|

|

市場調査レポート

商品コード

1432340

ナノコーティング市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2023年~2033年)Nanocoatings Market - A Global and Regional Analysis: Focus on Application, Product, and Region - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| ナノコーティング市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2023年~2033年) |

|

出版日: 2024年02月23日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のナノコーティングの市場規模は、2023年の142億8,750万米ドルから2033年には489億2,390万米ドルに達し、予測期間のCAGRは13.10%になると予測されています。

世界のナノコーティング市場は、いくつかの要因によって大きな成長を遂げています。これには、自動車、エレクトロニクス、ヘルスケア、建設などさまざまな産業で、耐スクラッチ性、耐腐食性、セルフクリーニング機能などの機能性を強化した高度なコーティングへの需要が高まっていることが挙げられます。さらに、ナノテクノロジーの進歩により、優れた性能特性を持つ新規コーティング処方が開発されています。さらに、環境に対する懸念や規制要件の高まりが、環境に優しいナノコーティングの採用を促進し、市場の拡大をさらに後押ししています。製品の耐久性、持続可能性、性能の向上に重点を置くことで、ナノコーティング市場は今後数年間、継続的な成長が見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023年~2033年 |

| 2023年の評価額 | 142億8,000万米ドル |

| 2033年の予測 | 489億2,000万米ドル |

| CAGR | 13.1% |

ナノコーティングは、表面工学における最先端の進歩を象徴しています。ナノサイズの粒子を構成要素として、綿密に設計されたこれらの薄膜は、様々な産業において多くの利点を提供します。自動車用途における耐スクラッチ性の向上や腐食保護の改善から、ヘルスケア環境における抗菌特性の強化に至るまで、ナノコーティングは表面の機能性を再定義します。ナノコーティングの比類のない精度と調整された特性は、エレクトロニクス、航空宇宙、自動車分野のイノベーションを促進し、性能と耐久性の向上を約束します。産業界が持続可能性と効率性をますます優先するようになるにつれ、ナノコーティングは不可欠なソリューションとして台頭し、製品の寿命、環境持続可能性、業務効能の変革的強化を推進しています。

世界のナノコーティング市場は、表面保護と強化への先駆的なアプローチを導入し、ナノテクノロジーの進歩を活用して、さまざまな産業で比類のない機能性を提供しています。これらのコーティングは、優れた耐摩耗性、耐久性の向上、表面機能の強化といった卓越した特性を提供し、自動車、エレクトロニクス、ヘルスケア、航空宇宙などの分野の進化する需要に対応しています。持続可能性と性能の最適化がますます重視される中、ナノコーティングは、表面保護と機能化における新たな課題に対処するための極めて重要なソリューションとなっています。産業界が製品の性能を高め、寿命を延ばす革新的な戦略を模索する中、世界のナノコーティング市場は、変革的な技術進歩の礎石として浮上しています。

当レポートでは、世界のナノコーティング市場について調査し、市場の概要とともに、用途別、製品別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現在および将来の影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 主要な世界的出来事の影響分析:COVID-19

- 市場力学:概要

第2章 用途

- 用途のセグメンテーション

- 用途の概要

- 世界のナノコーティング市場(エンドユーザー業界別)

第3章 製品

- 製品のセグメンテーション

- 製品概要

- 世界のナノコーティング市場(タイプ別)

第4章 地域

- 地域別の概要

- 促進要因と抑制要因

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Aquashield Technologies

- Bio-Gate AG

- Buhler AG

- CG2 Nanocoatings Inc.

- Inframat Corporation

- Nano-Care Deutschland AG

- Nanofilm

- Nanophase Technologies Corporation

- Nanovere Technologies, LLC.

- P2i Ltd.

- Surfix Diagnostics

- Tesla NanoCoatings, Inc.

- Advanced NanoTech Lab

- PPG Industries, Inc.

- actnano Inc.

第6章 調査手法

List of Figures

- Figure 1: Region with Largest Share of Market, 2022, 2026, and 2033

- Figure 2: Global Nanocoatings Market (by End-User Industry), 2022, 2026, and 2033

- Figure 3: Global Nanocoatings Market (by Type), 2022, 2026, and 2033

- Figure 4: Nanocoatings, Recent Developments

- Figure 5: Supply Chain and Risks within the Supply Chain

- Figure 6: Patent Analysis (by Country), January 2020-December 2023

- Figure 7: Patent Analysis (by Company), January 2020-December 2023

- Figure 8: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 9: Strategic Initiatives, 2021-2023

- Figure 10: Share of Strategic Initiatives

- Figure 11: Data Triangulation

- Figure 12: Top-Down and Bottom-Up Approach

- Figure 13: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Nanocoatings Market, Opportunities

- Table 3: Global Nanocoatings Market (by Region), $Million, 2022-2033

- Table 4: North America Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 5: North America Nanocoatings Market (by Type), $Million, 2022-2033

- Table 6: U.S. Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 7: U.S. Nanocoatings Market (by Type), $Million, 2022-2033

- Table 8: Canada Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 9: Canada Nanocoatings Market (by Type), $Million, 2022-2033

- Table 10: Mexico Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 11: Mexico Nanocoatings Market (by Type), $Million, 2022-2033

- Table 12: Europe Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 13: Europe Nanocoatings Market (by Type), $Million, 2022-2033

- Table 14: Germany Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 15: Germany Nanocoatings Market (by Type), $Million, 2022-2033

- Table 16: France Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 17: France Nanocoatings Market (by Type), $Million, 2022-2033

- Table 18: U.K. Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 19: U.K. Nanocoatings Market (by Type), $Million, 2022-2033

- Table 20: Italy Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 21: Italy Nanocoatings Market (by Type), $Million, 2022-2033

- Table 22: Spain Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 23: Spain Nanocoatings Market (by Type), $Million, 2022-2033

- Table 24: Rest-of-Europe Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 25: Rest-of-Europe Nanocoatings Market (by Type), $Million, 2022-2033

- Table 26: Asia-Pacific Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 27: Asia-Pacific Nanocoatings Market (by Type), $Million, 2022-2033

- Table 28: China Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 29: China Nanocoatings Market (by Type), $Million, 2022-2033

- Table 30: India Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 31: India Nanocoatings Market (by Type), $Million, 2022-2033

- Table 32: Japan Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 33: Japan Nanocoatings Market (by Type), $Million, 2022-2033

- Table 34: South Korea Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 35: South Korea Nanocoatings Market (by Type), $Million, 2022-2033

- Table 36: Rest-of-Asia-Pacific Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 37: Rest-of-Asia-Pacific Nanocoatings Market (by Type), $Million, 2022-2033

- Table 38: Rest-of-the-World Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 39: Rest-of-the-World Nanocoatings Market (by Type), $Million, 2022-2033

- Table 40: South America Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 41: South America Nanocoatings Market (by Type), $Million, 2022-2033

- Table 42: Middle East and Africa Nanocoatings Market (by End-User Industry), $Million, 2022-2033

- Table 43: Middle East and Africa Nanocoatings Market (by Type), $Million, 2022-2033

- Table 44: Market Share, 2022

The Global Nanocoatings Market Expected to Reach $48.92 Billion by 2033

Global Nanocoatings Market Overview

The global nanocoatings market is projected to reach $48,923.9 million by 2033 from $14,287.5 million in 2023, growing at a CAGR of 13.10% during the forecast period 2023-2033. The global nanocoatings market is experiencing significant growth due to several factors. These include the increasing demand for advanced coatings with enhanced functionalities such as scratch resistance, anti-corrosion properties, and self-cleaning capabilities across various industries, including automotive, electronics, healthcare, and construction. Additionally, advancements in nanotechnology have led to the development of novel coating formulations with superior performance characteristics. Moreover, growing environmental concerns and regulatory requirements are driving the adoption of eco-friendly nanocoatings, further fueling market expansion. With a focus on improving product durability, sustainability, and performance, the nanocoatings market is poised for continued growth in the coming years.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $14.28 Billion |

| 2033 Forecast | $48.92 Billion |

| CAGR | 13.1% |

Introduction to Nanocoatings

Nanocoatings epitomize cutting-edge advancements in surface engineering. These meticulously engineered thin films, with nano-sized particles as building blocks, offer a plethora of benefits across diverse industries. From augmented scratch resistance and improved corrosion protection in automotive applications to enhanced antimicrobial properties in healthcare settings, nanocoatings redefine surface functionalities. The unparalleled precision and tailored properties of nanocoatings facilitate innovations in electronics, aerospace, and automotive sectors, promising heightened performance and durability. As industries increasingly prioritize sustainability and efficiency, nanocoatings emerge as indispensable solutions, driving transformative enhancements in product longevity, environmental sustainability, and operational efficacy.

Market Introduction

The global nanocoatings market introduces a pioneering approach to surface protection and enhancement, leveraging nanotechnology advancements to provide unparalleled functionalities across diverse industries. These coatings offer exceptional properties such as superior abrasion resistance, enhanced durability, and heightened surface functionalities, catering to the evolving demands of sectors including automotive, electronics, healthcare, and aerospace. With increasing emphasis on sustainability and performance optimization, nanocoatings represent a pivotal solution for addressing emerging challenges in surface protection and functionalization. As industries seek innovative strategies to enhance product performance and prolong lifespan, the global nanocoatings market emerges as a cornerstone of transformative technological advancement.

Industrial Impact

The industrial landscape undergoes a profound transformation with the advent of nanocoatings, revolutionizing traditional surface treatment methods across diverse sectors. These coatings offer unparalleled protection against corrosion, wear, and environmental degradation, prolonging the lifespan of industrial assets and reducing maintenance costs. Additionally, nanocoatings enhance functionality by introducing features such as self-cleaning surfaces, antimicrobial properties, and thermal insulation. With their ability to improve efficiency, durability, and sustainability, nanocoatings are increasingly adopted in industries ranging from automotive and aerospace to healthcare and electronics. As industrial processes evolve to meet stringent performance and environmental standards, nanocoatings emerge as indispensable solutions for enhancing productivity and competitiveness in the global marketplace.

Market Segmentation:

Segmentation 1: by End-User Industry

- Electronics

- Aerospace

- Food and Packaging

- Automotive

- Medical and Healthcare

- Building and Construction

- Marine

- Others

Medical and Healthcare to Lead the Market (by End-User Industry)

In the global nanocoatings market, the medical and healthcare sector is positioned for notable leadership, propelled by a convergence of factors accentuating the sector's escalating appetite for cutting-edge materials and surface innovations. Nanocoatings stand out for their remarkable attributes, including potent antimicrobial properties, seamless biocompatibility, and enduring durability. These characteristics render them uniquely suited to cater to the precise requirements prevalent within the medical and healthcare landscape. By significantly augmenting the efficacy and lifespan of medical instruments, implants, and apparatus, nanocoatings assume a pivotal role in ensuring optimal performance standards. Moreover, they actively contribute to fostering sterile environments and mitigating the risks associated with healthcare-acquired infections (HAIs).

Segmentation 2: by Type

- Self-Cleaning (Photocatalytic) Nanocoatings

- Anti-Microbial Nanocoatings

- Conductive Nanocoatings

- Anti-Fouling Nanocoatings

- Self-Cleaning (Bionic) Nanocoatings

- Anti-Corrosion Nanocoatings

- Abrasion and Wear-Resistant Nanocoatings

- Thermal Barrier Nanocoatings

- Anti-Fingerprint Nanocoatings

- Anti-Icing Nanocoatings

- UV-Resistant Nanocoatings

Self-Cleaning (Photocatalytic) Nanocoatings to Grow at Higher Rates in the Market (by Type)

In the dynamic landscape of the global nanocoatings market, self-cleaning nanocoatings, also known as photocatalytic nanocoatings, stand out as a groundbreaking innovation. These coatings offer game-changing solutions that directly address the growing demand for sustainable and low-maintenance surfaces across a multitude of industries. Harnessing the power of photocatalysis, self-cleaning nanocoatings operate on a sophisticated principle, i.e., light energy activates a catalyst, triggering chemical reactions that effectively disintegrate organic substances and pollutants present on the coated surface. This unique mechanism results in surfaces that possess inherent self-cleaning properties. Dirt, grime, and organic contaminants are swiftly decomposed and subsequently rinsed away by natural elements such as rainwater, ensuring surfaces maintain a pristine appearance with minimal effort.

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America Region to Lead the Market (by Region)

In the dynamic landscape of the global nanocoatings market, North America stands out as a leader, underpinned by its advanced technological ecosystem, robust R&D investment, and the strategic presence of industry frontrunners. This North America region is buoyed by high demand across pivotal sectors, automotive, healthcare, electronics, and construction, leveraging nanocoatings for their exceptional durability, resistance, and functional properties. The adoption of these innovative coatings is further motivated by a strong regional commitment to sustainability and environmental stewardship, aligning with both industry needs and regulatory frameworks. The U.S. and Canada, in particular, are at the vanguard, driving forward market growth through cutting-edge research, development, and application of nanocoatings. This strategic orientation not only reinforces the North America market dominance but also sets the stage for sustained innovation and expansion in the global nanocoatings market.

Recent Developments in the Global Nanocoatings Market

- In November 2023, Nanofilm launched a $49.1 million lab in collaboration with Nanyang Technological University to develop nanotechnology products.

- In May 2023, PPG Industries, Inc. announced a $44 million investment to upgrade five powder coating manufacturing facilities in the U.S. and Latin America.

- In November 2022, Nanofilm announced that its new factory in Huizhou, China, would provide vacuum coating services for high-impact emerging markets such as semiconductors, microelectronics, electrical discharge machining, and industrial tooling.

Demand - Drivers, Restraints, and Opportunities

Market Drivers

The global nanocoatings market is witnessing robust growth driven by several key factors. Firstly, increasing demand from diverse end-user industries such as automotive, aerospace, healthcare, and electronics fuels the adoption of nanocoatings, which offer enhanced durability and functional properties. Secondly, advancements in nanotechnology contribute to the development of more effective and sustainable nanocoatings tailored to meet industry-specific needs. Thirdly, growing environmental awareness and stringent regulations encourage the use of eco-friendly nanocoatings, which minimize ecological impact while maintaining high-performance standards. These factors collectively shape the market landscape, prompting continuous research and development efforts to innovate nanocoating formulations and production methods. As industries strive for advanced, sustainable solutions, the nanocoatings market is poised for further expansion and innovation to meet evolving demands while aligning with environmental imperatives.

Market Restraints

The global nanocoatings market faces challenges due to the high cost of production and implementation stemming from complex manufacturing processes and specialized application methods. Companies are addressing this by innovating cost-effective production techniques and educating end-users on long-term benefits. Collaborative efforts and partnerships within the industry aim to reduce research and development expenses. Additionally, environmental and health concerns arise from potential risks associated with nanoparticles used in nanocoatings. Environmental worries include nanoparticle release and long-term stability effects, while health concerns revolve around respiratory and dermal risks for workers and consumers. Rigorous safety evaluations are necessary for products in direct contact with humans or utilized in food-related applications, ensuring compliance with health standards. Efforts to mitigate these concerns are essential for sustaining growth and ensuring the safe adoption of nanocoatings across industries.

Market Opportunities

The global nanocoatings market presents significant opportunities for growth and innovation through the development of new end-use applications and the transition from conventional coatings to eco-friendly nanocoatings. Nanocoatings offer advanced properties such as antimicrobial and self-cleaning capabilities, catering to diverse industries such as food packaging, textiles, automotive, and healthcare. Technological advancements in nanotechnology enable the creation of novel nanocoatings with enhanced functionalities and environmental sustainability, meeting regulatory requirements and consumer demands. The transition to eco-friendly nanocoatings aligns with increasing environmental consciousness, providing market players with opportunities for differentiation, market expansion, and technological innovation to meet evolving industry needs and consumer preferences.

How can this report add value to an organization?

Product/Innovation Strategy: Product and innovation strategies focus on developing coatings with enhanced functionalities, such as antimicrobial properties and self-cleaning surfaces. Continuous R&D drives the creation of novel formulations tailored to diverse industries, meeting evolving needs while emphasizing sustainability, durability, and regulatory compliance for market differentiation and growth.

Growth/Marketing Strategy: Growth and marketing strategies focus on leveraging technological advancements to develop innovative coatings with superior properties. Strategies include diversification into new industries, emphasizing eco-friendly solutions, and educating consumers on the benefits of nanocoatings to drive market expansion and meet evolving industry needs.

Competitive Strategy: By focusing on innovations, such as developing coatings with novel functionalities, strategic partnerships for market access, and prioritizing sustainability to meet regulatory demands, companies can effectively position themselves for sustained success amidst market competition.

Research Methodology

Factors for Data Prediction and Modeling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate has been taken from the historical exchange rate of the Oanda website.

- Nearly all the recent developments from January 2021 to December 2023 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major breakthroughs in technology.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global nanocoatings market.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the nanocoatings market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study of the nanocoatings market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as IRENA and IEA.

Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the nanocoatings market have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the prominent companies in this market are:

- Aquashield Technologies

- Bio-Gate AG

- Buhler AG

- CG2 Nanocoatings Inc.

- Inframat Corporation

- Nano-Care Deutschland AG

- Nanofilm

- Nanophase Technologies Corporation

- Nanovere Technologies, LLC.

- P2i Ltd.

- Surfix Diagnostics

- Tesla NanoCoatings Inc.

- Advanced NanoTech Lab

- PPG Industries, Inc.

- actnano Inc.

Companies that are not a part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Current and Future Impact Assessment

- 1.1.2 Increase in Demand for Healthcare and Hygiene Applications

- 1.1.3 Growth in the Building and Construction Sector

- 1.1.4 Technological Advancements and Product Innovation

- 1.2 Supply Chain Overview

- 1.2.1 Market Map

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.4.1 Consortiums and Associations

- 1.5 Impact Analysis for Key Global Events: COVID-19

- 1.6 Market Dynamics: Overview

- 1.6.1 Market Drivers

- 1.6.1.1 Increasing Demand from the End-User Industries

- 1.6.1.2 Advancements in Nanotechnology

- 1.6.1.3 Growing Environmental Awareness and Regulations

- 1.6.2 Market Restraints

- 1.6.2.1 High Cost of Production and Implementation

- 1.6.2.2 Environmental and Health Concerns

- 1.6.3 Market Opportunities

- 1.6.3.1 Development of New End-Use Applications

- 1.6.3.2 Switch from Conventional Coatings to Eco-friendly Nanocoatings

- 1.6.1 Market Drivers

2 Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Nanocoatings Market (by End-User Industry)

- 2.3.1 Electronics

- 2.3.2 Aerospace

- 2.3.3 Food and Packaging

- 2.3.4 Automotive

- 2.3.5 Medical and Healthcare

- 2.3.6 Building and Construction

- 2.3.7 Marine

- 2.3.8 Others

3 Products

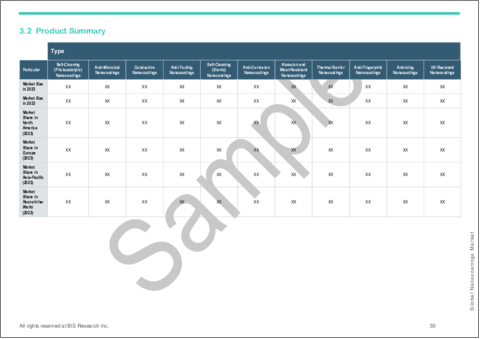

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Nanocoatings Market (by Type)

- 3.3.1 Self-Cleaning (Photocatalytic) Nanocoatings

- 3.3.2 Anti-Microbial Nanocoatings

- 3.3.3 Conductive Nanocoatings

- 3.3.4 Anti-Fouling Nanocoatings

- 3.3.5 Self-Cleaning (Bionic) Nanocoatings

- 3.3.6 Anti-Corrosion Nanocoatings

- 3.3.7 Abrasion and Wear-Resistant Nanocoatings

- 3.3.8 Thermal Barrier Nanocoatings

- 3.3.9 Anti-Fingerprint Nanocoatings

- 3.3.10 Anti-Icing Nanocoatings

- 3.3.11 UV-Resistant Nanocoatings

4 Regions

- 4.1 Regional Summary

- 4.2 Drivers and Restraints

- 4.3 North America

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 U.S.

- 4.3.6.1 Application

- 4.3.6.2 Product

- 4.3.7 Canada

- 4.3.7.1 Application

- 4.3.7.2 Product

- 4.3.8 Mexico

- 4.3.8.1 Application

- 4.3.8.2 Product

- 4.4 Europe

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.3.1 Application

- 4.4.3.2 Product

- 4.4.4 Germany

- 4.4.4.1 Application

- 4.4.4.2 Product

- 4.4.5 France

- 4.4.5.1 Application

- 4.4.5.2 Product

- 4.4.6 U.K.

- 4.4.6.1 Application

- 4.4.6.2 Product

- 4.4.7 Italy

- 4.4.7.1 Application

- 4.4.7.2 Product

- 4.4.8 Spain

- 4.4.8.1 Application

- 4.4.8.2 Product

- 4.4.9 Rest-of-Europe

- 4.4.9.1 Application

- 4.4.9.2 Product

- 4.5 Asia-Pacific

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.3.1 Application

- 4.5.3.2 Product

- 4.5.4 China

- 4.5.4.1 Application

- 4.5.4.2 Product

- 4.5.5 India

- 4.5.5.1 Application

- 4.5.5.2 Product

- 4.5.6 Japan

- 4.5.6.1 Application

- 4.5.6.2 Product

- 4.5.7 South Korea

- 4.5.7.1 Application

- 4.5.7.2 Product

- 4.5.8 Rest-of-Asia-Pacific

- 4.5.8.1 Application

- 4.5.8.2 Product

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Driving Factors for Market Growth

- 4.6.3 Factors Challenging the Market

- 4.6.3.1 Application

- 4.6.3.2 Product

- 4.6.4 South America

- 4.6.4.1 Application

- 4.6.4.2 Product

- 4.6.5 Middle East and Africa (MEA)

- 4.6.5.1 Application

- 4.6.5.2 Product

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.2.1 Aquashield Technologies

- 5.2.1.1 Overview

- 5.2.1.2 Top Products/Product Portfolio

- 5.2.1.3 Top Competitors

- 5.2.1.4 Target Customers

- 5.2.1.5 Analyst View

- 5.2.1.6 Market Share, 2022

- 5.2.2 Bio-Gate AG

- 5.2.2.1 Overview

- 5.2.2.2 Top Products/Product Portfolio

- 5.2.2.3 Top Competitors

- 5.2.2.4 Target Customers

- 5.2.2.5 Key Personnel

- 5.2.2.6 Analyst View

- 5.2.2.7 Market Share, 2022

- 5.2.3 Buhler AG

- 5.2.3.1 Overview

- 5.2.3.2 Top Products/Product Portfolio

- 5.2.3.3 Top Competitors

- 5.2.3.4 Target Customers

- 5.2.3.5 Key Personnel

- 5.2.3.6 Analyst View

- 5.2.3.7 Market Share, 2022

- 5.2.4 CG2 Nanocoatings Inc.

- 5.2.4.1 Overview

- 5.2.4.2 Top Products/Product Portfolio

- 5.2.4.3 Top Competitors

- 5.2.4.4 Target Customers

- 5.2.4.5 Key Personnel

- 5.2.4.6 Analyst View

- 5.2.4.7 Market Share, 2022

- 5.2.5 Inframat Corporation

- 5.2.5.1 Overview

- 5.2.5.2 Top Products/Product Portfolio

- 5.2.5.3 Top Competitors

- 5.2.5.4 Target Customers

- 5.2.5.5 Key Personnel

- 5.2.5.6 Analyst View

- 5.2.5.7 Market Share, 2022

- 5.2.6 Nano-Care Deutschland AG

- 5.2.6.1 Overview

- 5.2.6.2 Top Products/Product Portfolio

- 5.2.6.3 Top Competitors

- 5.2.6.4 Target Customers

- 5.2.6.5 Key Personnel

- 5.2.6.6 Analyst View

- 5.2.6.7 Market Share, 2022

- 5.2.7 Nanofilm

- 5.2.7.1 Overview

- 5.2.7.2 Top Products/Product Portfolio

- 5.2.7.3 Top Competitors

- 5.2.7.4 Target Customers

- 5.2.7.5 Key Personnel

- 5.2.7.6 Analyst View

- 5.2.7.7 Market Share, 2022

- 5.2.8 Nanophase Technologies Corporation

- 5.2.8.1 Overview

- 5.2.8.2 Top Products/Product Portfolio

- 5.2.8.3 Top Competitors

- 5.2.8.4 Target Customers

- 5.2.8.5 Key Personnel

- 5.2.8.6 Analyst View

- 5.2.8.7 Market Share, 2022

- 5.2.9 Nanovere Technologies, LLC.

- 5.2.9.1 Overview

- 5.2.9.2 Top Products/Product Portfolio

- 5.2.9.3 Top Competitors

- 5.2.9.4 Target Customers

- 5.2.9.5 Analyst View

- 5.2.9.6 Market Share, 2022

- 5.2.10 P2i Ltd.

- 5.2.10.1 Overview

- 5.2.10.2 Top Products/Product Portfolio

- 5.2.10.3 Top Competitors

- 5.2.10.4 Target Customers

- 5.2.10.5 Key Personnel

- 5.2.10.6 Analyst View

- 5.2.10.7 Market Share, 2022

- 5.2.11 Surfix Diagnostics

- 5.2.11.1 Overview

- 5.2.11.2 Top Products/Product Portfolio

- 5.2.11.3 Top Competitors

- 5.2.11.4 Target Customers

- 5.2.11.5 Key Personnel

- 5.2.11.6 Analyst View

- 5.2.11.7 Market Share, 2022

- 5.2.12 Tesla NanoCoatings, Inc.

- 5.2.12.1 Overview

- 5.2.12.2 Top Products/Product Portfolio

- 5.2.12.3 Top Competitors

- 5.2.12.4 Target Customers

- 5.2.12.5 Key Personnel

- 5.2.12.6 Analyst View

- 5.2.12.7 Market Share, 2022

- 5.2.13 Advanced NanoTech Lab

- 5.2.13.1 Overview

- 5.2.13.2 Top Products/Product Portfolio

- 5.2.13.3 Top Competitors

- 5.2.13.4 Target Customers

- 5.2.13.5 Key Personnel

- 5.2.13.6 Analyst View

- 5.2.13.7 Market Share, 2022

- 5.2.14 PPG Industries, Inc.

- 5.2.14.1 Overview

- 5.2.14.2 Top Products/Product Portfolio

- 5.2.14.3 Top Competitors

- 5.2.14.4 Target Customers

- 5.2.14.5 Key Personnel

- 5.2.14.6 Analyst View

- 5.2.14.7 Market Share, 2022

- 5.2.15 actnano Inc.

- 5.2.15.1 Overview

- 5.2.15.2 Top Products/Product Portfolio

- 5.2.15.3 Top Competitors

- 5.2.15.4 Target Customers

- 5.2.15.5 Key Personnel

- 5.2.15.6 Analyst View

- 5.2.15.7 Market Share, 2022

- 5.2.1 Aquashield Technologies

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast