|

|

市場調査レポート

商品コード

1245762

無線インフラの世界市場規模、シェア、産業動向分析レポートインフラ別、プラットフォーム別(商用、防衛、政府)、タイプ別(4G、5G、2G&3G、衛星)、地域別展望・予測、2022年~2028年Global Wireless Infrastructure Market Size, Share & Industry Trends Analysis Report By Infrastructure, By Platform (Commercial, Defense, and Government), By Type (4G, 5G, 2G & 3G, and Satellite), By Regional Outlook and Forecast, 2022 - 2028 |

||||||

| 無線インフラの世界市場規模、シェア、産業動向分析レポートインフラ別、プラットフォーム別(商用、防衛、政府)、タイプ別(4G、5G、2G&3G、衛星)、地域別展望・予測、2022年~2028年 |

|

出版日: 2023年02月28日

発行: KBV Research

ページ情報: 英文 235 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

無線インフラの世界市場規模は、2028年までに2,593億米ドルに達し、予測期間中にCAGR9.5%で上昇すると予想されています。

数多くの無線インフラの時分割複信(TDD)送信アプリケーションでは、送信機の迅速なオン/オフ送信が求められ、多くの場合1~5マイクロ秒以内に送信されます。信号経路のRFスイッチや、送信機チェーンのさまざまなステージの電源電圧のオン/オフ切り替えは、迅速なTxオン/オフ切り替えを実現する2つの方法です。後者の方法の利点は、低コスト、優れた性能、およびデバイスが使用されていない間の電力節約です。送信信号と他のすべての混合製品別をミキサーのRF出力から排除できるため、電源切り替えは送信アップコンバーティングミキサーで特に有益です。

COVID-19の影響分析

5Gは、ハードウェアの遅延やサプライチェーンの混乱により、短期的・中期的に挫折する可能性があります。パンデミック時に5Gの導入が一時的に停止したため、近い将来、市場の進展が鈍化すると予測されています。一方、メーカーは、競争力の強化、業務効率の向上、市場の独自性といった分野でコアビジネス価値を提供するために、デジタルトランスフォーメーションの計画を実施しています。また、プライベートワイヤレスネットワークと5Gの登場により、コアコネクティビティとビジネスオートメーションのニーズに対応することができます。これらの要素は、今後数年間、無線ネットワークインフラの構築を急がせる可能性があります。

市場の成長要因

無線通信網の拡大によるアプリケーションの増加

市場のプレーヤーは、コアネットワークで管理できるタワー、アンテナ、その他の機器の数の増加など、接続・輸送、サービス・アプリケーション、ストレージ・処理、各国の端末・デバイスなど、複数の産業における通信インフラを改善するさまざまな技術を導入しています。例えば、長期機関投資家のCaisse de depot et placement du Quebec(CDPQ)は2019年4月、米国最大の非公開会社で通信インフラを運営するVertical Bridge Holdings, LLCの株式の30%を購入したことを明らかにしました。

発展途上国政府の支援的な規制

カナダ政府は、全国のブロードバンド構想に貢献しました。この新しいプロジェクトにより、国内のさまざまな地方でのネットワーク接続や、国の緊急通信チャネルが改善され、市場拡大の推進力となることが期待されています。また、多くの国では、衛星インターネットの利用を促進・支援するために、企業や一般市民に対して補助金を支給しています。このような政府の動きは、衛星インターネットの普及を促進し、ひいては無線インフラへの需要を喚起するものと期待されています。

市場再整備の要因

アップデートのコストが高い

クラウドサービス事業者は、プラットフォームで生成されたファイルの出力に課金します。また、携帯電話のデータ転送は料金が発生します。更新サイズを50MBに抑えると、コストが削減されます。コンテンツデリバリーネットワークを使用することで、プロセスが複雑化し、費用がかかるにもかかわらず、クラウドプロバイダーの出発料金を下げる方法があるのです。したがって、自動車用OTAサービスの更新コストが高いことが、予測期間中、無線インフラ市場の拡大を制約することになるでしょう。

タイプ別展望

タイプ別に、無線インフラ市場は、衛星、2G&3G、4G、5Gに分類されます。2021年の無線インフラ市場では、4G分野が最も高い収益シェアを占めています。4Gワイヤレスプロバイダーがカバレッジ、容量、ユーザーベースを着実に拡大する努力をした結果、ワイヤレスネットワークは技術革新と経済拡大のための10年間の主要プラットフォームとなっています。4Gの10年間で、雇用創出は、ワイヤレス産業による堅牢でアクセスしやすい4Gネットワークの展開と、これらのネットワーク向けの将来の製品開発への技術産業の投資によってもたらされました。

プラットフォームの展望

プラットフォームに基づいて、無線インフラ市場は政府、防衛、商業に細分化されます。2021年の無線インフラ市場では、防衛分野が大きな収益シェアを獲得しています。情報・監視・偵察(ISR)システムと処理の改善、ロジスティクス業務の近代化による効率化、指揮・統制(C2)の新しい手法の創出が可能です。これらは、驚異的な速度の5Gネットワークを防衛とセキュリティに使用することで得られる潜在的な利点の一部です。

インフラストラクチャーの展望

インフラ別に見ると、無線インフラ市場は、スモール&マクロセル、モバイルコア、無線アクセスネットワーク、分散型エリアネットワーク、SATCOMに二分されます。2021年には、分散型エリアネットワーク分野が最大収益シェアで無線インフラ市場を独占しました。これは、インターネットユーザーの増加による分散型エリアネットワークシステムの需要増がもたらしたものです。また、セルラーネットワーク加入者の増加により、マイクロセルの配備数が増加する必要があります。しかし、モバイルサービスプロバイダーは、現在のマイクロセル基地局を使用してシームレスなカバレッジを提供することにまだ苦労しています。

地域別展望

地域別に見ると、無線インフラ市場は北米、欧州、アジア太平洋、LAMEAで分析されています。2021年、アジア太平洋地域は、最も高い収益シェアを獲得し、無線インフラ市場をリードしました。この背景には、同地域におけるパートナーシップの必要性の高まりや、コスト削減のための施策に注目が集まっていることが挙げられます。政府、通信、物流、ビジネスプロセスアウトソーシング(BPO)、BFSIだけでなく、その他の産業も、効果的なコラボレーションとコミュニケーションを促進するために、高度な通信通信に移行しています。ユニファイド・コミュニケーションのような最先端技術を導入し、無線インフラの利用を拡大することで、国内外への出張費を削減することも可能です。

市場参入企業がとる主な戦略は買収です。カーディナルマトリックスの分析によると、無線インフラ市場では、Qualcomm Technologies Inc.、Cisco Systems, Inc.、Huawei Technologies Co, Ltd.が先行しています。NXP Semiconductors N.V.、Capgemini SE、NEC Corporationなどの企業が、無線インフラ市場における主要な革新的企業の一社です。

目次

第1章 市場の範囲と調査手法

- 市場の定義

- 目的

- 市場の範囲

- セグメンテーション

- 無線インフラストラクチャの世界市場、インフラストラクチャー別

- 無線インフラストラクチャーの世界市場、プラットフォーム別

- 無線インフラストラクチャの世界市場:タイプ別

- 無線インフラストラクチャの世界市場、地域別

- 調査手法

第2章 市場の概要

- イントロダクション

- 概要

- 市場の構成とシナリオ

- 概要

- 市場に影響を与える主要因

- 市場促進要因

- 市場抑制要因

第3章 競合分析-世界

- KBVカーディナルマトリックス

- 最近の業界全体の戦略的展開

- パートナーシップ、コラボレーション、および契約

- 製品発売と製品拡大

- 買収と合併

- 主要成功戦略

- 主要なリーディングストラテジー:パーセンテージ分布(2018-2022)

- 主要な戦略的動き:(買収:2019年、2月~2022年、11月)主要プレイヤー

第4章 無線インフラストラクチャーの世界市場:インフラストラクチャー別

- 分散型エリアネットワークの世界市場:地域別

- モバイルコアの世界市場:地域別

- ラジオアクセスネットワークの世界市場:地域別

- スモールセルとマクロセルの世界市場:地域別

- SATCOMの世界市場:地域別

第5章 無線インフラストラクチャーの世界市場:プラットフォーム別

- 世界の商業市場:地域別

- 防衛の世界市場:地域別

- 官公庁の世界市場:地域別

第6章 無線インフラの世界市場:タイプ別

- 世界の4G市場:地域別

- 5Gの世界市場:地域別

- 2G・3Gの世界市場:地域別

- 衛星の世界市場:地域別

第7章 世界の無線インフラ市場:地域別

- 北米

- 北米の無線インフラ市場:国別内訳

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の無線インフラ市場:国別内訳

- 欧州

- 欧州の無線インフラ市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州

- 欧州の無線インフラ市場:国別

- アジア太平洋地域

- アジア太平洋の無線インフラ市場:国別内訳

- 中国

- 日本

- インド

- 韓国

- シンガポール

- オーストラリア

- その他アジア太平洋地域

- アジア太平洋の無線インフラ市場:国別内訳

- LAMEA

- LAMEAの無線インフラ市場:国別

- ブラジル

- アルゼンチン

- UAE

- サウジアラビア

- 南アフリカ

- ナイジェリア

- LAMEAのその他の地域

- LAMEAの無線インフラ市場:国別

第8章 企業プロファイル

- Qualcomm Inc.(Qualcomm Technologies, Inc.)

- Capgemini SE

- D-link Corporation

- ZTE Corporation

- Huawei Technologies Co., Ltd.(Huawei Investment & Holding Co., Ltd.)

- NXP Semiconductors N.V

- Cisco Systems, Inc.

- Fujitsu Limited

- NEC Corporation

- Ciena Corporation

LIST OF TABLES

- TABLE 1 Global Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 2 Global Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 3 Partnerships, Collaborations and Agreements- Wireless Infrastructure Market

- TABLE 4 Product Launches And Product Expansions- Wireless Infrastructure Market

- TABLE 5 Acquisition and Mergers- Wireless Infrastructure Market

- TABLE 6 Global Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 7 Global Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 8 Global Distributed Area Network Market by Region, 2018 - 2021, USD Million

- TABLE 9 Global Distributed Area Network Market by Region, 2022 - 2028, USD Million

- TABLE 10 Global Mobile Core Market by Region, 2018 - 2021, USD Million

- TABLE 11 Global Mobile Core Market by Region, 2022 - 2028, USD Million

- TABLE 12 Global Radio Access Network Market by Region, 2018 - 2021, USD Million

- TABLE 13 Global Radio Access Network Market by Region, 2022 - 2028, USD Million

- TABLE 14 Global Small & Macro cells Market by Region, 2018 - 2021, USD Million

- TABLE 15 Global Small & Macro cells Market by Region, 2022 - 2028, USD Million

- TABLE 16 Global SATCOM Market by Region, 2018 - 2021, USD Million

- TABLE 17 Global SATCOM Market by Region, 2022 - 2028, USD Million

- TABLE 18 Global Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 19 Global Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 20 Global Commercial Market by Region, 2018 - 2021, USD Million

- TABLE 21 Global Commercial Market by Region, 2022 - 2028, USD Million

- TABLE 22 Global Defense Market by Region, 2018 - 2021, USD Million

- TABLE 23 Global Defense Market by Region, 2022 - 2028, USD Million

- TABLE 24 Global Government Market by Region, 2018 - 2021, USD Million

- TABLE 25 Global Government Market by Region, 2022 - 2028, USD Million

- TABLE 26 Global Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 27 Global Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 28 Global 4G Market by Region, 2018 - 2021, USD Million

- TABLE 29 Global 4G Market by Region, 2022 - 2028, USD Million

- TABLE 30 Global 5G Market by Region, 2018 - 2021, USD Million

- TABLE 31 Global 5G Market by Region, 2022 - 2028, USD Million

- TABLE 32 Global 2G & 3G Market by Region, 2018 - 2021, USD Million

- TABLE 33 Global 2G & 3G Market by Region, 2022 - 2028, USD Million

- TABLE 34 Global Satellite Market by Region, 2018 - 2021, USD Million

- TABLE 35 Global Satellite Market by Region, 2022 - 2028, USD Million

- TABLE 36 Global Wireless Infrastructure Market by Region, 2018 - 2021, USD Million

- TABLE 37 Global Wireless Infrastructure Market by Region, 2022 - 2028, USD Million

- TABLE 38 North America Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 39 North America Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 40 North America Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 41 North America Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 42 North America Distributed Area Network Market by Country, 2018 - 2021, USD Million

- TABLE 43 North America Distributed Area Network Market by Country, 2022 - 2028, USD Million

- TABLE 44 North America Mobile Core Market by Country, 2018 - 2021, USD Million

- TABLE 45 North America Mobile Core Market by Country, 2022 - 2028, USD Million

- TABLE 46 North America Radio Access Network Market by Country, 2018 - 2021, USD Million

- TABLE 47 North America Radio Access Network Market by Country, 2022 - 2028, USD Million

- TABLE 48 North America Small & Macro cells Market by Country, 2018 - 2021, USD Million

- TABLE 49 North America Small & Macro cells Market by Country, 2022 - 2028, USD Million

- TABLE 50 North America SATCOM Market by Country, 2018 - 2021, USD Million

- TABLE 51 North America SATCOM Market by Country, 2022 - 2028, USD Million

- TABLE 52 North America Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 53 North America Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 54 North America Commercial Market by Country, 2018 - 2021, USD Million

- TABLE 55 North America Commercial Market by Country, 2022 - 2028, USD Million

- TABLE 56 North America Defense Market by Country, 2018 - 2021, USD Million

- TABLE 57 North America Defense Market by Country, 2022 - 2028, USD Million

- TABLE 58 North America Government Market by Country, 2018 - 2021, USD Million

- TABLE 59 North America Government Market by Country, 2022 - 2028, USD Million

- TABLE 60 North America Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 61 North America Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 62 North America 4G Market by Country, 2018 - 2021, USD Million

- TABLE 63 North America 4G Market by Country, 2022 - 2028, USD Million

- TABLE 64 North America 5G Market by Country, 2018 - 2021, USD Million

- TABLE 65 North America 5G Market by Country, 2022 - 2028, USD Million

- TABLE 66 North America 2G & 3G Market by Country, 2018 - 2021, USD Million

- TABLE 67 North America 2G & 3G Market by Country, 2022 - 2028, USD Million

- TABLE 68 North America Satellite Market by Country, 2018 - 2021, USD Million

- TABLE 69 North America Satellite Market by Country, 2022 - 2028, USD Million

- TABLE 70 North America Wireless Infrastructure Market by Country, 2018 - 2021, USD Million

- TABLE 71 North America Wireless Infrastructure Market by Country, 2022 - 2028, USD Million

- TABLE 72 US Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 73 US Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 74 US Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 75 US Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 76 US Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 77 US Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 78 US Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 79 US Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 80 Canada Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 81 Canada Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 82 Canada Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 83 Canada Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 84 Canada Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 85 Canada Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 86 Canada Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 87 Canada Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 88 Mexico Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 89 Mexico Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 90 Mexico Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 91 Mexico Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 92 Mexico Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 93 Mexico Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 94 Mexico Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 95 Mexico Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 96 Rest of North America Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 97 Rest of North America Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 98 Rest of North America Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 99 Rest of North America Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 100 Rest of North America Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 101 Rest of North America Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 102 Rest of North America Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 103 Rest of North America Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 104 Europe Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 105 Europe Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 106 Europe Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 107 Europe Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 108 Europe Distributed Area Network Market by Country, 2018 - 2021, USD Million

- TABLE 109 Europe Distributed Area Network Market by Country, 2022 - 2028, USD Million

- TABLE 110 Europe Mobile Core Market by Country, 2018 - 2021, USD Million

- TABLE 111 Europe Mobile Core Market by Country, 2022 - 2028, USD Million

- TABLE 112 Europe Radio Access Network Market by Country, 2018 - 2021, USD Million

- TABLE 113 Europe Radio Access Network Market by Country, 2022 - 2028, USD Million

- TABLE 114 Europe Small & Macro cells Market by Country, 2018 - 2021, USD Million

- TABLE 115 Europe Small & Macro cells Market by Country, 2022 - 2028, USD Million

- TABLE 116 Europe SATCOM Market by Country, 2018 - 2021, USD Million

- TABLE 117 Europe SATCOM Market by Country, 2022 - 2028, USD Million

- TABLE 118 Europe Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 119 Europe Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 120 Europe Commercial Market by Country, 2018 - 2021, USD Million

- TABLE 121 Europe Commercial Market by Country, 2022 - 2028, USD Million

- TABLE 122 Europe Defense Market by Country, 2018 - 2021, USD Million

- TABLE 123 Europe Defense Market by Country, 2022 - 2028, USD Million

- TABLE 124 Europe Government Market by Country, 2018 - 2021, USD Million

- TABLE 125 Europe Government Market by Country, 2022 - 2028, USD Million

- TABLE 126 Europe Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 127 Europe Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 128 Europe 4G Market by Country, 2018 - 2021, USD Million

- TABLE 129 Europe 4G Market by Country, 2022 - 2028, USD Million

- TABLE 130 Europe 5G Market by Country, 2018 - 2021, USD Million

- TABLE 131 Europe 5G Market by Country, 2022 - 2028, USD Million

- TABLE 132 Europe 2G & 3G Market by Country, 2018 - 2021, USD Million

- TABLE 133 Europe 2G & 3G Market by Country, 2022 - 2028, USD Million

- TABLE 134 Europe Satellite Market by Country, 2018 - 2021, USD Million

- TABLE 135 Europe Satellite Market by Country, 2022 - 2028, USD Million

- TABLE 136 Europe Wireless Infrastructure Market by Country, 2018 - 2021, USD Million

- TABLE 137 Europe Wireless Infrastructure Market by Country, 2022 - 2028, USD Million

- TABLE 138 Germany Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 139 Germany Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 140 Germany Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 141 Germany Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 142 Germany Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 143 Germany Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 144 Germany Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 145 Germany Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 146 UK Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 147 UK Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 148 UK Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 149 UK Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 150 UK Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 151 UK Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 152 UK Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 153 UK Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 154 France Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 155 France Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 156 France Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 157 France Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 158 France Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 159 France Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 160 France Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 161 France Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 162 Russia Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 163 Russia Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 164 Russia Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 165 Russia Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 166 Russia Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 167 Russia Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 168 Russia Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 169 Russia Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 170 Sp5Gn Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 171 Sp5Gn Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 172 Sp5Gn Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 173 Sp5Gn Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 174 Sp5Gn Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 175 Sp5Gn Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 176 Sp5Gn Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 177 Sp5Gn Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 178 Italy Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 179 Italy Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 180 Italy Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 181 Italy Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 182 Italy Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 183 Italy Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 184 Italy Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 185 Italy Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 186 Rest of Europe Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 187 Rest of Europe Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 188 Rest of Europe Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 189 Rest of Europe Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 190 Rest of Europe Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 191 Rest of Europe Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 192 Rest of Europe Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 193 Rest of Europe Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 194 Asia Pacific Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 195 Asia Pacific Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 196 Asia Pacific Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 197 Asia Pacific Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 198 Asia Pacific Distributed Area Network Market by Country, 2018 - 2021, USD Million

- TABLE 199 Asia Pacific Distributed Area Network Market by Country, 2022 - 2028, USD Million

- TABLE 200 Asia Pacific Mobile Core Market by Country, 2018 - 2021, USD Million

- TABLE 201 Asia Pacific Mobile Core Market by Country, 2022 - 2028, USD Million

- TABLE 202 Asia Pacific Radio Access Network Market by Country, 2018 - 2021, USD Million

- TABLE 203 Asia Pacific Radio Access Network Market by Country, 2022 - 2028, USD Million

- TABLE 204 Asia Pacific Small & Macro cells Market by Country, 2018 - 2021, USD Million

- TABLE 205 Asia Pacific Small & Macro cells Market by Country, 2022 - 2028, USD Million

- TABLE 206 Asia Pacific SATCOM Market by Country, 2018 - 2021, USD Million

- TABLE 207 Asia Pacific SATCOM Market by Country, 2022 - 2028, USD Million

- TABLE 208 Asia Pacific Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 209 Asia Pacific Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 210 Asia Pacific Commercial Market by Country, 2018 - 2021, USD Million

- TABLE 211 Asia Pacific Commercial Market by Country, 2022 - 2028, USD Million

- TABLE 212 Asia Pacific Defense Market by Country, 2018 - 2021, USD Million

- TABLE 213 Asia Pacific Defense Market by Country, 2022 - 2028, USD Million

- TABLE 214 Asia Pacific Government Market by Country, 2018 - 2021, USD Million

- TABLE 215 Asia Pacific Government Market by Country, 2022 - 2028, USD Million

- TABLE 216 Asia Pacific Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 217 Asia Pacific Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 218 Asia Pacific 4G Market by Country, 2018 - 2021, USD Million

- TABLE 219 Asia Pacific 4G Market by Country, 2022 - 2028, USD Million

- TABLE 220 Asia Pacific 5G Market by Country, 2018 - 2021, USD Million

- TABLE 221 Asia Pacific 5G Market by Country, 2022 - 2028, USD Million

- TABLE 222 Asia Pacific 2G & 3G Market by Country, 2018 - 2021, USD Million

- TABLE 223 Asia Pacific 2G & 3G Market by Country, 2022 - 2028, USD Million

- TABLE 224 Asia Pacific Satellite Market by Country, 2018 - 2021, USD Million

- TABLE 225 Asia Pacific Satellite Market by Country, 2022 - 2028, USD Million

- TABLE 226 Asia Pacific Wireless Infrastructure Market by Country, 2018 - 2021, USD Million

- TABLE 227 Asia Pacific Wireless Infrastructure Market by Country, 2022 - 2028, USD Million

- TABLE 228 China Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 229 China Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 230 China Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 231 China Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 232 China Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 233 China Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 234 China Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 235 China Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 236 Japan Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 237 Japan Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 238 Japan Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 239 Japan Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 240 Japan Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 241 Japan Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 242 Japan Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 243 Japan Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 244 India Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 245 India Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 246 India Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 247 India Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 248 India Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 249 India Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 250 India Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 251 India Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 252 South Korea Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 253 South Korea Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 254 South Korea Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 255 South Korea Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 256 South Korea Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 257 South Korea Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 258 South Korea Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 259 South Korea Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 260 Singapore Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 261 Singapore Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 262 Singapore Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 263 Singapore Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 264 Singapore Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 265 Singapore Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 266 Singapore Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 267 Singapore Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 268 Australia Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 269 Australia Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 270 Australia Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 271 Australia Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 272 Australia Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 273 Australia Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 274 Australia Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 275 Australia Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 276 Rest of Asia Pacific Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 277 Rest of Asia Pacific Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 278 Rest of Asia Pacific Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 279 Rest of Asia Pacific Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 280 Rest of Asia Pacific Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 281 Rest of Asia Pacific Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 282 Rest of Asia Pacific Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 283 Rest of Asia Pacific Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 284 LAMEA Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 285 LAMEA Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 286 LAMEA Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 287 LAMEA Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 288 LAMEA Distributed Area Network Market by Country, 2018 - 2021, USD Million

- TABLE 289 LAMEA Distributed Area Network Market by Country, 2022 - 2028, USD Million

- TABLE 290 LAMEA Mobile Core Market by Country, 2018 - 2021, USD Million

- TABLE 291 LAMEA Mobile Core Market by Country, 2022 - 2028, USD Million

- TABLE 292 LAMEA Radio Access Network Market by Country, 2018 - 2021, USD Million

- TABLE 293 LAMEA Radio Access Network Market by Country, 2022 - 2028, USD Million

- TABLE 294 LAMEA Small & Macro cells Market by Country, 2018 - 2021, USD Million

- TABLE 295 LAMEA Small & Macro cells Market by Country, 2022 - 2028, USD Million

- TABLE 296 LAMEA SATCOM Market by Country, 2018 - 2021, USD Million

- TABLE 297 LAMEA SATCOM Market by Country, 2022 - 2028, USD Million

- TABLE 298 LAMEA Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 299 LAMEA Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 300 LAMEA Commercial Market by Country, 2018 - 2021, USD Million

- TABLE 301 LAMEA Commercial Market by Country, 2022 - 2028, USD Million

- TABLE 302 LAMEA Defense Market by Country, 2018 - 2021, USD Million

- TABLE 303 LAMEA Defense Market by Country, 2022 - 2028, USD Million

- TABLE 304 LAMEA Government Market by Country, 2018 - 2021, USD Million

- TABLE 305 LAMEA Government Market by Country, 2022 - 2028, USD Million

- TABLE 306 LAMEA Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 307 LAMEA Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 308 LAMEA 4G Market by Country, 2018 - 2021, USD Million

- TABLE 309 LAMEA 4G Market by Country, 2022 - 2028, USD Million

- TABLE 310 LAMEA 5G Market by Country, 2018 - 2021, USD Million

- TABLE 311 LAMEA 5G Market by Country, 2022 - 2028, USD Million

- TABLE 312 LAMEA 2G & 3G Market by Country, 2018 - 2021, USD Million

- TABLE 313 LAMEA 2G & 3G Market by Country, 2022 - 2028, USD Million

- TABLE 314 LAMEA Satellite Market by Country, 2018 - 2021, USD Million

- TABLE 315 LAMEA Satellite Market by Country, 2022 - 2028, USD Million

- TABLE 316 LAMEA Wireless Infrastructure Market by Country, 2018 - 2021, USD Million

- TABLE 317 LAMEA Wireless Infrastructure Market by Country, 2022 - 2028, USD Million

- TABLE 318 Brazil Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 319 Brazil Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 320 Brazil Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 321 Brazil Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 322 Brazil Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 323 Brazil Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 324 Brazil Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 325 Brazil Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 326 Argentina Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 327 Argentina Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 328 Argentina Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 329 Argentina Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 330 Argentina Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 331 Argentina Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 332 Argentina Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 333 Argentina Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 334 UAE Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 335 UAE Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 336 UAE Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 337 UAE Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 338 UAE Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 339 UAE Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 340 UAE Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 341 UAE Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 342 Saudi Arabia Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 343 Saudi Arabia Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 344 Saudi Arabia Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 345 Saudi Arabia Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 346 Saudi Arabia Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 347 Saudi Arabia Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 348 Saudi Arabia Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 349 Saudi Arabia Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 350 South Africa Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 351 South Africa Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 352 South Africa Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 353 South Africa Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 354 South Africa Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 355 South Africa Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 356 South Africa Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 357 South Africa Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 358 Nigeria Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 359 Nigeria Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 360 Nigeria Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 361 Nigeria Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 362 Nigeria Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 363 Nigeria Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 364 Nigeria Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 365 Nigeria Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 366 Rest of LAMEA Wireless Infrastructure Market, 2018 - 2021, USD Million

- TABLE 367 Rest of LAMEA Wireless Infrastructure Market, 2022 - 2028, USD Million

- TABLE 368 Rest of LAMEA Wireless Infrastructure Market by Infrastructure, 2018 - 2021, USD Million

- TABLE 369 Rest of LAMEA Wireless Infrastructure Market by Infrastructure, 2022 - 2028, USD Million

- TABLE 370 Rest of LAMEA Wireless Infrastructure Market by Platform, 2018 - 2021, USD Million

- TABLE 371 Rest of LAMEA Wireless Infrastructure Market by Platform, 2022 - 2028, USD Million

- TABLE 372 Rest of LAMEA Wireless Infrastructure Market by Type, 2018 - 2021, USD Million

- TABLE 373 Rest of LAMEA Wireless Infrastructure Market by Type, 2022 - 2028, USD Million

- TABLE 374 Key Information - Qualcomm, Inc.

- TABLE 375 Key Information - Capgemini SE

- TABLE 376 Key Information - D-link Corporation

- TABLE 377 Key Information - ZTE Corporation

- TABLE 378 key information - Huawei Technologies Co., Ltd.

- TABLE 379 Key Information - NXP Semiconductors N.V.

- TABLE 380 Key Information - Cisco Systems, Inc.

- TABLE 381 Key Information - Fujitsu Limited

- TABLE 382 KEY INFORMATION - NEC Corporation

- TABLE 383 Key Information - Ciena Corporation

List of Figures

- FIG 1 Methodology for the research

- FIG 2 KBV Cardinal Matrix

- FIG 3 Key Leading Strategies: Percentage Distribution (2018-2022)

- FIG 4 Key Strategic Move: (acquisitions : 2019, feb - 2022, nov) Leading Players

- FIG 5 Global Wireless Infrastructure Market share by Infrastructure, 2021

- FIG 6 Global Wireless Infrastructure Market share by Infrastructure, 2028

- FIG 7 Global Wireless Infrastructure Market by Infrastructure, 2018 - 2028, USD Million

- FIG 8 Global Wireless Infrastructure Market share by Platform, 2021

- FIG 9 Global Wireless Infrastructure Market share by Platform, 2028

- FIG 10 Global Wireless Infrastructure Market by Platform, 2018 - 2028, USD Million

- FIG 11 Global Wireless Infrastructure Market share by Type, 2021

- FIG 12 Global Wireless Infrastructure Market share by Type, 2028

- FIG 13 Global Wireless Infrastructure Market by Type, 2018 - 2028, USD Million

- FIG 14 Global Wireless Infrastructure Market share by Region, 2021

- FIG 15 Global Wireless Infrastructure Market share by Region, 2028

- FIG 16 Global Wireless Infrastructure Market by Region, 2018 - 2028, USD Million

- FIG 17 Recent strategies and developments: Qualcomm Technologies, Inc.

- FIG 18 Recent strategies and developments: NEC Corporation

- FIG 19 Recent strategies and developments: Ciena Corporation

The Global Wireless Infrastructure Market size is expected to reach $259.3 billion by 2028, rising at a market growth of 9.5% CAGR during the forecast period.

Wireless infrastructure comprises various communication tools, connectivity guidelines, and connectivity options that come together to offer customers wireless networks. By doing away with the necessity for wire connections between various devices and components, this network concentrates on enhancing overall connectivity and connection performance. Moreover, wireless networking connects households, telecommunications networks, and commercial (business) installations without the expensive procedure of putting wires into a building or as a connection between different equipment locations.

Increased investments by market players in constructing high-speed networks are the main factor driving market expansion. Also, the increased usage of satellite data in the creation of smart cities and connected vehicles and the rising demand for linked automobiles are other factors that will assist the market's growth throughout the projected period.

Numerous wireless infrastructure time division duplex (TDD) send applications that ask for quick on/off transmitting of the transmitter, often within one to five microseconds. RF switches in the signal route or on/off switching of the supply voltage for various stages of the transmitter chain are two methods for implementing quick Tx on/off switching. The benefits of the latter approach include low cost, excellent performance, and power conservation while the Device is not in use. Supply switching is especially beneficial at the transmit upconverting mixer since it eliminates the transmit signal and all other mixing byproducts from the mixer RF output.

COVID-19 Impact Analysis

5G may have short- and medium-term setbacks due to hardware delays and supply chain disruptions. Due to a temporary halt in 5G implementation during the pandemic, it is projected that the progress of the market will be slowed down in the near future. On the other side, manufacturers are implementing plans for digital transformation to offer core business value in areas like competitive excellence, improved business efficiency, and market uniqueness. In addition, private wireless networks and the advent of 5G can address core connectivity and business automation needs. These elements could hasten the construction of wireless network infrastructure in the upcoming years.

Market Growth Factors

Rising expansion of wireless communication networks for several applications

Players in the market have introduced a variety of technologies to improve communication infrastructures in several industries, such as connectivity & transportation, services & applications, storage & processing, and terminals and devices of the countries, such as an increase in the number of towers, antennas, and other equipment that can be managed by a core network. For example, long-term institutional investor Caisse de depot et placement du Quebec (CDPQ) disclosed in April 2019 that it had purchased 30% of the shares of Vertical Bridge Holdings, LLC, one of the largest private companies and operators of communications infrastructure in the United States.

Supportive regulations of governments in the developing countries

The Canadian government contributed to broadband initiatives nationwide. The new project will improve network connectivity in various rural areas of the nation and the country's emergency communication channels, which is anticipated to propel market expansion. In addition, many nations are giving subsidies to businesses and the general people to promote and support the usage of satellite internet. Such government actions are anticipated to encourage the expansion of satellite internet, which will, in turn, fuel demand for wireless infrastructure.

Market Retraining Factors

High cost of updating

The cloud service provider charges for the output of platform-generated files. In addition, cellular data transfer incurs fees. The cost is reduced when the update size is reduced to 50MB. There are ways to lower the cloud provider's departure fee, despite the fact that using a content delivery network adds complexity and expense to the process. Hence, the high cost of updating automobile OTA services would constrain the expansion of wireless infrastructure market over the course of forecast period.

Type Outlook

Based on type, the wireless infrastructure market is segmented into satellite, 2G & 3G, 4G, and 5G. In 2021, the 4G segment held the highest revenue share in the wireless infrastructure market. As a result of the efforts of 4G wireless providers to steadily expand their coverage, capacity, and user base, wireless networks have become the decade's primary platform for technological innovation and economic expansion. In the 4G decade, job creation was driven by the wireless industry's deployment of robust and accessible 4G networks and the technology industry's investment in developing future products for these networks.

Platform Outlook

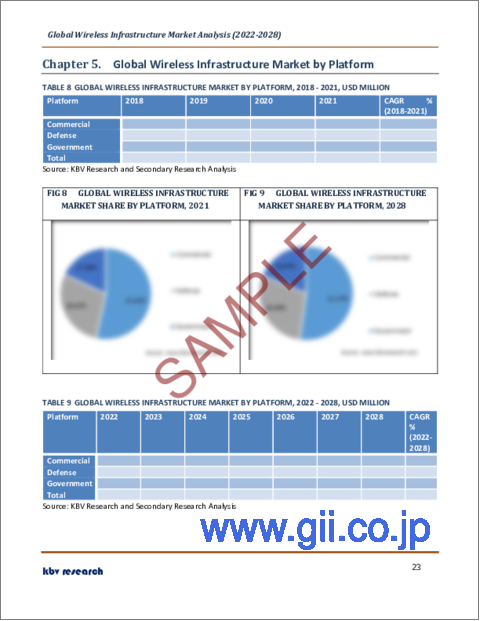

On the basis of platform, the wireless infrastructure market is fragmented into government, defense, and commercial. The defense segment garnered a significant revenue share in the wireless infrastructure market in 2021. It is possible to improve intelligence, surveillance, and reconnaissance (ISR) systems and processing, modernize logistics operations for greater efficiency and create new techniques for command and control (C2). These are a few potential benefits of using impressively fast 5G networks for defense and security.

Infrastructure Outlook

By infrastructure, the wireless infrastructure market is bifurcated into small & macro cells, mobile core, radio access network, distributed area network, and SATCOM. In 2021, the distributed area network segment dominated the wireless infrastructure market with the maximum revenue share. This is brought on by an increase in the demand for distributed area network systems by an increase in internet users. In addition, an increasing number of microcells must be deployed due to the rise in cellular network subscribers. However, mobile service providers still struggle to deliver seamless coverage using the current microcell base stations.

Regional Outlook

Region wise, the wireless infrastructure market is analyzed across North America, Europe, Asia Pacific and LAMEA. In 2021, the Asia Pacific region led the wireless infrastructure market by generating highest revenue share. This is explained by the increasing need for partnerships in the area and the focus on cost-cutting measures. Government, telecom, logistics, and business process outsourcing (BPO), BFSI, as well as other industries are moving towards advanced telecom communications to facilitate effective collaboration and communication. By implementing cutting-edge technology like unified communications, expanding the use of wireless infrastructure also makes it possible to lower travel expenses both domestically and abroad.

The major strategies followed by the market participants are Acquisitions. Based on the Analysis presented in the Cardinal matrix; Qualcomm Technologies Inc., Cisco Systems, Inc. and Huawei Technologies Co., Ltd. are the forerunners in the Wireless Infrastructure Market. Companies such as NXP Semiconductors N.V., Capgemini SE and NEC Corporation are some of the key innovators in Wireless Infrastructure Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Qualcomm Inc. (Qualcomm Technologies, Inc.), Capgemini SE, D-Link Corporation, ZTE Corporation, Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), NXP Semiconductors N.V., Cisco Systems, Inc., Fujitsu Limited, NEC Corporation, and Ciena Corporation.

Recent Strategies Deployed in Wireless Infrastructure Market

Mergers & Acquisition

Nov-2022: Ciena Corporation took over Tibit Communications, Inc., a privately-held company headquartered in Petaluma, California, and along with this Ciena Corporation acquired Benu Networks, Inc., a privately-held company headquartered in Burlington, Massachusetts. Through the double acquisitions, Ciena Corporation would be able to expand its capabilities to help customers' next-generation edge and metro strategies as service providers globally fasten investments to update their networks and enhance connectivity at the network edge.

Jul-2022: NEC Corporation took over Aspire Technology, an Irish company that specializes in the integration of open networks. Through this acquisition, NEC Corporation would strengthen its place in the growing Open Radio Access Network (OpenRAN) sector. Moreover, NEC Corporation would organize more satisfactorily as compared to any other supplier to integrate disaggregated network components into a well-tuned ecosystem.

Jun-2022: Qualcomm Technologies, Inc. took over Cellwize Wireless Technologies Pte. Ltd., a leader in mobile network automation and management. Through this acquisition, Qualcomm Technologies, Inc. would be able to strengthen its capability to guide the development of the modern 5G network with the assistance of Cellwize's best-in-class RAN automation technologies.

Jan-2022: NEC Corporation acquired Blue Danube Systems, Inc., a U.S.-based provider of CBRS/4G/5G RAN products and AI/ML-based software solutions. Through this acquisition, NEC Corporation would expand its customer support capability and assets in North America and further combines the breadth of its Open RAN solutions portfolio to keep the needs and demands of customers

Sep-2021: Ciena Corporation acquired Vyatta virtual routing and switching technology from AT&T, an American multinational telecommunications holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. Through this acquisition, Ciena Corporation would incorporate Vyatta talent and assets into its Switching and Routing business would grow Ciena's success in supporting customers to make virtualized networks and deploy the latest features.

Mar-2021: Qualcomm Technologies, Inc. acquired NUVIA, an international group specializing in nuclear technology. Through this acquisition, Qualcomm Technologies, Inc. would be able to elaborate its CPU Roadmap alongside expanding Qualcomm's leading technology place with the Android, Windows, and Chrome ecosystems.

Mar-2021: Capgemini SE took over RXP Services, Ltd., a company that provides a broad range of management, business, and ICT consulting, delivery, and support services. Through this acquisition, Capgemini SE would be able to increase the depths of its networks and abilities to satisfy the expected growth in demand for digital services.

Feb-2021: Cisco Systems, Inc. took over IMImobile PLC, a leading provider of cloud communications software and services. Through this acquisition, Cisco Systems, Inc. would be able to integrate IMImobile solution functionality with the All-New Webex Contact Center. Moreover, Cisco would be able to deliver a strong Customer Experience as a Service (CXaaS) offer.

Jun-2019: Capgemini SE acquired Altran Technologies, the global leader in Engineering and R&D services. Through this acquisition, Capgemini SE would be able to place itself as an evident strategic partner to help its clients in taking maximum advantage of the revolution initiated by the outcomes of Edge computing, cloud, artificial intelligence, IoT, and 5G.

Feb-2019: Capgemini SE took over Leidos Cyber, a recognized leader in cybersecurity across the federal government. Through this acquisition, Capgemini SE would be able to support its North American cybersecurity practice with the assistance of Leidos Cyber. Moreover, Leidos Cyber's security expertise would also be helping Capgemini's client base of global enterprises across multiple locations.

Product Launch and Product Expansions

Sep-2022: Fujitsu Limited launched Virtuora Service Management and Orchestration (SMO). This new Virtuora Service Management and Orchestration (SMO) provides automated, intelligent, and adaptive service delivery over multi-vendor mobile networks, multi-layer, network slices, subnets, and the cloud.

Feb-2022: ZTE Corporation unveiled the UniSite NEO solution. This new UniSite NEO solution and creative products can be used to help in such scenarios as 4G modernization, 5G construction, RAN sharing, and capacity enhancement to build a simplified, leading, and green 5G network.

Oct-2020: Cisco Systems, Inc. unveiled the new Wide Area Networking (WAN) edge platform. This new Wide Area Networking (WAN) edge platform would be able to aid customers fasten the cloud adoption and deliver automated and secured connectivity to applications across data centers, cloud, and edge.

Oct-2020: NXP Semiconductors unveiled the new family of 2x2 Wi-Fi 6 (802.11ax) Dual Band + Bluetooth/BLE solutions. This new family of 2x2 Wi-Fi 6 (802.11ax) Dual Band + Bluetooth/BLE solutions is operating a new phase of connectivity innovation for advanced gaming, industrial, audio, and IoT markets. Additionally, by allowing the world's first Wi-Fi 6-enabled gaming console, NXP's optimized IW62X family of products would be able to deliver improved efficiency, ability, and performance for next-generation connectivity solutions.

Partnerships, Collaborations & Agreements

Nov-2022: Qualcomm Technologies, Inc. collaborated with Siemens Smart Infrastructure, a German multinational conglomerate corporation. Under this collaboration, Qualcomm Technologies, Inc. would be able to fetch Siemens's leadership in building automation along with its expertise in edge and wireless computer technologies.

Feb-2022: Qualcomm Technologies, Inc. came into collaboration with Hewlett Packard Enterprise, an American multinational information technology company based in Spring, Texas, United States. Under this collaboration, Qualcomm Technologies, Inc. would be able to provide improved, effective, and trustworthy 5G experiences to consumers.

Feb-2022: Qualcomm Technologies, Inc. collaborated with Microsoft Corporation, an American multinational technology corporation headquartered in Redmond, Washington, United States. Under this collaboration, Microsoft Corporation would be able to provide a cost-effective, impressive, and efficient approach to deploying, designing, monitoring, operating, and 5G private networks. Moreover, this collaboration would further fasten the global adoption of companies combining private networks into their practices.

Dec-2021: ZTE Corporation partnered with Ooredoo Group, a Qatari multinational telecommunications company headquartered in Doha. Under this partnership, Ooredoo Group would be able to back itself with reliability and stability of supply along with the availability of advanced services and products to its customers with the assistance of ZTE Corporation.

Nov-2021: Qualcomm Technologies, Inc. came into collaboration with NEC Corporation, a Japanese multinational information technology and electronics corporation, headquartered in Minato, Tokyo. Under this collaboration, both organizations would be working collectively on the development of a 5G open and virtualized distributed unit (DU).

Oct-2021: Ciena Corporation came into collaboration with Samsung Electronics Co., Ltd., a South Korean multinational electronics corporation headquartered in Yeongtong-gu, Suwon, South Korea. Under this collaboration, both organizations would be providing 5G network solutions to the market. Moreover, Ciena Corporation would be able to develop the best-in-breed 5G networks that are scalable, open, and adaptive.

Jun-2021: Huawei Technologies Co., Ltd. partnered with Temenos, a banking software company. Under this partnership, Huawei Technologies Co., Ltd. would be able to strengthen cooperation with industry-leading technology solution-competent partners like Temenos. Furthermore, Huawei Technologies Co., Ltd. would be able to resolve problems and build value for customers together.

Jun-2021: NEC Corporation collaborated with Microelectronics Technology Inc., a leading network RF solutions provider. Under this collaboration, NEC Corporation would be able to improve the Open RAN ecosystem with a combination of radio options to cater to global 4G and 5G markets. Furthermore, NEC Corporation would be able to reinforce its responsibility to rev commercial Open RAN deployments and to provide better value to its customers.

Scope of the Study

Market Segments covered in the Report:

By Infrastructure

- Distributed Area Network

- Mobile Core

- Radio Access Network

- Small & Macro cells

- SATCOM

By Platform

- Commercial

- Defense

- Government

By Type

- 4G

- 5G

- 2G & 3G

- Satellite

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Australia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- Qualcomm Inc. (Qualcomm Technologies, Inc.)

- Capgemini SE

- D-Link Corporation

- ZTE Corporation

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- NXP Semiconductors N.V.

- Cisco Systems, Inc.

- Fujitsu Limited

- NEC Corporation

- Ciena Corporation

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Wireless Infrastructure Market, by Infrastructure

- 1.4.2 Global Wireless Infrastructure Market, by Platform

- 1.4.3 Global Wireless Infrastructure Market, by Type

- 1.4.4 Global Wireless Infrastructure Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market Overview

- 2.1 Introduction

- 2.1.1 Overview

- 2.1.1.1 Market Composition & Scenario

- 2.1.1 Overview

- 2.2 Key Factors Impacting the Market

- 2.2.1 Market Drivers

- 2.2.2 Market Restraints

Chapter 3. Competition Analysis - Global

- 3.1 KBV Cardinal Matrix

- 3.2 Recent Industry Wide Strategic Developments

- 3.2.1 Partnerships, Collaborations and Agreements

- 3.2.2 Product Launches and Product Expansions

- 3.2.3 Acquisition and Mergers

- 3.3 Top Winning Strategies

- 3.3.1 Key Leading Strategies: Percentage Distribution (2018-2022)

- 3.3.2 Key Strategic Move: (Acquisitions : 2019, Feb - 2022, Nov) Leading Players

Chapter 4. Global Wireless Infrastructure Market by Infrastructure

- 4.1 Global Distributed Area Network Market by Region

- 4.2 Global Mobile Core Market by Region

- 4.3 Global Radio Access Network Market by Region

- 4.4 Global Small & Macro cells Market by Region

- 4.5 Global SATCOM Market by Region

Chapter 5. Global Wireless Infrastructure Market by Platform

- 5.1 Global Commercial Market by Region

- 5.2 Global Defense Market by Region

- 5.3 Global Government Market by Region

Chapter 6. Global Wireless Infrastructure Market by Type

- 6.1 Global 4G Market by Region

- 6.2 Global 5G Market by Region

- 6.3 Global 2G & 3G Market by Region

- 6.4 Global Satellite Market by Region

Chapter 7. Global Wireless Infrastructure Market by Region

- 7.1 North America Wireless Infrastructure Market

- 7.1.1 North America Wireless Infrastructure Market by Infrastructure

- 7.1.1.1 North America Distributed Area Network Market by Country

- 7.1.1.2 North America Mobile Core Market by Country

- 7.1.1.3 North America Radio Access Network Market by Country

- 7.1.1.4 North America Small & Macro cells Market by Country

- 7.1.1.5 North America SATCOM Market by Country

- 7.1.2 North America Wireless Infrastructure Market by Platform

- 7.1.2.1 North America Commercial Market by Country

- 7.1.2.2 North America Defense Market by Country

- 7.1.2.3 North America Government Market by Country

- 7.1.3 North America Wireless Infrastructure Market by Type

- 7.1.3.1 North America 4G Market by Country

- 7.1.3.2 North America 5G Market by Country

- 7.1.3.3 North America 2G & 3G Market by Country

- 7.1.3.4 North America Satellite Market by Country

- 7.1.4 North America Wireless Infrastructure Market by Country

- 7.1.4.1 US Wireless Infrastructure Market

- 7.1.4.1.1 US Wireless Infrastructure Market by Infrastructure

- 7.1.4.1.2 US Wireless Infrastructure Market by Platform

- 7.1.4.1.3 US Wireless Infrastructure Market by Type

- 7.1.4.2 Canada Wireless Infrastructure Market

- 7.1.4.2.1 Canada Wireless Infrastructure Market by Infrastructure

- 7.1.4.2.2 Canada Wireless Infrastructure Market by Platform

- 7.1.4.2.3 Canada Wireless Infrastructure Market by Type

- 7.1.4.3 Mexico Wireless Infrastructure Market

- 7.1.4.3.1 Mexico Wireless Infrastructure Market by Infrastructure

- 7.1.4.3.2 Mexico Wireless Infrastructure Market by Platform

- 7.1.4.3.3 Mexico Wireless Infrastructure Market by Type

- 7.1.4.4 Rest of North America Wireless Infrastructure Market

- 7.1.4.4.1 Rest of North America Wireless Infrastructure Market by Infrastructure

- 7.1.4.4.2 Rest of North America Wireless Infrastructure Market by Platform

- 7.1.4.4.3 Rest of North America Wireless Infrastructure Market by Type

- 7.1.4.1 US Wireless Infrastructure Market

- 7.1.1 North America Wireless Infrastructure Market by Infrastructure

- 7.2 Europe Wireless Infrastructure Market

- 7.2.1 Europe Wireless Infrastructure Market by Infrastructure

- 7.2.1.1 Europe Distributed Area Network Market by Country

- 7.2.1.2 Europe Mobile Core Market by Country

- 7.2.1.3 Europe Radio Access Network Market by Country

- 7.2.1.4 Europe Small & Macro cells Market by Country

- 7.2.1.5 Europe SATCOM Market by Country

- 7.2.2 Europe Wireless Infrastructure Market by Platform

- 7.2.2.1 Europe Commercial Market by Country

- 7.2.2.2 Europe Defense Market by Country

- 7.2.2.3 Europe Government Market by Country

- 7.2.3 Europe Wireless Infrastructure Market by Type

- 7.2.3.1 Europe 4G Market by Country

- 7.2.3.2 Europe 5G Market by Country

- 7.2.3.3 Europe 2G & 3G Market by Country

- 7.2.3.4 Europe Satellite Market by Country

- 7.2.4 Europe Wireless Infrastructure Market by Country

- 7.2.4.1 Germany Wireless Infrastructure Market

- 7.2.4.1.1 Germany Wireless Infrastructure Market by Infrastructure

- 7.2.4.1.2 Germany Wireless Infrastructure Market by Platform

- 7.2.4.1.3 Germany Wireless Infrastructure Market by Type

- 7.2.4.2 UK Wireless Infrastructure Market

- 7.2.4.2.1 UK Wireless Infrastructure Market by Infrastructure

- 7.2.4.2.2 UK Wireless Infrastructure Market by Platform

- 7.2.4.2.3 UK Wireless Infrastructure Market by Type

- 7.2.4.3 France Wireless Infrastructure Market

- 7.2.4.3.1 France Wireless Infrastructure Market by Infrastructure

- 7.2.4.3.2 France Wireless Infrastructure Market by Platform

- 7.2.4.3.3 France Wireless Infrastructure Market by Type

- 7.2.4.4 Russia Wireless Infrastructure Market

- 7.2.4.4.1 Russia Wireless Infrastructure Market by Infrastructure

- 7.2.4.4.2 Russia Wireless Infrastructure Market by Platform

- 7.2.4.4.3 Russia Wireless Infrastructure Market by Type

- 7.2.4.5 Spain Wireless Infrastructure Market

- 7.2.4.5.1 Spain Wireless Infrastructure Market by Infrastructure

- 7.2.4.5.2 Spain Wireless Infrastructure Market by Platform

- 7.2.4.5.3 Spain Wireless Infrastructure Market by Type

- 7.2.4.6 Italy Wireless Infrastructure Market

- 7.2.4.6.1 Italy Wireless Infrastructure Market by Infrastructure

- 7.2.4.6.2 Italy Wireless Infrastructure Market by Platform

- 7.2.4.6.3 Italy Wireless Infrastructure Market by Type

- 7.2.4.7 Rest of Europe Wireless Infrastructure Market

- 7.2.4.7.1 Rest of Europe Wireless Infrastructure Market by Infrastructure

- 7.2.4.7.2 Rest of Europe Wireless Infrastructure Market by Platform

- 7.2.4.7.3 Rest of Europe Wireless Infrastructure Market by Type

- 7.2.4.1 Germany Wireless Infrastructure Market

- 7.2.1 Europe Wireless Infrastructure Market by Infrastructure

- 7.3 Asia Pacific Wireless Infrastructure Market

- 7.3.1 Asia Pacific Wireless Infrastructure Market by Infrastructure

- 7.3.1.1 Asia Pacific Distributed Area Network Market by Country

- 7.3.1.2 Asia Pacific Mobile Core Market by Country

- 7.3.1.3 Asia Pacific Radio Access Network Market by Country

- 7.3.1.4 Asia Pacific Small & Macro cells Market by Country

- 7.3.1.5 Asia Pacific SATCOM Market by Country

- 7.3.2 Asia Pacific Wireless Infrastructure Market by Platform

- 7.3.2.1 Asia Pacific Commercial Market by Country

- 7.3.2.2 Asia Pacific Defense Market by Country

- 7.3.2.3 Asia Pacific Government Market by Country

- 7.3.3 Asia Pacific Wireless Infrastructure Market by Type

- 7.3.3.1 Asia Pacific 4G Market by Country

- 7.3.3.2 Asia Pacific 5G Market by Country

- 7.3.3.3 Asia Pacific 2G & 3G Market by Country

- 7.3.3.4 Asia Pacific Satellite Market by Country

- 7.3.4 Asia Pacific Wireless Infrastructure Market by Country

- 7.3.4.1 China Wireless Infrastructure Market

- 7.3.4.1.1 China Wireless Infrastructure Market by Infrastructure

- 7.3.4.1.2 China Wireless Infrastructure Market by Platform

- 7.3.4.1.3 China Wireless Infrastructure Market by Type

- 7.3.4.2 Japan Wireless Infrastructure Market

- 7.3.4.2.1 Japan Wireless Infrastructure Market by Infrastructure

- 7.3.4.2.2 Japan Wireless Infrastructure Market by Platform

- 7.3.4.2.3 Japan Wireless Infrastructure Market by Type

- 7.3.4.3 India Wireless Infrastructure Market

- 7.3.4.3.1 India Wireless Infrastructure Market by Infrastructure

- 7.3.4.3.2 India Wireless Infrastructure Market by Platform

- 7.3.4.3.3 India Wireless Infrastructure Market by Type

- 7.3.4.4 South Korea Wireless Infrastructure Market

- 7.3.4.4.1 South Korea Wireless Infrastructure Market by Infrastructure

- 7.3.4.4.2 South Korea Wireless Infrastructure Market by Platform

- 7.3.4.4.3 South Korea Wireless Infrastructure Market by Type

- 7.3.4.5 Singapore Wireless Infrastructure Market

- 7.3.4.5.1 Singapore Wireless Infrastructure Market by Infrastructure

- 7.3.4.5.2 Singapore Wireless Infrastructure Market by Platform

- 7.3.4.5.3 Singapore Wireless Infrastructure Market by Type

- 7.3.4.6 Australia Wireless Infrastructure Market

- 7.3.4.6.1 Australia Wireless Infrastructure Market by Infrastructure

- 7.3.4.6.2 Australia Wireless Infrastructure Market by Platform

- 7.3.4.6.3 Australia Wireless Infrastructure Market by Type

- 7.3.4.7 Rest of Asia Pacific Wireless Infrastructure Market

- 7.3.4.7.1 Rest of Asia Pacific Wireless Infrastructure Market by Infrastructure

- 7.3.4.7.2 Rest of Asia Pacific Wireless Infrastructure Market by Platform

- 7.3.4.7.3 Rest of Asia Pacific Wireless Infrastructure Market by Type

- 7.3.4.1 China Wireless Infrastructure Market

- 7.3.1 Asia Pacific Wireless Infrastructure Market by Infrastructure

- 7.4 LAMEA Wireless Infrastructure Market

- 7.4.1 LAMEA Wireless Infrastructure Market by Infrastructure

- 7.4.1.1 LAMEA Distributed Area Network Market by Country

- 7.4.1.2 LAMEA Mobile Core Market by Country

- 7.4.1.3 LAMEA Radio Access Network Market by Country

- 7.4.1.4 LAMEA Small & Macro cells Market by Country

- 7.4.1.5 LAMEA SATCOM Market by Country

- 7.4.2 LAMEA Wireless Infrastructure Market by Platform

- 7.4.2.1 LAMEA Commercial Market by Country

- 7.4.2.2 LAMEA Defense Market by Country

- 7.4.2.3 LAMEA Government Market by Country

- 7.4.3 LAMEA Wireless Infrastructure Market by Type

- 7.4.3.1 LAMEA 4G Market by Country

- 7.4.3.2 LAMEA 5G Market by Country

- 7.4.3.3 LAMEA 2G & 3G Market by Country

- 7.4.3.4 LAMEA Satellite Market by Country

- 7.4.4 LAMEA Wireless Infrastructure Market by Country

- 7.4.4.1 Brazil Wireless Infrastructure Market

- 7.4.4.1.1 Brazil Wireless Infrastructure Market by Infrastructure

- 7.4.4.1.2 Brazil Wireless Infrastructure Market by Platform

- 7.4.4.1.3 Brazil Wireless Infrastructure Market by Type

- 7.4.4.2 Argentina Wireless Infrastructure Market

- 7.4.4.2.1 Argentina Wireless Infrastructure Market by Infrastructure

- 7.4.4.2.2 Argentina Wireless Infrastructure Market by Platform

- 7.4.4.2.3 Argentina Wireless Infrastructure Market by Type

- 7.4.4.3 UAE Wireless Infrastructure Market

- 7.4.4.3.1 UAE Wireless Infrastructure Market by Infrastructure

- 7.4.4.3.2 UAE Wireless Infrastructure Market by Platform

- 7.4.4.3.3 UAE Wireless Infrastructure Market by Type

- 7.4.4.4 Saudi Arabia Wireless Infrastructure Market

- 7.4.4.4.1 Saudi Arabia Wireless Infrastructure Market by Infrastructure

- 7.4.4.4.2 Saudi Arabia Wireless Infrastructure Market by Platform

- 7.4.4.4.3 Saudi Arabia Wireless Infrastructure Market by Type

- 7.4.4.5 South Africa Wireless Infrastructure Market

- 7.4.4.5.1 South Africa Wireless Infrastructure Market by Infrastructure

- 7.4.4.5.2 South Africa Wireless Infrastructure Market by Platform

- 7.4.4.5.3 South Africa Wireless Infrastructure Market by Type

- 7.4.4.6 Nigeria Wireless Infrastructure Market

- 7.4.4.6.1 Nigeria Wireless Infrastructure Market by Infrastructure

- 7.4.4.6.2 Nigeria Wireless Infrastructure Market by Platform

- 7.4.4.6.3 Nigeria Wireless Infrastructure Market by Type

- 7.4.4.7 Rest of LAMEA Wireless Infrastructure Market

- 7.4.4.7.1 Rest of LAMEA Wireless Infrastructure Market by Infrastructure

- 7.4.4.7.2 Rest of LAMEA Wireless Infrastructure Market by Platform

- 7.4.4.7.3 Rest of LAMEA Wireless Infrastructure Market by Type

- 7.4.4.1 Brazil Wireless Infrastructure Market

- 7.4.1 LAMEA Wireless Infrastructure Market by Infrastructure

Chapter 8. Company Profiles

- 8.1 Qualcomm Inc. (Qualcomm Technologies, Inc.)

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental and Regional Analysis

- 8.1.4 Research & Development Expense

- 8.1.5 Recent strategies and developments:

- 8.1.5.1 Partnerships, Collaborations, and Agreements:

- 8.1.5.2 Acquisition and Mergers:

- 8.2 Capgemini SE

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Regional Analysis

- 8.2.4 Recent strategies and developments:

- 8.2.4.1 Acquisition and Mergers:

- 8.3 D-link Corporation

- 8.3.1 Company Overview

- 8.3.2 Financial Analysis

- 8.3.3 Segmental Analysis

- 8.3.4 Research & Development Expenses

- 8.4 ZTE Corporation

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Segmental and Regional Analysis

- 8.4.4 Research & Development Expenses

- 8.4.5 Recent strategies and developments:

- 8.4.5.1 Partnerships, Collaborations, and Agreements:

- 8.4.5.2 Product Launches and Product Expansions:

- 8.5 Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Segmental and Regional Analysis

- 8.5.4 Research & Development Expense

- 8.5.5 Recent strategies and developments:

- 8.5.5.1 Partnerships, Collaborations, and Agreements:

- 8.6 NXP Semiconductors N.V.

- 8.6.1 Company Overview

- 8.6.2 Financial Analysis

- 8.6.3 Regional Analysis

- 8.6.4 Research & Development Expense

- 8.6.5 Recent strategies and developments:

- 8.6.5.1 Product Launches and Product Expansions:

- 8.7 Cisco Systems, Inc.

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Regional Analysis

- 8.7.4 Research & Development Expense

- 8.7.5 Recent strategies and developments:

- 8.7.5.1 Product Launches and Product Expansions:

- 8.7.5.2 Acquisition and Mergers:

- 8.8 Fujitsu Limited

- 8.8.1 Company Overview

- 8.8.2 Financial Analysis

- 8.8.3 Segmental and Regional Analysis

- 8.8.4 Research & Development Expenses

- 8.8.5 Recent strategies and developments:

- 8.8.5.1 Product Launches and Product Expansions:

- 8.9 NEC Corporation

- 8.9.1 Company Overview

- 8.9.2 Financial Analysis

- 8.9.3 Segmental and Regional Analysis

- 8.9.4 Research & Development Expenses

- 8.9.5 Recent strategies and developments:

- 8.9.5.1 Partnerships, Collaborations, and Agreements:

- 8.9.5.2 Acquisition and Mergers:

- 8.10. Ciena Corporation

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 Segmental and Regional Analysis

- 8.10.4 Research & Development Expense

- 8.10.5 Recent strategies and developments:

- 8.10.5.1 Partnerships, Collaborations, and Agreements:

- 8.10.5.2 Acquisition and Mergers: