|

|

市場調査レポート

商品コード

1230245

食品カプセル化の世界市場:シェル材料別 (脂質、多糖類、乳化剤、タンパク質)・技術別 (マイクロカプセル化、ナノカプセル化、ハイブリッドカプセル化)・用途別・方法別・コアフェーズ別・地域別の将来予測 (2027年まで)Food Encapsulation Market by Shell Material (Lipids, Polysaccharides, Emulsifiers, Proteins), Technology (Microencapsulation, Nanoencapsulation, Hybrid Encapsulation), Application, Method, Core Phase and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 食品カプセル化の世界市場:シェル材料別 (脂質、多糖類、乳化剤、タンパク質)・技術別 (マイクロカプセル化、ナノカプセル化、ハイブリッドカプセル化)・用途別・方法別・コアフェーズ別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月23日

発行: MarketsandMarkets

ページ情報: 英文 388 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の食品カプセル化の市場規模は、2022年に115億米ドルに達し、2022年から2027年にかけて8.2%の成長率で成長する、と推定されています。

食品カプセル化市場は、既製食品におけるカプセル型着色料・香料の需要増大や、カプセル型生物活性を使用する栄養補助食品の需要増大、技術進歩などの要因により、飛躍的な成長を遂げると予測されます。

方法別では、ナノカプセル化分野が2021年に最大のシェアを占め、9.1%のCAGRで成長する、と予測されています。ナノテクノロジーは、食品産業において非常に有望な分野です。機能性食品、パッケージング、保存料、酸化防止剤、香料など、さまざまな製品に利用されています。また、幅広い機器の利用可能性、大規模生産、連続的なユニット操作、操作の容易さ、低いプロセスコストといった利点があります。

用途別では、栄養補助食品のセグメントが予測期間中に7.8%の成長を示すと予測されています。栄養補助食品をカプセル化することで、その中の生理活性物質のバイオアベイラビリティと溶解度を向上させることができます。また、化学物質や外部環境との反応から生理活性物質を保護します。カプセル化された栄養補助食品は、低アレルギー性で、理想的なサプリメントとなります。

シェル材料別では、2022年に多糖類が市場を独占しています。多糖類は、その巨大な分子構造と生物活性を包含する能力から、送達システムの適切な構成要素だと考えられています。また、安価で安全なカプセル化用のシェル材料として広く利用されています。

当レポートでは、世界の食品カプセル化の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コアフェーズ別・技術別・シェル材料別・方法別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 小売業界の発展

- 共働き世帯の増加

- 慢性疾患の増加による栄養補助食品の需要拡大

- 市場力学

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 規制の枠組み

- 特許分析

- バリューチェーン分析

- 食品カプセル化市場のバイヤーに影響を与える動向/混乱

- 市場エコシステム

- 貿易分析

- 技術分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主な会議とイベント

- 主な利害関係者と購入基準

- 購入基準

- 食品カプセル化市場に対する景気後退の影響

第7章 食品カプセル化市場:コアフェーズ別

- イントロダクション

- ビタミン・ミネラル

- 脂溶性ビタミン

- 水溶性ビタミン

- 酵素

- 炭水化物分解酵素

- プロテアーゼ

- リパーゼ

- その他の酵素

- 有機酸

- クエン酸

- 酢酸

- リンゴ酸

- フマル酸

- 乳酸

- プロピオン酸

- アスコルビン酸

- その他の有機酸

- プロバイオティクス

- バクテリア

- 酵母

- 甘味料

- 栄養脂質

- 防腐剤

- 抗菌剤

- 抗酸化物質

- その他の防腐剤

- プレバイオティクス

- オリゴ糖

- イヌリン

- ポリデキストロース

- その他のプレバイオティクス

- 着色料

- 自然

- 人工

- アミノ酸

- フレーバー

- チョコレート・ブラウン

- バニラ

- フルーツ・ナッツ

- 乳製品

- スパイス

- その他のフレーバー

- タンパク質

- その他のコアフェーズ

第8章 食品カプセル化市場:技術別

- イントロダクション

- マイクロカプセル化

- ナノカプセル化

- ハイブリッドカプセル化

第9章 食品カプセル化市場:シェル材料別

- イントロダクション

- 多糖類

- タンパク質

- 脂質

- 乳化剤

第10章 食品カプセル化市場:方法別

- イントロダクション

- 物理的方法

- 霧化

- 噴霧乾燥

- 噴霧冷却

- スピニングディスク

- 流動床コーティング

- 押出

- その他の物理的方法

- 化学的方法

- 重合

- ゾルゲル法

- 物理化学的方法

- コアセルベーション

- 蒸発溶媒拡散

- LBL (Layer-By-Layer) カプセル化

- シクロデキストリン

- リポソーム

- その他の物理化学的方法

第11章 食品カプセル化市場:用途別

- イントロダクション

- 栄養補助食品

- 機能性食品

- ベーカリー製品

- 菓子類

- 飲料

- 冷凍製品

- 乳製品

- その他の用途

第12章 食品カプセル化市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

- 他の国々 (RoW)

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の収益分析:セグメント別

- 市場シェア分析

- 主要企業の評価クアドラント (主要企業)

- 製品フットプリント

- 競合リーダーシップマッピング (スタートアップ/中小企業)

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル (事業概要、提供製品/ソリューション/サービス、近年の動向、資本取引、MnMの見解、主な強み、決定された戦略的選択、弱み/競争上の脅威)

- 主要企業

- CARGILL, INCORPORATED

- BASF SE

- KERRY

- DSM

- INGREDION

- SYMRISE

- SENSIENT TECHNOLOGIES CORPORATION

- BALCHEM INC.

- INTERNATIONAL FLAVORS & FRAGRANCES INC.

- FIRMENICH SA

- FRIESLANDCAMPINA

- TASTETECH

- LYCORED

- RONALD T. DODGE COMPANY

- BLUE CALIFORNIA

- INNOV'IA

- GIVAUDAN

- ANABIO TECHNOLOGIES

- SPHERA ENCAPSULATION

- REED PACIFIC

- その他の企業

- AVEKA

- ADVANCED BIONUTRITION CORP

- CLEXTRAL

- VITABLEND

- ENCAPSYS LLC

第15章 隣接および関連市場

- イントロダクション

- マイクロカプセル市場

- 食品フレーバー市場

- 機能性食品素材市場

第16章 付録

The global market for food encapsulation has been estimated to be USD 11.5 billion in 2022 and is projected to grow at a rate of 8.2% between 2022 and 2027.

The food encapsulation market is projected to grow at an exponential rate due to factors such as rising demands for encapsulated colours and flavours in ready to eat foods, growing demand for dietary supplements that use encapsulated bioactives and advancements in technology.

Key players in the food encapsulation market include Cargill, Incorporated (US), BASF SE (Germany), Kerry (Ireland), DSM (Netherlands), Ingredion (US), Symrise (Germany), Sensient (Germany), Balchem (US), International Flavors & Fragrances Inc. (US), Firmenich SA (Switzerland), FrieslandCampina (Netherlands), TasteTech (UK), LycoRed Corp (Israel), Ronald T Dodge Company (US), Innov'io (France), Givaudan (Australia), AnaBio Technologies (Ireland), Sphera Encapsulation (Italy), Reed Pacific (Australia), Aveka (US), Advanced Bionutrition Corp (US), Clextral France (US), Vitablend (Netherlands), and Encapsys LLC (US).

"Nanoencapsulation segment is estimated to account for the largest share in 2021 with a CAGR of 9.1%."

Nanoencapsulation technology is a process of packaging or covering food ingredients in a miniature form. It helps in the protection of bioactive agents, such as proteins, lipids, vitamins, antioxidants, and carbohydrates. It helps in providing improved functionality and stability to produce functional foods and beverages. The size of the nano capsule is within a range of 1 to 100 nanometers. The technology helps enhance solubilization, improve odor and taste masking, and enhance the bioavailability of poorly absorbable function ingredients.

Nanotechnology is a very promising area in the food industry. It is used for various products, such as functional foods, packaging, preservatives, antioxidants, flavors, and fragrances. Its advantages include wide equipment availability, large-scale production, continuous unit operation, ease of manipulation, and low process cost. It is one of the most used encapsulation methods in the food industry.

"Dietary supplement application is projected to witness the growth of 7.8% during the forecast period."

Ensuring the bioavailability of ingested active ingredients is one of the key objectives of any supplement formulator.Dietary supplements are available in various formats, such as capsules, pills, liquids, and tablets. They focus on reducing the risk of diseases and improving human health. They contain active substances or mixtures of active agents in low concentrations.

Due to their instability, bioactive agents are prone to environmental degradation, which reduces their potency and the associated health benefits they provide. Encapsulation of dietary supplements helps enhance the bioavailability and solubility of these bioactive agents. It protects these agents from reacting with chemicals and the external environment. Encapsulated dietary supplements are of hypoallergenic quality, which makes them ideal supplements. Encapsulated dietary supplements are manufactured without adding artificial flavors, fragrances, binders, or other added coatings to avoid disrupting the ingredients' bioavailability. These advantageous improvements in dietary supplements are driving the demand for encapsulation in the dietary supplements industry.

"Polysaccharides dominate the food encapsulation market in 2022."

Polysaccharides are types of natural polymers. They are preferred to synthetic polymers because they are safe, inert, biocompatible, non-toxic, biodegradable, eco-friendly, low in cost, and abundantly available in nature. Polysaccharides have numerous resources, including plant resources, such as starch, pectin, and guar gum; algal resources, such as alginate; animal resources, such as chitosan; and microbial resources, such as dextran and xanthan gum. Polysaccharides are a composition of repeating monosaccharide units connected by glycoside bonds. The structure and properties of polysaccharides are extensively diverse and contain a wide range of chemical compositions and molecular weights. They contain many molecular chains, such as carboxyl, hydroxyl, and amino groups. Polysaccharides are easily chemically modifiable and provide numerous textures and viscosities. Because of their enormous molecular structure and ability to entrap bioactive, polysaccharides are considered the appropriate building blocks for delivery systems. Therefore, they are widely used as inexpensive and safe shell materials for encapsulation. There are numerous types of polysaccharides available in the market for the encapsulation process

Break-up of Primaries:

By Value Chain: Demand side - 41%, Supply side - 59%

By Designation: Managers - 24%, CXOs - 31%, and Executives- 45.0%

By Region: Europe - 29%, Asia Pacific - 32%, North America - 24%, RoW - 15%

Leading players profiled in this report:

Cargill, Incorporated (US)

BASF SE (Germany)

Kerry (Ireland)

DSM (Netherlands)

Ingredion (US)

Symrise(Germany)

Sensient (Germany)

Balchem (US)

International Flavors & Fragrances INC. IFF (US)

Firmenich SA (Switzerland)

FrieslandCampina (Netherlands)

TasteTech (UK)

LycoRed Corp (Israel)

Ronald T Dodge Company (US)

Blue California (US)

Innov'io (France)

Givaudan (Australia)

AnaBio Technologies (Ireland)

Sphera Encapsulation (Italy)

Reed Pacific (Australia)

Aveka (US)

Advanced Bionutrition Corp (US)

Clextral France (US)

Vitablend (Netherlands)

Encapsys LLC (US)

Research Coverage:

The report segments the food encapsulation market based on core phase, shell material, application, method, technology and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the food encapsulation market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

To get a comprehensive overview of the food encapsulation market

To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them.

To gain insights about the major countries/regions in which the food encapsulation market is flourishing.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2017-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FOOD ENCAPSULATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 FOOD ENCAPSULATION MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 FOOD ENCAPSULATION MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 FOOD ENCAPSULATION MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 FOOD ENCAPSULATION MARKET SIZE ESTIMATION, BY CORE PHASE (FLAVORS): SUPPLY SIDE

- 2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3 GROWTH RATE FORECAST ASSUMPTION

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- TABLE 2 ASSUMPTIONS

- 2.6 LIMITATIONS & ASSOCIATED RISKS

- TABLE 3 LIMITATIONS & ASSOCIATED RISKS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 4 FOOD ENCAPSULATION MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 9 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 FOOD ENCAPSULATION MARKET SHARE, BY SHELL MATERIAL, 2022 VS. 2027

- FIGURE 11 FOOD ENCAPSULATION MARKET, BY METHOD, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 14 FOOD ENCAPSULATION MARKET, BY REGION

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR FOOD ENCAPSULATION MARKET PLAYERS

- FIGURE 15 FOOD ENCAPSULATION: EMERGING MARKET WITH STEADY GROWTH POTENTIAL

- 4.2 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY AND REGION

- FIGURE 16 EUROPE TO LEAD ACROSS TECHNOLOGIES IN FOOD ENCAPSULATION MARKET BY 2027

- 4.3 EUROPE: FOOD ENCAPSULATION MARKET, BY KEY COUNTRY AND TYPE

- FIGURE 17 GERMANY: MAJOR CONSUMER OF FOOD ENCAPSULATION IN 2022

- 4.4 FOOD ENCAPSULATION MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 18 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- TABLE 5 FOOD ENCAPSULATION TECHNOLOGIES

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 DEVELOPMENTS IN RETAIL INDUSTRY

- FIGURE 19 INDIA: RETAIL MARKET, 2017-2026 (USD BILLION)

- FIGURE 20 AUSTRALIA: RETAIL SALES OF FUNCTIONAL AND FORTIFIED FOOD PRODUCTS, 2018-2022 (USD MILLION)

- FIGURE 21 GLOBAL RETAIL SALES, 2017-2022 (USD TRILLION)

- 5.2.2 RISE IN NUMBER OF DUAL-INCOME HOUSEHOLDS

- FIGURE 22 US: EMPLOYMENT STATUS OF PARENTS WITH CHILDREN OF UNDER 18 YEARS, 2020 VS. 2021

- 5.2.3 GROWING INCIDENCES OF CHRONIC DISEASES DRIVE DEMAND FOR DIETARY SUPPLEMENTS

- FIGURE 23 US: POPULATION WITH MULTIPLE CHRONIC ILLNESSES, 2021

- 5.2.1 DEVELOPMENTS IN RETAIL INDUSTRY

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- FIGURE 24 FOOD ENCAPSULATION MARKET DYNAMICS

- 5.3.2 DRIVERS

- 5.3.2.1 Increase in consumption of nutritional convenience and functional foods

- 5.3.2.2 Innovative food encapsulation technologies enhance market penetration

- 5.3.3 RESTRAINTS

- 5.3.3.1 More inclination toward traditional preservation methods over encapsulation techniques

- 5.3.3.2 High costs of food products using encapsulated ingredients

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Development of enhanced techniques for food encapsulation to bridge various gaps in food industry

- 5.3.4.1.1 Decreasing capsule size and increasing bioavailability

- 5.3.4.1.2 Multicomponent delivery system

- 5.3.4.2 Government support and improving economic conditions in developing nations

- 5.3.4.1 Development of enhanced techniques for food encapsulation to bridge various gaps in food industry

- 5.3.5 CHALLENGES

- 5.3.5.1 Poor stability of microencapsulated ingredients in varying atmospheres

- 5.3.1 INTRODUCTION

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 REGULATORY FRAMEWORK

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.2.2 REGULATORY FRAMEWORK

- 6.2.3 CODEX ALIMENTARIUS COMMISSION (CAC)

- 6.2.4 JOINT EXPERT COMMITTEE FOOD AND AGRICULTURE (JECFA)

- 6.2.5 FOOD AND DRUG ADMINISTRATION

- 6.2.6 EUROPEAN COMMISSION

- 6.2.7 COUNTRY-WISE REGULATORY AUTHORITIES FOR MICROENCAPSULATION IN FOOD

- 6.2.7.1 North America

- 6.2.7.1.1 US

- 6.2.7.1.2 Canada

- 6.2.7.2 Europe

- 6.2.7.3 Asia Pacific

- 6.2.7.3.1 Japan

- 6.2.7.3.2 India

- 6.2.7.3.3 China

- 6.2.7.3.4 Australia & New Zealand

- 6.2.7.4 South America

- 6.2.7.4.1 Brazil

- 6.2.7.4.2 Argentina

- 6.2.7.5 Rest of the World

- 6.2.7.5.1 Middle East

- 6.2.7.5.2 South Africa

- 6.2.7.1 North America

- 6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3 PATENT ANALYSIS

- FIGURE 25 NUMBER OF PATENTS APPROVED FOR FOOD ENCAPSULATION IN GLOBAL MARKET, 2012-2021

- TABLE 11 LIST OF MAJOR PATENTS PERTAINING TO FOOD ENCAPSULATION, 2012-2021

- FIGURE 26 JURISDICTIONS WITH HIGHEST PATENT APPROVALS FOR FOOD ENCAPSULATION, 2012-2021

- 6.4 VALUE CHAIN ANALYSIS

- FIGURE 27 VALUE CHAIN ANALYSIS

- 6.4.1 SOURCING OF RAW MATERIALS

- 6.4.2 PRODUCTION & PROCESSING

- 6.4.3 DISTRIBUTION, MARKETING, AND SALES

- 6.4.4 END-USER INDUSTRY

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS IN FOOD ENCAPSULATION MARKET

- FIGURE 28 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS FOOD ENCAPSULATION MARKET

- 6.6 MARKET ECOSYSTEM

- FIGURE 29 FOOD ENCAPSULATION: MARKET ECOSYSTEM MAP

- 6.6.1 UPSTREAM

- 6.6.1.1 Encapsulated product and ingredient manufacturers

- 6.6.1.2 Technology providers

- 6.6.2 DOWNSTREAM

- 6.6.2.1 Startups/Emerging companies

- 6.6.2.2 Regulatory bodies

- 6.6.2.3 End users

- TABLE 12 FOOD ENCAPSULATION: ECOSYSTEM VIEW

- 6.7 TRADE ANALYSIS

- FIGURE 30 EXPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 13 EXPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 31 IMPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 14 IMPORT VALUE OF PROVITAMINS AND VITAMINS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 32 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 15 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 33 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 16 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 34 EXPORT VALUE OF ACIDS, RATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 17 EXPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2021 (USD)

- FIGURE 35 IMPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 18 IMPORT VALUE OF ACIDS, SATURATED ACYCLIC MONOCARBOXYLIC ACIDS, AND ACETIC ACID, BY KEY COUNTRY, 2021 (USD)

- FIGURE 36 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 19 EXPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 37 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 20 IMPORT VALUE OF ACIDS AND CARBOXYLIC ACIDS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 38 EXPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 21 EXPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 39 IMPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 22 IMPORT VALUE OF SATURATED ACYCLIC MONOCARBOXYLIC ACIDS AND PROPIONIC ACID AND ITS SALTS AND ESTERS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 40 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 23 EXPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 41 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 24 IMPORT VALUE OF AMINO ACIDS AND THEIR ESTERS, BY KEY COUNTRY, 2021 (USD)

- FIGURE 42 EXPORT VALUE OF INULIN, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 25 EXPORT VALUE OF INULIN, BY KEY COUNTRY, 2021 (USD)

- FIGURE 43 IMPORT VALUE OF INULIN, BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 26 IMPORT VALUE OF INULIN, BY KEY COUNTRY, 2021 (USD)

- FIGURE 44 EXPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 27 EXPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2021 (USD)

- FIGURE 45 IMPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2017-2021 (USD)

- TABLE 28 IMPORT VALUE OF YEASTS (ACTIVE OR INACTIVE), BY KEY COUNTRY, 2021 (USD)

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 MICROENCAPSULATION OF FUNCTIONAL FOOD INGREDIENTS

- 6.8.1.1 Encapsulation of omega-3 to mask odor

- 6.8.2 INNOVATIVE AND DISRUPTIVE TECH

- 6.8.2.1 Robotics leading to innovations

- 6.8.2.2 3D printing to uplift dietary supplements market

- 6.8.1 MICROENCAPSULATION OF FUNCTIONAL FOOD INGREDIENTS

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 KERRY USED COATING CRUMB TECHNOLOGY TO CREATE APPEALING PRODUCTS

- 6.9.2 FRUNUTTA OFFERED EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 29 FOOD ENCAPSULATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT FROM SUBSTITUTES

- 6.10.5 THREAT FROM NEW ENTRANTS

- 6.11 KEY CONFERENCES & EVENTS

- TABLE 30 KEY CONFERENCES & EVENTS, 2022-2023

- 6.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- TABLE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TECHNOLOGY

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13 BUYING CRITERIA

- FIGURE 47 KEY BUYING CRITERIA FOR FOOD ENCAPSULATION TECHNOLOGY

- TABLE 32 KEY BUYING CRITERIA FOR FOOD ENCAPSULATION TECHNOLOGY

- 6.14 RECESSION IMPACT ON FOOD ENCAPSULATION MARKET

- 6.14.1 MACROECONOMIC INDICATORS OF RECESSION

- FIGURE 48 INDICATORS OF RECESSION

- FIGURE 49 WORLD INFLATION RATE, 2011-2021

- FIGURE 50 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 51 GLOBAL CORE PHASE MATERIAL MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

- FIGURE 52 RECESSION INDICATORS AND THEIR IMPACT ON FOOD ENCAPSULATION MARKET

- FIGURE 53 GLOBAL FOOD ENCAPSULATION MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST

- 6.14.1 MACROECONOMIC INDICATORS OF RECESSION

7 FOOD ENCAPSULATION MARKET, BY CORE PHASE

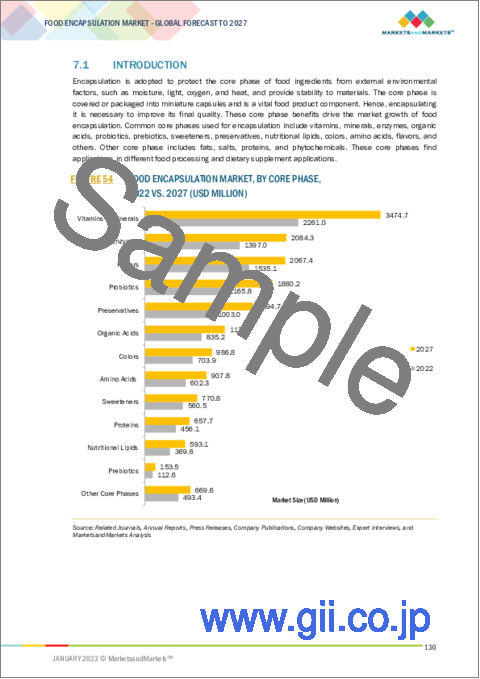

- 7.1 INTRODUCTION

- FIGURE 54 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022 VS. 2027 (USD MILLION)

- TABLE 33 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 34 FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- 7.2 VITAMINS & MINERALS

- 7.2.1 RISE IN NEED FOR SUPERFOODS TO IMPROVE BONE AND BRAIN HEALTH

- TABLE 35 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 36 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 37 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 VITAMINS & MINERALS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 39 VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 40 VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2.2 FAT-SOLUBLE VITAMINS

- 7.2.2.1 Nutrient retention and flavor masking to support market

- TABLE 41 FAT-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 42 FAT-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2.2.2 Vitamin A

- 7.2.2.2.1 Growth in consumption of vitamin A-based supplements among consumers

- 7.2.2.3 Vitamin D

- 7.2.2.3.1 Increase in cases of heart disease and diabetes

- 7.2.2.4 Vitamin E

- 7.2.2.4.1 Rise in awareness regarding benefits of vitamin E supplements

- 7.2.2.5 Vitamin K

- 7.2.2.5.1 Higher consumption of vitamin K supplements to prevent osteoporosis and hemorrhages

- 7.2.2.1 Nutrient retention and flavor masking to support market

- 7.2.3 WATER-SOLUBLE VITAMINS

- 7.2.3.1 Stability of encapsulated water-soluble vitamins

- TABLE 43 WATER-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 44 WATER-SOLUBLE VITAMINS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.2.3.2 Vitamin B complex

- 7.2.3.2.1 Greater need to ensure healthy vision

- 7.2.3.3 Vitamin C

- 7.2.3.3.1 Increased oxidative stress to boost consumption of vitamin C

- 7.2.3.1 Stability of encapsulated water-soluble vitamins

- 7.2.1 RISE IN NEED FOR SUPERFOODS TO IMPROVE BONE AND BRAIN HEALTH

- 7.3 ENZYMES

- 7.3.1 TARGETED DELIVERY OF NUTRIENTS SENSITIVE TO VARIOUS EXTERNAL FACTORS

- TABLE 45 ENZYMES: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 ENZYMES: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 47 ENZYMES: ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 48 ENZYMES: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.3.2 CARBOHYDRASES

- 7.3.2.1 Rise in demand for sports drinks globally

- 7.3.3 PROTEASE

- 7.3.3.1 Growth in adoption of baked products with better texture

- 7.3.4 LIPASES

- 7.3.4.1 Rise in preference for flavored dairy products

- 7.3.5 OTHER ENZYMES

- 7.3.1 TARGETED DELIVERY OF NUTRIENTS SENSITIVE TO VARIOUS EXTERNAL FACTORS

- 7.4 ORGANIC ACIDS

- 7.4.1 PROMPT ABSORPTION AND HIGH SOLUBILITY OF ENCAPSULATED CITRIC ACIDS

- TABLE 49 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 51 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 52 ORGANIC ACIDS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.4.2 CITRIC ACID

- 7.4.2.1 High dispersibility and preservation capacity of organic acids

- 7.4.3 ACETIC ACID

- 7.4.3.1 Increased demand for pickles and wine

- 7.4.4 MALIC ACID

- 7.4.4.1 Flavor enhancement properties of malic acid to better sugar-free confectionery

- 7.4.5 FUMARIC ACID

- 7.4.5.1 Rise in demand for confectionery with increased shelf life

- 7.4.6 LACTIC ACID

- 7.4.6.1 Flavor-enhancement an attribute of lactic acid

- 7.4.7 PROPIONIC ACID

- 7.4.7.1 Increase in popularity of propionic acid as preservative

- 7.4.8 ASCORBIC ACID

- 7.4.8.1 Rise in adoption of nutritional beverages

- 7.4.9 OTHER ORGANIC ACIDS

- 7.4.1 PROMPT ABSORPTION AND HIGH SOLUBILITY OF ENCAPSULATED CITRIC ACIDS

- 7.5 PROBIOTICS

- 7.5.1 GROWTH IN CONSUMPTION OF PROBIOTICS TO BOOST IMMUNITY

- TABLE 53 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 54 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 55 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 56 PROBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.5.2 BACTERIA

- 7.5.2.1 Higher usage of encapsulated bacterial probiotics in women's health supplements

- 7.5.3 YEAST

- 7.5.3.1 Growth in genetic engineering in yeast-based probiotics encapsulation

- 7.5.1 GROWTH IN CONSUMPTION OF PROBIOTICS TO BOOST IMMUNITY

- 7.6 SWEETENERS

- 7.6.1 SHIFT IN CONSUMPTION HABITS TOWARD LOW-CALORIE FOODS

- TABLE 57 SWEETENERS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 58 SWEETENERS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.6.1 SHIFT IN CONSUMPTION HABITS TOWARD LOW-CALORIE FOODS

- 7.7 NUTRITIONAL LIPIDS

- 7.7.1 HIGH STABILITY AND HIGH DOSAGE DELIVERY OF ENCAPSULATED NUTRITIONAL LIPIDS

- TABLE 59 NUTRITIONAL LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 NUTRITIONAL LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.7.1 HIGH STABILITY AND HIGH DOSAGE DELIVERY OF ENCAPSULATED NUTRITIONAL LIPIDS

- 7.8 PRESERVATIVES

- 7.8.1 OXYGEN-SCAVENGING ABILITY OF ENCAPSULATED PRESERVATIVES

- TABLE 61 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 62 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 63 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 64 PRESERVATIVES: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.8.2 ANTIMICROBIALS

- 7.8.2.1 Ability of antimicrobials to prevent enzymatic degradation in food products

- 7.8.3 ANTIOXIDANTS

- 7.8.3.1 Preventing rancidity of food containing fats to be major challenge to be tackled

- 7.8.4 OTHER PRESERVATIVES

- 7.8.1 OXYGEN-SCAVENGING ABILITY OF ENCAPSULATED PRESERVATIVES

- 7.9 PREBIOTICS

- 7.9.1 INCREASED FOCUS ON DIGESTIVE HEALTH AND IMMUNITY

- TABLE 65 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 66 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 67 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 68 PREBIOTICS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.9.2 OLIGOSACCHARIDES

- 7.9.2.1 Growth in usage of encapsulated oligosaccharides in nutraceuticals

- 7.9.3 INULIN

- 7.9.3.1 Surge in gastrointestinal issues

- 7.9.4 POLYDEXTROSE

- 7.9.4.1 Higher demand for gut health-boosting products

- 7.9.5 OTHER PREBIOTICS

- 7.9.1 INCREASED FOCUS ON DIGESTIVE HEALTH AND IMMUNITY

- 7.10 COLORS

- 7.10.1 GREATER DEMAND FOR NATURAL COLORS IN CONFECTIONERY

- TABLE 69 COLORS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 70 COLORS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 71 COLORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 72 COLORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.10.2 NATURAL

- 7.10.2.1 Shift in consumer preferences for clean food & beverages

- 7.10.3 ARTIFICIAL

- 7.10.3.1 Rise in inclination toward visually appealing health-oriented beverages

- 7.10.1 GREATER DEMAND FOR NATURAL COLORS IN CONFECTIONERY

- 7.11 AMINO ACIDS

- 7.11.1 INCREASE IN NEED TO IMPROVE METABOLIC HEALTH

- TABLE 73 AMINO ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 74 AMINO ACIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.11.1 INCREASE IN NEED TO IMPROVE METABOLIC HEALTH

- 7.12 FLAVORS

- 7.12.1 LIMITING DEGRADATION OR LOSS OF AROMA DURING PROCESSING OR STORAGE

- TABLE 75 FLAVORS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 FLAVORS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 77 FLAVORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 78 FLAVORS: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 7.12.2 CHOCOLATES & BROWNS

- 7.12.2.1 Innovation in chocolate flavors in bakery and confectionery industries

- 7.12.3 VANILLA

- 7.12.3.1 Rise in demand for balanced taste and strong aroma

- 7.12.4 FRUITS & NUTS

- 7.12.4.1 Growth in health awareness regarding fruits and nuts

- 7.12.5 DAIRY

- 7.12.5.1 Surge in demand for dairy products in developing countries

- 7.12.6 SPICES

- 7.12.6.1 Globalization of food systems increased popularity of spices & savory flavors

- 7.12.7 OTHER FLAVORS

- 7.12.1 LIMITING DEGRADATION OR LOSS OF AROMA DURING PROCESSING OR STORAGE

- 7.13 PROTEINS

- 7.13.1 EASE OF AVAILABILITY OF PROTEIN CONCENTRATES

- TABLE 79 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.13.1 EASE OF AVAILABILITY OF PROTEIN CONCENTRATES

- 7.14 OTHER CORE PHASES

- TABLE 81 OTHER CORE PHASES: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 82 OTHER CORE PHASES: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

8 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 55 MICROENCAPSULATION SEGMENT TO LEAD MARKET BY 2027

- TABLE 83 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 84 FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 8.2 MICROENCAPSULATION

- 8.2.1 GROWTH IN USE OF MICROENCAPSULATION TO MASK UNWANTED FLAVOR AND TASTE OF BIOACTIVE INGREDIENTS

- TABLE 85 MICROENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 86 MICROENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.2.1 GROWTH IN USE OF MICROENCAPSULATION TO MASK UNWANTED FLAVOR AND TASTE OF BIOACTIVE INGREDIENTS

- 8.3 NANOENCAPSULATION

- 8.3.1 RISE IN NEED TO IMPROVE MENTAL HEALTH

- TABLE 87 NANOENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 NANOENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3.1 RISE IN NEED TO IMPROVE MENTAL HEALTH

- 8.4 HYBRID ENCAPSULATION

- 8.4.1 HIGH BIOACTIVITY AND TARGETED DELIVERY OF BIOACTIVES

- TABLE 89 HYBRID ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 90 HYBRID ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4.1 HIGH BIOACTIVITY AND TARGETED DELIVERY OF BIOACTIVES

9 FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL

- 9.1 INTRODUCTION

- FIGURE 56 POLYSACCHARIDES SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- TABLE 91 FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 92 FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- 9.2 POLYSACCHARIDES

- 9.2.1 COMPOSITE MOLECULAR ARRANGEMENT OF POLYSACCHARIDES IN HEALTH SUPPLEMENTS

- TABLE 93 POLYSACCHARIDES: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 94 POLYSACCHARIDES: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.2.1 COMPOSITE MOLECULAR ARRANGEMENT OF POLYSACCHARIDES IN HEALTH SUPPLEMENTS

- 9.3 PROTEINS

- 9.3.1 ABILITY OF PROTEIN-BASED SHELL MATERIALS TO STABILIZE GEL FORMULATION IN FOOD PRODUCTS

- TABLE 95 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 PROTEINS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1 ABILITY OF PROTEIN-BASED SHELL MATERIALS TO STABILIZE GEL FORMULATION IN FOOD PRODUCTS

- 9.4 LIPIDS

- 9.4.1 HIGHER DEMAND FOR LIPIDS FOR ENCAPSULATION OF FUNCTIONAL FOODS

- TABLE 97 LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 98 LIPIDS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4.1 HIGHER DEMAND FOR LIPIDS FOR ENCAPSULATION OF FUNCTIONAL FOODS

- 9.5 EMULSIFIERS

- 9.5.1 INCREASE IN USE OF EMULSIFIERS IN PRODUCING BAKED GOODS

- TABLE 99 EMULSIFIERS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 EMULSIFIERS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5.1 INCREASE IN USE OF EMULSIFIERS IN PRODUCING BAKED GOODS

10 FOOD ENCAPSULATION MARKET, BY METHOD

- 10.1 INTRODUCTION

- FIGURE 57 PHYSICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- TABLE 101 FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 102 FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 10.2 PHYSICAL METHOD

- 10.2.1 IMPROVED STABILITY OF BIOACTIVE INGREDIENTS ACHIEVED THROUGH PHYSICAL METHOD

- TABLE 103 PHYSICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 104 PHYSICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 105 PHYSICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 106 PHYSICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2.2 ATOMIZATION

- 10.2.2.1 Ease of usage of atomization equipment

- TABLE 107 ATOMIZATION: PHYSICAL FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 108 ATOMIZATION: PHYSICAL FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.2.2.1 Ease of usage of atomization equipment

- 10.2.3 SPRAY DRYING

- 10.2.3.1 Rise in need to adopt cost-effective methods

- 10.2.4 SPRAY CHILLING

- 10.2.4.1 Energy-efficiency of spray chilling technique in bakery products

- 10.2.5 SPINNING DISK

- 10.2.5.1 High functionality and bioactivity of flavonoids to drive usage of spinning disk technique

- 10.2.6 FLUID BED COATING

- 10.2.6.1 Greater demand for low maintenance cost of encapsulating health supplements

- 10.2.7 EXTRUSION

- 10.2.7.1 Rise in use of extrusion method for encapsulating functional foods

- 10.2.8 OTHER PHYSICAL METHODS

- 10.2.1 IMPROVED STABILITY OF BIOACTIVE INGREDIENTS ACHIEVED THROUGH PHYSICAL METHOD

- 10.3 CHEMICAL METHOD

- 10.3.1 USE OF CHEMICAL METHOD TO ENCAPSULATE FUNCTIONAL FOOD

- TABLE 109 CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 110 CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 111 CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 112 CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.3.2 POLYMERIZATION

- 10.3.2.1 Adhesion to shell material and controlled bioactive diffusion encourage polymerization for food encapsulation

- 10.3.3 SOL-GEL METHOD

- 10.3.3.1 Growth in need to prevent oxidative damage

- 10.3.1 USE OF CHEMICAL METHOD TO ENCAPSULATE FUNCTIONAL FOOD

- 10.4 PHYSICO-CHEMICAL METHOD

- 10.4.1 RISE IN NEED FOR LOW COST AND REPRODUCIBILITY

- TABLE 113 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 114 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 115 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 116 PHYSICO-CHEMICAL: FOOD ENCAPSULATION MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 10.4.2 COACERVATION

- 10.4.2.1 High establishment and processing cost of coacervation to restrain usage in nutraceuticals

- 10.4.3 EVAPORATION-SOLVENT DIFFUSION

- 10.4.3.1 Clinical benefits due to controlled release of bioactive agents

- 10.4.4 LAYER-BY-LAYER ENCAPSULATION

- 10.4.4.1 Growth in need for cost-effectiveness in food encapsulation

- 10.4.5 CYCLODEXTRINS

- 10.4.5.1 Rise in demand to ensure safety and affordability in food encapsulation

- 10.4.6 LIPOSOMES

- 10.4.6.1 Increase in need for targeted controlled release of bioactive ingredients in vitamin encapsulation

- 10.4.7 OTHER PHYSICO-CHEMICAL METHODS

- 10.4.1 RISE IN NEED FOR LOW COST AND REPRODUCIBILITY

11 FOOD ENCAPSULATION MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 58 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 117 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 11.2 DIETARY SUPPLEMENTS

- 11.2.1 HIGHER NEED FOR EFFICIENT DELIVERY AND BIOAVAILABILITY OF BIOACTIVES

- TABLE 119 DIETARY SUPPLEMENTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 120 DIETARY SUPPLEMENTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2.1 HIGHER NEED FOR EFFICIENT DELIVERY AND BIOAVAILABILITY OF BIOACTIVES

- 11.3 FUNCTIONAL FOOD PRODUCTS

- 11.3.1 RISE IN NEED FOR HIGH SOLUBILITY OF MICROENCAPSULATED BIOACTIVES IN FUNCTIONAL FOOD PRODUCTS

- TABLE 121 FUNCTIONAL FOOD PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 122 FUNCTIONAL FOOD PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3.1 RISE IN NEED FOR HIGH SOLUBILITY OF MICROENCAPSULATED BIOACTIVES IN FUNCTIONAL FOOD PRODUCTS

- 11.4 BAKERY PRODUCTS

- 11.4.1 RISE IN PREFERENCE FOR BAKERY PRODUCTS WITH ENHANCED FLAVORS

- TABLE 123 BAKERY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 124 BAKERY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4.1 RISE IN PREFERENCE FOR BAKERY PRODUCTS WITH ENHANCED FLAVORS

- 11.5 CONFECTIONERY PRODUCTS

- 11.5.1 NEED TO ENHANCE AESTHETICS IN CONFECTIONERY PRODUCTS

- TABLE 125 CONFECTIONERY: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 126 CONFECTIONERY: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5.1 NEED TO ENHANCE AESTHETICS IN CONFECTIONERY PRODUCTS

- 11.6 BEVERAGES

- 11.6.1 GREATER NEED FOR IMPROVED PALATABILITY IN BEVERAGES

- TABLE 127 BEVERAGES: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 128 BEVERAGES: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6.1 GREATER NEED FOR IMPROVED PALATABILITY IN BEVERAGES

- 11.7 FROZEN PRODUCTS

- 11.7.1 ENCAPSULATED PROBIOTICS ADD SMOOTHNESS TO FROZEN FOODS

- TABLE 129 FROZEN PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 130 FROZEN PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.7.1 ENCAPSULATED PROBIOTICS ADD SMOOTHNESS TO FROZEN FOODS

- 11.8 DAIRY PRODUCTS

- 11.8.1 ENCAPSULATION GRANTS UNIFORM TASTE TO DAIRY PRODUCTS

- TABLE 131 DAIRY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 132 DAIRY PRODUCTS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.8.1 ENCAPSULATION GRANTS UNIFORM TASTE TO DAIRY PRODUCTS

- 11.9 OTHER APPLICATIONS

- TABLE 133 OTHER APPLICATIONS: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 134 OTHER APPLICATIONS: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

12 FOOD ENCAPSULATION MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 59 FOOD ENCAPSULATION: GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 135 FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 136 FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 60 NORTH AMERICA: FOOD ENCAPSULATION MARKET SNAPSHOT

- TABLE 137 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 NORTH AMERICA: FOOD ENCAPSULATION MARKET, 2022-2027 (USD MILLION)

- TABLE 139 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 140 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- TABLE 141 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 142 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 143 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 144 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- TABLE 145 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 147 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 148 NORTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 12.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 61 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 62 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- 12.2.2 US

- 12.2.2.1 Encapsulation to aid in development of treatment options for various chronic diseases in US

- TABLE 149 US: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 150 US: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 151 US: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 152 US: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.2.2.1 Encapsulation to aid in development of treatment options for various chronic diseases in US

- 12.2.3 CANADA

- 12.2.3.1 Emergence of novel drug delivery strategies utilizing encapsulation

- TABLE 153 CANADA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 154 CANADA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 155 CANADA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 156 CANADA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.2.3.1 Emergence of novel drug delivery strategies utilizing encapsulation

- 12.2.4 MEXICO

- 12.2.4.1 Encapsulation to extend shelf life of packaged foods

- TABLE 157 MEXICO: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 158 MEXICO: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 159 MEXICO: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 160 MEXICO: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.2.4.1 Encapsulation to extend shelf life of packaged foods

- 12.3 EUROPE

- TABLE 161 EUROPE: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 162 EUROPE: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 163 EUROPE: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 164 EUROPE: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- TABLE 165 EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 166 EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 167 EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 168 EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- TABLE 169 EUROPE: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 170 EUROPE: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 171 EUROPE: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 172 EUROPE: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 12.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 63 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 64 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- 12.3.2 GERMANY

- 12.3.2.1 Consuming encapsulated dietary supplements to help people meet nutritional needs while also pursuing healthier lifestyles

- TABLE 173 GERMANY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 174 GERMANY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 175 GERMANY: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 176 GERMANY: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.3.2.1 Consuming encapsulated dietary supplements to help people meet nutritional needs while also pursuing healthier lifestyles

- 12.3.3 UK

- 12.3.3.1 Increase in demand for healthy functional food to enhance its bioavailability

- TABLE 177 UK: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 178 UK: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 179 UK: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 180 UK: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.3.3.1 Increase in demand for healthy functional food to enhance its bioavailability

- 12.3.4 FRANCE

- 12.3.4.1 Consumption of probiotics in France due to health benefits associated

- TABLE 181 FRANCE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 182 FRANCE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 183 FRANCE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 184 FRANCE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.3.4.1 Consumption of probiotics in France due to health benefits associated

- 12.3.5 ITALY

- 12.3.5.1 Shifting dietary choices and adoption of high antioxidant dietary supplements to enhance active content drives market

- TABLE 185 ITALY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 186 ITALY: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 187 ITALY: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 188 ITALY: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.3.5.1 Shifting dietary choices and adoption of high antioxidant dietary supplements to enhance active content drives market

- 12.3.6 SPAIN

- 12.3.6.1 Increase in awareness of encapsulated nutrition and dietary supplements

- TABLE 189 SPAIN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 190 SPAIN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 191 SPAIN: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 192 SPAIN: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.3.6.1 Increase in awareness of encapsulated nutrition and dietary supplements

- 12.3.7 REST OF EUROPE

- TABLE 193 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 194 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 195 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 196 REST OF EUROPE: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 65 ASIA PACIFIC: FOOD ENCAPSULATION MARKET SNAPSHOT

- TABLE 197 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 198 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 199 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 200 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- TABLE 201 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 202 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 203 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 204 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- TABLE 205 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 206 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 208 ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 67 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- 12.4.2 CHINA

- 12.4.2.1 Encapsulated dietary supplements and sports nutrition in China

- TABLE 209 CHINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 210 CHINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 211 CHINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 212 CHINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.4.2.1 Encapsulated dietary supplements and sports nutrition in China

- 12.4.3 JAPAN

- 12.4.3.1 Rise in aging population to drive demand for encapsulated functional foods

- TABLE 213 JAPAN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 214 JAPAN: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 215 JAPAN: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 216 JAPAN: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.4.3.1 Rise in aging population to drive demand for encapsulated functional foods

- 12.4.4 INDIA

- 12.4.4.1 Encapsulation of herbs and spices for cooking to help mask flavor and taste of products

- TABLE 217 INDIA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 218 INDIA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 219 INDIA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 220 INDIA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.4.4.1 Encapsulation of herbs and spices for cooking to help mask flavor and taste of products

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Changing preferences of consumers to prevent chronic diseases to increase demand for encapsulated functional food products

- TABLE 221 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 222 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 223 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 224 AUSTRALIA & NEW ZEALAND: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.4.5.1 Changing preferences of consumers to prevent chronic diseases to increase demand for encapsulated functional food products

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 225 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.5 SOUTH AMERICA

- TABLE 229 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 230 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 231 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 232 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 233 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 234 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- TABLE 235 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 236 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 237 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 238 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 239 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 240 SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- 12.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 68 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 69 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- 12.5.2 BRAZIL

- 12.5.2.1 Expansions and investments in Brazil by key companies

- TABLE 241 BRAZIL: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 242 BRAZIL: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 243 BRAZIL: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 244 BRAZIL: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.5.2.1 Expansions and investments in Brazil by key companies

- 12.5.3 ARGENTINA

- 12.5.3.1 Rise in adoption of healthy foods and functional beverages

- TABLE 245 ARGENTINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 246 ARGENTINA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 247 ARGENTINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 248 ARGENTINA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.5.3.1 Rise in adoption of healthy foods and functional beverages

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 249 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.6 REST OF THE WORLD

- TABLE 253 ROW: FOOD ENCAPSULATION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 254 ROW: FOOD ENCAPSULATION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 255 ROW: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 256 ROW: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 257 ROW: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 258 ROW: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- TABLE 259 ROW: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 260 ROW: FOOD ENCAPSULATION MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- TABLE 261 ROW: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 262 ROW: FOOD ENCAPSULATION MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 263 ROW: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2018-2021 (USD MILLION)

- TABLE 264 ROW: FOOD ENCAPSULATION MARKET, BY CORE PHASE, 2022-2027 (USD MILLION)

- 12.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 70 ROW: INFLATION RATES, BY KEY COUNTRY, 2018-2021

- FIGURE 71 ROW: FOOD ENCAPSULATION MARKET: RECESSION IMPACT ANALYSIS

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Rise in number of local payers and continuous innovations in region

- TABLE 265 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 266 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 267 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 268 MIDDLE EAST: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.6.2.1 Rise in number of local payers and continuous innovations in region

- 12.6.3 AFRICA

- 12.6.3.1 Increase in government initiatives for fortification of food with essential vitamins and minerals

- TABLE 269 AFRICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2018-2021 (USD MILLION)

- TABLE 270 AFRICA: FOOD ENCAPSULATION MARKET, BY SHELL MATERIAL, 2022-2027 (USD MILLION)

- TABLE 271 AFRICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2018-2021 (USD MILLION)

- TABLE 272 AFRICA: FOOD ENCAPSULATION MARKET, BY METHOD, 2022-2027 (USD MILLION)

- 12.6.3.1 Increase in government initiatives for fortification of food with essential vitamins and minerals

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 72 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- TABLE 273 FOOD ENCAPSULATION MARKET: DEGREE OF COMPETITION (COMPETITIVE), 2021

- 13.5 KEY PLAYER EVALUATION QUADRANT (KEY PLAYERS)

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 73 FOOD ENCAPSULATION MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 13.6 PRODUCT FOOTPRINT

- TABLE 274 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 275 COMPANY PRODUCT FOOTPRINT, BY METHOD

- TABLE 276 COMPANY PRODUCT FOOTPRINT, BY REGION

- TABLE 277 COMPANY OVERALL FOOTPRINT

- 13.7 COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES)

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 STARTING BLOCKS

- 13.7.3 RESPONSIVE COMPANIES

- 13.7.4 DYNAMIC COMPANIES

- FIGURE 74 FOOD ENCAPSULATION MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 278 FOOD ENCAPSULATION: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 279 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 280 PRODUCT LAUNCHES, 2018

- 13.9.2 DEALS

- TABLE 281 DEALS, 2019-2022

- 13.9.3 OTHERS

- TABLE 282 OTHERS, 2020-2022

- 13.9.1 PRODUCT LAUNCHES

14 COMPANY PROFILES (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices made, Weakness competitive threats) *

- 14.1 KEY PLAYERS

- 14.1.1 CARGILL, INCORPORATED

- TABLE 283 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 75 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 284 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS OFFERED

- TABLE 285 CARGILL, INCORPORATED: OTHERS

- 14.1.2 BASF SE

- TABLE 286 BASF SE: BUSINESS OVERVIEW

- TABLE 287 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 BASF SE: PRODUCT LAUNCHES

- TABLE 289 BASF SE: DEALS

- 14.1.3 KERRY

- TABLE 290 KERRY: BUSINESS OVERVIEW

- FIGURE 77 KERRY: COMPANY SNAPSHOT

- TABLE 291 KERRY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 KERRY: DEALS

- TABLE 293 KERRY: OTHERS

- 14.1.4 DSM

- TABLE 294 DSM: BUSINESS OVERVIEW

- FIGURE 78 DSM: COMPANY SNAPSHOT

- TABLE 295 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 DSM: DEALS

- 14.1.5 INGREDION

- TABLE 297 INGREDION: BUSINESS OVERVIEW

- FIGURE 79 INGREDION: COMPANY SNAPSHOT

- TABLE 298 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 INGREDION: DEALS

- 14.1.6 SYMRISE

- TABLE 300 SYMRISE: BUSINESS OVERVIEW

- FIGURE 80 SYMRISE: COMPANY SNAPSHOT

- TABLE 301 SYMRISE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 SYMRISE: DEALS

- 14.1.7 SENSIENT TECHNOLOGIES CORPORATION

- TABLE 303 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 81 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 304 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.8 BALCHEM INC.

- TABLE 305 BALCHEM INC.: BUSINESS OVERVIEW

- FIGURE 82 BALCHEM INC.: COMPANY SNAPSHOT

- TABLE 306 BALCHEM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.9 INTERNATIONAL FLAVORS & FRAGRANCES INC.

- TABLE 307 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- FIGURE 83 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- TABLE 308 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 309 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 310 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- 14.1.10 FIRMENICH SA

- TABLE 311 FIRMENICH SA: BUSINESS OVERVIEW

- TABLE 312 FIRMENICH SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.11 FRIESLANDCAMPINA

- TABLE 313 FRIESLANDCAMPINA: BUSINESS OVERVIEW

- FIGURE 84 FRIESLANDCAMPINA: COMPANY SNAPSHOT

- TABLE 314 FRIESLANDCAMPINA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.12 TASTETECH

- TABLE 315 TASTETECH: BUSINESS OVERVIEW

- TABLE 316 TASTETECH: PRODUCTS OFFERED

- 14.1.13 LYCORED

- TABLE 317 LYCORED: BUSINESS OVERVIEW

- TABLE 318 LYCORED: PRODUCTS OFFERED

- 14.1.14 RONALD T. DODGE COMPANY

- TABLE 319 RONALD T. DODGE COMPANY: BUSINESS OVERVIEW

- 14.1.15 BLUE CALIFORNIA

- TABLE 320 BLUE CALIFORNIA: BUSINESS OVERVIEW

- 14.1.16 INNOV'IA

- TABLE 321 INNOV'IA: BUSINESS OVERVIEW

- 14.1.17 GIVAUDAN

- TABLE 322 GIVAUDAN: BUSINESS OVERVIEW

- 14.1.18 ANABIO TECHNOLOGIES

- TABLE 323 ANABIO TECHNOLOGIES: BUSINESS OVERVIEW

- 14.1.19 SPHERA ENCAPSULATION

- TABLE 324 SPHERA ENCAPSULATION: BUSINESS OVERVIEW

- 14.1.20 REED PACIFIC

- TABLE 325 REED PACIFIC: BUSINESS OVERVIEW

- 14.1.1 CARGILL, INCORPORATED

- 14.2 OTHER PLAYERS

- 14.2.1 AVEKA

- 14.2.2 ADVANCED BIONUTRITION CORP

- 14.2.3 CLEXTRAL

- 14.2.4 VITABLEND

- 14.2.5 ENCAPSYS LLC

Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices made, Weakness competitive threats might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 MICROENCAPSULATION MARKET

- 15.2.1 LIMITATIONS

- 15.2.2 MARKET DEFINITION

- 15.2.3 MARKET OVERVIEW

- 15.2.4 MICROENCAPSULATION MARKET, BY CORE MATERIAL

- TABLE 326 MICROENCAPSULATION MARKET, BY CORE MATERIAL, 2020-2025 (USD MILLION)

- 15.2.5 MICROENCAPSULATION MARKET, BY REGION

- TABLE 327 MICROENCAPSULATION MARKET, BY REGION, 2020-2025 (USD MILLION)

- 15.3 FOOD FLAVORS MARKET

- 15.3.1 LIMITATIONS

- 15.3.2 MARKET DEFINITION

- 15.3.3 MARKET OVERVIEW

- 15.3.4 FOOD FLAVORS MARKET, BY LABELING/REGULATION

- TABLE 328 FOOD FLAVORS MARKET, BY LABELING/REGULATION, 2019-2021 (USD MILLION)

- TABLE 329 FOOD FLAVORS MARKET, BY LABELING/REGULATION, 2022-2027 (USD MILLION)

- 15.3.5 FOOD FLAVORS MARKET, BY REGION

- TABLE 330 FOOD FLAVORS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 331 FOOD FLAVORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.4 FUNCTIONAL FOOD INGREDIENTS MARKET

- 15.4.1 LIMITATIONS

- 15.4.2 MARKET DEFINITION

- 15.4.3 MARKET OVERVIEW

- 15.4.4 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

- TABLE 332 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 333 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.4.5 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION

- TABLE 334 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 335 FUNCTIONAL FOOD INGREDIENTS MARKET, BY REGION, 2021-2026 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS