|

|

市場調査レポート

商品コード

1252925

ビタミンの世界市場:製品種類別 (ビタミンA、ビタミンB、ビタミンC、ビタミンD、ビタミンE、ビタミンK)・用途別 (ヘルスケア製品、食品・飲料、飼料、パーソナルケア用品)・原料別 (合成、天然)・地域別の将来予測 (2028年まで)Vitamins Market by Type (Vitamin A, Vitamin B, Vitamin C, Vitamin D, Vitamin E, & Vitamin K), Application (Healthcare Products, Food & Beverages, Feed, and Personal Care Products), Source (Synthetic and Natural) and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ビタミンの世界市場:製品種類別 (ビタミンA、ビタミンB、ビタミンC、ビタミンD、ビタミンE、ビタミンK)・用途別 (ヘルスケア製品、食品・飲料、飼料、パーソナルケア用品)・原料別 (合成、天然)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月29日

発行: MarketsandMarkets

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のビタミンの市場規模は、2023年には67億米ドル、2028年には89億米ドルに達すると予測され、金額ベースで予測期間中に6.0%のCAGRで成長するとされています。

ビタミン欠乏症の蔓延が、全世界のビタミン市場を牽引しています。

世界保健機関 (WHO) によると、ビタミンA欠乏症は子どもの予防可能な失明の原因となり、下痢やはしかなどの感染症のリスクを高める。妊娠中、ビタミンAの欠乏は妊娠第3期に起こります。適切な母乳育児は、6~59ヶ月の乳幼児のビタミンA欠乏症を防ぐことができます。また、適切な日光浴の不足や日焼け止めの使用の増加により、ビタミンD欠乏症は大人でも非常に多く見られます。パンデミック後は、在宅勤務の動向もあり、状況は非常に悪くなっています。このことから、ビタミン市場はメーカーにとって大きな可能性を持っていることがわかります。消費者に受け入れられやすいように、日用食品にビタミンを添加するメーカーもあります。このような製品を開拓することで、メーカー各社は成長するビタミン市場を開拓することができます。

"種類別では、予測期間中、ビタミンBセグメントが最大となる"

ビタミンBは、炭水化物や脂肪を使ってエネルギーを放出したり、アミノ酸を分解したり、エネルギーを含んだ酸素や栄養素を体に運んだりと、人体で様々な役割を担っています。ビタミンBは7種類あり、各々が皮膚強化、赤血球と細胞エネルギーの生産、神経系の適切な機能など、体内で異なる役割を担っています。また、ビタミンBは代謝、免疫力の維持、消化器官の健康にも役立ちます。このことから、ビタミンBはメーカーに成長機会を提供することがわかります。

"用途別では、食品・飲料セグメントが予測期間中に最も高い成長率で成長する"

より良いライフスタイルの開拓に必要な食生活の活用が進んでいることから、食品・飲料分野が世界のビタミン市場を独占しています。消費者の健康意識は高まり、食事にビタミンを加えることに積極的になっています。その結果、多くの企業が様々なビタミンやミネラルを添加した強化型食品・飲料を提供しています。

"原料別では、天然セグメントが予測期間中に最も高い成長率で成長すると予想されています。"

ビタミン市場を原料別に見ると、健康への関心の高まりによる天然製品への需要の高まりから、天然セグメントが予測期間中に最大のシェアを占めると予測されます。天然ビタミンは、植物、果物、その他の天然資源に由来する栄養素やミネラルを使用して作られています。天然資源に由来するため、アレルギー反応や有害な副作用を引き起こすことはありません。また、長期的な健康効果をもたらします。需要増加を受けて、メーカーは継続的に新製品の発売で動作しています。

"アジア太平洋がビタミン市場を独占する"

アジア太平洋は人口が多く、また中流家庭や健康志向の高い消費者の増加により、ビタミンや栄養補助食品の需要が高まっています。各国では健康志向が高まっており、ビタミンやその他の栄養補助食品の需要増につながる可能性があります。また、各国政府は国民に健康的なライフスタイルと予防ヘルスケアを推奨しており、これがサプリメントやビタミンの需要増加につながっています。国別では、中国は人口が多く、健康への関心が高まっているため、この地域で最大の市場シェアを占めています。eコマースの増加により、顧客は自分の都合に合わせて製品を購入することができるようになりました。これがビタミン市場の拡大に寄与しています。

当レポートでは、世界のビタミンの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・用途別・原料別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- 顧客のビジネスに影響を与える動向

- 価格分析

- バリューチェーン

- ビタミン市場のマッピングとエコシステム

- 貿易データ:ビタミン市場

- ポーターのファイブフォース分析

- 技術分析

- 特許分析

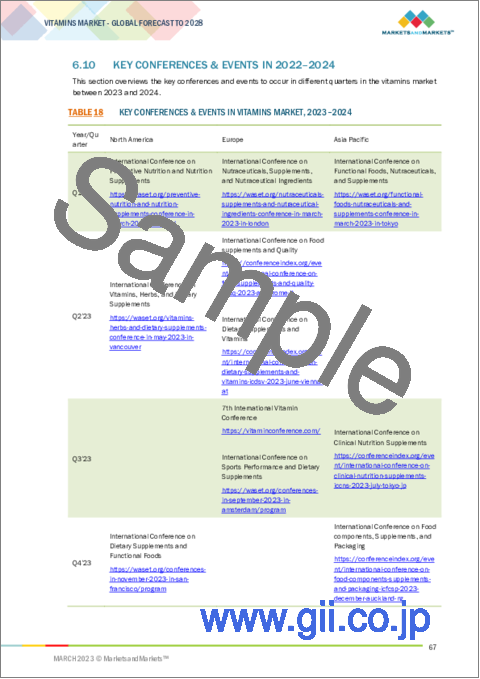

- 主な会議とイベント (2022年~2024年)

- 関税・規制状況

- 主な利害関係者と購入基準

- ケーススタディ

第7章 ビタミン市場:種類別

- イントロダクション

- ビタミンB

- ビタミンE

- ビタミンD

- ビタミンC

- ビタミンA

- ビタミンK

第8章 ビタミン市場:用途別

- イントロダクション

- ヘルスケア製品

- 食品・飲料

- 幼児食

- 乳製品

- ベーカリー製品・菓子類

- 飲料

- その他

- 飼料

- パーソナルケア用品

第9章 ビタミン市場:原料別

- イントロダクション

- 合成

- 天然

第10章 ビタミン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 主要企業の過去の収益分析

- 市場シェア分析

- 企業評価クアドラント (主要企業)

- ビタミン市場:スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

- 製品の発売

第12章 企業プロファイル

- 主要企業

- KONINKLIJKE DSM N.V.

- GLANBIA PLC

- ADM

- BASF

- LONZA GROUP

- ADISSEO

- VITABLEND NEDERLAND B.V.

- STERNVITAMIN GMBH & CO. KG

- FARBEST-TALLMAN FOODS CORPORATION

- THE WRIGHT GROUP

- ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD

- NEWGEN PHARMA

- RABAR PTY LTD.

- RESONAC

- BTSA BIOTECNOLOGIAS APLICADAS S.L

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- ビタミン・ミネラルプレミックス市場

- ビタミンD市場

第14章 付録

According to MarketsandMarkets, the vitamins market size is estimated to be valued at USD 6.7 billion in 2023 and is projected to reach USD 8.9 billion by 2028, recording a CAGR of 6.0% during the forecast period in terms of value. The increasing prevalence of vitamin deficiencies is driving the vitamins market across the globe.

According to the World Health Organization (WHO), vitamin A deficiency causes preventable blindness in children and increases the risk of infections like diarrhea and measles. During pregnancy, Vitamin A deficiency occurs in the third trimester. Proper breastfeeding can prevent vitamin A deficiency in infants and children between 6-59 months. Vitamin D deficiency is also very common in adults due to the lack of proper sun exposure and an increase in the use of sunblock. After the pandemic, the situation has become very bad due to the trend of working from home. This shows that the vitamins market has a lot of scope for the manufacturers. Some manufacturers are adding vitamins to daily food products so that consumers will accept their products easily. For example, The Wright Group introduced the vit-A rice, which contains vitamin A and folic acid. Developing such products can tap the growing vitamin market of manufacturers.

"By type, the Vitamin B segment is the largest segment during the forecast period."

Vitamin B has different roles to play in the human body, like releasing energy using carbohydrates and fats, breaking down the amino acids, and transporting the oxygen and nutrients which contains the energy to the body. Vitamin B is of seven types. They are B1, B2, B3, B5, B6, B9, and B12. The different type has different roles in the body, like enhancement of skin, production of red blood cell & cellular energy, and proper functioning of the nervous system. Vitamin B6& vitamin B12 help in reducing the risk of cancer and heart attacks. Vitamin B also helps in metabolism, maintaining immunity, and digestive health. This shows that vitamin B provides growth opportunities for manufacturers.

"By application, the food & beverages segment is expected to grow at the highest growth rate during the forecast period."

The food & beverages segment dominated the global vitamins market due to the increase in the utilization of dietary requirements in the development of a better lifestyle. Vitamins help in increasing immunity and give protection from various diseases. Consumers are becoming health conscious and willing to add vitamins to their diets. As a result, many companies are offering fortified food & drinks by adding various vitamins and minerals. Due to the popularity of fortified products, the vitamins market is growing. This creates new product launches, and continuous efforts in R&D. all the above factors help the Vitamins manufacturers to expand their business.

"By source, natural segment is expected to grow at the highest growth rate during the forecast period."

The natural segment, based on source, is projected to account for the largest share during the forecast period due to the rising demand for natural products due to increasing health concerns. Natural vitamins are made using the nutrients and minerals which are derived from plants, fruits, and other natural sources. They create allergic reactions and harmful side effects as they are derived from natural resources. Natural vitamins give long-term health benefits. As the demand is increasing, manufacturers are continuously working on new product launches. This creates the manufacturers to develop their business and meet the customers' demands.

"Asia Pacific market is estimated to dominate the vitamins market. "

Due to the large population, the increase in the number of middle-class families and health-conscious consumers increases the demand for vitamins and nutritional supplements. Asia Pacific is becoming more health conscious. These changes can lead to an increase in demand for vitamins and other dietary supplements. The governments in the Asia Pacific region are encouraging people towards healthy lifestyles and preventative healthcare, which has led to the increased demand for supplements and vitamins. The leading countries in the region include China, Japan, India, and Australia. China has a vast population and an increase in health concerns holds the largest market share in this region. The increase in e-commerce has helped customers to buy products at their convenience. This contributed to the expansion of the vitamin market.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Value Chain: Demand side- 43%, Supply-side- 57%

By Designation: CXOs- 29%, Managers- 21%, Executives- 50%

By Region: Asia Pacific- 16%, Europe- 37%, North America- 34%, Rest of the World- 12%, and RoW - 13%

Key vendors operating in this market are Koninklijke DSM N.V.(Netherlands), Glanbia PLC(Ireland), ADM (US), BASF (Germany), and Lonza Group(Switzerland), Adisseo (China), Vitablend Nederland B.V.(Netherlands).

Research Coverage:

This research report categorizes the vitamins market by application (healthcare products, food & beverages, feed, and personal care products), by Type (vitamin A, vitamin B, vitamin C, vitamin D, vitamin E, and vitamin K), by Source (natural and synthetic), and Region (North America, Europe, Asia Pacific, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the vitamins market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, new product launches, mergers & acquisitions, partnerships, agreements, and other recent developments with the vitamins market. Competitive analysis of upcoming startups in the vitamins market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall vitamins market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for nutritionally enriched processed food products in the market, Increasing prevalence of vitamin deficiencies, Feed fortification due to rise in global meat & dairy product consumption and feed production), restraints (Constrained supply of raw materials for natural vitamins coupled with high costs), opportunities (Sourcing of natural allergen-free vitamin E, Application of vitamin D in personal care products), and challenges (Scarcity of ingredients and price sensitivity, Environmental impact resulting in changes in regulatory policies) influencing the growth of the C4ISR market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the vitamins market

- Market Development: Comprehensive information about lucrative markets - the report analyses the C4ISR market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the vitamins market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Koninklijke DSM N.V., Glanbia PLC, ADM, BASF, Lonza Group, and among others in the vitamins market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2022

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 VITAMINS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH ONE: BOTTOM UP

- FIGURE 4 VITAMINS MARKET: APPROACH ONE (BOTTOM UP)

- 2.2.2 APPROACH TWO: TOP DOWN

- FIGURE 5 VITAMINS MARKET: APPROACH TWO (TOP DOWN)

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

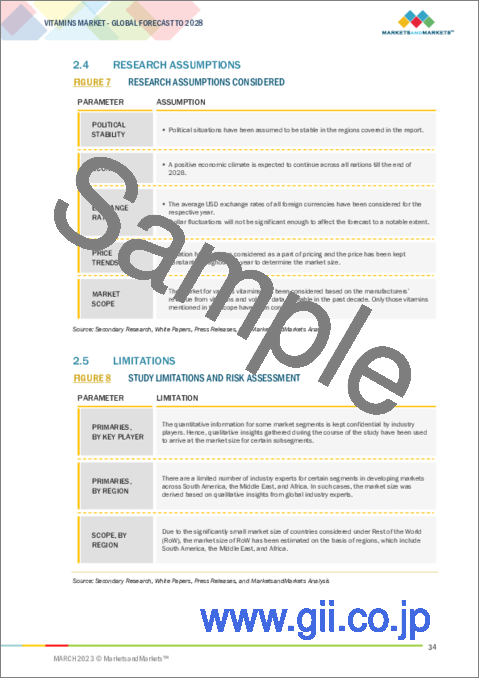

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 RESEARCH ASSUMPTIONS CONSIDERED

- 2.5 LIMITATIONS

- FIGURE 8 STUDY LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT ON VITAMINS MARKET

- 2.6.1 MACROINDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE, 2011-2021

- FIGURE 11 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON VITAMINS MARKET

- FIGURE 13 GLOBAL VITAMINS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 2 VITAMINS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 VITAMINS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VITAMINS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VITAMINS MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VITAMINS MARKET SHARE, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN VITAMINS MARKET

- FIGURE 18 GROWTH IN DEMAND FOR FUNCTIONAL AND NUTRITIONALLY ENRICHED PROCESSED FOOD PRODUCTS TO DRIVE DEMAND FOR VITAMINS

- 4.2 GLOBAL VITAMINS MARKET: CAGR OF MAJOR REGIONAL SUBMARKETS

- FIGURE 19 CHINA WAS FASTEST-GROWING MARKET GLOBALLY FOR VITAMINS IN 2022

- 4.3 ASIA PACIFIC: VITAMINS MARKET, BY TYPE & KEY COUNTRY

- FIGURE 20 VITAMIN B ACCOUNTED FOR LARGEST SHARE IN ASIA PACIFIC VITAMINS MARKET

- 4.4 GLOBAL VITAMINS MARKET, BY APPLICATION & REGION

- FIGURE 21 ASIA PACIFIC AND HEALTHCARE PRODUCTS SEGMENTS PROJECTED TO DOMINATE MARKET

- 4.5 GLOBAL VITAMINS MARKET, BY TYPE

- FIGURE 22 VITAMIN B PROJECTED TO DOMINATE DURING FORECAST PERIOD

- 4.6 GLOBAL VITAMINS MARKET, BY SOURCE

- FIGURE 23 SYNTHETIC SEGMENT PROJECTED TO DOMINATE VITAMINS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWING MICRONUTRIENT DEFICIENCY

- TABLE 3 VITAMIN DEFICIENCY AND ASSOCIATED RISKS

- 5.3 MARKET DYNAMICS

- FIGURE 24 MARKET DYNAMICS: VITAMINS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Growing demand for nutritionally enriched processed food products in market

- 5.3.1.2 Increasing prevalence of vitamin deficiencies

- 5.3.1.3 Feed fortification due to rise in global meat & dairy product consumption and feed production

- FIGURE 25 MEAT CONSUMPTION, BY LIVESTOCK MEAT TYPE, 2015-2024 (KT CWE)

- FIGURE 26 TOP 10 FEED-PRODUCING COUNTRIES, 2021 (MMT)

- 5.3.2 RESTRAINTS

- 5.3.2.1 Constrained supply of raw materials for natural vitamins coupled with high costs

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Sourcing of natural allergen-free vitamin E

- 5.3.3.2 Applications of vitamin D in personal care products

- 5.3.4 CHALLENGES

- 5.3.4.1 Scarcity of ingredients and price sensitivity

- 5.3.4.2 Environmental impact resulting in changes in regulatory policies

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS IMPACTING CUSTOMERS' BUSINESS

- FIGURE 27 REVENUE SHIFT FOR VITAMINS MARKET

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND ANALYSIS

- TABLE 4 VITAMINS MARKET: AVERAGE SELLING PRICE, BY TYPE & REGION, 2022 (USD/TON)

- TABLE 5 VITAMIN A: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- TABLE 6 VITAMIN B: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- TABLE 7 VITAMIN C: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- TABLE 8 VITAMIN D: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- TABLE 9 VITAMIN E: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- TABLE 10 VITAMIN K: AVERAGE SELLING PRICE, BY REGION, 2017-2022 (USD/TON)

- 6.4 VALUE CHAIN

- 6.4.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.4.2 RAW MATERIAL SOURCING

- 6.4.3 PRODUCTION AND PROCESSING

- 6.4.4 DISTRIBUTION

- 6.4.5 MARKETING & SALES

- FIGURE 28 VALUE CHAIN ANALYSIS OF VITAMINS MARKET

- 6.5 MARKET MAPPING AND ECOSYSTEM OF VITAMINS

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 29 VITAMINS: MARKET MAP

- TABLE 11 VITAMINS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.6 TRADE DATA: VITAMINS MARKET

- TABLE 12 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019 (USD THOUSAND)

- TABLE 13 IMPORT DATA OF VITAMINS, BY COUNTRY, 2019 (TONS)

- TABLE 14 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019 (USD THOUSAND)

- TABLE 15 EXPORT DATA OF VITAMINS, BY COUNTRY, 2019 (TONS)

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 VITAMINS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 TECHNOLOGY ANALYSIS

- 6.9 PATENT ANALYSIS

- FIGURE 30 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2023

- TABLE 17 PATENTS PERTAINING TO VITAMINS, 2020-2023

- 6.10 KEY CONFERENCES & EVENTS IN 2022-2024

- TABLE 18 KEY CONFERENCES & EVENTS IN VITAMINS MARKET, 2023-2024

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 VITAMIN REGULATIONS IN NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.3 VITAMIN REGULATIONS IN EUROPE

- 6.11.4 VITAMIN REGULATIONS IN ASIA PACIFIC

- 6.11.4.1 China

- 6.11.4.2 India

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING VITAMINS FOR DIFFERENT END-USE APPLICATIONS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VITAMINS

- 6.12.1 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP VITAMIN APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR KEY VITAMIN APPLICATIONS

- 6.13 CASE STUDIES

- TABLE 24 CASE STUDY: NEED FOR PLANT-BASED VITAMIN A TO CURB DEFICIENCY

7 VITAMINS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 33 VITAMINS MARKET, BY TYPE, 2023 VS. 2028

- TABLE 25 VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 26 VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 VITAMIN B

- 7.2.1 RISING AWARENESS OF VITAMIN B-FORTIFIED FOODS TO BOOST MARKET

- TABLE 27 VITAMIN B MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 VITAMIN B MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 29 VITAMIN B MARKET, BY REGION, 2017-2022 (KT)

- TABLE 30 VITAMIN B MARKET, BY REGION, 2023-2028 (KT)

- 7.3 VITAMIN E

- 7.3.1 LIFE-THREATENING CONDITIONS CAUSED BY VITAMIN E DEFICIENCY TO BOOST DEMAND

- TABLE 31 VITAMIN E MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 32 VITAMIN E MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 33 VITAMIN E MARKET, BY REGION, 2017-2022 (KT)

- TABLE 34 VITAMIN E MARKET, BY REGION, 2023-2028 (KT)

- 7.4 VITAMIN D

- 7.4.1 LESS SUN EXPOSURE AND INCREASING USAGE OF SUNBLOCK CAUSING VITAMIN D DEFICIENCY TO DRIVE DEMAND

- TABLE 35 VITAMIN D MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 VITAMIN D MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 37 VITAMIN D MARKET, BY REGION, 2017-2022 (KT)

- TABLE 38 VITAMIN D MARKET, BY REGION, 2023-2028 (KT)

- 7.5 VITAMIN C

- 7.5.1 SALES OF VITAMIN C GROWING DUE TO INCREASING APPLICATION IN IRON SUPPLEMENTS

- TABLE 39 VITAMIN C MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 VITAMIN C MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 41 VITAMIN C MARKET, BY REGION, 2017-2022 (KT)

- TABLE 42 VITAMIN C MARKET, BY REGION, 2023-2028 (KT)

- 7.6 VITAMIN A

- 7.6.1 INCREASING PREVALENCE OF VITAMIN A DEFICIENCY TO DEMAND INCREASED FORTIFICATION

- TABLE 43 VITAMIN A MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 VITAMIN A MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 45 VITAMIN A MARKET, BY REGION, 2017-2022 (KT)

- TABLE 46 VITAMIN A MARKET, BY REGION, 2023-2028 (KT)

- 7.7 VITAMIN K

- 7.7.1 IMPORTANCE OF VITAMIN K FOR BONE AND BLOOD HEALTH TO FUEL DEMAND

- TABLE 47 VITAMIN K MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 VITAMIN K MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 49 VITAMIN K MARKET, BY REGION, 2017-2022 (KT)

- TABLE 50 VITAMIN K MARKET, BY REGION, 2023-2028 (KT)

8 VITAMINS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 VITAMINS MARKET SHARE, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 51 VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 52 VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 HEALTHCARE PRODUCTS

- 8.2.1 GROWING FOCUS OF HEALTH-CONSCIOUS CONSUMERS ON PREVENTATIVE HEALTHCARE TO DRIVE MARKET

- TABLE 53 HEALTHCARE PRODUCTS: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 HEALTHCARE PRODUCTS: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 FOOD & BEVERAGES

- 8.3.1 NEED TO FULFILL DIETARY REQUIREMENTS TO CONTRIBUTE TO GROWTH IN DEMAND

- TABLE 55 FOOD & BEVERAGES: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 FOOD & BEVERAGES: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 INFANT FOOD

- 8.3.3 DAIRY PRODUCTS

- 8.3.4 BAKERY & CONFECTIONERY PRODUCTS

- 8.3.5 BEVERAGES

- 8.3.6 OTHERS

- TABLE 57 FOOD & BEVERAGES: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 58 FOOD & BEVERAGES: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.4 FEED

- 8.4.1 GROWING FOCUS OF DEVELOPING ECONOMIES ON ANIMAL NUTRITION TO FUEL DEMAND

- TABLE 59 FEED: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 FEED: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 PERSONAL CARE PRODUCTS

- 8.5.1 INCREASING DEMAND FOR PRODUCTS CONTAINING ESSENTIAL VITAMINS TO DRIVE GROWTH OF SEGMENT

- TABLE 61 PERSONAL CARE PRODUCTS: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 PERSONAL CARE PRODUCTS: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 VITAMINS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- FIGURE 35 VITAMINS MARKET, BY SOURCE, 2023 VS. 2028

- TABLE 63 VITAMINS MARKET, BY SOURCE, 2017-2022 (USD MILLION)

- TABLE 64 VITAMINS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 9.2 SYNTHETIC

- 9.2.1 LOW PRODUCTION COST OF SYNTHETIC VITAMINS TO FUEL DEMAND

- TABLE 65 SYNTHETIC: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 SYNTHETIC: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 NATURAL

- 9.3.1 RISING DEMAND FOR NATURAL PRODUCTS TO BOOST GROWTH

- TABLE 67 NATURAL: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 NATURAL: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 VITAMINS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO BE FASTEST-GROWING MARKET, 2023-2028

- TABLE 69 VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 VITAMINS MARKET, BY REGION, 2017-2022 (KT)

- TABLE 72 VITAMINS MARKET, BY REGION, 2023-2028 (KT)

- 10.2 NORTH AMERICA

- TABLE 73 NORTH AMERICA: VITAMINS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: VITAMINS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2017-2022 (KT)

- TABLE 78 NORTH AMERICA: VITAMINS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 79 NORTH AMERICA: VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: VITAMINS MARKET, BY SOURCE, 2017-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: VITAMINS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 37 NORTH AMERICAN VITAMINS MARKET: RECESSION IMPACT ANALYSIS

- 10.2.2 US

- 10.2.2.1 Rising demand and multiple strategic deals by key players to boost growth

- TABLE 83 US: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 84 US: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Growing importance of fortification in human and animal diets to fuel demand for vitamins

- TABLE 85 CANADA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 86 CANADA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 High prevalence of lifestyle diseases to demand more health supplements fortified with vitamins

- TABLE 87 MEXICO: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 88 MEXICO: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 38 EUROPE: VITAMINS MARKET SNAPSHOT

- TABLE 89 EUROPE: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 90 EUROPE: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 EUROPE: VITAMINS MARKET, BY SOURCE, 2017-2022 (USD MILLION)

- TABLE 92 EUROPE: VITAMINS MARKET, BY NATURE, 2023-2028 (USD MILLION)

- TABLE 93 EUROPE: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 94 EUROPE: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 95 EUROPE: VITAMINS MARKET, BY TYPE, 2017-2022 (KT)

- TABLE 96 EUROPE: VITAMINS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 97 EUROPE: VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 98 EUROPE: VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Changing lifestyles and preferences for fortified food and dietary supplements to contribute to growth

- TABLE 99 GERMANY: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 100 GERMANY: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising applications of wheat protein in feed sector to drive market

- TABLE 101 FRANCE: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 102 FRANCE: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Rising popularity of dietary supplements to fuel growth of vitamins market

- TABLE 103 UK: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 104 UK: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Rising popularity of healthy and functional foods driving demand for vitamins

- TABLE 105 ITALY: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 106 ITALY: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Growing feed and food ingredients market to fuel demand for vitamins

- TABLE 107 SPAIN: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 108 SPAIN: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- 10.3.7.1 Growing economies and rising awareness of health to drive demand for vitamins

- TABLE 109 REST OF EUROPE: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 39 ASIA PACIFIC: VITAMINS MARKET SNAPSHOT

- TABLE 111 ASIA PACIFIC: VITAMINS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: VITAMINS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: VITAMINS MARKET, BY SOURCE, 2017-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: VITAMINS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: VITAMINS MARKET SIZE, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2017-2022 (KT)

- TABLE 118 ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 119 ASIA PACIFIC: VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Large geriatric population to fuel demand for vitamins

- TABLE 121 CHINA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 122 CHINA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Significant demand for nutrient-enriched products to support market growth

- TABLE 123 JAPAN: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 124 JAPAN: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Rising popularity of dietary supplements to fuel demand for vitamins

- TABLE 125 INDIA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 126 INDIA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.5 AUSTRALIA & NEW ZEALAND

- 10.4.5.1 Changing consumer preferences and increasing health consciousness to drive demand

- TABLE 127 AUSTRALIA & NEW ZEALAND: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- 10.4.6.1 Growing trend of combining beauty solutions with health to augment demand for vitamins

- TABLE 129 REST OF ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5 ROW

- 10.5.1 ROW: RECESSION IMPACT ANALYSIS

- TABLE 131 ROW: VITAMINS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 132 ROW: VITAMINS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 133 ROW: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 134 ROW: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 135 ROW: VITAMINS MARKET, BY TYPE, 2017-2022 (KT)

- TABLE 136 ROW: VITAMINS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 137 ROW: VITAMINS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 138 ROW: VITAMINS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 139 ROW: VITAMINS MARKET, BY SOURCE, 2017-2022 (USD MILLION)

- TABLE 140 ROW: VITAMINS MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Increased vitamin consumption to fuel growth

- TABLE 141 SOUTH AMERICA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increasing demand for processed food products to drive market

- TABLE 143 MIDDLE EAST: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.4 AFRICA

- 10.5.4.1 High prevalence of malnutrition and micronutrient deficiencies to fuel demand for vitamin supplements

- TABLE 145 AFRICA: VITAMINS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 146 AFRICA: VITAMINS MARKET, BY TYPE, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 147 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2020-2022 (USD BILLION)

- 11.4 MARKET SHARE ANALYSIS

- TABLE 148 MARKET SHARE ANALYSIS OF VITAMINS MARKET, 2022

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 41 VITAMINS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 11.5.5 VITAMINS MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 149 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 150 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

- TABLE 151 COMPANY FOOTPRINT, BY SOURCE (KEY PLAYERS)

- TABLE 152 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 153 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- 11.6 VITAMINS MARKET: EVALUATION QUADRANT OF STARTUPS/SMES

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 42 VITAMINS MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 11.6.5 VITAMINS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 154 VITAMINS MARKET: PRODUCT LAUNCHES, 2019-2023

- TABLE 155 VITAMINS MARKET: DEALS, 2019-2022

- TABLE 156 VITAMINS MARKET: OTHERS, 2019-2022

12 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)*

- 12.1 KEY PLAYERS

- 12.1.1 KONINKLIJKE DSM N.V.

- TABLE 157 KONINKLIJKE DSM N.V.: BUSINESS OVERVIEW

- FIGURE 43 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

- TABLE 158 KONINKLIJKE DSM N.V.: PRODUCTS OFFERED

- TABLE 159 KONINKLIJKE DSM N.V.: PRODUCT LAUNCHES

- TABLE 160 KONINKLIJKE DSM N.V.: DEALS

- TABLE 161 KONINKLIJKE DSM N.V.: OTHERS

- 12.1.2 GLANBIA PLC

- TABLE 162 GLANBIA PLC: BUSINESS OVERVIEW

- FIGURE 44 GLANBIA PLC: COMPANY SNAPSHOT

- TABLE 163 GLANBIA PLC: PRODUCTS OFFERED

- 12.1.3 ADM

- TABLE 164 ADM: BUSINESS OVERVIEW

- FIGURE 45 ADM: COMPANY SNAPSHOT

- TABLE 165 ADM: PRODUCTS OFFERED

- TABLE 166 ADM: DEALS

- 12.1.4 BASF

- TABLE 167 BASF: BUSINESS OVERVIEW

- FIGURE 46 BASF: COMPANY SNAPSHOT

- TABLE 168 BASF: PRODUCTS OFFERED

- 12.1.5 LONZA GROUP

- TABLE 169 LONZA GROUP: BUSINESS OVERVIEW

- FIGURE 47 LONZA GROUP: COMPANY SNAPSHOT

- TABLE 170 LONZA GROUP: PRODUCTS OFFERED

- 12.1.6 ADISSEO

- TABLE 171 ADISSEO: BUSINESS OVERVIEW

- TABLE 172 ADISSEO: PRODUCTS OFFERED

- 12.1.7 VITABLEND NEDERLAND B.V.

- TABLE 173 VITABLEND NEDERLAND B.V.: BUSINESS OVERVIEW

- TABLE 174 VITABLEND NEDERLAND B.V.: PRODUCTS OFFERED

- 12.1.8 STERNVITAMIN GMBH & CO. KG

- TABLE 175 STERNVITAMIN GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 176 STERNVITAMIN GMBH & CO. KG: PRODUCTS OFFERED

- 12.1.9 FARBEST-TALLMAN FOODS CORPORATION

- TABLE 177 FARBEST-TALLMAN: BUSINESS OVERVIEW

- TABLE 178 FARBEST-TALLMAN: PRODUCTS OFFERED

- TABLE 179 FARBEST-TALLMAN: OTHERS

- 12.1.10 THE WRIGHT GROUP

- TABLE 180 THE WRIGHT GROUP: BUSINESS OVERVIEW

- TABLE 181 THE WRIGHT GROUP: PRODUCTS OFFERED

- 12.1.11 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD

- TABLE 182 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: BUSINESS OVERVIEW

- TABLE 183 ZHEJIANG GARDEN BIOCHEMICAL HIGH-TECH CO., LTD: PRODUCTS OFFERED

- 12.1.12 NEWGEN PHARMA

- TABLE 184 NEWGEN PHARMA: BUSINESS OVERVIEW

- TABLE 185 NEWGEN PHARMA: PRODUCTS OFFERED

- 12.1.13 RABAR PTY LTD.

- TABLE 186 RABAR PTY LTD.: BUSINESS OVERVIEW

- TABLE 187 RABAR PTY LTD.: PRODUCTS OFFERED

- 12.1.14 RESONAC

- TABLE 188 RESONAC: BUSINESS OVERVIEW

- TABLE 189 RESONAC: PRODUCTS OFFERED

- 12.1.15 BTSA BIOTECNOLOGIAS APLICADAS S.L

- TABLE 190 BTSA BIOTECNOLOGIAS APLICADAS S.L: BUSINESS OVERVIEW

- TABLE 191 BTSA BIOTECNOLOGIAS APLICADAS S.L: PRODUCTS OFFERED

- TABLE 192 BTSA BIOTECNOLOGIAS APLICADAS S.L: OTHERS

- Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)* might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 193 ADJACENT MARKETS TO VITAMINS MARKET

- 13.2 LIMITATIONS

- 13.3 VITAMINS & MINERALS PREMIXES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 194 VITAMINS & MINERALS PREMIXES MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 195 VITAMINS & MINERAL PREMIXES MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.4 VITAMIN D MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- TABLE 196 VITAMIN D MARKET, BY FORM, 2019-2021 (USD MILLION)

- TABLE 197 VITAMIN D MARKET, BY FORM, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS