|

|

市場調査レポート

商品コード

1468738

VSaaSの世界市場:タイプ別、機能別、AI視覚分析別、業界別、地域別 - 予測(~2029年)VSaaS Market by Type (Hosted, Managed, Hybrid), Feature (AI-enabled VSaaS, Non-AI VSaaS), AI Visual Analysis (Object Detection & Recognition, Intrusion Detection, Facial Recognition, Anomaly Detection), Vertical & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| VSaaSの世界市場:タイプ別、機能別、AI視覚分析別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年04月18日

発行: MarketsandMarkets

ページ情報: 英文 230 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のVSaaSの市場規模は、2024年に50億米ドル、2029年までに107億米ドルに達し、2024年~2029年にCAGRで16.1%の成長が見込まれます。

市場が成長している主な理由は、さまざまな業界で遠隔監視・モニタリングソリューションの需要が高まっているためです。企業は、従来のオンプレミスシステムに対する、拡張性、柔軟性、費用対効果などのクラウドベースのビデオ監視の利点を認識しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | タイプ別、機能別、AI視覚分析、業界別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

「マネージドタイプのVSaaS市場が予測期間に2番目に高い市場シェアを占めます。」

VSaaS市場は、複数の要因からマネージドサービス向けに拡大しています。まず、企業はシステム管理の複雑性や負担を軽減するために、ビデオ監視のニーズをマネージドサービスプロバイダーにアウトソーシングするケースが増えています。マネージドサービスは、監視システムの展開、モニタリング、保守に関する専門知識とサポートを企業に提供するため、企業は中核業務に集中することができます。さらに、マネージドサービスは多くの場合、予測可能な価格設定モデルと拡張性を提供するため、コストを管理し、ニーズの変化に対応したいと考えている企業にとって魅力的です。

「AI対応VSaaS市場が予測期間にもっとも高いCAGRを占めます。」

VSaaS市場は、AIがビデオ監視にもたらす変革的な機能により、AI対応ソリューション向けに拡大しています。AIを搭載したVSaaSは、リアルタイムの物体検出、顔認識、行動分析などの先進の機能を提供し、企業がセキュリティを強化し、業務を最適化し、ビデオデータから価値ある知見を引き出すことを可能にします。このAIとVSaaSの組み合わせにより、脅威や異常をより正確かつ効率的に検知し、誤報を減らし、セキュリティインシデントへの事前対応を可能にします。

「VSaaS市場において商業が予測期間にもっとも高い市場シェアを占めます。」

VSaaS市場は、複数の要因により商業で顕著な成長を示しています。まず、さまざまな業界の企業が、資産の保護、従業員の保護、盗難、破壊行為、賠償請求などのリスクを軽減するために、セキュリティと監視を優先するようになってきています。VSaaSソリューションは、規模や複雑性に関係なく、効率的に監視システムを展開し管理できる柔軟性を営利団体に提供し、遠隔でのアクセスやモニタリングの機能も提供します。さらに、VSaaSの拡張性により、企業は必要に応じて監視インフラを容易に拡張することができ、成長と進化するセキュリティ要件に対応することができます。

「北米のVSaaS市場が予測期間に2番目に高い市場シェアを占めます。」

VSaaS市場は、複数の要因により北米で大きく成長しています。第一に、犯罪、テロ、職場事故に対する懸念の高まりにより、さまざまな業界でセキュリティと安全性が重視されています。北米の企業は、資産、従業員、顧客を保護するためにVSaaSのような先進の監視ソリューションに投資しています。第二に、この地域はITインフラが高度に発達しており、技術に精通した企業が多いため、クラウドベースのソリューションの採用に適しています。VSaaSは拡張性、柔軟性、展開の容易さを提供するため、北米の企業にとって特に魅力的です。

当レポートでは、世界のVSaaS市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- VSaaS市場の企業にとって魅力的な機会

- アジア太平洋のVSaaS市場:国別、機能別

- 北米のVSaaS市場:国別

- VSaaS市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 主要企業が提供するVSaaSソリューションの平均販売価格:業界別

- VSaaSカメラの平均販売価格:地域別

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- ケーススタディ分析

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 標準

- 政府の規制

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 VSaaSの用途

- イントロダクション

- 銃器検出

- 産業用温度モニタリング

- 煙・火災検知

- 誤報フィルタリング

- 車両識別・ナンバープレートモニタリング

- 駐車モニタリング

第7章 VSaaS市場:タイプ別

- イントロダクション

- ホスト

- マネージド

- ハイブリッド

第8章 VSaaS市場:機能別

- イントロダクション

- AI対応VSaaS

- AI非対応VSaaS

第9章 VSaaS市場:AI視覚分析別

- イントロダクション

- 物体検知・認識

- 侵入検知

- 顔認識

- 異常検知

第10章 VSaaS市場:業界別

- イントロダクション

- 商業

- 住宅

- 工業

- 軍事・防衛

- インフラ

- 公共施設

第11章 VSaaS市場:地域別

- イントロダクション

- 北米

- 北米のVSaaS市場に対する不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のVSaaS市場に対する不況の影響

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋のVSaaS市場に対する不況の影響

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のVSaaS市場に対する不況の影響

- 中東

- 南米

- アフリカ

第12章 競合情勢

- イントロダクション

- 主な企業戦略/有力企業(2019年~2023年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2023年)

- 企業の評価と財務指標

- ブランド/製品の比較

- 企業評価マトリクス:主要企業(2023年)

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- ADT

- JOHNSON CONTROLS

- AXIS COMMUNICATIONS AB

- MOTOROLA SOLUTIONS, INC.

- SECURITAS AB

- ROBERT BOSCH GMBH

- HONEYWELL INTERNATIONAL INC.

- ALARM.COM

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- ARCULES, INC.

- その他の企業

- DURANC

- EAGLE EYE NETWORKS

- GENETEC INC.

- PACIFIC CONTROLS

- ARLO

- MOBOTIX

- MORPHEAN

- VERKADA INC.

- VIVINT, INC.

- CAMIOLOG, INC.

- IVIDEON

- IRONYUN USA, INC.

- SOLINK CORP.

- 3DEYE

- CAMCLOUD

第14章 付録

The global VSaaS market is expected to be valued at USD 5.0 billion in 2024 and is projected to reach USD 10.7 billion by 2029; it is expected to grow at a CAGR of 16.1% from 2024 to 2029. The VSaaS market is experiencing growth primarily due to the increasing demand for remote monitoring and surveillance solutions across various industries. Businesses are recognizing the benefits of cloud-based video surveillance, such as scalability, flexibility, and cost-effectiveness, compared to traditional on-premises systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Feature, AI Visual Analysis, Vertical & Region |

| Regions covered | Asia Pacific, North America, Europe, RoW |

"VSaaS market for managed type to account for the second highest market share during the forecast period."

The VSaaS market is expanding for managed services due to several factors. Firstly, businesses are increasingly outsourcing their video surveillance needs to managed service providers to reduce the complexity and burden of system management. Managed services offer businesses access to expertise and support for deploying, monitoring, and maintaining their surveillance systems, allowing them to focus on their core operations. Additionally, managed services often provide predictable pricing models and scalability, making them attractive to businesses looking to control costs and adapt to changing needs.

"VSaaS market for AI-enabled VSaaS to account for the highest CAGR during the forecast period."

The VSaaS market is expanding for AI-enabled solutions due to the transformative capabilities that artificial intelligence (AI) brings to video surveillance. AI-powered VSaaS offers advanced features such as real-time object detection, facial recognition, and behavior analysis, enabling businesses to enhance security, optimize operations, and extract valuable insights from video data. This combination of AI and VSaaS allows for more accurate and efficient detection of threats and anomalies, reducing false alarms and enabling proactive responses to security incidents.

"Commercial vertical in VSaaS market to account for the highest market share during the forecast period."

The VSaaS market is experiencing notable growth in the commercial vertical due to several key factors. Firstly, businesses across various industries are increasingly prioritizing security and surveillance to safeguard assets, protect employees, and mitigate risks such as theft, vandalism, and liability claims. VSaaS solutions offer commercial entities the flexibility to deploy and manage surveillance systems efficiently, regardless of their size or complexity, while also providing remote access and monitoring capabilities. Additionally, the scalability of VSaaS allows businesses to easily expand their surveillance infrastructure as needed, accommodating growth and evolving security requirements.

"VSaaS market for North America to account for the second highest market share during the forecast period."

The VSaaS market is growing significantly in the North American region due to several key factors. Firstly, there is a strong emphasis on security and safety across various industries, driven by increasing concerns about crime, terrorism, and workplace incidents. Businesses in North America are investing in advanced surveillance solutions like VSaaS to protect their assets, employees, and customers. Secondly, the region has a highly developed IT infrastructure and a large base of technology-savvy businesses, making it ripe for the adoption of cloud-based solutions. VSaaS offers scalability, flexibility, and ease of deployment, making it particularly attractive to businesses in North America.

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 55%, Europe - 20%, Asia Pacific - 15%, RoW - 10%

The key players operating in the VSaaS market are ADT (US), Johnson Controls (Ireland), Axis Communication AB (Sweden), Motorola Solutions, Inc. (US), Securitas AB (Sweden).

Research Coverage:

The research report categorizes the VSaaS market, By Type (Hosted, Managed, Hybrid), Feature (AI-enabled VSaaS, Non-AI VSaaS), AI Visual Analysis (Object Detection & Recognition, Intrusion Detection, Facial Recognition, Anomaly Detection), Use Case (Gun Detection, Industrial Temperature Monitoring, Smoke and Fire Detection, False Alarm Filtering, Vehicle Identification and Number Plate Monitoring, Parking Monitoring) Vertical (Commercial, Residential, Industrial, Infrastructure, Military & Defense, Public Facilities), Region (North America, Europe, Asia Pacific, and RoW).

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing adoption of IoT remote monitoring technologies, Rising investment in hyperscale cloud computing infrastructure, Growing emphasis on installing intelligent security systems, Increasing popularity of video analytics solutions), restraints (Concerns regarding data privacy and security, Complexity in integrating VSaaS into existing infrastructure, Delays in video transmission in areas with poor internet connection), opportunities (Rapid advancement in artificial intelligence technology, Proliferation of smart city initiatives, Increased demand for cloud-based surveillance systems in healthcare and retail sectors), and challenges (Requirement for high-capacity storage and bandwidth, Interoperability and vendor lock-in issues) influencing the growth of the VSaaS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the VSaaS market

- Market Development: Comprehensive information about lucrative markets - the report analyses the VSaaS market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the VSaaS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like ADT (US), Johnson Controls (Ireland), Axis Communication AB (Sweden), Motorola Solutions, Inc. (US), Securitas AB (Sweden) among others in the VSaaS market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VSAAS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 VSAAS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 3 VSAAS MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 VSAAS MARKET: REVENUE FROM SALES OF VSAAS PRODUCTS AND SOLUTIONS

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 5 VSAAS MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- FIGURE 6 VSAAS MARKET: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 VSAAS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 VSAAS MARKET: RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 1 VSAAS MARKET: RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON VSAAS MARKET

- TABLE 2 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON VSAAS MARKET

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 HOSTED TYPE TO HOLD LARGEST SHARE OF VSAAS MARKET IN 2029

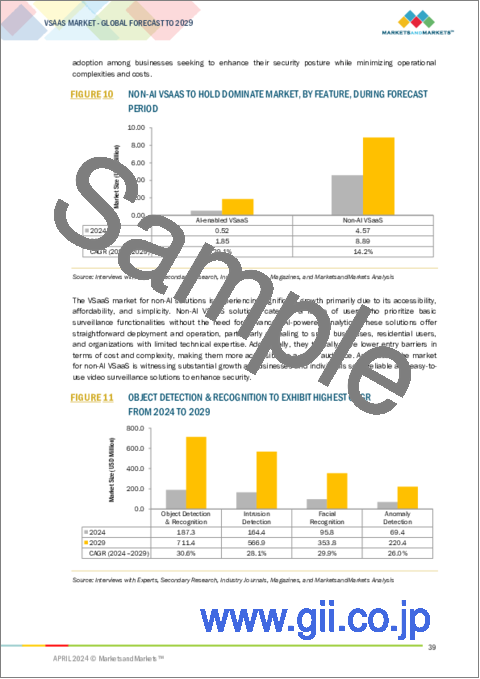

- FIGURE 10 NON-AI VSAAS TO HOLD DOMINATE MARKET, BY FEATURE, DURING FORECAST PERIOD

- FIGURE 11 OBJECT DETECTION & RECOGNITION TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 12 COMMERCIAL VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF VSAAS MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN VSAAS MARKET

- FIGURE 14 INCREASING BURDEN OF SECURITY THREATS AND CRIMINAL ACTIVITIES TO CONTRIBUTE TO MARKET GROWTH

- 4.2 VSAAS MARKET IN ASIA PACIFIC, BY COUNTRY AND FEATURE

- FIGURE 15 CHINA AND NON-AI VSAAS TO HOLD LARGEST SHARES OF ASIA PACIFIC VSAAS MARKET IN 2024

- 4.3 VSAAS MARKET IN NORTH AMERICA, BY COUNTRY

- FIGURE 16 US TO HOLD LARGEST SHARE OF VSAAS MARKET IN 2029

- 4.4 VSAAS MARKET, BY COUNTRY

- FIGURE 17 CHINA TO RECORD HIGHEST CAGR IN VSAAS MARKET FROM 2024 TO 2029

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 VSAAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 19 IMPACT ANALYSIS: DRIVERS

- 5.2.1.1 Increasing adoption of IoT remote monitoring technologies

- 5.2.1.2 Rising investment in hyperscale cloud computing infrastructure

- 5.2.1.3 Burgeoning demand for intelligent security systems

- 5.2.1.4 Increasing deployment of video analytics technology

- 5.2.2 RESTRAINTS

- FIGURE 20 IMPACT ANALYSIS: RESTRAINTS

- 5.2.2.1 Concerns regarding data privacy and security

- 5.2.2.2 Complexities in integrating VSaaS into existing infrastructure

- 5.2.2.3 Delays in video transmission due to poor internet connection

- 5.2.3 OPPORTUNITIES

- FIGURE 21 IMPACT ANALYSIS: OPPORTUNITIES

- 5.2.3.1 Rapid advancement in artificial intelligence technology

- 5.2.3.2 Proliferation of smart city initiatives

- 5.2.3.3 Increased demand for cloud-based surveillance systems in healthcare and retail sectors

- 5.2.4 CHALLENGES

- FIGURE 22 IMPACT ANALYSIS: CHALLENGES

- 5.2.4.1 High cost of cloud-based data storage

- 5.2.4.2 Interoperability and vendor lock-in issues

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 VSAAS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICAL

- FIGURE 24 AVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICAL (USD)

- TABLE 3 AVERAGE SELLING PRICE OF VSAAS SOLUTIONS OFFERED BY KEY PLAYERS, BY VERTICAL (USD)

- 5.4.2 AVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION

- TABLE 4 AVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION (USD)

- FIGURE 25 AVERAGE SELLING PRICE OF VSAAS CAMERAS, BY REGION, 2020-2023 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 26 VSAAS MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 27 VSAAS ECOSYSTEM

- TABLE 5 ROLE OF COMPANIES IN VSAAS ECOSYSTEM

- 5.7 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 INVESTMENT AND FUNDING SCENARIO, 2018-2023

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Cloud computing

- 5.8.1.2 Video management software (VMS)

- 5.8.1.3 Artificial intelligence (AI)

- 5.8.1.4 Video analytics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Access control systems

- 5.8.2.2 Alarm systems

- 5.8.2.3 Networking infrastructure

- 5.8.2.4 Storage solutions

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Internet of Things (IoT)

- 5.8.3.2 Big data analytics

- 5.8.3.3 Cybersecurity solutions

- 5.8.3.4 Biometric authentication

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 29 VSAAS MARKET: PATENTS APPLIED AND GRANTED, 2013-2023

- TABLE 6 LIST OF PATENTS, 2021-2024

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- TABLE 7 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 30 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- 5.10.2 EXPORT SCENARIO

- TABLE 8 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- 5.11 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 AMAZON ADOPTS EAGLE EYE NETWORKS' ADVANCED ANALYTICS SOLUTIONS TO ENHANCE REMOTE MONITORING

- 5.12.2 MCDONALD'S IMPLEMENTS VERKADA'S CLOUD-BASED SURVEILLANCE SYSTEMS TO STREAMLINE SECURITY OPERATIONS

- 5.12.3 MARRIOTT INTERNATIONAL ADOPTS GENETEC'S INTEGRATED SURVEILLANCE PLATFORMS TO INCREASE SECURITY AND OPERATIONAL EFFICIENCY

- 5.12.4 WALMART LEVERAGES AVIGILON CORPORATION'S CLOUD-BASED SURVEILLANCE SOLUTIONS TO PROTECT RETAIL STORES, DISTRIBUTION CENTERS, AND CORPORATE FACILITIES

- 5.12.5 GOOGLE PARTNERS WITH CAMCLOUD TO DEPLOY CLOUD-BASED SURVEILLANCE PLATFORMS IN DATA CENTERS AND OFFICE CAMPUSES TO ENHANCE SECURITY

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- TABLE 10 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 11 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 12 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.13.4 GOVERNMENT REGULATIONS

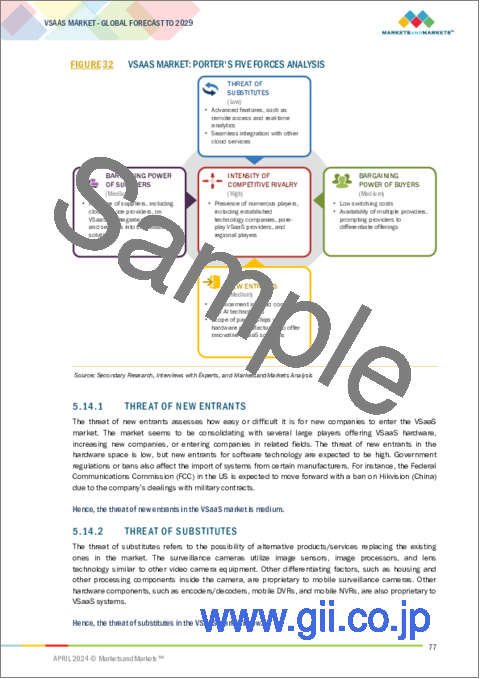

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 VSAAS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 VSAAS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE KEY VERTICALS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR THREE KEY VERTICALS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR THREE KEY VERTICALS

- TABLE 19 KEY BUYING CRITERIA FOR THREE KEY VERTICALS

6 APPLICATIONS OF VSAAS

- 6.1 INTRODUCTION

- 6.2 GUN DETECTION

- 6.3 INDUSTRIAL TEMPERATURE MONITORING

- 6.4 SMOKE & FIRE DETECTION

- 6.5 FALSE ALARM FILTERING

- 6.6 VEHICLE IDENTIFICATION & NUMBER PLATE MONITORING

- 6.7 PARKING MONITORING

7 VSAAS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 HOSTED TYPE TO DOMINATE VSAAS MARKET DURING FORECAST PERIOD

- TABLE 20 VSAAS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 21 VSAAS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- 7.2 HOSTED

- 7.2.1 DEPLOYMENT IN RETAIL STORES TO PREVENT THEFT TO FOSTER SEGMENTAL GROWTH

- TABLE 22 HOSTED: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 23 HOSTED: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 7.3 MANAGED

- 7.3.1 RELIANCE ON OUTSOURCING TO FOCUS MORE ON CORE OPERATIONS TO ACCELERATE SEGMENTAL GROWTH

- TABLE 24 MANAGED: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 25 MANAGED: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 7.4 HYBRID

- 7.4.1 ADOPTION IN INDUSTRIES WITH BANDWIDTH LIMITATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- TABLE 26 HYBRID: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 27 HYBRID: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

8 VSAAS MARKET, BY FEATURE

- 8.1 INTRODUCTION

- FIGURE 36 NON-AI VSAAS FEATURE TO CAPTURE LARGER MARKET SHARE THAN AI-ENABLED VSAAS FEATURE IN 2029

- TABLE 28 VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 29 VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 8.2 AI-ENABLED VSAAS

- 8.2.1 ADVANCED ANALYTICS FUNCTIONALITIES TO BOOST SEGMENTAL GROWTH

- TABLE 30 AI-ENABLED VSAAS: VSAAS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 31 AI-ENABLED VSAAS: VSAAS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 32 AI-ENABLED VSAAS: VSAAS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 33 AI-ENABLED VSAAS: VSAAS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 34 AI-ENABLED VSAAS: VSAAS MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 35 AI-ENABLED VSAAS: VSAAS MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- 8.3 NON-AI VSAAS

- 8.3.1 ACCESSIBILITY AND EASE OF IMPLEMENTATION TO EXPEDITE SEGMENTAL GROWTH

- TABLE 36 NON-AI VSAAS: VSAAS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 37 NON-AI VSAAS: VSAAS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- TABLE 38 NON-AI VSAAS: VSAAS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 39 NON-AI VSAAS: VSAAS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 40 NON-AI VSAAS: VSAAS MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 41 NON-AI VSAAS: VSAAS MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

9 VSAAS MARKET, BY AI VISUAL ANALYSIS

- 9.1 INTRODUCTION

- FIGURE 37 OBJECT DETECTION & RECOGNITION SEGMENT TO DOMINATE MARKET, BY AI VISUAL ANALYSIS, DURING FORECAST PERIOD

- TABLE 42 VSAAS MARKET, BY AI VISUAL ANALYSIS, 2020-2023 (USD MILLION)

- TABLE 43 VSAAS MARKET, BY AI VISUAL ANALYSIS, 2024-2029 (USD MILLION)

- 9.2 OBJECT DETECTION & RECOGNITION

- 9.2.1 RELIANCE ON AI-ENABLED VSAAS TO AUTOMATE SURVEILLANCE TASKS TO FUEL SEGMENTAL GROWTH

- 9.3 INTRUSION DETECTION

- 9.3.1 ADOPTION OF ADVANCED ANALYTICS TECHNOLOGIES TO IDENTIFY UNAUTHORIZED ACCESS TO DRIVE MARKET

- 9.4 FACIAL RECOGNITION

- 9.4.1 USE OF AI-ENABLED VSAAS SOLUTIONS IN TRANSPORTATION HUBS TO ENHANCE PASSENGER SAFETY TO EXPEDITE SEGMENTAL GROWTH

- 9.5 ANOMALY DETECTION

- 9.5.1 DEPLOYMENT OF VSAAS TECHNOLOGY TO DETECT UNUSUAL EVENTS OR PATTERNS IN VIDEO FEEDS TO PROPEL MARKET

10 VSAAS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 38 COMMERCIAL VERTICAL TO HOLD LARGEST MARKET SHARE IN 2023

- TABLE 44 VSAAS MARKET, BY VERTICAL, 2020-2023 (USD BILLION)

- TABLE 45 VSAAS MARKET, BY VERTICAL, 2024-2029 (USD BILLION)

- 10.2 COMMERCIAL

- TABLE 46 COMMERCIAL: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 47 COMMERCIAL: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- TABLE 48 COMMERCIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 49 COMMERCIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 50 COMMERCIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 51 COMMERCIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.2.1 RETAIL STORES & MALLS

- 10.2.1.1 Adoption of real-time monitoring solutions in retail sector to increase security and operational efficiency to drive market

- 10.2.2 ENTERPRISES & DATA CENTERS

- 10.2.2.1 Reliance on AI-enabled surveillance tools to prevent unauthorized access across IT firms to boost segmental growth

- 10.2.3 BANKING & FINANCE BUILDINGS

- 10.2.3.1 Regulatory requirements for continuous monitoring of ATMs to contribute to segmental growth

- 10.2.4 HOSPITALITY CENTERS

- 10.2.4.1 Use of cloud video surveillance solutions to enhance guest safety and prevent theft to facilitate segmental growth

- 10.2.5 WAREHOUSES

- 10.2.5.1 Adoption of video analytics solutions to track movement of goods and detect inventory anomalies to fuel segmental growth

- 10.3 RESIDENTIAL

- 10.3.1 INTRODUCTION OF SMART HOME DEVICES TO INCREASE SECURITY TO ACCELERATE SEGMENTAL GROWTH

- TABLE 52 RESIDENTIAL: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 53 RESIDENTIAL: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 10.4 INDUSTRIAL

- TABLE 54 INDUSTRIAL: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 55 INDUSTRIAL: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- TABLE 56 INDUSTRIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 57 INDUSTRIAL: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 58 INDUSTRIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 59 INDUSTRIAL: NON-AI VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- 10.4.1 MANUFACTURING FACILITIES

- 10.4.1.1 Installation of cutting-edge video surveillance solutions to detect production line anomalies to facilitate segmental growth

- 10.4.2 CONSTRUCTION SITES

- 10.4.2.1 Increasing demand for hazard detection solutions in construction site to prevent accidents to expedite segmental growth

- 10.5 MILITARY & DEFENSE

- TABLE 60 MILITARY & DEFENSE: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 61 MILITARY & DEFENSE: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- TABLE 62 MILITARY & DEFENSE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 63 MILITARY & DEFENSE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 64 MILITARY & DEFENSE: NON-AI VSAAS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 65 MILITARY & DEFENSE: NON-AI VSAAS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.5.1 PRISON & CORRECTION FACILITIES

- 10.5.1.1 Use of intelligent video analytics solutions to detect suspicious behavior and inmate violence to fuel segmental growth

- 10.5.2 LAW ENFORCEMENT

- 10.5.2.1 Adoption of surveillance systems to prevent vandalism and theft to segmental growth

- 10.5.3 BORDER SURVEILLANCE

- 10.5.3.1 Employment of video analytics tools to ensure real-time border monitoring to drive market

- 10.5.4 COASTAL SURVEILLANCE

- 10.5.4.1 Challenges associated with illegal immigration and smuggling to foster segmental growth

- 10.6 INFRASTRUCTURE

- TABLE 66 INFRASTRUCTURE: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 67 INFRASTRUCTURE: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- TABLE 68 INFRASTRUCTURE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 69 INFRASTRUCTURE: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 70 INFRASTRUCTURE: NON-AI VSAAS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 71 INFRASTRUCTURE: NON-AI VSAAS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.6.1 TRANSPORTATION & CITY SURVEILLANCE

- 10.6.1.1 Reliance on intelligent video analytics to reduce safety events among drivers to boost segmental growth

- 10.6.2 PUBLIC PLACES

- 10.6.2.1 Need for real-time surveillance to identify and respond to security threats promptly to propel market

- 10.6.3 UTILITIES

- 10.6.3.1 Requirement for surveillance systems to ensure compliance with regulatory requirements to facilitate segmental growth

- 10.7 PUBLIC FACILITIES

- TABLE 72 PUBLIC FACILITIES: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 73 PUBLIC FACILITIES: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- TABLE 74 PUBLIC FACILITIES: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 75 PUBLIC FACILITIES: AI-ENABLED VSAAS MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 76 PUBLIC FACILITIES: NON-AI VSAAS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 77 PUBLIC FACILITIES: NON-AI VSAAS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.7.1 HEALTHCARE BUILDINGS

- 10.7.1.1 Need for patient remote monitoring solutions to drive market

- 10.7.2 EDUCATIONAL BUILDINGS

- 10.7.2.1 Adoption of comprehensive security measures to establish secure learning environments to boost segmental growth

- 10.7.3 GOVERNMENT BUILDINGS

- 10.7.3.1 Need for surveillance solutions to protect sensitive government information to contribute to segmental growth

- 10.7.4 RELIGIOUS BUILDINGS

- 10.7.4.1 Adoption of intelligent video analytics solutions to safeguard valuable religious artifacts to drive market

11 VSAAS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 VSAAS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2024 AND 2029

- TABLE 78 VSAAS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 79 VSAAS MARKET, BY REGION, 2024-2029 (USD BILLION)

- 11.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: VSAAS MARKET SNAPSHOT

- 11.2.1 RECESSION IMPACT ON VSAAS MARKET IN NORTH AMERICA

- TABLE 80 NORTH AMERICA: VSAAS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 81 NORTH AMERICA: VSAAS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 82 NORTH AMERICA: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 83 NORTH AMERICA: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 11.2.2 US

- 11.2.2.1 Substantial investment in security infrastructure to contribute to market growth

- 11.2.3 CANADA

- 11.2.3.1 Increased allocation of budgets to enhance remote monitoring capabilities to foster market growth

- 11.2.4 MEXICO

- 11.2.4.1 High emphasis on combating crimes and improving public safety to accelerate market growth

- 11.3 EUROPE

- FIGURE 41 EUROPE: VSAAS MARKET SNAPSHOT

- 11.3.1 RECESSION IMPACT ON VSAAS MARKET IN EUROPE

- TABLE 84 EUROPE: VSAAS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 85 EUROPE: VSAAS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 86 EUROPE: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 87 EUROPE: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 11.3.2 UK

- 11.3.2.1 Increasing adoption of could-based monitoring systems to improve situational awareness to propel market

- 11.3.3 GERMANY

- 11.3.3.1 Rising emphasis on meeting stringent privacy and security standards to augment market growth

- 11.3.4 FRANCE

- 11.3.4.1 Surging demand for advanced surveillance technologies to foster market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: VSAAS MARKET SNAPSHOT

- 11.4.1 RECESSION IMPACT ON VSAAS MARKET IN ASIA PACIFIC

- TABLE 88 ASIA PACIFIC: VSAAS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 89 ASIA PACIFIC: VSAAS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 90 ASIA PACIFIC: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 91 ASIA PACIFIC: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing development of smart cities to contribute to market growth

- 11.4.3 JAPAN

- 11.4.3.1 Rising emphasis on crime prevention and disaster management to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Growing adoption of AI video surveillance in smart city projects to fuel market growth

- 11.4.5 INDIA

- 11.4.5.1 Increasing development of transportation networks to accelerate market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 RECESSION IMPACT ON VSAAS MARKET IN ROW

- TABLE 92 ROW: VSAAS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 93 ROW: VSAAS MARKET, BY REGION, 2024-2029 (USD BILLION)

- TABLE 94 ROW: VSAAS MARKET, BY FEATURE, 2020-2023 (USD BILLION)

- TABLE 95 ROW: VSAAS MARKET, BY FEATURE, 2024-2029 (USD BILLION)

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Utilization of cloud-based monitoring solutions in urban areas to enhance public safety to facilitate market growth

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Adoption of innovative surveillance solutions in smart cities and urban areas to drive market

- 11.5.4 AFRICA

- 11.5.4.1 Rise in terrorism and civil unrest to contribute to market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2023

- TABLE 96 VSAAS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2023

- 12.3 REVENUE ANALYSIS, 2019-2023

- FIGURE 43 REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019-2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 44 VSAAS MARKET SHARE ANALYSIS, 2023

- TABLE 97 VSAAS MARKET: DEGREE OF COMPETITION, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 45 COMPANY VALUATION (USD MILLION), 2023

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA), 2023

- 12.6 BRAND/PRODUCT COMPARISON

- FIGURE 47 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 48 VSAAS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.7.5.1 Overall footprint

- FIGURE 49 VSAAS MARKET: OVERALL FOOTPRINT

- 12.7.5.2 Type footprint

- TABLE 98 VSAAS MARKET: TYPE FOOTPRINT

- 12.7.5.3 AI visual analysis footprint

- TABLE 99 VSAAS MARKET: AI VISUAL ANALYSIS FOOTPRINT

- 12.7.5.4 Feature footprint

- TABLE 100 VSAAS MARKET: FEATURE FOOTPRINT

- 12.7.5.5 Vertical footprint

- TABLE 101 VSAAS MARKET: VERTICAL FOOTPRINT

- 12.7.5.6 Region footprint

- TABLE 102 VSAAS MARKET: REGION FOOTPRINT

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 50 VSAAS MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 12.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 12.8.5.1 List of key start-ups/SMEs

- TABLE 103 VSAAS MARKET: LIST OF KEY START-UPS/SMES

- 12.8.5.2 Competitive benchmarking of key start-ups/SMEs

- TABLE 104 VSAAS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 105 VSAAS MARKET: PRODUCT LAUNCHES, JANUARY 2019-DECEMBER 2023

- 12.9.2 DEALS

- TABLE 106 VSAAS MARKET: DEALS, JANUARY 2019-DECEMBER 2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 ADT

- TABLE 107 ADT: COMPANY OVERVIEW

- FIGURE 51 ADT: COMPANY SNAPSHOT

- TABLE 108 ADT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 ADT: PRODUCT LAUNCHES

- TABLE 110 ADT: DEALS

- 13.1.2 JOHNSON CONTROLS

- TABLE 111 JOHNSON CONTROLS: COMPANY OVERVIEW

- FIGURE 52 JOHNSON CONTROLS: COMPANY SNAPSHOT

- TABLE 112 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 114 JOHNSON CONTROLS: DEALS

- 13.1.3 AXIS COMMUNICATIONS AB

- TABLE 115 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 116 AXIS COMMUNICATIONS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 118 AXIS COMMUNICATIONS AB: DEALS

- 13.1.4 MOTOROLA SOLUTIONS, INC.

- TABLE 119 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- FIGURE 53 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 120 MOTOROLA SOLUTIONS, INC.: PRODUCT/SOLUTION/SERVICE OFFERED

- TABLE 121 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES

- 13.1.5 SECURITAS AB

- TABLE 122 SECURITAS AB: COMPANY OVERVIEW

- FIGURE 54 SECURITAS AB: COMPANY SNAPSHOT

- TABLE 123 SECURITAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 SECURITAS AB: DEALS

- 13.1.6 ROBERT BOSCH GMBH

- TABLE 125 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 126 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- 13.1.7 HONEYWELL INTERNATIONAL INC.

- TABLE 128 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 56 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 129 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 131 HONEYWELL INTERNATIONAL INC.: DEALS

- 13.1.8 ALARM.COM

- TABLE 132 ALARM.COM: COMPANY OVERVIEW

- FIGURE 57 ALARM.COM: COMPANY SNAPSHOT

- TABLE 133 ALARM.COM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 134 ALARM.COM: PRODUCT LAUNCHES

- TABLE 135 ALARM.COM: DEALS

- 13.1.9 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- TABLE 136 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 137 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- 13.1.10 ARCULES, INC.

- TABLE 139 ARCULES, INC.: COMPANY OVERVIEW

- TABLE 140 ARCULES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ARCULES, INC.: PRODUCT LAUNCHES

- TABLE 142 ARCULES, INC.: EXPANSIONS

- 13.2 OTHER PLAYERS

- 13.2.1 DURANC

- 13.2.2 EAGLE EYE NETWORKS

- 13.2.3 GENETEC INC.

- 13.2.4 PACIFIC CONTROLS

- 13.2.5 ARLO

- 13.2.6 MOBOTIX

- 13.2.7 MORPHEAN

- 13.2.8 VERKADA INC.

- 13.2.9 VIVINT, INC.

- 13.2.10 CAMIOLOG, INC.

- 13.2.11 IVIDEON

- 13.2.12 IRONYUN USA, INC.

- 13.2.13 SOLINK CORP.

- 13.2.14 3DEYE

- 13.2.15 CAMCLOUD

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS