|

|

市場調査レポート

商品コード

1653918

米国の室内空気品質 (IAQ) 市場U.S. Indoor Air Quality Market |

||||||

|

|||||||

| 米国の室内空気品質 (IAQ) 市場 |

|

出版日: 2025年02月06日

発行: BCC Research

ページ情報: 英文 119 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国の室内空気品質 (IAQ) の市場規模は、2023年の102億米ドル、2024年の105億米ドルから、予測期間中はCAGR 4.3%で推移し、2029年には129億米ドルに達すると予測されています。

南部地域は、2024年の41億米ドルから、予測期間中はCAGR 5.3%で推移し、2029年には53億米ドルに達すると予測されています。また、北東部は、2024年の17億米ドルから、CAGR 4.4%で推移し、2029年には21億米ドルに達すると予測されます。

当レポートでは、米国の室内空気品質 (IAQ) の市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場概要

- 市場力学と成長

- セグメント分析

- 地域別洞察と新興市場

- 結論

第2章 市場概要

- 市場概要と将来のシナリオ

- サプライチェーン分析

- ポーターのファイブフォース分析

- マクロ経済要因分析

- 規制枠組みの最近の動向

- 米国のIAQプロジェクトのケーススタディ

第3章 市場力学

- 概要

- 市場促進要因

- IAQを支援する政府規制

- IAQ製品の必要性に関する消費者の認識

- 室内空気汚染の増加

- 市場抑制要因

- IAQ製品の初期コスト

- 標準化の欠如

- 市場機会

- IAQ製品の技術開発

- 産業部門の拡大

- 市場動向

- IAQを監視するスマート技術

- 支援投資とプログラム助成金

- 市場力学の短期的・長期的影響

第4章 新興技術と開発

- 概要

- 新興技術/用途

- 空気の質を改善するホームオートメーション

- 空気清浄技術の進歩

- IAQ製品へのIoTの統合

- AIとMLの統合

- 特許分析

- 概要

- 主要特許

- サマリー

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- サマリー

- 米国のIAQ市場:タイプ別

- 機器

- サービス

- 米国のIAQ市場:製品タイプ別

- サマリー

- 空気清浄機

- 加湿器

- 換気システム

- エアフィルター

- 除湿機

- 紫外線ランプ

- 一酸化炭素警報器

- 米国のIAQ市場:エンドユーザー産業別

- サマリー

- 住宅

- 商業

- 産業

- その他

- 地理的内訳

- サマリー

- 米国のIAQ市場:地域別

- 南部

- 西部

- 中西部

- 北東部

第6章 競合情報

- 概要

- 市場シェア分析

- 企業戦略と製品ポートフォリオマトリックス

- 製品マッピング分析

- 戦略と財務パフォーマンス分析

第7章 米国のIAQ市場における持続可能性:ESGの観点

- 概要

- 環境への影響

- 社会的影響

- ガバナンスの影響

- 米国のIAQ業界におけるESGの現状

- ケーススタディ:ESGの成功事例

- Honeywell International Inc.

- Johnson Controls

- Carrier

- ESGに対する消費者の態度

- BCCによる総論

第8章 付録

- 調査手法

- 調査のステップ

- 参考文献

- 略語

- 企業プロファイル

- APRILAIRE

- BEYOND BY AERUS

- BLUEAIR

- CAMFIL

- CARRIER

- DAIKIN INDUSTRIES LTD.

- HONEYWELL INTERNATIONAL INC.

- JOHNSON CONTROLS

- LENNOX INTERNATIONAL INC.

- MANN+HUMMEL

- PANASONIC CORP.

- RECTORSEAL

- RGF ENVIRONMENTAL GROUP INC.

- RHEEM MANUFACTURING CO.

- TRANE TECHNOLOGIES PLC.

- 小規模および新興企業

List of Tables

- Summary Table A : U.S. IAQ Market, by Region, Through 2029

- Summary Table B : U.S. IAQ Market Volume, by Region, Through 2029

- Table 1 : Recent Developments in Regulatory Frameworks, February 2023-April 2024

- Table 2 : Impact of Market Drivers

- Table 3 : Impact of Market Opportunities

- Table 4 : Impact of Market Restraints

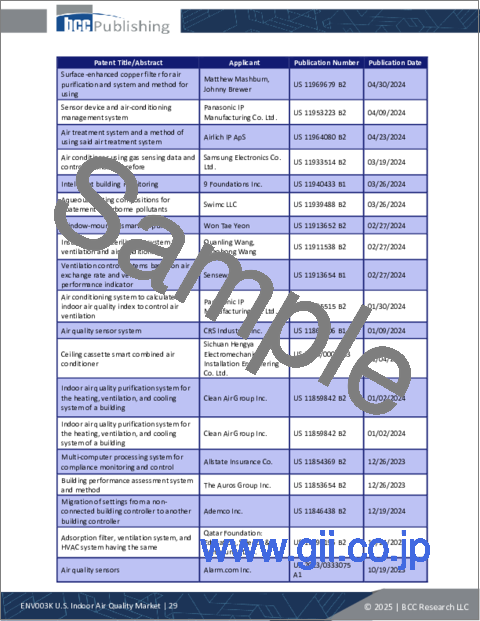

- Table 5 : Active Patents for IAQ Products, January 2023-December 2024

- Table 6 : Active Patents for IAQ Products in the U.S., 2023 and 2024

- Table 7 : U.S. IAQ Market, by Type, Through 2029

- Table 8 : U.S. IAQ Market Volume, by Type, Through 2029

- Table 9 : U.S. IAQ Market, by Product Type, Through 2029

- Table 10 : U.S. IAQ Market Volume, by Product Type, Through 2029

- Table 11 : U.S. IAQ Market, by End-Use Industry, Through 2029

- Table 12 : U.S. IAQ Market Volume, by End-Use Industry, Through 2029

- Table 13 : U.S. IAQ Market, by Region, Through 2029

- Table 14 : U.S. IAQ Market Volume, by Region, Through 2029

- Table 15 : Company Strategies and Product Portfolios in the U.S. IAQ Market, 2023

- Table 16 : Product Mapping Analysis of U.S. IAQ Market, by Product Type, 2023

- Table 17 : Product Introductions in the U.S. IAQ Market, 2022-2024

- Table 18 : Recent Developments in the U.S. IAQ Market, 2024

- Table 19 : ESG Risk Ratings, by Company, 2024

- Table 20 : Sustainability Performance, by Johnson Controls in 2023

- Table 21 : Abbreviations Used in the Report

- Table 22 : AprilAire: Company Snapshot

- Table 23 : AprilAire: Product Portfolio

- Table 24 : AprilAire: News/Key Developments, 2023 and 2024

- Table 25 : Beyond by Aerus: Company Snapshot

- Table 26 : Beyond by Aerus: Product Portfolio

- Table 27 : Blueair: Company Snapshot

- Table 28 : Blueair: Product Portfolio

- Table 29 : Camfil: Company Snapshot

- Table 30 : Camfil: Product Portfolio

- Table 31 : Camfil: News/Key Developments, 2024

- Table 32 : Carrier: Company Snapshot

- Table 33 : Carrier: Financial Performance, FY 2022 and 2023

- Table 34 : Carrier: Product Portfolio

- Table 35 : Daikin Industries Ltd.: Company Snapshot

- Table 36 : Daikin Industries Ltd.: Financial Performance, FY 2022 and 2023

- Table 37 : Daikin Industries Ltd.: Product Portfolio

- Table 38 : Daikin Industries Ltd.: News/Key Developments, 2023

- Table 39 : Honeywell International Inc.: Company Snapshot

- Table 40 : Honeywell International Inc.: Financial Performance, FY 2022 and 2023

- Table 41 : Honeywell International Inc.: Product Portfolio

- Table 42 : Honeywell International Inc.: News/Key Developments, 2022

- Table 43 : Johnson Controls: Company Snapshot

- Table 44 : Johnson Controls: Financial Performance, FY 2023 and 2024

- Table 45 : Johnson Controls: Product Portfolio

- Table 46 : Johnson Controls: News/Key Developments, 2022

- Table 47 : Lennox International Inc.: Company Snapshot

- Table 48 : Lennox International Inc.: Financial Performance, FY 2022 and 2023

- Table 49 : Lennox International Inc.: Product Portfolio

- Table 50 : Lennox International Inc.: News/Key Developments, 2023

- Table 51 : Mann+Hummel: Company Snapshot

- Table 52 : Mann+Hummel: Financial Performance, FY 2022 and 2023

- Table 53 : Mann+Hummel: Product Portfolio

- Table 54 : Mann+Hummel: News/Key Developments, 2023

- Table 55 : Panasonic Corp.: Company Snapshot

- Table 56 : Panasonic Corp.: Financial Performance, FY 2022 and 2023

- Table 57 : Panasonic Corp.: Product Portfolio

- Table 58 : RectorSeal: Company Snapshot

- Table 59 : RectorSeal: Product Portfolio

- Table 60 : RGF Environmental Group Inc.: Company Snapshot

- Table 61 : RGF Environmental Group Inc.: Product Portfolio

- Table 62 : RGF Environmental Group Inc.: News/Key Developments, 2024

- Table 63 : Rheem Manufacturing Co.: Company Snapshot

- Table 64 : Rheem Manufacturing Co.: Product Portfolio

- Table 65 : Trane Technologies Plc.: Company Snapshot

- Table 66 : Trane Technologies Plc.: Financial Performance, FY 2022 and 2023

- Table 67 : Trane Technologies Plc.: Product Portfolio

- Table 68 : Small and Emerging Players in the U.S. Indoor Air Quality Market

List of Figures

- Summary Figure A : Share of U.S. IAQ Market, by Region, 2023

- Summary Figure B : Share of U.S. IAQ Market Volume, by Region, 2023

- Figure 1 : Supply Chain for the U.S. IAQ Market

- Figure 2 : Porter's Five Forces Model for the U.S. IAQ Market

- Figure 3 : Growth in Health Expenditures Compared to Per Capita Spending in the U.S., 2021-2023

- Figure 4 : Trends in Average Annual Consumer Expenditures Compared to GDP Growth in the U.S., 2020-2023

- Figure 5 : U.S. Indoor Air Quality Market Dynamics

- Figure 6 : PM2.5 Concentrations in Major U.S. Cities, 2022 and 2023

- Figure 7 : Share of Patents in the U.S. IAQ Market, by Leading Manufacturers, 2023

- Figure 8 : Share of U.S. IAQ Market, by Type, 2023

- Figure 9 : Share of U.S. IAQ Market Volume, by Type, 2023

- Figure 10 : Share of U.S. IAQ Market, by Product Type, 2023

- Figure 11 : Share of U.S. IAQ Market Volume, by Product Type, 2023

- Figure 12 : Share of U.S. IAQ Market, by End-Use Industry, 2023

- Figure 13 : Share of U.S. IAQ Market Volume, by End-Use Industry, 2023

- Figure 14 : Share of U.S. IAQ Market, by Region, 2023

- Figure 15 : Share of U.S. IAQ Market Volume, by Region, 2023

- Figure 16 : Wildland Fires in Three Southern States, 2022 and 2023

- Figure 17 : Share of the U.S. IAQ Market, by Company, 2023

- Figure 18 : Strategy and Financial Performance Analysis, U.S. IAQ Market, 2023

- Figure 19 : Carrier: Revenue Share, by Business Unit, FY 2023

- Figure 20 : Carrier: Revenue Share, by Country/Region, FY 2023

- Figure 21 : Daikin Industries Ltd.: Revenue Share, by Business Unit, FY 2023

- Figure 22 : Daikin Industries Ltd.: Revenue Share, by Country/Region, FY 2023

- Figure 23 : Honeywell International Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 24 : Honeywell International Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 25 : Johnson Controls: Revenue Share, by Business Unit, FY 2024

- Figure 26 : Johnson Controls: Revenue Share, by Country/Region, FY 2024

- Figure 27 : Lennox International Inc.: Revenue Share, by Business Unit, FY 2023

- Figure 28 : Lennox International Inc.: Revenue Share, by Country/Region, FY 2023

- Figure 29 : Mann+Hummel: Revenue Share, by Business Unit, FY 2023

- Figure 30 : Mann+Hummel: Revenue Share, by Country/Region, FY 2023

- Figure 31 : Panasonic Corp.: Revenue Share, by Business Unit, FY 2023

- Figure 32 : Panasonic Corp.: Revenue Share, by Country/Region, FY 2023

- Figure 33 : Trane Technologies Plc.: Revenue Share, by Business Unit, FY 2023

- Figure 34 : Trane Technologies Plc.: Revenue Share, by Country/Region, FY 2023

The U.S. indoor air quality (IAQ) market was valued at $10.2 billion in 2023. It is expected to grow from $10.5 billion in 2024 to $12.9 billion by 2029, at a compound annual growth rate (CAGR) of 4.3% from 2024 through 2029.

The South region of the U.S. IAQ market is expected to grow from $4.1 billion in 2024 to $5.3 billion by 2029, at a CAGR of 5.3% from 2024 through 2029.

The Northeast region of the U.S. IAQ market is expected to grow from $1.7 billion in 2024 to $2.1 billion by 2029, at a CAGR of 4.4% from 2024 through 2029.

Report Scope

The U.S. indoor air quality (IAQ) market was valued at $10.2 billion in 2023. It is expected to grow from $10.5 billion in 2024 to $12.9 billion by 2029, at a compound annual growth rate (CAGR) of 4.3% from 2024 through 2029.

Report Includes

- 19 data tables and 51 additional tables

- An updated overview and in-depth analysis of the U.S. market for indoor air quality (IAQ) products and services

- Analyses of the market trends, with sales data for 2023, estimates for 2024, forecasts for 2025, 2027, and projections of compound annual growth rates (CAGRs) through 2029

- Estimation of the actual market size and revenue forecasts for the U.S. indoor air quality market, and corresponding market share analysis by type, product segments, end-use industry, and region

- Discussion of the major factors driving the growth of IAQ industry, history and importance, market trends and environment, regulatory concerns, and the effects of IAQ contaminants

- Analysis of the market opportunities with a holistic study of Porter's Five Forces model and supply chain analysis of the IAQ industry considering both the micro and macro environmental factors prevailing in the marketplace

- Insight into the recent industry structure for indoor air quality market, government regulations and standards, key development issues, and the vendor landscape and operational integration

- Analysis of the key patent grants and intellectual property aspects of the market

- A discussion on ESG challenges and practices of the industry

- Competitive landscape featuring the leading manufacturers of IAQ products in U.S., their current ranking and company share analysis, along with the latest key developments within the industry

- Profiles of the leading market players, including Carrier, Daikin Industries Ltd., Honeywell International Inc., Johnson Controls and Trane Technologies Plc.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Market Dynamics and Growth

- Segmental Analysis

- Regional Insights and Emerging Markets

- Conclusion

Chapter 2 Market Overview

- Market Overview and Future Scenarios

- Supply Chain Analysis

- Raw Material Suppliers

- Component Providers

- Technology and Systems Integrators

- IAQ Manufacturers

- End Users

- Porter's Five Forces Analysis for the U.S. IAQ Market

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Potential for New Entrants to the Market

- Competition in the Industry

- Threat of Substitutes

- Macro-Economic Factors Analysis

- U.S. Per Capita Spending on Health

- U.S. Gross Domestic Product

- Growing Investment in the Construction Sector

- Regulatory Outlook

- Clean Air Act

- Building Codes and Certifications

- Recent Developments in Regulatory Framework

- Prospects in Regulations

- Case Studies for IAQ Projects in the U.S.

- City of Oviedo Healthy Buildings

- Richmond School District, Wisconsin

Chapter 3 Market Dynamics

- Overview

- Market Drivers

- Supportive Government Regulations for IAQ

- Consumer Awareness of the need for IAQ Products

- Increase in Indoor Air Pollution

- Market Restraints

- Initial Cost of IAQ Products

- Lack of Standardization

- Market Opportunities

- Technological Developments in IAQ Products

- Expansion of the Industrial Sector

- Market Trends

- Smart Technologies for Monitoring IAQ

- Supportive Investments and Program Grants

- Short- and Long-Term Impacts of Market Dynamics

Chapter 4 Emerging Technologies and Developments

- Overview

- Emerging Technologies/Applications

- Home Automation for Improving Air Quality

- Advances in Air Purification Technologies

- Integration of IoT in IAQ Products

- Integration of AI and ML

- Patent Analysis

- Overview

- Key Patents

- Takeaways

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Takeaways

- U.S. IAQ Market, by Type

- Equipment

- Services

- U.S. IAQ Market, by Product Type

- Takeaways

- Air Purifiers

- Humidifiers

- Ventilation Systems

- Air Filters

- Dehumidifiers

- Ultraviolet Lamps

- Carbon Monoxide Alarms

- U.S. IAQ Market, by End-Use Industry

- Takeaways

- Residential

- Commercial

- Industrial

- Others

- Geographic Breakdown

- Takeaways

- U.S. IAQ Market, by Region

- South

- West

- Midwest

- Northeast

Chapter 6 Competitive Intelligence

- Overview

- Market Share Analysis

- Company Strategy and Product Portfolio Matrix

- Product Mapping Analysis

- Strategy and Financial Performance Analysis

- Recent Developments

Chapter 7 Sustainability in the U.S. IAQ Market: An ESG Perspective

- Overview

- Environmental Impact

- Social Impact

- Governance Impact

- Status of ESG in the U.S. IAQ Industry

- Case Study: Examples of Successful Implementation of ESG

- Honeywell International Inc.

- Johnson Controls

- Carrier

- Consumer Attitudes Towards ESG

- Concluding Remarks from BCC

Chapter 8 Appendix

- Methodology

- Research Steps

- References

- Abbreviations

- Company Profiles

- APRILAIRE

- BEYOND BY AERUS

- BLUEAIR

- CAMFIL

- CARRIER

- DAIKIN INDUSTRIES LTD.

- HONEYWELL INTERNATIONAL INC.

- JOHNSON CONTROLS

- LENNOX INTERNATIONAL INC.

- MANN+HUMMEL

- PANASONIC CORP.

- RECTORSEAL

- RGF ENVIRONMENTAL GROUP INC.

- RHEEM MANUFACTURING CO.

- TRANE TECHNOLOGIES PLC.

- Small and Emerging Players in the U.S. Indoor Air Quality Market