|

|

市場調査レポート

商品コード

1306574

水ベース冷暖房システムの世界市場:加熱コンポーネント別 (ヒートポンプ、対流式ヒーター、ラジエーター、ボイラー)・冷却コンポーネント別 (チラー、AHU、冷却塔、膨張タンク)・冷却の種類別 (直接、間接)・実装の種類別・業種別・地域別の将来予測 (2028年まで)Water-based Heating & Cooling Systems Market by Heating (Heat Pump, Convector Heater, Radiator, Boiler), Cooling (Chiller, AHU, Cooling Tower, Tank), Cooling Type (Direct, Indirect), Implementation Type, Vertical & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 水ベース冷暖房システムの世界市場:加熱コンポーネント別 (ヒートポンプ、対流式ヒーター、ラジエーター、ボイラー)・冷却コンポーネント別 (チラー、AHU、冷却塔、膨張タンク)・冷却の種類別 (直接、間接)・実装の種類別・業種別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月22日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の水ベース冷暖房システムの市場規模は、2023年には377億米ドルとなり、2028年には552億米ドルに達し、2023年から2028年までの間に7.9%のCAGRで成長すると予測されています。

政府の規制と業界基準は、低GWP冷媒の開発と採用を推進する上で重要な役割を果たしています。世界各国は高GWP冷媒を段階的に廃止し、エコフレンドリーな代替品の使用を促進する施策を実施しています。欧州連合のFガス規制のような組織や、モントリオール議定書のキガリ改正のような国際協定は、高GWP冷媒の段階的削減のためのガイドラインと目標を提供しています。

"冷却用AHUが水冷システム市場で第2位のシェアを占める"

エアハンドリングユニット (AHU) は水冷システムにおいて重要な役割を果たし、複数の主要使用事例に対応しています。AHUの主な用途の1つは、セントラル空調を必要とする大規模な商業ビルや産業ビルです。AHUは、冷却された空気を建物全体に循環させ、快適な室内環境を維持する役割を担っています。さらにAHUは、精密な温度と湿度の制御が精密機器の信頼性の高い動作に不可欠なデータセンターでも一般的に使用されています。AHUを水冷システムに組み込むことで、データセンターはサーバーやその他の電子機器から発生する熱を効率的に除去し、最適な動作条件を維持することができます。

"商業用の分野が、業種別でCAGRが最も高い"

水ベース冷暖房システムは、居住者に快適で健康的な室内環境を提供するため、現代のオフィスビルには不可欠なコンポーネントです。オフィスビルにおける水ベース冷暖房システムには、AHU、チラー、ボイラー、冷却塔、ラジエーターなど様々な部品が含まれます。従って、オフィスにおける経済的でコスト削減可能なHVACシステムに対する需要の増加は、水ベース冷暖房システム市場の成長を促進すると予想されます。

"米国が、北米の水ベース冷暖房システム市場で最も高いCAGRで成長する"

米国のハイテク産業が、多くの労働者を収容すべく、新しい住宅や商業ビル、交通インフラの改善に対する需要を生み出しています。Google、Apple、Facebook、Microsoft、Amazonなどの企業は、さまざまな建物にHVACシステムを設置するために多額の投資を促しています。さらに、米国土木学会によると、米国は2025年までに、国内の空港、学校、道路の状態を改善するために4兆5,000億米ドルを費やす必要があります。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 顧客のビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 技術分析

- 平均販売価格の分析

- 特許分析

- 貿易分析

- 料金分析

- 基準と規制状況

- 主要な会議とイベント (2023年~2024年)

第6章 水ベース冷暖房システム市場:加熱コンポーネント別

- イントロダクション

- 対流式ヒーター

- ラジエーター

- ヒートポンプ

- ボイラー

第7章 水ベース冷暖房システム市場:冷却コンポーネント別

- イントロダクション

- チラー

- エアハンドリングユニット (AHU)

- 冷却塔

- 膨張タンク

第8章 水ベース冷暖房システム市場:冷却の種類別

- イントロダクション

- 直接冷却

- 間接冷却

第9章 水ベース冷暖房システム市場:実装の種類別

- イントロダクション

- 新築

- 改築

第10章 水ベース冷暖房システム市場:業種別

- イントロダクション

- 商業用

- 住宅用

- 産業用

第11章 水ベース冷暖房システム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他のアジア太平洋

- その他の地域 (ROW)

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 大手企業が採用した主な戦略

- 企業収益分析 (2020年~2022年)

- 市場シェア分析 (2022年)

- 企業評価マトリックス (2022年)

- スタートアップ/中小企業の評価マトリックス (2022年)

- 水ベース冷暖房システム市場:企業のフットプリント

- スタートアップ/中小企業の評価マトリックス (2022年)

- 主要スタートアップ/中小企業の詳細リスト

- 競争シナリオと動向

第13章 企業プロファイル

- 主要企業

- DAIKIN

- JOHNSON CONTROLS

- CARRIER

- TRANE TECHNOLOGIES PLC

- FUJITSU

- VASCO GROUP

- PURMO GROUP

- VERTIV HOLDINGS

- SCHNEIDER ELECTRIC

- LENNOX INTERNATIONAL INC.

- JAGA N.V.

- BETHERMA B.V.

- CASTRADS LTD

- MHS RADIATORS

- EUCOTHERM

- その他の企業

- MIDEA

- BOSCH THERMOTECHNIK GMBH

- ELECTROLUX

- FERROLI S.P.A

- SIEMENS AG

- VAILLANT GROUP

- ALFA LAVAL AB

- STIEBEL ELTRON

- GLEN DIMPLEX GROUP

- SIGMA THERMAL

第14章 付録

The global water-based heating & cooling systems market is expected to be valued at USD 37.7 billion in 2023 and is projected to reach USD 55.2 billion by 2028; it is expected to grow at a CAGR of 7.9% from 2023 to 2028. Government regulations and industry standards play a significant role in driving the development and adoption of low-GWP refrigerants. Countries and regions are implementing measures to phase out high-GWP refrigerants and promote the use of environmentally friendly alternatives. Organizations like the European Union's F-Gas Regulation and international agreements like the Kigali Amendment to the Montreal Protocol provide guidelines and targets for the phase-down of high-GWP refrigerants.

"AHU in cooling component to account for the second largest market share for water-based cooling systems market."

Air Handling Units (AHUs) play a crucial role in water-based cooling systems, serving multiple key use cases. One major application of AHUs is in large commercial or industrial buildings where central air conditioning is required. AHUs are responsible for circulating cooled air throughout the building, maintaining a comfortable indoor environment. Additionally, AHUs are commonly used in data centers, where precise temperature and humidity control are essential for the reliable operation of sensitive equipment. By incorporating AHUs into water-based cooling systems, data centers can efficiently remove the heat generated by servers and other electronics, maintaining optimal operating conditions.

"Commercial vertical to account for the highest CAGR of water-based heating & cooling systems market."

Water-based heating and cooling systems are an essential component of modern office buildings as they provide a comfortable and healthy indoor environment for occupants. The water-based heating and cooling systems in office buildings include various components such as air handling units, chillers, boilers, cooling towers, and radiators. Thus, the increasing demand for economic and cost-saving HVAC systems in offices is expected to propel the growth of the water-based heating and cooling systems market.

"US to grow at the highest CAGR for North American water-based heating & cooling systems market."

The tech industry in the US is creating a demand for new residential and commercial buildings, as well as improved transport infrastructure, for the accommodation of many workers. Companies such as Google, Apple, Facebook, Microsoft, and Amazon are encouraging significant investments to install HVAC systems across different buildings. Moreover, according to the American Society of Civil Engineers, the US needs to spend ~USD 4.5 trillion by 2025 on improving the state of the country's airports, schools, and roads.

The study contains various industry experts' insights, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 25%, and Tier 3 - 35%

- By Designation: C-level Executives - 33%, Directors - 48%, and Others - 19%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 18%, RoW - 7%

The key players operating in the water-based heating & cooling systems market are Daikin (Japan), Johnson Controls (US), Carrier Global Corporation (US), Trane Technologies (US), and Fujitsu (Japan).

The research report categorizes the water-based heating & cooling systems market by Heating Component (Heat Pumps, Convector Heaters, Radiators, and Boilers), by Cooling Component (Chillers, AHUs, Cooling Towers, and Expansion Tank), by Cooling Type (Direct, Indirect), by Implementation Type (New Construction, Retrofit), by Vertical (Residential, Commercial, and Industrial), and by region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the water-based heating & cooling systems market. A detailed analysis of the key industry players has been done to provide insights into their business overviews, products, key strategies, Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the water-based heating & cooling systems market. Competitive analysis of upcoming startups in the water-based heating & cooling systems market ecosystem is covered in this report.

Research Coverage:

Key Benefits of Buying the Report

- Analysis of critical drivers (Increasing demand for energy-efficient water-based heating and cooling systems, Increasing constructions activities in residential and industrial sectors, Government regulatory policies and incentives to ensure energy saving and conservation of natural resources, and Growing demand for indoor and outdoor air quality), restraints (High maintenance, repair and installation costs for water-based heating and cooling systems, Limited space in commercial and residential buildings for large water-based heating and cooling systems, Lack of technical knowledge to the owners and shortage of skilled labor), opportunities (Rapid transformation of IoT within HVAC industry, Growing Demand for Sustainable Solutions, and Efforts to develop next-generation low global warming potential refrigerants), and challenges (Lack of awareness about benefits of water-based systems in developing countries, and Increase in environmental concerns and aging infrastructure) influencing the growth of the water-based heating & cooling systems market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the water-based heating & cooling systems market

- Market Development: Comprehensive information about lucrative markets - the report analyses the water-based heating & cooling systems market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the water-based heating & cooling systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Daikin (Japan), Johnson Controls (US), Carrier Global Corporation (US), Trane Technologies (US), Fujitsu (Japan), among others in the water-based heating & cooling systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 WATER-BASED HEATING & COOLING SYSTEMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY-SIDE)-IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive at market size using top-down analysis

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- 2.6 ASSUMPTIONS CONSIDERED TO ANALYZE IMPACT OF RECESSION

- TABLE 2 ASSUMPTIONS: RECESSION

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 HEAT PUMPS TO HOLD LARGEST SHARE OF WATER-BASED HEATING SYSTEMS MARKET DURING 2023-2028

- FIGURE 8 CHILLERS TO RECORD HIGHEST CAGR DURING 2023-2028

- FIGURE 9 NEW CONSTRUCTION IMPLEMENTATION TYPE TO HOLD HIGHEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 COMMERCIAL VERTICAL TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 WATER-BASED HEATING & COOLING SYSTEMS MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR FROM 2023 TO 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET

- FIGURE 12 IMPLEMENTATION OF IOT ACROSS WATER-BASED HEATING & COOLING SYSTEMS TO TRANSFORM COMMERCIAL AND RESIDENTIAL VERTICALS

- 4.2 NORTH AMERICA WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY AND HEATING COMPONENT

- FIGURE 13 US AND HEAT PUMPS ARE EXPECTED TO HOLD LARGEST SHARE OF NORTH AMERICAN WATER-BASED HEATING & COOLING SYSTEMS MARKET IN 2023

- 4.3 ASIA PACIFIC WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT

- FIGURE 14 CHILLERS TO SECURE LARGEST SHARE OF WATER-BASED HEATING & COOLING SYSTEMS MARKET IN ASIA PACIFIC DURING 2023-2028

- 4.4 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY

- FIGURE 15 WATER-BASED HEATING & COOLING SYSTEMS MARKET IN CHINA TO DISPLAY HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 17 DRIVERS AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.2.1.1 Increasing demand for energy-efficient water-based heating & cooling systems

- 5.2.1.2 Increasing construction activities in residential and industrial sectors

- 5.2.1.3 Government regulatory policies and incentives to ensure energy saving and conservation of natural resources

- 5.2.1.4 Growing focus on enhancing indoor and outdoor air quality

- 5.2.2 RESTRAINTS

- FIGURE 18 RESTRAINTS AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.2.2.1 High maintenance and installation costs

- 5.2.2.2 Limited space in commercial and residential buildings

- 5.2.2.3 Lack of technical knowledge among owners and shortage of skilled labor

- 5.2.3 OPPORTUNITIES

- FIGURE 19 OPPORTUNITIES AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.2.3.1 Rapid transformation of IoT within water-based heating & cooling industry

- 5.2.3.2 Growing demand for sustainable solutions

- 5.2.3.3 Efforts to develop next-generation low global warming potential refrigerants for water-based heating & cooling

- 5.2.4 CHALLENGES

- FIGURE 20 CHALLENGES AND THEIR IMPACT ON WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.2.4.1 Lack of awareness about benefits of water-based heating & cooling systems in developing countries

- 5.2.4.2 Environmental concerns and aging infrastructure

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 21 WATER-BASED HEATING & COOLING SYSTEMS MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 22 KEY PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET

- TABLE 3 ROLE OF WATER-BASED HEATING & COOLING SYSTEM MANUFACTURERS IN ECOSYSTEM

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.6.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 REVENUE SHIFT FOR PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 TOWER OF LONDON INSTALLS HVAC SYSTEMS FROM AIREDALE

- 5.8.2 THE EBELL OF LOS ANGELES AND WILSHIRE EBELL THEATER HOUSE REPLACES OLD AND INEFFICIENT WATER-BASED HEATING & COOLING SYSTEMS

- 5.8.3 SCHOOL IN GEORGIA UPGRADES WATER-BASED HEATING & COOLING SYSTEMS AND LOWERS ENERGY COSTS

- 5.8.4 VIRGINIA DATA CENTER INSTALLS MODULAR HVAC SYSTEMS

- 5.8.5 LIBRARY IN FLORIDA IMPLEMENTS INNOVATIVE WATER-BASED HEATING & COOLING SYSTEMS FROM ICEBANK ENERGY STORAGE SYSTEM

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Cooling units

- 5.9.1.2 Heating units

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Sensors

- 5.9.2.2 Building automation systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Software technologies

- 5.9.1 KEY TECHNOLOGIES

- 5.10 AVERAGE SELLING PRICE ANALYSIS

- FIGURE 27 AVERAGE SELLING PRICE OF WATER-BASED HEATING & COOLING SYSTEM COMPONENTS, BY VERTICAL

- 5.10.1 AVERAGE SELLING PRICES OF WATER-BASED HEATING & COOLING SYSTEMS COMPONENT, BY VERTICAL

- TABLE 7 AVERAGE SELLING PRICE OF WATER-BASED HEATING & COOLING SYSTEM COMPONENTS, BY VERTICAL

- 5.10.2 AVERAGE SELLING PRICE TRENDS

- FIGURE 28 AVERAGE SELLING PRICE OF DIFFERENT COOLING COMPONENTS (USD)

- FIGURE 29 AVERAGE SELLING PRICE OF DIFFERENT HEATING COMPONENTS (USD)

- 5.11 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS GRANTED IN WATER-BASED HEATING & COOLING SYSTEMS MARKET, 2012-2023

- TABLE 8 LIST OF PATENTS IN WATER-BASED HEATING & COOLING SYSTEMS, 2021-2023

- 5.12 TRADE ANALYSIS

- TABLE 9 IMPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 31 IMPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 10 EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 32 EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.13 TARIFF ANALYSIS

- TABLE 11 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY US (2022)

- TABLE 12 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY CHINA (2022)

- TABLE 13 MFN TARIFF FOR HS CODE: 8415 EXPORTED BY INDIA (2022)

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.1 North America: List of regulatory bodies, government agencies, and other organizations

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.2 Europe: List of regulatory bodies, government agencies, and other organizations

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.3 Asia Pacific: List of regulatory bodies, government agencies, and other organizations

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.1.4 RoW: List of regulatory bodies, government agencies, and other organizations

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO WATER-BASED HEATING & COOLING SYSTEMS MARKET

- 5.14.2.1 Environmental WHBC requirements

- 5.14.2.1.1 Current HCFC regulations

- 5.14.2.1.2 New HFC regulations

- 5.14.2.1.3 US regulations

- 5.14.2.1.4 Canadian regulations

- 5.14.2.2 Water-based heating & cooling system efficiency standards

- 5.14.2.3 Water-based heating & cooling systems tech certifications

- 5.14.2.1 Environmental WHBC requirements

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 18 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

6 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT

- 6.1 INTRODUCTION

- FIGURE 33 HEAT PUMPS TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 19 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 20 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 21 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (MILLION UNITS)

- TABLE 22 WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (MILLION UNITS)

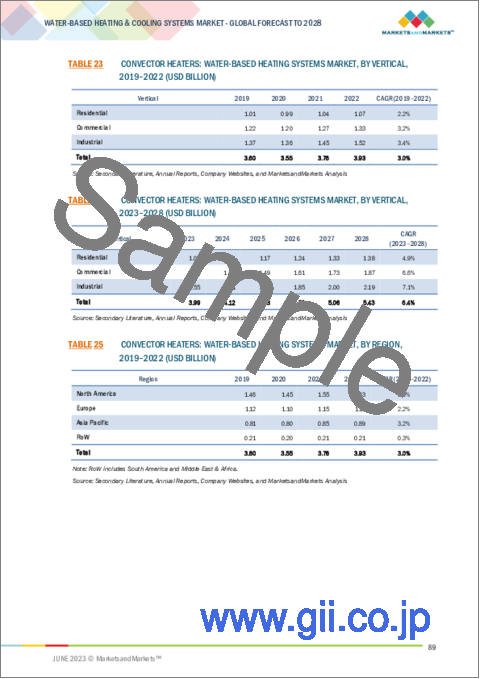

- 6.2 CONVECTOR HEATERS

- 6.2.1 INNOVATIONS IN CONVECTOR DESIGNING AND MANUFACTURING TO DRIVE MARKET

- TABLE 23 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 24 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 25 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 26 CONVECTOR HEATERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.3 RADIATORS

- 6.3.1 RESIDENTIAL, COMMERCIAL, AND INDUSTRIAL BUILDINGS TO GENERATE SIGNIFICANT DEMAND

- TABLE 27 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 28 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 29 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 30 RADIATORS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.4 HEAT PUMPS

- 6.4.1 COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET

- 6.4.1.1 Air-to-water heat pumps

- 6.4.1.2 Water-to-water heat pumps

- TABLE 31 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 32 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 33 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 34 HEAT PUMPS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.4.1 COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET

- 6.5 BOILERS

- 6.5.1 GROWING FOCUS ON SUSTAINABILITY TO DRIVE MARKET

- 6.5.1.1 Steam boilers

- 6.5.1.2 Hot water boilers

- TABLE 35 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 36 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 37 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 38 BOILERS: WATER-BASED HEATING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.5.1 GROWING FOCUS ON SUSTAINABILITY TO DRIVE MARKET

7 WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT

- 7.1 INTRODUCTION

- FIGURE 34 CHILLERS TO HOLD LARGEST SHARE OF WATER-BASED HEATING SYSTEMS MARKET FOR COOLING COMPONENTS IN 2028

- TABLE 39 WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 40 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 41 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019-2022 (THOUSAND UNITS)

- TABLE 42 WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (THOUSAND UNITS)

- 7.2 CHILLERS

- 7.2.1 NEW INFRASTRUCTURE PROJECTS TO BOOST DEMAND

- 7.2.1.1 Scroll chillers

- 7.2.1.2 Screw chillers

- 7.2.1.3 Centrifugal chillers

- 7.2.1.4 Reciprocating chillers

- 7.2.1.5 Absorption chillers

- TABLE 43 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 44 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 45 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 46 CHILLERS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 7.2.1 NEW INFRASTRUCTURE PROJECTS TO BOOST DEMAND

- 7.3 AIR HANDLING UNITS

- 7.3.1 REDUCED ENERGY COSTS TO STRENGTHEN MARKET

- TABLE 47 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 48 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- TABLE 49 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 50 AIR HANDLING UNITS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 7.4 COOLING TOWERS

- 7.4.1 INCREASING ADOPTION OF RENEWABLE ENERGY SOURCES TO DRIVE DEMAND

- 7.4.1.1 Evaporative cooling towers

- 7.4.1.2 Dry cooling towers

- 7.4.1.3 Hybrid cooling towers

- TABLE 51 COOLING TOWERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 52 COOLING TOWERS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 53 COOLING TOWERS: WATER-BASED COOLING SYSTEM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 COOLING TOWERS: WATER-BASED COOLING SYSTEM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.1 INCREASING ADOPTION OF RENEWABLE ENERGY SOURCES TO DRIVE DEMAND

- 7.5 EXPANSION TANKS

- 7.5.1 USE OF EXPANSION TANKS HELP TO CONTROL PRESSURE IN COOLING SYSTEM TO DRIVE MARKET

- TABLE 55 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 56 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 57 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 EXPANSION TANKS: WATER-BASED COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 WATER-BASED COOLING SYSTEMS MARKET, BY COOLING TYPE

- 8.1 INTRODUCTION

- 8.2 DIRECT COOLING

- 8.2.1 DATA CENTERS AND AIR CONDITIONERS TO OFFER SIGNIFICANT OPPORTUNITIES

- 8.3 INDIRECT COOLING

- 8.3.1 CAPABILITY TO MAINTAIN CLEANER AND HEALTHIER INDOOR ENVIRONMENT TO DRIVE DEMAND

9 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE

- 9.1 INTRODUCTION

- FIGURE 35 NEW CONSTRUCTION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 59 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019-2022 (USD BILLION)

- TABLE 60 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023-2028 (USD BILLION)

- 9.2 NEW CONSTRUCTION

- 9.2.1 GOVERNMENT-LED INITIATIVES TO PROMOTE ENERGY-SAVING DEVICES AND CONSUMER AWARENESS TO BOOST MARKET

- TABLE 61 NEW CONSTRUCTION: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 62 NEW CONSTRUCTION: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 9.3 RETROFITS

- 9.3.1 GOVERNMENT REGULATIONS FOR GREEN BUILDINGS TO DRIVE MARKET

- TABLE 63 RETROFITS: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 64 RETROFITS: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

10 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 36 COMMERCIAL VERTICAL TO ATTAIN HIGHEST MARKET SHARE DURING 2023-2028

- TABLE 65 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY VERTICAL, 2019-2022 (USD BILLION)

- TABLE 66 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY VERTICAL, 2023-2028 (USD BILLION)

- 10.2 COMMERCIAL

- 10.2.1 GLOBAL TEMPERATURE RISE AND POLLUTION FROM CONSTRUCTION ACTIVITIES TO BOOST DEMAND

- TABLE 67 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 68 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 69 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 70 COMMERCIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- 10.2.1.1 Office

- 10.2.1.2 Government

- 10.2.1.3 Healthcare

- 10.2.1.4 Education

- 10.2.1.5 Retail

- 10.2.1.6 Airport

- 10.3 RESIDENTIAL

- 10.3.1 GOVERNMENT REGULATIONS AND TAX CREDIT PROGRAMS TO PROMOTE BOOST DEMAND IN RESIDENTIAL SECTOR

- TABLE 71 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 72 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 73 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 74 RESIDENTIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- 10.4 INDUSTRIAL

- 10.4.1 WAREHOUSES, CONTROL ROOMS, AND PRODUCTION FACILITIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- TABLE 75 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 76 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 77 INDUSTRIAL: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 78 INDUSTRIAL: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- 10.4.1.1 Data center

- 10.4.1.2 Manufacturing facility

- 10.4.1.3 Power plant

11 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 37 ASIA PACIFIC REGION TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 80 WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 38 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 82 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 83 NORTH AMERICA: WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 84 NORTH AMERICA: WATER-BASED HEATING SYSTEMS MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 85 NORTH AMERICA: WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: WATER-BASED COOLING SYSTEMS MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019-2022 (USD BILLION)

- TABLE 88 NORTH AMERICA: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023-2028 (USD BILLION)

- 11.2.2 US

- 11.2.2.1 Increasing number of construction projects to drive demand

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives for energy saving to boost demand

- 11.2.4 MEXICO

- 11.2.4.1 Increasing focus on promoting use of energy-efficient water-based heating & cooling systems to strengthen market

- 11.3 EUROPE

- 11.3.1 EUROPE: IMPACT OF RECESSION

- FIGURE 39 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- TABLE 89 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 90 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 91 EUROPE: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 92 EUROPE: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 93 EUROPE: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 94 EUROPE: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- TABLE 95 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019-2022 (USD BILLION)

- TABLE 96 EUROPE: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023-2028 (USD BILLION)

- 11.3.2 UK

- 11.3.2.1 High demand for energy-efficient devices from commercial and residential users to boost market

- 11.3.3 GERMANY

- 11.3.3.1 Increasing innovations in software solutions for water-based heating & cooling to support market growth

- 11.3.4 FRANCE

- 11.3.4.1 Rising focus on reducing greenhouse gases to spur demand

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 40 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET SNAPSHOT

- TABLE 97 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 98 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 99 ASIA PACIFIC: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 100 ASIA PACIFIC: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 101 ASIA PACIFIC: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019-2022 (USD BILLION)

- TABLE 102 ASIA PACIFIC: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (USD BILLION)

- TABLE 103 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019-2022 (USD BILLION)

- TABLE 104 ASIA PACIFIC: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023-2028 (USD BILLION)

- 11.4.2 CHINA

- 11.4.2.1 Growing industrialization and urbanization to fuel market

- 11.4.3 INDIA

- 11.4.3.1 Surging need to save energy to boost demand

- 11.4.4 JAPAN

- 11.4.4.1 Strict regulations for energy conservation to upsurge demand

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 ROW: IMPACT OF RECESSION

- TABLE 105 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2019-2022 (USD BILLION)

- TABLE 106 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 107 ROW: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 108 ROW: WATER-BASED HEATING SYSTEM MARKET, BY HEATING COMPONENT, 2023-2028 (USD MILLION)

- TABLE 109 ROW: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2019-2022 (USD MILLION)

- TABLE 110 ROW: WATER-BASED COOLING SYSTEM MARKET, BY COOLING COMPONENT, 2023-2028 (USD MILLION)

- TABLE 111 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2019-2022 (USD BILLION)

- TABLE 112 ROW: WATER-BASED HEATING & COOLING SYSTEMS MARKET, BY IMPLEMENTATION TYPE, 2023-2028 (USD BILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Strong focus on infrastructure development to boost market

- 11.5.3 MIDDLE EAST & AFRICA

- 11.5.3.1 Stringent regulations for enhancing energy performance of buildings to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYER

- TABLE 113 OVERVIEW OF STRATEGIES DEPLOYED BY WATER-BASED HEATING & COOLING SYSTEM OEMS

- 12.3 COMPANY REVENUE ANALYSIS, 2020-2022

- FIGURE 41 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS, 2020-2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 42 SHARE OF MAJOR PLAYERS IN WATER-BASED HEATING & COOLING SYSTEMS MARKET, 2022

- TABLE 114 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX, 2022

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 43 COMPANY EVALUATION MATRIX, 2022

- 12.6 STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 44 STARTUPS/SMES EVALUATION QUADRANT, 2022

- 12.7 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPANY FOOTPRINT

- TABLE 115 COMPANY FOOTPRINT

- TABLE 116 VERTICAL FOOTPRINT

- TABLE 117 PRODUCT FOOTPRINT

- TABLE 118 REGION FOOTPRINT

- 12.8 STARTUPS/SMES EVALUATION MATRIX, 2022

- TABLE 119 WATER-BASED HEATING & COOLING SYSTEMS MARKET: STARTUPS/SMES

- 12.8.1 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 120 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 121 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS, BY COMPONENT

- TABLE 122 WATER-BASED HEATING & COOLING SYSTEMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 DEALS

- TABLE 123 WATER-BASED HEATING & COOLING SYSTEMS MARKET: DEALS, 2020-2023

- TABLE 124 WATER-BASED HEATING & COOLING SYSTEMS MARKET: PRODUCT LAUNCHES, 2020-2023

- TABLE 125 WATER-BASED HEATING & COOLING SYSTEMS MARKET: OTHERS, 2022-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 DAIKIN

- TABLE 126 DAIKIN: BUSINESS OVERVIEW

- FIGURE 45 DAIKIN: COMPANY SNAPSHOT

- TABLE 127 DAIKIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 128 DAIKIN: PRODUCT LAUNCHES

- TABLE 129 DAIKIN: DEALS

- TABLE 130 DAIKIN: OTHERS

- 13.1.2 JOHNSON CONTROLS

- TABLE 131 JOHNSON CONTROLS: BUSINESS OVERVIEW

- FIGURE 46 JOHNSON CONTROLS: COMPANY SNAPSHOT

- TABLE 132 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 134 JOHNSON CONTROLS: DEALS

- 13.1.3 CARRIER

- TABLE 135 CARRIER: BUSINESS OVERVIEW

- FIGURE 47 CARRIER: COMPANY SNAPSHOT

- TABLE 136 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 CARRIER: PRODUCT LAUNCHES

- TABLE 138 CARRIER: DEALS

- 13.1.4 TRANE TECHNOLOGIES PLC

- TABLE 139 TRANE TECHNOLOGIES PLC: BUSINESS OVERVIEW

- FIGURE 48 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- TABLE 140 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 TRANE TECHNOLOGIES PLC: PRODUCT LAUNCHES

- TABLE 142 TRANE TECHNOLOGIES PLC: DEALS

- 13.1.5 FUJITSU

- TABLE 143 FUJITSU: BUSINESS OVERVIEW

- FIGURE 49 FUJITSU: COMPANY SNAPSHOT

- TABLE 144 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 FUJITSU: PRODUCT LAUNCHES

- TABLE 146 FUJITSU: DEALS

- 13.1.6 VASCO GROUP

- TABLE 147 VASCO GROUP: BUSINESS OVERVIEW

- TABLE 148 VASCO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 PURMO GROUP

- TABLE 149 PURMO GROUP: BUSINESS OVERVIEW

- FIGURE 50 PURMO GROUP: COMPANY SNAPSHOT

- TABLE 150 PURMO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 PURMO GROUP: PRODUCT LAUNCHES

- TABLE 152 PURMO GROUP: DEALS

- 13.1.8 VERTIV HOLDINGS

- TABLE 153 VERTIV HOLDINGS: BUSINESS OVERVIEW

- FIGURE 51 VERTIV HOLDINGS: COMPANY SNAPSHOT

- TABLE 154 VERTIV HOLDINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 SCHNEIDER ELECTRIC

- TABLE 155 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 52 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 156 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 SCHNEIDER ELECTRIC: DEALS

- 13.1.10 LENNOX INTERNATIONAL INC.

- TABLE 158 LENNOX INTERNATIONAL INC.: BUSINESS OVERVIEW

- FIGURE 53 LENNOX INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 159 LENNOX INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 LENNOX INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 161 LENNOX INTERNATIONAL INC.: DEALS

- TABLE 162 LENNOX INTERNATIONAL INC.: OTHERS

- 13.1.11 JAGA N.V.

- TABLE 163 JAGA N.V.: BUSINESS OVERVIEW

- TABLE 164 JAGA N.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 JAGA N.V.: PRODUCT LAUNCHES

- TABLE 166 JAGA N.V.: DEALS

- 13.1.12 BETHERMA B.V.

- TABLE 167 BETHERMA B.V.: BUSINESS OVERVIEW

- TABLE 168 BETHERMA B.V.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 169 BETHERMA B.V.: PRODUCT LAUNCHES

- TABLE 170 BETHERMA B.V.: DEALS

- 13.1.13 CASTRADS LTD

- TABLE 171 CASTRADS LTD: BUSINESS OVERVIEW

- TABLE 172 CASTRADS LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 CASTRADS LTD: PRODUCT LAUNCHES

- TABLE 174 CASTRADS LTD: DEALS

- 13.1.14 MHS RADIATORS

- TABLE 175 MHS RADIATORS: BUSINESS OVERVIEW

- TABLE 176 MHS RADIATORS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 MHS RADIATORS: PRODUCT LAUNCHES

- TABLE 178 MHS RADIATORS: DEALS

- 13.1.15 EUCOTHERM

- TABLE 179 EUCOTHERM: BUSINESS OVERVIEW

- TABLE 180 EUCOTHERM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 EUCOTHERM: PRODUCT LAUNCHES

- 13.2 OTHER PLAYERS

- 13.2.1 MIDEA

- 13.2.2 BOSCH THERMOTECHNIK GMBH

- 13.2.3 ELECTROLUX

- 13.2.4 FERROLI S.P.A

- 13.2.5 SIEMENS AG

- 13.2.6 VAILLANT GROUP

- 13.2.7 ALFA LAVAL AB

- 13.2.8 STIEBEL ELTRON

- 13.2.9 GLEN DIMPLEX GROUP

- 13.2.10 SIGMA THERMAL

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS