|

|

市場調査レポート

商品コード

1259446

ポリブチレンアジペートテレフタレート (PBAT) の世界市場:グレード別・用途別 (フィルム・シート・ビンライナー、コーティング・接着剤、成形品、繊維)・最終用途産業別 (包装、日用品、農業、生物医学)・地域別の将来予測 (2027年まで)Polybutylene Adipate Terephthalate Market by Grade, Application (Films, Sheets & Bin Liners, Coatings & Adhesives, Molded Products, Fibers), End-Use Industry (Packaging, Consumer Goods, Agriculture, Bio-medical), and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポリブチレンアジペートテレフタレート (PBAT) の世界市場:グレード別・用途別 (フィルム・シート・ビンライナー、コーティング・接着剤、成形品、繊維)・最終用途産業別 (包装、日用品、農業、生物医学)・地域別の将来予測 (2027年まで) |

|

出版日: 2023年04月13日

発行: MarketsandMarkets

ページ情報: 英文 242 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリブチレンアジペートテレフタレート (PBAT) の市場規模は、2022年の15億米ドルから13.1%のCAGRで成長し、2027年には28億米ドルに達すると予測されています。

新興市場での需要拡大や消費者の関心増大が、PBATのメーカーに大きな成長機会をもたらすと期待されています。

"PBAT市場の包装セグメントでは、非食品包装が金額ベースで最大のシェアを占める"

PBATは、持続可能で環境に優しい包装材料の製造に広く使用されている生分解性ポリマーです。PBATベースの包装材料は、化粧品・日用品・パーソナルケア製品など、食品以外の製品に使用されています。さらに非食品包装業界では、環境への影響を軽減するために持続可能なソリューションの採用が進んでいます。従来の包装材料に代わる環境に優しい代替品を求める企業が増えており、この動向がPBAT市場の成長を後押ししています。

"成形品は、金額ベースで2番目に急成長している用途である"

PBATは、その熱可塑性の性質により、様々な成形品の製造に使用することができます。このため、簡単に溶かしてさまざまな形状に成形することができます。PBAT成形品の一般的な用途としては、使い捨て型カトラリー、食品包装、医療機器、日用品などが挙げられます。

"欧州はPBATの2番目に大きな市場である"

欧州はPBATの第二の市場です。特に、ドイツ・イタリア・フランス・スペイン・英国が主要国となっています。この地域では、生分解性ポリマー市場の成長の回復が期待されており、各国は顧客の要求やニーズに合わせて新しい包装技術に多額の投資を行っています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 原材料の分析

- ポーターのファイブフォース分析

- 影響分析

- エコシステム

- 特許分析

- 平均販売価格分析

- 関税と規制

- 購入決定に影響を与える主な要因

- 主な会議とイベント (2023年)

- 顧客のビジネスに影響を与える動向/混乱

- マクロ経済指標

- 技術分析

- 貿易分析

- 製造工程の評価

- ケーススタディ分析

第6章 ポリブチレンアジペートテレフタレート市場:グレード別

- イントロダクション

- 押出グレード

- 熱成形グレード

- その他のグレード

第7章 ポリブチレンアジペートテレフタレート市場:用途別

- イントロダクション

- フィルム・シート・ビンライナー (ゴミ袋)

- コーティング・接着剤

- 成形品

- 繊維

- その他の用途

第8章 ポリブチレンアジペートテレフタレート市場:最終用途産業別

- イントロダクション

- 包装

- 食品包装

- 非食品包装

- 日用品

- 農業

- マルチフィルム

- 網製品

- 生物医学

- その他の最終用途産業

第9章 ポリブチレンアジペートテレフタレート市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- トルコ

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業のランキング分析 (2022年)

- 市場シェア分析

- 主要企業の収益分析

- 市場評価マトリックス

- 企業評価マトリックス (ティア1、2022年)

- スタートアップ・中小企業の評価マトリックス

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- BASF SE

- KINGFA SCI & TEC CO

- NOVAMONT S.P.A

- GO YEN CHEMICAL INDUSTRIAL CO., LTD. (GYC GROUP)

- ANHUI JUMEI BIOTECHNOLOGY CO., LTD

- CHANG CHUN GROUP

- HANGZHOU PEIJIN CHEMICAL CO., LTD

- JINHUI ZHAOLONG ADVANCED TECHNOLOGY CO., LTD.

- MITSUI PLASTICS, INC.

- WILLEAP

- ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO., LTD

- その他の主要企業

- DONGGUAN XINHAI ENVIRONMENTAL-FRIENDLY MATERIAL CO., LTD

- GREEN SCIENCE ALLIANCE

- HENGLI PETROCHEMICAL

- JUNYUAN PETROLEUM GROUP

- KD. FEDDERSEN & CO.

- LOTTE CHEMICALS

- NANJING BAITONG NEW MATERIAL CO. LTD

- ORINKO ADVANCED PLASTICS CO. LTD

- QINGDAO ZHOUSHI PLASTIC PACKAGING CO. LTD

- RED AVENUE NEW MATERIALS GROUP CO. LTD

- SGA POLYCHEM PVT LTD

- TASNEE NEW MATERIAL (WEIFANG) CO. LTD

- TORISE BIOMATERIALS CO. LTD

- XINJIANG BLUE RIDGE TUNHE SCI. & TECH. CO. LTD

第12章 付録

The global PBAT market is projected to reach USD 2.8 billion by 2027, at a CAGR of 13.1% from USD 1.5 billion in 2022. Rising demand from emerging markets and growing consumer awareness are expected to offer significant growth opportunities to manufacturers of PBAT.

"The non-food packaging accounted for the largest share in the packaging segment of PBAT market in terms of value."

PBAT is a biodegradable polymer widely used in the production of sustainable and environmentally friendly packaging materials. In the non-food packaging industry, PBAT-based packaging materials are used for products other than food items, such as cosmetics, household goods, and personal care products. Moreover, the non-food packaging industry is increasingly adopting sustainable solutions to reduce environmental impact. This trend is driving the growth of the PBAT market as more companies are looking for eco-friendly alternatives to traditional packaging materials.

"Molded products is the second-fastest growing application of PBAT, in terms of value."

PBAT can be used in the manufacturing of various molded products due to its thermoplastic nature. This enables it to be easily melted and molded into different shapes. Some common applications of PBAT molded products include disposable cutlery, food packaging, medical devices and consumer goods.

"Europe is estimated to be the second-largest market for PBAT"

Europe is the second market for PBAT. Germany, Italy, France, Spain, and the UK are the major countries in the European PBAT market. The region has a strong industrial base in developed economies, such as the UK, France, Italy, Spain, and Germany. The region is expecting a rebound in the growth of the biodegradable polymers market, with the countries investing heavily in new packaging technology to suit customer demands and needs.

Europe accounts for a significant share of the PBAT market due to the high consumer demand for sustainable packaging materials. The governments of European countries are promoting the use of biodegradable plastics, such as PBAT, by setting up the infrastructure for composting these plastics.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the PBAT market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives- 20%, Directors - 10%, and Others - 70%

- By Region: APAC - 50%, Europe - 20%, North America - 10%, the Middle East & Africa -10%, and South America- 10%

The key players in this market are BASF SE (Germany), Novamont S.p.A (Italy), Willeap (South Korea), Kingfa (China), Hangzhou Peijin Chemical Co. Ltd (China), Zhejiang Biodegradable Advanced Material Co. Ltd (China), Anhui Jumei Biotechnology (China), Go Yen Chemical Industrial Co., Ltd (Taiwan), Jinhui Zhaolong Advanced Technology Co. Ltd (China), Mitsui Plastics, Inc (US), and Chang Chun Group (China).

Research Coverage

This report segments the market for PBAT market on the basis of grade, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for PBAT market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the PBAT market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on PBAT market offered by top players in the global PBAT market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the PBAT market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for PBAT market across regions.

- Market Capacity: Production capacities of companies producing PBAT are provided wherever available with upcoming capacities for the PBAT market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the PBAT market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 3 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 6 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND MARKET RISKS

3 EXECUTIVE SUMMARY

- FIGURE 7 EXTRUSION GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 FILMS, SHEETS & BIN LINERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 PACKAGING INDUSTRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET

- FIGURE 11 HIGH GROWTH POTENTIAL IN ASIA PACIFIC TO DRIVE MARKET

- 4.2 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, TOP THREE END-USE INDUSTRIES AND COUNTRIES

- FIGURE 12 PACKAGING SEGMENT AND CHINA TO LEAD MARKET IN ASIA PACIFIC

- 4.3 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE

- FIGURE 13 EXTRUSION GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

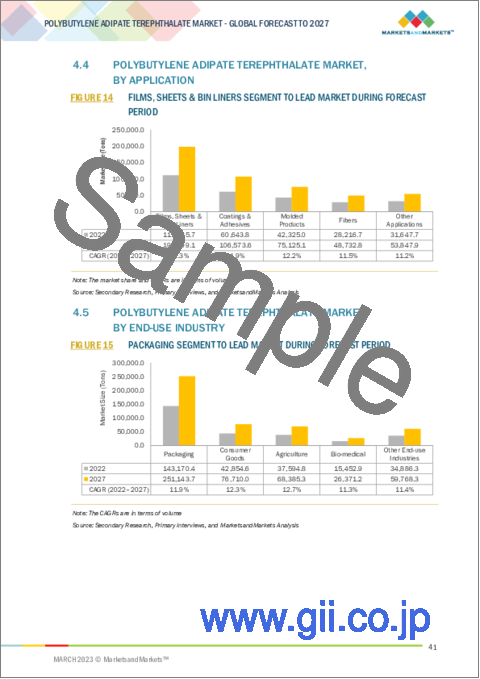

- 4.4 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION

- FIGURE 14 FILMS, SHEETS & BIN LINERS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY

- FIGURE 15 PACKAGING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY

- FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Shift in consumer preference toward bio-based plastics

- TABLE 1 ADVERSE HEALTH EFFECTS DUE TO CONVENTIONAL PLASTICS USAGE

- TABLE 2 UPCOMING POLYBUTYLENE ADIPATE TEREPHTHALATE CAPACITIES

- 5.2.1.2 Increasing use of packaging and compostable applications

- 5.2.1.3 Technological advancements in biodegradable plastics

- 5.2.1.4 Government focus on green procurement policies and regulations

- TABLE 3 REGULATIONS ON USE OF PLASTIC BAGS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Technical characteristics and performance issues of PBAT

- 5.2.2.2 High production cost of PBAT

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of new applications

- 5.2.3.2 High potential of PBAT in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Easy availability of competitive products

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 RESIN MANUFACTURERS

- 5.3.3 COMPOUNDERS

- 5.3.4 END PRODUCT MANUFACTURERS

- 5.3.5 DISTRIBUTORS/END CONSUMERS

- 5.4 RAW MATERIAL ANALYSIS

- 5.4.1 SUGARCANE

- 5.4.2 CORN STARCH

- 5.4.3 VEGETABLE OIL

- 5.4.4 ADIPIC ACID

- 5.4.5 TEREPHTHALIC ACID

- 5.4.6 1,4-BUTANEDIOL

- 5.4.7 SUCCINIC ACID

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES MODEL ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREATS OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 4 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6 IMPACT ANALYSIS

- 5.7 ECOSYSTEM

- FIGURE 20 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: ECOSYSTEM

- TABLE 5 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: ECOSYSTEM

- 5.8 PATENT ANALYSIS

- 5.8.1 INTRODUCTION

- 5.8.2 METHODOLOGY

- 5.8.3 DOCUMENT TYPE

- FIGURE 21 PATENT APPLICATIONS SEGMENT TO ACCOUNT FOR HIGHEST COUNT SHARE IN LAST TEN YEARS

- FIGURE 22 PUBLICATION TRENDS OVER LAST TEN YEARS

- 5.8.4 INSIGHTS

- 5.8.5 LEGAL STATUS OF PATENTS

- FIGURE 23 LEGAL STATUS OF PATENTS

- 5.8.6 JURISDICTION ANALYSIS

- FIGURE 24 TOP JURISDICTIONS, BY DOCUMENT

- 5.8.7 TOP COMPANIES/APPLICANTS

- TABLE 6 TOP TEN PATENT OWNERS IN LAST TEN YEARS

- 5.9 AVERAGE SELLING PRICE ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- 5.9.2 AVERAGE SELLING PRICE, BY APPLICATION

- TABLE 7 AVERAGE SELLING PRICE BASED ON APPLICATIONS (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE, BY MARKET PLAYER (USD/KG)

- 5.10 TARIFF & REGULATIONS

- 5.10.1 NORTH AMERICA

- 5.10.1.1 US

- 5.10.1.2 Canada

- 5.10.2 ASIA PACIFIC

- 5.10.3 EUROPE

- 5.10.4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 NORTH AMERICA

- 5.11 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.11.1 QUALITY

- 5.11.2 SERVICE

- FIGURE 27 SUPPLIER SELECTION CRITERION

- 5.12 KEY CONFERENCES & EVENTS, 2023

- TABLE 9 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: LIST OF CONFERENCES & EVENTS, 2023

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET

- 5.14 MACROECONOMIC INDICATORS

- 5.14.1 GROSS DOMESTIC PRODUCT TRENDS AND FORECASTS

- TABLE 10 PROJECTED REAL GROSS DOMESTIC PRODUCT GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018-2025

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 ENZYMATIC RECYCLING OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.15.2 3D PRINTING OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.15.3 BIOMEDICAL APPLICATIONS OF POLYBUTYLENE ADIPATE TEREPHTHALATE

- 5.16 TRADE ANALYSIS

- TABLE 11 IMPORT TRADE DATA FOR ADIPIC ACID OF TOP TEN COUNTRIES, 2018-2022 (USD THOUSAND)

- TABLE 12 EXPORT TRADE DATA FOR ADIPIC ACID OF TOP TEN COUNTRIES, 2018-2022 (USD THOUSAND)

- 5.17 MANUFACTURING PROCESS ASSESSMENT

- 5.17.1 MANUFACTURING PROCESS

- 5.17.2 SUCCESS FACTORS

- 5.17.3 RISK FACTORS

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 BASF SE

- 5.18.2 BIOBAG

6 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE

- 6.1 INTRODUCTION

- FIGURE 29 EXTRUSION GRADE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 13 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 14 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 15 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 16 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- 6.2 EXTRUSION GRADE

- 6.2.1 GOOD MELT STRENGTH AND VISCOSITY OF POLYBUTYLENE ADIPATE TEREPHTHALATE TO MAKE EXTRUSION FAVORABLE

- 6.3 THERMOFORMING GRADE

- 6.3.1 LOW SHRINKAGE AND EXCELLENT CLARITY OF POLYBUTYLENE ADIPATE TEREPHTHALATE TO HELP IN THERMOFORMING PROCESS

- 6.4 OTHER GRADES

7 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 30 FILMS, SHEETS & BIN LINERS APPLICATION TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 17 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 18 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 19 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 20 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- 7.2 FILMS, SHEETS & BIN LINERS

- 7.2.1 BIODEGRADABILITY AND COMPOSTABILITY OF POLYBUTYLENE ADIPATE TEREPHTHALATE TO DRIVE DEMAND

- 7.3 COATINGS & ADHESIVES

- 7.3.1 POLYBUTYLENE ADIPATE TEREPHTHALATE COATING TO IMPROVE SHELF LIFE OF MATERIALS

- 7.4 MOLDED PRODUCTS

- 7.4.1 THERMOPLASTIC NATURE OF POLYBUTYLENE ADIPATE TEREPHTHALATE TO HELP MANUFACTURE MOLDED PRODUCTS

- 7.5 FIBERS

- 7.5.1 POLYBUTYLENE ADIPATE TEREPHTHALATE FIBERS TO BE CONSIDERED SUSTAINABLE ALTERNATIVE TO SYNTHETIC FIBERS

- 7.6 OTHER APPLICATIONS

8 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 31 PACKAGING SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 21 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 22 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 23 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 24 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 8.2 PACKAGING

- 8.2.1 RISING DEMAND FOR ENVIRONMENT-FRIENDLY FOOD PACKAGING SOLUTIONS TO DRIVE MARKET

- 8.2.2 FOOD PACKAGING

- 8.2.3 NON-FOOD PACKAGING

- 8.3 CONSUMER GOODS

- 8.3.1 INCREASING INCLINATION OF MANUFACTURERS TOWARD GREEN PRODUCTS TO BOOST MARKET

- 8.4 AGRICULTURE

- 8.4.1 INCREASING USAGE OF POLYBUTYLENE ADIPATE TEREPHTHALATE IN MULCH FILMS TO PROPEL MARKET

- 8.4.2 MULCH FILMS

- 8.4.3 NETTING

- 8.5 BIO-MEDICAL

- 8.5.1 GROWING USAGE OF POLYBUTYLENE ADIPATE TEREPHTHALATE IN BONE IMPLANT SECTOR TO DRIVE MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 25 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 27 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2018-2021 (TON)

- TABLE 28 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY REGION, 2022-2027 (TON)

- 9.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 29 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 30 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 31 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 32 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 33 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 34 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 35 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 36 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- TABLE 37 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 38 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 39 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 40 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- TABLE 41 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 42 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 43 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 44 ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2.1 CHINA

- 9.2.1.1 Ban on single-use plastics and rising awareness regarding negative impacts of plastic waste to drive market

- TABLE 45 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 46 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 47 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 48 CHINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2.2 JAPAN

- 9.2.2.1 Implementation of policies promoting biodegradable plastics and reducing plastic waste to drive market

- TABLE 49 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 50 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 51 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 52 JAPAN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2.3 INDIA

- 9.2.3.1 Increasing consumer awareness about negative impact of plastic waste on environment to drive market

- TABLE 53 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 54 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 55 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 56 INDIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Focus on environmental sustainability and reducing plastic waste to boost market

- TABLE 57 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 58 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 59 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 60 SOUTH KOREA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.2.5 REST OF ASIA PACIFIC

- TABLE 61 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 62 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 64 REST OF ASIA PACIFIC: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3 EUROPE

- FIGURE 34 EUROPE: MARKET SNAPSHOT

- TABLE 65 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 66 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 67 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 68 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 69 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 70 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 71 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 72 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- TABLE 73 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 74 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 75 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 76 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- TABLE 77 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 78 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 79 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 80 EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.1 GERMANY

- 9.3.1.1 Consumer awareness about importance of sustainable products and strict government regulations to drive market

- TABLE 81 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 82 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 83 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 84 GERMANY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.2 UK

- 9.3.2.1 Implementation of policies and regulations to reduce plastic waste to drive market

- TABLE 85 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 86 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 87 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 88 UK: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.3 FRANCE

- 9.3.3.1 Demand for sustainable biodegradable plastics from consumers to drive market

- TABLE 89 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 90 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 91 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 92 FRANCE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.4 ITALY

- 9.3.4.1 Booming food processing industry to drive market

- TABLE 93 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 94 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 95 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 96 ITALY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.5 SPAIN

- 9.3.5.1 Rising demand for sustainable packaging solutions to drive market

- TABLE 97 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 98 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 99 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 100 SPAIN: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.6 TURKEY

- 9.3.6.1 Implementation of government policies to ban single-use plastic bags to drive market

- TABLE 101 TURKEY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 102 TURKEY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 103 TURKEY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 104 TURKEY: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.3.7 REST OF EUROPE

- TABLE 105 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 106 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 107 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 108 REST OF EUROPE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.4 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 109 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 112 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 113 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 115 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 116 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- TABLE 117 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 118 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 119 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 120 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- TABLE 121 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 122 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 123 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 124 NORTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.4.1 US

- 9.4.1.1 Focus on manufacturing bioplastic packaging products by private sector companies to boost market

- TABLE 125 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 126 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 127 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 128 US: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.4.2 CANADA

- 9.4.2.1 Prime focus of plastic industry on manufacturing certified compostable bags to drive market

- TABLE 129 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 130 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 131 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 132 CANADA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.4.3 MEXICO

- 9.4.3.1 Growing developments in biodegradable plastics sector and focus on sustainability to influence market

- TABLE 133 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 134 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 135 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 136 MEXICO: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.5 SOUTH AMERICA

- TABLE 137 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 138 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 139 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 140 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 141 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 142 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 143 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 144 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- TABLE 145 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 147 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 148 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- TABLE 149 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 150 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 151 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 152 SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.5.1 BRAZIL

- 9.5.1.1 Rising demand for sustainable packaging solutions from agricultural sector to drive market

- TABLE 153 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 154 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 155 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 156 BRAZIL: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.5.2 ARGENTINA

- 9.5.2.1 Rising demand for environmentally friendly materials and growing adoption of biodegradable plastics to drive market

- TABLE 157 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 158 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 159 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 160 ARGENTINA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.5.3 REST OF SOUTH AMERICA

- TABLE 161 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 163 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 164 REST OF SOUTH AMERICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 165 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 168 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY COUNTRY, 2022-2027 (TON)

- TABLE 169 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2018-2021 (TON)

- TABLE 172 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY GRADE, 2022-2027 (TON)

- TABLE 173 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 176 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY APPLICATION, 2022-2027 (TON)

- TABLE 177 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 180 MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.6.1 SAUDI ARABIA

- 9.6.1.1 Decision of SASO to limit application of technical regulations for biodegradable plastics to drive market

- TABLE 181 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 182 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 183 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 184 SAUDI ARABIA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.6.2 UAE

- 9.6.2.1 Consumer demand for eco-friendly products and government initiatives to reduce plastic waste to drive market

- TABLE 185 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 186 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 187 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 188 UAE: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Advancements in bioplastics research to improve management of renewable biological resources and propel market

- TABLE 189 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 190 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 191 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 192 SOUTH AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

- 9.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 193 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 194 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (USD MILLION)

- TABLE 195 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2018-2021 (TON)

- TABLE 196 REST OF MIDDLE EAST & AFRICA: POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, BY END-USE INDUSTRY, 2022-2027 (TON)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- FIGURE 36 ACQUISITIONS AND EXPANSIONS ADOPTED BY COMPANIES AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2022

- 10.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET, 2022

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 38 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET SHARE, BY COMPANY, 2022

- TABLE 197 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE ANALYSIS OF TOP PLAYERS

- 10.5 MARKET EVALUATION MATRIX

- TABLE 198 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET EVALUATION MATRIX

- 10.6 COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 39 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.7 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES EVALUATION MATRIX

- 10.7.1 RESPONSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 PROGRESSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 40 POLYBUTYLENE ADIPATE TEREPHTHALATE MARKET: STARTUPS AND SMES MATRIX, 2022

- 10.7.5 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.7.6 COMPANY REGION FOOTPRINT

- 10.8 STRENGTH OF PRODUCT PORTFOLIO

- 10.9 BUSINESS STRATEGY EXCELLENCE

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES

- TABLE 199 PRODUCT LAUNCHES, 2018-2022

- 10.10.2 DEALS

- TABLE 200 DEALS, 2018-2022

- 10.10.3 OTHER DEVELOPMENTS

- TABLE 201 OTHER DEVELOPMENTS, 2018-2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 11.1.1 BASF SE

- TABLE 202 BASF SE: COMPANY OVERVIEW

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- TABLE 203 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 BASF SE: DEALS

- 11.1.2 KINGFA SCI & TEC CO

- TABLE 205 KINGFA SCI & TEC CO: COMPANY OVERVIEW

- TABLE 206 KINGFA SCI & TEC CO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 KINGFA SCI & TEC CO: OTHERS

- 11.1.3 NOVAMONT S.P.A

- TABLE 208 NOVAMONT S.P.A: COMPANY OVERVIEW

- TABLE 209 NOVAMONT S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NOVAMONT S.P.A: PRODUCT LAUNCHES

- TABLE 211 NOVAMONT SPA: DEALS

- TABLE 212 NOVAMONT SPA: OTHERS

- 11.1.4 GO YEN CHEMICAL INDUSTRIAL CO., LTD. (GYC GROUP)

- TABLE 213 GO YEN CHEMICAL INDUSTRIAL CO., LTD. (GYC GROUP): COMPANY OVERVIEW

- TABLE 214 GO YEN CHEMICAL INDUSTRIAL CO., LTD. (GYC GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 ANHUI JUMEI BIOTECHNOLOGY CO., LTD

- TABLE 215 ANHUI JUMEI BIOTECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 216 ANHUI JUMEI BIOTECHNOLOGY CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.6 CHANG CHUN GROUP

- TABLE 217 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 218 CHANG CHUN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.7 HANGZHOU PEIJIN CHEMICAL CO., LTD

- TABLE 219 HANGZHOU PEIJIN CHEMICAL CO., LTD: COMPANY OVERVIEW

- TABLE 220 HANGZHOU PEIJEN CHEMICAL CO. LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.8 JINHUI ZHAOLONG ADVANCED TECHNOLOGY CO., LTD.

- TABLE 221 JINHUI ZHAOLONG ADVANCED TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 222 JINHUI ZHAOLONG ADVANCED TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.9 MITSUI PLASTICS, INC.

- TABLE 223 MITSUI PLASTICS, INC.: COMPANY OVERVIEW

- TABLE 224 MITSUI PLASTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.10 WILLEAP

- TABLE 225 WILLEAP: COMPANY OVERVIEW

- TABLE 226 WILLEAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.11 ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO., LTD

- TABLE 227 ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO., LTD: COMPANY OVERVIEW

- TABLE 228 ZHEJIANG BIODEGRADABLE ADVANCED MATERIAL CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 11.2 OTHER KEY PLAYERS

- 11.2.1 DONGGUAN XINHAI ENVIRONMENTAL-FRIENDLY MATERIAL CO., LTD

- 11.2.2 GREEN SCIENCE ALLIANCE

- 11.2.3 HENGLI PETROCHEMICAL

- 11.2.4 JUNYUAN PETROLEUM GROUP

- 11.2.5 KD. FEDDERSEN & CO.

- 11.2.6 LOTTE CHEMICALS

- 11.2.7 NANJING BAITONG NEW MATERIAL CO. LTD

- 11.2.8 ORINKO ADVANCED PLASTICS CO. LTD

- 11.2.9 QINGDAO ZHOUSHI PLASTIC PACKAGING CO. LTD

- 11.2.10 RED AVENUE NEW MATERIALS GROUP CO. LTD

- 11.2.11 SGA POLYCHEM PVT LTD

- 11.2.12 TASNEE NEW MATERIAL (WEIFANG) CO. LTD

- 11.2.13 TORISE BIOMATERIALS CO. LTD

- 11.2.14 XINJIANG BLUE RIDGE TUNHE SCI. & TECH. CO. LTD

12 APPENDIX

- 12.1 INSIGHTS OF INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS