|

|

市場調査レポート

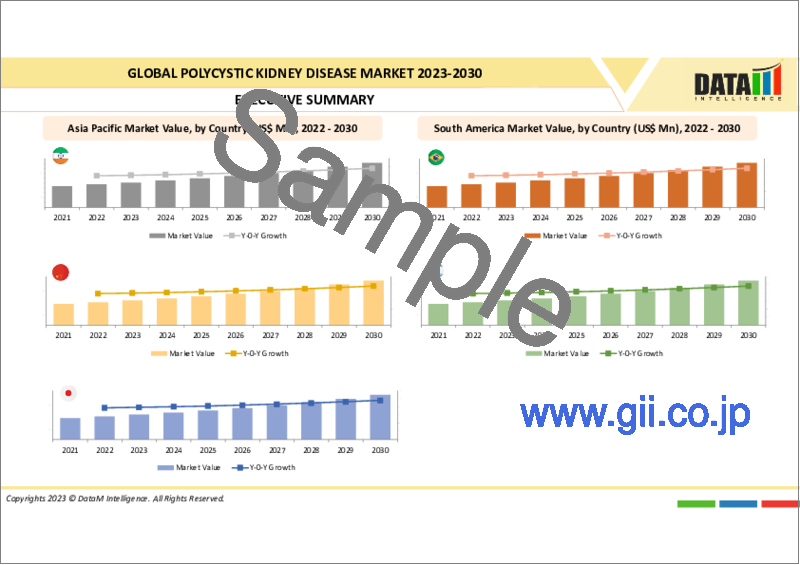

商品コード

1345428

多発性嚢胞腎の世界市場 (2023年~2030年)Global Polycystic Kidney Disease Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 多発性嚢胞腎の世界市場 (2023年~2030年) |

|

出版日: 2023年09月06日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

概要

世界の多発性嚢胞腎市場は、2022年に4億9,500万米ドルに達し、2023-2030年の予測期間中にCAGR 5.8%で成長し、2030年には7億6,900万米ドルに達すると予測されています。

常染色体優性多発性嚢胞腎(ADPKD)は、多数の液体で満たされた腎嚢胞の発生と継続的な増殖を特徴とし、ほとんどの個体で最終的な腎機能低下をもたらします。ADPKDの症状は腎臓だけにとどまりません。将来の心血管系イベントおよび死亡率の重要な予測因子である動脈硬化がADPKDの初期にみられることはよく知られています。

多発性嚢胞腎では、腎臓が嚢胞を伴って肥大し、正常な腎機能が損なわれます。このため、時には腎不全に至り、透析や腎移植が必要となることもあります。米国では腎不全の原因の第4位です。男性も女性も同じようにこの病気のリスクがあります。腎不全の原因の約5%を占めています。

さらに、研究資金の動向は、多発性嚢胞腎市場の成長を促進する重要な傾向です。多発性嚢胞腎市場は、多くの新興市場や研究開発活動によって、先端技術開発のための投資が増加し、医薬品の承認や上市が急増することによって牽引されています。

ダイナミクス

進歩の高まり

新規の予測バイオマーカーを特定するための最近のアプローチは、患者の尿濃縮能力に基づいて疾患の重症度を評価することから始まっています。さらに、トルバプタン投与群では、ベースラインから3週目までのコペプチンの増加率が有意に高く、3年後の腎臓の肥大とeGFRの低下が少なく、良好な転帰を示した30。30その他、腎障害分子1、B2ミクログロブリン、好中球ゼラチナーゼ関連リポカリン、単球走化性蛋白1、線維芽細胞増殖因子23、マイクロRNAなどが疾患進行の予後指標としての可能性を示しているバイオマーカーです。

コロラド大学とメリーランド大学は共同で、ADPKD患者におけるエンパグリフロジンの安全性と忍容性を検討する第2相臨床試験を実施しました。エンパグリフロジン投与前、投与3カ月後、投与12カ月後に身長調整総腎容積をMRIで調べます。終了予定日は2025年7月1日です。

認知度向上のための取り組み

多発性嚢胞腎に関する認知度向上への取り組みも、市場シェアを押し上げる要因の1つとして期待されています。多発性嚢胞腎の管理戦略や、多発性嚢胞腎の効果的治療のための強化医薬品の製造・開発に積極的な主要企業は、多発性嚢胞腎市場の成長を促進する要因です。

PKD Foundation Centers of Excellence and Partner Clinicsは、PKD Foundationが定めた患者中心のADPKD専門基準を満たす医療提供者の全国ネットワークです。腎臓内科の診療所やクリニックを対象としたこのエリート指定は、ADPKDに罹患した患者が病気をよりよく管理し、生活の質を維持・向上させ、将来の計画を立てられるよう支援するものです。例えば、多発性嚢胞腎財団は、多発性嚢胞腎の治療と治癒のみを目的とする米国唯一の非営利団体です。1,300件を超える調査研究に資金が提供され、15億米ドルの研究資金が活用されています。

高額な治療費

多発性嚢胞腎の管理コストは高く、市場成長の妨げになると予想されます。例えば、感度評価では、ADPKDにかかる年間予想総額は103億米ドルから156億米ドルでした。

基本シナリオにおける総費用73億米ドルのうち、直接的医療費は57億米ドル(78.6%)を占め、腎代替療法を必要とする患者が大部分(32億米ドル;43.3%)を占めました。

間接費は14億米ドル(19.7%)で、失業による生産性低下(7億8,400万米ドル:10.7%)、仕事の生産性低下(3億9,000万米ドル:5.3%)が大半を占めています。この問題は、世界の多発性嚢胞腎市場の拡大をさらに妨げる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 進歩の高まり

- 認知度向上への取り組み

- 抑制要因

- 高額な治療費

- 機会

- 腎臓関連疾患への投資の増加

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 常染色体優性多発性嚢胞腎(ADPKD)

- 常染色体劣性多発性嚢胞腎(ARPKD)

- その他

第8章 治療タイプ別

- 診断

- 尿検査

- 血液検査

- 画像検査

- 超音波検査

- コンピューター断層撮影 (CT)

- 磁気共鳴画像法 (MRI)

- その他

- 薬剤/治療

- トルバプタン

- フルオキセチン

- ベンラファキシン

- デュロキセチン

- 透析療法

- 腎移植

- その他

第9章 エンドユーザー別

- 病院

- 外来手術センター

- 専門クリニック

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Otsuka Pharmaceuticals

- 企業概要

- 製品ポートフォリオと概要

- 財務概要

- 主な動向

- Camber Pharmaceuticals

- Apotex Corp

- Ascend Laboratories

- Par Pharmaceuticals

- Teva Pharmaceutical Industries

- Merck and Co

- Accord Healthcare

- Pfizer

- PD-Rx Pharmaceuticals, Inc

第13章 付録

Overview

Global Polycystic Kidney Disease Market reached US$ 495 million in 2022 and is expected to reach US$ 769 million by 2030 growing with a CAGR of 5.8% during the forecast period 2023-2030.

Autosomal dominant polycystic kidney disease (ADPKD) is characterized by the development and continued growth of numerous fluid-filled kidney cysts, resulting in ultimate kidney function loss in most individuals. ADPKD manifestations are not limited to the kidney. It is well established that arterial stiffness, a significant predictor of future cardiovascular events and mortality, is present early in ADPKD.

In people with polycystic kidney disease, the kidneys become enlarged with cysts that impair normal kidney function. This can sometimes lead to kidney failure and the need for dialysis or kidney transplantation. In US, it is the fourth leading cause of kidney failure. Men and women are equally at risk for the disease. It causes about 5% of all kidney failure.

Furthermore, Increasing research funding is a critical polycystic kidney disease trend propelling the market growth. The polycystic kidney disease market is driven by the number of emerging markets and research and development activities raising investment for developing advanced technologies and surging drug approvals and launches.

Dynamics

Rising Advancements

Recent approaches to identifying novel predictive biomarkers have ranged from assessing disease severity based on the urine concentrating ability in patients. Furthermore, tolvaptan-treated individuals with a more significant percentage increase in copeptin from baseline to week 3 had a better disease outcome, with less kidney growth and eGFR decline after three years. 30 Other biomarkers that have shown potential as prognostic indicators of disease progression are kidney injury molecule 1, B2 microglobulin, neutrophil gelatinase-associated lipocalin, monocyte chemoattractant protein 1, fibroblast growth factor 23, and microRNAs, among others.

The University of Colorado and the University of Maryland collaborated to conduct phase 2 clinical trials to determine the safety and tolerability of empagliflozin in ADPKD patients. Height-adjusted total kidney volume will be examined by magnetic resonance imaging at baseline, three months, and 12 months after treatment with empagliflozin. The estimated completion date is July 1, 2025.

Initiatives To Raise Awareness

Initiatives to raise awareness about polycystic kidney disease are also one of the factors that is expected to drive the market share. Polycystic kidney disease management strategies, as well as key firms active in the manufacturing and developing enhanced pharmaceuticals for effective polycystic kidney disease therapy, are drivers driving the growth of the polycystic kidney disease market.

The PKD Foundation Centers of Excellence and Partner Clinics is a national network of providers meeting patient-centered, specialized ADPKD criteria established by the PKD Foundation. This elite designation for nephrology practices and clinics helps those affected by ADPKD better manage their disease, maintain and improve their quality of life, and plan for the future. For instance, the Polycystic Kidney Disease Foundation is the only non-profit organization in the United States dedicated only to treating and curing polycystic kidney disease. Over 1,300 research investigations have been financed, with USD 1.5 billion in research money leveraged.

High Cost of the Treatment

The cost of managing polycystic kidney disease is high, which is expected to hinder market growth. For instance, in sensitivity assessments, the anticipated total annual prices ascribed to ADPKD ranged from $10.3 to $15.6 billion.

Direct healthcare expenditures accounted for $5.7 billion (78.6%) of the total $7.3 billion costs in the basic scenario, with patients requiring renal replacement treatment accounting for the majority ($3.2 billion; 43.3%).

Indirect expenses accounted for $1.4 billion (19.7%), with productivity loss owing to unemployment ($784 million; 10.7%) and lower productivity at work ($390 million; 5.3%) accounting for the majority of the cost. This issue may further impede the expansion of the global polycystic kidney disease market.

Segment Analysis

The global polycystic kidney disease market is segmented based on type, treatment type, end user and region.

The Autosomal Dominant Polycystic Kidney Disease (ADPKD) Segment Accounted for Approximately 47.5% of the Market Share

Autosomal dominant polycystic kidney disease, or ADPKD, is a form of chronic kidney disease caused by mutations in the PKD1 or PKD2 genes. ADPKD is the fourth leading cause of chronic kidney disease (CKD), affecting 1 in every 400 to 1,000 people (approximately 140,000 patients in the US), and is the most common kidney disorder passed down through family members. More than 50% of ADPKD patients develop renal failure by age 50, followed by dialysis and kidney transplantation.

In March 2023, POXEL SA, a clinical-stage biopharmaceutical company developing innovative treatments for chronic severe diseases with metabolic pathophysiology, including non-alcoholic steatohepatitis (NASH) and rare metabolic disorders, launched the publication of preclinical results in autosomal dominant polycystic kidney disease (ADPKD) for PXL770, a novel, first-in-class direct adenosine monophosphate-activated protein kinase (AMPK) activator. It is focused on treating adrenoleukodystrophy (ALD) and autosomal dominant polycystic kidney disease (ADPKD). The potential utility of AMPK activation is confirmed for this disease and supports the development of PXL770 in a Phase 2 clinical program for ADPKD.

Geographical Analysis

North America accounted for Approximately 39.5% of the Market Share in 2022

North America is leading in the drug discovery pipeline as the demand is more in that region due to rise in the chronic diseases. According to the Centers for Disease Control and Prevention (CDC), chronic diseases are the leading cause of death and disability in the United States. About 133 million Americans, i.e., 45% of the population, have at least one chronic disease. Chronic diseases are responsible for seven out of every 10 deaths in the U.S., killing more than 1.7 million Americans every year. Hence, drug development became mandatory for the treatment of various diseases in this region.

Major drug developers are investigating their lead agents in making different drugs gradually progress into the front line of polycystic kidney disease treatment. Pipeline therapies such as Empagliflozin, Bardoxolone methyl, Ziltivekimab, KBP-5074, AZD9977, and others are under different phases of clinical trials.

For instance, in January 2023, the U.S. Food and Drug Administration (FDA) accepted a supplemental New Drug Application (sNDA) for Jardiance (empagliflozin) tablets, which is being investigated as a potential treatment to reduce the risk of kidney disease progression and cardiovascular death in adults with chronic kidney disease (CKD), Boehringer Ingelheim and Eli Lilly and Company announced.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic in late 2019 created unprecedented challenges for industries worldwide, including the global polycystic kidney disease market, as countries grappled with lockdowns, supply chain disruptions, and reduced economic activity.

The polycystic kidney disease (PKD) market faced challenges because of a shortage of highly qualified workers and a lack of healthcare infrastructure in developing nations. Lack of knowledge and COVID-19's impact on the supply chain will constrain and impede the market's expansion. There is an urgent need to improve the transparency of the overall pharmaceutical information. During the pandemic, people living with cancer, heart diseases, chronic respiratory diseases, diabetes, and other NCDs experienced difficulties in accessing their routine medicines. Hence, the market is expected to be impacted during COVID-19 pandemic.

By Type

- Autosomal dominant polycystic kidney disease (ADPKD)

- Autosomal recessive polycystic kidney disease (ARPKD)

By Treatment Type

- Diagnosis

- Urine Tests

- Blood Tests

- Imaging Tests

- Ultrasound

- Computed Tomography

- Magnetic Resonance Imaging

- Others

- Drug/Therapy

- Tolvaptan

- fluoxetine

- venlafaxine

- duloxetine

- Dialysis

- Kidney Transplantation

- Others

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- France

- Spain

- Italy

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2023, XORTX Therapeutics Inc., a late-stage clinical pharmaceutical company focused on developing innovative therapies to treat progressive kidney disease, is pleased to announce the grant of Orphan Drug Designation for oxypurinol, orphan-drug designation request of oxypurinol is granted for the treatment of autosomal dominant polycystic kidney disease.

- In November 2022, Regulus Therapeutics Inc., a biopharmaceutical company focused on the discovery and development of innovative medicines targeting microRNAs, announced the dosing of the first patient in the Phase 1b MAD study of RGSL8429 for the treatment of Autosomal Dominant Polycystic Kidney Disease (ADPKD).

- In March 2023, POXEL SA, a clinical-stage biopharmaceutical company developing innovative treatments for serious chronic diseases with metabolic pathophysiology, including launched the publication of preclinical results in autosomal dominant polycystic kidney disease (ADPKD) for PXL770, a novel, first-in-class direct adenosine monophosphate-activated protein kinase (AMPK) activator.

Competitive Landscape

The major global polycystic kidney disease market players in the market include: Otsuka Pharmaceuticals, Camber Pharmaceuticals, Apotex Corp, Ascend Laboratories, Par Pharmaceuticals, Teva Pharmaceutical Industries, Merck and Co, Accord Healthcare, Pfizer, and PD-Rx Pharmaceuticals, Inc among others.

Why Purchase the Report?

- To visualize the global polycystic kidney disease segmentation based on type, treatment type, end user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of polycystic kidney disease market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global polycystic kidney disease market report would provide approximately 53 tables, 54 figures, and 195 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Treatment Type

- 3.3. Snippet by End User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Advancements

- 4.1.1.2. Initiatives To Raise Awareness

- 4.1.2. Restraints

- 4.1.2.1. High Cost of the Treatment

- 4.1.3. Opportunity

- 4.1.3.1.1. Rising Investments in kidney related Disorders

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Autosomal dominant polycystic kidney disease (ADPKD)

- 7.3. Autosomal recessive polycystic kidney disease (ARPKD)

- 7.4. Others

8. By Treatment Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 8.1.2. Market Attractiveness Index, By Treatment Type

- 8.2. Diagnosis

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.2.3. Urine Tests

- 8.2.4. Blood Tests

- 8.2.5. Imaging Tests

- 8.2.5.1.1. Ultrasound

- 8.2.5.1.2. Computed Tomography

- 8.2.5.1.3. Magnetic Resonance Imaging

- 8.2.6. Others

- 8.3. Drug/Therapy

- 8.3.1. Tolvaptan

- 8.3.2. fluoxetine

- 8.3.3. venlafaxine

- 8.3.4. duloxetine

- 8.3.5. Dialysis

- 8.3.6. Kidney Transplantation

- 8.3.7. Others

9. By End User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 9.1.2. Market Attractiveness Index, By End User

- 9.2. Hospitals

- 9.3. Ambulatory Surgical Centers

- 9.4. Specialty Clinics

- 9.5. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Treatment Type

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Otsuka Pharmaceuticals

- 12.1.1. Company Overview

- 12.1.2. Type Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Camber Pharmaceuticals

- 12.3. Apotex Corp

- 12.4. Ascend Laboratories

- 12.5. Par Pharmaceuticals

- 12.6. Teva Pharmaceutical Industries

- 12.7. Merck and Co

- 12.8. Accord Healthcare

- 12.9. Pfizer

- 12.10. PD-Rx Pharmaceuticals, Inc

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us