|

|

市場調査レポート

商品コード

1446308

BPaaSの世界市場:ビジネスプロセス・展開モデル・組織規模・産業・地域別 - 予測(~2028年)BPaaS Market by Business Process, Deployment Model, Organization Size, Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| BPaaSの世界市場:ビジネスプロセス・展開モデル・組織規模・産業・地域別 - 予測(~2028年) |

|

出版日: 2024年03月01日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

BPaaSの市場規模は、2023年の633億米ドルから、予測期間中は8.0%のCAGRで推移し、2028年には922億米ドルの規模に成長すると予測されています。

組織が柔軟性と拡張性をますます優先するようになる中、BPaaSは戦略的なイネーブラーとして登場し、進化する市場力学に適応して持続可能な成長を達成することを可能にします。BPaaSモデルの柔軟性と拡張性により、企業は変化する市場力学に適応し、それに応じて事業を拡大することができます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | ビジネスプロセス・展開モデル・組織規模・産業 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

ビジネスプロセス別では、調達・サプライチェーン管理・オペレーションの部門が予測期間中2番目に高いCAGRで成長する見込みです。BPaaS市場は、クラウドベースのソリューションによって急速な変貌を遂げています。これらのビジネスプロセスは、サプライチェーンのライフサイクル全体にわたってエンドツーエンドのサポートを提供することで、従来の慣習に革命をもたらします。調達、ソーシングから在庫管理、ロジスティクス、フルフィルメントに至るまで、BPaaSプラットフォームはスケーラブルでカスタマイズ可能なツール群を提供します。これらのソリューションは、AI、機械学習、予測分析などの最先端魏技術を活用することで、在庫レベルの最適化、サプライヤーとの関係の合理化、業務効率の向上を可能にします。サプライチェーンデータをリアルタイムで可視化することで、俊敏な意思決定が可能になり、市場の変動や顧客の要求に対する迅速な対応が可能になります。さらに、BPaaSプロバイダーは柔軟な展開モデルを提供するため、企業は資本支出を抑えながら業務をシームレスに拡張することができます。調達、サプライチェーン、オペレーションにBPaaSを導入することで、企業は費用対効果の改善、リスクの軽減、進化し続けるマーケットプレースにおけるイノベーションの推進能力を通じて、競争上の優位性を獲得することができます。

産業別では、ヘルスケア&ライフサイエンスの部門が2023年に2番目に高いCAGRで成長する見込みです。同部門はプロセスを最適化し、患者ケアを強化するための革新的なソリューションを求めているため、大きな成長を示しています。BPaaSはヘルスケアプロバイダー、製薬会社、研究機関向けにカスタマイズされたサービスを提供し、管理業務の効率化、患者データの安全な管理、規制要件への効果的な準拠を可能にします。クラウドベースのプラットフォームを活用することで、BPaaSはヘルスケア専門家間のコラボレーションを強化し、遠隔患者モニタリングを容易にし、臨床試験を加速します。さらに、BPaaSソリューションは高度なアナリティクスとAIを活用し、膨大なヘルスケアデータから洞察を導き出し、最終的には診断の改善、個別化治療、患者の転帰改善につながります。

地域別では、北米が予測期間中最大の市場シェアを占めると思われます。BPaaSは、ワークフローの自動化、敏捷性の向上、さまざまな業界におけるコスト削減によって北米市場を再構築しています。北米のBPaaS産業の影響は、ヘルスケア、金融、製造、小売などの分野で顕著です。新たな雇用機会を創出する一方で、BPaaSはIBM、Oracle、SAPのような大手企業間の競争を激化させ、イノベーションとより良い価格設定を促進しています。セキュリティへの懸念は根強く、プロバイダーの慎重な選択と強固な対策が必要です。中小企業は、クラウドコンピューティングとAIの台頭も手伝って、手頃な価格と使いやすさからBPaaSを採用するケースが増えています。全体として、BPaaSは北米の生産性向上、雇用創出、経済成長に貢献しています。

当レポートでは、世界のBPaaSの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- 顧客のビジネスに影響を与える動向/ディスラプション

- 主なステークホルダーと購入基準

- ビジネスモデル分析

- 投資と資金調達のシナリオ

- 主要な会議とイベント

第6章 BPaaS市場:ビジネスプロセス別

- 人的資源管理

- 給与計算処理

- 従業員の新人研修

- 福利厚生管理

- その他

- 会計&ファイナンス

- 買掛金勘定

- 総勘定元帳

- 財務報告

- その他

- セールス&マーケティング

- リードジェネレーションサービス

- 顧客関係管理 (CRM) サービス

- その他

- カスタマーサービス&サポート

- コールセンター業務

- ヘルプデスクサポート

- チケット管理

- その他

- 調達・サプライチェーン管理・オペレーション

- ベンダー管理

- 注文書処理

- 在庫最適化

- 流通・物流

- その他

- その他のビジネスプロセス

第7章 BPaaS市場:展開モデル別

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第8章 BPaaS市場:組織規模別

- 大企業

- 中小企業

第9章 BPaaS市場:産業別

- BFSI

- IT・通信

- 製造

- 小売・Eコマース

- ヘルスケア・ライフサイエンス

- 政府・公共部門

- その他

第10章 BPaaS市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 製品/ブランドの比較

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリクス

- 会社の財務指標

- 市場における主要な展開

第12章 企業プロファイル

- 主要企業

- ACCENTURE

- CAPGEMINI

- COGNIZANT

- IBM

- HCL

- TCS

- FUJITSU

- GENPACT

- WIPRO

- TECH MAHINDRA

- その他の企業

- EXL

- DXC TECHNOLOGY

- CONDUENT

- INFOSYS BPM

- BIZAGI

- IGRAFX

- AURAQUANTIC

- PIPEFY

- CFLOW

- AGILEPOINT

- WORKFLOWGEN

- FLOKZU

- INTEGRIFY

- LINX

- QUIXY

第13章 隣接/関連市場

第14章 付録

The BPaaS market is expected to grow from USD 63.3 billion in 2023 to USD 92.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 8.0% during the forecast period. As organizations increasingly prioritize flexibility and scalability, BPaaS emerges as a strategic enabler, enabling them to adapt to evolving market dynamics and achieve sustainable growth. The flexibility and scalability of BPaaS models allow businesses to adapt to changing market dynamics and scale their operations accordingly.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Business Process, Deployment Model, Organization Size, and Vertical. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"As per the business process, the procurement, supply chain management & operations segment is expected to grow at the second highest CAGR during the forecast period. "

The BPaaS market is witnessing a rapid transformation driven by cloud-based solutions. These business processes revolutionize traditional practices by providing end-to-end support across the entire supply chain lifecycle. From procurement and sourcing to inventory management, logistics, and fulfillment, BPaaS platforms offer a suite of scalable and customizable tools. These solutions empower organizations to optimize inventory levels, streamline supplier relationships, and enhance operational efficiency by leveraging cutting-edge technologies such as artificial intelligence, machine learning, and predictive analytics. Real-time visibility into supply chain data enables agile decision-making, facilitating faster response times to market fluctuations and customer demands. Moreover, BPaaS providers offer flexible deployment models, allowing businesses to scale their operations seamlessly while reducing capital expenditures. By embracing BPaaS in procurement, supply chain, and operations, companies gain a competitive edge through improved cost-effectiveness, risk mitigation, and the ability to drive innovation in an ever-evolving marketplace.

"As per vertical, the healthcare & life sciences vertical to grow at second highest CAGR in 2023."

In the healthcare and life sciences sector, the BPaaS market is witnessing significant growth as organizations seek innovative solutions to optimize processes and enhance patient care. BPaaS offers tailored services to healthcare providers, pharmaceutical companies, and research institutions, enabling them to streamline administrative tasks, manage patient data securely, and comply with regulatory requirements more effectively. By leveraging cloud-based platforms, BPaaS enhances collaboration among healthcare professionals, facilitates remote patient monitoring, and accelerates clinical trials. Additionally, BPaaS solutions utilize advanced analytics and artificial intelligence to drive insights from vast amounts of healthcare data, ultimately leading to improved diagnoses, personalized treatments, and better patient outcomes.

As per region, North America will witness the largest market share during the forecast period.

BPaaS is reshaping the North American market by automating workflows, enhancing agility, and reducing costs across various industries. The impact of the North American BPaaS industry is evident in sectors like healthcare, finance, manufacturing, and retail. While creating new job opportunities, BPaaS also intensifies competition among major players like IBM, Oracle, and SAP, fostering innovation and better pricing. Security concerns persist, requiring careful selection of providers and robust measures. Small and medium-sized businesses increasingly adopt BPaaS for its affordability and ease of use, aided by the rise of cloud computing and artificial intelligence. Overall, BPaaS contributes to increased productivity, job creation, and economic growth in North America.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 40%, Tier II: 35%, and Tier III: 25%

- By Designation: C-Level Executives: 45%, Director Level: 35%, and Others: 20%

- By Region: North America: 35%, Europe: 25%, Asia Pacific: 30%, Rest of World: 10%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Some of the significant vendors offering BPaaS Solutions across the globe include.

Accenture (Ireland), Capgemini (France), Cognizant (US), IBM(US), HCL (India), TCS (India), Fujitsu (Japan), Genpact (US), Wipro (India), Tech Mahindra (India), EXL (US), DXC Technology (US), Conduent (US), Infosys BPM (India), Bizagi (US).

Research coverage:

The market study covers the BPaaS market across segments. It aims to estimate the market size and the growth potential of this market across different market segments, such as business process, deployment model, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall BPaaS market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (cloud adoption fuels BPaaS demand, emphasizing scalability and flexibility also cost optimization drives BPaaS exploration, seeking efficient alternatives), restraints (rising security & compliance concerns), opportunities (cloud ecosystem growth facilitates BPaaS scalability and integration), and challenges (challenges integrating BPaaS with existing system) influencing the development of the BPaaS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the BPaaS market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the BPaaS market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the BPaaS market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and business processes offered in BPaaS of leading players like Accenture (Ireland), Capgemini (France), Cognizant (US), IBM (US), TCS (India), among others in the BPaaS market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 BPAAS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 BPAAS MARKET SEGMENTATION, BY REGION

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 3 BPAAS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 4 BREAKUP OF PRIMARY PROFILES, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- FIGURE 5 BPAAS MARKET: KEY INDUSTRY INSIGHTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 BPAAS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 BPAAS MARKET: RESEARCH FLOW

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 11 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 12 CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 13 DEMAND-SIDE APPROACH

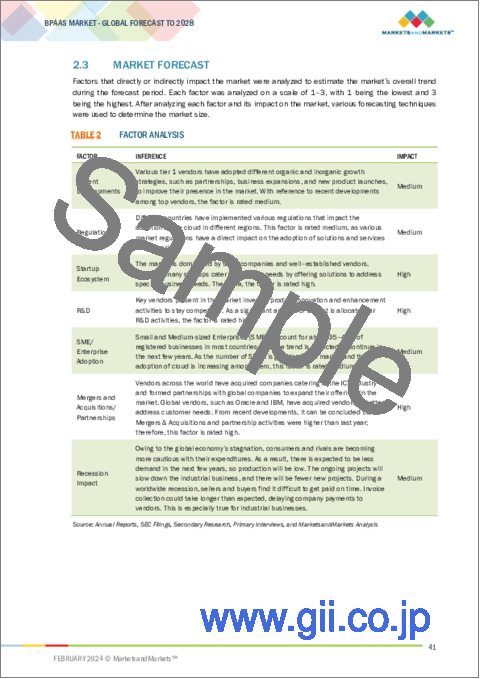

- 2.3 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 14 BPAAS MARKET: DATA TRIANGULATION

- 2.5 IMPACT OF RECESSION ON GLOBAL BPAAS MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 BPAAS MARKET SIZE AND GROWTH, 2018-2022 (USD MILLION AND Y-O-Y)

- TABLE 4 BPAAS MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION AND Y-O-Y)

- FIGURE 15 GLOBAL BPAAS TO WITNESS SIGNIFICANT GROWTH

- FIGURE 16 FASTEST-GROWING SEGMENTS IN BPAAS MARKET, 2023-2028

- FIGURE 17 BPAAS MARKET: REGIONAL SNAPSHOT, 2023-2028

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF BPAAS MARKET

- FIGURE 18 STREAMLINING AND OPTIMIZING BUSINESS PROCESSES THROUGH BPAAS TO RESULT IN IMPROVED CUSTOMER EXPERIENCES

- 4.2 BPAAS MARKET, BY BUSINESS PROCESS

- FIGURE 19 HUMAN RESOURCE MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE AMONG BUSINESS PROCESS DURING FORECAST PERIOD

- 4.3 BPAAS MARKET, BY DEPLOYMENT MODEL

- FIGURE 20 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SHARE AMONG DEPLOYMENT MODELS DURING FORECAST PERIOD

- 4.4 BPAAS MARKET, BY ORGANIZATION SIZE

- FIGURE 21 LARGE ENTERPRISES TO ACCOUNT FOR LARGER ADOPTION OF BPAAS MARKET DURING FORECAST PERIOD

- 4.5 BPAAS MARKET, BY VERTICAL

- FIGURE 22 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.6 BPAAS MARKET: REGIONAL SCENARIO

- FIGURE 23 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BPAAS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Cloud adoption emphasized scalability and flexibility

- 5.2.1.2 Cost optimization to drive need for efficient alternatives

- 5.2.1.3 Automation and AI enhance operational efficiency of BPaaS

- 5.2.1.4 Surge in industry-specific BPaaS solutions, fostering innovation and customization

- 5.2.1.5 Growth of BPaaS adoption among SMEs, enhancing accessibility and competitiveness

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rise in security and compliance concerns

- 5.2.2.2 Dependency concerns on specific BPaaS providers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Focus on multi-process business workflow

- 5.2.3.2 Expanding market access and inclusivity in BPaaS solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges integrating BPaaS with existing systems

- 5.2.4.2 Navigating evolving regulations hampers growth and innovation

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 ACCENTURE'S SYNOPS FUELED OPERATIONAL EXCELLENCE FOR LEADING OIL & GAS COMPANY

- 5.3.2 COGNIZANT BPAAS DROVE HEALTH PLAN TO EFFICIENCY AND REVENUE LEADERSHIP

- 5.3.3 INFOSYS BPM SCALED TECH LEADER'S NLP WITH IMPROVED EFFICIENCY AND SIGNIFICANT CONFLICT REDUCTION

- 5.3.4 GENPACT'S OPERATIONAL RESILIENCE FRAMEWORK ENABLED LEADING FINANCIAL ORGANIZATION TO ANTICIPATE AND ADAPT

- 5.3.5 TCS SUPPORTED OPERATIONAL EXCELLENCE THROUGH COST REDUCTION AND RISK MITIGATION FOR LARGE GLOBAL INVESTMENT BANK

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 25 BPAAS MARKET: VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- FIGURE 26 BPAAS MARKET: ECOSYSTEM

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Cloud computing

- 5.6.1.2 Data analytics

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Internet of things (IoT)

- 5.6.2.2 AR/VR

- 5.6.2.3 5G

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Blockchain

- 5.6.3.2 AI/ML

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY SERVICE

- FIGURE 27 BPAAS ASP OF KEY PLAYERS, BY SERVICE (USD/MONTH)

- TABLE 5 INDICATIVE PRICING ANALYSIS OF BPAAS VENDORS, BY OFFERING

- 5.8 PATENT ANALYSIS

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2013-2023

- FIGURE 29 TOP FIVE GLOBAL PATENT OWNERS

- TABLE 6 US: TOP 10 PATENT APPLICANTS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 BPAAS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 PORTER'S FIVE FORCES IMPACT ON BPAAS MARKET

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 31 REVENUE SHIFT FOR BPAAS MARKET

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- 5.12.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR END USERS

- TABLE 13 KEY BUYING CRITERIA FOR END USERS

- 5.13 BUSINESS MODEL ANALYSIS

- FIGURE 34 BPAAS MARKET: BUSINESS MODEL

- 5.14 INVESTMENT AND FUNDING SCENARIO

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO OF MAJOR BPAAS COMPANIES

- 5.15 KEY CONFERENCES AND EVENTS

- TABLE 14 BPAAS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2024

6 BPAAS MARKET, BY BUSINESS PROCESS

- 6.1 INTRODUCTION

- FIGURE 36 HUMAN RESOURCE MANAGEMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- 6.1.1 BUSINESS PROCESS: BPAAS MARKET DRIVERS

- TABLE 15 BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 16 BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- 6.2 HUMAN RESOURCE MANAGEMENT

- 6.2.1 OPTIMIZING RESOURCE UTILIZATION, IMPROVING OPERATIONAL EFFICIENCY, AND FOCUSING ON STRATEGIC INITIATIVES

- 6.2.2 PAYROLL PROCESSING

- 6.2.3 EMPLOYEE ONBOARDING

- 6.2.4 BENEFITS ADMINISTRATION

- 6.2.5 OTHER HUMAN RESOURCE MANAGEMENT PROCESSES

- TABLE 17 BPAAS MARKET IN HUMAN RESOURCE MANAGEMENT, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 BPAAS MARKET IN HUMAN RESOURCE MANAGEMENT, BY REGION, 2023-2028 (USD MILLION)

- 6.3 ACCOUNTING & FINANCE

- 6.3.1 NEED TO MITIGATE RISKS ASSOCIATED WITH FINANCIAL TRANSACTIONS

- 6.3.2 ACCOUNTS PAYABLE

- 6.3.3 GENERAL LEDGER

- 6.3.4 FINANCIAL REPORTING

- 6.3.5 OTHER ACCOUNTING & FINANCE PROCESSES

- TABLE 19 BPAAS MARKET IN ACCOUNTING & FINANCE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 BPAAS MARKET IN ACCOUNTING & FINANCE, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SALES & MARKETING

- 6.4.1 NEED FOR LEAD SCORING, CUSTOMER SEGMENTATION, EMAIL MARKETING, AND SOCIAL MEDIA MANAGEMENT

- 6.4.2 LEAD GENERATION SERVICES

- 6.4.3 CUSTOMER RELATIONSHIP MANAGEMENT (CRM) SERVICES

- 6.4.4 OTHER SALES & MARKETING PROCESSES

- TABLE 21 BPAAS MARKET IN SALES & MARKETING, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 BPAAS MARKET IN SALES & MARKETING, BY REGION, 2023-2028 (USD MILLION)

- 6.5 CUSTOMER SERVICE & SUPPORT

- 6.5.1 GROWTH IN AWARENESS REGARDING CUSTOMER SATISFACTION AND LOYALTY IN COMPETITIVE MARKETS

- 6.5.2 CALL CENTER OPERATIONS

- 6.5.3 HELP DESK SUPPORT

- 6.5.4 TICKET MANAGEMENT

- 6.5.5 OTHER CUSTOMER SERVICE & SUPPORT PROCESSES

- TABLE 23 BPAAS MARKET IN CUSTOMER SERVICE & SUPPORT, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 BPAAS MARKET IN CUSTOMER SERVICE & SUPPORT, BY REGION, 2023-2028 (USD MILLION)

- 6.6 PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONS

- 6.6.1 STREAMLINING PROCUREMENT AND SUPPLY CHAINS & OPERATIONS WITH END-TO-END SUPPORT

- 6.6.2 VENDOR MANAGEMENT

- 6.6.3 PURCHASE ORDER PROCESSING

- 6.6.4 INVENTORY OPTIMIZATION

- 6.6.5 DISTRIBUTION & LOGISTICS

- 6.6.6 OTHER PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATION PROCESSES

- TABLE 25 BPAAS MARKET IN PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 BPAAS MARKET IN PROCUREMENT, SUPPLY CHAIN MANAGEMENT, AND OPERATIONS, BY REGION, 2023-2028 (USD MILLION)

- 6.7 OTHER BUSINESS PROCESSES

- TABLE 27 BPAAS MARKET IN OTHER BUSINESS PROCESSES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 BPAAS MARKET IN OTHER BUSINESS PROCESSES, BY REGION, 2023-2028 (USD MILLION)

7 BPAAS MARKET, BY DEPLOYMENT MODEL

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODEL: BPAAS MARKET DRIVERS

- FIGURE 37 HYBRID CLOUD DEPLOYMENT MODEL TO RECORD HIGHEST CAGR

- TABLE 29 BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 30 BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- 7.2 PUBLIC CLOUD

- 7.2.1 SCALABILITY, FLEXIBILITY, AND COST-EFFICIENCY SOUGHT BY ORGANIZATIONS

- TABLE 31 PUBLIC CLOUD-BASED BPAAS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 PUBLIC CLOUD-BASED BPAAS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 PRIVATE CLOUD

- 7.3.1 MEETING SPECIFIC WORKLOAD REQUIREMENTS TO ENSURE OPTIMAL PERFORMANCE AND USER SATISFACTION

- TABLE 33 PRIVATE CLOUD-BASED BPAAS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 PRIVATE CLOUD-BASED BPAAS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 HYBRID CLOUD

- 7.4.1 INTEROPERABILITY BETWEEN ON-PREMISES SYSTEMS AND CLOUD SERVICES TO OFFER ADDED LEVERAGE IN USING NEWER TECHNOLOGIES

- TABLE 35 HYBRID CLOUD-BASED BPAAS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 HYBRID CLOUD-BASED BPAAS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 BPAAS MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: BPAAS MARKET DRIVERS

- FIGURE 38 SMALL & MEDIUM-SIZED ENTERPRISES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 37 BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 38 BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 BUSINESS PROCESS SERVICES TAILORED TO NEEDS OF LARGE ENTERPRISES

- TABLE 39 BPAAS MARKET FOR LARGE ENTERPRISES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 BPAAS MARKET FOR LARGE ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 8.3.1 ECONOMICAL BUSINESS PROCESS SERVICES ALIGNING WITH NEEDS OF SMES

- TABLE 41 BPAAS MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 BPAAS MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2023-2028 (USD MILLION)

9 BPAAS MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: BPAAS MARKET DRIVERS

- FIGURE 39 RETAIL & ECOMMERCE VERTICAL TO RECORD HIGHER CAGR

- TABLE 43 BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 44 BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BFSI

- 9.2.1 BFSI: USE CASES

- 9.2.1.1 Retail banking

- 9.2.1.2 Investment banking

- 9.2.2 OTHER BFSI USE CASES

- TABLE 45 BPAAS MARKET IN BFSI VERTICAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 BPAAS MARKET IN BFSI VERTICAL, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 BFSI: USE CASES

- 9.3 IT & TELECOM

- 9.3.1 IT & TELECOM: USE CASES

- 9.3.1.1 Billing & invoicing

- 9.3.1.2 Network management

- 9.3.1.3 Other it & telecom use cases

- TABLE 47 BPAAS MARKET IN IT & TELECOM VERTICAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 BPAAS MARKET IN IT & TELECOM VERTICAL, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 IT & TELECOM: USE CASES

- 9.4 MANUFACTURING

- 9.4.1 MANUFACTURING: USE CASES

- 9.4.1.1 Production planning & control

- 9.4.2 ASSET MANAGEMENT

- 9.4.3 OTHER MANUFACTURING USE CASES

- TABLE 49 BPAAS MARKET IN MANUFACTURING VERTICAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 BPAAS MARKET IN MANUFACTURING VERTICAL, BY REGION, 2023-2028 (USD MILLION)

- 9.4.1 MANUFACTURING: USE CASES

- 9.5 RETAIL & ECOMMERCE

- 9.5.1 UNIFIED SHOPPING EXPERIENCE ACROSS ALL CHANNELS

- 9.5.2 RETAIL & ECOMMERCE: USE CASES

- 9.5.2.1 Order processing

- 9.5.2.2 Inventory management

- 9.5.2.3 Other Retail & eCommerce use cases

- TABLE 51 BPAAS MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 BPAAS MARKET IN RETAIL & ECOMMERCE VERTICAL, BY REGION, 2023-2028 (USD MILLION)

- 9.6 HEALTHCARE & LIFE SCIENCES

- 9.6.1 PERSONALIZED TREATMENTS TO FACILITATE BPAAS WITH PRECISE ANALYTICS

- 9.6.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 9.6.2.1 Medical billing

- 9.6.3 CLAIMS PROCESSING

- 9.6.4 OTHER HEALTHCARE & LIFE SCIENCES USE CASES

- TABLE 53 BPAAS MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 BPAAS MARKET IN HEALTHCARE & LIFE SCIENCES, BY REGION, 2023-2028 (USD MILLION)

- 9.7 GOVERNMENT & PUBLIC SECTOR

- 9.7.1 SERVICES FOR PUBLIC WITH ENHANCED FINANCIAL AND SECURITY DRIVEN BY BPAAS

- 9.7.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 9.7.2.1 Regulatory Compliance

- 9.7.2.2 Public Finance & Budgeting

- 9.7.2.3 Other government & public sector use cases

- TABLE 55 BPAAS MARKET IN GOVERNMENT & PUBLIC SECTOR VERTICAL, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 BPAAS MARKET IN GOVERNMENT & PUBLIC SECTOR VERTICAL, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER VERTICALS

- TABLE 57 BPAAS MARKET IN OTHER VERTICALS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 BPAAS MARKET IN OTHER VERTICALS, BY REGION, 2023-2028 (USD MILLION)

10 BPAAS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN BPAAS MARKET

- TABLE 59 BPAAS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 BPAAS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: BPAAS MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 41 NORTH AMERICA: BPAAS MARKET SNAPSHOT

- TABLE 61 NORTH AMERICA: BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: BPAAS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: BPAAS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Huge cloud adoption with industry-specific BPaaS offerings

- TABLE 71 US: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 72 US: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 73 US: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 74 US: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Prioritizing AI and RPA integration for enhanced automation and efficiency with high concentration of SMEs

- TABLE 75 CANADA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 76 CANADA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 77 CANADA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 78 CANADA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPEAN BPAAS MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 79 EUROPE: BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 80 EUROPE: BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- TABLE 81 EUROPE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 82 EUROPE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 83 EUROPE: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 84 EUROPE: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 86 EUROPE: BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: BPAAS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 88 EUROPE: BPAAS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Growing adoption of advanced technologies to increase demand for BPaaS

- TABLE 89 UK: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 90 UK: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 91 UK: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 92 UK: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Rise in emphasis on enhancing customer experience using BPaaS solutions

- TABLE 93 GERMANY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 94 GERMANY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 95 GERMANY: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 96 GERMANY: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Rise in adoption of cloud-based BPaaS solutions

- TABLE 97 FRANCE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 98 FRANCE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 99 FRANCE: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 100 FRANCE: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Increase in adoption of BPaaS in SMEs

- TABLE 101 ITALY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 102 ITALY: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 103 ITALY: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 104 ITALY: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 105 REST OF EUROPE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 106 REST OF EUROPE: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 108 REST OF EUROPE: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: BPAAS MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 42 ASIA PACIFIC: BPAAS MARKET SNAPSHOT

- TABLE 109 ASIA PACIFIC: BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: BPAAS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: BPAAS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Rapid adoption of cloud-based services due to rise in work-from-home operations

- TABLE 119 CHINA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 120 CHINA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 121 CHINA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 122 CHINA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Growth in need to standardize or customize services

- TABLE 123 JAPAN: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 124 JAPAN: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 125 JAPAN: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 126 JAPAN: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Enhanced efficiency across organizations with BPaaS

- TABLE 127 AUSTRALIA & NEW ZEALAND: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 129 AUSTRALIA & NEW ZEALAND: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 130 AUSTRALIA & NEW ZEALAND: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 131 REST OF ASIA PACIFIC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: BPAAS MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 135 MIDDLE EAST & AFRICA: BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: BPAAS MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: BPAAS MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 10.5.3 GCC

- 10.5.3.1 Huge demand for outsourcing critical processes

- TABLE 145 GCC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 146 GCC: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 147 GCC: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 148 GCC: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 149 GCC: BPAAS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 150 GCC: BPAAS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3.2 Saudi Arabia

- 10.5.3.3 UAE

- 10.5.3.4 Rest of GCC

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Increase in use of cloud services that offer cost optimization

- TABLE 151 SOUTH AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 152 SOUTH AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 153 SOUTH AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 154 SOUTH AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 155 REST OF MIDDLE EAST & AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST & AFRICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: BPAAS MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 159 LATIN AMERICA: BPAAS MARKET, BY BUSINESS PROCESS, 2018-2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: BPAAS MARKET, BY BUSINESS PROCESS, 2023-2028 (USD MILLION)

- TABLE 161 LATIN AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 162 LATIN AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 163 LATIN AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 164 LATIN AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 165 LATIN AMERICA: BPAAS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 166 LATIN AMERICA: BPAAS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 167 LATIN AMERICA: BPAAS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 168 LATIN AMERICA: BPAAS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Development of IT industry

- TABLE 169 BRAZIL: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 170 BRAZIL: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 171 BRAZIL: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 172 BRAZIL: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Higher focus on improving business operations with remote access to skilled professionals

- TABLE 173 MEXICO: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 174 MEXICO: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 175 MEXICO: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 176 MEXICO: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.6.5 REST OF LATIN AMERICA

- TABLE 177 REST OF LATIN AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2018-2022 (USD MILLION)

- TABLE 178 REST OF LATIN AMERICA: BPAAS MARKET, BY DEPLOYMENT MODEL, 2023-2028 (USD MILLION)

- TABLE 179 REST OF LATIN AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 180 REST OF LATIN AMERICA: BPAAS MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 181 OVERVIEW OF STRATEGIES ADOPTED BY KEY BPAAS VENDORS

- 11.3 REVENUE ANALYSIS

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN PAST FIVE YEARS (USD BILLION)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 44 SHARE OF LEADING COMPANIES IN BPAAS MARKET, 2022

- TABLE 182 BPAAS MARKET: DEGREE OF COMPETITION

- 11.5 PRODUCT/BRAND COMPARISON

- TABLE 183 VENDOR PRODUCTS/BRANDS COMPARISON

- 11.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 45 BPAAS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.6.5 COMPANY FOOTPRINT FOR KEY PLAYERS

- FIGURE 46 COMPANY FOOTPRINT

- TABLE 184 REGION FOOTPRINT

- TABLE 185 BUSINESS PROCESS FOOTPRINT

- TABLE 186 DEPLOYMENT MODEL FOOTPRINT

- TABLE 187 ORGANIZATION SIZE FOOTPRINT

- TABLE 188 VERTICAL FOOTPRINT

- 11.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 47 BPAAS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.7.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 189 BPAAS MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2023

- TABLE 190 BPAAS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.8 COMPANY FINANCIAL METRICS

- FIGURE 48 COMPANY FINANCIAL METRICS, 2024

- 11.9 KEY MARKET DEVELOPMENTS

- 11.9.1 PRODUCT LAUNCHES & PRODUCT ENHANCEMENTS

- TABLE 191 BPAAS MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, SEPTEMBER 2020-NOVEMBER 2023

- 11.9.2 DEALS

- TABLE 192 BPAAS MARKET: DEALS, FEBRUARY 2023-JANUARY 2024

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.1.1 ACCENTURE

- TABLE 193 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 49 ACCENTURE: COMPANY SNAPSHOT

- TABLE 194 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ACCENTURE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 196 ACCENTURE: DEALS

- 12.1.2 CAPGEMINI

- TABLE 197 CAPGEMINI: COMPANY OVERVIEW

- FIGURE 50 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 198 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CAPGEMINI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 200 CAPGEMINI: DEALS

- 12.1.3 COGNIZANT

- TABLE 201 COGNIZANT: BUSINESS OVERVIEW

- FIGURE 51 COGNIZANT: COMPANY SNAPSHOT

- TABLE 202 COGNIZANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 COGNIZANT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 204 COGNIZANT DEALS

- 12.1.4 IBM

- TABLE 205 IBM: BUSINESS OVERVIEW

- FIGURE 52 IBM: COMPANY SNAPSHOT

- TABLE 206 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 208 IBM: DEALS

- 12.1.5 HCL

- TABLE 209 HCL: BUSINESS OVERVIEW

- FIGURE 53 HCL: COMPANY SNAPSHOT

- TABLE 210 HCL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 HCL: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 212 HCL: DEALS

- 12.1.6 TCS

- TABLE 213 TCS: COMPANY OVERVIEW

- FIGURE 54 TCS: COMPANY SNAPSHOT

- TABLE 214 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TCS: DEALS

- 12.1.7 FUJITSU

- TABLE 216 FUJITSU: COMPANY OVERVIEW

- FIGURE 55 FUJITSU: COMPANY SNAPSHOT

- TABLE 217 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 FUJITSU: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 219 FUJITSU: DEALS

- 12.1.8 GENPACT

- TABLE 220 GENPACT: COMPANY OVERVIEW

- FIGURE 56 GENPACT: COMPANY SNAPSHOT

- TABLE 221 GENPACT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 GENPACT: DEALS

- 12.1.9 WIPRO

- TABLE 223 WIPRO: COMPANY OVERVIEW

- FIGURE 57 WIPRO: COMPANY SNAPSHOT

- TABLE 224 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 WIPRO: DEALS

- 12.1.10 TECH MAHINDRA

- TABLE 226 TECH MAHINDRA: COMPANY OVERVIEW

- FIGURE 58 TECH MAHINDRA: COMPANY SNAPSHOT

- TABLE 227 TECH MAHINDRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 TECH MAHINDRA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 229 TECH MAHINDRA: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER KEY PLAYERS

- 12.2.1 EXL

- 12.2.2 DXC TECHNOLOGY

- 12.2.3 CONDUENT

- 12.2.4 INFOSYS BPM

- 12.2.5 BIZAGI

- 12.2.6 IGRAFX

- 12.2.7 AURAQUANTIC

- 12.2.8 PIPEFY

- 12.2.9 CFLOW

- 12.2.10 AGILEPOINT

- 12.2.11 WORKFLOWGEN

- 12.2.12 FLOKZU

- 12.2.13 INTEGRIFY

- 12.2.14 LINX

- 12.2.15 QUIXY

13 ADJACENT/RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 230 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 BPAAS MARKET ECOSYSTEM AND ADJACENT MARKETS

- 13.4 BUSINESS PROCESS AUTOMATION MARKET

- 13.4.1 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT

- TABLE 231 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT, 2016-2019 (USD MILLION)

- TABLE 232 BUSINESS PROCESS AUTOMATION MARKET, BY COMPONENT, 2020-2026 (USD MILLION)

- 13.4.2 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE

- TABLE 233 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2016-2019 (USD MILLION)

- TABLE 234 BUSINESS PROCESS AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2026 (USD MILLION)

- 13.5 BUSINESS PROCESS MANAGEMENT MARKET

- 13.5.1 BUSINESS PROCESS MANAGEMENT MARKET, BY COMPONENT

- TABLE 235 BUSINESS PROCESS MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- 13.5.2 BUSINESS PROCESS MANAGEMENT MARKET, BY BUSINESS FUNCTION

- TABLE 236 BUSINESS PROCESS MANAGEMENT MARKET, BY BUSINESS FUNCTION, 2018-2025 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS