|

|

市場調査レポート

商品コード

1067326

コンパニオン診断薬開発サービス市場(第2版):提供サービスタイプ別(フィージビリティスタディ、アッセイ開発、分析バリデーション、臨床バリデーション、製造)、使用分析技法別Companion Diagnostics Development Services Market (2nd Edition): Distribution by Type of Service Offered (Feasibility Studies, Assay Development, Analytical Validation, Clinical Validation and Manufacturing), Analytical Technique Used |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| コンパニオン診断薬開発サービス市場(第2版):提供サービスタイプ別(フィージビリティスタディ、アッセイ開発、分析バリデーション、臨床バリデーション、製造)、使用分析技法別 |

|

出版日: 2022年03月30日

発行: Roots Analysis

ページ情報: 英文 405 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

インサイト例

ここ数年、疾病の発症に関わる分子メカニズムの解明が進み、いくつかの標的治療薬が開発されるようになりました。これらの治療法は、特定の疾患関連分子シグネチャーを標的とするよう調整されており、患者固有の遺伝子プロファイルを医師に認識させ、情報に基づいた治療関連の意思決定を可能にするために、適切なコンパニオン診断薬(CDx)が必要とされています。これらの検査は、ほとんどの場合、治験薬の安全性と有効性を確認し、標的に対する治療効果を測定するために、治験薬と並行して開発されます。

当レポートでは、世界のコンパニオン診断薬開発サービス市場について調査し、市場の概要とともに、コンパニオン診断薬の応用動向、サービスプロバイダーの競合力分析とプロファイルなどを提供しています。目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 章の概要

- 個別化医療の進化

- コンパニオン診断薬の概要

- さまざまな治療領域にわたるコンパニオン診断薬の応用

- 腫瘍学

- 感染症

- 神経学的障害

- コンパニオン診断薬のための規制レビューおよび承認プロセス

- 既存の課題

- 診断受託機関(CDO)を選択するための重要なガイドライン

- 今後の展望

第4章 コンパニオン診断薬サービスプロバイダー:市場情勢

- 章の概要

- コンパニオン診断薬サービスプロバイダー:参入企業のリスト

第5章 コンパニオン診断薬サービスプロバイダー:企業の競争力分析

- 章の概要

- 調査手法

- 仮定/主要なパラメータ

- 競争力分析:コンパニオン診断薬サービスプロバイダー

- 北米に拠点を置くコンパニオン診断薬サービスプロバイダー

- 欧州に拠点を置くコンパニオン診断薬サービスプロバイダー

- アジア太平洋およびその他の地域に拠点を置くコンパニオン診断薬サービスプロバイダー

- 主要参入企業の概要

第6章 コンパニオン診断薬サービスプロバイダー:企業プロファイル

- 章の概要

- 北米の主要参入企業

- Geneuity Clinical Research Services

- Interpace Biosciences

- Labcorp

- Quest Diagnostics

- Q2 Solutions

- ResearchDx

- 欧州の主要参入企業

- Almac Diagnostic Services

- Biocartis

- Cerba Research

- Eurofins

- MLM Medical Labs

- QIAGEN

- アジア太平洋およびその他の地域の主要参入企業

- BGI Genomics

- MEDx (Suzhou) Translational Medicine

- MEDICAL & BIOLOGICAL LABORATORIES (MBL)

- Novogene

第7章 コンパニオン診断薬:市場情勢

第8章 パートナーシップとコラボレーション

- 章の概要

- パートナーシップモデル

- パートナーシップとコラボレーションのリスト

第9章 パートナー候補分析

第10章 合併と買収

- 章の概要

- 合併と買収のモデル

- 合併と買収のリスト

第11章 ステークホルダーのニーズ分析

- 章の概要

- コンパニオン診断薬:さまざまなステークホルダーのニーズ

- さまざまなステークホルダーのニーズの比較

第12章 バリューチェーン分析

第13章 癌バイオマーカーに関する臨床調査:大手製薬会社の展望

第14章 コンパニオン診断薬で使用されているバイオマーカー主導の標的療法に関するケーススタディ

第15章 精密医療ソフトウェアソリューションのケーススタディ

第16章 コンパニオン診断薬サービスプロバイダー:市場予測と機会分析

- 章の概要

- 重要な仮定と予測調査手法

- 世界のコンパニオン診断薬サービス市場、2022年~2035年

- 北米のコンパニオン診断薬サービス市場、2022年~2035年

- 欧州のコンパニオン診断薬サービス市場、2022年~2035年

- アジア太平洋およびその他の地域のコンパニオン診断薬サービス市場、2022年~2035年

第17章 エグゼクティブインサイト

第18章 結論

第19章 付録1:集計データ

第20章 付録2:企業と組織のリスト

List Of Tables

- Table 4.1 Companion Diagnostics Service Providers: List of Players

- Table 4.2 Companion Diagnostics Service Providers: Information on Type of Service(s) Offered

- Table 4.3 Companion Diagnostics Service Providers: Information on Type of Analytical Technique(s) Used

- Table 4.4 Companion Diagnostics Service Providers: Information on Therapeutic Area(s)

- Table 4.5 Companion Diagnostics Service Providers: Additional Information on Regulatory Certification(s) / Accreditation(s)

- Table 6.1 Companion Diagnostics Service Providers: List of Companies Profiled

- Table 6.2 Geneuity Clinical Research Services: Company Snapshot

- Table 6.3 Geneuity Clinical Research Services: Companion Diagnostics Service Portfolio

- Table 6.4 Geneuity Clinical Research Services: Recent Developments and Future Outlook

- Table 6.5 Interpace Biosciences: Company Snapshot

- Table 6.6 Interpace Biosciences: Companion Diagnostics Service Portfolio

- Table 6.7 Interpace Biosciences: Recent Developments and Future Outlook

- Table 6.8 Labcorp: Company Snapshot

- Table 6.9 Labcorp: Companion Diagnostics Service Portfolio

- Table 6.10 Labcorp: Recent Developments and Future Outlook

- Table 6.11 ResearchDx: Company Snapshot

- Table 6.12 ResearchDx: Companion Diagnostics Service Portfolio

- Table 6.13 ResearchDx: Recent Developments and Future Outlook

- Table 6.14 Quest Diagnostics: Company Snapshot

- Table 6.15 Quest Diagnostics: Companion Diagnostics Service Portfolio

- Table 6.16 Quest Diagnostics: Recent Developments and Future Outlook

- Table 6.17 Q2 Solutions: Company Snapshot

- Table 6.18 Q2 Solutions: Companion Diagnostics Service Portfolio

- Table 6.19 Q2 Solutions: Recent Developments and Future Outlook

- Table 6.20 Almac Diagnostic Services: Company Snapshot

- Table 6.21 Almac Diagnostic Services: Companion Diagnostics Service Portfolio

- Table 6.22 Almac Diagnostic Services: Recent Developments and Future Outlook

- Table 6.23 Biocartis: Company Snapshot

- Table 6.24 Biocartis: Companion Diagnostics Service Portfolio

- Table 6.25 Biocartis: Recent Developments and Future Outlook

- Table 6.26 Cerba Research: Company Snapshot

- Table 6.27 Cerba Research: Companion Diagnostics Service Portfolio

- Table 6.28 Cerba Research: Recent Developments and Future Outlook

- Table 6.29 Eurofins: Company Snapshot

- Table 6.30 Eurofins: Companion Diagnostics Service Portfolio

- Table 6.31 Eurofins: Recent Developments and Future Outlook

- Table 6.32 MLM Medical Labs: Company Snapshot

- Table 6.33 MLM Medical Labs: Companion Diagnostics Service Portfolio

- Table 6.34 MLM Medical Labs: Recent Developments and Future Outlook

- Table 6.35 QIAGEN: Company Snapshot

- Table 6.36 QIAGEN: Companion Diagnostics Service Portfolio

- Table 6.37 QIAGEN: Recent Developments and Future Outlook

- Table 6.38 BGI Genomics: Company Snapshot

- Table 6.39 BGI Genomics: Companion Diagnostics Service Portfolio

- Table 6.40 BGI Genomics: Recent Developments and Future Outlook

- Table 6.41 MEDx (Suzhou) Translational Medicine: Company Snapshot

- Table 6.42 MEDx (Suzhou) Translational Medicine: Companion Diagnostics Service Portfolio

- Table 6.43 MEDx (Suzhou) Translational Medicine: Recent Developments and Future Outlook

- Table 6.44 MEDICAL & BIOLOGICAL LABORATORIES (MBL): Company Snapshot

- Table 6.45 MEDICAL & BIOLOGICAL LABORATORIES (MBL): Companion Diagnostics Service Portfolio

- Table 6.46 MEDICAL & BIOLOGICAL LABORATORIES (MBL): Recent Developments and Future Outlook

- Table 6.47 Novogene: Company Snapshot

- Table 6.48 Novogene: Companion Diagnostics Service Portfolio

- Table 6.49 Novogene: Recent Developments and Future Outlook

- Table 8.1 Companion Diagnostics Service Providers: List of Partnerships and Collaborations, 2017-2021

- Table 9.1 Companies / Organizations Working on the Amyloid Beta Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.2 Companies / Organizations Working on the Tau Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.3 Companies / Organizations Working on the BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.4 Companies / Organizations Working on the HER Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.5 Companies / Organizations Working on the HR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.6 Companies / Organizations Working on the PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.7 Companies / Organizations Working on the BRAF Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.8 Companies / Organizations Working on the EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.9 Companies / Organizations Working on the KRAS Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.10 Companies / Organizations Working on the MSI Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.11 Companies / Organizations Working on the NRAS Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.12 Companies / Organizations Working on the CCR5 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.13 Companies / Organizations Working on the ALK Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.14 Companies / Organizations Working on the EGFR Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.15 Companies / Organizations Working on the PD-L1 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.16 Companies / Organizations Working on the RET Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.17 Companies / Organizations Working on the ROS Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.18 Companies / Organizations Working on the AST Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.19 Companies / Organizations Working on the BRCA Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.20 Companies / Organizations Working on the CA-125 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 9.21 Companies / Organizations Working on the AR-V7 Biomarker: Potential Partners for Companion Diagnostic Service Providers

- Table 10.1 Companion Diagnostics Service Providers: Mergers and Acquisitions, 2017-2021

- Table 11.1 Comparison of Needs of Stakeholders

- Table 13.1 List of Likely Drug Candidates / Potential Collaborators for Companion Diagnostic Developers

- Table 13.2 List of Biomarkers across Moderately Popular Indications

- Table 13.3 List of Biomarkers across Emerging Indications

- Table 14.1 Biomarker Driven Targeted Therapies: Information on Commercial Availability, Type of Molecule and Route of Administration

- Table 14.2 Biomarker Driven Targeted Therapies: List of Developers

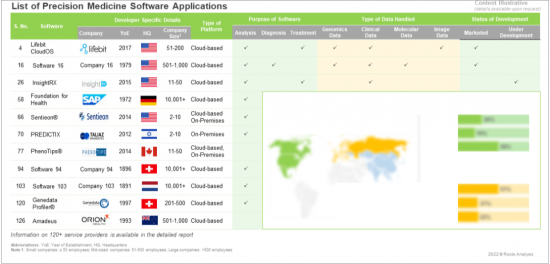

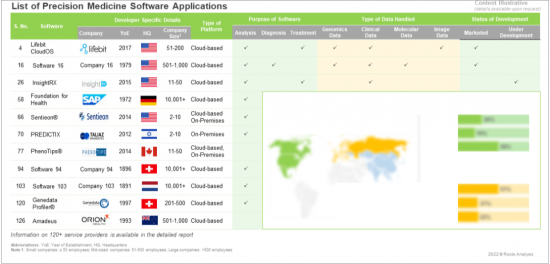

- Table 15.1 Precision Medicine Software Solutions: Information on Type of Platform, Status of Development and Compliance

- Table 15.2 Precision Medicine Software Solutions: Information on Purpose of Software, Type of Data Handled, Therapeutic Area and End User

- Table 15.3 Precision Medicine Software Solution Developers: Information on Year of Establishment, Company Size and Location of Headquarters

- Table 17.1 Genomenon: Company Snapshot

- Table 17.2 Tymora Analytical Operations: Company Snapshot

- Table 17.3 Novodiax: Company Snapshot

- Table 17.4 OWL Metabolomics: Company Snapshot

- Table 17.5 NeoGenomics Laboratories: Company Snapshot

- Table 19.1 Companion Diagnostics Service Providers: Distribution by Year of Establishment

- Table 19.2 Companion Diagnostics Service Providers: Distribution by Company Size

- Table 19.3 Companion Diagnostics Service Providers: Distribution by Company Ownership

- Table 19.4 Companion Diagnostics Service Providers: Distribution by Location of Headquarters

- Table 19.5 World Map Representation: Distribution by Geography

- Table 19.6 Companion Diagnostics Service Providers: Distribution by Service Offered

- Table 19.7 Companion Diagnostics Service Providers: Distribution by Other Affiliated Service Offered

- Table 19.8 Companion Diagnostics Service Providers: Distribution by Type of Analytical Technique

- Table 19.9 Companion Diagnostics Service Providers: Distribution by Therapeutic Area

- Table 19.10 Companion Diagnostics Service Providers: Distribution by Regulatory Accreditation / Certification

- Table 19.11 Interpace Biosciences: Annual Revenues, FY 2016-Q3 2021 (USD Million)

- Table 19.12 Labcorp Drug Development: Annual Revenues, FY 2016-2021 (USD Billion)

- Table 19.13 Quest Diagnostics: Annual Revenues, FY 2016-2021 (USD Billion)

- Table 19.14 Q2 Solutions: Annual Revenues, FY 2016-2021 (USD Million)

- Table 19.15 Almac Group Diagnostics: Annual Revenues, FY 2016-2021 (GBP Million)

- Table 19.16 Biocartis: Annual Revenues, FY 2016-H1 2021 (EUR Billion)

- Table 19.17 Eurofins: Annual Revenues, FY 2016-H1 2021 (EUR Billion)

- Table 19.18 QIAGEN: Annual Revenues, FY 2016-2021 (USD Billion)

- Table 19.19 Companion Diagnostics: Distribution by Assay Technique Used

- Table 19.20 Companion Diagnostics: Distribution by Target Disease Indication

- Table 19.21 Companion Diagnostics: Distribution by Therapeutic Area

- Table 19.22 Companion Diagnostics: Distribution by Type of Biomarker Detected

- Table 19.23 Companion Diagnostics: Distribution by Biochemical Nature of Biomarker Detected

- Table 19.24 Companion Diagnostics: Distribution by Type of Sample Used

- Table 19.25 Companion Diagnostics: Distribution by Commercial Availability and Therapeutic Area

- Table 19.26 Companion Diagnostics: Distribution by Year of Initiation of Development of Investigational Programs

- Table 19.27 Companion Diagnostics: Distribution by Year of Approval of Marketed Products

- Table 19.28 Companion Diagnostics: Distribution by Regulatory Authority Involved in the Approval of Marketed Programs

- Table 19.29 Companion Diagnostics: Distribution by Expediated Review Designation and Type of Biomarker Detected

- Table 19.30 Companion Diagnostic Developers: Distribution by Year of Establishment

- Table 19.31 Companion Diagnostic Developers: Distribution by Company Size

- Table 19.32 Companion Diagnostic Developers: Distribution by Company Ownership

- Table 19.33 Companion Diagnostic Developers: Distribution by Location of Headquarters

- Table 19.34 World Map Representation: Distribution by Geography

- Table 19.35 Most Active Players: Distribution by Number of Marketed Products and Investigational Programs

- Table 19.36 Most Active Players: Distribution by Number of Marketed Products

- Table 19.37 Most Active Players: Distribution by Number of Target Disease Indications

- Table 19.38 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 19.39 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 19.40 Partnerships and Collaborations: Distribution by Type of Partner

- Table 19.41 Partnerships and Collaborations: Distribution by Year of Partnership and Type of Partner

- Table 19.42 Partnerships and Collaborations: Distribution by Type of Partnership and Type of Partner

- Table 19.43 Partnerships and Collaborations: Distribution by Type of Therapeutic Area

- Table 19.44 Partnerships and Collaborations: Distribution by Year and Type of Partners

- Table 19.45 Most Active Players: Distribution by Number of Partnerships

- Table 19.46 Partnerships and Collaborations: Regional Distribution

- Table 19.47 Partnerships and Collaborations: Intercontinental and Intracontinental Distribution

- Table 19.48 World Map Representation: Regional Distribution of Amyloid Beta Biomarker Focused Clinical Trials

- Table 19.49 World Map Representation: Regional Distribution of Tau Biomarker Focused Clinical Trials

- Table 19.50 World Map Representation: Regional Distribution of BRCA Biomarker Focused Clinical Trials

- Table 19.51 World Map Representation: Regional Distribution of HER Biomarker Focused Clinical Trials

- Table 19.52 World Map Representation: Regional Distribution of HR Biomarker Focused Clinical Trials

- Table 19.53 World Map Representation: Regional Distribution of PD-L1 Biomarker Focused Clinical Trials

- Table 19.54 World Map Representation: Regional Distribution of BRAF Biomarker Focused Clinical Trials

- Table 19.55 World Map Representation: Regional Distribution of EGFR Biomarker Focused Clinical Trials

- Table 19.56 World Map Representation: Regional Distribution of KRAS Biomarker Focused Clinical Trials

- Table 19.57 World Map Representation: Regional Distribution of MSI Biomarker Focused Clinical Trials

- Table 19.58 World Map Representation: Regional Distribution of NRAS Biomarker Focused Clinical Trials

- Table 19.59 World Map Representation: Regional Distribution of CCR5 Biomarker Focused Clinical Trials

- Table 19.60 World Map Representation: Regional Distribution of ALK Biomarker Focused Clinical Trials

- Table 19.61 World Map Representation: Regional Distribution of EGFR Biomarker Focused Clinical Trials

- Table 19.62 World Map Representation: Regional Distribution of PD-L1 Biomarker Focused Clinical Trials

- Table 19.63 World Map Representation: Regional Distribution of RET Biomarker Focused Clinical Trials

- Table 19.64 World Map Representation: Regional Distribution of ROS Biomarker Focused Clinical Trials

- Table 19.65 World Map Representation: Regional Distribution of AST Biomarker Focused Clinical Trials

- Table 19.66 World Map Representation: Regional Distribution of BRCA Biomarker Focused Clinical Trials

- Table 19.67 World Map Representation: Regional Distribution of CA-125 Biomarker Focused Clinical Trials

- Table 19.68 World Map Representation: Regional Distribution of AR-V7 Biomarker Focused Clinical Trials

- Table 19.69 Mergers and Acquisitions: Distribution by Type of Deal

- Table 19.70 Mergers and Acquisitions: Distribution by Year of Deal

- Table 19.71 Mergers and Acquisitions: Regional Distribution

- Table 19.72 Mergers and Acquisitions: Continent-wise Distribution

- Table 19.73 Mergers and Acquisitions: Intercontinental and Intracontinental Deals

- Table 19.74 Mergers and Acquisitions: Country-wise Distribution

- Table 19.75 Mergers and Acquisitions: Distribution by Company Size

- Table 19.76 Mergers and Acquisitions: Ownership Change Matrix

- Table 19.77 Mergers and Acquisitions: Distribution by Key Value Drivers

- Table 19.78 Mergers and Acquisitions: Valuation by Acquisition Deal Multiples

- Table 19.79 Key Players: Distribution by Number of Deals

- Table 19.80 Clinical Trial Analysis: Distribution by Trial Registration Year

- Table 19.81 Clinical Trial Analysis: Distribution by Phase of Development

- Table 19.82 Clinical Trial Analysis: Distribution by Sponsor

- Table 19.83 Clinical Trial Analysis: Distribution by Recruitment Status

- Table 19.84 Clinical Trial Analysis: Distribution by Therapy Design

- Table 19.85 Clinical Trial Analysis: Distribution by Geography

- Table 19.86 Clinical Trial Analysis: Distribution by Enrolled Patient Population

- Table 19.87 Clinical Trial Analysis: Distribution by Most Popular Biomarkers

- Table 19.88 Clinical Trial Analysis: Distribution by Moderately Popular Biomarkers

- Table 19.89 Clinical Trial Analysis: Distribution by Less Popular / Preliminary Stage Biomarkers

- Table 19.90 Other Emerging Biomarkers: Word Cloud

- Table 19.91 Clinical Trial Analysis: Distribution of Trials of Most Popular Biomarkers by Trial Registration Year

- Table 19.92 Clinical Trial Analysis: Distribution of Trials of Moderately Popular Biomarkers by Trial Registration Year

- Table 19.93 Clinical Trial Analysis: Distribution of Trials of Less Popular and Other Biomarkers by Trial Registration Year

- Table 19.94 Clinical Trial Analysis: Distribution of Trials of Most Popular Biomarkers by Phase of Development

- Table 19.95 Clinical Trial Analysis: Distribution of Trials of Moderately Popular Biomarkers by Phase of Development

- Table 19.96 Clinical Trial Analysis: Distribution of Trials of Less Popular and Other Biomarkers by Phase of Development

- Table 19.97 Clinical Trial Analysis: Distribution of Trials of Most Popular Biomarkers by Sponsors

- Table 19.98 Clinical Trial Analysis: Distribution of Trials of Moderately Popular Biomarkers by Sponsors

- Table 19.99 Clinical Trial Analysis: Distribution of Trials of Less Popular and Other Biomarkers by Sponsors

- Table 19.100 Clinical Trial Analysis: Distribution of Trials for Most Popular Indications

- Table 19.101 Clinical Trial Analysis: Distribution of Trials for Moderately Popular Indications

- Table 19.102 Clinical Trial Analysis: Distribution of Trials for Less Popular and Other Indications

- Table 19.103 Other Emerging Indications: Word Cloud

- Table 19.104 Clinical Trial Analysis: Distribution of Trials of Most Popular Indications by Trial Registration Year

- Table 19.105 Clinical Trial Analysis: Distribution of Trial of Moderately Popular Indications by Trial Registration Year

- Table 19.106 Clinical Trial Analysis: Distribution of Trials of Less Popular and Other Indications by Trial Registration Year

- Table 19.107 Clinical Trial Analysis: Distribution of Trials of Most Popular Indications by Phase of Development

- Table 19.108 Clinical Trial Analysis: Distribution of Trials of Moderately Popular Indications by Phase of Development

- Table 19.109 Clinical Trial Analysis: Distribution of Trials of Less Popular and Emerging Indications by Phase of Development

- Table 19.110 Clinical Trial Analysis: Distribution of Trials of Most Popular Indications by Sponsor

- Table 19.111 Clinical Trial Analysis: Distribution of Trials of Moderately Popular Indications by Sponsor

- Table 19.112 Clinical Trial Analysis: Distribution of Trials of Less Popular and Emerging Indications by Sponsor

- Table 19.113 Clinical Trial Analysis: Distribution of Trials of Lung Cancer by Affiliated Biomarkers

- Table 19.114 Clinical Trials Summary: Distribution of Trials of Breast Cancer by Affiliated Biomarkers

- Table 19.115 Clinical Trials Summary: Distribution of Trials of Lymphoma by Affiliated Biomarkers

- Table 19.116 Clinical Trials Summary: Distribution of Trials of Ovarian Cancer by Affiliated Biomarkers

- Table 19.117 Clinical Trials Summary: Distribution of Trials of Prostate Cancer by Affiliated Biomarkers

- Table 19.118 Clinical Trials Summary: Distribution of Trials of Melanoma by Affiliated Biomarkers

- Table 19.119 Clinical Trials Summary: Distribution of Trials of Colon / Colorectal Cancer by Affiliated Biomarkers

- Table 19.120 Clinical Trials Summary: Distribution of Trials of Head and Neck Cancer by Affiliated Biomarkers

- Table 19.121 Biomarker-Driven Targeted Therapies: Distribution by Commercial Availability

- Table 19.122 Biomarker-Driven Targeted Therapies: Distribution by Type of Molecule

- Table 19.123 Biomarker-Driven Targeted Therapies: Distribution by Commercial Availability and Type of Molecule

- Table 19.124 Biomarker-Driven Targeted Therapies: Distribution by Route of Administration

- Table 19.125 Leading Biomarker-Driven Targeted Therapies: Distribution by Number of Companion Diagnostic Products / Programs

- Table 19.126 Biomarker-Driven Targeted Therapy Developers: Distribution by Year of Establishment

- Table 19.127 Biomarker-Driven Targeted Therapy Developers: Distribution by Company Size

- Table 19.128 Biomarker-Driven Targeted Therapy Developers: Distribution by Company Ownership

- Table 19.129 Biomarker-Driven Targeted Therapy Developers: Distribution by Location of Headquarters

- Table 19.130 Leading Players: Distribution by Number of Biomarker-Driven Targeted Therapies

- Table 19.131 Precision Medicine Software Solutions: Distribution by Type of Platform

- Table 19.132 Precision Medicine Software Solutions: Distribution by Purpose of Software Applications

- Table 19.133 Precision Medicine Software Solutions: Distribution by Type of Data Handled

- Table 19.134 Precision Medicine Software Solutions: Distribution by Therapeutic Area

- Table 19.135 Precision Medicine Software Solutions: Distribution by Type of End User

- Table 19.136 Precision Medicine Software Solution Developers: Distribution by Year of Establishment

- Table 19.137 Precision Medicine Software Solution Developers: Distribution by Company Size

- Table 19.138 Precision Medicine Software Solution Developers: Distribution by Location of Headquarters

- Table 19.139 World Map Representation: Distribution by Geography

- Table 19.140 Global Companion Diagnostics Development Services Market, 2022-2035 (USD Million)

- Table 19.141 Global Companion Diagnostics Development Services Market: Distribution by Type of Service Offered, 2022-2035 (USD Million)

- Table 19.142 Global Companion Diagnostics Development Services Market: Distribution by Type of Analytical Technique, 2022-2035 (USD Million)

- Table 19.143 Global Companion Diagnostics Development Services Market: Distribution by Therapeutic Area, 2022-2035 (USD Million)

- Table 19.144 Global Companion Diagnostics Development Services Market: Distribution by Region, 2022-2035 (USD Million)

- Table 19.145 Companion Diagnostics Development Services Market in North America, 2022-2035 (USD Million)

- Table 19.146 Companion Diagnostics Development Services Market in North America: Distribution by Type of Service Offered, 2022-2035 (USD Million)

- Table 19.147 Companion Diagnostics Development Services Market in North America: Distribution by Type of Analytical Technique, 2022-2035 (USD Million)

- Table 19.148 Companion Diagnostics Development Services Market in North America: Distribution by Therapeutic Area, 2022-2035 (USD Million)

- Table 19.149 Companion Diagnostics Development Services Market in Europe, 2022-2035 (USD Million)

- Table 19.150 Companion Diagnostics Development Services Market in Europe: Distribution by Type of Service Offered, 2022-2035 (USD Million)

- Table 19.151 Companion Diagnostics Development Services Market in Europe: Distribution by Type of Analytical Technique, 2022-2035 (USD Million)

- Table 19.152 Companion Diagnostics Development Services Market in Europe: Distribution by Therapeutic Area, 2022-2035 (USD Million)

- Table 19.153 Companion Diagnostics Development Services Market in Asia-Pacific and Rest of the World, 2022-2035 (USD Million)

- Table 19.154 Companion Diagnostics Development Services Market in Asia-Pacific and Rest of the World: Distribution by Type of Service Offered, 2022-2035 (USD Million)

- Table 19.155 Companion Diagnostics Development Services Market in Asia-Pacific and Rest of The World: Distribution by Type of Analytical Technique Offered, 2022-2035 (USD Million)

- Table 19.156 Companion Diagnostics Development Services Market in Asia-Pacific and Rest of the World: Distribution by Therapeutic Area, 2022-2035 (USD Million)

List Of Companies

The following companies / institutes / government bodies and organizations have been mentioned in this report.

- 1. 20/20 GeneSystems

- 2. 2bPrecise (acquired by AccessDX)

- 3. 3D Medicines

- 4. 4D Path

- 5. A&G Pharmaceutical

- 6. A2 Biotherapeutics

- 7. AB-BIOTICS

- 8. Abbott

- 9. AbbVie

- 10. Abcam

- 11. Abnova

- 12. AccuGenomics

- 13. ACOBIOM (formerly known as Skuldtech)

- 14. MD Diagnostics (acquired by ACT Genomics)

- 15. actMED

- 16. Adial Pharmaceuticals

- 17. Admera Health

- 18. Advanced Cell Diagnostics

- 19. Agena Bioscience (acquired by Mesa Laboratories)

- 20. Agendia

- 21. Agilent Technologies

- 22. Agios Pharmaceuticals (acquired by Servier)

- 23. Ainnova Tech

- 24. AIQ Solutions

- 25. AKESOgen (acquired by Tempus)

- 26. Akoya Biosciences

- 27. Allergan (acquired by AbbVie)

- 28. Almac Diagnostic Services

- 29. AltheaDx

- 30. Altis Labs

- 31. Alva10

- 32. Amarantus BioScience

- 33. AMedSU

- 34. Amgen

- 35. Amoy Diagnostics (AmoyDx)

- 36. Anagenics

- 37. Anavex Life Sciences

- 38. ANGLE

- 39. ApoCell (acquired by Precision for Medicine)

- 40. Apogenix

- 41. Applied BioCode

- 42. ARIAD Pharmaceuticals (acquired by Takeda)

- 43. Ariel Precision Medicine

- 44. Array BioPharma (acquired by Pfizer)

- 45. ARUP Laboratories

- 46. Ascenda Biosciences

- 47. ASPIRA Women's Health (formerly known as Vermillion)

- 48. Astarte Medical

- 49. Astellas Pharma

- 50. Asterand Bioscience (acquired by BioIVT)

- 51. AstraZeneca

- 52. Asuragen (acquired by Bio-Techne)

- 53. Atlas Link Biotech

- 54. AVA LifeScience

- 55. AVEO Oncology

- 56. Azenta Life Sciences (formerly known as Brooks Automation)

- 57. Bayer

- 58. Baylor Genetics

- 59. Beaufort

- 60. BeiGene

- 61. BerGenBio

- 62. BGI Genomics

- 63. Biocartis

- 64. Biocept

- 65. BioClavis

- 66. biocrates life sciences

- 67. Biodesix

- 68. Biofidelity

- 69. Biogazelle (acquired by CellCarta)

- 70. BioIVT (formerly known as BioreclamationIVT)

- 71. Biolidics (formerly known as Clearbridge BioMedics)

- 72. BioMarin Pharmaceutical

- 73. BioMarker Strategies

- 74. BiomarkerBay

- 75. Biomedical Advanced Research and Development Authority (BARDA)

- 76. bioMérieux

- 77. BioNTech

- 78. Bio-Techne

- 79. BioVariance

- 80. Bliss Biopharmaceutical

- 81. Blueprint Medicines

- 82. Boehringer Ingelheim

- 83. Bosch Healthcare Solutions

- 84. Brainomix

- 85. Breakthrough Genomics

- 86. Bristol Myers Squibb

- 87. Burning Rock Biotech

- 88. C2i Genomics

- 89. Canadian Pathology Quality Assurance

- 90. CANbridge Pharmaceuticals

- 91. Cancer Treatment Centers of America (CTCA)

- 92. CancerIQ

- 93. Canon Medical Systems

- 94. Canopy Biosciences (acquired by Bruker)

- 95. Caris Life Sciences

- 96. CD Genomics

- 97. Celgene (acquired by Bristol Myers Squibb)

- 98. CellCarta (formerly known as Caprion - HistoGeneX)

- 99. Anagenics (formerly known as Cellmid)

- 100. Cenetron Diagnostics (acquired by Versiti)

- 101. CENTOGENE

- 102. Cerba Research

- 103. Charles River Laboratories

- 104. CHEPLAPHARM

- 105. Chipscreen Biosciences

- 106. Chugai Pharmaceutical (acquired by Roche)

- 107. CIRCULOGENE

- 108. CirQuest Labs (acquired by MLM Medical Labs)

- 109. Cizzle Biotechnology

- 110. ClearPoint Diagnostic Laboratories (acquired by Quest Diagnostics)

- 111. Cleveland HeartLab (acquired by Quest Diagnostics)

- 112. Clinical Reference Laboratory

- 113. Clovis Oncology

- 114. Cofactor Genomics

- 115. Cohesic

- 116. Community Clinical Oncology Research Network

- 117. CompanDx (formerly known as Compandia)

- 118. Compass Laboratory Services

- 119. ConcertAI

- 120. Concr

- 121. Context Therapeutics

- 122. CORE Diagnostics (acquired by Canopy Biosciences)

- 123. Core Precision

- 124. Corgenix Medical (subsidiary of ORGENTEC Diagnostik)

- 125. Creative Biolabs

- 126. Creatv MicroTech

- 127. Cureline

- 128. CureMatch

- 129. Curii

- 130. CytoTest

- 131. Daiichi Sankyo

- 132. Data4Cure

- 133. Debiopharm

- 134. deCODE genetics

- 135. Deep Lens

- 136. Definiens (acquired by MedImmune)

- 137. Denovo Biopharma

- 138. DiaCarta

- 139. Diaceutics

- 140. DiaDx

- 141. DiagnosTear

- 142. DiaSorin

- 143. Discovery Life Sciences

- 144. DNAnexus

- 145. Dr. Falk Pharma

- 146. Eisai

- 147. Eledon Pharmaceuticals (formerly known as Novus Therapeutics)

- 148. Eli Lilly

- 149. Elthera

- 150. Elucigene Diagnostics (acquired by Yourgene Health)

- 151. Elypta

- 152. Empire Genomics

- 153. Endpoint Health

- 154. Enzo Biochem

- 155. EONE-Diagnomics Genome Center (EDGC)

- 156. Epic Sciences

- 157. Epizyme

- 158. ESN Cleer

- 159. Eurobio Scientific (formerly known as Diaxonhit)

- 160. European Organisation for the Research and Treatment of Cancer

- 161. Eutropics Pharmaceuticals

- 162. Ex5 Genomics (acquired by Yourgene Health)

- 163. Exagen

- 164. Exosome Diagnostics (acquired by Bio-Techne)

- 165. Fabric Genomics (formerly known as Omicia)

- 166. FALCO biosystems

- 167. Farsight Genome Systems

- 168. Fast Track Diagnostics (acquired by Siemens Healthineers)

- 169. Ferring Pharmaceuticals

- 170. Five Prime Therapeutics (acquired by Amgen)

- 171. Flagship Biosciences

- 172. Flatiron Health

- 173. Foundation Medicine

- 174. Freenome

- 175. Frontage Laboratories

- 176. Gencurix

- 177. GeneCast Biotechnology

- 178. GeneCentric Therapeutics

- 179. Genedata

- 180. Genelex (acquired by Invitae)

- 181. Genentech (acquired by Roche)

- 182. Geneseeq Technology

- 183. Geneseq Biosciences

- 184. Genetron Health

- 185. Geneuity Clinical Research Services

- 186. GENEWIZ (acquired by Azenta Life Sciences)

- 187. geneXplain

- 188. Genomas (acquired by Rennova Health)

- 189. Genomenon

- 190. Genomictree

- 191. Genomind

- 192. GenomOncology

- 193. GenomSys

- 194. Genoptix (acquired by Novartis)

- 195. Genosity (acquired by Invitae)

- 196. Genospace

- 197. GenXys

- 198. Gilead Sciences

- 199. GlaxoSmithKline

- 200. GNS Healthcare

- 201. Golden Helix

- 202. GRAIL (acquired by Illumina)

- 203. GreenM

- 204. Guangzhou Wondfo Biotech

- 205. Guardant Health

- 206. Guardian Research Network

- 207. Haihe Biopharma

- 208. Halozyme

- 209. HalioDx (acquired by Veracyte)

- 210. Hangzhou Normal University

- 211. HangZhou Watson Biotech

- 212. Healthgen

- 213. Helomics (formerly known as Precision Therapeutics)

- 214. Hematogenix Pharma Services

- 215. HengRui

- 216. HiberCell

- 217. HistoCyte Laboratories

- 218. HistoGeneX

- 219. HistologiX

- 220. Horizon Discovery

- 221. HTG Molecular Diagnostics

- 222. Human Longevity

- 223. Hummingbird Diagnostics

- 224. Hygea Precision Medicine

- 225. Hyperfine

- 226. Ibex Medical Analytics

- 227. IBM

- 228. iCellate Medical

- 229. ICON Specialty Laboratories (formerly known as MolecularMD)

- 230. IDbyDNA

- 231. Idera Pharmaceuticals

- 232. Ignyta (acquired by Roche)

- 233. Ikonisys

- 234. Illumina

- 235. Imaginostics

- 236. Immunex (acquired by Amgen)

- 237. ImmunoGen

- 238. IMPACT Therapeutics

- 239. In Vitro ADMET Laboratories (acquired by Discovery Life Sciences)

- 240. IncellDx

- 241. Incyte (acquired by Novartis)

- 242. InDex Pharmaceuticals

- 243. Indivior

- 244. iNDX.Ai

- 245. InformedDNA

- 246. Inivata

- 247. InnaVirVax

- 248. Inotrem

- 249. INOVIO Pharmaceuticals

- 250. Insight Genetics (acquired by Oncocyte)

- 251. InsightRX

- 252. Inspirata

- 253. IntegraGen (acquired by OncoDNA)

- 254. IntelliHealth Solutions

- 255. International Development Association (IDA)

- 256. Intero Life Sciences

- 257. Interpace Biosciences (formerly known as Interpace Diagnostics)

- 258. Intertrust Technologies

- 259. Intezyne Technologies

- 260. IntrinsiQ Specialty Solutions

- 261. Invitae (formerly known as ArcherDx)

- 262. Invivoscribe

- 263. IQVIA

- 264. Janssen Pharmaceutical (acquired by Johnson & Johnson)

- 265. JSR Life Sciences

- 266. Kaneka

- 267. Kartos Therapeutics

- 268. Keen Eye Technologies

- 269. KingMed Diagnostics

- 270. Kronos Bio

- 271. Kura Oncology

- 272. Kyowa Kirin

- 273. Lab21 Healthcare (part of Novacyt)

- 274. Labcorp (formerly known as Covance)

- 275. LaserGen (acquired by Agilent Technologies)

- 276. Leica Biosystems (acquired by Danaher)

- 277. LEO Pharma

- 278. Lexent Bio (acquired by Foundation Medicine)

- 279. Lifebit

- 280. LifeOmic Health

- 281. Linkage Biosciences

- 282. Locus Biosciences

- 283. Loxo Oncology (acquired by Eli Lilly)

- 284. Lucence

- 285. Luminex (acquired by DiaSorin)

- 286. LunaPBC

- 287. M2GEN

- 288. MacroGenics

- 289. MapKure (owned by BeiGene and SpringWorks Therapeutics)

- 290. Massachusetts General Hospital

- 291. MC Diagnostics

- 292. MD Biosciences (acquired by MLM Medical Labs)

- 293. MDNA Life Sciences

- 294. MDxHealth (formerly known as OncoMethylome Sciences)

- 295. Med Fusion (acquired by Quest Diagnostics)

- 296. MEDx (Suzhou) Translational Medicine (formerly known as QIAGEN (Suzhou) Translational Medicine)

- 297. MedGenome

- 298. MEDICAL & BIOLOGICAL LABORATORIES (acquired by JSR Life Sciences)

- 299. Medipredict

- 300. Medneon (acquired by Invitae)

- 301. MEDx Translational Medicine (formerly known as QIAGEN (Suzhou) Translational Medicine)

- 302. Memorial Sloan Kettering Cancer Center

- 303. Menarini Silicon Biosystems

- 304. Merck

- 305. Mesa Laboratories

- 306. Metabolon

- 307. Metanomics Health (acquired by BIOCRATES Life Sciences)

- 308. Mirati Therapeutics (formerly known as MethylGene)

- 309. Mission Bio

- 310. MLM Medical Labs

- 311. Molecular Health

- 312. MolecularMatch

- 313. Monogram Biosciences (acquired by Laboratory Corporation of America)

- 314. Montpellier University Hospital

- 315. Mosaic Laboratories (acquired by Caprion-HistoGeneX)

- 316. Mount Sinai Health System Clinical Outreach Laboratories (acquired by Labcorp)

- 317. mymo.AI

- 318. Myriad Genetics

- 319. NanoString Technologies

- 320. NantHealth

- 321. Nashville Biosciences

- 322. Natera

- 323. National Cancer Center Hospital

- 324. Navigate BioPharma Services

- 325. NeoGenomics Laboratories

- 326. NG Biotech

- 327. NGeneBio

- 328. NGX Bio

- 329. Nichirei Biosciences

- 330. Nodality

- 331. N-of-One (acquired by QIAGEN)

- 332. North American Science Associates (NAMSA)

- 333. Novartis

- 334. Novodiax

- 335. Novogene

- 336. NuSirt Biopharma

- 337. Ocean Ridge Biosciences (acquired by Frontage Laboratories)

- 338. OcnoDNA

- 339. Olink Proteomics

- 340. OmniSeq

- 341. Oncimmune USA (subsidiary of Oncimmune)

- 342. Oncocyte

- 343. OncoMed Pharmaceuticals

- 344. Oncoquest Laboratories

- 345. Oncora Medical

- 346. OncXerna Therapeutics

- 347. OneOncology

- 348. Oracle

- 349. Orion Health

- 350. Outcomes4Me

- 351. OWL Metabolomics (formerly known as OWL GENOMICS)

- 352. Oxford BioDynamics (OBD)

- 353. Oxford Cancer Biomarkers

- 354. Pangea Oncology

- 355. Paragon Genomics

- 356. Parexel

- 357. Parkway Laboratories

- 358. Partner Therapeutics

- 359. PathAI

- 360. Perceiv AI

- 361. Personal Genome Diagnostics (acquired by Labcorp)

- 362. Personalis

- 363. Pfizer

- 364. Pharmaceutical Product Development (acquired by Thermo Fisher Scientific)

- 365. PharmaLex

- 366. Pharmatech (acquired by Caris Life Sciences)

- 367. Pharmatics

- 368. PhenoTips

- 369. Philips

- 370. Phoenix Molecular Designs

- 371. Phosphorus

- 372. PierianDx

- 373. Pierre Fabre

- 374. Pillar Biosciences

- 375. Pinnacle Healthcare (acquired by University of Pittsburgh Medical Center)

- 376. PipelineRx (acquired by CarePathRx)

- 377. Precision Digital Health

- 378. Precision for Medicine

- 379. Precision Health Informatics (subsidiary of Texas Oncology)

- 380. Precision Health Software

- 381. Progenika Biopharma

- 382. ProMedDx (acquired by Precision for Medicine)

- 383. Promega

- 384. Prometheus (formerly known as Precision IBD)

- 385. ProMIS Neurosciences (formerly known as Amorfix Life Sciences)

- 386. Protagen Diagnostics

- 387. Protavio (formerly known as ProtATonce)

- 388. Provista Diagnostics (acquired by Todos Medical)

- 389. Psomagen (formerly known as Macrogen)

- 390. Psyche Systems

- 391. Puma Biotechnology

- 392. Q2 Solutions (acquired by IQVIA)

- 393. QED Therapeutics (subsidiary of BridgeBio Pharma)

- 394. QIAGEN

- 395. Qlucore

- 396. QualTek Molecular Laboratories (acquired by Discovery Life Sciences)

- 397. Quanterix

- 398. Queen's University Belfast

- 399. Quest Diagnostics

- 400. Qynapse

- 401. Race Oncology

- 402. Radius Health

- 403. Randox Biosciences (part of Randox Laboratories)

- 404. RareCyte

- 405. Razor Genomics (acquired by Oncocyte)

- 406. R-Biopharm

- 407. Regeneron Pharmaceuticals

- 408. regenold

- 409. Regulus Therapeutics

- 410. Renalytix

- 411. Repertoire Genesis

- 412. ResearchDx

- 413. Resolomics

- 414. Resolution Bioscience (acquired by Agilent Technologies)

- 415. Resonance Health

- 416. ResourcePath

- 417. Reveal Biosciences (acquired by CellCarta)

- 418. Riken Genesis

- 419. Roche

- 420. Roche Tissue Diagnostics (formerly known as Ventana Medical Systems)

- 421. RxMx

- 422. SAGA Diagnostics

- 423. Saladax Biomedical

- 424. Sanofi

- 425. Sanomics

- 426. SAP

- 427. Saphetor

- 428. SCA Robotics

- 429. Science 37

- 430. Sebia

- 431. Sengenics

- 432. Sentieon

- 433. SeraCare Life Sciences (acquired by LCG)

- 434. Seven Bridges

- 435. Shanghai Biotechnology (formerly known as ShanghaiBio)

- 436. Shanghai Henlius Biotech

- 437. Shanghai Promega Biological Products

- 438. Sheba Medical Center

- 439. Shuwen Biotech

- 440. Siemens Healthineers (formerly known as Siemens Healthcare)

- 441. Simcere Pharmaceutical

- 442. Sirius Genomics

- 443. SkylineDx

- 444. SocialGenomics MOONSHOT

- 445. SomaLogic

- 446. Sonrai Analytics

- 447. SOPHiA GENETICS

- 448. Source BioScience

- 449. Spectrum Pharmaceuticals

- 450. Spesana

- 451. SRL Diagnostics

- 452. Stone Checker Software

- 453. Strand Life Sciences

- 454. Sundance Diagnostics

- 455. Sunquest Information Systems (acquired by Roper Industries)

- 456. Svar Life Science (formerly known as Euro Diagnostica)

- 457. Syapse

- 458. Sysmex Inostics

- 459. Tabula Rasa HealthCare (formerly known as CareKinesis)

- 460. TaiRx

- 461. Takeda Pharmaceutical

- 462. Taliaz

- 463. Targos Molecular Pathology (acquired by Discovery Life Sciences)

- 464. Teladoc Health

- 465. TellBio

- 466. Tempus

- 467. Tepnel Pharma Services

- 468. Terumo Medical

- 469. TESARO (acquired by GlaxoSmithKline)

- 470. The Intelligent Tissue Group

- 471. The Max Planck Society

- 472. The University of Cambridge

- 473. Thermo Fisher Scientific

- 474. TIGAR Health Technologies

- 475. Tissue Diagnostics

- 476. Tissue Solutions (acquired by BioIVT)

- 477. Todos Medical

- 478. Tokyo Medical and Dental University (TMDU)

- 479. Tolero Pharmaceuticals

- 480. Translational Software

- 481. Trialbee

- 482. Turning Point Therapeutics

- 483. Twist Bioscience

- 484. Tymora Analytical Operations

- 485. uBiome

- 486. UgenTec

- 487. UmanDiagnostics (acquired by Quanterix)

- 488. uMETHOD

- 489. Unilabs

- 490. University of Bonn

- 491. University of Missouri

- 492. Valley Biomedical Products & Services (acquired by BioIVT)

- 493. Variantyx

- 494. Verastem Oncology

- 495. Veridex (subsidiary of Johnson & Johnson)

- 496. Verily Life Sciences (formerly known as Google Life Sciences)

- 497. Versiti

- 498. Viatris

- 499. Visiopharm

- 500. Vivia Biotech

- 501. Vyant Bio (formerly known as Cancer Genetics)

- 502. Wave Life Sciences

- 503. Xeptagen

- 504. Xiamen Spacegen

- 505. XIFIN

- 506. Yemaachi Biotech

- 507. Yourgene Health

- 508. YouScript (acquired by Invitae

Title:

Companion Diagnostics Development Services Market (2nd Edition):

Distribution by Type of Service Offered (Feasibility Studies, Assay Development, Analytical Validation, Clinical Validation and Manufacturing), Analytical Technique Used (Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Immunohistochemistry / in situ Hybridization (IHC / ISH), Liquid Biopsy and Others), Therapeutic Areas (Oncological and Non-oncological) and Key Geographies (North America, Europe, Asia-Pacific and Rest of the World): Industry Trends and Global Forecasts, 2022-2035.

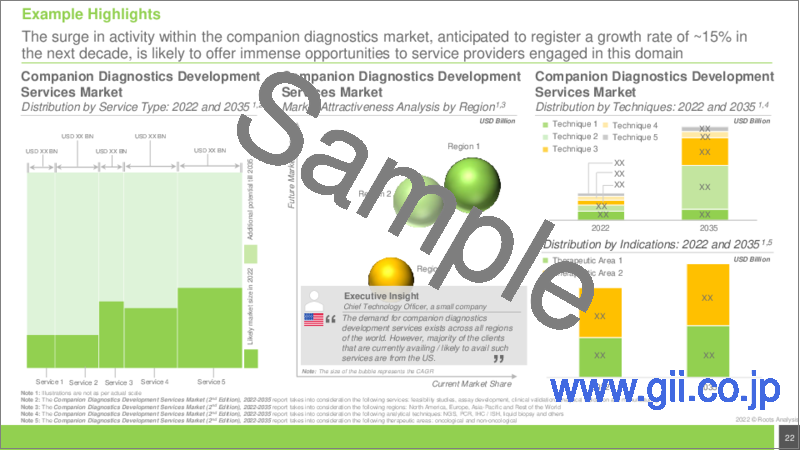

Example Insights:

Overview

Over the past few years, the improved understanding of molecular mechanisms involved in disease pathogenesis has resulted in the development of several targeted therapies. These therapies are tailored to target specific disease-related molecular signatures and require appropriate companion diagnostics (CDx) in order to make physicians aware of patients' unique genetic profiles, enabling them to make informed treatment related decisions. These tests are most often developed parallel to an investigational drug in order to identify the latter's safety and efficacy and measure its therapeutic effect on the target. With the approval of trastuzumab and HercepTest™ (an IHC-based companion diagnostic assay designed for determination of HER2 overexpression) by the USFDA in 1998, several novel targeted cancer drugs guided by a diagnostic assay, have progressed into clinical stages or are approved for commercial use. In fact, since 2020, a total of 44 companion diagnostics have been approved by the USFDA. Further, a study of nearly 200 unique pharmacological interventions evaluated across more than 670 clinical trials, suggests that the likelihood of a lead compound passing through various phases of clinical development and eventually getting approved is only 11%. The use of disease-specific biomarker information to recruit patients not only increases the success rates of the studies, but also reduces the trial costs by nearly 60%.

Given the various benefits, the healthcare industry is gradually shifting from the conventional, one-drug-for-all, paradigm to using tailored pharmacological interventions, which is expected to increase the need for companion diagnostics as well. However, given the complexities involved in the co-development of a drug and the affiliated companion diagnostic test, drug developers have demonstrated the preference to outsource the diagnostics development operations. In fact, around 80% of the companies are known to rely on third-party service providers for companion diagnostics development, primarily owing to the lack of in-house expertise for the development of these tests. As a result, many companies have made heavy investments in order to install robust tools and technologies, such as polymerase chain reaction (PCR), immunohistochemistry (IHC), in situ hybridization (ISH), next generation sequencing (NGS) and offer end-to-end services to sponsor companies engaged in this domain. In addition to conventional analytical techniques, several innovators have made latest upgrades in their portfolio by installing novel solutions, including digital PCR (dPCR) and digital immunoassay, in order to cater to the evolving needs of their customers. Given the growing demand for personalized therapies and ongoing innovations in technologies, we are led to believe that the opportunity for companion diagnostic developers / service providers is likely to witness a sustained growth over the coming years.

Scope of the Report

The "Companion Diagnostics Development Services Market (2nd nd Edition): Distribution by Type of Service Offered (Feasibility Studies, Assay Development, Analytical Validation, Clinical Validation and Manufacturing), Analytical Technique Used (Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Immunohistochemistry / in situ Hybridization (IHC / ISH), Liquid Biopsy and Others), Therapeutic Areas (Oncological and Non-oncological) and Key Geographies (North America, Europe, Asia-Pacific and Rest of the World): Industry Trends and Global Forecasts, 2022-2035" report features an extensive study of the current market landscape, offering an informed opinion on the likely outsourcing of diagnostic development and manufacturing operations during 2022-2035. It features an in-depth analysis, highlighting the capabilities of various stakeholders involved in the companion diagnostics development value chain. Amongst other elements, the report includes:

- A detailed review of the overall landscape of the companion diagnostics development services market, highlighting the contributions of industry players, along with information on their year of establishment, company size, ownership, geographical location of headquarters, types of services offered, types of analytical techniques used, therapeutic areas assessed and regulatory certifications / accreditations.

- A region-wise competitiveness analysis of companies, highlighting the prominent companion diagnostics service providers, by taking into consideration their supplier power (in terms of their experience and company size) and portfolio specifications (in terms of number of services offered, number of analytical techniques used, therapeutic areas assessed, and number of precision medicine related deals signed since 2017).

- Elaborate profiles of prominent service providers in this domain. Each company profile includes a brief overview of the company, its financial information (if available), information on its companion diagnostics-related service portfolio, recent developments, and an informed future outlook.

- A comprehensive assessment of the current market landscape of companion diagnostics that are either marketed / being developed by various stakeholders, providing information on the assay technique used, target disease indication, therapeutic areas, type of biomarker detected and its chemical nature, type of sample used, regulatory authority involved and expediated review designation (for marketed products), and year of initiation of development (for investigational programs). It also provides details on the diagnostic developers, highlighting their year of establishment, company size, ownership and geographical location of their headquarters.

- An analysis of the partnerships and collaborations established for companion diagnostics services during 2017- 2021, featuring a detailed set of analyses based on various parameters, such as the type of partnership, year of partnership, therapeutic areas involved, geographical location of the companies involved and the most active players.

- An insightful analysis of companies segregated on the basis of their likelihood to enter into collaborations with companion diagnostics service providers. The chapter features a list of 300+ drug developers sponsoring clinical trials of therapies targeting several disease-specific biomarkers. The players have been shortlisted based on relevant parameters, namely number of biomarker-focused clinical trials sponsored and the time to market their proprietary personalized medicine products.

- A detailed analysis of various mergers and acquisitions of companies in this domain, highlighting the trend in the number of companies acquired during the time period between 2017- 2021, based on several relevant parameters, such as year of agreement, type of deal, geographical location of headquarters, company size, key value drivers and acquisition deal multiples (based on revenues). In addition, it presents an ownership change matrix, providing a summary of the involvement of private and public sector entities in this domain.

- A qualitative assessment of the current and long-term needs of different stakeholders (drug developers, diagnostic developers, testing laboratories, physicians, payers and patients) involved in this domain. In addition, it highlights key areas of concerns associated with this industry, along with our opinion (based on past and prevalent trends) on how the industry is anticipated to address them over the coming years.

- A value chain analysis featuring a discussion on various steps of development operations, namely R&D, clinical assessment of the product, manufacturing and assembly, payer negotiation and marketing activities, of a companion diagnostic, as well as the cost requirements across each of the aforementioned stages.

- An assessment of the completed, ongoing and planned biomarker-driven oncology clinical trials sponsored by prominent big pharmaceutical companies, in the last five years. The chapter highlights the key trends associated with these clinical studies across various parameters, such as trial registration year, phase of development, trial sponsors, recruitment status, therapy design, enrolled patient population, popularity of biomarkers, and popularity of target indications.

- A case study on various therapies in use with companion diagnostics, providing information on their commercial availability, type of molecule, route of administration, and number of corresponding marketed companion diagnostics products / investigational programs. In addition, it provides details on drug developers, including information on their year of establishment, company size, ownership and geographical location of their headquarters.

- A case study on the current market landscape of precision medicine software solutions that offer intelligent insights to diagnostic developers, service providers, patients and healthcare experts, for making informed decisions. The chapter features information on the type of platform utilized, purpose of software solution, type of data processed, therapeutic area, and types of end users. In addition, it presents a list of developers of the software solutions, along with analysis on their year of establishment, company size, ownership and geographical location of headquarters.

One of the key objectives of the report was to estimate the existing market size and the potential future growth opportunities for companion diagnostics development service providers. Based on multiple parameters, such as the service cost of various steps involved in companion diagnostics development and manufacturing, and partnerships inked in the last few years for outsourcing of such operations, we have developed informed estimates on the evolution of the market for the time period 2022- 2035. Our year-wise projections of the current and forecasted opportunity have further been segmented across key services offered (feasibility studies, assay development, analytical validation, clinical validation and manufacturing), analytical techniques used (NGS, PCR, IHC-ISH, liquid biopsy and Others), therapeutic areas (oncological and non-oncological), and key geographical locations (North America, Europe and Asia- Pacific and Rest of the World). In order to account for future uncertainties and to add robustness to our model, we have provided three market forecast scenarios, namely conservative, base and optimistic scenarios, representing different tracks of the industry's growth. In order to account for future uncertainties and to add robustness to our model, we have provided three forecast scenarios, portraying the conservative, base and optimistic tracks of the market's evolution.

The opinions and insights presented in the report were influenced by discussions held with several key players in this domain. The report features detailed transcripts of interviews held with the following industry stakeholders:

- Mike Klein (Chief Executive Officer, Genomenon)

- Mark Kiel (Founder and Chief Scientific Officer, Genomenon)

- Candace Chapman (Vice President of Marketing, Genomenon)

- Anton Iliuk (President and Chief Technology Officer, Tymora Analytical Operations)

- Paul Kortschak (Former Senior Vice President, Novodiax)

- Pablo Ortiz (Chief Executive officer, OWL Metabolomics)

- Lawrence M. Weiss (Former Chief Scientific Officer, NeoGenomics Laboratories)

Key Questions Answered:

- Who are the leading players offering services for the development of companion diagnostics?

- What are the key geographies where companion diagnostics development service providers are located?

- Which analytical techniques are leveraged by the service providers engaged in this domain?

- Who are the leading companion diagnostics developers?

- Which biomarkers are most commonly targeted by the marketed products / investigational programs?

- Which partnership models are commonly adopted by stakeholders offering companion diagnostics development services?

- Which drug developers are most likely to partner with the service providers to seek their expertise?

- What are the key value drivers of the merger and acquisition activity within this domain?

- Which biomarker-focused targeted drugs developed by big pharmaceutical companies are likely to be administered with companion diagnostics?

- How is the current and future opportunity likely to be distributed across key market segments?

Chapter Outlines

Chapter 2 is an executive summary of the insights captured in our research. It offers a high- level view on the likely evolution of the companion diagnostics services market in the mid to long term.

Chapter 3 is an introductory chapter that highlights the importance of companion diagnostics in relation to personalized medicine. The chapter describes the approaches used to develop a companion diagnostic, along with information on various analytical techniques that form the basis for such tests. In addition, the chapter highlights the key considerations while selecting a contract diagnostics partner (CDO), along with key market drivers and challenges associated with outsourcing the development and manufacturing of companion diagnostics.

Chapter 4 provides an overview of the companion diagnostics services market, including information on 150 players offering contract services for one or multiple steps involved in the development and manufacturing of companion diagnostics. It features an in-depth analysis of the industry players, based on a number of parameters, such as year of establishment, company size, ownership, geographical location of headquarters, companion diagnostics-related service portfolio (biomarker discovery / identification, biomarker development, assay development, feasibility studies, analytical validation, clinical validation, regulatory assistance, commercialization, manufacturing and other supporting services), analytical techniques used (enzyme-linked immune sorbent assay (ELISA), flow cytometry, in situ hybridization (ISH), immunohistochemistry (IHC), microarray, next generation sequencing (NGS), polymerase chain reaction (PCR), sanger sequencing and spectroscopy), and regulatory certification / accreditation (College of American Pathologists (CAP), Clinical Laboratory Improvement Amendments (CLIA), Good Clinical Practice (GCP), Good Laboratory Practice (GLP), and International Organization for Standardization (ISO)).

Chapter 5 provides an insightful competitiveness analysis of the companion diagnostics development service providers based in North America, Europe and Asia- Pacific and Rest of the World. The analysis compares the capabilities of companies on the basis of their supplier strength (in terms of experience and company size) and service portfolio strength (in terms of number of services offered, number of analytical techniques used, therapeutic areas assessed, and number of precision medicine related deals signed since 2017).

Chapter 6 includes detailed profiles the key players offering companion diagnostics development services. Each company profile features a brief overview of the company, its financial information (if available), information on its companion diagnostics-related service portfolio, recent developments, and an informed future outlook.

Chapter 7 provides a list of companion diagnostics along with information on their commercial availability (approved / investigational), assay technique used (enzyme-linked immune sorbent assay (ELISA), flow cytometry, in situ hybridization (ISH), immunohistochemistry (IHC), micro array, next generation sequencing (NGS), polymerase chain reaction (PCR), sanger sequencing and spectroscopy), target disease indications, therapeutic areas (oncological disorders, infectious diseases, metabolic disorders, neurological disorders, inflammatory disorders and others), type of sample analyzed (tumor tissue, blood, bone marrow and saliva), type of biomarker detected (alteration(s) in ALK, BCR, BRAF, BRCA, ErbB, MET, MSI / dMMR, NTRK, PD-L1, RAS, PGR, ROS and PIK3CA), chemical nature of biomarker (gene and protein), regulatory certification / accreditation (FDA PMA, CE Mark, MHLW, PMDA, NMPA and others) and expediated review designation (for marketed products), and year of initiation of development (for investigational programs). It also provides details on the developers, highlighting their year of establishment, company size, ownership and geographical location of their headquarters.

Chapter 8 presents an analysis of the partnerships and collaborations for companion diagnostics services established during 2017- 2021, featuring a detailed set of analyses based on various parameters, such as the type of partnership, year of partnership, analytical technique used, geographical location of involved companies and the most active players.

Chapter 9 features a list of 300+ stakeholders that are anticipated to partner with companion diagnostics services providers in the foreseen future. The players have been shortlisted based on a detailed analysis of relevant parameters, namely number of biomarker-focused clinical trials sponsored and the time to market their proprietary personalized medicine products.

Chapter 10 presents insights from a detailed analysis of the mergers and acquisitions reported in this domain, during the period 2017- 2021. It is worth mentioning that the data captured during our research was analyzed based on multiple parameters, such as year of agreement, type of deal, geographical location, size and ownership of the companies involved, key value drivers, and acquisition deal multiples (based on revenues).

Chapter 11 provides a qualitative assessment of the current and long-term needs of different stakeholders (drug developers, diagnostic developers, testing laboratories, physicians, payers and patients) involved in this domain. In addition, it highlights key areas of concerns associated with this industry, along with our opinion (based on past and prevalent trends) on how the industry is anticipated to address them over the coming years.

Chapter 12 presents a value chain analysis featuring a discussion on various steps of the companion diagnostics development operations, namely R&D, clinical assessment of the product, manufacturing and assembly, payer negotiation and marketing activities, as well as the cost requirements across each of the aforementioned stages.

Chapter 13 provides a detailed clinical trial analysis of completed, ongoing and planned biomarker-driven oncology clinical trials sponsored by prominent big pharmaceutical companies, in the last five years. The analysis highlights the key trends associated with these clinical studies across various parameters, such as trial registration year, phase of development, trial sponsors, recruitment status, therapy design, enrolled patient population, popularity of biomarkers, and popularity of target indications.

Chapter 14 is a case study presenting a list of therapies currently in use with companion diagnostics, providing information on their commercial availability, type of molecule, route of administration, and number of corresponding companion diagnostics products / programs. In addition, it provides details on drug developers, including information on their year of establishment, company size, ownership and geographical location of their headquarters.

Chapter 15 is a case study focused on the current market landscape of precision medicine software solutions that offer intelligent insights to facilitate informed decision making to different stakeholders in this industry. It presents a list of software solutions, along with information on the type of platform utilized, purpose of software solution, type of data processed, therapeutic area, and types of end users. In addition, it presents a list of developers of software solutions, along with analysis on their year of establishment, company size, ownership and geographical location of headquarters.

Chapter 16 presents an insightful market forecast analysis, highlighting the future potential of the companion diagnostics development and manufacturing services market, till 2035. We have segregated the opportunity of the market on the basis of Type of Service Offered (Feasibility Studies, Assay Development, Analytical Validation, Clinical Validation and Manufacturing), Analytical Techniques Used (NGS, PCR, IHC / ISH, Liquid Biopsy and Others), Therapeutic Areas (Oncological and Non-oncological Disorders), and Key Geographies (North America, Europe, Asia- Pacific and Rest of the World): Industry Trends and Global Forecasts, 2022- 2035.

Chapter 17 summarizes the entire report, highlighting various facts related to contemporary market trend and the likely evolution of the companion diagnostics development services market.

Chapter 18 is a collection of interview transcripts of the discussions held with stakeholders in this market. In this chapter, we have presented the details of interviews held with Mike Klein, (Chief Executive Officer, Genomenon), Mark Kiel (Founder and Chief Scientific Officer, Genomenon), Candace Chapman (Vice President of Marketing, Genomenon), Anton Iliuk (President and Chief Technology Officer, Tymora Analytical Operations), Paul Kortschak (Former Senior Vice President, Novodiax), Pablo Ortiz (Chief Executive Officer, OWL Metabolomics) and Lawrence M. Weiss (Former Chief Scientific Officer, NeoGenomics Laboratories).

Chapter 19 is an appendix, which provides tabulated data and numbers for all the figures provided in the report.

Chapter 20 is an appendix, which provides a list of companies and organizations mentioned in this report.

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.3. Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Chapter Overview

- 3.2. Evolution of Personalized Medicines

- 3.3. Overview of Companion Diagnostics

- 3.3.1. Development of Companion Diagnostics

- 3.3.2. Analytical Techniques Used in Companion Diagnostic Tests

- 3.3.2.1. Immunohistochemistry

- 3.3.2.2. In situ Hybridization

- 3.3.2.3. Polymerase Chain Reaction (PCR)

- 3.3.2.4. DNA Sequencing / Next Generation Sequencing

- 3.3.2.5. Liquid Biopsy

- 3.3.2.6. Flow Cytometry

- 3.3.3. Advantages of Companion Diagnostics

- 3.4. Applications of Companion Diagnostics across Different Therapeutic Areas

- 3.4.1. Oncology

- 3.4.2. Infectious Diseases

- 3.4.3. Neurological Disorders

- 3.5. Regulatory Review and Approval Process for Companion Diagnostics

- 3.6. Existing Challenges

- 3.7. Key Guidelines for Selecting a Contract Diagnostics Organization (CDO)

- 3.8. Future Perspectives

4. COMPANION DIAGNOSTICS SERVICE PROVIDERS: MARKET LANDSCAPE

- 4.1. Chapter Overview

- 4.2. Companion Diagnostics Service Providers: List of Players

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Company Ownership

- 4.2.4. Analysis by Location of Headquarters

- 4.2.5. Analysis by Type of Service Offered

- 4.2.6. Analysis by Other Affiliated Services Offered

- 4.2.7. Analysis by Type of Analytical Technique Used

- 4.2.8. Analysis by Therapeutic Area

- 4.2.9. Grid Representation: Analysis by Company Size, Location of Headquarters and Type of Service Offered

- 4.2.10. Grid Representation: Analysis by Company Size, Location of Headquarters and Type of Analytical Technique Used

- 4.2.11. Analysis by Regulatory Accreditation / Certification

5. COMPANION DIAGNOSTICS SERVICE PROVIDERS: COMPANY COMPETITIVENESS ANALYSIS

- 5.1 Chapter Overview

- 5.2 Methodology

- 5.3 Assumptions / Key Parameters

- 5.4 Competitiveness Analysis: Companion Diagnostics Service Providers

- 5.4.1 Companion Diagnostics Service Providers based in North America

- 5.4.2 Companion Diagnostics Service Providers based in Europe

- 5.4.3 Companion Diagnostics Service Providers based in Asia-Pacific and Rest of the World

- 5.5. Summary of Key Players

6. COMPANION DIAGNOSTICS SERVICE PROVIDERS: COMPANY PROFILES

- 6.1. Chapter Overview

- 6.2. Key Players in North America

- 6.2.1. Geneuity Clinical Research Services

- 6.2.1.1. Company Overview

- 6.2.1.2. Service Portfolio

- 6.2.1.3. Recent Developments and Future Outlook

- 6.2.2. Interpace Biosciences

- 6.2.2.1. Company Overview

- 6.2.2.2. Service Portfolio

- 6.2.2.3. Financial Information

- 6.2.2.4. Recent Developments and Future Outlook

- 6.2.3. Labcorp (formerly known as Covance)

- 6.2.3.1. Company Overview

- 6.2.3.2. Service Portfolio

- 6.2.3.3. Financial Information

- 6.2.3.4. Recent Developments and Future Outlook

- 6.2.4. Quest Diagnostics

- 6.2.4.1. Company Overview

- 6.2.4.2. Service Portfolio

- 6.2.4.3. Financial Information

- 6.2.4.4. Recent Developments and Future Outlook

- 6.2.5. Q2 Solutions

- 6.2.5.1. Company Overview

- 6.2.5.2. Service Portfolio

- 6.2.5.3. Financial Information

- 6.2.5.4. Recent Developments and Future Outlook

- 6.2.6. ResearchDx

- 6.2.6.1. Company Overview

- 6.2.6.2. Service Portfolio

- 6.2.6.3. Recent Developments and Future Outlook

- 6.2.1. Geneuity Clinical Research Services

- 6.3. Key Players in Europe

- 6.3.1. Almac Diagnostic Services

- 6.3.1.1. Company Overview

- 6.3.1.2. Service Portfolio

- 6.3.1.3. Financial Information

- 6.3.1.4. Recent Developments and Future Outlook

- 6.3.2. Biocartis

- 6.3.2.1. Company Overview

- 6.3.2.2. Service Portfolio

- 6.3.2.3. Financial Information

- 6.3.2.4. Recent Developments and Future Outlook

- 6.3.3. Cerba Research

- 6.3.3.1. Company Overview

- 6.3.3.2. Service Portfolio

- 6.3.3.3. Recent Developments and Future Outlook

- 6.3.4. Eurofins

- 6.3.4.1. Company Overview

- 6.3.4.2. Service Portfolio

- 6.3.4.3. Financial Information

- 6.3.4.4. Recent Developments and Future Outlook

- 6.3.5. MLM Medical Labs

- 6.3.5.1. Company Overview

- 6.3.5.2. Service Portfolio

- 6.3.5.3. Recent Developments and Future Outlook

- 6.3.6. QIAGEN

- 6.3.6.1. Company Overview

- 6.3.6.2. Service Portfolio

- 6.3.6.3. Financial Information

- 6.3.6.4. Recent Developments and Future Outlook

- 6.3.1. Almac Diagnostic Services

- 6.4. Key Players in Asia-Pacific and Rest of the World

- 6.4.1. BGI Genomics

- 6.4.1.1. Company Overview

- 6.4.1.2. Service Portfolio

- 6.4.1.3. Recent Developments and Future Outlook

- 6.4.2. MEDx (Suzhou) Translational Medicine (formerly known as QIAGEN (Suzhou) Translational Medicine)

- 6.4.2.1. Company Overview

- 6.4.2.2. Service Portfolio

- 6.4.2.3. Recent Developments and Future Outlook

- 6.4.3. MEDICAL & BIOLOGICAL LABORATORIES (MBL)

- 6.4.3.1. Company Overview

- 6.4.3.2. Service Portfolio

- 6.4.3.3. Recent Developments and Future Outlook

- 6.4.4. Novogene

- 6.4.4.1. Company Overview

- 6.4.4.2. Service Portfolio

- 6.4.4.3. Recent Developments and Future Outlook

- 6.4.1. BGI Genomics

7. COMPANION DIAGNOSTICS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Companion Diagnostics: List of Marketed Products / Investigational Programs

- 7.2.1. Analysis by Assay Technique Used

- 7.2.2. Analysis by Target Disease Indication

- 7.2.3. Analysis by Therapeutic Area

- 7.2.4. Analysis by Type of Biomarker Detected

- 7.2.5. Analysis by Chemical Nature of Biomarker

- 7.2.6. Analysis by Type of Sample Used

- 7.2.7. Analysis by Commercial Availability and Therapeutic Area

- 7.2.8. Investigational Programs: Analysis by Year of Initiation of Development

- 7.2.9. Marketed Products: Analysis by Year of Approval

- 7.2.10. Marketed Products: Analysis by Regulatory Authority Involved

- 7.2.11. Marketed Products: Analysis by Year of Approval and Regulatory Authority Involved

- 7.2.12. Marketed Products: Analysis by Expediated Review Designation and Type of Biomarker

- 7.2.13. Heat Map Representation: Analysis by Target Disease Indication and Assay Technique Used

- 7.3. Companion Diagnostic Devices: List of Developers

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Company Ownership

- 7.3.4. Analysis by Location of Headquarters

- 7.3.5. Most Active Players: Analysis by Number of Marketed Products and Investigational Programs

- 7.3.6. Most Active Players: Analysis by Number of Marketed Products

- 7.3.7. Most Active Players: Analysis by Number of Target Disease Indications

8. PARTNERSHIPS AND COLLABORATIONS

- 8.1. Chapter Overview

- 8.2. Partnership Models

- 8.3. List of Partnerships and Collaborations

- 8.3.1. Analysis by Year of Partnership

- 8.3.2. Analysis by Type of Partnership

- 8.3.3. Analysis by Type of Partner

- 8.3.4. Analysis by Year of Partnership and Type of Partner

- 8.3.5. Analysis by Type of Partnership and Type of Partner

- 8.3.6. Analysis by Therapeutic Area

- 8.3.7. Most Active Players: Analysis by Number of Partnerships

- 8.3.8. Regional Analysis

- 8.3.9. Intercontinental and Intracontinental Agreements

9. LIKELY PARTNER ANALYSIS

- 9.1. Chapter Overview

- 9.2. Scope and Methodology

- 9.3. Scoring Criteria and Key Assumptions

- 9.4. Likely Partners for Companion Diagnostics Service Providers: Alzheimer's Disease

- 9.4.1. Potential Strategic Partners for Initiatives on Amyloid Beta Biomarker

- 9.4.1.1. Companies Working on the Amyloid Beta Biomarker

- 9.4.1.2. World Map Representation: Amyloid Beta Biomarker Focused Clinical Trials

- 9.4.2. Potential Strategic Partners for Initiatives on Tau Biomarker

- 9.4.2.1. Companies Working on the Tau Biomarker

- 9.4.2.2. World Map Representation: Tau Biomarker Focused Clinical Trials

- 9.4.1. Potential Strategic Partners for Initiatives on Amyloid Beta Biomarker

- 9.5. Likely Partners for Companion Diagnostics Service Providers: Breast Cancer

- 9.5.1. Potential Strategic Partners for Initiatives on BRCA Biomarker

- 9.5.1.1. Companies Working on the BRCA Biomarker

- 9.5.1.2. World Map Representation: BRCA Biomarker Focused Clinical Trials

- 9.5.2. Potential Strategic Partners for Initiatives on HER Biomarker

- 9.5.2.1. Companies Working on the HER Biomarker

- 9.5.2.2. World Map Representation: HER Biomarker Focused Clinical Trials

- 9.5.3. Potential Strategic Partners for Initiatives on HR Biomarker

- 9.5.3.1. Companies Working on the HR Biomarker

- 9.5.3.2. World Map Representation: HR Biomarker Focused Clinical Trials

- 9.5.4. Potential Strategic Partners for Initiatives on PD-L1 Biomarker

- 9.5.4.1. Companies Working on the PD-L1 Biomarker

- 9.5.4.2. World Map Representation: PD-L1 Biomarker Focused Clinical Trials

- 9.5.1. Potential Strategic Partners for Initiatives on BRCA Biomarker

- 9.6. Likely Partners for Companion Diagnostics Service Providers: Colorectal Cancer

- 9.6.1. Potential Strategic Partners for Initiatives on BRAF Biomarker

- 9.6.1.1. Companies Working on the BRAF Biomarker

- 9.6.1.2. World Map Representation: BRAF Biomarker Focused Clinical Trials

- 9.6.2. Potential Strategic Partners for Initiatives on EGFR Biomarker

- 9.6.2.1. Companies Working on the EGFR Biomarker

- 9.6.2.2. World Map Representation: EGFR Biomarker Focused Clinical Trials

- 9.6.3. Potential Strategic Partners for Initiatives on KRAS Biomarker

- 9.6.3.1. Companies Working on the KRAS Biomarker

- 9.6.3.2. World Map Representation: KRAS Biomarker Focused Clinical Trials

- 9.6.4. Potential Strategic Partners for Initiatives on MSI Biomarker

- 9.6.4.1. Companies Working on the MSI Biomarker

- 9.6.4.2. World Map Representation: MSI Biomarker Focused Clinical Trials

- 9.6.5. Potential Strategic Partners for Initiatives on NRAS Biomarker

- 9.6.5.1. Companies Working on the NRAS Biomarker

- 9.6.5.2. World Map Representation: NRAS Biomarker Focused Clinical Trials

- 9.6.1. Potential Strategic Partners for Initiatives on BRAF Biomarker

- 9.7. Likely Partners for Companion Diagnostic Service Providers: HIV

- 9.7.1. Potential Strategic Partners for Initiatives on CCR5 Biomarker

- 9.7.1.1. Companies Working on the CCR5 Biomarker