|

|

市場調査レポート

商品コード

1134282

冷蔵陳列ケースの世界市場 (2022~2030年):成長・将来の展望・競合分析Refrigerated Display Cases Market - Growth, Future Prospects and Competitive Analysis, 2022 - 2030 |

||||||

| 冷蔵陳列ケースの世界市場 (2022~2030年):成長・将来の展望・競合分析 |

|

出版日: 2022年10月10日

発行: Acute Market Reports

ページ情報: 英文 118 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

冷蔵陳列ケースの市場規模は2022年から2030年の予測期間中に10%のCAGRで成長すると予測されています。

冷蔵陳列ケースのニーズは小売食品・飲料部門で着実に増え続けており、同市場の成長につながっています。これは、先進国、新興国を問わず広く見られるパターンであり、小売店舗数の急激な増加が要因であると考えられています。また、設計別では、特に食品・飲料業界において、縦型/多段型の部門が急速に成長すると予測されています。特に米国では、都市化の進展に伴い、食品・飲料の倉庫や輸送の必要性がますます高まってきています。また、顧客の多忙なライフスタイルに合わせたフードサービスが求められるようになり、クイックサービスを提供するレストランが増加しています。このような背景からも、冷蔵陳列ケースの販売に新たな可能性が生まれています。

当レポートでは、世界の冷蔵陳列ケースの市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、主要企業のプロファイルなどをまとめています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 冷蔵陳列ケース市場:事業の見通しと市場力学

- 市場規模:2020年~2030年

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

- 促進要因・抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- PESTEL分析

第4章 冷蔵陳列ケース市場:タイプ別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- プラグイン

- セミプラグイン

- リモート

第5章 冷蔵陳列ケース市場:設計別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

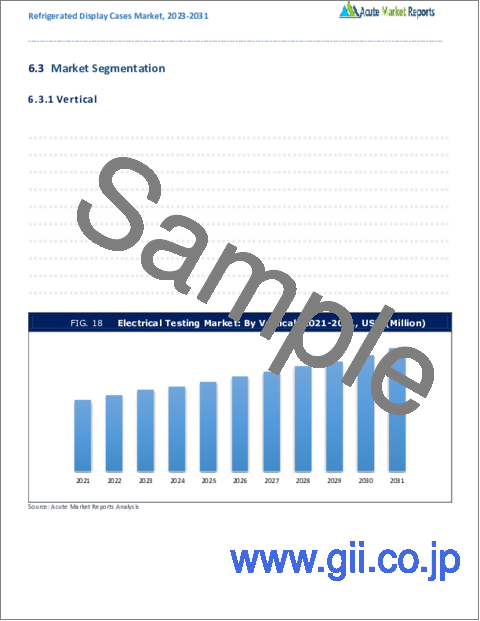

- 縦型

- 横型

- ハイブリッド

第6章 冷蔵陳列ケース市場:エンドユーザー別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- フードサービス部門

- 小売食品・飲料部門

第7章 北米の冷蔵陳列ケース市場

- 市場概要

- 冷蔵陳列ケース市場:タイプ別

- 冷蔵陳列ケース市場:設計別

- 冷蔵陳列ケース市場:エンドユーザー別

- 冷蔵陳列ケース市場:地域別

第8章 英国およびEUの冷蔵陳列ケース市場

- 市場概要

- 冷蔵陳列ケース市場:タイプ別

- 冷蔵陳列ケース市場:設計別

- 冷蔵陳列ケース市場:エンドユーザー別

- 冷蔵陳列ケース市場:地域別

第9章 アジア太平洋の冷蔵陳列ケース市場

- 市場概要

- 冷蔵陳列ケース市場:タイプ別

- 冷蔵陳列ケース市場:設計別

- 冷蔵陳列ケース市場:エンドユーザー別

- 冷蔵陳列ケース市場:地域別

第10章 ラテンアメリカの冷蔵陳列ケース市場

- 市場概要

- 冷蔵陳列ケース市場:タイプ別

- 冷蔵陳列ケース市場:設計別

- 冷蔵陳列ケース市場:エンドユーザー別

- 冷蔵陳列ケース市場:地域別

第11章 中東・アフリカの冷蔵陳列ケース市場

- 市場概要

- 冷蔵陳列ケース市場:タイプ別

- 冷蔵陳列ケース市場:設計別

- 冷蔵陳列ケース市場:エンドユーザー別

- 冷蔵陳列ケース市場:地域別

第12章 企業プロファイル

- Carrier Corporation

- Danfoss A/S

- Frigoglass SAIC

- EptaS.p.a. Dover Corporation

- Haier Group

- Arneg S.p.A.

- Fagor Industrial

- Illinois Tool Works

- Daikin Industries, Ltd.

- CAREL INDUSTRIES S.p.A.

List of Tables

- TABLE 1 Global Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 2 Global Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 3 Global Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 4 Global Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 5 Global Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

- TABLE 6 North America Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 7 North America Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 8 North America Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 9 North America Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 10 North America Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

- TABLE 11 UK and European Union Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 12 UK and European Union Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 13 UK and European Union Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 14 UK and European Union Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 15 UK and European Union Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

- TABLE 16 Asia Pacific Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 17 Asia Pacific Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 18 Asia Pacific Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 19 Asia Pacific Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 20 Asia Pacific Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

- TABLE 21 Latin America Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 22 Latin America Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 23 Latin America Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 24 Latin America Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 25 Latin America Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

- TABLE 26 Middle East and Africa Refrigerated Display Cases Market By Type, 2020-2030, USD (Million)

- TABLE 27 Middle East and Africa Refrigerated Display Cases Market By Design, 2020-2030, USD (Million)

- TABLE 28 Middle East and Africa Refrigerated Display Cases Market By End-use, 2020-2030, USD (Million)

- TABLE 29 Middle East and Africa Refrigerated Display Cases Market By Food Service Sector, 2020-2030, USD (Million)

- TABLE 30 Middle East and Africa Refrigerated Display Cases Market By Retail Food & Beverage Sector, 2020-2030, USD (Million)

List of Figures

- FIG. 1 Global Refrigerated Display Cases Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Refrigerated Display Cases Market: Quality Assurance

- FIG. 5 Global Refrigerated Display Cases Market, By Type, 2021

- FIG. 6 Global Refrigerated Display Cases Market, By Design, 2021

- FIG. 7 Global Refrigerated Display Cases Market, By End-use, 2021

- FIG. 8 Global Refrigerated Display Cases Market, By Geography, 2021

- FIG. 9 Global Refrigerated Display Cases Market, By Type, 2021 Vs 2030, %

- FIG. 10 Global Refrigerated Display Cases Market, By Design, 2021 Vs 2030, %

- FIG. 11 Global Refrigerated Display Cases Market, By End-use, 2021 Vs 2030, %

- FIG. 12 U.S. Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 13 Canada Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 14 Rest of North America Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 15 UK Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 16 Germany Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 17 Spain Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 18 Italy Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 19 France Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 20 Rest of Europe Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 21 China Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 22 Japan Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 23 India Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 24 Australia Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 25 South Korea Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 26 Rest of Asia Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 27 Brazil Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 28 Mexico Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 29 Rest of Latin America Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 30 GCC Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 31 Africa Refrigerated Display Cases Market (US$ Million), 2020 - 2030

- FIG. 32 Rest of Middle East and Africa Refrigerated Display Cases Market (US$ Million), 2020 - 2030

The refrigerated display cabinets (RDC) market is expected to grow at a CAGR of 10% during the forecast period of 2022 to 2030.RDCs are a type of food service equipment that is used for the purpose of displaying and keeping various types of edible goods. They are put to use to maintain the appropriate temperatures for the food items. They are typically utilised at grocery shops, gas stations, and more intimate food and beverage establishments such as "corner stores" and delicatessens. Produce, meat, fish, poultry, dairy products, deli items (with dedicated employees), and frozen goods are shown in supermarkets using refrigerated display cabinets. Supermarket's stock a variety of frozen foods. RDCs are utilised for the presentation of chilled beverages and ice-confectionary at gas stations as well as by smaller merchants.RDCs allow the stored products to be directly viewed through an opening in the cabinet or through transparent doors, lids, or covers that are usually kept closed and can be opened to access the contents. Additionally, these cabinets allow users to access any of the contents without stepping inside the refrigerated space, which is a huge time saver. The market for refrigerated display cabinets is expanding due to the expansion of retail (food retail) store networks, increases in consumers' disposable incomes, and shifts in the consumers' lifestyles. Plug-in has the largest market share in the global market for chilled display cases, although the remote operated device category has the highest market share overall.

Market For RDCs Is Expanding as The Number of Restaurants Grow

The need for refrigerated display cases in the retail food and beverage sector has been steadily and consistently increasing, which has led to growth in the global market for these cases. This is a widespread pattern that can be seen in both industrialised and emerging nations, and it can be attributed to the rapid increase in the number of retail establishments. In addition, based on design, the vertical/multideck RDC market is projected to grow at a quick pace, notably in the food and beverage industry. This is particularly the case in the United States.The need for warehousing and transporting food and drink has become progressively more important as urbanisation has progressed. Customers are looking for food services that can keep up with their hectic lifestyles, which has led to an increase in the number of restaurants offering rapid service. This has been a significant contributor to the development of lucrative new potential for the sale of refrigerated display cases. The growing prevalence of metropolitan areas has led to a dramatic growth in the demand for facilities that can store and convey food and beverages. In addition, profitable high development potential for the market is presented by the huge expansion in the number of quick service restaurants located all over the world. The demand for quick-service restaurants (QSRs) is expanding at a faster rate than that for casual dining, mostly because of reasons such as rising per capita income and urbanisation, as well as increased participation of women in the labour sector. The quick-service restaurant business is thriving across Asia, particularly in India and China, which will help drive the demand for refrigerated display cases in these nations.

Expanding Retail Sector Fuels Growth for RDC Market

Opportunities for growth will also be created by the expansion of the retail sector, which includes the establishment of supermarkets, hypermarkets, and convenience stores. These distribution channels need for efficient space usage as well as regular upkeep of the interior environment. Because of this, there is a greater need for refrigerated display cases that include condensers that are situated at a distance from the main body of the store. This ensures that there is no heat loss within the store itself while also making more room for inventory.

Increasing Investment in Research and Development for Technically Advanced RDCs

The leading manufacturers in the global market for refrigerated display cases are investing heavily in research and development operations in order to provide products that are more technologically advanced and efficient in their use of energy. Some of the important trends that are promoting research and development initiatives include giving competitive prices, increasing the degree to which end users are satisfied with the performance, and making use of sophisticated technologies.These cases are made possible by the most recent technological developments, such as remotely positioned condensers, which ensure that there is no heat loss in the shop interior while also making it possible to have more space for storage. Refrigerated display cabinets that are controlled remotely have a very low overall energy consumption and a high user volume. The new cutting-edge function, which was made possible thanks to the incorporation of IOT technology, enables remote monitoring and control of the RDCs.

Environment-Friendly RDCs Are Being Developed

Refrigerated display cases are making steady progress toward the development of environmentally friendly refrigerants. In an effort to lessen their impact on the environment, retail establishments are moving away from open display cabinets and toward closed ones. Because of EU F-gas legislation in Europe, hydrofluorocarbon (HFC) refrigerants have been capped. If food stores switched from using F-gases to natural refrigerants, they would be eligible for significant financial incentives. Technological progress, including the introduction of solar-powered screens, will present an opportunity for business expansion. The introduction of the magnetic cooling system, which uses water as the coolant instead of the refrigerant gas that is the primary cause of climate change, has produced an environmentally friendly solution that uses very little energy.

High Price of RDCsis A Challenge

However, the high price of refrigerator display cases is the primary factor that is expected to be the primary factor that will restrain the growth of the market for refrigerated display cases. The market for refrigerated display cases is anticipated to experience growth restraints on account of factors including high electricity consumption and rising levels of environmental concern.

The global market for refrigerated display cases is observing a rise in product innovation as well as shifting trends as a result of technological advancements and shifting consumer preferences. These factors are driving the emergence of new varieties and experimentation. At the moment, the implementation of RFID technology promises significant expansion for the market. This comes at a time when the retail industry is competing with e-commerce to win a larger portion of the market for refrigerated items. It is anticipated that the growing demand for chilled foods and the growing emphasis on quality will drive large growth for the market as key drivers of growth during the projected period. During this time, the industry is predicted to experience significant expansion. As a result of advances in digital technology, automated systems are becoming increasingly popular once again.

Retail Food and Beverage Sector Is a Dominant Player

The retail food and beverage sector held the dominant position in 2021. This is because of the growing demand from convenience stores, grocery stores, hypermarkets, and discount stores in new and emerging retail food and beverage operations all over the world. RDCs help to attract customers by displaying food and drink products in a way that is visually appealing to the consumer. The need for refrigerated display cases has been on the rise due to the significant increase that the retail industry has experienced over the past few years. Regarding the design, it is anticipated that there would be an increased need for vertical cases.

The ever-increasing need for energy-efficient refrigerated cases in the commercial food service sector has resulted in the requirement for ongoing research and development in refrigeration display case (RDC) technology. Increasing regulatory compliances and rising concerns for the safety of food are two main factors that are driving the growth of the market for refrigerated display cases. Some of the issues that are inhibiting the growth of the refrigerated display case market include low awareness and restricted acceptance in less developed regions, as well as growing worries about the environment. To meet the ever-increasing requirements of the commercial food business, the main market companies are producing energy-efficient RDCs of a variety of sorts and designs. This is being made possible by advances in technology.

Plug-In Refrigerated Display Cases Held the Largest Share of The Market

Plug-in refrigerated display cases held the largest share of the market for refrigerator display cases in 2021. Plug-in RDCs can take the form of anything from small chilled cases that are mounted to a wall in order to be opened, to curved glass display cases that are stored on the ground. It is anticipated that bottle coolers that are plug-in devices would have the quickest increase because of the growing demand for bottled and carbonated drinks. In the current RDC market business landscape, plug-in RDCs are frequently employed because they offer a bigger storage capacity at a lower cost. This is the primary reason for their widespread adoption. Customers like to make use of these refrigeration units since not only are they appealing but also offer the highest possible storage capacity. The RDC market has developed to its full potential in significant economies such as those of Europe and North America. RDCs have been implemented in the majority of grocery stores and other retail and food service locations across Europe, which is a significant revenue generator for the international market.

Vertical Refrigerated Display Cases Are Growing in Popularity

Vertical RDCs segment held the largest share in the market in 2021. Vertical refrigerated display cases are growing in popularity due to the fact that they take up less floor area and provide an increasing variety of products. Additionally, they are simple to relocate and require little in the way of upkeep. Because an increasing number of individuals prefer to buy their food already packaged and processed, even stores that sell food are eager to show off their display cabinets in an effort to entice customers. These cabinets give an enhanced visual attraction towards the food items that are housed within them as a result of developments in the product line, the adoption of LED lighting, and the use of frost-free glasses. Therefore, having a beneficial impact on the purchasing decision of clients; the food appears to be freshly prepared, which leaves a pleasant impression in the mind of a customer.

APAC to Remain as the Most Dominant Region During the Forecast Period

During the forecast period of 2022 to 2030, it is anticipated that Asia-Pacific will emerge as the market with the highest CAGR growth rate.It is probable that the pace of adoption of refrigerated display cases will increase as a result of advances in commercial practises within the retail food sector of developing nations. The rapid expansion of the refrigeration storage industry in Asia-Pacific and the Middle East is projected to be a driving force behind the expansion of the RDC market on a worldwide scale. RDC devices are becoming more commonplace in supermarkets and hypermarkets with the purpose of ensuring the proper storage and safety of food. RDCs are finding uses in a variety of industries, including the biomedical industry for the storage of flowers and in corner food retail shops to handle the growing concerns of product safety and temperature maintenance.

Intense Competition Due to Market Fragmentation

Due to the presence of numerous market players, the market for refrigerated display cases is extremely fragments and is therefore, characterized by intense competition. The top players control more than two thirds of the total market share worldwide. Some of the firms are concentrating on developing a specialisation inside a particular market segment. In addition to this, there is a significant emphasis placed on new product development and introductions.The key companies include Carrier Corporation, Danfoss A/S, and Frigoglass SAIC, EptaS.p.a. Dover Corporation, Haier Group, and Arneg S.p.A., Fagor Industrial Illinois Tool Works Daikin Industries, Ltd. CAREL INDUSTRIES S.p.A. Illinois Tool Works Daikin Industries, Ltd.

Historical & Forecast Period

This study report represents analysis of each segment from 2020 to 2030 considering 2021 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2022 to 2030.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Refrigerated Display Cases market are as follows:

Research and development budgets of manufacturers and government spending

Revenues of key companies in the market segment

Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report

Micro and macro environment factors that are currently influencing the Refrigerated Display Cases market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

ATTRIBUTE DETAILS

Research Period 2020-2030

Base Year 2021

Forecast Period 2022-2030

Historical Year 2020

Unit USD Million

Segmentation

Type

Plug-In

Semi Plug-In

Remote

Design

Vertical

Horizontal

Hybrid

End-use

Food Service Sector

Quick service restaurant

Bakeries

Hotels

Others

Retail Food & Beverage Sector

Fuel Station Stores

Hypermarkets

Supermarkets

Discount Stores

Region Segment (2020-2030; US$ Million)

North America

U.S.

Canada

Rest of North America

UK and European Union

UK

Germany

Spain

Italy

France

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Rest of Asia Pacific

Latin America

Brazil

Mexico

Rest of Latin America

Middle East and Africa

GCC

Africa

Rest of Middle East and Africa

Global Impact of Covid-19 Segment (2020-2021; US$ Million )

Pre Covid-19 situation

Post Covid-19 situation

Key questions answered in this report

What are the key micro and macro environmental factors that are impacting the growth of Refrigerated Display Cases market?

What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

Estimated forecast and market projections up to 2030.

Which segment accounts for the fastest CAGR during the forecast period?

Which market segment holds a larger market share and why?

Are low and middle-income economies investing in the Refrigerated Display Cases market?

Which is the largest regional market for Refrigerated Display Cases market?

What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

Which are the key trends driving Refrigerated Display Cases market growth?

Who are the key competitors and what are their key strategies to enhance their market presence in the Refrigerated Display Cases market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Refrigerated Display Cases Market

- 2.2. Global Refrigerated Display Cases Market, By Type, 2021 (US$ Million)

- 2.3. Global Refrigerated Display Cases Market, By Design, 2021 (US$ Million)

- 2.4. Global Refrigerated Display Cases Market, By End-use, 2021 (US$ Million)

- 2.5. Global Refrigerated Display Cases Market, By Geography, 2021 (US$ Million)

- 2.6. Impact of Covid 19

- 2.7. Attractive Investment Proposition by Geography, 2021

- 2.8. Competitive Analysis

- 2.8.1. Market Positioning of Key Refrigerated Display Cases Market Vendors

- 2.8.2. Strategies Adopted by Refrigerated Display Cases Market Vendors

- 2.8.3. Key Industry Strategies

3. Refrigerated Display Cases Market: Business Outlook & Market Dynamics

- 3.1. Introduction

- 3.2. Global Refrigerated Display Cases Market Value, 2020 - 2030, (US$ Million)

- 3.3. Market Dynamics

- 3.3.1. Market Drivers

- 3.3.2. Market Restraints

- 3.3.3. Key Challenges

- 3.3.4. Key Opportunities

- 3.4. Impact Analysis of Drivers and Restraints

- 3.5. See-Saw Analysis

- 3.6. Porter's Five Force Model

- 3.6.1. Supplier Power

- 3.6.2. Buyer Power

- 3.6.3. Threat Of Substitutes

- 3.6.4. Threat Of New Entrants

- 3.6.5. Competitive Rivalry

- 3.7. PESTEL Analysis

- 3.7.1. Political Landscape

- 3.7.2. Economic Landscape

- 3.7.3. Technology Landscape

- 3.7.4. Legal Landscape

- 3.7.5. Social Landscape

4. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 4.1. Market Overview

- 4.2. Growth & Revenue Analysis: 2021 Versus 2030

- 4.3. Market Segmentation

- 4.3.1. Plug-In

- 4.3.2. Semi Plug-In

- 4.3.3. Remote

5. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2021 Versus 2030

- 5.3. Market Segmentation

- 5.3.1. Vertical

- 5.3.2. Horizontal

- 5.3.3. Hybrid

6. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2021 Versus 2030

- 6.3. Market Segmentation

- 6.3.1. Food Service Sector

- 6.3.1.1. Quick service restaurant

- 6.3.1.2. Bakeries

- 6.3.1.3. Hotels

- 6.3.1.4. Others

- 6.3.2. Retail Food & Beverage Sector

- 6.3.2.1. Fuel Station Stores

- 6.3.2.2. Hypermarkets

- 6.3.2.3. Supermarkets

- 6.3.2.4. Discount Stores

- 6.3.1. Food Service Sector

7. North America Refrigerated Display Cases Market, 2020-2030, USD (Million)

- 7.1. Market Overview

- 7.2. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 7.3. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 7.4. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 7.5.Refrigerated Display Cases Market: By Region, 2020-2030, USD (Million)

- 7.5.1.North America

- 7.5.1.1. U.S.

- 7.5.1.2. Canada

- 7.5.1.3. Rest of North America

- 7.5.1.North America

8. UK and European Union Refrigerated Display Cases Market, 2020-2030, USD (Million)

- 8.1. Market Overview

- 8.2. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 8.3. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 8.4. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 8.5.Refrigerated Display Cases Market: By Region, 2020-2030, USD (Million)

- 8.5.1.UK and European Union

- 8.5.1.1. UK

- 8.5.1.2. Germany

- 8.5.1.3. Spain

- 8.5.1.4. Italy

- 8.5.1.5. France

- 8.5.1.6. Rest of Europe

- 8.5.1.UK and European Union

9. Asia Pacific Refrigerated Display Cases Market, 2020-2030, USD (Million)

- 9.1. Market Overview

- 9.2. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 9.3. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 9.4. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 9.5.Refrigerated Display Cases Market: By Region, 2020-2030, USD (Million)

- 9.5.1.Asia Pacific

- 9.5.1.1. China

- 9.5.1.2. Japan

- 9.5.1.3. India

- 9.5.1.4. Australia

- 9.5.1.5. South Korea

- 9.5.1.6. Rest of Asia Pacific

- 9.5.1.Asia Pacific

10. Latin America Refrigerated Display Cases Market, 2020-2030, USD (Million)

- 10.1. Market Overview

- 10.2. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 10.3. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 10.4. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 10.5.Refrigerated Display Cases Market: By Region, 2020-2030, USD (Million)

- 10.5.1.Latin America

- 10.5.1.1. Brazil

- 10.5.1.2. Mexico

- 10.5.1.3. Rest of Latin America

- 10.5.1.Latin America

11. Middle East and Africa Refrigerated Display Cases Market, 2020-2030, USD (Million)

- 11.1. Market Overview

- 11.2. Refrigerated Display Cases Market: By Type, 2020-2030, USD (Million)

- 11.3. Refrigerated Display Cases Market: By Design, 2020-2030, USD (Million)

- 11.4. Refrigerated Display Cases Market: By End-use, 2020-2030, USD (Million)

- 11.5.Refrigerated Display Cases Market: By Region, 2020-2030, USD (Million)

- 11.5.1.Middle East and Africa

- 11.5.1.1. GCC

- 11.5.1.2. Africa

- 11.5.1.3. Rest of Middle East and Africa

- 11.5.1.Middle East and Africa

12. Company Profile

- 12.1. Carrier Corporation

- 12.1.1. Company Overview

- 12.1.2. Financial Performance

- 12.1.3. Product Portfolio

- 12.1.4. Strategic Initiatives

- 12.2. Danfoss A/S

- 12.2.1. Company Overview

- 12.2.2. Financial Performance

- 12.2.3. Product Portfolio

- 12.2.4. Strategic Initiatives

- 12.3. Frigoglass SAIC

- 12.3.1. Company Overview

- 12.3.2. Financial Performance

- 12.3.3. Product Portfolio

- 12.3.4. Strategic Initiatives

- 12.4. EptaS.p.a. Dover Corporation

- 12.4.1. Company Overview

- 12.4.2. Financial Performance

- 12.4.3. Product Portfolio

- 12.4.4. Strategic Initiatives

- 12.5. Haier Group

- 12.5.1. Company Overview

- 12.5.2. Financial Performance

- 12.5.3. Product Portfolio

- 12.5.4. Strategic Initiatives

- 12.6. Arneg S.p.A.

- 12.6.1. Company Overview

- 12.6.2. Financial Performance

- 12.6.3. Product Portfolio

- 12.6.4. Strategic Initiatives

- 12.7. Fagor Industrial Illinois Tool Works Daikin Industries, Ltd. CAREL INDUSTRIES S.p.A. Illinois Tool Works Daikin Industries, Ltd.

- 12.7.1. Company Overview

- 12.7.2. Financial Performance

- 12.7.3. Product Portfolio

- 12.7.4. Strategic Initiatives