|

|

市場調査レポート

商品コード

1419008

欧州の衛星スペクトルモニタリング市場:分析・予測 (2023-2033年)Europe Satellite Spectrum Monitoring Market: Analysis and Forecast, 2023-2033 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 欧州の衛星スペクトルモニタリング市場:分析・予測 (2023-2033年) |

|

出版日: 2024年01月31日

発行: BIS Research

ページ情報: 英文 93 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

欧州の衛星スペクトルモニタリングの市場規模は、2023年の8億9,000万米ドルから、予測期間中は8.68%のCAGRで推移し、2033年には20億5,000万米ドルに達すると予測されています。

同市場の成長は、衛星ベースの通信システムや広範な宇宙通信ネットワークへのニーズの高まりなど、さまざまな要因によって推進されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 8億9,000万米ドル |

| 2033年予測 | 20億5,000万米ドル |

| CAGR | 8.68% |

欧州の衛星スペクトルモニタリングの市場は、衛星通信用の限られた周波数帯域を管理することの重要性の高まりを受けて、大きく発展してきました。この必要性は、20世紀半ばに最初の人工衛星が打ち上げられたときに初めて認識されました。衛星技術が進歩するにつれて、効果的なスペクトルモニタリングと管理がますます重要になっています。今日の市場は、より自動化されたソフトウェア定義のモニタリングシステムへとシフトしており、リアルタイムのデータ解析と干渉検出のために高度なアルゴリズムと機械学習技術を使用しています。

当レポートでは、欧州の衛星スペクトルモニタリングの市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、主要国別の詳細分析、主要企業の分析などをまとめています。

市場の分類

セグメンテーション1:エンドユーザー別

- 航空宇宙

- 船舶・海洋

- 石油・ガス

- 軍事

- 政府機関

- 電気通信

- メディア・エンターテインメント

セグメンテーション2:サービス別

- SaaS (クラウドベーススペクトルモニタリング)

- サービス型スペクトルモニタリング (Spectrum Monitoring-as-a Service)

セグメンテーション3:地域別

- 英国

- ドイツ

- フランス

- その他

目次

エグゼクティブサマリー

第1章 市場

- 業界の展望

- 衛星通信業界における衛星スペクトルモニタリングの役割

- SatComモニタリングに関連するシステムソリューション

- 主要国の規制の枠組み

- 衛星通信に関するITU規則

- 業界の動向

- NGSOネットワーク

- NB-IoT

- スペクトル共有

- 現在のプロジェクトでカバーされている周波数帯の概要

- SKY Perfect JSAT C-Band Spectrum Monitoring Facility

- National Science Foundation's Spectrum Innovation Initiative (SII)

- MilSpace 2 Project

- ESA Advanced Research in Telecommunications Systems (ARTES) Programme

- サプライチェーン分析

- 事業力学

- 事業促進要因

- 事業上の課題

- 事業戦略

- 事業機会

第2章 欧州

- 衛星スペクトルモニタリング市場 (地域別)

- 欧州

- 市場

- 用途

- サービス

- 欧州 (国別)

第3章 市場:競合ベンチマーキング・企業プロファイル

- 市場シェア分析

- Atos

- CRFS Limited

- Integrasys S.A.

- Narda Safety Test Solutions

- Rohde & Schwarz GmbH & Co

- その他

- Cobham

- Microwave Vision Group

- Unseenlabs

第4章 調査手法

List of Figures

- Figure 1: Europe Satellite Spectrum Monitoring Market, $Billion, 2022-2033

- Figure 2: Europe Satellite Spectrum Monitoring Market (by End User), $Million, 2022 and 2033

- Figure 3: Europe Satellite Spectrum Monitoring Market (by Service), $Million, 2022 and 2033

- Figure 4: Satellite Spectrum Monitoring Market (by Region), $Million, 2033

- Figure 5: Satellite Spectrum Monitoring Service Market (by Region), $Million, 2033

- Figure 6: Satellite Spectrum Monitoring Market, Supply Chain Analysis

- Figure 7: Satellite Spectrum Monitoring Market, Business Dynamics

- Figure 8: Share of Key Business Strategies and Developments, January 2020-May 2023

- Figure 9: Satellite Spectrum Monitoring Market Share Analysis (by Company), 2022

- Figure 10: Research Methodology

- Figure 11: Top-Down and Bottom-Up Approach

- Figure 12: Assumptions and Limitations

List of Tables

- Table 1: Partnerships, Collaborations, Agreements and Contracts, January 2020-May 2023

- Table 2: Others, January 2020-May 2023

- Table 3: Satellite Spectrum Monitoring Market (by Region), $Million, 2022-2033

- Table 4: Satellite Spectrum Monitoring Service Market (by Region), $Million, 2022-2033

- Table 5: Europe Satellite Spectrum Monitoring Market (by End User), $Million, 2022-2033

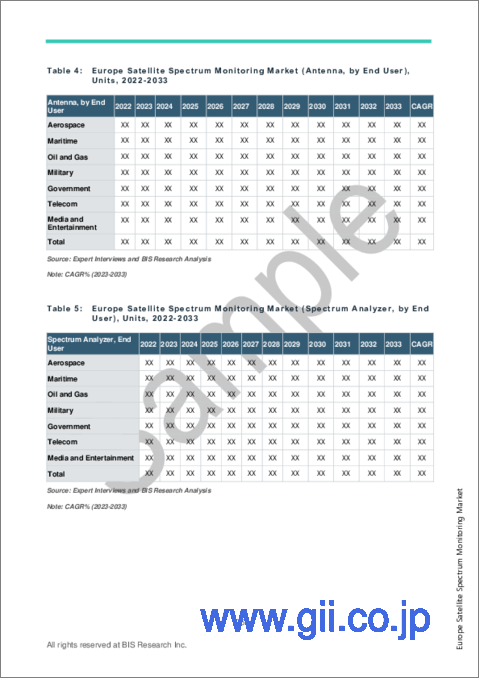

- Table 6: Europe Satellite Spectrum Monitoring Market (Antenna, by End User), Units, 2022-2033

- Table 7: Europe Satellite Spectrum Monitoring Market (Spectrum Analyzer, by End User), Units, 2022-2033

- Table 8: Europe Satellite Spectrum Monitoring Market (Receiver, by End User), Units, 2022-2033

- Table 9: Europe Satellite Spectrum Monitoring Market (Direction Finder, by End User), Units, 2022-2033

- Table 10: Europe Satellite Spectrum Monitoring Market (by Service), $Million, 2022-2033

- Table 11: Germany Satellite Spectrum Monitoring Market (by End User), $Million, 2022-2033

- Table 12: Germany Satellite Spectrum Monitoring Market (Antenna, by End User), Units, 2022-2033

- Table 13: Germany Satellite Spectrum Monitoring Market (Spectrum Analyzer, by End User), Units, 2022-2033

- Table 14: Germany Satellite Spectrum Monitoring Market (Receiver, by End User), Units, 2022-2033

- Table 15: Germany Satellite Spectrum Monitoring Market (Direction Finder, by End User), Units, 2022-2033

- Table 16: U.K. Satellite Spectrum Monitoring Market (by End User), $Million, 2022-2033

- Table 17: U.K. Satellite Spectrum Monitoring Market (Antenna, by End User), Units, 2022-2033

- Table 18: U.K. Satellite Spectrum Monitoring Market (Spectrum Analyzer, by End User), Units, 2022-2033

- Table 19: U.K. Satellite Spectrum Monitoring Market (Receiver, by End User), Units, 2022-2033

- Table 20: U.K. Satellite Spectrum Monitoring Market (Direction Finder, by End User), Units, 2022-2033

- Table 21: France Satellite Spectrum Monitoring Market (by End User), $Million, 2022-2033

- Table 22: France Satellite Spectrum Monitoring Market (Antenna, by End User), Units, 2022-2033

- Table 23: France Satellite Spectrum Monitoring Market (Spectrum Analyzer, by End User), Units, 2022-2033

- Table 24: France Satellite Spectrum Monitoring Market (Receiver, by End User), Units, 2022-2033

- Table 25: France Satellite Spectrum Monitoring Market (Direction Finder, by End User), Units, 2022-2033

- Table 26: Rest-of-Europe Satellite Spectrum Monitoring Market (by End User), $Million, 2022-2033

- Table 27: Rest-of-Europe Satellite Spectrum Monitoring Market (Antenna, by End User), Units, 2022-2033

- Table 28: Rest-of-Europe Satellite Spectrum Monitoring Market (Spectrum Analyzer, by End User), Units, 2022-2033

- Table 29: Rest-of-Europe Satellite Spectrum Monitoring Market (Receiver, by End User), Units, 2022-2033

- Table 30: Rest-of-Europe Satellite Spectrum Monitoring Market (Direction Finder, by End User), Units, 2022-2033

- Table 31: Atos: Product Portfolio

- Table 32: Atos: Partnerships, Collaborations, Agreements, and Contracts

- Table 33: CRFS Limited: Product Portfolio

- Table 34: CRFS Limited: Partnerships, Collaborations, Agreements, and Contracts

- Table 35: Integrasys S.A.: Product Portfolio

- Table 36: Integrasys S.A.: Partnerships, Collaborations, Agreements, and Contracts

- Table 37: Narda Safety Test Solutions: Product Portfolio

- Table 38: Narda Safety Test Solutions: New Product Launches

- Table 39: Rohde & Schwarz GmbH & Co.: Product Portfolio

- Table 40: Rohde & Schwarz GmbH & Co.: New Product Launches

- Table 41: Rohde & Schwarz GmbH & Co.: Partnerships, Collaborations, Agreements, and Contracts

“The Europe Satellite Spectrum Monitoring Market Expected to Reach $2.05 Billion by 2033.”

Introduction to Europe Satellite Spectrum Monitoring Market

The Europe satellite spectrum monitoring market is estimated to reach $2.05 billion by 2033 from $0.89 billion in 2023, at a growth rate of 8.68% during the forecast period 2023-2033. The growth of the satellite spectrum monitoring market is propelled by various factors, including the increasing need for satellite-based communication systems and extensive space communication networks.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $0.89 Billion |

| 2033 Forecast | $2.05 Billion |

| CAGR | 8.68% |

Market Introduction

The Europe Satellite Spectrum Monitoring Market has evolved significantly in response to the growing importance of managing the limited frequency spectrum for satellite communications. This necessity was initially recognized when the first artificial satellites were launched in the mid-20th century. As satellite technology advanced, effective spectrum monitoring and management became increasingly critical. In the 1960s and 1970s, the focus of satellite spectrum monitoring was primarily on ensuring clear and interference-free communications. Monitoring stations were established to detect and track unauthorized broadcasts, unexpected interference, and signal quality issues. These early efforts relied on manual observation and basic instruments. Today, the European Satellite Spectrum Monitoring Market has shifted towards more automated and software-defined monitoring systems, using advanced algorithms and machine learning techniques for real-time data analysis and interference detection.

Market Segmentation:

Segmentation 1: by End User

- Aerospace

- Maritime

- Oil and Gas

- Military

- Government

- Telecom

- Media and Entertainment

Segmentation 2: by Service

- Software-as-a-Service (Cloud-Based Spectrum Monitoring)

- Spectrum Monitoring-as-a Service

Segmentation 3: by Region

- U.K.

- Germany

- France

- Rest-of-Europe

How can this report add value to an organization?

Product/Innovation Strategy: The study provides the reader with a detailed understanding of the satellite spectrum monitoring market by end user (aerospace, maritime, oil and gas, military, government, telecom, and media and entertainment), and service (software-as-a-service and spectrum monitoring as-a-service).

Growth/Marketing Strategy: The satellite spectrum monitoring market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been merger and acquisition to strengthen their position in the satellite spectrum monitoring market.

Competitive Strategy: Key players in the Europe satellite spectrum monitoring market analyzed and profiled in the study involve major satellite spectrum monitoring products and services offering companies providing hardware and software, respectively. Moreover, a detailed competitive benchmarking of the players operating in the satellite spectrum monitoring market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and regional presence.

Some of the prominent names in this market are:

|

|

Table of Contents

Executive Summary

1. Markets

- 1.1. Industry Outlook

- 1.1.1. Role of Satellite Spectrum Monitoring in Satellite Communication Industry

- 1.1.2. Relevant System Solutions for SatCom Monitoring

- 1.2. Regulatory Framework of Key Countries

- 1.2.1. International Telecommunication Union (ITU) Regulations on Satellite Communications

- 1.3. Industry Trends

- 1.3.1. Non-Geostationary Satellite Operators (NGSO) Networks

- 1.3.2. Narrowband Internet of Things (NB-IoT)

- 1.3.3. Spectrum Sharing

- 1.4. Summary of Bands Covered by Current Projects

- 1.4.1. SKY Perfect JSAT C-Band Spectrum Monitoring Facility

- 1.4.2. National Science Foundation's Spectrum Innovation Initiative (SII)

- 1.4.3. MilSpace 2 Project

- 1.4.4. European Space Agency (ESA) Advanced Research in Telecommunications Systems (ARTES) Programme

- 1.5. Supply Chain Analysis

- 1.6. Business Dynamics

- 1.6.1. Business Drivers

- 1.6.1.1. Increasing Demand for Satellite-Based Communication Services

- 1.6.1.2. Deep Space Communication Networks

- 1.6.1.3. Space Debris Mitigation

- 1.6.2. Business Challenges

- 1.6.2.1. High Equipment and Infrastructure Cost

- 1.6.2.2. Rapidly Evolving Technology

- 1.6.3. Business Strategies

- 1.6.3.1. Partnerships, Collaborations, Agreements, and Contracts

- 1.6.3.2. Others

- 1.6.4. Business Opportunities

- 1.6.4.1. Increasing Adoption of Satellite Connectivity for IoT Applications

- 1.6.1. Business Drivers

2. Europe

- 2.1. Satellite Spectrum Monitoring Market (by Region)

- 2.2. Europe

- 2.2.1. Market

- 2.2.1.1. Key Manufacturers and Suppliers in Europe

- 2.2.1.2. Business Drivers

- 2.2.1.3. Business Challenges

- 2.2.2. Application

- 2.2.2.1. Europe Satellite Spectrum Monitoring Market (by End User)

- 2.2.3. Service

- 2.2.3.1. Europe Satellite Spectrum Monitoring Market (by Service)

- 2.2.4. Europe (by Country)

- 2.2.4.1. Germany

- 2.2.4.1.1. Market

- 2.2.4.1.1.1. Key Players in Germany

- 2.2.4.1.2. Application

- 2.2.4.1.2.1. Germany Satellite Spectrum Monitoring Market (by End User)

- 2.2.4.1.1. Market

- 2.2.4.2. U.K.

- 2.2.4.2.1. Market

- 2.2.4.2.1.1. Key Manufacturers and Suppliers in the U.K.

- 2.2.4.2.2. Application

- 2.2.4.2.2.1. U.K. Satellite Spectrum Monitoring Market (by End User)

- 2.2.4.2.1. Market

- 2.2.4.3. France

- 2.2.4.3.1. Market

- 2.2.4.3.1.1. Key Manufacturers and Service Providers in France

- 2.2.4.3.2. Application

- 2.2.4.3.2.1. France Satellite Spectrum Monitoring Market (by End User)

- 2.2.4.3.1. Market

- 2.2.4.4. Rest-of-Europe

- 2.2.4.4.1. Application

- 2.2.4.4.1.1. Rest-of-Europe Satellite Spectrum Monitoring Market (by End User)

- 2.2.4.4.1. Application

- 2.2.4.1. Germany

- 2.2.1. Market

3. Markets - Competitive Benchmarking and Company Profiles

- 3.1. Market Share Analysis

- 3.2. Atos

- 3.2.1. Company Overview

- 3.2.1.1. Role of Atos in Satellite Spectrum Monitoring Market

- 3.2.1.2. Product Portfolio

- 3.2.2. Corporate Strategies

- 3.2.2.1. Partnerships, Collaborations, Agreements, and Contracts

- 3.2.3. Analyst View

- 3.2.1. Company Overview

- 3.3. CRFS Limited

- 3.3.1.1. Company Overview

- 3.3.1.2. Role of CRFS Limited in the Satellite Spectrum Monitoring Market

- 3.3.1.3. Product Portfolio

- 3.3.2. Corporate Strategies

- 3.3.2.1. Partnerships, Collaborations, Agreements, and Contracts

- 3.3.3. Analyst View

- 3.4. Integrasys S.A.

- 3.4.1. Company Overview

- 3.4.1.1. Role of Integrasys S.A. in the Satellite Spectrum Monitoring Market

- 3.4.1.2. Service Portfolio

- 3.4.2. Corporate Strategies

- 3.4.2.1. Partnerships, Collaborations, Agreements, and Contracts

- 3.4.3. Analyst View

- 3.4.1. Company Overview

- 3.5. Narda Safety Test Solutions

- 3.5.1. Company Overview

- 3.5.1.1. Role of Narda Safety Test Solutions in Satellite Spectrum Monitoring Market

- 3.5.1.2. Product Portfolio

- 3.5.2. Business Strategies

- 3.5.2.1. New Product Launches

- 3.5.3. Analyst View

- 3.5.1. Company Overview

- 3.6. Rohde & Schwarz GmbH & Co

- 3.6.1. Company Overview

- 3.6.1.1. Role of Rohde & Schwarz GmbH & Co. in Satellite Spectrum Monitoring Market

- 3.6.1.2. Product Portfolio

- 3.6.2. Business Strategies

- 3.6.2.1. New Product Launches

- 3.6.3. Corporate Strategies

- 3.6.3.1. Partnerships, Collaborations, Agreements, and Contracts

- 3.6.4. Analyst View

- 3.6.1. Company Overview

- 3.7. Other Key Players

- 3.7.1. Cobham

- 3.7.1.1. Company Overview

- 3.7.2. Microwave Vision Group

- 3.7.2.1. Company Overview

- 3.7.3. Unseenlabs

- 3.7.3.1. Company Overview

- 3.7.1. Cobham

4. Research Methodology

- 4.1. Factors for Data Prediction and Modeling