|

|

市場調査レポート

商品コード

1712822

バイオスティミュラントの世界市場:有効成分別、適用形態別、形態別、作物タイプ別、地域別 - 2030年までの予測Biostimulants Market by Active Ingredients (Humic Substances, Seaweed Extracts, Amino Acids, Minerals & Vitamins), Crop Type, Mode of Application (Foliar treatment, Soil treatment, Seed treatment), Form, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バイオスティミュラントの世界市場:有効成分別、適用形態別、形態別、作物タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月16日

発行: MarketsandMarkets

ページ情報: 英文 318 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のバイオスティミュラントの市場規模は、2025年に44億6,000万米ドルと予測され、予測期間中のCAGRは11.9%と見込まれており、2030年には78億4,000万米ドルに達すると予測されています。

消費者が化学薬品を使用せず、持続可能な方法で生産された食品を求める傾向が強まっているため、有機農業に対する需要の高まりがバイオスティミュラント市場の大きな促進要因となっています。バイオスティミュラントは、合成肥料や農薬に頼らずに作物の収量、品質、環境ストレスへの耐性を高めようとする農家の間で人気を集めています。養分の取り込みを改善し、土壌の健全性を促進し、植物の成長を促進するその能力は、有機農業の実践によく合致しており、その採用をさらに加速させています。さらに、持続可能な農業を奨励する政府の支援政策が、様々な作物におけるバイオスティミュラントの使用増加に寄与しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2025年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(米ドル)および数量(KT) |

| セグメント | 有効成分別、適用形態別、形態別、作物タイプ別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

葉面処理は、栄養素と生物刺激化合物を植物の葉に直接送達し、迅速な吸収と迅速な反応を保証するその有効性により、生物刺激剤市場の適用モードセグメントで最高の市場シェアを占めています。この方法は、果実、野菜、観賞用植物などの高価値作物において、植物の成長を促進し、養分利用効率を改善し、ストレス耐性を高めるために特に人気があります。他の農薬との相性がよく、散布システムによる散布が容易なため、農家の間で好まれています。

穀物および穀類は、大規模農業における作物の収量、品質、および生物的ストレスに対する回復力を強化する必要性の高まりによって、バイオスティミュラント市場で大きな市場シェアを占めています。小麦、米、トウモロコシ、大麦のような主食作物は世界の食糧安全保障に不可欠であるため、農家は栄養吸収、根の開発、ストレス耐性を向上させるためにバイオスティミュラントを採用する傾向が強まっています。干ばつや塩害などの劣悪な環境条件下で生産性を向上させるバイオスティミュラントの能力は、穀物や穀物の栽培において特に貴重です。さらに、持続可能な農業慣行に対する需要の高まりと、化学肥料の使用量を削減する必要性が、この分野におけるバイオスティミュラントの採用をさらに促進しています。

南米は、この地域の農業部門の拡大と持続可能な農法の採用増加により、バイオスティミュラント市場で大きな成長が見込まれています。大豆、トウモロコシ、サトウキビの主要生産国であるブラジルやアルゼンチンなどの国々では、作物の収量、品質、および生物学的ストレスに対する回復力を高めるために、バイオスティミュラントの利用が増加しています。さらに、世界の食糧需要の増加に対応するため、この地域では土壌の健全性と栄養効率の改善に重点を置いており、バイオスティミュラントの採用をさらに後押ししています。有機農業と持続可能な農業投入物を促進する政府の好意的な取り組みも、南米におけるバイオスティミュラント市場の急成長に寄与しています。

当レポートでは、世界のバイオスティミュラント市場について調査し、有効成分別、適用形態別、形態別、作物タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- AI/生成AIがバイオスティミュラント市場に与える影響

第6章 業界動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 2025年~2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 バイオスティミュラント市場(有効成分別)

- イントロダクション

- 腐植物質

- 海藻エキス

- アミノ酸

- 微生物改良剤

- ミネラルとビタミン

- その他

第8章 バイオスティミュラント市場(適用形態別)

- イントロダクション

- 種子処理

- 土壌処理

- 葉面処理

第9章 バイオスティミュラント市場(形態別)

- イントロダクション

- 液体

- ドライ

第10章 バイオスティミュラント市場(作物タイプ別)

- イントロダクション

- 穀物

- 油糧種子と豆類

- 果物と野菜

- 花と観賞植物

- その他

第11章 バイオスティミュラント市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- スペイン

- イタリア

- フランス

- ドイツ

- 英国

- ロシア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- インドネシア

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2019年~2023年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- UPL

- FMC CORPORATION

- CORTEVA

- SYNGENTA GROUP

- SUMITOMO CHEMICAL CO., LTD.

- NUFARM

- NOVONESIS GROUP

- BASF SE

- BAYER AG

- PI INDUSTRIES

- T.STANES AND COMPANY LIMITED

- J.M. HUBER CORPORATION

- HAIFA NEGEV TECHNOLOGIES LTD.

- GOWAN COMPANY

- KOPPERT

- スタートアップ/中小企業

- ACADIAN SEAPLANTS LIMITED

- QINGDAO SEAWIN BIOTECH GROUP CO., LTD.

- OMEX

- SEIPASA, S.A.

- SUSTAINABLE AGRO SOLUTIONS, S.A.U.

- ALGAENERGY

- LAWRIECO

- AMINOCORE

- KELPAK

- CASCADIA SEAWEED

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 BIOSTIMULANTS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2020-2024

- TABLE 3 BIOSTIMULANTS MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 4 IMPORT VALUE OF BIOSTIMULANTS, BY COUNTRY, 2024 (USD THOUSAND)

- TABLE 5 EXPORT VALUE OF BIOSTIMULANTS, BY COUNTRY, 2024 (USD THOUSAND)

- TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS, BY ACTIVE INGREDIENT, 2024 (USD/TON)

- TABLE 7 AVERAGE SELLING PRICE TREND OF BIOSTIMULANTS, BY ACTIVE INGREDIENT, 2020-2024 (USD/TON)

- TABLE 8 AVERAGE SELLING PRICE TREND OF BIOSTIMULANTS, BY REGION, 2020-2024 (USD/TON)

- TABLE 9 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 LIST OF MAIN PATENTS PERTAINING TO BIOSTIMULANTS MARKET, 2014-2024

- TABLE 11 BIOSTIMULANTS MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 PORTER'S FIVE FORCES IMPACT ON BIOSTIMULANTS MARKET

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ACTIVE INGREDIENTS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE ACTIVE INGREDIENTS

- TABLE 20 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 21 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 22 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 23 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 24 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 27 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 28 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 29 HUMIC SUBSTANCES: BIOSTIMULANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 SEAWEED EXTRACTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 SEAWEED EXTRACTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SEAWEED EXTRACTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 33 SEAWEED EXTRACTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 34 AMINO ACIDS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 AMINO ACIDS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 AMINO ACIDS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 37 AMINO ACIDS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 38 MICROBIAL AMENDMENTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 MICROBIAL AMENDMENTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 MICROBIAL AMENDMENTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 41 MICROBIAL AMENDMENTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 42 MINERALS & VITAMINS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 MINERALS & VITAMINS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 MINERALS & VITAMINS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 45 MINERALS & VITAMINS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 46 OTHER ACTIVE INGREDIENTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 OTHER ACTIVE INGREDIENTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 OTHER ACTIVE INGREDIENTS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 49 OTHER ACTIVE INGREDIENTS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 50 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 51 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 SEED TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 SEED TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 SOIL TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 SOIL TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 FOLIAR TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 FOLIAR TREATMENT: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 59 BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 60 LIQUID: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 LIQUID: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 DRY: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 DRY: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 65 BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 66 CEREALS & GRAINS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 CEREALS & GRAINS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 CEREALS & GRAINS: BIOSTIMULANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 69 CEREALS & GRAINS: BIOSTIMULANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 OILSEEDS & PULSES: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 OILSEEDS & PULSES: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 OILSEEDS & PULSES: BIOSTIMULANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 73 OILSEEDS & PULSES: BIOSTIMULANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 FRUITS & VEGETABLES: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 FRUITS & VEGETABLES: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 FRUITS & VEGETABLES: BIOSTIMULANTS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 77 FRUITS & VEGETABLES: BIOSTIMULANTS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 78 FLOWERS & ORNAMENTALS: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 FLOWERS & ORNAMENTALS: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 OTHER CROP TYPES: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 OTHER CROP TYPES: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (KT)

- TABLE 85 BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (KT)

- TABLE 86 NORTH AMERICA: BIOSTIMULANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: BIOSTIMULANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 91 NORTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 92 NORTH AMERICA: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 98 US: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 99 US: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 100 CANADA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 101 CANADA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 102 MEXICO: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 103 MEXICO: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 104 EUROPE: BIOSTIMULANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 105 EUROPE: BIOSTIMULANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 106 EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 107 EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 109 EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 110 EUROPE: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 111 EUROPE: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 113 EUROPE: BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 116 SPAIN: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 117 SPAIN: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 118 ITALY: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 119 ITALY: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 120 FRANCE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 121 FRANCE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 122 GERMANY: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 123 GERMANY: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 124 UK: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 125 UK: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 126 RUSSIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 127 RUSSIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 128 REST OF EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 129 REST OF EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 130 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 133 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 134 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 135 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 136 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 142 CHINA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 143 CHINA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 144 JAPAN: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 145 JAPAN: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 146 INDIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 147 INDIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 148 AUSTRALIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 149 AUSTRALIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 150 INDONESIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 151 INDONESIA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 157 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 159 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 160 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 161 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 163 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 165 SOUTH AMERICA: BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 166 BRAZIL: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 167 BRAZIL: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 168 ARGENTINA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 169 ARGENTINA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 172 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 173 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 174 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 175 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 176 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (KT)

- TABLE 177 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (KT)

- TABLE 178 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2020-2024 (USD MILLION)

- TABLE 179 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025-2030 (USD MILLION)

- TABLE 180 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY CROP TYPE, 2020-2024 (USD MILLION)

- TABLE 181 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY CROP TYPE, 2025-2030 (USD MILLION)

- TABLE 182 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY FORM, 2020-2024 (USD MILLION)

- TABLE 183 REST OF THE WORLD: BIOSTIMULANTS MARKET, BY FORM, 2025-2030 (USD MILLION)

- TABLE 184 AFRICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 185 AFRICA: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2020-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025-2030 (USD MILLION)

- TABLE 188 BIOSTIMULANTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 189 BIOSTIMULANTS MARKET: DEGREE OF COMPETITION

- TABLE 190 BIOSTIMULANTS MARKET: REGION FOOTPRINT

- TABLE 191 BIOSTIMULANTS MARKET: ACTIVE INGREDIENT FOOTPRINT

- TABLE 192 BIOSTIMULANTS MARKET: MODE OF APPLICATION FOOTPRINT

- TABLE 193 BIOSTIMULANTS MARKET: FORM FOOTPRINT

- TABLE 194 BIOSTIMULANTS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 195 BIOSTIMULANTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 196 BIOSTIMULANTS MARKET: PRODUCT LAUNCHES, JANUARY 2020-FEBRUARY 2025

- TABLE 197 BIOSTIMULANTS MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 198 BIOSTIMULANTS MARKET: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 199 BIOSTIMULANTS MARKET: OTHER DEVELOPMENTS, JANUARY 2020-FEBRUARY 2025

- TABLE 200 UPL: COMPANY OVERVIEW

- TABLE 201 UPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 UPL: DEALS

- TABLE 203 FMC CORPORATION: COMPANY OVERVIEW

- TABLE 204 FMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 FMC CORPORATION: DEALS

- TABLE 206 FMC CORPORATION: OTHER DEVELOPMENTS

- TABLE 207 CORTEVA: COMPANY OVERVIEW

- TABLE 208 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 CORTEVA: PRODUCT LAUNCHES

- TABLE 210 CORTEVA AGRISCIENCE: DEALS

- TABLE 211 SYNGENTA GROUP: COMPANY OVERVIEW

- TABLE 212 SYNGENTA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 SYNGENTA GROUP: PRODUCT LAUNCHES

- TABLE 214 SYNGENTA GROUP: DEALS

- TABLE 215 SYNGENTA GROUP: EXPANSIONS

- TABLE 216 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 217 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 SUMITOMO CHEMICAL CO., LTD.: DEALS

- TABLE 219 SUMITOMO CHEMICAL CO., LTD.: EXPANSIONS

- TABLE 220 NUFARM: COMPANY OVERVIEW

- TABLE 221 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NUFARM: PRODUCT LAUNCHES

- TABLE 223 NOVONESIS GROUP: COMPANY OVERVIEW

- TABLE 224 NOVONESIS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 NOVONESIS GROUP: DEALS

- TABLE 226 BASF SE: COMPANY OVERVIEW

- TABLE 227 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 BASF SE: DEALS

- TABLE 229 BASF SE: EXPANSIONS

- TABLE 230 BAYER AG: COMPANY OVERVIEW

- TABLE 231 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 BAYER AG: DEALS

- TABLE 233 PI INDUSTRIES: COMPANY OVERVIEW

- TABLE 234 PI INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 PI INDUSTRIES: DEALS

- TABLE 236 T.STANES AND COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 237 T.STANES AND COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 J.M. HUBER CORPORATION: COMPANY OVERVIEW

- TABLE 239 J.M. HUBER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 J.M. HUBER CORPORATION: DEALS

- TABLE 241 HAIFA NEGEV TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 242 HAIFA NEGEV TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 HAIFA NEGEV TECHNOLOGIES LTD.: PRODUCT LAUNCHES

- TABLE 244 HAIFA NEGEV TECHNOLOGIES LTD.: DEALS

- TABLE 245 HAIFA NEGEV TECHNOLOGIES LTD.: EXPANSIONS

- TABLE 246 GOWAN COMPANY: COMPANY OVERVIEW

- TABLE 247 GOWAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 GOWAN COMPANY: DEALS

- TABLE 249 KOPPERT: COMPANY OVERVIEW

- TABLE 250 KOPPERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 KOPPERT: DEALS

- TABLE 252 KOPPERT: EXPANSIONS

- TABLE 253 ACADIAN SEAPLANTS LIMITED: COMPANY OVERVIEW

- TABLE 254 ACADIAN SEAPLANTS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 ACADIAN SEAPLANTS LIMITED: DEALS

- TABLE 256 QINGDAO SEAWIN BIOTECH GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 257 QINGDAO SEAWIN BIOTECH GROUP CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 258 OMEX: COMPANY OVERVIEW

- TABLE 259 OMEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 SEIPASA, S.A.: COMPANY OVERVIEW

- TABLE 261 SEIPASA, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 SEIPASA, S.A.: PRODUCT LAUNCHES

- TABLE 263 SEIPASA, S.A.: EXPANSIONS

- TABLE 264 SUSTAINABLE AGRO SOLUTIONS, S.A.U.: COMPANY OVERVIEW

- TABLE 265 SUSTAINABLE AGRO SOLUTIONS, S.A.U.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 266 SUSTAINABLE AGRO SOLUTIONS, S.A.U.: DEALS

- TABLE 267 ALGAENERGY: COMPANY OVERVIEW

- TABLE 268 LAWRIECO: COMPANY OVERVIEW

- TABLE 269 AMINOCORE: COMPANY OVERVIEW

- TABLE 270 KELPAK: COMPANY OVERVIEW

- TABLE 271 CASCADIA SEAWEED: COMPANY OVERVIEW

- TABLE 272 ADJACENT MARKETS TO BIOSTIMULANTS

- TABLE 273 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 274 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 275 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 276 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 277 PLANT GROWTH REGULATORS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 278 PLANT GROWTH REGULATORS MARKET, BY TYPE, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 BIOSTIMULANTS MARKET SEGMENTATION

- FIGURE 2 BIOSTIMULANTS MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM SECONDARY SOURCES

- FIGURE 4 KEY DATA FROM PRIMARY SOURCES

- FIGURE 5 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 BIOSTIMULANTS MARKET: DEMAND-SIDE CALCULATION

- FIGURE 8 BIOSTIMULANTS MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: TOP-DOWN APPROACH

- FIGURE 9 BIOSTIMULANTS MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: TOP DOWN APPROACH BY REVENUE ANALYSIS

- FIGURE 10 BIOSTIMULANTS MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 BIOSTIMULANTS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 BIOSTIMULANTS MARKET, BY CROP TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 16 BIOSTIMULANTS MARKET SHARE AND GROWTH RATE, BY REGION

- FIGURE 17 RISING DEMAND FOR ORGANIC FOOD AND AGRICULTURAL PRACTICES AND GOVERNMENT INITIATIVES & INCENTIVES TO DRIVE MARKET

- FIGURE 18 SEAWEED EXTRACTS SEGMENT AND SPAIN TO ACCOUNT FOR LARGEST MARKET SHARES IN EUROPE

- FIGURE 19 US TO ACCOUNT FOR LARGEST MARKET SHARE (BY VALUE) IN 2025

- FIGURE 20 SEAWEED EXTRACTS SEGMENT TO LEAD MARKET ACROSS REGIONS DURING FORECAST PERIOD

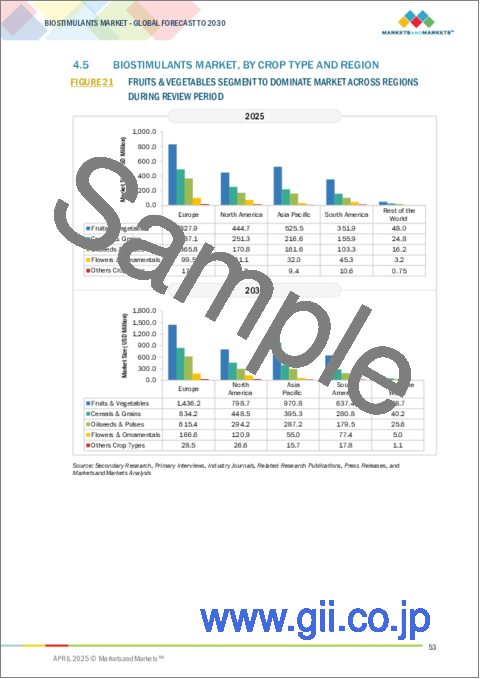

- FIGURE 21 FRUITS & VEGETABLES SEGMENT TO DOMINATE MARKET ACROSS REGIONS DURING REVIEW PERIOD

- FIGURE 22 LIQUID SEGMENT TO DOMINATE MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 23 FOLIAR TREATMENT SEGMENT TO LEAD MARKET ACROSS REGIONS DURING FORECAST PERIOD

- FIGURE 24 TOP TEN COUNTRIES WITH ORGANIC AGRICULTURAL LAND, 2022 (MILLION HECTARES)

- FIGURE 25 BIOSTIMULANTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 TOP 10 EXPORTERS OF SEAWEED, 2021 (USD MILLION)

- FIGURE 27 PRIMARY CROP PRODUCTION, BY REGION, 2021 (THOUSAND TONNES)

- FIGURE 28 ADOPTION OF GEN AI IN BIOSTIMULANTS PRODUCTION PROCESS

- FIGURE 29 BIOSTIMULANTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 30 BIOSTIMULANTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 31 IMPORT VALUE OF BIOSTIMULANTS FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 32 EXPORT VALUE OF BIOSTIMULANTS FOR KEY COUNTRIES, 2020-2024 (USD THOUSAND)

- FIGURE 33 KEY STAKEHOLDERS IN BIOSTIMULANTS MARKET ECOSYSTEM

- FIGURE 34 BIOSTIMULANTS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 35 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 36 REGIONAL ANALYSIS OF PATENT GRANTED FOR BIOSTIMULANTS MARKET, 2014-2024

- FIGURE 37 BIOSTIMULANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE ACTIVE INGREDIENTS

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE ACTIVE INGREDIENTS

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO OF THREE KEY PLAYERS, 2024 (USD THOUSAND)

- FIGURE 41 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 42 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 43 BIOSTIMULANTS MARKET, BY FORM, 2025 VS. 2030 (USD MILLION)

- FIGURE 44 BIOSTIMULANTS MARKET, BY CROP TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 45 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 EUROPE: BIOSTIMULANTS MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: BIOSTIMULANTS MARKET SNAPSHOT

- FIGURE 48 BIOSTIMULANTS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 49 SHARE ANALYSIS OF BIOSTIMULANTS MARKET, 2024

- FIGURE 50 BIOSTIMULANTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 BIOSTIMULANTS MARKET: COMPANY FOOTPRINT

- FIGURE 52 BIOSTIMULANTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 COMPANY VALUATION

- FIGURE 54 FINANCIAL METRICS

- FIGURE 55 BRAND/PRODUCT COMPARISON OF KEY PLAYERS

- FIGURE 56 UPL: COMPANY SNAPSHOT

- FIGURE 57 FMC CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 CORTEVA: COMPANY SNAPSHOT

- FIGURE 59 SYNGENTA GROUP: COMPANY SNAPSHOT

- FIGURE 60 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 NUFARM: COMPANY SNAPSHOT

- FIGURE 62 NOVONESIS GROUP: COMPANY SNAPSHOT

- FIGURE 63 BASF SE: COMPANY SNAPSHOT

- FIGURE 64 BAYER AG: COMPANY SNAPSHOT

- FIGURE 65 PI INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 66 T.STANES AND COMPANY LIMITED: COMPANY SNAPSHOT

The global market for biostimulants is estimated to be valued at USD 4.46 billion in 2025 and is projected to reach USD 7.84 billion by 2030, at a CAGR of 11.9% during the forecast period. The growing demand for organic farming is a significant driver of the biostimulants market, as consumers increasingly seek chemical-free, sustainably produced food. Biostimulants are gaining popularity among farmers looking to enhance crop yield, quality, and resilience to environmental stress without relying on synthetic fertilizers or pesticides. Their ability to improve nutrient uptake, promote soil health, and boost plant growth aligns well with organic farming practices, further accelerating their adoption. Additionally, supportive government policies encouraging sustainable agriculture are contributing to the rising use of biostimulants across various crops.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | Active Ingredient, Form, Crop Type, Mode of Application, Form, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"The foliar treatment segment holds the highest market share in the mode of application segment of the biostimulants market."

Foliar treatment holds the highest market share in the mode of application segment of the biostimulants market due to its effectiveness in delivering nutrients and biostimulant compounds directly to plant leaves, ensuring rapid absorption and quick response. This method is particularly popular for enhancing plant growth, improving nutrient use efficiency, and boosting stress tolerance in high-value crops like fruits, vegetables, and ornamental plants. Its compatibility with other agrochemicals and ease of application through spraying systems make it a preferred choice among farmers.

"The cereals & grains segment is projected to grow at a significant rate during the forecast period."

Cereals and grains hold a significant market share in the biostimulants market, driven by the increasing need to enhance crop yield, quality, and resilience against abiotic stress in large-scale farming. As staple crops like wheat, rice, corn, and barley are essential for global food security, farmers are increasingly adopting biostimulants to improve nutrient absorption, root development, and stress tolerance. The ability of biostimulants to boost productivity under adverse environmental conditions, such as drought and salinity, makes them particularly valuable for cereal and grain cultivation. Additionally, the growing demand for sustainable agricultural practices and the need to reduce chemical fertilizer usage are further promoting the adoption of biostimulants in this segment.

South America to grow at a significant rate in the global biostimulants market.

South America is expected to grow at a significant rate in the biostimulants market, driven by the region's expanding agricultural sector and increasing adoption of sustainable farming practices. Countries like Brazil and Argentina, major producers of soybeans, corn, and sugarcane, are increasingly utilizing biostimulants to enhance crop yield, quality, and resilience against abiotic stress. Additionally, the region's focus on improving soil health and nutrient efficiency to meet rising global food demand further supports the adoption of biostimulants. Favorable government initiatives promoting organic farming and sustainable agricultural inputs are also contributing to the rapid growth of the biostimulants market in South America.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the biostimulants market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

Prominent companies in the market include UPL (India), FMC Corporation (US), Corteva (US), Syngenta Group (Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Nufarm (Australia), Novonesis Group (Denmark), BASF SE (Germany), Bayer AG (Germany), PI Industries (India), T.Stanes and Company Limited (India), Gowan Company (US), J.M. Huber Corporation (US), Haifa Negev technologies LTD (Israel), and Koppert (Netherlands).

Other players include Acadian Plant Health (Canada), Qingdao Seawin Biotech Group Co., Ltd. (China), Sustainable Agro Solutions, S.A.U. (Spain), SEIPASA, S.A. (Spain), OMEX (UK), AlgaEnergy (Spain), LawrieCo (Australia), Aminocore (Germany), Kelpak (South Africa), and Cascadia Seaweed (Canada).

Research Coverage:

This research report categorizes the biostimulants market by active ingredient (humic substances, seaweed extracts, amino acids, minerals & vitamins, microbial amendments), mode of application (foliar, soil, and seed), crop type (cereals & grains, fruits & vegetables, oilseeds & pulses), form (Liquid, dry), and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the biostimulants market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the biostimulants market. Competitive analysis of upcoming startups in the biostimulants market ecosystem is covered in this report. Furthermore, industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others, are also covered in the study.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall biostimulants and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rise in need for sustainable agriculture), restraints (commercialization of low-quality biostimulant products), opportunities (technological innovations), and challenges (uncertainty in global biostimulants regulatory framework) influencing the growth of the biostimulants market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the biostimulants market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the biostimulants market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the biostimulants market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as UPL (India), FMC Corporation (US), Corteva (US), Syngenta Group (Switzerland), Sumitomo Chemical Co., Ltd. (Japan), Nufarm (Australia), and other players in the biostimulants market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.5.1 CURRENCY/VALUE UNIT

- 1.5.2 VOLUME CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BIOSTIMULANTS MARKET

- 4.2 EUROPE: BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT & COUNTRY

- 4.3 BIOSTIMULANTS MARKET: SHARE OF KEY REGIONAL SUBMARKETS

- 4.4 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT AND REGION

- 4.5 BIOSTIMULANTS MARKET, BY CROP TYPE AND REGION

- 4.6 BIOSTIMULANTS MARKET, BY FORM AND REGION

- 4.7 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWTH IN DEMAND FOR ORGANIC FOOD

- 5.2.2 DAMAGE AND LOSS OF AGRICULTURAL LAND

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising need for sustainable agriculture

- 5.3.1.2 Easy availability of seaweed as raw material

- 5.3.1.3 Growing demand for high-value crops

- 5.3.2 RESTRAINTS

- 5.3.2.1 Commercialization of low-quality biostimulants

- 5.3.2.2 Storage complexities and limited shelf life

- 5.3.2.3 Preference for synthetic plant growth regulators in emerging economies

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological advancements in biostimulant production

- 5.3.3.2 Significant developments in seed treatment

- 5.3.3.3 Integration of biostimulants with fertilizers to optimize nutrient uptake

- 5.3.3.4 Shift toward regenerative agriculture and sustainable practices

- 5.3.4 CHALLENGES

- 5.3.4.1 Uncertainty in global biostimulants regulatory framework

- 5.3.4.2 Lack of awareness and adoption

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON BIOSTIMULANTS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN BIOSTIMULANTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 MANUFACTURING & PRODUCTION

- 6.3.4 PACKAGING, STORAGE, & DISTRIBUTION

- 6.3.5 POST-SALES SERVICES

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 3808)

- 6.4.2 EXPORT SCENARIO (HS CODE 3808)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Software to operationalize analytics

- 6.5.1.2 Nanoencapsulation

- 6.5.1.3 EnNuVi

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Precision agriculture

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 CRISPR and gene editing

- 6.5.3.2 Carbon sequestration

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY ACTIVE INGREDIENT

- 6.6.2 AVERAGE SELLING PRICE TREND OF BIOSTIMULANTS, BY ACTIVE INGREDIENT

- 6.6.3 AVERAGE SELLING PRICE TREND OF BIOSTIMULANTS, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Mexico

- 6.11.2.3 Canada

- 6.11.3 EUROPE

- 6.11.3.1 Austria

- 6.11.3.2 France

- 6.11.3.3 Germany

- 6.11.3.4 Italy

- 6.11.3.5 Ireland

- 6.11.3.6 Spain

- 6.11.3.7 UK

- 6.11.4 ASIA PACIFIC

- 6.11.4.1 India

- 6.11.4.2 China

- 6.11.4.3 Japan

- 6.11.4.4 Australia

- 6.11.5 SOUTH AMERICA

- 6.11.5.1 Brazil

- 6.11.5.2 Argentina

- 6.11.5.3 Chile

- 6.11.6 MIDDLE EAST

- 6.11.6.1 Egypt

- 6.11.6.2 UAE

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.12.2 BARGAINING POWER OF SUPPLIERS

- 6.12.3 BARGAINING POWER OF BUYERS

- 6.12.4 THREAT OF SUBSTITUTES

- 6.12.5 THREAT OF NEW ENTRANTS

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 INFLUENCE OF BIOSTIMULANTS ON GROWTH OF WHEAT ENRICHED WITH SELENIUM

- 6.14.2 ROLE OF BIOSTIMULANTS IN PROMOTING ROOT GROWTH AND PHYSIOLOGICAL PROCESSES IN PLANTS

- 6.14.3 OPTIMIZING RICE PRODUCTION WITH ECOSTIM BIOSTIMULANTS

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 BIOSTIMULANTS MARKET, BY ACTIVE INGREDIENT

- 7.1 INTRODUCTION

- 7.2 HUMIC SUBSTANCES

- 7.2.1 ABILITY TO STABILIZE SOIL TEMPERATURE, PREVENT WATER EVAPORATION, AND FACILITATE NUTRIENT UPTAKE TO DRIVE DEMAND

- 7.3 SEAWEED EXTRACTS

- 7.3.1 NEED TO BOOST SOIL FERTILITY, ENHANCE SEED GERMINATION, AND IMPROVE CROP PRODUCTIVITY TO FUEL DEMAND

- 7.4 AMINO ACIDS

- 7.4.1 INCREASING AWARENESS ABOUT VITAL ROLE IN PLANT GROWTH TO DRIVE DEMAND

- 7.5 MICROBIAL AMENDMENTS

- 7.5.1 NEED TO ENHANCE PLANT NUTRIENT UPTAKE AND IMPROVE SOIL CONDITIONS TO DRIVE DEMAND

- 7.5.2 BACTERIAL BIOSTIMULANTS

- 7.5.3 FUNGAL BIOSTIMULANTS

- 7.6 MINERALS & VITAMINS

- 7.6.1 EFFECTIVENESS AGAINST DROUGHT STRESS TO DRIVE DEMAND

- 7.7 OTHER ACTIVE INGREDIENTS

8 BIOSTIMULANTS MARKET, BY MODE OF APPLICATION

- 8.1 INTRODUCTION

- 8.2 SEED TREATMENT

- 8.2.1 NEED FOR ENHANCED STRESS TOLERANCE AND BETTER NUTRIENT UPTAKE IN PLANTS TO DRIVE DEMAND

- 8.3 SOIL TREATMENT

- 8.3.1 FOCUS ON REPLENISHING SOIL HEALTH AND PROMOTING PLANT GROWTH TO DRIVE DEMAND

- 8.4 FOLIAR TREATMENT

- 8.4.1 EMPHASIS ON ENHANCING ABSORPTION AND UPTAKE OF MICRONUTRIENTS TO DRIVE DEMAND

9 BIOSTIMULANTS MARKET, BY FORM

- 9.1 INTRODUCTION

- 9.2 LIQUID

- 9.2.1 EASE OF APPLICATION, UNIFORM DISTRIBUTION, AND RAPID ABSORPTION BY CROPS

- 9.3 DRY

- 9.3.1 LONGER SHELF LIFE AND REDUCED WATER USAGE

10 BIOSTIMULANTS MARKET, BY CROP TYPE

- 10.1 INTRODUCTION

- 10.2 CEREALS & GRAINS

- 10.2.1 DEMAND FOR INCREASED YIELD TO DRIVE MARKET

- 10.2.2 CORN

- 10.2.3 WHEAT

- 10.2.4 RICE

- 10.2.5 OTHER CEREALS & GRAINS

- 10.3 OILSEEDS & PULSES

- 10.3.1 GROWING NEED TO ENHANCE PLANT TOLERANCE TO ABIOTIC STRESS TO DRIVE MARKET

- 10.3.2 SOYBEAN

- 10.3.3 SUNFLOWER

- 10.3.4 OTHER OILSEEDS & PULSES

- 10.4 FRUITS & VEGETABLES

- 10.4.1 RISING GLOBAL CONSUMPTION AND HIGH EXPORT POTENTIAL OF FRUITS & VEGETABLES TO DRIVE MARKET

- 10.4.2 POME FRUITS

- 10.4.3 CITRUS FRUITS

- 10.4.4 BERRIES

- 10.4.5 ROOT & TUBER VEGETABLES

- 10.4.6 LEAFY VEGETABLES

- 10.4.7 OTHER FRUITS & VEGETABLES

- 10.5 FLOWERS & ORNAMENTALS

- 10.5.1 DEMAND FOR ENHANCED NUTRIENT UPTAKE, EFFICIENCY, AND STRESS TOLERANCE TO DRIVE MARKET

- 10.6 OTHER CROP TYPES

11 BIOSTIMULANTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Partnerships between key industry players to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increasing production of kelp to boost demand for seaweed-based biostimulants

- 11.2.3 MEXICO

- 11.2.3.1 Promotion of biostimulant products by industry players to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 SPAIN

- 11.3.1.1 Increasing cultivation of high-value crops to drive market

- 11.3.2 ITALY

- 11.3.2.1 Rise of organic sector to drive demand for biostimulants

- 11.3.3 FRANCE

- 11.3.3.1 Increase in biologicals plant health area to drive market

- 11.3.4 GERMANY

- 11.3.4.1 Focus on organic farming expansion and partnerships between industry players to drive market

- 11.3.5 UK

- 11.3.5.1 Climate change to increase demand for biostimulants

- 11.3.6 RUSSIA

- 11.3.6.1 Rising number of certified organic agricultural producers to drive market

- 11.3.7 REST OF EUROPE

- 11.3.1 SPAIN

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Leadership in seaweed production to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Agricultural sustainability goals to drive market

- 11.4.3 INDIA

- 11.4.3.1 Recent regulatory framework for biostimulant products to drive market

- 11.4.4 AUSTRALIA

- 11.4.4.1 Adoption of regenerative agriculture to drive market

- 11.4.5 INDONESIA

- 11.4.5.1 Shift toward organic farming and promotion of organic inputs to boost demand for biostimulants

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Favorable laws and awareness initiatives to drive adoption of biostimulants

- 11.5.2 ARGENTINA

- 11.5.2.1 Rising interest in organic production to boost market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 AFRICA

- 11.6.1.1 Rising environmental stress to increase demand for biostimulants

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Investments in algae-based biostimulants to drive market

- 11.6.1 AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Active ingredient footprint

- 12.5.5.4 Mode of application footprint

- 12.5.5.5 Form footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 UPL

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 FMC CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CORTEVA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 SYNGENTA GROUP

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SUMITOMO CHEMICAL CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 NUFARM

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.4 MnM view

- 13.1.7 NOVONESIS GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 BASF SE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.4 MnM view

- 13.1.9 BAYER AG

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.10 PI INDUSTRIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.11 T.STANES AND COMPANY LIMITED

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.12 J.M. HUBER CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.4 MnM view

- 13.1.13 HAIFA NEGEV TECHNOLOGIES LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.13.3.2 Deals

- 13.1.13.3.3 Expansions

- 13.1.13.4 MnM view

- 13.1.14 GOWAN COMPANY

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.4 MnM view

- 13.1.15 KOPPERT

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Expansions

- 13.1.15.4 MnM view

- 13.1.1 UPL

- 13.2 STARTUPS/SMES

- 13.2.1 ACADIAN SEAPLANTS LIMITED

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Deals

- 13.2.1.4 MnM view

- 13.2.2 QINGDAO SEAWIN BIOTECH GROUP CO., LTD.

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 MnM view

- 13.2.3 OMEX

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 MnM view

- 13.2.4 SEIPASA, S.A.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Expansions

- 13.2.4.4 MnM view

- 13.2.5 SUSTAINABLE AGRO SOLUTIONS, S.A.U.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.6 ALGAENERGY

- 13.2.7 LAWRIECO

- 13.2.8 AMINOCORE

- 13.2.9 KELPAK

- 13.2.10 CASCADIA SEAWEED

- 13.2.1 ACADIAN SEAPLANTS LIMITED

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 BIOPESTICIDES MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 PLANT GROWTH REGULATORS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS