|

|

市場調査レポート

商品コード

1117105

車両電動化の世界市場予測:システム別(冷却システム、エネルギー貯蔵、電力変換)、電圧別(48V、24V、14V、12V)、製品タイプ別、車両タイプ別、ハイブリッド度別、販売チャネル別、地域別の分析(2028年まで)Vehicle Electrification Market Forecasts to 2028 - Global Analysis By System (Cooling Systems, Energy Storage, Power Conversions), Voltage (48V, 24V, 14V, 12V), Product Type, Vehicle Type, Degree of Hybridization, Sales Channel, and By Geography |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 車両電動化の世界市場予測:システム別(冷却システム、エネルギー貯蔵、電力変換)、電圧別(48V、24V、14V、12V)、製品タイプ別、車両タイプ別、ハイブリッド度別、販売チャネル別、地域別の分析(2028年まで) |

|

出版日: 2022年08月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の車両電動化の市場規模は、2022年の985億4,000万米ドルから、2028年までに1,945億米ドルに達し、予測期間中にCAGRで12.0%の成長が予測されています。

当レポートでは、世界の車両電動化市場を調査し、市場の促進要因・抑制要因、市場機会、COVID-19の影響、セグメント別の市場解析、競合情勢、主要企業のプロファイルなど、体系的な情報を提供しています。

目次

第1章 エグゼクティブサマリー

第2章 序文

第3章 市場動向分析

- 促進要因

- 抑制要因

- 市場機会

- 脅威

- 製品分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

第5章 世界の車両電動化市場:システム別

- 冷却システム

- エネルギー貯蔵

- 電力変換

- 発電

- 牽引駆動システム

第6章 世界の車両電動化市場:電圧別

- 48V

- 24V

- 14V

- 12V

第7章 世界の車両電動化市場:製品タイプ別

- 熱電発電機

- スターターモーター

- スタート/ストップシステム

- 液体ヒーター正温度係数(PTC)

- 統合型スタータージェネレーター(ISG)

- 電動ウォーターポンプ

- 電動バキュームポンプ

- 電動パワーステアリング(EPS)

- 電動オイルポンプ

- 電動燃料ポンプ

- 電気自動車モーター

- 電動エアコンコンプレッサー

- オルタネーター

- アクチュエータ

第8章 世界の車両電動化市場:ハイブリッド度別

- プラグインハイブリッド電気自動車(PHEV)

- マイクロ・フルハイブリッド車

- 内燃機関(ICE)

- ハイブリッド電気自動車(HEV)

- 燃料電池自動車(FCEV)

- バッテリー式電気自動車(BEV)

第9章 世界の車両電動化市場:車両タイプ別

- 乗用車

- ハッチバック

- セダン

- スポーツユーティリティビークル(SUV)

- マルチユーティリティビークル(MUV)

- 小型商用車(LCV)

- ピックアップトラック

- 軽トラック

- 大型商用車

- 大型トラック

- バス・コーチ

- スポーツカー

第10章 世界の車両電動化市場:販売チャネル別

- アフターマーケット

- OEM(相手先商標製品の製造会社)

第11章 世界の車両電動化市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他

第12章 主要な発展

- 契約、パートナーシップ、提携、合弁事業

- 買収・合併

- 新製品の発売

- 事業拡張

- その他の主要戦略

第13章 企業プロファイル

- Aisin Seiki Co., Ltd.

- Borgwarner Inc

- Continental Ag

- Delphi Technologies

- Denso Corporation

- Ford Motors Company

- Friedrichshafen Ag

- Hitachi Automotive Systems, Ltd

- Honda Motors Co. Ltd

- Johnson Electric Holdings Limited

- Magna International Inc

- Robert Bosch Gmbh

- Suzuki Motor Corporation

- Toyota Motors Corporation

- Volkswagen

- XL Fleet Corp

List of Tables

- Table 1 Global Vehicle Electrification Market Outlook, By Region (2020-2028) ($MN)

- Table 2 Global Vehicle Electrification Market Outlook, By System (2020-2028) ($MN)

- Table 3 Global Vehicle Electrification Market Outlook, By Cooling Systems (2020-2028) ($MN)

- Table 4 Global Vehicle Electrification Market Outlook, By Energy Storage (2020-2028) ($MN)

- Table 5 Global Vehicle Electrification Market Outlook, By Power Conversions (2020-2028) ($MN)

- Table 6 Global Vehicle Electrification Market Outlook, By Power Generation (2020-2028) ($MN)

- Table 7 Global Vehicle Electrification Market Outlook, By Traction Drive Systems (2020-2028) ($MN)

- Table 8 Global Vehicle Electrification Market Outlook, By Voltage (2020-2028) ($MN)

- Table 9 Global Vehicle Electrification Market Outlook, By 48V (2020-2028) ($MN)

- Table 10 Global Vehicle Electrification Market Outlook, By 24V (2020-2028) ($MN)

- Table 11 Global Vehicle Electrification Market Outlook, By 14V (2020-2028) ($MN)

- Table 12 Global Vehicle Electrification Market Outlook, By 12V (2020-2028) ($MN)

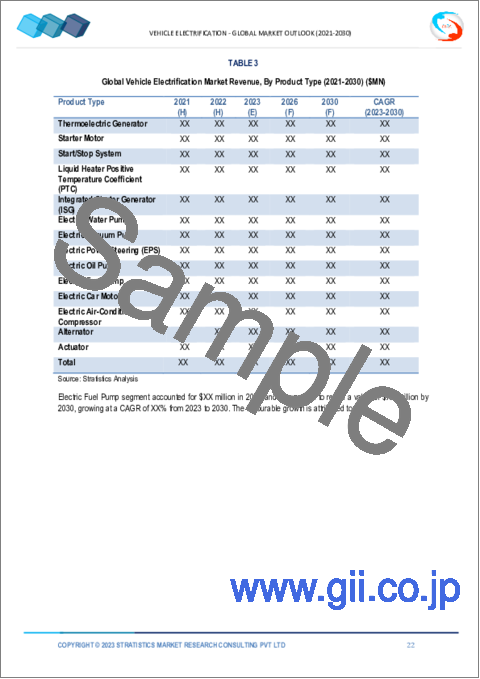

- Table 13 Global Vehicle Electrification Market Outlook, By Product Type (2020-2028) ($MN)

- Table 14 Global Vehicle Electrification Market Outlook, By Thermoelectric Generator (2020-2028) ($MN)

- Table 15 Global Vehicle Electrification Market Outlook, By Starter Motor (2020-2028) ($MN)

- Table 16 Global Vehicle Electrification Market Outlook, By Start/Stop System (2020-2028) ($MN)

- Table 17 Global Vehicle Electrification Market Outlook, By Liquid Heater Positive Temperature Coefficient (PTC) (2020-2028) ($MN)

- Table 18 Global Vehicle Electrification Market Outlook, By Integrated Starter Generator (ISG) (2020-2028) ($MN)

- Table 19 Global Vehicle Electrification Market Outlook, By Electric Water Pump (2020-2028) ($MN)

- Table 20 Global Vehicle Electrification Market Outlook, By Electric Vacuum Pump (2020-2028) ($MN)

- Table 21 Global Vehicle Electrification Market Outlook, By Electric Power Steering (EPS) (2020-2028) ($MN)

- Table 22 Global Vehicle Electrification Market Outlook, By Electric Oil Pump (2020-2028) ($MN)

- Table 23 Global Vehicle Electrification Market Outlook, By Electric Fuel Pump (2020-2028) ($MN)

- Table 24 Global Vehicle Electrification Market Outlook, By Electric Car Motor (2020-2028) ($MN)

- Table 25 Global Vehicle Electrification Market Outlook, By Electric Air-Conditioner Compressor (2020-2028) ($MN)

- Table 26 Global Vehicle Electrification Market Outlook, By Alternator (2020-2028) ($MN)

- Table 27 Global Vehicle Electrification Market Outlook, By Actuator (2020-2028) ($MN)

- Table 28 Global Vehicle Electrification Market Outlook, By Degree of Hybridization (2020-2028) ($MN)

- Table 29 Global Vehicle Electrification Market Outlook, By Plug-In Hybrid Electric Vehicle (PHEV) (2020-2028) ($MN)

- Table 30 Global Vehicle Electrification Market Outlook, By Micro & Full Hybrid Vehicle (2020-2028) ($MN)

- Table 31 Global Vehicle Electrification Market Outlook, By Internal Combustion Engine (ICE) (2020-2028) ($MN)

- Table 32 Global Vehicle Electrification Market Outlook, By Hybrid Electric Vehicle (HEV) (2020-2028) ($MN)

- Table 33 Global Vehicle Electrification Market Outlook, By Fuel Cell Electric Vehicle (FCEV) (2020-2028) ($MN)

- Table 34 Global Vehicle Electrification Market Outlook, By Battery Electric Vehicle (BEV) (2020-2028) ($MN)

- Table 35 Global Vehicle Electrification Market Outlook, By Vehicle Type (2020-2028) ($MN)

- Table 36 Global Vehicle Electrification Market Outlook, By Passenger Car (2020-2028) ($MN)

- Table 37 Global Vehicle Electrification Market Outlook, By Hatchback (2020-2028) ($MN)

- Table 38 Global Vehicle Electrification Market Outlook, By Sedan (2020-2028) ($MN)

- Table 39 Global Vehicle Electrification Market Outlook, By Sport Utility Vehicle (SUV) (2020-2028) ($MN)

- Table 40 Global Vehicle Electrification Market Outlook, By Multi Utility Vehicle (MUV) (2020-2028) ($MN)

- Table 41 Global Vehicle Electrification Market Outlook, By Light Commercial Vehicle (LCV) (2020-2028) ($MN)

- Table 42 Global Vehicle Electrification Market Outlook, By Pickup Trucks (2020-2028) ($MN)

- Table 43 Global Vehicle Electrification Market Outlook, By Light Trucks (2020-2028) ($MN)

- Table 44 Global Vehicle Electrification Market Outlook, By Heavy Commercial Vehicles (2020-2028) ($MN)

- Table 45 Global Vehicle Electrification Market Outlook, By Heavy Trucks (2020-2028) ($MN)

- Table 46 Global Vehicle Electrification Market Outlook, By Buses & Coaches (2020-2028) ($MN)

- Table 47 Global Vehicle Electrification Market Outlook, By Sports Cars (2020-2028) ($MN)

- Table 48 Global Vehicle Electrification Market Outlook, By Sales Channel (2020-2028) ($MN)

- Table 49 Global Vehicle Electrification Market Outlook, By Aftermarket (2020-2028) ($MN)

- Table 50 Global Vehicle Electrification Market Outlook, By Original Equipment Manufacturers (OEMs) (2020-2028) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Vehicle Electrification Market is accounted for $98.54 billion in 2022 and is expected to reach $194.50 billion by 2028 growing at a CAGR of 12.0% during the forecast period. Vehicle Electrification refers to a vehicle with electrical means of propulsion as well as electricity paying a major role in components functionality. It covers many aspects of electrification in the such as start/stop systems, electric power steering, electric vacuum pump, electric oil pump, and many other accessories which utilize mode of electric propulsion as well as help user to gain improved fuel economy when installing in conventional ICE vehicles.

Between 2021 and 2027, the size of the global electric vehicle market is expected to increase over four-fold to reach an estimated global market size of some 1.4 trillion U.S. dollars by 2027. This translates to a notable compound annual growth rate (CAGR) of more than 19.19 percent between 2022 and 2027. The Tesla Model 3 was the world's most popular plug-in electric vehicle with worldwide unit sales of roughly 501,000 in 2021. That year, deliveries of Tesla's Model 3 and Model Y have more than doubled year-over-year, and these two models accounted for 97 percent of Tesla's sales volume in 2021.

Market Dynamics:

Driver:

Growing demand for mild hybrids

The idea of or mild hybrids is gaining rapid traction around the globe, which is consequently expected to drive the demand for vehicle electrification in the near future. Full hybrid vehicles offer a better fuel economy as compared to mild hybrids. According to the International Moreover, factors such as the higher cost and weight of vehicles are major challenges for full hybrid vehicle manufacturers. The only addition to the cost is that of the electric motor, which is balanced by the removal of the starter motor and alternator from the conventional ICE engine. Mild hybrid systems with a 48 V battery are not as efficient as full hybrid systems but are cost-effective. Hence, OEMs prefer the mild hybrid concept. This involves the use of a conventional ICE engine and the addition of an electric motor with a power of up to 15 kW.

Restraint:

Problems in maintaining optimum power to weight ratio

The power to weight ratio is a calculation commonly applied to engines and power sources to enable the comparison of one vehicle to another. The power-to-weight ratio applies to the vehicle power in kW divided by the weight of the vehicle in kilograms. The lesser the weight of the vehicle, it is observed to have more power, better efficiency, and high range. OEMs and Tier I companies are working hard to improve the power-to-weight ratio by implementing lightweight materials and different advanced products such as e-CVT and e-axles, albeit still on a developmental stage. Advanced, lightweight components and materials are required to achieve optimum power-to-weight ratio.

Opportunity:

Stimulation of commercial vehicles

With the rising trend toward mobility on demand, taxis and passenger cars are focused more on greener technologies. Most of the efforts in the field of vehicle electrification are for passenger cars. There are very limited electrical systems and components for commercial vehicles that can replace conventional mechanical systems because of the higher loads. Developing electric powertrains for commercial vehicles is a costly affair as it involves a great amount of R&D. Governments from various countries are taking initiatives to increase the use of electric vehicles in their public transportation to reduce CO2 emissions by providing incentives and tax rebates on using e-trucks and e-buses. Some of the electric vehicle models are the Mercedes Benz electric truck, and BYD K9 and Tata Starbus Hybrid e-buses. The demand for public transportation is triggered by the growing population in urban areas where the existing transportation infrastructure is proving to be insufficient. As each OEM is now focusing on reducing the global carbon footprint, they are promoting the use of electric vehicles. As with the wide-scale adoption of these vehicles, the demand for more reliable and better-performing systems would increase. This is where e-drive systems would help in vehicle weight reduction.

Threat:

Risks associated with the components

There are several risks associated with introduction of advanced technologies, such as thermal runaway of battery bank and fire, which need to be cautiously assessed. Numerous safety aspects need to be considered regarding vehicle electrification, including electric system safety, functional system safety, battery charging safety, and vehicle maintenance, operation, and training. The current challenges that hinder the popularity of electric vehicles are high battery cost, overheating, the total energy storage capacity of the battery, and the development of batteries for vehicles. Thus, automobile manufacturers need to ensure that customers use systems that operate efficiently in varied conditions to effectively promote the use of these electrical systems and their components. Additionally, it is essential to examine the vehicle behavior as these systems often fail, making them inefficient when compared to ICE vehicles.

COVID-19 Impact

Transport has been one of the most affected sectors. In general, the global car market is very sensitive to macroeconomic conditions. This applies especially to electric vehicles, which are still very dependent on financial support measures. A combination of travel restrictions, unemployment, and low oil prices could have significant impact on electric vehicles. This paper provides an overview of the development of electric vehicles and corresponding policies covering the period before and during the COVID crisis.

The integrated starter generator (ISG) segment is expected to be the largest during the forecast period

The integrated starter generator (ISG) segment is estimated to have a lucrative growth. Increasing greenhouse gas emissions from conventional vehicles have fuelled the demand for advanced vehicles that are being integrated with the ISG system, which helps to curb the emissions from the vehicle. The integrated starter generator acts as a two-directional power converter by changing mechanical energy into electrical energy and vice versa. It also provides noiseless and vibration-less operation of the engine. The integrated starter generator replaces the starter motor and alternator in the conventional vehicles bevs by automatically controlling its start/stop system and, in turn, offers better fuel efficiency and fuel economy.

The passenger car segment is expected to have the highest CAGR during the forecast period

The passenger car segment is anticipated to witness the fastest CAGR growth during the forecast period and is anticipated to dominate the market over the forecast period. Rising sales of passenger cars are likely to drive the market over the forecast period. The passenger cars have one advantage over other industries from a decarbonization point: The zero-emissions option (e.g., the BEV) is cheaper than the current alternative (ICE) from a total cost of ownership perspective in some countries today and by 2025 at the latest in countries without incentives.

Region with highest share:

North America is projected to hold the largest market share during the forecast period owin to the growing charging infrastructure and significant investments by OEMs in the development of vehicle electrification. As the US has the presence of major OEMs and Tier I players, adoption of electric components in ICE vehicles, BEVs, HEVs, and PHEVs is very high. Federal tax credits and rebate incentives are accelerating the growth of vehicle electrification market, especially in the US. The US is set to dominate the North American vehicle electrification market, holding the highest market share in the forecast period. Therefore, North America is expected to be the have highest growth rate.

Region with highest CAGR:

Asia Pacific is projected to have the highest CAGR over the forecast period owing to the proliferation of electric vehicles and increased electrification of commercial vehicles. Besides, increased government regulation to reduce emission and emission standards for gasoline and diesel vehicles enables manufacturers to move towards the development of electric vehicles. The development of electric vehicles results in the growth of vehicle electrification. Moreover, vast R&D investments for new product development and improve performances of existing product lines drive the market growth. The burgeoning automotive industry in the region creates substantial market demand.

Key players in the market

Some of the key players profiled in the Vehicle Electrification Market include Aisin Seiki Co., Ltd., Borgwarner Inc, Continental Ag, Delphi Technologies, Denso Corporation, Ford Motors Company, Friedrichshafen Ag, Hitachi Automotive Systems, Ltd, Honda Motors Co. Ltd, Johnson Electric Holdings Limited, Magna International Inc, Robert Bosch Gmbh, Suzuki Motor Corporation, Toyota Motors Corporation, Volkswagen, and XL Fleet Corp.

Key Developments:

In June 2021, Ford announced the acquisition of Electriphi, California-based charging management and fleet monitoring software provider for electric automobiles. The Electriphi's team and services will be integrated with the "Ford Pro." The acquisition will positively influence Ford's vehicle electrification.

In February 2021, Ford Motors Company announced that its European division would soon phase out of fossil fuel-powered vehicle production, and by 2026 Ford will only offer plug-in hybrid and electric models. Moreover, by 2030 the all passenger vehicles will be powered by batteries only.

In July 2021, Suzuki Motor Corporation and Daihatsu Motor Co., Ltd announced that they had joined forces for the Commercial Japan Partnership commercial vehicle project to accelerate their carbon neutrality initiatives in mini-vehicles through the dissemination of CASE technologies and services. The collaboration will accelerate the electrification of mini-vehicles.

In June 2021, XL Fleet Corp., the leader in fleet electrification solutions for municipal and commercial fleets, announced a collaboration agreement with Rubicon, a software platform, which offers smart waste and recycling solutions for governments and businesses worldwide. The collaboration will provide XL Fleet's offering for fleet electrification to Rubicon's waste and recycling hauler partners.

Systems Covered:

- Cooling Systems

- Energy Storage

- Power Conversions

- Power Generation

- Traction Drive Systems

Voltages Covered:

- 48V

- 24V

- 14V

- 12V

Product Types Covered:

- Thermoelectric Generator

- Starter Motor

- Start/Stop System

- Liquid Heater Positive Temperature Coefficient (PTC)

- Integrated Starter Generator (ISG)

- Electric Water Pump

- Electric Vacuum Pump

- Electric Power Steering (EPS)

- Electric Oil Pump

- Electric Fuel Pump

- Electric Car Motor

- Electric Air-Conditioner Compressor

- Alternator

- Actuator

Degree of Hybridizations Covered:

- Plug-In Hybrid Electric Vehicle (PHEV)

- Micro & Full Hybrid Vehicle

- Internal Combustion Engine (ICE)

- Hybrid Electric Vehicle (HEV)

- Fuel Cell Electric Vehicle (FCEV)

- Battery Electric Vehicle (BEV)

Vehicle Types Covered:

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicles

- Sports Cars

Sales Channels Covered:

- Aftermarket

- Original Equipment Manufacturers (OEMs)

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2020, 2021, 2022, 2025, and 2028

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Vehicle Electrification Market, By System

- 5.1 Introduction

- 5.2 Cooling Systems

- 5.3 Energy Storage

- 5.4 Power Conversions

- 5.5 Power Generation

- 5.6 Traction Drive Systems

6 Global Vehicle Electrification Market, By Voltage

- 6.1 Introduction

- 6.2 48V

- 6.3 24V

- 6.4 14V

- 6.5 12V

7 Global Vehicle Electrification Market, By Product Type

- 7.1 Introduction

- 7.2 Thermoelectric Generator

- 7.3 Starter Motor

- 7.4 Start/Stop System

- 7.5 Liquid Heater Positive Temperature Coefficient (PTC)

- 7.6 Integrated Starter Generator (ISG)

- 7.7 Electric Water Pump

- 7.8 Electric Vacuum Pump

- 7.9 Electric Power Steering (EPS)

- 7.10 Electric Oil Pump

- 7.11 Electric Fuel Pump

- 7.12 Electric Car Motor

- 7.13 Electric Air-Conditioner Compressor

- 7.14 Alternator

- 7.15 Actuator

8 Global Vehicle Electrification Market, By Degree of Hybridization

- 8.1 Introduction

- 8.2 Plug-In Hybrid Electric Vehicle (PHEV)

- 8.3 Micro & Full Hybrid Vehicle

- 8.4 Internal Combustion Engine (ICE)

- 8.5 Hybrid Electric Vehicle (HEV)

- 8.6 Fuel Cell Electric Vehicle (FCEV)

- 8.7 Battery Electric Vehicle (BEV)

9 Global Vehicle Electrification Market, By Vehicle Type

- 9.1 Introduction

- 9.2 Passenger Car

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 Sport Utility Vehicle (SUV)

- 9.2.4 Multi Utility Vehicle (MUV)

- 9.3 Light Commercial Vehicle (LCV)

- 9.3.1 Pickup Trucks

- 9.3.2 Light Trucks

- 9.4 Heavy Commercial Vehicles

- 9.4.1 Heavy Trucks

- 9.4.2 Buses & Coaches

- 9.5 Sports Cars

10 Global Vehicle Electrification Market, By Sales Channel

- 10.1 Introduction

- 10.2 Aftermarket

- 10.3 Original Equipment Manufacturers (OEMs)

11 Global Vehicle Electrification Market, By Geography

- 11.1 Introduction

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 Italy

- 11.3.4 France

- 11.3.5 Spain

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 Japan

- 11.4.2 China

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 New Zealand

- 11.4.6 South Korea

- 11.4.7 Rest of Asia Pacific

- 11.5 South America

- 11.5.1 Argentina

- 11.5.2 Brazil

- 11.5.3 Chile

- 11.5.4 Rest of South America

- 11.6 Middle East & Africa

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 Qatar

- 11.6.4 South Africa

- 11.6.5 Rest of Middle East & Africa

12 Key Developments

- 12.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 12.2 Acquisitions & Mergers

- 12.3 New Product Launch

- 12.4 Expansions

- 12.5 Other Key Strategies

13 Company Profiling

- 13.1 Aisin Seiki Co., Ltd.

- 13.2 Borgwarner Inc

- 13.3 Continental Ag

- 13.4 Delphi Technologies

- 13.5 Denso Corporation

- 13.6 Ford Motors Company

- 13.7 Friedrichshafen Ag

- 13.8 Hitachi Automotive Systems, Ltd

- 13.9 Honda Motors Co. Ltd

- 13.10 Johnson Electric Holdings Limited

- 13.11 Magna International Inc

- 13.12 Robert Bosch Gmbh

- 13.13 Suzuki Motor Corporation

- 13.14 Toyota Motors Corporation

- 13.15 Volkswagen

- 13.16 XL Fleet Corp