|

|

市場調査レポート

商品コード

1823727

電気バスの世界市場:バスの全長別、バッテリータイプ別、バッテリー容量別、出力別、航続距離別、乗車定員別、用途別、消費者別、車両総重量別、推進力別、コンポーネント別、自律走行レベル別、地域別 - 2032年までの予測Electric Bus Market by Propulsion, Battery, Length, Battery Capacity, Application, Seating Capacity, Range, Power Output, Autonomy Level, Component, Consumer and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| 電気バスの世界市場:バスの全長別、バッテリータイプ別、バッテリー容量別、出力別、航続距離別、乗車定員別、用途別、消費者別、車両総重量別、推進力別、コンポーネント別、自律走行レベル別、地域別 - 2032年までの予測 |

|

出版日: 2025年09月19日

発行: MarketsandMarkets

ページ情報: 英文 430 Pages

納期: 即納可能

|

概要

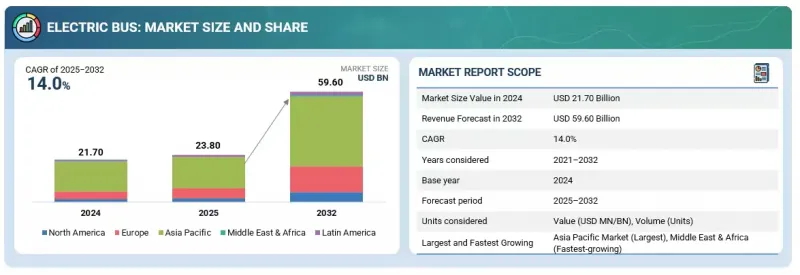

電気バスの市場規模は、2025年の238億米ドルから2032年には596億米ドルに成長し、CAGRは14.0%になると予測されています。

世界の電気バス市場は、政府の支援と大幅な技術進歩に牽引され、一貫した成長を遂げています。バッテリーのエネルギー密度と充電速度の向上により、航続距離不安などの懸念が解消され、電気バスがディーゼル車両と同等の運行性能を発揮できるようになります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象ユニット | 数量(台)および金額(100万米ドル/10億米ドル) |

| セグメント | バスの全長別、バッテリータイプ別、バッテリー容量別、出力別、航続距離別、乗車定員別、用途別、消費者別、車両総重量別、推進力別、コンポーネント別、自律走行レベル別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、ラテンアメリカ、中東・アフリカ |

高度なバッテリー管理システムを開発し、LFPバッテリー化学を採用することで、安全性、寿命、効率が向上します。さらに、総所有コスト(TCO)は、車両のライフサイクルにおける燃料コストとメンテナンスコストが低いため、電気バスの需要を促進する重要な要因の1つです。

電気バスは、都市部や都市間路線への広範な配備を可能にする大規模な補助金と義務化により、主に公共交通フリートを通じて、政府部門で重要な用途を持つ態勢を整えています。国や都市レベルの政府は、補助金、拘束力のある規制、車両更新の義務化を通じて、地方交通当局に電気バスを調達するよう積極的に働きかけています。例えば、中国政府は深センで電気バス車両に補助金を支給し、その結果、Shenzhen Bus Groupのような自治体会社によって1万6,000台以上の公開電気バスが運行されています。インドでは、FAME-IIスキームが州交通事業に対して電気バス1台あたり₹2~4万米ドルの補助金を提供しており、ムンバイのBESTのような自治体向けに7,120台の公共電気バスを調達し、2027年までに全国で5万台の電気バスを目標としています。米国連邦交通局は、超党派インフラ法に基づき17億米ドルを割り当て、オレゴン州の公立学校の電気バス保有台数の70%をカバーするビーバートン学区の28台のEスクールバスに見られるように、1,300台以上のゼロエミッション公共交通バスに資金を提供しています。欧州では、EUのクリーンバス普及イニシアティブが、ハンブルクのホッホバーン(Hochbahn)のような公共事業者のために、2024年に7,779台のEバス登録を推進し、ゼロエミッション車両への補助金によって、2030年までに100%の電化目標を達成しています。

これとは対照的に、企業のシャトルバスや宅配便のような民間セクターへの適用は、ニッチであることに変わりはありませんが、同等の政府支援がなければ初期費用が高くなるため、遅れています。オランダでは、非公開会社が政府との契約に基づいて公共バスを運行しています。規模や資金面では政府主導の取り組みが有利であり、民間の導入は空港シャトルのような特殊な用途に限られています。

燃料電池電気バス(FCEV)は、バッテリー電気バス(BEV)の対抗馬として、特に長距離路線や充電インフラが限られた地域で注目を集めています。電気バス専門誌によると、欧州ではFCEVバスの登録台数は2023年の207台から2024年には378台と82%も増加したが、ゼロエミッションバスの4.6%程度に過ぎません。

FCEVバスに関する主な供給契約には、イタリアのボローニャの公共交通会社(TPER)が、2023年後半に130台のソラリスUrbino 12水素バスを発注し、2026年からの納入を計画していることなどがあります。英国では、リバプール市が2023年に20台のAlexander Dennis Enviro400FCEVを導入し、Wrightbus(英国)が2024年にケルンにHydroliner FCEVダブルデッカーバスを納入しました。アジアでは、ヒュンダイのElec City FCEVが2019年から市販され、2024年9月には韓国での販売台数が1,000台を突破しました。インドでは、最初の水素燃料電池バスが2025年初頭にラダックで運行を開始し、困難な地形における重要なマイルストーンとなっています。

BEVと比較した場合の燃料電池バスの利点は、燃料補給時間の速さと走行距離の長さにあり、都市間および地域間サービスに適しています。しかし、FCEVのエネルギー効率は低く、BEVの85~90%に対し、FCEVは60~70%しかエネルギーを変換しないです。また、価格もBEVバスの2倍から3倍です。2023年にイタリアのボルツァーノで行われた調査によると、FCEBのランニングコストはバッテリーバスの2倍以上であり、その主な原因は水素の製造、流通、燃料補給のインフラコストでした。このコストギャップは、FCEVを選択するのが民間事業者ではなく、政府や公共交通機関のみである理由を説明しています。

北米、特に米国とカナダは、予測期間中、電気バスにとって最も重要な市場の一つとして浮上しています。米国では、電気スクールバス分野がディーゼルから電気バスへの移行を主導しています。この背景には、EPAのクリーン・スクールバス・プログラムがあり、2026年まで50億米ドルの資金を提供し、ディーゼルのスクールバスを電気バスに置き換えることを支援しています。2024年後半までに、EPAは1,000の学区で約12,000台の電気式スクールバスに補助金を交付しており、この地域にとって最も重要な需要の牽引役となっています。2023年に17億米ドルが割り当てられ、2025年までゼロエミッションの輸送用バスと充電インフラに資金が分配され続ける見込みの連邦運輸局の低排出ガス車プログラム(Low-No Program)に支えられて、運輸機関も採用を改善しています。

カナダも同様の道をたどっており、ゼロ・エミッション・トランジット基金(ZETF)が2026年まで20億米ドルの支援を提供し、自治体が電気輸送バスを調達し、充電施設を建設するのを支援しています。2024年現在、カナダでは700台以上の電気バスが販売されており、2025年にはさらに増加すると予想されています。こうした連邦政府や州レベルの優遇措置により、米国とカナダは北米における電気バス導入のリーダーとして位置づけられています。電気バスの全体的な販売台数では中国と欧州が依然として優位を占めているが、北米がスクールバスの電化に力を入れていることは、この地域ならではの特徴です。

当レポートでは、世界の電気バス市場について調査し、バスの全長別、バッテリータイプ別、バッテリー容量別、出力別、航続距離別、乗車定員別、用途別、消費者別、車両総重量別、推進力別、コンポーネント別、自律走行レベル別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

第6章 業界動向

- AI/生成AIが電気バス市場に与える影響

- 貿易分析

- エコシステム分析

- サプライチェーン分析

- 総所有コスト:ディーゼルバスvs.電気バス

- 価格分析

- 特許分析

- 規制状況

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 部品表分析

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- サプライヤー分析

- 投資と資金調達のシナリオ

第7章 OEM分析

第8章 技術分析

- 技術分析

- 主要技術

- 隣接技術

- 補完的技術

第9章 電気バス市場(バスの全長別)

- イントロダクション

- 9M未満

- 9~14M

- 14M以上

- 主要な業界洞察

第10章 電気バス市場(バッテリータイプ別)

- イントロダクション

- NMCバッテリー

- LFPバッテリー

- NCAバッテリー

- その他

- 主要な業界洞察

第11章 電気バス市場(バッテリー容量別)

- イントロダクション

- 400KWH未満

- 400KWH以上

- 主要な業界洞察

第12章 電気バス市場(出力別)

- イントロダクション

- 250kW未満

- 250kW以上

- 主要な洞察

第13章 電気バス市場(航続距離別)

- イントロダクション

- 300マイル未満

- 300マイル以上

- 主要な洞察

第14章 電気バス市場(乗車定員別)

- イントロダクション

- 40席未満

- 40~70席

- 70席以上

- 主要な業界洞察

第15章 電気バス市場(用途別)

- イントロダクション

- 市内バス/路線バス

- コーチ

- スクールバス

- その他

- 主要な業界洞察

第16章 電気バス市場(消費者別)

- イントロダクション

- プライベート

- 政府

- 主要な業界洞察

第17章 電気バス市場(車両総重量(GVW)別)

- イントロダクション

- 10トン未満

- 10~20トン

- 20トン以上

- 主要な業界洞察

第18章 電気バス市場(推進力別)

- イントロダクション

- バッテリー電気バス

- 燃料電池電気バス

- 主要な業界洞察

第19章 電気バス市場(コンポーネント別)

- イントロダクション

- モーター

- バッテリー

- 燃料電池スタック

- バッテリー管理システム

- バッテリー冷却システム

- DC-DCコンバータ

- インバーター

- AC/DC充電器

- EVコネクタ

- 主要な業界洞察

第20章 電気バス市場(自律走行レベル別)

- イントロダクション

- 半自律型

- 自律型

- 主要な業界洞察

第21章 電気バス市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- シンガポール

- インドネシア

- オーストラリア

- 欧州

- マクロ経済見通し

- フランス

- ドイツ

- スペイン

- イタリア

- ノルウェー

- スウェーデン

- デンマーク

- オランダ

- ベルギー

- 英国

- フィンランド

- ポーランド

- 北米

- マクロ経済見通し

- 米国

- カナダ

- ラテンアメリカ

- マクロ経済見通し

- アルゼンチン

- ブラジル

- チリ

- メキシコ

- コロンビア

- 中東・アフリカ

- マクロ経済見通し

- 南アフリカ

- アラブ首長国連邦

- カタール

第22章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 電気バス市場シェア分析(2024年)

- 収益分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 企業評価

- 財務指標

- ブランド/製品比較

- 競合シナリオ

第23章 企業プロファイル

- 主要参入企業

- BYD COMPANY LTD.

- YUTONG BUS CO., LTD.

- ZHEJIANG GEELY HOLDING GROUP

- DAIMLER TRUCK AG

- NFI GROUP

- AB VOLVO

- CAF(SOLARIS BUS & COACH SP. Z O.O.)

- ZHONGTONG BUS HOLDING CO., LTD.

- CRRC CORPORATION LIMITED

- VDL GROEP

- EBUSCO

- XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.

- その他の企業

- BLUE BIRD CORPORATION

- GILLIG LLC.

- THE LION ELECTRIC COMPANY

- TATA MOTORS LIMITED.

- ASHOK LEYLAND

- SUNDA NEW ENERGY TECHNOLOGY CO., LTD.

- GREE ALTAIRNANO NEW ENERGY INC.

- XIAMEN GOLDEN DRAGON BUS CO. LTD.

- JBM GROUP

- SCANIA AB

- IRIZAR GROUP

- IVECO S.P.A

- BLUEBUS

- BOZANKAYA

- CAETANOBUS

- CHARIOT MOTORS

- HEULIEZ BUS

- OTOKAR OTOMOTIV VE SAVUNMA SANAYI A.S.

- TEMSA

- URSUS S.A.

- VAN HOOL

- KARSAN

- MELLOR

- HINO MOTORS, LTD.

- ANHUI ANKAI AUTOMOBILE CO., LTD.

- OLECTRA GREENTECH LIMITED