章 Wi-Fi市場:用途別

- イントロダクション

- 住宅

- インダストリー4.0

- スマート教育

- 公共Wi-Fi・密集した環境

- スマート医療

- スマート交通

- 企業

- スマートリテール

- スマートホスピタリティ

- その他の用途

第11章 Wi-Fi市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- 北欧諸国

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 韓国

- 東南アジア

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのマクロ経済の見通し

- サウジアラビア王国(KSA)

- アラブ首長国連邦

- クウェート

- バーレーン

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 市場ランキング分析

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオと動向

- ブランド/製品の比較

- 主なWi-Fi市場のプロバイダーの企業評価と財務指標

第13章 企業プロファイル

- 主要企業

- CISCO SYSTEMS

- HPE

- EXTREME NETWORKS, INC.

- JUNIPER NETWORKS

- FORTINET

- NETGEAR, INC.

- COMMSCOPE

- ALCATEL-LUCENT ENTERPRISE

- TP-LINK

- BROADCOM

- COMCAST BUSINESS

- VODAFONE

- TELSTRA

- FUJITSU

- AT&T

- HUAWEI

- UBIQUITI NETWORKS

- D-LINK

- ORANGE BUSINESS SERVICES

- KEYSIGHT TECHNOLOGIES

- スタートアップ/中小企業

- LEVER TECHNOLOGY GROUP

- REDWAY NETWORKS

- CAMBIUM NETWORKS

- ADB GLOBAL

- ACTIONTEC ELECTRONICS

- SDMC TECHNOLOGY

- EDGEWATER WIRELESS SYSTEMS

- AGILE CONTENT

第14章 隣接/関連市場

- イントロダクション

- SD-WAN市場 - 世界の予測(~2027年)

- 市場の定義

- 市場の概要

- SD-WAN市場:コンポーネント別

- SD-WAN市場:展開方式別

- SD-WAN市場:エンドユーザー別

- SD-WAN市場:地域別

- 公共安全向け無線ブロードバンド市場

- 市場の定義

- 市場の概要

- 公共安全向け無線ブロードバンド市場:技術別

- 公共安全向け無線ブロードバンド市場:エンドユーザー別

- 公共安全向け無線ブロードバンド市場:用途別

- 公共安全向け無線ブロードバンド市場:地域別

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 TARIFF RELATED TO MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA, INCLUDING SWITCHING AND ROUTING APPARATUS (HSN: 851762), 2024

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, BY HARDWARE (USD)

- TABLE 10 INDICATIVE PRICING LEVELS OF KEY PLAYERS, BY DEPLOYMENT TYPE, 2024

- TABLE 11 LIST OF MAJOR PATENTS

- TABLE 12 WI-FI MARKET: PORTER'S FIVE FORCES

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 WI-FI MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 17 WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 18 WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 19 WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 20 HARDWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 21 HARDWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 22 ACCESS POINT: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 23 ACCESS POINT: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 24 ROUTERS: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 25 ROUTERS: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 CONTROLLERS: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 27 CONTROLLERS: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 OTHER HARDWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 29 OTHER HARDWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 31 WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 32 SOFTWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 SOFTWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

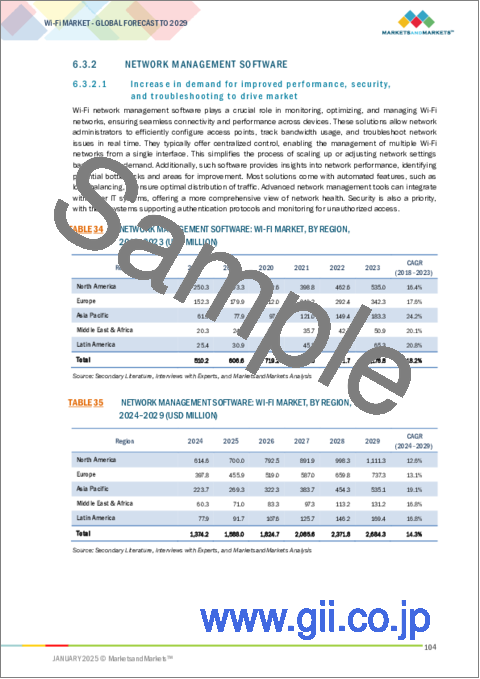

- TABLE 34 NETWORK MANAGEMENT SOFTWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 35 NETWORK MANAGEMENT SOFTWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 ANALYTICS & MONITORING SOFTWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 ANALYTICS & MONITORING SOFTWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 SECURITY SOFTWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 SECURITY SOFTWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 OTHER SOFTWARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 41 OTHER SOFTWARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 43 WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 44 SERVICES: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 45 SERVICES: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 47 WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 49 PROFESSIONAL SERVICES: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 TRAINING & CONSULTING: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 TRAINING & CONSULTING: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 NETWORK PLANNING, DESIGNING, AND IMPLEMENTATION: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 53 NETWORK PLANNING, DESIGNING, AND IMPLEMENTATION: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 54 SUPPORT & MAINTENANCE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 55 SUPPORT & MAINTENANCE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 MANAGED SERVICES: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 57 MANAGED SERVICES: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 59 WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 60 HIGH-DENSITY WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 61 HIGH-DENSITY WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 MEDIUM-DENSITY WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 63 MEDIUM-DENSITY WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 LOW-DENSITY WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 65 LOW-DENSITY WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 67 WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 68 INDOOR: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 69 INDOOR: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 70 OUTDOOR: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 71 OUTDOOR: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 73 WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 74 WI-FI 5 MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 75 WI-FI 5 MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 WI-FI 6 MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 77 WI-FI 6 MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 78 WI-FI 7 MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 79 WI-FI 7 MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 OTHER TECHNOLOGIES: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 81 OTHER TECHNOLOGIES: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 83 WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 84 RESIDENTIAL: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 85 RESIDENTIAL: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 INDUSTRY 4.0: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 87 INDUSTRY 4.0: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 SMART EDUCATION: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 89 SMART EDUCATION: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 90 PUBLIC WI-FI & DENSE ENVIRONMENT: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 91 PUBLIC WI-FI & DENSE ENVIRONMENT: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 SMART HEALTHCARE: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 93 SMART HEALTHCARE: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 SMART TRANSPORTATION: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 95 SMART TRANSPORTATION: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 CORPORATE ENTERPRISES: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 97 CORPORATE ENTERPRISES: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 98 SMART RETAIL: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 99 SMART RETAIL: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 SMART HOSPITALITY: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 101 SMART HOSPITALITY: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 104 WI-FI MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 105 WI-FI MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 106 NORTH AMERICA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 107 NORTH AMERICA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 108 NORTH AMERICA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 109 NORTH AMERICA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 110 NORTH AMERICA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 111 NORTH AMERICA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 112 NORTH AMERICA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 113 NORTH AMERICA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 114 NORTH AMERICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 115 NORTH AMERICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 116 NORTH AMERICA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 117 NORTH AMERICA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 118 NORTH AMERICA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 119 NORTH AMERICA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 122 NORTH AMERICA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 123 NORTH AMERICA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: WI-FI MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 125 NORTH AMERICA: WI-FI MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 126 US: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 127 US: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 128 US: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 129 US: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 130 US: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 131 US: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 132 US: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 133 US: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 134 US: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 135 US: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 136 US: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 137 US: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 138 US: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 139 US: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 140 US: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 141 US: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 142 US: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 143 US: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 144 CANADA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 145 CANADA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 146 CANADA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 147 CANADA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 148 CANADA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 149 CANADA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 150 CANADA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 151 CANADA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 152 CANADA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 153 CANADA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 154 CANADA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 155 CANADA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 156 CANADA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 157 CANADA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 158 CANADA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 159 CANADA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 160 CANADA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 161 CANADA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 162 EUROPE: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 163 EUROPE: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 164 EUROPE: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 165 EUROPE: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 166 EUROPE: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 167 EUROPE: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 168 EUROPE: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 169 EUROPE: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 170 EUROPE: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 171 EUROPE: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 172 EUROPE: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 173 EUROPE: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 174 EUROPE: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 175 EUROPE: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 176 EUROPE: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 177 EUROPE: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 178 EUROPE: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 179 EUROPE: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 180 EUROPE: WI-FI MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 181 EUROPE: WI-FI MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 182 GERMANY: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 183 GERMANY: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 184 GERMANY: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 185 GERMANY: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 186 GERMANY: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 187 GERMANY: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 188 GERMANY: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 189 GERMANY: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 190 GERMANY: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 191 GERMANY: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 192 GERMANY: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 193 GERMANY: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 194 GERMANY: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 195 GERMANY: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 196 GERMANY: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 197 GERMANY: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 198 GERMANY: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 199 GERMANY: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 200 ASIA PACIFIC: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 201 ASIA PACIFIC: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 202 ASIA PACIFIC: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 203 ASIA PACIFIC: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 204 ASIA PACIFIC: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 205 ASIA PACIFIC: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 206 ASIA PACIFIC: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 207 ASIA PACIFIC: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 208 ASIA PACIFIC: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 209 ASIA PACIFIC: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 210 ASIA PACIFIC: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 211 ASIA PACIFIC: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 212 ASIA PACIFIC: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 213 ASIA PACIFIC: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 214 ASIA PACIFIC: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 215 ASIA PACIFIC: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 216 ASIA PACIFIC: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 217 ASIA PACIFIC: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 218 ASIA PACIFIC: WI-FI MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 219 ASIA PACIFIC: WI-FI MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 220 CHINA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 221 CHINA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 222 CHINA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 223 CHINA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 224 CHINA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 225 CHINA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 226 CHINA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 227 CHINA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 228 CHINA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 229 CHINA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 230 CHINA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 231 CHINA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 232 CHINA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 233 CHINA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 234 CHINA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 235 CHINA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 236 CHINA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 237 CHINA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: WI-FI MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: WI-FI MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 258 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 259 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 260 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 261 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 262 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 263 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 264 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 265 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 266 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 267 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 268 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 269 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 270 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 271 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 272 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 273 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 274 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 275 KINGDOM OF SAUDI ARABIA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 276 LATIN AMERICA: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 277 LATIN AMERICA: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 278 LATIN AMERICA: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 279 LATIN AMERICA: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 280 LATIN AMERICA: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 281 LATIN AMERICA: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 282 LATIN AMERICA: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 283 LATIN AMERICA: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 284 LATIN AMERICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 285 LATIN AMERICA: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 286 LATIN AMERICA: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 287 LATIN AMERICA: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 288 LATIN AMERICA: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 289 LATIN AMERICA: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 290 LATIN AMERICA: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 291 LATIN AMERICA: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 292 LATIN AMERICA: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 293 LATIN AMERICA: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 294 LATIN AMERICA: WI-FI MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 295 LATIN AMERICA: WI-FI MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 296 BRAZIL: WI-FI MARKET, BY OFFERING, 2018-2023 (USD MILLION)

- TABLE 297 BRAZIL: WI-FI MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 298 BRAZIL: WI-FI MARKET, BY HARDWARE, 2018-2023 (USD MILLION)

- TABLE 299 BRAZIL: WI-FI MARKET, BY HARDWARE, 2024-2029 (USD MILLION)

- TABLE 300 BRAZIL: WI-FI MARKET, BY SOFTWARE, 2018-2023 (USD MILLION)

- TABLE 301 BRAZIL: WI-FI MARKET, BY SOFTWARE, 2024-2029 (USD MILLION)

- TABLE 302 BRAZIL: WI-FI MARKET, BY SERVICE, 2018-2023 (USD MILLION)

- TABLE 303 BRAZIL: WI-FI MARKET, BY SERVICE, 2024-2029 (USD MILLION)

- TABLE 304 BRAZIL: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2018-2023 (USD MILLION)

- TABLE 305 BRAZIL: WI-FI MARKET, BY PROFESSIONAL SERVICE, 2024-2029 (USD MILLION)

- TABLE 306 BRAZIL: WI-FI MARKET, BY DEPLOYMENT, 2018-2023 (USD MILLION)

- TABLE 307 BRAZIL: WI-FI MARKET, BY DEPLOYMENT, 2024-2029 (USD MILLION)

- TABLE 308 BRAZIL: WI-FI MARKET, BY DENSITY, 2018-2023 (USD MILLION)

- TABLE 309 BRAZIL: WI-FI MARKET, BY DENSITY, 2024-2029 (USD MILLION)

- TABLE 310 BRAZIL: WI-FI MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 311 BRAZIL: WI-FI MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 312 BRAZIL: WI-FI MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 313 BRAZIL: WI-FI MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 314 OVERVIEW OF STRATEGIES ADOPTED BY KEY WI-FI MARKET VENDORS

- TABLE 315 WI-FI MARKET: DEGREE OF COMPETITION

- TABLE 316 WI-FI MARKET: OFFERING FOOTPRINT

- TABLE 317 WI-FI MARKET: DEPLOYMENT FOOTPRINT

- TABLE 318 WI-FI MARKET: DENSITY FOOTPRINT

- TABLE 319 WI-FI MARKET: APPLICATION FOOTPRINT

- TABLE 320 WI-FI MARKET: REGIONAL FOOTPRINT

- TABLE 321 WI-FI MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 322 WI-FI MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 323 WI-FI MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, JANUARY 2022-DECEMBER 2024

- TABLE 324 WI-FI MARKET: DEALS, JANUARY 2022-DECEMBER 2024

- TABLE 325 CISCO SYSTEMS: COMPANY OVERVIEW

- TABLE 326 CISCO SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 CISCO SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 328 CISCO SYSTEMS: DEALS

- TABLE 329 HPE: COMPANY OVERVIEW

- TABLE 330 HPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 332 HPE: DEALS

- TABLE 333 EXTREME NETWORKS: COMPANY OVERVIEW

- TABLE 334 EXTREME NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 EXTREME NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 336 EXTREME NETWORKS: DEALS

- TABLE 337 JUNIPER NETWORKS: COMPANY OVERVIEW

- TABLE 338 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 JUNIPER NETWORKS: DEALS

- TABLE 340 FORTINET: COMPANY OVERVIEW

- TABLE 341 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 FORTINET: DEALS

- TABLE 343 NETGEAR, INC.: COMPANY OVERVIEW

- TABLE 344 NETGEAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 NETGEAR: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 346 NETGEAR: DEALS

- TABLE 347 COMMSCOPE: COMPANY OVERVIEW

- TABLE 348 COMMSCOPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 COMMSCOPE: DEALS

- TABLE 350 ALCATEL-LUCENT ENTERPRISE: COMPANY OVERVIEW

- TABLE 351 ALCATEL-LUCENT ENTERPRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 ALCATEL-LUCENT ENTERPRISE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 353 ALCATEL-LUCENT ENTERPRISE: DEALS

- TABLE 354 TP-LINK: COMPANY OVERVIEW

- TABLE 355 TP-LINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 356 TP-LINK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 357 TP-LINK: DEALS

- TABLE 358 BROADCOM: COMPANY OVERVIEW

- TABLE 359 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 361 BROADCOM: DEALS

- TABLE 362 SD-WAN MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 363 SD-WAN MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 364 SD-WAN MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 365 SD-WAN MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 366 SD-WAN MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 367 SD-WAN MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 368 SD-WAN MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 369 SD-WAN MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 370 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY TECHNOLOGY, 2018-2023 (USD MILLION)

- TABLE 371 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 372 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY END USER, 2018-2023 (USD MILLION)

- TABLE 373 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY END USER, 2024-2029 (USD MILLION)

- TABLE 374 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY APPLICATION, 2018-2023 (USD MILLION)

- TABLE 375 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 376 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 377 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 WI-FI MARKET SEGMENTATION

- FIGURE 2 WI-FI MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 WI-FI MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN WI-FI MARKET

- FIGURE 6 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): WI-FI MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 WI-FI MARKET, 2022-2029 (USD MILLION)

- FIGURE 11 WI-FI MARKET, BY REGION (2024)

- FIGURE 12 GOVERNMENT INITIATIVES FOR SMART CITY PROJECTS TO DRIVE MARKET

- FIGURE 13 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 ACCESS POINTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 NETWORK MANAGEMENT SOFTWARE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 NETWORK PLANNING, DESIGNING, & IMPLEMENTATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 RESIDENTIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 INDOOR SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 WI-FI 6/6E TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 HIGH-DENSITY WI-FI TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 HARDWARE AND INDOOR SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2024

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WI-FI MARKET

- FIGURE 24 WI-FI EVOLUTION

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICES AMONG KEY PLAYERS, BY HARDWARE

- FIGURE 28 LIST OF MAJOR PATENTS FOR WI-FI SOLUTIONS

- FIGURE 29 WI-FI MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 33 WI-FI MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 34 WI-FI DEVICES EXPORT, BY KEY COUNTRY, 2016-2023 (USD MILLION)

- FIGURE 35 WI-FI DEVICES IMPORT, BY KEY COUNTRY, 2016-2023 (USD MILLION)

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO

- FIGURE 37 USE CASES OF GENERATIVE AI IN WI-FI

- FIGURE 38 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 CONTROLLERS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ANALYTICS & MONITORING SOFTWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 MANAGED SERVICES TO BE FASTER GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 42 TRAINING, SUPPORT, AND MAINTENANCE TO REGISTER HIGHEST CAGR

- FIGURE 43 HIGH-DENSITY WI-FI SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 OUTDOOR SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 WI-FI 7 TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 SMART HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: WI-FI MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: WI-FI MARKET SNAPSHOT

- FIGURE 49 REVENUE ANALYSIS OF KEY COMPANIES FROM 2019 TO 2023

- FIGURE 50 SHARE OF LEADING COMPANIES IN WI-FI MARKET, 2024

- FIGURE 51 MARKET RANKING ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 52 WI-FI MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 53 WI-FI MARKET: COMPANY FOOTPRINT

- FIGURE 54 WI-FI MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 55 BRAND/PRODUCT COMPARISON

- FIGURE 56 FINANCIAL METRICS OF KEY WI-FI MARKET VENDORS

- FIGURE 57 COMPANY VALUATION OF KEY WI-FI MARKET VENDORS

- FIGURE 58 CISCO SYSTEMS: COMPANY SNAPSHOT

- FIGURE 59 HPE: COMPANY SNAPSHOT

- FIGURE 60 EXTREME NETWORKS: COMPANY SNAPSHOT

- FIGURE 61 JUNIPER NETWORKS: COMPANY SNAPSHOT

- FIGURE 62 FORTINET: COMPANY SNAPSHOT

- FIGURE 63 NETGEAR: COMPANY SNAPSHOT

- FIGURE 64 COMMSCOPE: COMPANY SNAPSHOT

- FIGURE 65 BROADCOM: COMPANY SNAPSHOT

The Wi-Fi market is estimated at USD 22.06 billion in 2024 to USD 45.12 billion by 2029, at a Compound Annual Growth Rate (CAGR) of 15.4%. Wi-Fi is a core component of Smart City initiatives since it provides reliable connectivity for most applications in cities. It supports numerous IoT devices simultaneously to make utilities such as electricity and water evenly distributed and avoid the wastage of these resources. Public safety systems such as smart surveillance and emergency communication will also be enhanced through real-time data transmission. Its usage in transportation allows for connected traffic management and tracking public transport, thus improving transit. Adoption of Wi-Fi and its scalable cost-effective solutions has accelerated the transformation of cities into intelligent, efficient, and livable spaces.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2024 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By Offering Deployment, Technology, Application and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

"By deployment, the Indoor segment will hold the larger market size during the forecast period."

Indoor Wi-Fi deployments are tailored for enclosed spaces such as homes, offices, shopping malls, hospitals, and educational institutions that require fast connectivity. These indoor setups ensure strategic placement of access points to achieve the most effective coverage with minimal interference from walls and other obstacles. Features such as beamforming and MU-MIMO ensure optimal performance in high-density environments, such as open-plan offices or classrooms. Seamless roaming enables devices to maintain connectivity regardless of the position of the users within the premises. Security in enterprise environments will be ensured with emerging standards such as WPA3. Centralized network management would enable real-time monitoring and troubleshooting of issues. Indoor Wi-Fi supports smart building systems, video conferencing, IoT devices, and high-bandwidth applications necessary in modern, connected indoor spaces.

"The High-density Wi-FI segment will register the fastest growth rate during the forecast period."

High-density Wi-Fi networks are designed to deliver reliable connectivity in environments with a large number of devices. They ensure seamless internet access across various applications. They use advanced technologies such as Wi-Fi 6 and Wi-Fi 7 to handle a high demand from a wide range of devices, such as smartphones, laptops, and IoT. With intelligent network design, including optimal access points and signal strength, high-density Wi-Fi ensures consistency in every area, even in the densest spaces. Techniques such as load balancing and band steering also assist in stronger connectivity by better redistributing traffic patterns and thereby reducing congestion. Robust encryption, enhanced monitoring features, and fine-tuned access control ensure secure and reliable connections. With proactive capacity planning and continuous performance monitoring, high-density Wi-Fi networks ensure a stable, safe, and high-performing experience even at peak usage times.

"Asia Pacific will witness the highest market growth rate during the forecast period."

The Asia Pacific region's Wi-Fi landscape firmly pushes towards bridging the digital divide and fostering digital inclusion. In Japan, KDDI Corporation and Wire & Wireless launched a free Wi-Fi network platform using OpenRoaming, starting in April 2023, to enhance secure connectivity in high-density environments such as various municipalities in Toky. This platform offers advanced features, including encrypted wireless communication, 6GHz support (Wi-Fi 6E), and compatibility with multiple operating systems and languages, ensuring easy access for users across various regions. Similarly, South Korea has set a global standard by equipping over 35,000 buses with free Wi-Fi, benefiting millions of passengers, with the initiative completed by December 2020. Other nations are following suit with ambitious initiatives. Thailand's Free Public Wi-Fi and the Net Pracharat project have connected rural areas to high-speed broadband, with over 74,987 villages connected. The Philippines' Free Wi-Fi for All program continues to expand, complementing government-led digital infrastructure projects. Vietnam's National Broadband Plan, launched in June 2024, aims for nationwide high-speed internet by 2025. Indonesia's Digital Village initiative and Smart Islands program are strengthening connectivity with widespread free Wi-Fi support, enhancing local economies and infrastructure.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the Wi-Fi market.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors -25%, Managers - 35%, and Others - 40%

- By Region: North America - 42%, Europe - 37%, Asia Pacific - 21%

The major players in the Wi-Fi market include Cisco Systems (US), HPE (US), NETGEAR (US), Extreme Networks (US), Juniper Networks (US), Fortinet (US), CommScope (US), Alcatel-Lucent Enterprise (France), TP-Link (China), Broadcom (US), Comcast Business (US), Vodafone (UK), Telstra (Australia), Fujitsu (Japan), AT&T (US), Huawei (China), Ubiquiti Networks ( US), D-Link (Taiwan), Orange Business Services (France), Keysight Technologies (US), Lever Technology Group (UK), Redway Networks (UK), Cabium Networks (US), ADB Global (Switzerland), Actiontec Electronics ( US), SDMC Technology (China), Edgewater Wireless (Canada), Agile Content (Spain). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their Wi-Fi market footprint.

Research Coverage

The market study covers the Wi-Fi market size across different segments. It aims at estimating the market size and the growth potential across various segments, including by offering (hardware (access points, routers, controllers, other hardware (range extenders, antennas, load balancers)), software (network management software, analytics and monitoring software, security software, other software (location-based services, guest access and captive portals), services (professional services (training & consulting network planning, designing, and implementation, support & maintenance) managed services), by deployment (indoor, outdoor), by density (high density Wi-Fi, medium density Wi-Fi, low density Wi-Fi), by technology ( Wi-Fi 5, Wi-Fi 6, Wi-Fi 7, other technologies (Wi-Fi 4 & older versions), by application (residential, industry 4.0, smart education, public Wi-Fi & dense environment, smart transportation, corporate enteprises, smart healthcare, smart retail , smart hospitality, other applications (smart utilities, smart agriculture) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global Wi-Fi market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising adoption of digital solutions for quality wireless network connectivity, Increasing investments by telecom players in wireless network infrastructure, Increase in smartphone and wireless device adoption, growth in adoption of byod and cyod trend among organizations, widespread adoption of IoT devices), restraints (stringent government data regulations and guidelines, contention loss and co-channel interference) opportunities (stringent government data regulations and guidelines, contention loss and co-channel interference), and challenges (poor user experience in high-density environment, data security and privacy concerns) influencing the growth of the Wi-Fi market.

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Wi-Fi market.

Market Development: The report provides comprehensive information about lucrative markets and analyses the Wi-Fi market across various regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Wi-Fi market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading include Cisco Systems (US), HPE (US), NETGEAR (US), Extreme Networks (US), Juniper Networks (US), Fortinet (US), CommScope (US), Alcatel-Lucent Enterprise (France), TP-Link (China), Broadcom (US), Comcast Business (US), Vodafone (UK), Telstra (Australia), Fujitsu (Japan), AT&T (US), Huawei (China), Ubiquiti Networks ( US), D-Link (Taiwan), Orange Business Services (France), Keysight Technologies (US), Lever Technology Group (UK), Redway Networks (UK), Cabium Networks (US), ADB Global (Switzerland), Actiontec Electronics ( US), SDMC Technology (China), Edgewater Wireless (Canada), Agile Content(Spain).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 WI-FI MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 LIMITATIONS AND RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR KEY PLAYERS IN WI-FI MARKET

- 4.2 WI-FI MARKET, BY OFFERING

- 4.3 WI-FI MARKET, BY HARDWARE

- 4.4 WI-FI MARKET, BY SOFTWARE

- 4.5 WI-FI MARKET, BY SERVICE

- 4.6 WI-FI MARKET, BY PROFESSIONAL SERVICE

- 4.7 WI-FI MARKET, BY APPLICATION

- 4.8 WI-FI MARKET, BY DEPLOYMENT

- 4.9 WI-FI MARKET, BY TECHNOLOGY

- 4.10 WI-FI MARKET, BY DENSITY

- 4.11 NORTH AMERICA: WI-FI MARKET, BY OFFERING AND DEPLOYMENT

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of digital solutions for quality wireless network connectivity

- 5.2.1.2 Increasing investments by telecom players in wireless network infrastructure

- 5.2.1.3 Increase in smartphone and wireless device adoption

- 5.2.1.4 Growth in adoption of BYOD and CYOD trend among organizations

- 5.2.1.5 Widespread adoption of IoT devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent government data regulations and guidelines

- 5.2.2.2 Contention loss and co-channel interference

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government initiatives for smart city projects

- 5.2.3.2 Rapid evolution of carrier Wi-Fi

- 5.2.3.3 Continuous upgrades in Wi-Fi standards

- 5.2.4 CHALLENGES

- 5.2.4.1 Poor user experience in high-density environments

- 5.2.4.2 Lack of data security and privacy concerns

- 5.2.1 DRIVERS

- 5.3 WI-FI EVOLUTION

- 5.3.1 2009

- 5.3.2 2014

- 5.3.3 2019

- 5.3.4 2024

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 HUAWEI WI-FI SOLUTION BOOSTS UNIEURO'S ROI

- 5.5.2 BUILDING SAFER LEARNING ENVIRONMENT AT MURRAY CITY SCHOOL DISTRICT

- 5.5.3 AI-DRIVEN WI-FI AT UNIVERSITY OF OXFORD

- 5.5.4 ENHANCING NETWORK PERFORMANCE AT UNIVERSITY OF LAMPUNG (UNILA)

- 5.5.5 FRASER VALLEY REGIONAL LIBRARY - RUCKUS SWITCHES HELP LAUNCH NEW CHAPTER IN ONLINE LIBRARY SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TARIFF AND REGULATORY LANDSCAPE

- 5.7.1 TARIFF RELATED TO MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA, INCLUDING SWITCHING AND ROUTING APPARATUS

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.3 KEY REGULATIONS: WI-FI

- 5.7.3.1 North America

- 5.7.3.1.1 US

- 5.7.3.1.2 Canada

- 5.7.3.2 Europe

- 5.7.3.2.1 Germany

- 5.7.3.2.2 Spain

- 5.7.3.2.3 Italy

- 5.7.3.2.4 UK

- 5.7.3.3 Asia Pacific

- 5.7.3.3.1 South Korea

- 5.7.3.3.2 China

- 5.7.3.3.3 India

- 5.7.3.4 Middle East & Africa

- 5.7.3.4.1 UAE

- 5.7.3.4.2 KSA

- 5.7.3.4.3 South Africa

- 5.7.3.5 Latin America

- 5.7.3.5.1 Brazil

- 5.7.3.5.2 Mexico

- 5.7.3.1 North America

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS, BY HARDWARE

- 5.8.2 INDICATIVE PRICING ANALYSIS, OF KEY PLAYERS, BY DEPLOYMENT TYPE, 2024

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 IEEE 802.11 standards

- 5.9.1.2 OFDM (Orthogonal Frequency Division Multiplexing)

- 5.9.1.3 MU-MIMO (Multi-User, Multiple Input Multiple Output)

- 5.9.1.4 Beamforming

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Blockchain

- 5.9.2.2 Edge computing

- 5.9.2.3 IoT

- 5.9.2.4 Cloud computing

- 5.9.2.5 AR/VR (Augmented Reality/Virtual Reality)

- 5.9.2.6 AI/ML

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Cellular networks

- 5.9.3.2 Bluetooth

- 5.9.3.3 LoRaWAN

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR WI-FI MARKET

- 5.15.1 SHORT-TERM ROADMAP (2023-2025)

- 5.15.2 MID-TERM ROADMAP (2026-2028)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN WI-FI MARKET

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 WI-FI MARKET: TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.19 TRADE ANALYSIS

- 5.19.1 EXPORT SCENARIO OF WI-FI DEVICES

- 5.19.2 IMPORT SCENARIO OF WI-FI DEVICES

- 5.20 INVESTMENT AND FUNDING SCENARIO

- 5.21 IMPACT OF AI/GEN AI ON WI-FI MARKET

- 5.21.1 IMPACT OF AI/GENERATIVE AI ON WI-FI

- 5.21.2 USE CASES OF GENERATIVE AI IN WI-FI

6 WI-FI MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 BY OFFERING: WI-FI MARKET DRIVERS

- 6.2 HARDWARE

- 6.2.1 ACCESS POINTS

- 6.2.1.1 Centralized control, scalability, and real-time monitoring to drive growth

- 6.2.2 ROUTERS

- 6.2.2.1 Shift toward cloud gaming services to drive market demand

- 6.2.3 CONTROLLERS

- 6.2.3.1 Increase in demand for Wi-Fi controllers to manage traffic and optimize performance in dense environments to drive demand

- 6.2.4 OTHER HARDWARE

- 6.2.1 ACCESS POINTS

- 6.3 SOFTWARE

- 6.3.1 NEED FOR UNIFIED, SECURE, AND HIGH-SPEED INTERNET ACCESS FOR ENTERPRISES AND BUSINESSES TO DRIVE MARKET

- 6.3.2 NETWORK MANAGEMENT SOFTWARE

- 6.3.2.1 Increase in demand for improved performance, security, and troubleshooting to drive market

- 6.3.3 ANALYTICS & MONITORING SOFTWARE

- 6.3.3.1 Rise in demand for data insights and real-time monitoring to drive need for analytics software

- 6.3.4 SECURITY SOFTWARE

- 6.3.4.1 Increase in cybersecurity threats to drive demand for advanced security software

- 6.3.5 OTHER SOFTWARE

- 6.4 SERVICES

- 6.4.1 PROFESSIONAL SERVICES

- 6.4.1.1 Need for adequate optimization of network devices to boost growth

- 6.4.1.2 Training & consulting

- 6.4.1.3 Network planning, design, and implementation

- 6.4.1.4 Support & maintenance

- 6.4.2 MANAGED SERVICES

- 6.4.2.1 Rise in demand for specialized MSPs and cloud-based managed Wi-Fi services to drive segment

- 6.4.1 PROFESSIONAL SERVICES

7 WI-FI MARKET, BY DENSITY

- 7.1 INTRODUCTION

- 7.1.1 DENSITY: WI-FI MARKET DRIVERS

- 7.2 HIGH-DENSITY WI-FI

- 7.2.1 NEED FOR LARGE WI-FI DEPLOYMENT IN PRESENCE OF UNCONTROLLABLE VARIABLES IN PUBLIC SPACES TO DRIVE DEMAND

- 7.3 MEDIUM-DENSITY WI-FI

- 7.3.1 INCREASING USE OF WIFI IN SCHOOLS, RETAIL STORES, AND SMALL EVENT VENUES TO DRIVE MARKET

- 7.4 LOW-DENSITY WI-FI

- 7.4.1 NEED FOR COST-EFFECTIVE, RELIABLE SOLUTIONS FOR SMALL BUSINESSES AND HOMES TO DRIVE MARKET

8 WI-FI MARKET, BY DEPLOYMENT TYPE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT TYPE: WI-FI MARKET DRIVERS

- 8.2 INDOOR

- 8.2.1 INCREASE IN DEMAND FOR RELIABLE CONNECTIVITY AND HIGHER BANDWIDTH IN INDOOR ENVIRONMENTS TO DRIVE MARKET

- 8.3 OUTDOOR

- 8.3.1 INCREASE IN DEMAND FOR CONNECTIVITY IN OUTDOOR SPACES TO DRIVE MARKET

9 WI-FI MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.1.1 BY TECHNOLOGY: WI-FI MARKET DRIVERS

- 9.2 WI-FI 5 (802.11AC)

- 9.2.1 INCREASE IN USE OF INTERNET AND SMART DEVICES TO DRIVE MARKET

- 9.3 WI-FI 6 (802.11AX)/6E

- 9.3.1 IMPROVED PERFORMANCE WITHOUT REQUIRING FULL NETWORK UPGRADE TO DRIVE MARKET

- 9.4 WI-FI 7 (802.11 BE)

- 9.4.1 FASTER SPEEDS AND LOWER LATENCY SUPPORTING AI, CLOUD GAMING, AND DATA ANALYTICS TO DRIVE MARKET

- 9.5 OTHER TECHNOLOGIES

10 WI-FI MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.1.1 BY APPLICATION: WIFI MARKET DRIVERS

- 10.2 RESIDENTIAL

- 10.2.1 STABLE INTERNET FOR MULTIPLE CONNECTED DEVICES IN HOUSEHOLDS TO DRIVE MARKET

- 10.3 INDUSTRY 4.0

- 10.3.1 ENHANCED MACHINE AUTOMATION AND DAY-TO-DAY INDUSTRIAL OPERATIONS TO DRIVE MARKET

- 10.4 SMART EDUCATION

- 10.4.1 DYNAMIC, INTERACTIVE LEARNING ENVIRONMENTS TO DRIVE MARKET

- 10.5 PUBLIC WI-FI & DENSE ENVIRONMENT

- 10.5.1 COST-EFFECTIVE ACCESS IN PUBLIC SPACES, REDUCING RELIANCE ON CELLULAR NETWORKS TO DRIVE MARKET

- 10.6 SMART HEALTHCARE

- 10.6.1 REAL-TIME MONITORING OF PATIENTS THROUGH WEARABLE DEVICES TO DRIVE MARKET

- 10.7 SMART TRANSPORTATION

- 10.7.1 REAL-TIME VEHICLE TRACKING, BOOSTING FLEET MANAGEMENT AND LOGISTICS TO DRIVE MARKET

- 10.8 CORPORATE ENTERPRISES

- 10.8.1 NEED TO ENSURE SECURE ACCESS TO CLOUD-BASED BUSINESS APPLICATIONS TO DRIVE MARKET

- 10.9 SMART RETAIL

- 10.9.1 PERSONALIZED SHOPPING EXPERIENCES THROUGH LOCATION-BASED SERVICES TO DRIVE MARKET

- 10.10 SMART HOSPITALITY

- 10.10.1 SEAMLESS CHECK-IN/CHECK-OUT, IMPROVING GUEST CONVENIENCE TO DRIVE MARKET

- 10.11 OTHER APPLICATIONS

11 WI-FI MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Smart stadiums and government initiatives to drive market

- 11.2.3 CANADA

- 11.2.3.1 Rapid adoption of new technologies and innovations to fuel growth

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 GERMANY

- 11.3.2.1 Strong government initiatives for development of smart cities to fuel growth

- 11.3.3 UK

- 11.3.3.1 Adoption of cloud-based services to bolster market

- 11.3.4 ITALY

- 11.3.4.1 Government initiatives focused on expanding connectivity to drive growth

- 11.3.5 FRANCE

- 11.3.5.1 Public Wi-Fi initiatives to drive market growth

- 11.3.6 SPAIN

- 11.3.6.1 Robust Wi-Fi infrastructure to drive market growth

- 11.3.7 NORDIC COUNTRIES

- 11.3.7.1 Digital inclusion initiatives to drive market growth

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Public Wi-Fi initiatives and smart city projects to boost demand

- 11.4.3 INDIA

- 11.4.3.1 Need for high-speed internet connection and growing penetration of connected devices to drive growth

- 11.4.4 JAPAN

- 11.4.4.1 Extensive use of Wi-Fi for disaster preparedness to drive market

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Government initiatives and free Wi-Fi services to drive market growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Extensive public Wi-Fi coverage to drive market

- 11.4.7 SOUTHEAST ASIA

- 11.4.7.1 Digital tourism and digital infrastructure projects to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.2 KINGDOM OF SAUDI ARABIA (KSA)

- 11.5.2.1 Increasing government investments in digital infrastructure to drive market

- 11.5.3 UAE

- 11.5.3.1 Public Wi-Fi initiatives and collaboration amongst private players to drive market

- 11.5.4 KUWAIT

- 11.5.4.1 Robust digital infrastructure and government innovations to drive market

- 11.5.5 BAHRAIN

- 11.5.5.1 Wi-Fi 7 and initiatives aiming for increased internet accessibility to drive market

- 11.5.6 SOUTH AFRICA

- 11.5.6.1 Significant public and private sector initiatives to drive market

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.2 BRAZIL

- 11.6.2.1 Public Wi-Fi initiatives to address connectivity gaps to drive growth

- 11.6.3 MEXICO

- 11.6.3.1 Internet for All Program and extensive public Wi-Fi coverage to drive market

- 11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 MARKET RANKING ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Offering footprint

- 12.6.5.2 Deployment footprint

- 12.6.5.3 Density footprint

- 12.6.5.4 Application footprint

- 12.6.5.5 Regional footprint

- 12.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 12.7.5.1 Key Start-Ups/SMEs

- 12.7.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 12.8.2 DEALS

- 12.9 BRAND/PRODUCT COMPARISON

- 12.10 COMPANY VALUATION AND FINANCIAL METRICS OF KEY WI-FI MARKET PROVIDERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 CISCO SYSTEMS

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and enhancements

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 HPE

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and enhancements

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 EXTREME NETWORKS, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and enhancements

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 JUNIPER NETWORKS

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FORTINET

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 NETGEAR, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches and enhancements

- 13.1.6.3.2 Deals

- 13.1.7 COMMSCOPE

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 ALCATEL-LUCENT ENTERPRISE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches and enhancements

- 13.1.9 TP-LINK

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches and enhancements

- 13.1.9.3.2 Deals

- 13.1.10 BROADCOM

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches and enhancements

- 13.1.10.3.2 Deals

- 13.1.11 COMCAST BUSINESS

- 13.1.12 VODAFONE

- 13.1.13 TELSTRA

- 13.1.14 FUJITSU

- 13.1.15 AT&T

- 13.1.16 HUAWEI

- 13.1.17 UBIQUITI NETWORKS

- 13.1.18 D-LINK

- 13.1.19 ORANGE BUSINESS SERVICES

- 13.1.20 KEYSIGHT TECHNOLOGIES

- 13.1.1 CISCO SYSTEMS

- 13.2 STARTUPS/SMES

- 13.2.1 LEVER TECHNOLOGY GROUP

- 13.2.2 REDWAY NETWORKS

- 13.2.3 CAMBIUM NETWORKS

- 13.2.4 ADB GLOBAL

- 13.2.5 ACTIONTEC ELECTRONICS

- 13.2.6 SDMC TECHNOLOGY

- 13.2.7 EDGEWATER WIRELESS SYSTEMS

- 13.2.8 AGILE CONTENT

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 SD-WAN MARKET - GLOBAL FORECAST TO 2027

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.3 SD-WAN MARKET, BY COMPONENT

- 14.2.4 SD-WAN MARKET, BY DEPLOYMENT MODE

- 14.2.5 SD-WAN MARKET, BY END USER

- 14.2.6 SD-WAN MARKET, BY REGION

- 14.3 WIRELESS BROADBAND PUBLIC SAFETY MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.3 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY TECHNOLOGY

- 14.3.4 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY END USER

- 14.3.5 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY APPLICATION

- 14.3.6 WIRELESS BROADBAND IN PUBLIC SAFETY MARKET, BY REGION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS