|

|

市場調査レポート

商品コード

1275434

アクリレートの世界市場:化学別、用途別(塗料・コーティング、プラスチック、接着剤・シーラント、ファブリック)、最終用途産業別(建築・建設、包装、消費財、自動車、テキスタイル、バイオメディカル)、地域別 - 2028年までの予測Acrylate Market by Chemistry, Application (Paints & Coatings, Plastics, Adhesives & Sealants, Fabrics), End-use Industry (Building & Construction, Packaging, Consumer Goods, Automotive, Textiles, Biomedical), & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| アクリレートの世界市場:化学別、用途別(塗料・コーティング、プラスチック、接着剤・シーラント、ファブリック)、最終用途産業別(建築・建設、包装、消費財、自動車、テキスタイル、バイオメディカル)、地域別 - 2028年までの予測 |

|

出版日: 2023年05月11日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のアクリレートの市場規模は、2023年の108億米ドルから、2028年までに147億米ドルに達し、CAGRで6.4%の成長が予測されています。

アジア太平洋地域には、建築・建設部門が急成長している新興国がいくつかあり、これがアクリレートの需要をさらに押し上げています。この地域では、中国がアクリレートの最大の生産国となっています。中国におけるアクリレート需要の増加は、主に建築・建設、包装、消費財部門の拡大により、さまざまな産業でアクリレートの需要が増加しているためです。

"アクリル酸エチルセグメントは、2022年に第2位のシェアを占めると予想される"

アクリル酸エチル(EA)は、アクリル酸のエチルエステルで、酸触媒の存在下でアクリル酸とエタノールをエステル化することにより生成されます。無色の液体で刺激臭があり、樹脂、ゴム、プラスチック、テキスタイル、不織布、塗料、義歯材料などの製造に使用されています。また、アクリル酸エチルは、各種医薬中間体の合成に試薬として使用されます。

"用途別では、接着剤・シーラントが、金額ベースで予測期間中にアクリレート市場で2番目に急成長すると予想される"

アクリレートは、水性接着剤に広く使用されています。エマルジョン接着剤と分散接着剤の使用の増加が、アクリレートの使用を促進しています。VOC排出規制により、溶剤系接着剤の使用が減り、水性接着剤の採用が増えるため、アクリレート市場に利益がもたらされます。

"地域別では、アジア太平洋地域が、2022年のアクリレートの最大市場(金額ベース)"

アジア太平洋地域は、2022年に金額ベースで世界のアクリレートの最大市場となりました。アジア太平洋地域の市場は、同地域の技術革新、産業拡大、技術開発がアクリレートの消費を後押ししています。また、世界経済の改善も市場の成長を後押しすると予想されます。中国はアジア太平洋地域の主要市場であり、同地域のさまざまな最終用途産業でアクリレートが多く使用されていることから、予測期間中に高い成長を遂げることが期待されています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 特許分析

- エコシステムマッピング

- バリューチェーン分析

- ポーターのファイブフォース分析

- 技術分析

- 貿易分析

- 関税と規制

- 主要な会議とイベント(2022年~2023年)

- 購入決定に影響を与える主な要因

- ケーススタディ分析

- 平均販売価格分析

- 顧客のビジネスに影響を与える動向と混乱

- マクロ経済指標

第6章 アクリレート市場:化学別

- イントロダクション

- アクリル酸ブチル

- アクリル酸エチル

- アクリル酸メチル

- アクリル酸2-エチルヘキシル

- その他

第7章 アクリレート市場:用途別

- イントロダクション

- 塗料・コーティング、印刷用インク

- プラスチック

- 接着剤・シーラント

- ファブリック

- その他

第8章 アクリレート市場:最終用途産業別

- イントロダクション

- 包装

- 消費財

- 建築・建設

- 自動車

- テキスタイル

- バイオメディカル

- 化粧品・パーソナルケア

- その他

第9章 アクリレート市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- 台湾

- オーストラリア

- その他のアジア太平洋地域

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- ベルギー

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要市場企業のランキング分析(2022年)

- 市場シェア分析

- 上位企業の収益分析

- 市場評価マトリックス

- 2022年の企業評価マトリックス(ティア1)

- スタートアップ/中小企業の評価マトリックス

- 企業の最終用途産業のフットプリント

- 企業の地域のフットプリント

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- ARKEMA S.A.

- BASF SE

- DOW INC.

- NIPPON SHOKUBAI CO., LTD.

- EVONIK

- LG CHEM

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SASOL

- SIBUR

- WANHUA CHEMICAL GROUP CO. LTD.

- その他の企業

- KH CHEMICALS

- THE KURARAY GROUP

- LABDHI CHEMICALS

- RESONAC CORPORATION

- SHANGHAI HUAYI ACRYLIC ACID CO., LTD.

- NATIONAL INDUSTRIALIZATION CO.(TASNEE)

- JURONG GROUP

- LOBHA CHEMIE PVT. LTD.

- HIHANG INDUSTRY CO. LTD.

- BPCL

- TOAGOSEI CO. LTD.

- ETERNAL MATERIALS CO. LTD.

- MERCK MILLIPORE

- TCI CHEMICALS

- PARSOL CHEMICALS LTD.

第12章 付録

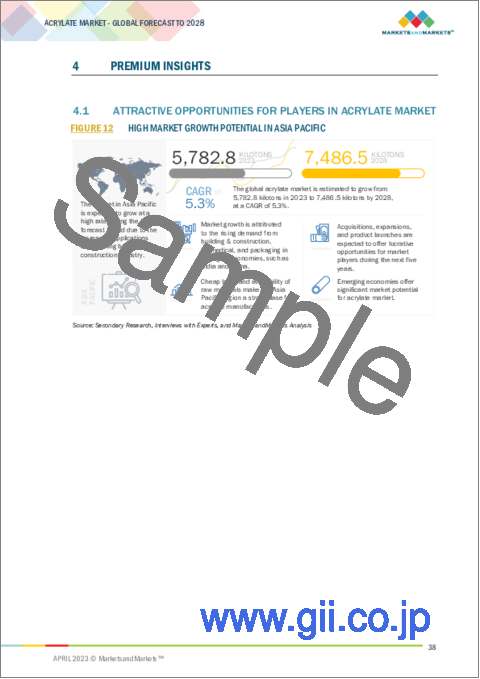

The acrylate market is projected to reach USD 14.7 billion by 2028, at a CAGR of 6.4% from USD 10.8 billion in 2023. Asia Pacific is home to several emerging economies with rapidly growing building and construction sectors, which further drives the demand for acrylates. China is the largest producer of acrylates in the region. The growing demand for acrylates in China is mainly driven by the expanding building and construction, packaging, and consumer goods sectors, which have increased the demand for acrylates in various industries.

"Ethyl Acrylate segment is expected to account for the second-largest share in 2022."

Ethyl acrylate (EA) is the ethyl ester of acrylic acid, produced through the esterification of acrylic acid with ethanol in the presence of acid catalysts. It is a colorless liquid with a pungent odor and is used in the production of resins, rubbers, plastics, textiles, non-woven fibers, paints, and denture materials. Ethyl acrylate is also used as a reagent in the synthesis of various pharmaceutical intermediates.

"Adhesives & sealants is expected to be the second-fastest growing application type for acrylate market during the forecast period, in terms of value."

Acrylates are widely used in water-based adhesives. The increase in the use of emulsion and dispersion adhesives is driving the use of acrylates. The VOC emission regulations will decrease the use of solvent-based adhesives and increase the adoption of water-based adhesives, thus benefiting the acrylate market.

"Based on region, Asia Pacific region was the largest market for acrylate in 2022, in terms of value."

Asia Pacific was the largest market for global acrylate in terms of value in 2022. The market in Asia Pacific is being driven by innovation, industrial expansion, and technological developments in the region, which are fueling the consumption of acrylate. The growth of the market is also expected to be supported by the improving global economy. China is a key market in Asia Pacific and is expected to witness high growth during the forecast period due to the high use of acrylate in various end-use industries in the region.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa-5%, and Latin America-5%

The key players in this market are include Arkema S.A. (France), BASF SE (Germany), Dow Inc. (US), Nippon Shokubai Co., Ltd. (Japan), Evonik (Germany), LG Chem (South Korea), Mitsubishi Chemical Group Corporation (Japan), Sasol (South Africa), Sibur (Russia), and Wanhua Chemical Group Co. Ltd. (China).

Research Coverage

This report segments the acrylate market based on chemistry, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the acrylate market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the acrylate market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on acrylate market offered by top players in the global acrylate market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the acrylate market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for acrylate market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global acrylate market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the acrylate market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 ACRYLATE MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ACRYLATE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 ACRYLATE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 ACRYLATE MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 7 ACRYLATE MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 8 BUTYL ACRYLATE SEGMENT TO DOMINATE DURING FORECAST PERIOD

- FIGURE 9 PAINTS & COATINGS AND PRINTING INKS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PACKAGING INDUSTRY TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACRYLATE MARKET

- FIGURE 12 HIGH MARKET GROWTH POTENTIAL IN ASIA PACIFIC

- 4.2 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 13 BUILDING & CONSTRUCTION SEGMENT AND CHINA ACCOUNTED FOR LARGEST MARKET SIZE IN 2022

- 4.3 ACRYLATE MARKET, BY CHEMISTRY

- FIGURE 14 BUTYL ACRYLATE TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 ACRYLATE MARKET, BY APPLICATION

- FIGURE 15 PAINTS & COATINGS AND PRINTING INKS TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 ACRYLATE MARKET, BY END-USE INDUSTRY

- FIGURE 16 BUILDING & CONSTRUCTION TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 ACRYLATE MARKET, BY KEY COUNTRY

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACRYLATE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of construction and automotive sectors

- 5.2.1.2 Rapid industrialization and urbanization

- 5.2.1.3 Increased use of dispersive adhesives

- 5.2.1.4 Rising demand for coatings in end-use industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental and health hazards

- TABLE 1 ECOTOXICOLOGICAL PROPERTIES

- TABLE 2 ENVIRONMENTAL HAZARD LEVELS

- TABLE 3 ENVIRONMENTAL PROPERTIES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercialization of bio-based acrylic acid

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- 5.2.4.2 Stringent regulations and restrictions

- 5.3 PATENT ANALYSIS

- 5.3.1 METHODOLOGY

- 5.3.2 DOCUMENT TYPES

- FIGURE 19 GRANTED PATENTS

- FIGURE 20 PUBLICATION TRENDS (LAST 10 YEARS)

- 5.3.3 INSIGHTS

- FIGURE 21 JURISDICTION ANALYSIS

- 5.3.4 TOP APPLICANTS

- 5.3.5 PATENTS BY BASF SE

- 5.3.6 PATENTS BY EVONIK ROEHM GMBH

- 5.3.7 MAJOR PATENT OWNERS (LAST 10 YEARS)

- 5.4 ECOSYSTEM MAPPING

- FIGURE 22 ACRYLATE MARKET: ECOSYSTEM

- TABLE 4 KEY PLAYERS IN ACRYLATE ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 ACRYLATE MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 MANUFACTURERS

- 5.5.3 DISTRIBUTORS

- 5.5.4 END USERS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 ACRYLATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 BARGAINING POWER OF BUYERS

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 THREAT OF NEW ENTRANTS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS: ACRYLATE MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 FUNCTIONALIZATION TECHNOLOGY

- 5.7.2 CONTROLLED RADICAL POLYMERIZATION

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT-EXPORT SCENARIO OF ACRYLATE MARKET

- TABLE 6 IMPORT TRADE DATA OF ACRYLATE FOR TOP COUNTRIES, 2020-2022 (USD THOUSAND)

- TABLE 7 EXPORT TRADE DATA OF ACRYLATE FOR TOP COUNTRIES, 2020-2022 (USD THOUSAND)

- 5.9 TARIFFS AND REGULATIONS

- 5.9.1 NORTH AMERICA

- 5.9.2 ASIA PACIFIC

- 5.9.3 EUROPE

- 5.9.4 MIDDLE EAST, AFRICA, AND SOUTH AMERICA

- TABLE 8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2022-2023

- TABLE 9 ACRYLATE MARKET: KEY CONFERENCES AND EVENTS

- 5.11 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.11.1 QUALITY

- 5.11.2 SERVICE

- FIGURE 25 SUPPLIER SELECTION CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ARKEMA S.A.

- 5.12.2 BASF SE

- 5.13 AVERAGE SELLING PRICE ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 26 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 5.13.2 AVERAGE SELLING PRICE, BY APPLICATION

- TABLE 10 AVERAGE SELLING PRICE, BY APPLICATION (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE, BY KEY PLAYER (USD/KILOTON)

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN ACRYLATE MARKET

- 5.15 MACROECONOMIC INDICATORS

- 5.15.1 GROSS DOMESTIC PRODUCT TRENDS AND FORECASTS

- TABLE 11 PROJECTED REAL GROSS DOMESTIC PRODUCT GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.15.2 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 12 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2022 (UNITS)

6 ACRYLATE MARKET, BY CHEMISTRY

- 6.1 INTRODUCTION

- FIGURE 29 BUTYL ACRYLATE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 13 ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 14 ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 15 ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 16 ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- 6.2 BUTYL ACRYLATE

- 6.2.1 USED IN PRODUCTION OF COATINGS, ADHESIVES, AND SEALANTS

- 6.2.2 N-BUTYL ACRYLATE

- TABLE 17 PROPERTIES OF N-BUTYL ACRYLATE

- 6.2.3 T-BUTYL ACRYLATE

- TABLE 18 PROPERTIES OF T-BUTYL ACRYLATE

- 6.2.4 I-BUTYL ACRYLATE

- TABLE 19 PROPERTIES OF I-BUTYL ACRYLATE

- 6.3 ETHYL ACRYLATE

- 6.3.1 USED IN PRODUCTION OF PAINTS, PLASTICS, AND PHARMACEUTICAL INTERMEDIATES

- TABLE 20 PROPERTIES OF ETHYL ACRYLATE

- 6.4 METHYL ACRYLATE

- 6.4.1 USED IN SYNTHETIC CARPETS, PHARMACEUTICAL PRODUCTS, AND ACRYLIC FIBERS

- TABLE 21 PROPERTIES OF METHYL ACRYLATE

- 6.5 2-ETHYLHEXYL ACRYLATE

- 6.5.1 USED IN PRODUCTION OF ACRYLIC POLYMERS

- TABLE 22 PROPERTIES OF 2-ETHYLHEXYL ACRYLATE

- 6.6 OTHER CHEMISTRIES

7 ACRYLATE MARKET, BY APPLICATION

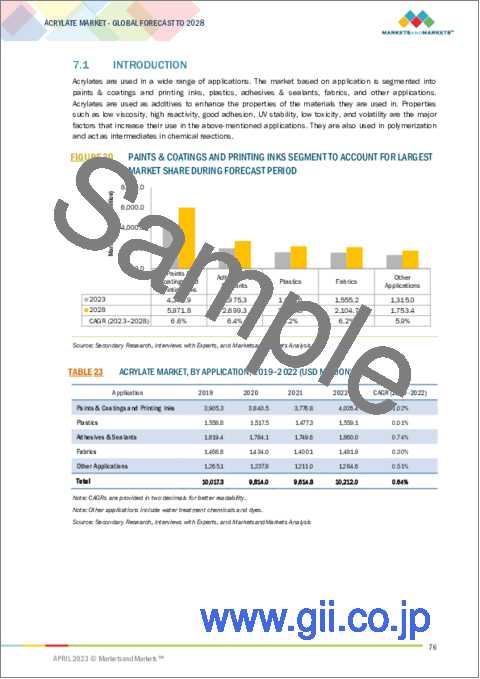

- 7.1 INTRODUCTION

- FIGURE 30 PAINTS & COATINGS AND PRINTING INKS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 23 ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 24 ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 25 ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 26 ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 7.2 PAINTS & COATINGS AND PRINTING INKS

- 7.2.1 INCREASED USE OF PAINTS AND INKS TO FUEL DEMAND FOR ACRYLATE MONOMERS

- 7.3 PLASTICS

- 7.3.1 HIGH PRODUCTION OF POLYMERS AND PLASTICS TO BOOST DEMAND FOR ACRYLATES

- 7.4 ADHESIVES & SEALANTS

- 7.4.1 GROWTH OF CONSTRUCTION AND AUTOMOTIVE INDUSTRIES TO INCREASE DEMAND FOR DISPERSIVE ADHESIVES

- 7.5 FABRICS

- 7.5.1 RISE IN TEXTILE INDUSTRY TO DRIVE DEMAND FOR ACRYLATES

- 7.6 OTHER APPLICATIONS

8 ACRYLATE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 31 BUILDING & CONSTRUCTION INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 27 ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 29 ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 30 ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.2 PACKAGING

- 8.2.1 USE OF ACRYLIC ADHESIVES IN PACKAGING TO DRIVE MARKET

- 8.3 CONSUMER GOODS

- 8.3.1 INCREASING USE OF COATINGS, FABRICS, AND INKS TO FUEL DEMAND FOR ACRYLATES

- 8.4 BUILDING & CONSTRUCTION

- 8.4.1 INCREASING USE OF ACRYLIC SEALANTS IN CONSTRUCTION ACTIVITIES TO PROPEL MARKET

- 8.5 AUTOMOTIVE

- 8.5.1 RESISTANCE TO ABRASION AND ENVIRONMENTAL FACTORS TO FUEL DEMAND FOR ACRYLATE MONOMERS

- 8.6 TEXTILES

- 8.6.1 USE OF ACRYLIC FIBERS IN TEXTILE INDUSTRY TO DRIVE MARKET

- 8.7 BIOMEDICAL

- 8.7.1 USE OF ACRYLATE MONOMERS IN TARGETED DRUG DELIVERY TO PROPEL MARKET

- 8.8 COSMETICS & PERSONAL CARE

- 8.8.1 INCREASING USE OF COSMETICS TO FUEL DEMAND FOR ACRYLATES

- 8.9 OTHER END-USE INDUSTRIES

9 ACRYLATE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 31 ACRYLATE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 ACRYLATE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 ACRYLATE MARKET, BY REGION, 2019-2022 (KILOTON)

- TABLE 34 ACRYLATE MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: ACRYLATE MARKET SNAPSHOT

- TABLE 35 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 36 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 38 ASIA PACIFIC: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 39 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 40 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 42 ASIA PACIFIC: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- TABLE 43 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 44 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 46 ASIA PACIFIC: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 47 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 48 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 50 ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.1 RECESSION IMPACT ON ASIA PACIFIC

- 9.2.2 CHINA

- 9.2.2.1 Growing construction industry to drive market

- TABLE 51 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 52 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 53 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 54 CHINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.3 JAPAN

- 9.2.3.1 Rise in tourism industry to drive market

- TABLE 55 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 56 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 57 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 58 JAPAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.4 INDIA

- 9.2.4.1 Government infrastructure projects to fuel market growth

- TABLE 59 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 60 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 61 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 62 INDIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Environmental sustainability to boost market

- TABLE 63 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 64 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 65 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 66 SOUTH KOREA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.6 TAIWAN

- 9.2.6.1 Export-oriented economy to boost market

- TABLE 67 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 68 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 69 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 70 TAIWAN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.7 AUSTRALIA

- 9.2.7.1 Development initiatives by government to drive market

- TABLE 71 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 72 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 73 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 74 AUSTRALIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.8 REST OF ASIA PACIFIC

- TABLE 75 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 76 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 77 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 78 REST OF ASIA PACIFIC: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3 EUROPE

- FIGURE 34 EUROPE: ACRYLATE MARKET SNAPSHOT

- TABLE 79 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 81 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 82 EUROPE: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 83 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 84 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 86 EUROPE: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- TABLE 87 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 90 EUROPE: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 91 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 92 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 93 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 94 EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.1 RECESSION IMPACT ON EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Growth of packaging industry to drive market

- TABLE 95 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 96 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 97 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 98 GERMANY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.3 UK

- 9.3.3.1 Rise in biopharmaceutical industry to propel market

- TABLE 99 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 100 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 101 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 102 UK: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.4 FRANCE

- 9.3.4.1 Demand for sustainable packaging to fuel market growth

- TABLE 103 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 104 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 105 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 106 FRANCE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5 ITALY

- 9.3.5.1 Growth of packaging industry to fuel demand for acrylates

- TABLE 107 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 108 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 109 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 110 ITALY: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.6 SPAIN

- 9.3.6.1 Increased foreign investments and economic growth to drive market

- TABLE 111 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 113 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 114 SPAIN: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.7 NETHERLANDS

- 9.3.7.1 Renovation strategies to fuel demand for acrylates

- TABLE 115 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 116 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 117 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 118 NETHERLANDS: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.8 BELGIUM

- 9.3.8.1 Growth of construction industry to propel market

- TABLE 119 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 120 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 121 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 122 BELGIUM: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.9 REST OF EUROPE

- TABLE 123 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 126 REST OF EUROPE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 127 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 130 NORTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 131 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 134 NORTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- TABLE 135 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 136 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 137 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 138 NORTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 139 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 140 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 141 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 142 NORTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.1 RECESSION IMPACT ON NORTH AMERICA

- 9.4.2 US

- 9.4.2.1 Need for sustainable packaging products to fuel acrylate demand

- TABLE 143 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 144 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 145 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 146 US: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.3 CANADA

- 9.4.3.1 Foreign trade to drive market

- TABLE 147 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 148 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 149 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 150 CANADA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.4 MEXICO

- 9.4.4.1 Advancements in construction sector to fuel demand for acrylates

- TABLE 151 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 152 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 153 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 154 MEXICO: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5 SOUTH AMERICA

- TABLE 155 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 156 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 157 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 158 SOUTH AMERICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 159 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 160 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 161 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 162 SOUTH AMERICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- TABLE 163 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 164 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 166 SOUTH AMERICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 167 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 168 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 169 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 170 SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.1 BRAZIL

- 9.5.1.1 Rising demand for sustainable packaging solutions from agricultural sector to drive acrylate market

- TABLE 171 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 172 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 173 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 174 BRAZIL: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.2 ARGENTINA

- 9.5.2.1 Rising urban population to increase demand for residential and commercial buildings

- TABLE 175 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 176 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 177 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 178 ARGENTINA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.3 REST OF SOUTH AMERICA

- TABLE 179 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 182 REST OF SOUTH AMERICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 183 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2019-2022 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2019-2022 (KILOTON)

- TABLE 190 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY CHEMISTRY, 2023-2028 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.1 SAUDI ARABIA

- 9.6.1.1 Development in real estate sector to fuel demand for acrylates

- TABLE 199 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 200 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 201 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 202 SAUDI ARABIA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.2 UAE

- 9.6.2.1 Construction pipelines to fuel demand for acrylate

- TABLE 203 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 204 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 205 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 206 UAE: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ACRYLATE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 36 COMPANIES ADOPTED ACQUISITIONS AND EXPANSIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN ACRYLATE MARKET, 2022

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 38 ACRYLATE MARKET SHARE, BY COMPANY (2022)

- TABLE 211 ACRYLATE MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 212 ACRYLATE MARKET: REVENUE ANALYSIS

- 10.5 MARKET EVALUATION MATRIX

- TABLE 213 MARKET EVALUATION MATRIX

- 10.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 39 ACRYLATE MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.7 START-UP/SME EVALUATION MATRIX

- 10.7.1 RESPONSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 PROGRESSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 40 ACRYLATE MARKET: START-UP/SME MATRIX, 2022

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- 10.10 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 41 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ACRYLATE MARKET

- 10.11 BUSINESS STRATEGY EXCELLENCE

- FIGURE 42 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN ACRYLATE MARKET

- 10.12 COMPETITIVE SCENARIO

- 10.12.1 PRODUCT LAUNCHES

- TABLE 214 PRODUCT LAUNCHES, 2018-2023

- 10.12.2 DEALS

- TABLE 215 DEALS, 2018-2023

- 10.12.3 OTHER DEVELOPMENTS

- TABLE 216 OTHER DEVELOPMENTS, 2018-2023

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 KEY PLAYERS

- 11.1.1 ARKEMA S.A.

- TABLE 217 ARKEMA S.A.: COMPANY OVERVIEW

- FIGURE 43 ARKEMA S.A.: COMPANY SNAPSHOT

- TABLE 218 ARKEMA S.A.: PRODUCTS OFFERED

- TABLE 219 ARKEMA S.A.: PRODUCT LAUNCHES

- TABLE 220 ARKEMA S.A.: DEALS

- TABLE 221 ARKEMA S.A.: OTHERS

- 11.1.2 BASF SE

- TABLE 222 BASF SE: COMPANY OVERVIEW

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- TABLE 223 BASF SE: PRODUCTS OFFERED

- TABLE 224 BASF SE: DEALS

- TABLE 225 BASF SE: OTHERS

- 11.1.3 DOW INC.

- TABLE 226 DOW INC.: COMPANY OVERVIEW

- FIGURE 45 DOW INC.: COMPANY SNAPSHOT

- TABLE 227 DOW INC.: PRODUCTS OFFERED

- TABLE 228 DOW INC.: PRODUCT LAUNCHES

- TABLE 229 DOW INC.: OTHERS

- 11.1.4 NIPPON SHOKUBAI CO., LTD.

- TABLE 230 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- FIGURE 46 NIPPON SHOKUBAI CO. LTD.: COMPANY SNAPSHOT

- TABLE 231 NIPPON SHOKUBAI CO., LTD.: PRODUCTS OFFERED

- TABLE 232 NIPPON SHOKUBAI CO., LTD.: DEALS

- TABLE 233 NIPPON SHOKUBAI CO., LTD.: OTHERS

- 11.1.5 EVONIK

- TABLE 234 EVONIK: COMPANY OVERVIEW

- FIGURE 47 EVONIK: COMPANY SNAPSHOT

- TABLE 235 EVONIK: PRODUCTS OFFERED

- TABLE 236 EVONIK: DEALS

- TABLE 237 EVONIK: OTHERS

- 11.1.6 LG CHEM

- TABLE 238 LG CHEM: COMPANY OVERVIEW

- FIGURE 48 LG CHEM: COMPANY SNAPSHOT

- TABLE 239 LG CHEM: PRODUCTS OFFERED

- 11.1.7 MITSUBISHI CHEMICAL GROUP CORPORATION

- TABLE 240 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- FIGURE 49 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- TABLE 241 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS OFFERED

- TABLE 242 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- 11.1.8 SASOL

- TABLE 243 SASOL: COMPANY OVERVIEW

- FIGURE 50 SASOL: COMPANY SNAPSHOT

- TABLE 244 SASOL: PRODUCTS OFFERED

- 11.1.9 SIBUR

- TABLE 245 SIBUR: COMPANY OVERVIEW

- TABLE 246 SIBUR: PRODUCTS OFFERED

- 11.1.10 WANHUA CHEMICAL GROUP CO. LTD.

- TABLE 247 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY OVERVIEW

- FIGURE 51 WANHUA CHEMICAL GROUP CO. LTD.: COMPANY SNAPSHOT

- TABLE 248 WANHUA CHEMICAL GROUP CO. LTD.: PRODUCTS OFFERED

- 11.2 OTHER PLAYERS

- 11.2.1 KH CHEMICALS

- 11.2.2 THE KURARAY GROUP

- 11.2.3 LABDHI CHEMICALS

- 11.2.4 RESONAC CORPORATION

- 11.2.5 SHANGHAI HUAYI ACRYLIC ACID CO., LTD.

- 11.2.6 NATIONAL INDUSTRIALIZATION CO. (TASNEE)

- 11.2.7 JURONG GROUP

- 11.2.8 LOBHA CHEMIE PVT. LTD.

- 11.2.9 HIHANG INDUSTRY CO. LTD.

- 11.2.10 BPCL

- 11.2.11 TOAGOSEI CO. LTD.

- 11.2.12 ETERNAL MATERIALS CO. LTD.

- 11.2.13 MERCK MILLIPORE

- 11.2.14 TCI CHEMICALS

- 11.2.15 PARSOL CHEMICALS LTD.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS