|

|

市場調査レポート

商品コード

1224456

航空宇宙・防衛用金属ベローズの世界市場 (2023-2028年):市場規模・シェア・動向・予測・競合分析・成長機会Aerospace & Defense Metal Bellows Market Size, Share, Trend, Forecast, Competitive Analysis, and Growth Opportunity: 2023-2028 |

||||||

| 航空宇宙・防衛用金属ベローズの世界市場 (2023-2028年):市場規模・シェア・動向・予測・競合分析・成長機会 |

|

出版日: 2023年02月06日

発行: Stratview Research

ページ情報: 英文 162 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の航空宇宙・防衛用金属ベローズの市場規模は、COVID-19の影響により、2020年に34%超のマイナスを記録しました。しかし、市場は2022年には回復に向かい、予測期間中は7.6%のCAGRで成長し、2028年には3億880万米ドルの規模に成長すると予測されています。

航空宇宙産業におけるさまざまな用途での金属ベローズの継続的な使用の増加、高温用途で金属ベローズが好まれる傾向、民間航空機の大規模な受注残、主要航空機プログラムの生産率の上昇予想などの要因が、予測期間中の金属ベローズ需要を促進すると予想されています。

当レポートでは、世界の航空宇宙・防衛用金属ベローズの市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、製品タイプ・用途・地域など各種区分別の内訳、競合環境、主要企業のプロファイル、成長機会の分析などをまとめています。

目次

第1章 エグゼクティブサマリー

第2章 航空宇宙・防衛用金属ベローズ市場:環境分析

- サプライチェーン分析

- PEST分析

- 産業ライフサイクル分析

- 市場促進要因

- 市場の課題

第3章 航空宇宙・防衛用金属ベローズ市場:市場評価

- 金属ベローズ市場全体に占める航空宇宙・防衛部門のシェア

- 航空宇宙・防衛用金属ベローズ市場の動向・予測

- 市場シナリオ分析:さまざまな市場環境における成長の軌跡

- COVID-19:影響評価と予想回復曲線

第4章 航空宇宙・防衛用金属ベローズ市場:各種区分別の分析

- 地域別の動向・予測:製品タイプ別

- エッジ溶接ベローズ

- 機械成形ベローズ

- その他

- 地域別の動向・予測:材料タイプ別

- チタン合金

- ステンレス鋼合金

- ニッケル合金

- その他

- 地域別の動向・予測:ジョイントタイプ別

- ボールジョイント

- ジンバルジョイント

- ダイレクトベローズ

- その他

- 地域別の動向・予測:プラットフォーム別

- 民間航空機

- リージョナル機

- ジェネラルアビエーション

- ヘリコプター

- 軍用機

- その他

- 地域別の動向・予測:用途別

- エンジン

- 機体

- その他

- 地域分析:国別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 競合分析

- 市場統合レベル

- 競合情勢

- 市場シェア分析

- 製品ポートフォリオ分析

- 地域的プレゼンス

- 新製品の発売

- 戦略的提携

- ポーターのファイブフォース分析

第6章 戦略的成長機会

- 市場の魅力分析

- 新たな動向

- 戦略的影響

- 主な成功要因

第7章 主要企業のプロファイル

- AMETEK, Inc.(FMH Aerospace Corp.)

- Alloy Precision Technologies

- EagleBurgmann Germany GmbH & Co. KG

- Eaton Corporation Plc

- Enpro Industries

- KSM Co. Ltd.

- Meggitt PLC(Parker-Hannifin Corporation)

- MW Industries

- Senior plc

- Smiths Group plc

- Unison Industries, LLC

- U.S. Bellows, Inc.

第8章 付録

Market Insights

Metal bellows, a type of flexible seals, are thin-walled cylindrical components whose surface area features a corrugated structure perpendicular to the cylinder axis. This corrugated structure helps the bellow to act flexibly during axial, lateral, and/or angular deformation. The bellows are pressure, temperature, and corrosion-resistant as well as torsion-resistant.

The performance of the bellows depends on several factors including the type of raw material used, its properties, design factor, manufacturing process, etc. They are used in a wide range of industries including aerospace, automotive, oil & gas, pharmaceutical, etc. among all the end-use industries, the aerospace industry is the biggest demand generator of metal bellows, alone capturing a more than 25% share of the market (value basis) in 2022.

In 2020, the outbreak of the COVID-19 pandemic shook the aerospace industry, mainly due to the decline in aircraft production, order cancellations, and supply chain disruptions. As a result, the industry recorded a massive decline in the year 2020 across regions. The impact of this has been recorded across the supply chain including the demand for metal bellows. Aerospace & defense metal bellows, a sizeable market, could not escape from such trends and witnessed a colossal decline (-34%+ in 2020).

However, the market started recovering from the disruption brought on by the COVID pandemic in the year 2022. The aerospace & defense metal bellows market is estimated to grow at a healthy CAGR of 7.6% during the forecast period to reach a value of US$ 308.8 million in 2028. Major factors, such as a continuous rise in the use of metal bellows for various applications in the aerospace industry, increasing preference of metal bellows for high-temperature applications, huge order backlogs of commercial aircraft, and expected rise in the production rate of the key aircraft programs are expected to fuel the demand for metal bellows during the forecast period.

Recent Market JVs and Acquisitions:

- In 2022, Parker-Hannifin Corporation acquired Meggitt plc, a leading provider of components and sub-systems for the aerospace and defense markets.

- In 2018, AMETEK Inc. acquired FMH Aerospace, a manufacturer of metal bellows, bellow joints, metal ducting, and metal hoses, for the commercial aerospace, defense, space, and industrial markets.

- In 2018, Satair A/S and Senior Metal Bellows (Senior Plc) extended the existing agreement to distribute all commercial aerospace aftermarket products, such as accumulators, bellows, thermal valves, and, compressors, in Europe and Asia-Pacific.

- Based on the product type, the aerospace & defense metal bellows market is segmented into edge-welded bellows, mechanically formed bellows and others. Edge-welded bellows are expected to remain the largest and fastest-growing product type in the market during the forecast period. Edge-welded bellows offer a wide range of operating temperatures, superior stroke capabilities, and more precise spring rates, making them suitable for a variety of applications where performance is critical.

- Based on the material type, the market is segmented into titanium alloys, stainless steel alloys, nickel alloys, and others. Titanium alloy-based metal bellows is expected to remain the dominant as well as the fastest-growing material type in the market during the forecast period. Titanium alloy bellows provide many advantages, such as extremely lightweight construction, high strength, excellent price-performance ratio, and high corrosive fluid resistance. Also, the rising demand for lightweight construction, high-strength material, and good media compatibility drives the demand for titanium in the A&D industry. It is estimated that there would be a further increase in the penetration of titanium in the crucial sections (including metal bellows) of the latest aircraft programs.

- Based on the application type, the market is segmented into airframe, engine, and others. The airframe is estimated to remain the most dominant application in the coming years. The engine also accounts for a reasonable share of the market. Key application areas of the engine are bleed air ducts, drain systems, firewall seals, nacelle seals, and duct seals. Major material types used in engine applications are high-temperature titanium alloys, CRES, and nickel alloys.

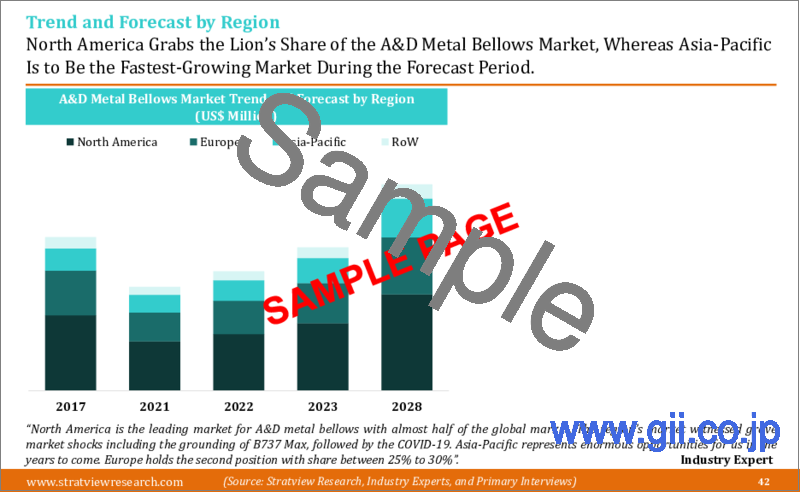

- In terms of regions, North America is expected to remain the largest market for aerospace & defense metal bellows during the forecast period. This region has a presence of a large number of major OEMs and aerospace giants, such as Boeing, which make the region a growth engine of the aerospace industry. Most of the aerospace & defense metal bellows suppliers have their presence in the region.

- Asia-Pacific, a relatively small market, is likely to heal up at the fastest pace in the post-pandemic market scenario. The region's market will be driven by a host of factors including an expected increase in the demand for commercial aircraft to support rising passenger traffic, the opening of assembly plants of Boeing and Airbus in China for B737, A320, A330, and A350 aircraft programs; upcoming indigenous commercial and regional aircraft (COMAC C919); rising aircraft fleet size; and increasing military expenditure by key countries such as China and India.

- Key Players

- The market is highly populated with the presence of some local, regional, and global players. Most of the major players compete in some of the governing factors including price, product offerings, regional presence, etc. The following are the key players in the aerospace & defense metal bellows market.

- Senior plc

- Eaton Corporation Plc

- Meggitt PLC

- Unison Industries, LLC

- MW Industries

- Smiths Group plc

- EagleBurgmann Germany GmbH & Co. KG

- AMETEK, Inc. (FMH Aerospace Corp.)

- U.S. Bellows, Inc.

- Enpro Industries

- Research Methodology

- This strategic assessment report, from Stratview Research, provides a comprehensive analysis that reflects today's aerospace & defense metal bellows market realities and future market possibilities for the forecast period. The report segments and analyzes the market in the most detailed manner in order to provide a panoramic view of the market. The vital data/information provided in the report can play a crucial role for the market participants as well as investors in the identification of the low-hanging fruits available in the market as well as to formulate the growth strategies to expedite their growth process.

- This report offers high-quality insights and is the outcome of a detailed research methodology comprising extensive secondary research, rigorous primary interviews with industry stakeholders, and validation and triangulation with Stratview Research's internal database and statistical tools. More than 1,000 authenticated secondary sources, such as company annual reports, fact books, press releases, journals, investor presentations, white papers, patents, and articles, have been leveraged to gather the data. We conducted more than 15 detailed primary interviews with the market players across the value chain in all four regions and industry experts to obtain both qualitative and quantitative insights.

- Report Features

This report provides market intelligence in the most comprehensive way. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market. The following are the key features of the report:

- Market structure: Overview, industry life cycle analysis, supply chain analysis.

- Market environment analysis: Growth drivers and constraints, Porter's five forces analysis, SWOT analysis.

- Market trend and forecast analysis.

- Market segment trend and forecast.

- Competitive landscape and dynamics: Market share, Product portfolio, New Product Launches, etc.

- COVID-19 impact and its recovery curve

- Attractive market segments and associated growth opportunities.

- Emerging trends.

- Strategic growth opportunities for the existing and new players.

- Key success factors.

- The aerospace & defense metal bellows market is segmented into the following categories.

- Aerospace & Defense Metal Bellows Market, by Product Type

- Edge-Welded Bellows (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Mechanically Formed Bellows (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerospace & Defense Metal Bellows Market, by Material Type

- Titanium Alloys (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Stainless Steel Alloys (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Nickel Alloys (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerospace & Defense Metal Bellows Market, by Joint Type

- Ball Joints (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Gimbal Joints (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Direct Bellows (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerospace & Defense Metal Bellows Market, by Platform Type

- Commercial Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Regional Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- General Aviation (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Helicopter (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Military Aircraft (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerospace & Defense Metal Bellows Market, by Application Type

- Engine (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Airframe (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Others (Regional Analysis: North America, Europe, Asia-Pacific, and RoW)

- Aerospace & Defense Metal Bellows Market, by Region

- North America (Country Analysis: The USA, Canada, and Mexico)

- Europe (Country Analysis: Germany, France, The UK, Russia, and Rest of Europe)

- Asia-Pacific (Country Analysis: Japan, China, India, and the Rest of Asia-Pacific)

- Rest of the World (Country Analysis: Brazil, Saudi Arabia, and Others)

Table of Contents

- Report Scope

- Report Objectives

- Research Methodology

- Market Segmentation

- Secondary Research

- Key Information Gathered from Secondary Research

- Primary Research

- Key Information Gathered from Primary Research

- Breakdown of Primary Interviews by Region, Designation, and Value Chain Node

- Data Analysis and Triangulation

1. Executive Summary

2. Aerospace & Defense Metal Bellows Market Environment Analysis

- 2.1. Supply Chain Analysis

- 2.2. PEST Analysis

- 2.3. Industry Life Cycle Analysis

- 2.4. Market Drivers

- 2.5. Market Challenges

3. Aerospace & Defense Metal Bellows Market Assessment (2017-2028) (US$ Million)

- 3.1. Share of Aerospace & Defense in the Total Metal Bellows Market

- 3.2. Aerospace & Defense Metal Bellows Market Trend and Forecast (US$ Million)

- 3.3. Market Scenario Analysis: Growth Trajectories in Different Market Conditions

- 3.4. COVID-19 Impact Assessment and Expected Recovery Curve

4. Aerospace & Defense Metal Bellows Market Segment Analysis (2017-2028) (US$ Million)

- 4.1. Product-Type Analysis

- 4.1.1. Edge-Welded Bellows: Regional Trend and Forecast (US$ Million)

- 4.1.2. Mechanically Formed Bellows: Regional Trend and Forecast (US$ Million)

- 4.1.3. Others: Regional Trend and Forecast (US$ Million)

- 4.2. Material-Type Analysis

- 4.2.1. Titanium Alloys: Regional Trend and Forecast (US$ Million)

- 4.2.2. Stainless Steel Alloys: Regional Trend and Forecast (US$ Million)

- 4.2.3. Nickel Alloys: Regional Trend and Forecast (US$ Million)

- 4.2.4. Others: Regional Trend and Forecast (US$ Million)

- 4.3. Joint-Type Analysis

- 4.3.1. Ball Joints: Regional Trend and Forecast (US$ Million)

- 4.3.2. Gimbal Joints: Regional Trend and Forecast (US$ Million)

- 4.3.3. Direct Bellows: Regional Trend and Forecast (US$ Million)

- 4.3.4. Others: Regional Trend and Forecast (US$ Million)

- 4.4. Platform-Type Analysis

- 4.4.1. Commercial Aircraft: Regional Trend and Forecast (US$ Million)

- 4.4.2. Regional Aircraft: Regional Trend and Forecast (US$ Million)

- 4.4.3. General Aviation: Regional Trend and Forecast (US$ Million)

- 4.4.4. Helicopter: Regional Trend and Forecast (US$ Million)

- 4.4.5. Military Aircraft: Regional Trend and Forecast (US$ Million)

- 4.4.6. Others: Regional Trend and Forecast (US$ Million)

- 4.5. Application-Type Analysis

- 4.5.1. Engine: Regional Trend and Forecast (US$ Million)

- 4.5.2. Airframe: Regional Trend and Forecast (US$ Million)

- 4.5.3. Others: Regional Trend and Forecast (US$ Million)

- 4.6. Regional Analysis

- 4.6.1. North American Aerospace & Defense Metal Bellows Market: Country Analysis

- 4.6.2. The USA's Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.3. Canadian Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.4. Mexican Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.5. European Aerospace & Defense Metal Bellows Market: Country Analysis

- 4.6.6. German Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.7. French Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.8. Russian Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.9. The UK's Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.10. Rest of the European Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.11. Asia-Pacific's Aerospace & Defense Metal Bellows Market: Country Analysis

- 4.6.12. Indian Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.13. Chinese Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.14. Japanese Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.15. Rest of the Asia-Pacific's Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.16. Rest of the World's (RoW) Aerospace & Defense Metal Bellows Market: Country Analysis

- 4.6.17. Brazilian Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.18. Saudi Arabian Aerospace & Defense Metal Bellows Market T&F (US$ Million)

- 4.6.19. Other Aerospace & Defense Metal Bellows Market T&F (US$ Million)

5. Competitive Analysis

- 5.1. Market Consolidation Level

- 5.2. Competitive Landscape

- 5.3. Market Share Analysis

- 5.4. Product Portfolio Analysis

- 5.5. Geographical Presence

- 5.6. New Product Launches

- 5.7. Strategic Alliances

- 5.8. Porter's Five Forces Analysis

6. Strategic Growth Opportunities

- 6.1. Market Attractiveness Analysis

- 6.1.1. Market Attractiveness by Product Type

- 6.1.2. Market Attractiveness by Material Type

- 6.1.3. Market Attractiveness by Joint Type

- 6.1.4. Market Attractiveness by Platform Type

- 6.1.5. Market Attractiveness by Application Type

- 6.1.6. Market Attractiveness by Region

- 6.1.7. Market Attractiveness by Country

- 6.2. Emerging Trends

- 6.3. Strategic Implications

- 6.4. Key Success Factors (KSFs)

7. Company Profile of Key Players (Alphabetically Arranged)

- 7.1. AMETEK, Inc. (FMH Aerospace Corp.)

- 7.2. Alloy Precision Technologies

- 7.3. EagleBurgmann Germany GmbH & Co. KG

- 7.4. Eaton Corporation Plc

- 7.5. Enpro Industries

- 7.6. KSM Co. Ltd.

- 7.7. Meggitt PLC (Parker-Hannifin Corporation)

- 7.8. MW Industries

- 7.9. Senior plc

- 7.10. Smiths Group plc

- 7.11. Unison Industries, LLC

- 7.12. U.S. Bellows, Inc.

8. Appendix

- 8.1. Disclaimer

- 8.2. Copyright

- 8.3. Abbreviation

- 8.4. Currency Exchange

- 8.5. Market Numbers