|

|

市場調査レポート

商品コード

1453786

精密農業ソフトウェアの世界市場:デリバリーモデル別、用途別、サービス別、技術別、地域別-2029年までの予測Precision Farming Software Market by Delivery Model (On-premises, Cloud-based), Application (Yield Monitoring, Field Mapping, Variable Rate Application, Weather Tracking & Forecasting), Service, Technology and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 精密農業ソフトウェアの世界市場:デリバリーモデル別、用途別、サービス別、技術別、地域別-2029年までの予測 |

|

出版日: 2024年03月19日

発行: MarketsandMarkets

ページ情報: 英文 268 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

精密農業ソフトウェアの市場規模は、2024年の17億米ドルから2029年には31億米ドルに達すると予測され、2024年から2029年までのCAGRは12.5%になる見込みです。

作物スカウティングは、センサーやドローンによって収集されたデータを補完するリアルタイムの地上レベルでの洞察を提供し、精密農業に不可欠な要素として機能しています。作物スカウティングは、即座の現場観察を提供することで、農家が正確かつタイムリーな意思決定を行うことを可能にします。さらに、作物スカウティングは問題の早期発見において重要な役割を果たし、農家は害虫の蔓延、病気、栄養不足などの問題が深刻化する前に特定することができます。この早期発見により、農家は被害を軽減し、潜在的な収量損失を防ぐための事前対策を講じることができます。さらに、スカウティングデータを精密農業ソフトウェアに統合することで、圃場の特定エリアに合わせた的を絞った介入が可能になり、このプロアクティブアプローチが強化されます。作物のスカウティングから得られる洞察を活用することで、農家は問題に対処するための的確で効果的な戦略を実施し、資源配分を最適化し、最終的に作物の健全性と生産性を全体的に向上させることができます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | デリバリーモデル別、用途別、サービス別、技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

精密農業ソフトウェア市場で事業を展開する主要企業は、Deere &Company、Trimble Inc.、AGCO Corporation、Raven Industries, Inc.、AgEagle Aerial Systems Incです。

クラウドベースのソリューションの拡張性により、農家は大規模なインフラ投資を行うことなく、要件に応じて業務を適応させる柔軟性を得ることができます。この柔軟性により、農家は大規模なハードウェアのアップグレードを必要とすることなく、小規模な家族経営の農場であれ大規模な営利企業であれ、事業規模を容易に調整することができます。さらに、クラウドベースの精密農業ソフトウェアが提供するアクセシビリティにより、農家はインターネット接続があればどこからでも作業を監視・管理することができます。このアクセシビリティにより、農家は物理的な場所に関係なくタイムリーな意思決定を行うことができ、全体的な作業効率が向上します。

アジア太平洋地域は人口が多く、人口が拡大しているため、食糧安全保障に対する需要が高まっており、精密農業ソフトウェアの重要な役割が浮き彫りになっています。収量を最大化し、作物の品質を向上させ、収穫後のロスを軽減することで、精密農業ソフトウェアは、増大する食糧需要を満たす上で極めて重要な役割を果たしています。さらに、政府が補助金、イニシアティブ、支援プログラムを通じて精密農業を積極的に推進していることは、食糧安全保障の強化における精密農業の重要性をさらに浮き彫りにしています。農家に精密農業の導入を奨励することで、政府は農業生産性を向上させ、食糧不足を解消し、農村開発を促進することを目指しています。要するに、精密農業ソフトウェアは、アジア太平洋地域における食糧安全保障の課題に対処するための重要なソリューションであり、持続可能な農業実践への道筋を提供し、この地域の人口に信頼できる食糧供給を保証するものです。

当レポートでは、世界の精密農業ソフトウェア市場について調査し、デリバリーモデル別、技術別、用途別、サービス別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 貿易分析

- 特許分析

- 2024年の主要な会議とイベント

- 規制状況と基準

- 主要な利害関係者と購入基準

- 価格分析

第6章 精密農業ソフトウェアサービス

- イントロダクション

- システムインテグレーションサービス

- マネージドサービス

- 接続サービス

- 専門支援サービス

- メンテナンス、アップグレード、サポートサービス

第7章 精密農業ソフトウェア市場、デリバリーモデル別

- イントロダクション

- オンプレミス

- クラウドベース

第8章 精密農業ソフトウェア市場、技術別

- イントロダクション

- ガイダンス技術

- リモートセンシングおよび制御システム技術

- 可変作業技術

第9章 精密農業ソフトウェア市場、用途別

- イントロダクション

- 収量監視

- 作物スカウティング

- フィールドマッピング

- 天気の追跡と予報

- 在庫管理

- 可変作業の適用

- 農場労働者の管理

- 財務管理

- その他

第10章 精密農業ソフトウェア市場、地域別

- イントロダクション

- 米国

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略、2020年~2023年

- 市場シェア分析、2023年

- 主要5社の収益分析、2019~2023年

- 企業評価と財務指標

- ブランド/製品の比較

- 企業評価マトリックス:主要企業、2023年

- 企業評価マトリックス:新興企業/中小企業、2023年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- DEERE & COMPANY

- TRIMBLE INC.

- AGCO CORPORATION

- RAVEN INDUSTRIES, INC.

- AGJUNCTION LLC

- AG LEADER TECHNOLOGY

- AGEAGLE AERIAL SYSTEMS INC

- TOPCON CORPORATION

- CLIMATE LLC

- TEEJET TECHNOLOGIES

- その他の企業

- HEXAGON AB

- ABACO S.P.A.

- PRECISIONHAWK

- EC2CE

- DESCARTES LABS INC.

- CROPX INC.

- FARMERS EDGE INC.

- GROWNETICS

- CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED

- GAMAYA

- FIELDBEE

- AVMAP S.R.L.

- DICKEY-JOHN

- TELUS

- MULLER-ELEKTRONIK GMBH

第13章 付録

The Precision Farming Software Market is projected to reach from USD 1.7 billion in 2024 to USD 3.1 billion by 2029; it is expected to grow at a CAGR of 12.5% from 2024 to 2029. Crop scouting serves as a vital component in precision farming, offering real-time, ground-level insights that complement data collected by sensors and drones. By providing immediate, on-the-ground observations, crop scouting empowers farmers to make decisions that are both accurate and timely. Additionally, crop scouting plays a crucial role in early issue detection, allowing farmers to identify problems such as pest infestations, diseases, and nutrient deficiencies before they escalate. This early detection enables farmers to take proactive measures to mitigate damage and prevent potential yield losses. Furthermore, the integration of scouting data into precision farming software enhances this proactive approach by enabling targeted interventions tailored to specific areas of the field. By leveraging the insights gained from crop scouting, farmers can implement precise and effective strategies to address issues, optimize resource allocation, and ultimately enhance overall crop health and productivity..

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Delivery Model, Application, Service, Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

Key players operating in the precision farming software market are Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US) and AgEagle Aerial Systems Inc (US).

The cloud-based delivery model is projected to grow at the highest CAGR during the forecast period.

The scalability of cloud-based solutions provides farmers with the flexibility to adapt their operations according to their requirements without significant infrastructure investments. This flexibility allows farmers to easily adjust the scale of their operations, whether they are managing a small family farm or a large commercial enterprise, without the need for extensive hardware upgrades. Additionally, the accessibility offered by cloud-based precision farming software enables farmers to monitor and manage their operations from any location with an internet connection. This accessibility empowers farmers to make timely decisions regardless of their physical location, thereby enhancing overall operational efficiency

Variable rate technology is projected to have the highest growth during the forecast period.

Varibale rate technology plays a crucial role in facilitating yield maximization by addressing spatial variability within fields and effectively managing various factors such as nutrient deficiencies, pest pressures, and irrigation needs. By utilizing VRT, farmers can tailor their input applications to the specific needs of different areas within their fields, optimizing crop growth and ultimately leading to higher yields and increased profitability. Additionally, VRT contributes to environmental sustainability by reducing over-application of inputs, thereby minimizing environmental impacts such as nutrient runoff and soil erosion. This targeted approach not only conserves resources but also helps protect ecosystems and water quality, promoting long-term sustainability in agriculture.

Asia Pacific region is likely to grow at the highest CAGR.

With the Asia Pacific region hosting a large and expanding population, the demand for food security is escalating, underscoring the critical role of precision farming software. By maximizing yields, enhancing crop quality, and mitigating post-harvest losses, precision farming software plays a pivotal role in meeting this growing demand for food. Moreover, the active promotion of precision farming by governments through subsidies, initiatives, and support programs further highlights its significance in bolstering food security. By incentivizing farmers to adopt precision farming practices, governments aim to increase agricultural productivity, reduce food shortages, and foster rural development. In essence, precision farming software stands as a key solution in addressing the challenges of food security in the Asia Pacific region, offering a pathway towards sustainable agricultural practices and ensuring a reliable food supply for the region's population.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 35%, Tier 2 - 40%, Tier 3 - 25%

- By Designation- C-level Executives - 30%, Directors - 40%, Others - 30%

- By Region-Americas - 40%, Europe - 32%, Asia Pacific - 23%, RoW - 5%

The precision farming software market is dominated by a few globally established players such as Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US), AgJunction LLC (US), Ag Leader Technology (US), TOPCON CORPORATION (Japan), Climate LLC (US), TeeJet Technologies (US). The study includes an in-depth competitive analysis of these key players in the precision farming software market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the precision farming software market and forecasts its size by delivery model, technology, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-Americas, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the precision farming software ecosystem.

Key Benefits to Buy the Report:

- Analysis of Key Drivers (Rapid adoption of advanced technologies in precision farming software, Rapid adoption of advanced technologies in precision farming software, Rapid adoption of advanced technologies in precision farming software). Restraints (Rapid adoption of advanced technologies in precision farming software, Requires specialized expertise to navigate effectively). Opportunities (Requires specialized expertise to navigate effectively, Establishing intellectual property benefits on farming innovations, Rising use of AI-based solutions in precision farming software, Adoption of digital technologies in sustainable farming) and Challenges (Legal, ethical and social barriers related to data ownership, privacy and security, Lack of standardization and compatibility among different technologies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the precision farming software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the precision farming software market across varied regions

- Market Diversification: Exhaustive information about new software, untapped geographies, recent developments, and investments in the precision farming software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Deere & Company (US), Trimble Inc. (US), AGCO Corporation (US), Raven Industries, Inc. (US), AgEagle Aerial Systems Inc (US) among others in the precision farming software market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 PRECISION FARMING SOFTWARE MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 PRECISION FARMING SOFTWARE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 3 PRECISION FARMING SOFTWARE MARKET: PROCESS FLOW

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach to arrive at market size using top-down analysis (supply side)

- FIGURE 4 PRECISION FARMING SOFTWARE MARKET: TOP-DOWN APPROACH

- FIGURE 5 PRECISION FARMING SOFTWARE MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE (APPROACH 1)

- FIGURE 6 PRECISION FARMING SOFTWARE MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY SIDE (APPROACH 2)

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 7 PRECISION FARMING SOFTWARE MARKET: BOTTOM-UP APPROACH

- FIGURE 8 PRECISION FARMING SOFTWARE MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- 2.3 GROWTH FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 PRECISION FARMING SOFTWARE MARKET: DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 1 PRECISION FARMING SOFTWARE MARKET: RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK FACTORS

- TABLE 2 PRECISION FARMING SOFTWARE MARKET: RISK FACTORS

- 2.8 RISK ASSESSMENT

- FIGURE 10 PRECISION FARMING SOFTWARE MARKET: RISK ASSESSMENT

- TABLE 3 PRECISION FARMING SOFTWARE MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 11 PRECISION FARMING SOFTWARE MARKET, 2020-2029 (USD BILLION)

- FIGURE 12 ON-PREMISES DELIVERY MODEL TO HOLD LARGER SHARE OF PRECISION FARMING SOFTWARE MARKET IN 2029

- FIGURE 13 GUIDANCE TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

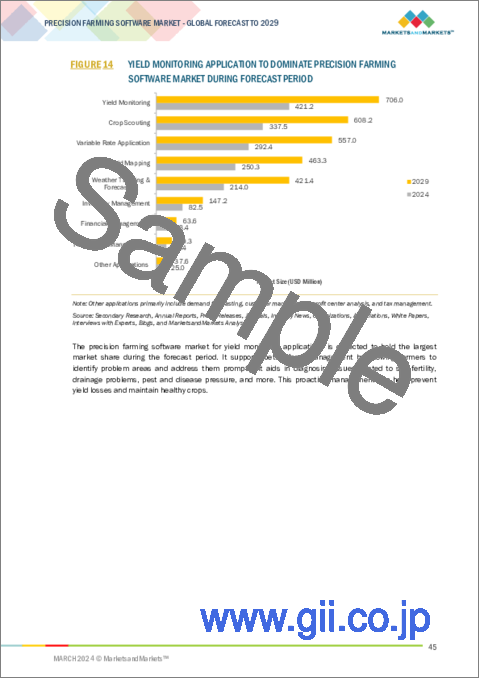

- FIGURE 14 YIELD MONITORING APPLICATION TO DOMINATE PRECISION FARMING SOFTWARE MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR IN PRECISION FARMING SOFTWARE MARKET BETWEEN 2024 AND 2029

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FARMING SOFTWARE MARKET

- FIGURE 16 RISING ADOPTION OF ADVANCED AGRICULTURAL TECHNOLOGIES TO OFFER LUCRATIVE OPPORTUNITIES FOR PLAYERS IN PRECISION FARMING SOFTWARE MARKET

- 4.2 PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL

- FIGURE 17 ON-PREMISES DELIVERY MODEL TO DOMINATE MARKET FROM 2024 TO 2029

- 4.3 PRECISION FARMING SOFTWARE MARKET, BY APPLICATION

- FIGURE 18 YIELD MONITORING APPLICATION TO HOLD LARGEST MARKET SHARE IN 2029

- 4.4 PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY

- FIGURE 19 GUIDANCE TECHNOLOGY TO DOMINATE MARKET BETWEEN 2024 AND 2029

- 4.5 PRECISION FARMING SOFTWARE MARKET, BY REGION

- FIGURE 20 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRECISION FARMING SOFTWARE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 PRECISION FARMING SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advancements in AI and ML technologies

- 5.2.1.2 Increased adoption of IoT devices to collect real-time agricultural data

- 5.2.1.3 High emphasis on enhancing food security

- FIGURE 22 IMPACT ANALYSIS: DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High upfront costs of precision farming software

- 5.2.2.2 Requirement for high expertise to effectively operate farming software

- FIGURE 23 IMPACT ANALYSIS: RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Establishment of standardized agricultural data protocols

- 5.2.3.2 Development of supportive intellectual property frameworks

- 5.2.3.3 Use of AI-powered drones in farming

- 5.2.3.4 Adoption of digital technologies to promote sustainable farming

- FIGURE 24 IMPACT ANALYSIS: OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Legal, ethical, and social issues related to agricultural data ownership, privacy, and security

- 5.2.4.2 Lack of standardization of agricultural technologies

- FIGURE 25 IMPACT ANALYSIS: CHALLENGES

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 26 PRECISION FARMING SOFTWARE MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- TABLE 4 ROLE OF KEY PLAYERS IN PRECISION FARMING SOFTWARE ECOSYSTEM

- FIGURE 27 KEY PLAYERS IN PRECISION FARMING SOFTWARE ECOSYSTEM

- 5.5 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 PRECISION FARMING SOFTWARE MARKET: INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 29 PRECISION FARMING SOFTWARE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGY

- 5.7.1.1 Global positioning systems/Global navigation satellite systems

- 5.7.1.2 Data analytics & machine learning

- 5.7.2 COMPLIMENTARY TECHNOLOGY

- 5.7.2.1 Artificial intelligence

- 5.7.3 ADJACENT TECHNOLOGY

- 5.7.3.1 Internet of Things (IoT)

- 5.7.1 KEY TECHNOLOGY

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 LOACKER DEPLOYS CROPIN'S SMART FARMING SOLUTIONS TO ENSURE SUSTAINABLE HAZELNUT PRODUCTION

- 5.8.2 ACCENTURE COLLABORATES WITH PROAGRICA TO DEVELOP USER INTERFACES AND DATA SERVICE PLATFORMS FOR FARMERS

- 5.8.3 CROPX TECHNOLOGIES LTD. AND REINKE MANUFACTURING CO., INC. DEVELOP WATER MANAGEMENT SOLUTIONS TO BOOST SUSTAINABLE FARMING

- 5.8.4 AGCO CORPORATION DEVELOPS INNOVATIVE SOLUTIONS TO INTEGRATE FARM EQUIPMENT INTO SINGLE PLATFORM

- 5.9 PORTER'S FIVE FORCE ANALYSIS

- TABLE 5 PRECISION FARMING SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 PRECISION FARMING SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 31 IMPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 6 IMPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.10.2 EXPORT SCENARIO

- FIGURE 32 EXPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 8433-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11 PATENT ANALYSIS

- TABLE 8 PRECISION FARMING SOFTWARE MARKET: LIST OF PATENTS, 2020-2023

- FIGURE 33 PRECISION FARMING SOFTWARE: PATENTS APPLIED AND GRANTED, 2014-2023

- 5.12 KEY CONFERENCES AND EVENTS, 2024

- TABLE 9 PRECISION FARMING SOFTWARE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024

- 5.13 REGULATORY LANDSCAPE AND STANDARDS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 PRECISION FARMING SOFTWARE MARKET: INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 14 PRECISION FARMING SOFTWARE MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.14.2 BUYING CRITERIA

- FIGURE 35 PRECISION FARMING SOFTWARE MARKET: KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 15 PRECISION FARMING SOFTWARE MARKET: KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.15 PRICING ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE

- FIGURE 36 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE, 2020-2023

- 5.15.2 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE OFFERED BY KEY PLAYERS

- TABLE 16 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE OFFERED BY KEY PLAYERS, 2023

- 5.15.3 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE FOR CLOUD-BASED DELIVERY MODEL, BY REGION

- TABLE 17 AVERAGE SELLING PRICE OF PRECISION FARMING SOFTWARE FOR CLOUD-BASED DELIVERY MODEL, BY REGION, 2020-2023 (USD)

6 PRECISION FARMING SOFTWARE SERVICES

- 6.1 INTRODUCTION

- 6.2 SYSTEM INTEGRATION SERVICES

- 6.3 MANAGED SERVICES

- 6.3.1 FARM OPERATION SERVICES

- 6.3.2 DATA SERVICES

- 6.3.3 ANALYTICS SERVICES

- 6.4 CONNECTIVITY SERVICES

- 6.5 ASSISTED PROFESSIONAL SERVICES

- 6.5.1 SUPPLY CHAIN MANAGEMENT SERVICES

- 6.5.2 CLIMATE INFORMATION SERVICES

- 6.5.3 OTHER ASSISTED PROFESSIONAL SERVICES

- 6.6 MAINTENANCE, UPGRADATION & SUPPORT SERVICES

7 PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL

- 7.1 INTRODUCTION

- TABLE 18 PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 19 PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- FIGURE 37 CLOUD-BASED DELIVERY MODEL TO RECORD HIGHEST CAGR IN PRECISION FARMING SOFTWARE MARKET DURING FORECAST PERIOD

- 7.2 ON-PREMISES

- 7.2.1 ENFORCEMENT OF REGULATIONS TO ENSURE AGRICULTURAL DATA PRIVACY AND SECURITY TO BOOST SEGMENTAL GROWTH

- TABLE 20 ON-PREMISES: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 21 ON-PREMISES: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 22 ON-PREMISES: PRECISION FARMING SOFTWARE MARKET IN AMERICAS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 23 ON-PREMISES: PRECISION FARMING SOFTWARE MARKET IN AMERICAS, BY REGION, 2024-2029 (USD MILLION)

- 7.3 CLOUD-BASED

- 7.3.1 EASY ACCESSIBILITY AND SCALABILITY TO FUEL DEMAND FOR CLOUD-BASED PRECISION FARMING TECHNOLOGY

- TABLE 24 CLOUD-BASED: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 25 CLOUD-BASED: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 CLOUD-BASED: PRECISION FARMING SOFTWARE MARKET IN AMERICAS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 CLOUD-BASED: PRECISION FARMING SOFTWARE MARKET IN AMERICAS, BY REGION, 2024-2029 (USD MILLION)

- 7.3.2 SOFTWARE-AS-A-SERVICE

- 7.3.3 PLATFORM-AS-A-SERVICE

8 PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- TABLE 28 PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 29 PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- FIGURE 38 GUIDANCE TECHNOLOGY TO DOMINATE PRECISION FARMING SOFTWARE MARKET BETWEEN 2024 AND 2029

- 8.2 GUIDANCE TECHNOLOGY

- TABLE 30 GUIDANCE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 GUIDANCE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 GUIDANCE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 33 GUIDANCE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.2.1 GPS-/GNSS-BASED

- 8.2.1.1 Deployment of GPS-/GNSS-based guidance technology to customize agricultural fields to facilitate segmental growth

- 8.2.2 GIS-BASED

- 8.2.2.1 Reliance on GIS technology to manage spatial data to contribute to segmental growth

- 8.3 REMOTE SENSING & CONTROL SYSTEM TECHNOLOGY

- TABLE 34 REMOTE SENSING & CONTROL SYSTEM TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 REMOTE SENSING & CONTROL SYSTEM TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 REMOTE SENSING & CONTROL SYSTEM TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 37 REMOTE SENSING & CONTROL SYSTEM TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.3.1 HANDHELD/GROUND-BASED SENSORS

- 8.3.1.1 Implementation of handheld/ground-based sensors to collect real-time crop health data to accelerate segmental growth

- 8.3.2 SATELLITE/AERIAL SENSORS

- 8.3.2.1 Adoption of satellite/aerial sensors to analyze field and crop conditions to foster segmental growth

- 8.4 VARIABLE RATE TECHNOLOGY

- TABLE 38 VARIABLE RATE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 VARIABLE RATE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 VARIABLE RATE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 41 VARIABLE RATE TECHNOLOGY: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 8.4.1 MAP-BASED

- 8.4.1.1 Deployment of variable rate technology to generate detailed field maps and allocate resources to boost segmental growth

- 8.4.2 SENSOR-BASED

- 8.4.2.1 Utilization of advanced sensors in precision farming to collect real-time data to propel market

9 PRECISION FARMING SOFTWARE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 42 PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 43 PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- FIGURE 39 WEATHER TRACKING & FORECASTING APPLICATION TO RECORD HIGHEST CAGR FROM 2024 TO 2029

- 9.2 YIELD MONITORING

- TABLE 44 YIELD MONITORING BENEFITS

- TABLE 45 YIELD MONITORING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 YIELD MONITORING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 YIELD MONITORING: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 48 YIELD MONITORING: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.2.1 ON-FARM

- 9.2.1.1 Adoption of on-farm yield monitoring systems to address yield inconsistencies caused by irrigation to fuel segmental growth

- 9.2.2 OFF-FARM

- 9.2.2.1 Use of off-farm yield monitors to draw data from agricultural cooperatives to accelerate segmental growth

- 9.3 CROP SCOUTING

- 9.3.1 REQUIREMENT FOR MITIGATING CROP DAMAGE AND ENHANCING YIELDS TO BOOST SEGMENTAL GROWTH

- TABLE 49 CROP SCOUTING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 CROP SCOUTING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3.2 PRE-SEEDING SCOUTING

- 9.3.3 POST-SEEDING SCOUTING

- 9.3.4 CROP MONITORING

- 9.4 FIELD MAPPING

- TABLE 51 FIELD MAPPING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 FIELD MAPPING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 53 FIELD MAPPING: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 54 FIELD MAPPING: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.4.1 BOUNDARY MAPPING

- 9.4.1.1 Reliance on boundary mapping solutions to facilitate precise farm resource management to drive market

- 9.4.2 DRAINAGE MAPPING

- 9.4.2.1 Adoption of precision farming software to optimize drainage infrastructure to augment segmental growth

- 9.5 WEATHER TRACKING & FORECASTING

- 9.5.1 REQUIREMENT FOR REAL-TIME WEATHER DATA TO ENHANCE CROP MANAGEMENT TO PROPEL MARKET

- TABLE 55 WEATHER TRACKING & FORECASTING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 WEATHER TRACKING & FORECASTING: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 INVENTORY MANAGEMENT

- 9.6.1 IMPLEMENTATION OF INVENTORY MANAGEMENT SOFTWARE WITH TRACEABILITY FEATURES TO FOSTER SEGMENTAL GROWTH

- TABLE 57 INVENTORY MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 INVENTORY MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 VARIABLE RATE APPLICATION

- TABLE 59 VARIABLE RATE APPLICATION: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 VARIABLE RATE APPLICATION: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 VARIABLE RATE APPLICATION: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 62 VARIABLE RATE APPLICATION: PRECISION FARMING SOFTWARE MARKET, BY TYPE, 2024-2029 (USD MILLION)

- 9.7.1 PRECISION IRRIGATION

- 9.7.1.1 Use of precision irrigation systems to reduce water wastage to contribute to segmental growth

- 9.7.2 PRECISION FERTILIZATION

- 9.7.2.1 Adoption of precision fertilization systems to optimize nutrient usage and enhance plant growth to drive market

- 9.7.3 PRECISION SEEDING

- 9.7.3.1 Reliance on precision seeding systems to minimize seed wastage to facilitate segmental growth

- 9.7.4 OTHER VARIABLE RATE APPLICATIONS

- 9.8 FARM LABOR MANAGEMENT

- 9.8.1 NEED FOR EFFECTIVE FARM LABOR MANAGEMENT TO ENHANCE OPERATIONAL EFFICIENCY TO DRIVE MARKET

- TABLE 63 FARM LABOR MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 FARM LABOR MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.9 FINANCIAL MANAGEMENT

- 9.9.1 USE OF FINANCIAL MANAGEMENT SOLUTIONS TO MANAGE EXPENSES AND IMPROVE BUSINESS OPERATIONS TO PROPEL MARKET

- TABLE 65 FINANCIAL MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 FINANCIAL MANAGEMENT: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.10 OTHER APPLICATIONS

- TABLE 67 OTHER APPLICATIONS: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

10 PRECISION FARMING SOFTWARE MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 69 PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 70 PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- FIGURE 40 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN PRECISION FARMING SOFTWARE MARKET BETWEEN 2024 AND 2029

- 10.2 AMERICAS

- 10.2.1 RECESSION IMPACT ON PRECISION FARMING SOFTWARE MARKET IN AMERICAS

- FIGURE 41 AMERICAS: PRECISION FARMING SOFTWARE MARKET SNAPSHOT

- TABLE 71 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 72 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 74 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- TABLE 75 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 76 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 77 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 78 AMERICAS: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 10.2.2 NORTH AMERICA

- TABLE 79 NORTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- 10.2.2.1 US

- 10.2.2.1.1 Rising investment in harvesting robots to facilitate market growth

- 10.2.2.2 Canada

- 10.2.2.2.1 Increasing use of agricultural drones to contribute to market growth

- 10.2.2.3 Mexico

- 10.2.2.3.1 Growing emphasis on promoting sustainable farming practices to accelerate market growth

- 10.2.2.1 US

- 10.2.3 SOUTH AMERICA

- TABLE 83 SOUTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 SOUTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 SOUTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 86 SOUTH AMERICA: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- 10.2.3.1 Brazil

- 10.2.3.1.1 Increasing adoption of autonomous harvesting technology by commercial farmers to augment market growth

- 10.2.3.2 Argentina

- 10.2.3.2.1 Rising focus on advancing precision agriculture technologies to increase crop productivity to propel market

- 10.2.3.3 Rest of South America

- 10.2.3.1 Brazil

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT ON PRECISION FARMING SOFTWARE MARKET IN EUROPE

- FIGURE 42 EUROPE: PRECISION FARMING SOFTWARE MARKET SNAPSHOT

- TABLE 87 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 88 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 89 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 90 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- TABLE 91 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 92 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 93 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Increasing development of autonomous farming vehicles to facilitate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Rising foreign investment in agriculture industry to contribute to market growth

- 10.3.4 FRANCE

- 10.3.4.1 Growing allocation of funds to ensure food security to fuel market growth

- 10.3.5 ITALY

- 10.3.5.1 Rapid advancements in irrigation sensors and other farming technologies to augment market growth

- 10.3.6 NETHERLANDS

- 10.3.6.1 Increasing development of harvesting robots to offer lucrative opportunities for precision farming software developers

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 RECESSION IMPACT ON PRECISION FARMING SOFTWARE MARKET IN ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET SNAPSHOT

- TABLE 95 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Government-led investments in AI farming technology to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Advancements in soil sensors and nutrient mapping systems to foster market growth

- 10.4.4 AUSTRALIA

- 10.4.4.1 Emphasis on enhancing profitability and sustainability of farming solutions to accelerate market growth

- 10.4.5 INDIA

- 10.4.5.1 Adoption of autonomous vehicles to perform agricultural tasks to fuel market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Establishment of smart farming villages to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 RECESSION IMPACT ON PRECISION FARMING SOFTWARE MARKET IN ROW

- TABLE 103 ROW: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY/REGION, 2020-2023 (USD MILLION)

- TABLE 104 ROW: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- TABLE 105 ROW: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2020-2023 (USD MILLION)

- TABLE 106 ROW: PRECISION FARMING SOFTWARE MARKET, BY DELIVERY MODEL, 2024-2029 (USD MILLION)

- TABLE 107 ROW: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 108 ROW: PRECISION FARMING SOFTWARE MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 109 ROW: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 110 ROW: PRECISION FARMING SOFTWARE MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- 10.5.2 MIDDLE EAST & AFRICA

- TABLE 111 MIDDLE EAST & AFRICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY/REGION, 2020-2023 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: PRECISION FARMING SOFTWARE MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- 10.5.2.1 GCC countries

- 10.5.2.1.1 Deployment of advanced agricultural technologies to drive market

- 10.5.2.2 Rest of Middle East & Africa

- 10.5.2.1 GCC countries

- 10.5.3 RUSSIA

- 10.5.3.1 Increasing development of crop production software to accelerate market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 113 PRECISION FARMING SOFTWARE MARKET: STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 11.2.1 PRODUCT PORTFOLIO EXPANSION

- 11.2.2 REGIONAL FOOTPRINT EXPANSION

- 11.2.3 MANUFACTURING FOOTPRINT EXPANSION

- 11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 44 PRECISION FARMING SOFTWARE MARKET SHARE ANALYSIS, 2023

- TABLE 114 PRECISION FARMING SOFTWARE MARKET: DEGREE OF COMPETITION, 2023

- 11.4 REVENUE ANALYSIS OF FIVE KEY COMPANIES, 2019-2023

- FIGURE 45 PRECISION FARMING SOFTWARE MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019-2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 46 PRECISION FARMING SOFTWARE MARKET: ENTERPRISE VALUATION

- FIGURE 47 PRECISION FARMING SOFTWARE MARKET: FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- FIGURE 48 PRECISION FARMING SOFTWARE: BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 49 PRECISION FARMING SOFTWARE: COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.7.5.1 Overall footprint

- FIGURE 50 PRECISION FARMING SOFTWARE MARKET: OVERALL FOOTPRINT

- 11.7.5.2 Technology footprint

- TABLE 115 PRECISION FARMING SOFTWARE MARKET: TECHNOLOGY FOOTPRINT

- 11.7.5.3 Application footprint

- TABLE 116 PRECISION FARMING SOFTWARE MARKET: APPLICATION FOOTPRINT

- 11.7.5.4 Region footprint

- TABLE 117 PRECISION FARMING SOFTWARE MARKET: REGION FOOTPRINT

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 51 PRECISION FARMING SOFTWARE MARKET: COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 11.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 11.8.5.1 List of key start-ups/SMEs

- TABLE 118 PRECISION FARMING SOFTWARE MARKET: LIST OF KEY START-UPS/SMES

- 11.8.5.2 Competitive benchmarking of key start-ups/SMEs

- TABLE 119 PRECISION FARMING SOFTWARE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.9 COMPETITIVE SCENARIOS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- TABLE 120 PRECISION FARMING SOFTWARE MARKET: PRODUCT LAUNCHES, JANUARY 2020-DECEMBER 2023

- 11.9.2 DEALS

- TABLE 121 PRECISION FARMING SOFTWARE MARKET: DEALS, JANUARY 2020-DECEMBER 2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 DEERE & COMPANY

- TABLE 122 DEERE & COMPANY: COMPANY OVERVIEW

- FIGURE 52 DEERE & COMPANY: COMPANY SNAPSHOT

- TABLE 123 DEERE & COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 DEERE & COMPANY: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 125 DEERE & COMPANY: DEALS

- 12.1.2 TRIMBLE INC.

- TABLE 126 TRIMBLE INC.: COMPANY OVERVIEW

- FIGURE 53 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 127 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 TRIMBLE INC.: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 129 TRIMBLE INC.: DEALS

- 12.1.3 AGCO CORPORATION

- TABLE 130 AGCO CORPORATION: COMPANY OVERVIEW

- FIGURE 54 AGCO CORPORATION: COMPANY SNAPSHOT

- TABLE 131 AGCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 AGCO CORPORATION: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 133 AGCO CORPORATION: DEALS

- TABLE 134 AGCO CORPORATION: OTHERS

- 12.1.4 RAVEN INDUSTRIES, INC.

- TABLE 135 RAVEN INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 55 RAVEN INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 136 RAVEN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 RAVEN INDUSTRIES, INC.: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 138 RAVEN INDUSTRIES, INC.: DEALS

- TABLE 139 RAVEN INDUSTRIES, INC.: EXPANSIONS

- 12.1.5 AGJUNCTION LLC

- TABLE 140 AGJUNCTION LLC: COMPANY OVERVIEW

- TABLE 141 AGJUNCTION LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 AGJUNCTION LLC: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 143 AGJUNCTION LLC: DEALS

- 12.1.6 AG LEADER TECHNOLOGY

- TABLE 144 AG LEADER TECHNOLOGY: COMPANY OVERVIEW

- TABLE 145 AG LEADER TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 AG LEADER TECHNOLOGY: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- 12.1.7 AGEAGLE AERIAL SYSTEMS INC

- TABLE 147 AGEAGLE AERIAL SYSTEMS INC: COMPANY OVERVIEW

- FIGURE 56 AGEAGLE AERIAL SYSTEMS INC: COMPANY OVERVIEW

- 12.1.7.2 Products/Solutions/Services offered

- TABLE 148 AGEAGLE AERIAL SYSTEMS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches/developments

- 12.1.7.3 Recent developments

- TABLE 149 AGEAGLE AERIAL SYSTEMS INC: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- 12.1.7.3.2 Deals

- TABLE 150 AGEAGLE AERIAL SYSTEMS INC: DEALS

- 12.1.8 TOPCON CORPORATION

- TABLE 151 TOPCON CORPORATION: COMPANY OVERVIEW

- FIGURE 57 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 152 TOPCON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 TOPCON CORPORATION: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 154 TOPCON CORPORATION: DEALS

- TABLE 155 TOPCON CORPORATION: OTHERS

- 12.1.9 CLIMATE LLC

- TABLE 156 CLIMATE LLC: COMPANY OVERVIEW

- TABLE 157 CLIMATE LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 CLIMATE LLC: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 159 CLIMATE LLC: DEALS

- 12.1.10 TEEJET TECHNOLOGIES

- TABLE 160 TEEJET TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 161 TEEJET TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 HEXAGON AB

- 12.2.2 ABACO S.P.A.

- 12.2.3 PRECISIONHAWK

- 12.2.4 EC2CE

- 12.2.5 DESCARTES LABS INC.

- 12.2.6 CROPX INC.

- 12.2.7 FARMERS EDGE INC.

- 12.2.8 GROWNETICS

- 12.2.9 CROPIN TECHNOLOGY SOLUTIONS PRIVATE LIMITED

- 12.2.10 GAMAYA

- 12.2.11 FIELDBEE

- 12.2.12 AVMAP S.R.L.

- 12.2.13 DICKEY-JOHN

- 12.2.14 TELUS

- 12.2.15 MULLER-ELEKTRONIK GMBH

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS