|

|

市場調査レポート

商品コード

1334460

建物一体型太陽光発電市場- 世界の市場規模、シェア、動向分析、機会、予測レポート、2019-2029年Building Integrated Photovoltaics Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2019-2029, Segmented By Product, By Technology, By Application, By End User, By Region |

||||||

| 建物一体型太陽光発電市場- 世界の市場規模、シェア、動向分析、機会、予測レポート、2019-2029年 |

|

出版日: 2023年08月08日

発行: Blueweave Consulting

ページ情報: 英文 400 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

建物一体型太陽光発電(BIPV)の世界市場規模が3倍以上に拡大、2029年までに444億5,000万米ドルに達する

世界の建物一体型太陽光発電(BIPV)市場は、再生可能エネルギーによる発電への志向の高まり、BIPVのエコロジー的利点に対する消費者の意識の高まり、各国の太陽光発電(PV)設置容量の拡大などにより、活況を呈しています。

戦略コンサルティング・市場調査の大手であるBlueWeave Consulting社は、最近の調査で、2022年の世界の建物一体型太陽光発電(BIPV)市場規模を140億6,000万米ドルと推定しました。BlueWeave社は、2023年から2029年にかけての予測期間中、世界の建物一体型太陽光発電(BIPV)市場規模はCAGR 21%の大幅な成長を遂げ、2029年には444億5,000万米ドルに達すると予測しています。世界の建物一体型太陽光発電市場の主な成長促進要因には、再生可能エネルギー源の採用増加、持続可能な建設慣行への注目の高まり、政府の支援策や規制、BIPVの急速な技術進歩、グリーンビルディングに対する需要の高まりなどがあります。さらに、エネルギー効率と持続可能な市場開拓が重視されていることも市場を後押ししており、予測期間中も継続的な成長が見込まれています。太陽光発電に対する世界の認識と導入は、エネルギー安全保障と自給自足を優先する国々によって推進されてきました。温室効果ガス排出量削減のための政府立法や公約が、市場の成長をさらに後押ししています。太陽エネルギーへの移行を推進している主要国には、ドイツ、イタリア、フランス、英国、米国、中国、日本、インドなどがあります。こうした好条件を背景に、ソーラーパネル市場は今後数年間で大きく拡大する見通しです。しかし、投資の初期費用が高く、建物一体型太陽光発電(BIPV)の設置が複雑であることが、分析期間中の市場全体の成長を抑制すると予想されます。

本レポートの詳細な分析により、世界の建物一体型太陽光発電市場の成長可能性、今後の動向、統計に関する情報を提供します。また、総市場規模の予測を促進する要因も取り上げています。当レポートは、世界の建物一体型太陽光発電市場における最近の技術動向や、意思決定者が健全な戦略的意思決定を行うための業界洞察を提供することをお約束します。さらに、市場の成長促進要因・課題・競争力についても分析しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の建物一体型太陽光発電(BIPV)市場に関する洞察

- 業界のバリューチェーン分析

- DROC分析

- 成長促進要因

- 各国の太陽光発電(PV)設置能力の急速な拡大

- 再生可能エネルギーベースの発電への志向の高まり

- BIPVのいくつかの生態学的利点に対する消費者の意識の高まり

- 抑制要因

- 初期投資コストが高い

- 建物一体型太陽光発電(BIPV)設備の構築の複雑さ

- 機会

- 建設および建築部門における急速な近代化

- 高度なモジュール技術の優れた統合を目的としたいくつかの研究開発活動への投資が増加

- 課題

- 標準化の欠如

- 認識と市場教育が限られている

- 成長促進要因

- 技術の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

第4章 世界の建物一体型太陽光発電(BIPV)市場概要

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- 屋根材

- 遮光

- クラッディング

- 艶出し

- 壁一体型ソリューション

- ガラス

- その他

- テクノロジー別

- 結晶シリコン

- 薄膜

- その他

- 用途別

- 屋根

- 壁

- ガラス

- ファサード

- その他

- エンドユーザー別

- 住宅

- 商業用

- 産業用

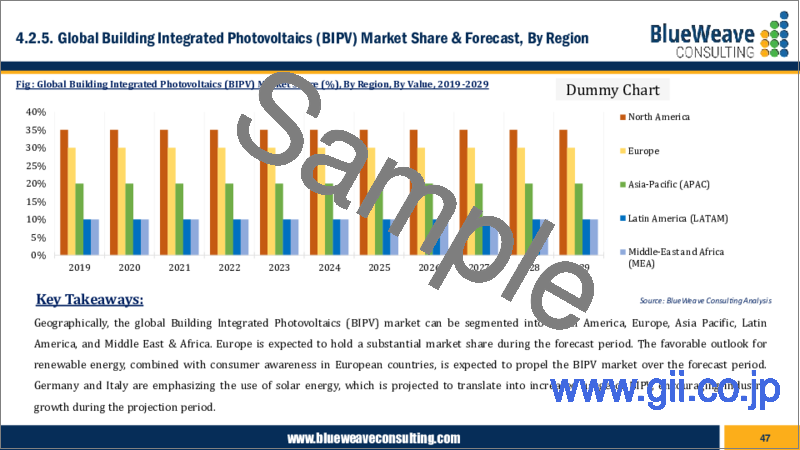

- 地域別

- 北米

- 欧州

- アジア太平洋(APAC)

- ラテンアメリカ(LATAM)

- 中東およびアフリカ(MEA)

- 製品別

第5章 北米のビル建物一体型太陽光発電(BIPV)市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- テクノロジー別

- 用途別

- エンドユーザー別

- 国別

- 米国

- カナダ

第6章 欧州のビル建物一体型太陽光発電(BIPV)市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- テクノロジー別

- 用途別

- エンドユーザー別

- 国別

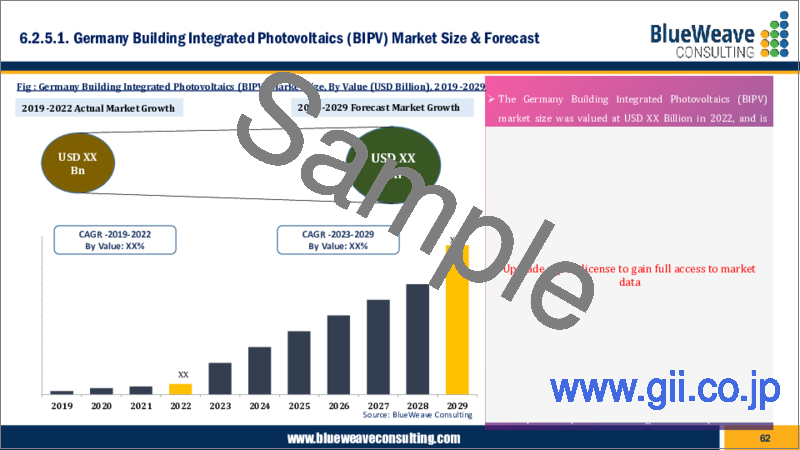

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- ベルギー

- ロシア

- オランダ

- その他欧州

第7章 アジア太平洋地域の建物一体型太陽光発電(BIPV)市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- テクノロジー別

- 用途別

- エンドユーザー別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- インドネシア

- マレーシア

- シンガポール

- ベトナム

- APACのその他の地域

第8章 ラテンアメリカの建物一体型太陽光発電(BIPV)市場

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- テクノロジー別

- 用途別

- エンドユーザー別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- 中南米のその他の地域

第9章 中東およびアフリカの建物一体型太陽光発電(BIPV)市場の構築

- 市場規模と予測、2019~2029年

- 金額別

- 市場シェアと予測

- 製品別

- テクノロジー別

- 用途別

- エンドユーザー別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- 南アフリカ

- ナイジェリア

- アルジェリア

- MEAのその他の地域

第10章 競合情勢

- 主要企業とその製品のリスト

- 世界のビル建物一体型太陽光発電(BIPV)市場シェア分析、2022年

- 動作パラメータによる競合ベンチマーキング

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 世界の建物一体型太陽光発電(BIPV)市場に対するCOVID-19の影響

第12章 企業プロファイル(会社概要、財務マトリックス、競合情勢、主要な人材、主要な競合、連絡先住所、戦略的展望、 SWOT分析)

- AGC Solar

- Belectric

- Heliatek GmBH

- Canadian Solar Inc.

- Ertex Solartechnik Gmbh

- Tesla Inc.

- Solaria Corporation

- Carmanah Technologies Corporation

- Greatcell Solar Limited

- Hanergy Holding Group Limited

- Onyx Solar Group LLC

- NanoPV Solar Inc.

- Polysolar Ltd

- ViaSolis

- Other Prominent Players

第13章 主要な戦略的推奨事項

第14章 調査手法

- 定性的調査

- 一次および2次調査

- 定量的調査

- 市場内訳とデータの三角測量

- 2次調査

- 1次調査

- 1次調査回答者の地域別内訳

- 前提と制限

Global Building Integrated Photovoltaics (BIPV) Market Size Zooming More Than 3X to Touch USD 44.45 Billion by 2029.

Global building integrated photovoltaics (BIPV) market is flourishing because of the growing inclination towards power generation from renewable energy sources, rising consumer awareness toward several ecological benefits of BIPV, and an increasing expansion of the solar photovoltaic (PV) installation capacities of different countries.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimated the global building integrated photovoltaics (BIPV) market size at USD 14.06 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global building integrated photovoltaics (BIPV) market size to grow at a significant CAGR of 21% reaching a value of USD 44.45 billion by 2029. Major growth drivers for the global building integrated photovoltaics market include an increasing adoption of renewable energy sources, a growing focus on sustainable construction practices, supportive government incentives and regulations, rapid technological advancements in BIPV, and rising demand for green buildings. The market is further propelled by a strong emphasis on energy efficiency and sustainable development, with expectations of continued growth in the forecast period. Global awareness and adoption of solar power have been driven by countries prioritizing energy security and self-sufficiency. Supportive government legislations and commitments to reduce greenhouse gas emissions further fuel market growth. Key countries driving the transition to solar energy include Germany, Italy, France, the United Kingdom, the United States, China, Japan, and India. With these favorable conditions, the solar panel market is poised for significant expansion in the upcoming years. However, high initial costs of investments and complexity of building integrated photovoltaics (BIPV) installations are anticipated to restrain the overall market growth during the period in analysis.

Global Building Integrated Photovoltaics Market - Overview:

The global building integrated photovoltaics (BIPV) market refers to the integration of photovoltaic materials into building elements, such as windows, facades, and roofs, to generate electricity while simultaneously serving their functional purposes. BIPV technology enables the seamless incorporation of solar panels into the building's design, allowing for the production of renewable energy on-site. This innovative approach combines the benefits of solar power generation with the aesthetics and functionality of building materials. BIPV systems can contribute to energy efficiency, reduce reliance on traditional power sources, and lower carbon emissions. The global BIPV market encompasses various technologies, materials, and applications aimed at integrating solar power generation into the built environment to meet the increasing demand for sustainable and energy-efficient buildings.

Impact of COVID-19 on Global Building Integrated Photovoltaics Market:

COVID-19 pandemic had a mixed impact on the global building integrated photovoltaics (BIPV) market. The pandemic caused disruptions in supply chains, project delays, and reduced construction activities, which affected the BIPV market. Economic uncertainties and financial constraints also affected investment decisions and slowed down the adoption of BIPV solutions. On the other hand, the pandemic heightened awareness about the importance of sustainable and resilient buildings, leading to an increased focus on green energy solutions like BIPV. Government stimulus packages and recovery plans emphasizing renewable energy and green building initiatives are expected to drive the market's recovery and growth in the post-pandemic period.

Global Building Integrated Photovoltaics Market - By Technology:

Based on technology, the global building integrated photovoltaics (BIPV) market is bifurcated into Crystalline Silicon and Thin Film segments. The crystalline silicon technology segment held a higher market share in 2022. Smart mounting systems allow for the seamless integration of crystalline silicon cells into building roofs, preserving the roof's integrity. This integration method offers high efficiency and does not require significant investments. Another approach involves replacing traditional roof tiles with crystalline silicon cells, providing an alternative means of integration. Additionally, the market is witnessing the utilization of anti-reflective coatings, enhancing solar energy capture and overall efficiency. Crystalline silicon currently boasts the highest energy conversion efficiency, with commercial modules typically converting 13% to 21% of incident sunlight into electricity. This makes it a highly desirable choice for building-integrated photovoltaics (BIPV). The continuous advancements in crystalline silicon technology are driving efficiency improvements and expanding the potential applications of BIPV systems.

Competitive Landscape:

Major players operating in the global building integrated photovoltaics (BIPV) market include: AGC Solar, Belectric, Heliatek GmBH, Canadian Solar Inc., Ertex Solartechnik Gmbh, Tesla Inc., Solaria Corporation, Carmanah Technologies Corporation, Greatcell Solar Limited, Hanergy Holding Group Limited, Onyx Solar Group LLC, NanoPV Solar Inc., Polysolar Ltd, and ViaSolis. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Building Integrated Photovoltaics Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in the Global Building Integrated Photovoltaics Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Building Integrated Photovoltaics (BIPV) Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Rapid expansion of the solar photovoltaic (PV) installation capacities of different countries

- 3.2.1.2. Increasing inclination towards renewables-based power generation

- 3.2.1.3. Rise in consumer awareness toward several ecological benefits of BIPV

- 3.2.2. Restraints

- 3.2.2.1. High initial cost of investments

- 3.2.2.2. Complexity of building integrated photovoltaics (BIPV) installations

- 3.2.3. Opportunities

- 3.2.3.1. Rapid modernization in the construction and building sector

- 3.2.3.2. Rise in investments in several R&D activities for superior integration of advanced module technologies

- 3.2.4. Challenges

- 3.2.4.1. Lack of standardization

- 3.2.4.2. Limited awareness and market education

- 3.2.1. Growth Drivers

- 3.3. Technology Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Building Integrated Photovoltaics (BIPV) Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Billion)

- 4.2. Market Share and Forecast

- 4.2.1. By Product

- 4.2.1.1. Roofing

- 4.2.1.2. Shading

- 4.2.1.3. Cladding

- 4.2.1.4. Glazing

- 4.2.1.5. Wall integrated Solution

- 4.2.1.6. Glass

- 4.2.1.7. Others

- 4.2.2. By Technology

- 4.2.2.1. Crystalline silicon

- 4.2.2.2. Thin film

- 4.2.2.3. Others

- 4.2.3. By Application

- 4.2.3.1. Roofs

- 4.2.3.2. Walls

- 4.2.3.3. Glass

- 4.2.3.4. Facade

- 4.2.3.5. Others

- 4.2.4. By End User

- 4.2.4.1. Residential

- 4.2.4.2. Commercial

- 4.2.4.3. Industrial

- 4.2.5. By Region

- 4.2.5.1. North America

- 4.2.5.2. Europe

- 4.2.5.3. Asia Pacific (APAC)

- 4.2.5.4. Latin America (LATAM)

- 4.2.5.5. Middle East and Africa (MEA)

- 4.2.1. By Product

5. North America Building Integrated Photovoltaics (BIPV) Market

- 5.1. Market Size & Forecast, 2019-2029

- 5.1.1. By Value (USD Billion)

- 5.2. Market Share & Forecast

- 5.2.1. By Product

- 5.2.2. By Technology

- 5.2.3. By Application

- 5.2.4. By End User

- 5.2.5. By Country

- 5.2.5.1. United States

- 5.2.5.1.1. By Product

- 5.2.5.1.2. By Technology

- 5.2.5.1.3. By Application

- 5.2.5.1.4. By End User

- 5.2.5.2. Canada

- 5.2.5.2.1. By Product

- 5.2.5.2.2. By Technology

- 5.2.5.2.3. By Application

- 5.2.5.2.4. By End User

6. Europe Building Integrated Photovoltaics (BIPV) Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Billion)

- 6.2. Market Share & Forecast

- 6.2.1. By Product

- 6.2.2. By Technology

- 6.2.3. By Application

- 6.2.4. By End User

- 6.2.5. By Country

- 6.2.5.1. Germany

- 6.2.5.1.1. By Product

- 6.2.5.1.2. By Technology

- 6.2.5.1.3. By Application

- 6.2.5.1.4. By End User

- 6.2.5.2. United Kingdom

- 6.2.5.2.1. By Product

- 6.2.5.2.2. By Technology

- 6.2.5.2.3. By Application

- 6.2.5.2.4. By End User

- 6.2.5.3. Italy

- 6.2.5.3.1. By Product

- 6.2.5.3.2. By Technology

- 6.2.5.3.3. By Application

- 6.2.5.3.4. By End User

- 6.2.5.4. France

- 6.2.5.4.1. By Product

- 6.2.5.4.2. By Technology

- 6.2.5.4.3. By Application

- 6.2.5.4.4. By End User

- 6.2.5.5. Spain

- 6.2.5.5.1. By Product

- 6.2.5.5.2. By Technology

- 6.2.5.5.3. By Application

- 6.2.5.5.4. By End User

- 6.2.5.6. Belgium

- 6.2.5.6.1. By Product

- 6.2.5.6.2. By Technology

- 6.2.5.6.3. By Application

- 6.2.5.6.4. By End User

- 6.2.5.7. Russia

- 6.2.5.7.1. By Product

- 6.2.5.7.2. By Technology

- 6.2.5.7.3. By Application

- 6.2.5.7.4. By End User

- 6.2.5.8. The Netherlands

- 6.2.5.8.1. By Product

- 6.2.5.8.2. By Technology

- 6.2.5.8.3. By Application

- 6.2.5.8.4. By End User

- 6.2.5.9. Rest of Europe

- 6.2.5.9.1. By Product

- 6.2.5.9.2. By Technology

- 6.2.5.9.3. By Application

- 6.2.5.9.4. By End User

7. Asia-Pacific Building Integrated Photovoltaics (BIPV) Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Billion)

- 7.2. Market Share & Forecast

- 7.2.1. By Product

- 7.2.2. By Technology

- 7.2.3. By Application

- 7.2.4. By End User

- 7.2.5. By Country

- 7.2.5.1. China

- 7.2.5.1.1. By Product

- 7.2.5.1.2. By Technology

- 7.2.5.1.3. By Application

- 7.2.5.1.4. By End User

- 7.2.5.2. India

- 7.2.5.2.1. By Product

- 7.2.5.2.2. By Technology

- 7.2.5.2.3. By Application

- 7.2.5.2.4. By End User

- 7.2.5.3. Japan

- 7.2.5.3.1. By Product

- 7.2.5.3.2. By Technology

- 7.2.5.3.3. By Application

- 7.2.5.3.4. By End User

- 7.2.5.4. South Korea

- 7.2.5.4.1. By Product

- 7.2.5.4.2. By Technology

- 7.2.5.4.3. By Application

- 7.2.5.4.4. By End User

- 7.2.5.5. Australia & New Zealand

- 7.2.5.5.1. By Product

- 7.2.5.5.2. By Technology

- 7.2.5.5.3. By Application

- 7.2.5.5.4. By End User

- 7.2.5.6. Indonesia

- 7.2.5.6.1. By Product

- 7.2.5.6.2. By Technology

- 7.2.5.6.3. By Application

- 7.2.5.6.4. By End User

- 7.2.5.7. Malaysia

- 7.2.5.7.1. By Product

- 7.2.5.7.2. By Technology

- 7.2.5.7.3. By Application

- 7.2.5.7.4. By End User

- 7.2.5.8. Singapore

- 7.2.5.8.1. By Product

- 7.2.5.8.2. By Technology

- 7.2.5.8.3. By Application

- 7.2.5.8.4. By End User

- 7.2.5.9. Vietnam

- 7.2.5.9.1. By Product

- 7.2.5.9.2. By Technology

- 7.2.5.9.3. By Application

- 7.2.5.9.4. By End User

- 7.2.5.10. Rest of APAC

- 7.2.5.10.1. By Product

- 7.2.5.10.2. By Technology

- 7.2.5.10.3. By Application

- 7.2.5.10.4. By End User

8. Latin America Building Integrated Photovoltaics (BIPV) Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Billion)

- 8.2. Market Share & Forecast

- 8.2.1. By Product

- 8.2.2. By Technology

- 8.2.3. By Application

- 8.2.4. By End User

- 8.2.5. By Country

- 8.2.5.1. Brazil

- 8.2.5.1.1. By Product

- 8.2.5.1.2. By Technology

- 8.2.5.1.3. By Application

- 8.2.5.1.4. By End User

- 8.2.5.2. Mexico

- 8.2.5.2.1. By Product

- 8.2.5.2.2. By Technology

- 8.2.5.2.3. By Application

- 8.2.5.2.4. By End User

- 8.2.5.3. Argentina

- 8.2.5.3.1. By Product

- 8.2.5.3.2. By Technology

- 8.2.5.3.3. By Application

- 8.2.5.3.4. By End User

- 8.2.5.4. Peru

- 8.2.5.4.1. By Product

- 8.2.5.4.2. By Technology

- 8.2.5.4.3. By Application

- 8.2.5.4.4. By End User

- 8.2.5.5. Rest of LATAM

- 8.2.5.5.1. By Product

- 8.2.5.5.2. By Technology

- 8.2.5.5.3. By Application

- 8.2.5.5.4. By End User

9. Middle East & Africa Building Integrated Photovoltaics (BIPV) Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Billion)

- 9.2. Market Share & Forecast

- 9.2.1. By Product

- 9.2.2. By Technology

- 9.2.3. By Application

- 9.2.4. By End User

- 9.2.5. By Country

- 9.2.5.1. Saudi Arabia

- 9.2.5.1.1. By Product

- 9.2.5.1.2. By Technology

- 9.2.5.1.3. By Application

- 9.2.5.1.4. By End User

- 9.2.5.2. UAE

- 9.2.5.2.1. By Product

- 9.2.5.2.2. By Technology

- 9.2.5.2.3. By Application

- 9.2.5.2.4. By End User

- 9.2.5.3. Qatar

- 9.2.5.3.1. By Product

- 9.2.5.3.2. By Technology

- 9.2.5.3.3. By Application

- 9.2.5.3.4. By End User

- 9.2.5.4. Kuwait

- 9.2.5.4.1. By Product

- 9.2.5.4.2. By Technology

- 9.2.5.4.3. By Application

- 9.2.5.4.4. By End User

- 9.2.5.5. South Africa

- 9.2.5.5.1. By Product

- 9.2.5.5.2. By Technology

- 9.2.5.5.3. By Application

- 9.2.5.5.4. By End User

- 9.2.5.6. Nigeria

- 9.2.5.6.1. By Product

- 9.2.5.6.2. By Technology

- 9.2.5.6.3. By Application

- 9.2.5.6.4. By End User

- 9.2.5.7. Algeria

- 9.2.5.7.1. By Product

- 9.2.5.7.2. By Technology

- 9.2.5.7.3. By Application

- 9.2.5.7.4. By End User

- 9.2.5.8. Rest of MEA

- 9.2.5.8.1. By Product

- 9.2.5.8.2. By Technology

- 9.2.5.8.3. By Application

- 9.2.5.8.4. By End User

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Building Integrated Photovoltaics (BIPV) Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, etc.)

11. Impact of Covid-19 on Global Building Integrated Photovoltaics (BIPV) Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT Analysis)

- 12.1. AGC Solar

- 12.2. Belectric

- 12.3. Heliatek GmBH

- 12.4. Canadian Solar Inc.

- 12.5. Ertex Solartechnik Gmbh

- 12.6. Tesla Inc.

- 12.7. Solaria Corporation

- 12.8. Carmanah Technologies Corporation

- 12.9. Greatcell Solar Limited

- 12.10. Hanergy Holding Group Limited

- 12.11. Onyx Solar Group LLC

- 12.12. NanoPV Solar Inc.

- 12.13. Polysolar Ltd

- 12.14. ViaSolis

- 12.15. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations