|

|

市場調査レポート

商品コード

1218813

正極材の世界市場:2028年までの予測 - 材料、タイプ、用途、エンドユーザー、地域別の分析Cathode Materials Market Forecasts to 2028 - Global Analysis By Material, Type, Application, End User, and Geography |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 正極材の世界市場:2028年までの予測 - 材料、タイプ、用途、エンドユーザー、地域別の分析 |

|

出版日: 2023年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 175+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

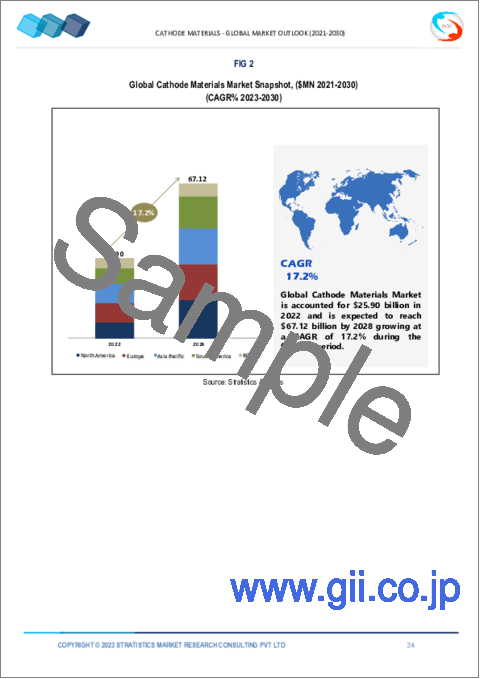

Stratistics MRCによると、正極材料の世界市場は2022年に259億米ドルを占め、2028年には671億2000万米ドルに達し、予測期間中にCAGR17.2%で成長すると予測されています。

電池には正極があり、放電時に電子を蓄積する役割を担っています。携帯電話、ノートパソコン、タブレット端末、カメラなどの携帯電子機器に多く使用されているリチウムイオン電池の最も重要な要素は、正極材です。電気自動車にもこの電池が使われています。正極材の世界市場は、電気自動車や携帯用電子機器の需要の高まりによって拡大しました。また、長時間の充電に耐えられる金ナノワイヤー電池など、リチウム技術の発展に伴い、正極材の多様な用途への活用が進んでいます。

世界のエネルギー産業に関する情報を提供する米国の専門誌「Power-Technology」によると、2021年上半期の電気自動車の販売台数は160%増加し、260万台となりました。また、中国は2021年上半期に110万台を販売し、販売台数の12%を占め、世界一のEV市場を維持しました。

市場力学

促進要因

リチウムイオン電池の用途拡大が需要を押し上げる

最も人気のある電池タイプはリチウムイオンで、ポータブルパワーバンク、船舶・電気自動車、ソーラーエネルギー貯蔵など、さまざまな製品で活用されています。リチウムイオン電池の容量と電圧は、製造に使用される正極材料によって決定されます。リチウムイオン電池は、従来の二次電池に比べて、充電持続時間が長く、エネルギー密度、電圧容量、自己放電率が低く、単電池としての電力効率に優れています。そのため、家電製品や電気自動車に多く使用されています。また、電気自動車や家電製品の需要拡大により、リチウムイオン電池のニーズが高まり、正極材の市場も拡大すると予想されます。

抑制要因

原料の入手難と安全性の問題

ほとんどのリチウムイオン電池の負極には、希少金属であるコバルトが使用されています。重金属であるコバルトは、非倫理的な採掘方法、不安定な価格変動、不安定な世界サプライチェーンに関連しています。電池の正極材としてよく使われるコバルトは、以前、オーストラリアやアフリカの製造拠点が閉鎖され、供給問題が発生したことがあります。電池関連の問題の取り扱いは、市場の第二の難関です。リチウム電池は、保管や輸送の際に慎重に取り扱わなければ、破損して大きな火災や爆発を引き起こす可能性があります。また、電池の取り扱いや使用、充電が不適切な場合、電池だけでなく、使用者が怪我をする可能性もあります。このように、電池の安全性の問題や原材料の不足が、市場の拡大を妨げています。

機会

欧州における電気自動車需要の増加

欧州では、電気自動車の普及に伴い、正極材の需要が高まっています。電気自動車用の電池は、これらの材料で作られています。環境汚染への懸念や政府の補助金などにより、欧州は急速に電気自動車(EV)分野の世界の拠点になりつつあります。また、因果関係ベースデータによると、欧州におけるEVとプラグインハイブリッド車(PHEV)の販売台数は、それぞれ2,82,000台、1,32,000台となっています。PHEVは3, 45,000台、EVは1, 90,000台で、両車種とも22%増加しています。このため、電気自動車の需要に伴い、二酸化鉛、カーボンナノチューブ、コバルト酸リチウムなどの正極材のニーズが高まると考えられます。このため、欧州での正極材の需要は大きく膨らむことになります。

脅威

政府による補助金・奨励金の不足

ドイツ、中国、米国など、ほとんどの国でリチウムイオン電池の需要が伸びています。これらの電池の用途には、再生可能エネルギー源の貯蔵や電気自動車が含まれます。各国の政府は、再生可能エネルギーを推進するために、リチウムイオン電池の生産を刺激する補助金やインセンティブに力を入れています。しかし、アフリカなどでは、政府がリチウムイオン電池の製造促進にあまり寄与していません。そのため、正極材の市場にも悪影響を及ぼし、電池の開拓を阻んでいます。

COVID-19の影響

COVID-19の流行は、正極材のサプライチェーンに大きな変化をもたらし、より環境に優しく、信頼性の高い、持続可能なエネルギー源に転換する動きが活発化しているため、企業は努力の調整を迫られています。さらに、世界経済の減速、ウクライナ戦争の影響、潜在的な市場シナリオによるスタグフレーションのリスクへの懸念から、正極材セクターのプレーヤーがより注意深く、先見性を持つ必要性が迫られているのです。正極材メーカー等では、新興国での経済・社会的影響の地域差が大きいことから、国別の戦略策定を進めています。

予測期間中、リチウムコバルト酸化物セグメントが最大になると予想される

コバルト酸リチウムセグメントは、リチウムイオン二次電池の正極として、粒子径がナノメートルからマイクロメートルのコバルト酸リチウムまたはコバルト酸リチウム化合物が使用されているため、有利な成長を遂げると推定されます。ニッケル・コバルト・アルミニウム(NCA)系酸化物を正極に用いた電池に比べ、比較的安定で、容量や出力が小さいのが特徴。リチウムコバルト酸化物電池の最大の特徴は、エネルギー密度が高く、スマートフォン、タブレット端末、ノートパソコン、カメラなどの携帯電子機器の駆動時間を長くすることができることです。また、ニッケルを多く含む他の材料とは異なり、熱安定性にも優れています。これらの材料の特徴により、コバルト酸リチウムのニーズが高まり、正極材市場がさらに活性化することが期待されます。

予測期間中、最も高いCAGRが見込まれるポータブルガジェット分野

スマートフォン、ラップトップ、カメラ、パワーバンク、スピーカーなどのポータブルデバイス用充電池の生産には、正極材料の大きなニーズがあるため、ポータブルガジェットセグメントは予測期間中に最も速いCAGRの成長を示すと予想されます。リチウムイオン電池は、高い出力密度、自己放電性、低いメンテナンス要件、高いセル電圧により、使用時間の延長を可能にするため、これらの機器に最も頻繁に利用されているのです。リチウムイオン二次電池は、スマートフォンの電力供給、蓄電、熱安定性など、携帯機器に不可欠なものです。正極材は、これらの機器の販売に比例して市場が拡大します。

最大のシェアを持つ地域

インド、中国、タイなどの新興国における工業化の進展により、アジア太平洋地域が予測期間中に最大の市場シェアを占めると予想され、アジア太平洋地域は正極材の世界市場において最大のシェアを獲得しています。中国が正極材の世界需要を牽引すると予想されるのは、政府の支援、製造業の好調、業界大手による電気自動車生産への投資の増加などによるものです。このような背景から、中国は現在、正極材のトップクラスの消費国となっています。

CAGRが最も高い地域

北米は、航空宇宙、自動車、エレクトロニクス産業におけるUAVや電動航空機など、より互換性の高い製品の開発により、予測期間中のCAGRが最も高くなると予測されます。また、自動車業界では、軽量化、電気自動車、ハイブリッド車の生産が拡大しており、調査期間中の市場拡大に拍車がかかると予想されます。

主な発展

2020年11月、BASF SEは、ドイツのシュヴァルツハイドに正極活物質生産工場を新設することを発表しました。この新工場は、世界をリードするプロセス技術を備え、年間約40万台のフル電気自動車にBASFの電池材料を供給することを可能にします。これは正極材市場の成長をさらに後押しするものです。

2019年12月、Umicore N.V.はFreeport Cobaltからフィンランドのコッコラにおけるコバルト精製および正極材プリカーサー活動の買収を完了しました。この買収により、ユミコアのバッテリー材料バリューチェーンの拡大は、正極材料の生産能力を強化し、欧州市場での地位を強化しました。

2019年8月、ナノワンマテリアルズ株式会社は、高エネルギーリチウムイオン電池をより安全で耐久性のあるものにすることを目的とした新材料「リチウムニッケルマンガンコバルト(NMC)」を上市しました。この新しい発売により、Nano One Materials Nano Oneは顧客向けの製品提供を拡大し、正極材市場の成長をさらに促進させるでしょう。

本レポートの内容

- 地域別・国別セグメントの市場シェア評価

- 新規参入企業への戦略的提言

- 2020年、2021年、2022年、2025年、2028年の市場データを網羅

- 市場動向(促進要因・制約要因・機会・脅威・課題・投資機会・推奨事項)

- 市場推定に基づく、主要ビジネスセグメントにおける戦略的推奨事項

- 主要な共通トレンドをマッピングした競合情勢

- 詳細な戦略、財務、最近の開発状況を含む企業プロファイル

- 最新の技術的進歩をマッピングしたサプライチェーン動向

無料カスタマイズサービス

本レポートをご購読のお客様には、以下のカスタマイズオプションのいずれかを無償でご提供いたします。

- 企業プロファイル

- 追加市場プレイヤーの包括的なプロファイリング(最大3社まで)

- 主要プレイヤーのSWOT分析(3社まで)

- 地域別セグメンテーション

- お客様のご希望に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによります。)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要プレイヤーのベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 仮定

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- アプリケーション分析

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターズファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の正極材料市場:材料別

- 二酸化鉛

- リン酸鉄リチウム

- リチウムニッケルマンガンコバルト

- リチウムコバルト酸化物(LCO)

- マンガン酸リチウム(LMO)

- オキシ水酸化物

- リン酸鉄ナトリウム

- 硫黄陰極

- リチウムニッケルコバルト酸化アルミニウム

- その他の資料

第6章 世界の正極材料市場:タイプ別

- リチウムイオン

- 鉛酸

- その他のタイプ

第7章 世界の正極材市場:用途別

- 携帯用ガジェット

- パワーツール

- 医療機器

- 蓄電システム

- ワイヤレス周辺機器またはコードレスデバイス

- その他のアプリケーション

第8章 世界の正極材市場:エンドユーザー別

- パワーツール

- 自動車

- 家電

- エネルギーシステムストレージ

- その他のエンドユーザー

第9章 世界の正極材料市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイル

- Mitsubishi Chemical Holdings

- DOW Chemical

- 3M

- BASF

- Hitachi Chemical

- Nippon Chemical Industrial Co. Ltd.

- LG Chem Ltd.

- Asahi Kasei Corporation

- Tanaka Chemical Corporation

- Kureha Corporation

- NEI Corporation

- Johnson Matthey plc

- Sumitomo Corporation

- Advanced Lithium Electrochemistry

- Umicore N.V

- Nano One Materials Corp.

List of Tables

- 1 Global Cathode Materials Market Outlook, By Region (2020-2028) ($MN)

- 2 Global Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 3 Global Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 4 Global Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 5 Global Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 6 Global Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 7 Global Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 8 Global Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 9 Global Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 10 Global Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 11 Global Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 12 Global Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 13 Global Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 14 Global Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 15 Global Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 16 Global Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 17 Global Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 18 Global Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 19 Global Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 20 Global Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 21 Global Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 22 Global Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 23 Global Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 24 Global Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 25 Global Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 26 Global Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 27 Global Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 28 Global Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 29 Global Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

- 30 North America Cathode Materials Market Outlook, By Country (2020-2028) ($MN)

- 31 North America Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 32 North America Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 33 North America Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 34 North America Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 35 North America Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 36 North America Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 37 North America Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 38 North America Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 39 North America Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 40 North America Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 41 North America Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 42 North America Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 43 North America Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 44 North America Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 45 North America Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 46 North America Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 47 North America Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 48 North America Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 49 North America Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 50 North America Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 51 North America Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 52 North America Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 53 North America Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 54 North America Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 55 North America Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 56 North America Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 57 North America Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 58 North America Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

- 59 Europe Cathode Materials Market Outlook, By Country (2020-2028) ($MN)

- 60 Europe Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 61 Europe Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 62 Europe Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 63 Europe Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 64 Europe Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 65 Europe Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 66 Europe Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 67 Europe Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 68 Europe Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 69 Europe Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 70 Europe Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 71 Europe Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 72 Europe Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 73 Europe Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 74 Europe Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 75 Europe Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 76 Europe Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 77 Europe Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 78 Europe Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 79 Europe Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 80 Europe Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 81 Europe Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 82 Europe Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 83 Europe Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 84 Europe Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 85 Europe Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 86 Europe Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 87 Europe Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

- 88 Asia Pacific Cathode Materials Market Outlook, By Country (2020-2028) ($MN)

- 89 Asia Pacific Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 90 Asia Pacific Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 91 Asia Pacific Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 92 Asia Pacific Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 93 Asia Pacific Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 94 Asia Pacific Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 95 Asia Pacific Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 96 Asia Pacific Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 97 Asia Pacific Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 98 Asia Pacific Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 99 Asia Pacific Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 100 Asia Pacific Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 101 Asia Pacific Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 102 Asia Pacific Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 103 Asia Pacific Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 104 Asia Pacific Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 105 Asia Pacific Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 106 Asia Pacific Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 107 Asia Pacific Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 108 Asia Pacific Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 109 Asia Pacific Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 110 Asia Pacific Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 111 Asia Pacific Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 112 Asia Pacific Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 113 Asia Pacific Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 114 Asia Pacific Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 115 Asia Pacific Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 116 Asia Pacific Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

- 117 South America Cathode Materials Market Outlook, By Country (2020-2028) ($MN)

- 118 South America Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 119 South America Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 120 South America Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 121 South America Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 122 South America Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 123 South America Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 124 South America Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 125 South America Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 126 South America Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 127 South America Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 128 South America Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 129 South America Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 130 South America Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 131 South America Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 132 South America Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 133 South America Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 134 South America Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 135 South America Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 136 South America Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 137 South America Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 138 South America Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 139 South America Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 140 South America Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 141 South America Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 142 South America Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 143 South America Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 144 South America Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 145 South America Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

- 146 Middle East & Africa Cathode Materials Market Outlook, By Country (2020-2028) ($MN)

- 147 Middle East & Africa Cathode Materials Market Outlook, By Material (2020-2028) ($MN)

- 148 Middle East & Africa Cathode Materials Market Outlook, By Lead Dioxide (2020-2028) ($MN)

- 149 Middle East & Africa Cathode Materials Market Outlook, By Lithium Iron Phosphate (2020-2028) ($MN)

- 150 Middle East & Africa Cathode Materials Market Outlook, By Lithium Nickel Manganese Cobalt (2020-2028) ($MN)

- 151 Middle East & Africa Cathode Materials Market Outlook, By Lithium Cobalt Oxide (LCO) (2020-2028) ($MN)

- 152 Middle East & Africa Cathode Materials Market Outlook, By Lithium Manganese Oxide (LMO) (2020-2028) ($MN)

- 153 Middle East & Africa Cathode Materials Market Outlook, By Oxyhydroxide (2020-2028) ($MN)

- 154 Middle East & Africa Cathode Materials Market Outlook, By Sodium Iron Phosphate (2020-2028) ($MN)

- 155 Middle East & Africa Cathode Materials Market Outlook, By Sulfur Cathodes (2020-2028) ($MN)

- 156 Middle East & Africa Cathode Materials Market Outlook, By Lithium Nickel Cobalt Aluminum Oxide (2020-2028) ($MN)

- 157 Middle East & Africa Cathode Materials Market Outlook, By Other Materials (2020-2028) ($MN)

- 158 Middle East & Africa Cathode Materials Market Outlook, By Type (2020-2028) ($MN)

- 159 Middle East & Africa Cathode Materials Market Outlook, By Lithium Ion (2020-2028) ($MN)

- 160 Middle East & Africa Cathode Materials Market Outlook, By Lead Acid (2020-2028) ($MN)

- 161 Middle East & Africa Cathode Materials Market Outlook, By Other Types (2020-2028) ($MN)

- 162 Middle East & Africa Cathode Materials Market Outlook, By Application (2020-2028) ($MN)

- 163 Middle East & Africa Cathode Materials Market Outlook, By Portable Gadgets (2020-2028) ($MN)

- 164 Middle East & Africa Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 165 Middle East & Africa Cathode Materials Market Outlook, By Medical Devices (2020-2028) ($MN)

- 166 Middle East & Africa Cathode Materials Market Outlook, By Power Storage Systems (2020-2028) ($MN)

- 167 Middle East & Africa Cathode Materials Market Outlook, By Wireless Peripherals or Cordless Devices (2020-2028) ($MN)

- 168 Middle East & Africa Cathode Materials Market Outlook, By Other Applications (2020-2028) ($MN)

- 169 Middle East & Africa Cathode Materials Market Outlook, By End User (2020-2028) ($MN)

- 170 Middle East & Africa Cathode Materials Market Outlook, By Power Tools (2020-2028) ($MN)

- 171 Middle East & Africa Cathode Materials Market Outlook, By Automotive (2020-2028) ($MN)

- 172 Middle East & Africa Cathode Materials Market Outlook, By Consumer Electronics (2020-2028) ($MN)

- 173 Middle East & Africa Cathode Materials Market Outlook, By Energy System Storage (2020-2028) ($MN)

- 174 Middle East & Africa Cathode Materials Market Outlook, By Other End Users (2020-2028) ($MN)

According to Stratistics MRC, the Global Cathode Materials Market is accounted for $25.90 billion in 2022 and is expected to reach $67.12 billion by 2028 growing at a CAGR of 17.2% during the forecast period. Batteries have cathodes, which serve as electron storage during discharge. The most crucial element of a lithium-ion battery, which is frequently used in portable electronic devices like cell phones, laptops, tablets, cameras, and other similar ones, is the cathode material. Electric vehicles also use this kind of battery. The global cathode materials market has expanded as a result of the rising demand for electric vehicles and portable electronic gadgets. Additionally, the utilisation of cathode materials in diverse applications is rising as lithium technology develops, such as with gold nanowire batteries that can endure prolonged recharging.

According to Power-Technology, a US-based journal which provides information on the global energy industry, there was an increase in the sale of electric vehicles by 160% in the first half of 2021, which stood at 2.6 million units. In addition, China remained the world's top EV market, with 1.1 million vehicles sold in the first half of 2021, accounting for 12% of sales.

Market Dynamics:

Driver:

Increasing Applications of Lithium-Ion Batteries Boosting the Demand

The most popular battery type is lithium-ion, which is utilised in a variety of products including portable power banks, marine & electric vehicles, and solar energy storage. Lithium-ion batteries' capacity and voltage are determined by the cathode materials utilised in their production. They are superior to conventional rechargeable batteries in terms of longer charge retention, higher energy density, voltage capacity, lower self-discharge rate, and better power efficiency as a single cell. They are frequently utilised in consumer electronics and electric cars as a result of these qualities. In addition, rising demand for EVs and consumer electronics will drive up the need for lithium-ion batteries, which will in turn drive up the market for cathode materials.

Restraint:

Lack of raw material availability and safety issues

The negatively charged electrode, or cathode, in practically all lithium-ion batteries contains cobalt, a rare mineral. The heavy metal cobalt is linked to unethical mining methods, erratic price swings, and a precarious global supply chain. Cobalt, a common cathode material for batteries, has previously had supply issues as a result of the closure of manufacturing facilities in Australia and Africa. The handling of batteries-related problems is the market's second main obstacle. Lithium batteries should be handled very carefully when being stored and transported; if not, they could become damaged and start a large fire or explosion. Furthermore, inappropriate battery handling, use, or charging can injure the user as well as the battery. As a result, difficulties with battery safety and a scarcity of raw materials are impeding the market's expansion.

Opportunity:

Increased demand for electric vehicles in Europe

Demand for Cathode material is increasing in Europe as a result of the growing popularity of EVs. Batteries for electric vehicles are made of these materials. Due to growing worries about environmental pollution and government subsidies, Europe is quickly becoming into a global hub for the electric vehicle (EV) sector. Additionally, according to causal base data, the sales of EV and Plug-in Hybrid Electric Vehicles (PHEV) in Europe were 2, 82,000 and 1, 32,000 units, respectively. Sales for both types of vehicles increased by 22%, with 3, 45,000 PHEVs and 1, 90,000 EVs sold. As a result, the need for cathode materials like lead dioxide, carbon nanotubes, and lithium cobalt oxide will increase along with the demand for electric vehicles. Because of this, the demand for cathode material in Europe will be greatly fuelled.

Threat:

Lack of government subsidies and incentives

Most nations, including Germany, China, and the US, are experiencing an increase in demand for lithium-ion batteries. Applications for these batteries include the storage of renewable energy sources and electric cars. Governments from different nations are concentrating on subsidies and incentives to stimulate the production of lithium-ion batteries in an effort to promote renewable energy. However, the government does not make a lot of contributions to boosting lithium-ion battery manufacture in places like Africa. This is impeding the development of these batteries, which is having a detrimental effect on the market for cathode materials.

COVID-19 Impact

Companies are being forced to coordinate their efforts due to the significant changes the COVID-19 epidemic has brought about in the supply chain for cathode materials and the growing movement to switch to greener, more dependable, and sustainable energy sources. Further, the need for Cathode Materials sector players to be more watchful and forward-thinking is pressing due to worries about the global economic slowdown, the impact of the war in Ukraine, and the risks of stagflation with potential market scenarios. Manufacturers of cathode materials and other related entities are developing country-specific strategies in response to the significant regional variations in the economic and social impact of COVID.

The lithium cobalt oxide segment is expected to be the largest during the forecast period

The lithium cobalt oxide segment is estimated to have a lucrative growth, due to the usage of lithium cobalt oxide or lithium cobaltate compounds, whose particle sizes range from nanometers to micrometres, as the cathode in rechargeable lithium-ion batteries. Compared to batteries using nickel-cobalt-aluminum (NCA) oxide cathodes, lithium-cobalt oxide batteries are relatively stable, have low capacity, and produce less power. The lithium cobalt oxide battery's key feature is its high energy density, which translates into a lengthy runtime for portable electronics like smartphones, tablets, laptops, and cameras. As opposed to other nickel-rich materials, lithium cobalt oxide manages any problem with heat stability. These materials' features will increase the need for lithium cobalt oxide, which will further fuel the market for cathode materials.

The portable gadgets segment is expected to have the highest CAGR during the forecast period

The portable gadgets segment is anticipated to witness the fastest CAGR growth during the forecast period; due to the production of rechargeable batteries for portable devices like smartphones, laptops, cameras, power banks, and speakers has a significant need for cathode material. Due to their high power density, self-discharge-ability, low maintenance requirements, and greater cell voltage, Li-ion batteries are the most frequently utilised in these devices because they allow for extended usage times. Rechargeable Li-ion batteries are essential to these portable devices' ability to power smartphones, store energy, and have good thermal stability. The market for cathode materials will expand in direct proportion to the sales of these devices.

Region with largest share:

Asia Pacific is projected to hold the largest market share during the forecast period owing to the growing industrialization of emerging nations like India, China, and Thailand, the Asia-Pacific region held the greatest market share for cathode materials globally. Because of its supportive government, robust manufacturing sector, and increasing investment in the production of electric vehicles by industry titans, China is anticipated to drive the global demand for cathode materials. The nation is now among the top consumers of cathode material as a result of these considerations.

Region with highest CAGR:

North America is projected to have the highest CAGR over the forecast period, owing to the development of more compatible products, like UAVs and electric-powered aircraft, in the aerospace, automotive, and electronics industries. Additionally, the expansion of the market during the study period is anticipated to be fuelled by the automotive industry's growing production of lightweight, electric, and hybrid vehicles.

Key players in the market

Some of the key players profiled in the xxx Market include Mitsubishi Chemical Holdings, DOW Chemical, 3M, BASF, Hitachi Chemical, Nippon Chemical Industrial Co. Ltd., LG Chem Ltd., Asahi Kasei Corporation, Tanaka Chemical Corporation, Kureha Corporation, NEI Corporation, Johnson Matthey plc, Sumitomo Corporation and Advanced Lithium Electrochemistry, Umicore N.V and Nano One Materials Corp.

Key Developments:

In November 2020, BASF SE announced a new cathode active materials production plant in Schwarzheide, Germany. This new plant equipped with world-leading process technology and enables the supply of around 400,000 full electric vehicles per year with BASF battery materials. This will further drive the cathode material market growth.

In December 2019, Umicore N.V. completed the acquisition of the cobalt refining and cathode precursor activities in Kokkola, Finland, from Freeport Cobalt. With this acquisition, Umicore's expanded battery materials value chain enhanced cathode materials production capacity, and strengthened its position in the European market.

In August 2019, Nano One Materials Corp. launched a new material "Lithium Nickel Manganese Cobalt (NMC)" with an aim to make high energy lithium-ion batteries safer and more durable. With this new launch Nano One Materials Nano One expanded its products offering for its customers, which will further drive the cathode material market growth.

Materials Covered:

- Lead Dioxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Cobalt Oxide (LCO)

- Lithium Manganese Oxide (LMO)

- Oxyhydroxide

- Sodium Iron Phosphate

- Sulfur Cathodes

- Lithium Nickel Cobalt Aluminum Oxide

- Other Materials

Types Covered:

- Lithium Ion

- Lead Acid

- Other Types

Applications Covered:

- Power Tools

- Automotive

- Consumer Electronics

- Energy System Storage

- Other End Users

End Users Covered:

- Building & Construction

- Industrial Packaging & Transport

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2020, 2021, 2022, 2025, and 2028

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Application Analysis

- 3.7 End User Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Cathode Materials Market, By Material

- 5.1 Introduction

- 5.2 Lead Dioxide

- 5.3 Lithium Iron Phosphate

- 5.4 Lithium Nickel Manganese Cobalt

- 5.5 Lithium Cobalt Oxide (LCO)

- 5.6 Lithium Manganese Oxide (LMO)

- 5.7 Oxyhydroxide

- 5.8 Sodium Iron Phosphate

- 5.9 Sulfur Cathodes

- 5.10 Lithium Nickel Cobalt Aluminum Oxide

- 5.11 Other Materials

6 Global Cathode Materials Market, By Type

- 6.1 Introduction

- 6.2 Lithium Ion

- 6.3 Lead Acid

- 6.4 Other Types

7 Global Cathode Materials Market, By Application

- 7.1 Introduction

- 7.2 Portable Gadgets

- 7.3 Power Tools

- 7.4 Medical Devices

- 7.5 Power Storage Systems

- 7.6 Wireless Peripherals or Cordless Devices

- 7.7 Other Applications

8 Global Cathode Materials Market, By End User

- 8.1 Introduction

- 8.2 Power Tools

- 8.3 Automotive

- 8.4 Consumer Electronics

- 8.5 Energy System Storage

- 8.6 Other End Users

9 Global Cathode Materials Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 Mitsubishi Chemical Holdings

- 11.2 DOW Chemical

- 11.3 3M

- 11.4 BASF

- 11.5 Hitachi Chemical

- 11.6 Nippon Chemical Industrial Co. Ltd.

- 11.7 LG Chem Ltd.

- 11.8 Asahi Kasei Corporation

- 11.9 Tanaka Chemical Corporation

- 11.10 Kureha Corporation

- 11.11 NEI Corporation

- 11.12 Johnson Matthey plc

- 11.13 Sumitomo Corporation

- 11.14 Advanced Lithium Electrochemistry

- 11.15 Umicore N.V

- 11.16 Nano One Materials Corp.