|

|

市場調査レポート

商品コード

1148286

世界と中国のHDマップ産業の分析 (2022年)Global and China HD Map Industry Report, 2022 |

||||||

| 世界と中国のHDマップ産業の分析 (2022年) |

|

出版日: 2022年10月12日

発行: ResearchInChina

ページ情報: 英文 330 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

中国では2022年上半期に、10万台以上の乗用車にHDマップが搭載されました。HDマップはこれまで主にオプションとして扱われてきたが、現在はLi L9、NIO ET7、HiPhiなど、徐々に自動車の標準構成に組み込まれてきています。

OEMによるHDマップの搭載率が高まる中、都市部での活用は新たな分野となりました。マップ事業者は、データ収集の迅速化やSDマップ技術との融合を通じて、都市型シナリオの展開を積極的に行っています。

当レポートでは、世界と中国のHDマップ産業について分析し、HDマップの概略や関連政策・規制、HDマップの市場規模・構造やビジネスモデル、HDマップの関連技術 (制作・更新・配信・融合など) の概略、主な活用事例、外資系・国内系企業のプロファイルと主力技術・製品、といった情報を取りまとめてお届けいたします。

目次

第1章 HDマップの政策・基準・規制

- HDマップに関連する政策

- 2022年の最新政策:インテリジェントコネクテッドビークル向けのHDマップのパイロット適用を実施

- 2022年の最新政策:運輸省がBaiduのHDマップパイロットの実施を承認

- 2022年の最新政策:上海はインテリジェントコネクテッドビークルのイノベーションと開発を加速

- HDマップに関する規制

- HDマップに関する外国の規制

- HDマップに関する国内の規制

- 2022年の最新規制:HDマップのマッピング資格の見直しが徐々に強化される (1)

- 2022年の最新規制:HDマップのマッピング資格の見直しが徐々に強化される (2)

- 2022年の最新規制:天然資源省は、自動車センサーとインテリジェントコネクテッドビークルの製造が違法なマッピング活動であることを明確にする (3)

- 2022年の最新規制:重慶が発行したインテリジェントコネクテッドビークル向けのHDマップ管理措置 (4)

- HDマップに関連する規格

- 海外の地図規格のエコロジー:欧州

- 海外の地図規格のエコロジー:日本

- 外国のHDマップ規格開発:現状

- 中国HDマップ標準カスタマイズの現状 (公開)

- 中国HDマップ標準カスタマイズの現状 (事前調査)

- 中国のHDマップ標準の進歩:クラウドソーシングの更新標準の段階的改善

- 2022年最新規格「道路交差点の交通情報ホログラフィック取得システムの一般仕様書」グループ規格を正式公開 (1)

- 2022年の最新規格:初の国内道路HD電子ナビマップの品質仕様・業界標準の認定 (2)

- 2022年の最新規格:国内向け自動駐車マップ規格の近日公開 (3)

- 2022年の最新標準:インテリジェントコネクテッドビークルマップに焦点を当てた、最初の省別ローカル標準の発表 (4)

- HDマップの準拠

- 省による自動車データのセキュリティ管理の強化

- HDマップのデータコンプライアンス・生成プロセス

- HDマップコンプライアンス・データサービス

- HDマップコンプライアンス開発パス:HD動的マップの基本プラットフォームの構築

第2章 HDマップの市場規模と競争パターン

- HDマップの市場規模

- 2022年に、中国で自動運転車にHDマップが搭載される見通し

- 中国における乗用車向けOEM HDマップの市場規模 (1)

- 中国における乗用車向けOEM HDマップの市場規模 (2)

- HDマップ市場の競合情勢

- HDマップの市場パターン

- HDマップ企業 (1):国内の伝統的なマップサプライヤー上位10社 (1)

- HDマップ企業 (1):国内の伝統的なマップサプライヤー上位10社 (2)

- HDマップ企業 (1):主要なマップ企業の製品比較

- HDマップ企業 (I):大手マップメーカー3社の比較

- HDマップ企業 (2):OEMのHDマップ・レイアウト

- HDマップ企業 (2):OEMはHDマップを外注化せず、自社開発する傾向がある

- HDマップ企業 (2):独自のHDマップを開発するOEMが直面している困難

- HDマップ企業 (2):OEMのHDマップレイアウトの事例 (1)

- HDマップ企業 (2):OEMのHDマップレイアウトの事例 (2)

- HDマップ企業 (3):外資系のマップ会社

- HDマップのビジネスモデル

- HDマップの商用化シナリオ

- HDマップのビジネスモデル (1):自動運転

- HDマップのビジネスモデル (2):駐車場

- HDマップ収益モデルの分類

- HDマップのビジネスモデルの概略:国内系マップ企業 (1)

- HDマップのビジネスモデルの概略:国内系マップ企業 (2)

- HDマップのビジネスモデルの概略:外資系マップ企業 (1)

- HDマップのビジネスモデルの概略:外資系マップ企業 (2)

- HDマップの収益モデルの事例:クラウドSaaSサービスモデル

第3章 HDマップの大量生産のための主要技術

- HDマップ制作

- HDマップ制作の流れ

- HDマップ制作の流れ (I):都市道路のHDマップ収集の難しさ

- HDマップ制作の流れ (Ⅱ):点群HDマップの生成

- HDマップ制作の流れ (Ⅱ):ビジュアルフュージョン・ポイントクラウドマッピング

- HDマップ制作の流れ (Ⅱ):LiDARでの点群マッピング

- HDマップ制作の流れ (Ⅲ):特徴抽出

- HDマップ制作ツール:オープンソースアーキテクチャ Lanelet2

- HDマップ制作ツール:オープンソースアーキテクチャ OpenDRIVE

- HDマップ制作事例 (I):百度

- HDマップ制作事例 (Ⅱ):NavInfoの自動地図制作ライン

- HDマップ制作事例 (Ⅱ):NavInfoの新たな自動地図作成技術

- 弱いHDマップの制作フロー

- 弱いHDマップの制作フロー (I):異なるセンサー空間の融合

- 弱いHDマップの制作フロー (Ⅱ):環境モデリング

- 弱いHDマップの制作フロー (Ⅲ):オンラインHDベクトル地図再構築の実現

- HDマップの制作技術の動向:SD/HDマップの統合制作

- HDマップの更新

- HDマップ更新の動向:プロ収集からクラウドソーシング更新まで

- HDマップのクラウドソーシングでの更新方法

- HDマップのクラウドソーシングでの更新の課題 (I)

- HDマップのクラウドソーシングでの更新の課題 (Ⅱ)

- HDマップのクラウドソーシング更新ソリューション (I):低コストのコレクション+SLAMアルゴリズム

- HDマップのクラウドソーシング更新ソリューション (Ⅱ):ビジョンのみ+ディープラーニング+SLAMアルゴリズム (1)

- HDマップのクラウドソーシング更新ソリューション (Ⅱ):ビジョンのみ+ディープラーニング+SLAMアルゴリズム (2)

- HDマップのクラウドソーシング更新ソリューション (Ⅱ):ビジョンのみ+ディープラーニング+SLAMアルゴリズム (3)

- HDマップのクラウドソーシング更新ソリューション (Ⅲ):クラウド+端末フォーム更新のクローズドループ

- HDマップ更新の対象 (I):OEMのクラウドソーシング更新ソリューション (1)

- HDマップ更新の対象 (I):OEMのクラウドソーシング更新ソリューション (2)

- HDマップアップデートの課題 (Ⅱ):テクノロジープロバイダーのクラウドソーシングアップデートソリューション

- HDマップのクラウドソーシングの更新事例 (I):NavInfoの新しいマップ学習プラットフォーム (1)

- HDマップのクラウドソーシングの更新事例 (I):NavInfoの新しいマップ学習プラットフォーム (2)

- HDマップのクラウドソーシングの更新事例 (I):NavInfoの新しいマップ学習プラットフォーム (3)

- HDマップのクラウドソーシングの更新事例 (I):NavInfoの独自のデータ処理プラットフォーム

- HDマップのクラウドソーシング更新事例 (Ⅱ):TomTomがクラウド上でクラウドソーシングされたデータフュージョンを完了

- HDマップデータの配布・融合

- HDマップデータの配布・融合プロセス

- プロセス1:HDマップデータ配信エンジンのアーキテクチャ

- プロセス1:HDマップデータ配信エンジンの道路網モデル

- プロセス1:HDマップデータ配信エンジンの統合フォーム

- プロセス1:HDマップデータ配信エンジンの統合フォームでのHDマップボックス

- プロセス1:主要なHDデータ配信エンジンプロバイダー

- プロセス2:HDマップデータ形式の変換 (1)

- プロセス2:HDマップデータ形式の変換 (2)

- プロセス3:HDマップデータ配信と受信端末の相互作用

- プロセス4:HDマップデータの融合

- プロセス4:HDマップデータ配信とADASの統合

- プロセス4:HDマップデータ配信とADASアプリケーションの関係

- HDマップデータの配布と融合の事例 (I):NavInfoの相互相関層

- HDマップデータの配布と融合の事例 (Ⅱ):Amapのデータ融合と適用方法

- HDマップデータの配信と融合の動向:中央ドメインコントローラーでの集中処理

- HDマップとV2X技術の融合応用

- V2XにおけるHDマップの役割 (I):インフラ

- V2XにおけるHDマップの役割 (Ⅱ):データサポート

- V2XにおけるHDマップの役割 (Ⅲ):高精度測位の実現に貢献

- HDマップにおけるV2Xの役割 (I):データストレージ

- HDマップにおけるV2Xの役割 (Ⅱ):データ配信 (1)

- HDマップにおけるV2Xの役割 (Ⅱ):データ配信 (2)

- HDマップにおけるV2Xの役割 (Ⅲ):マップデータの更新

- HDマップとV2Xの融合の活用事例:信号機プロンプト

- 車線レベル測位に適用されるHDマップ

- HDマップベースの車線レベル測位ソリューションの構造

- 車線レベル測位ソリューションにおけるマップマッチング技術 (I):点群に基づくマップマッチング

- 車線レベル測位ソリューションにおけるマップマッチング技術 (I):点群に基づくマップマッチングアルゴリズム (1)

- 車線レベル測位ソリューションにおけるマップマッチング技術 (I):点群に基づくマップマッチングアルゴリズム (2)

- 車線レベル測位ソリューションにおけるマップマッチング技術 (Ⅱ):深層学習に基づくマップマッチング (1)

- 車線レベル測位ソリューションにおけるマップマッチング技術 (Ⅱ):深層学習に基づくマップマッチング (2)

- HDマップベースの車線レベル測位ソリューションのプロバイダー

- 適用事例 (I):Mxnavi - HDマップに基づく車線レベル測位ソリューション

- 活用事例 (Ⅱ):Voyah - 弱いHDマップに基づく都市道路HD測位ソリューション

第4章 HDマップ大量生産の活用シナリオ

- 各種自動運転レベルのHDマップの需要

- 各種自動運転レベルのHDマップ道路要素の需要

- HDマップ要素の自動運転の要件:L2 NOA

- HDマップ要素の自動運転の要件:L2ハンズフリー

- HDマップ要素の自動運転の要件:L3

- HDマップ要素の自動運転の要件:L4 (1)

- HDマップ要素の自動運転の要件:L4 (2)

- 自動運転の開発段階:人と車の協調運転

- 人間と車の共同運転段階におけるHDマップフレームワーク

- 人間と車の協調運転段階からHDマップ産業への課題

- HDマップの活用シナリオ 1:乗用車の高速道路自動運転

- 独立系ブランドの量産乗用車へのHDマップ搭載 (1)

- 独立系ブランドの量産乗用車へのHDマップ搭載 (2)

- 独立系ブランドの量産乗用車へのHDマップ搭載 (3)

- 独立系ブランドの量産乗用車へのHDマップ搭載 (4)

- 独立系ブランドの量産乗用車へのHDマップ搭載 (5)

- 合弁ブランドの量産乗用車へのHDマップ設置

- 量産事例 (1):GAC Aion HDマップの設置需要

- 量産事例 (1):GAC Aion HDマップソリューション

- 量産事例 (1):GAC Aion EHP

- 量産事例 (1):GAC Aion HDマップの曲率と傾斜

- 量産事例 (2):Xpeng HDマップインストールソリューション

- 量産事例 (2):XPeng P7 HDマップの機能

- 量産事例 (2):XPengによる、HDマップに基づく都市支援運転の実現

- 量産事例 (3):GWM WEY - HDマップによるP2P自動運転を実現

- 量産事例 (4):GM - HDマップのインストールソリューション

- 量産事例 (5):Li Auto - HDマップのインストール

- 量産事例 (6):NIO - 2020年からHDマップを導入

- 量産事例 (6):HDマップと統合されたNIO NOP

- 量産事例 (7):SAIC IM自動運転ハードウェアソリューション

- 量産事例 (8):SAIC MAXUS MIFA 9

- 量産事例 (9):Geely - ZEEKR 001

- 量産事例 (10):AVATR 11 と高速道路+都市シナリオ支援運転

- 量産計画 (1):BMW HDマップのインストール要件とソリューション (1)

- 量産計画 (1):BMW HDマップの設置需要と解決策 (2)

- 量産計画 (1):BMW HDマップ量産機能

- 乗用車の自動運転の新たな戦場:都市シナリオ

- 都市シナリオにおける自動運転のためのHDマップソリューション:SD Pro Map

- 都市型自動運転乗用車HDマップ導入ソリューション (1):マルチセンサーフュージョン+HDマップ

- 都市型自動運転乗用車HDマップ導入ソリューション (2):知覚重視・地図軽量化

- 知覚重視・地図軽量化アプリケーションの事例 (1):IDRIVERPLUS

- 知覚重視・地図軽量化アプリケーションの事例 (2):Haomo AI

- HDマップの活用シナリオ (2):乗用車の低速自動駐車

- AVPマップの種類 (1):HDマップ

- AVPマップの種類 (1):SLAMリアルタイムマップ

- 駐車場用 HDマップのサプライヤー上位5社

- 活用事例 (1):Roadgrids - 駐車場HD地図作成システム

- 活用事例 (2):ZongMu Technology - HDマップベースの駐車製品

- 自動駐車マップの開発動向:車両・フィールド・クラウド・APPのワンマップ

- HD Mapアプリケーションシナリオ (3):貨物輸送用の自動運転

- 低速自動運転におけるHDマップの重要性

- 低速自動運転用HDマップの構築手法:SLAM

- 貨物輸送用の自動運転のHDマップ:サプライヤーのパターン (1)

- 貨物輸送用の自動運転のHDマップ:サプライヤーのパターン (2)

- 貨物輸送用の自動運転の活用事例 (1):Meituan の自動運転配送車

- 貨物輸送用の自動運転の活用事例 (1):JD 自動運転配送車

- HDマップの活用シナリオ 4:人員輸送用の自動運転

- 高度な自動運転にはHDマップが必須

- 人員輸送用の自動運転の活用事例 (1):自動運転ロボタクシー用HDマップアプリ

- 人員輸送用の自動運転の活用事例 (1):ロボットバス用HDマップアプリ

- 人員輸送用の自動運転の活用事例:自動運転ミニバスを動かすPIX

第5章 中国系・外資系のHDマップのプロバイダー

- Baidu Map

- NavInfo

- eMapgo

- Amap

- Tencent

- ECARX

- BrightMap

- Mxnavi

- Huawei

- Heading Data Intelligence

- JD.com

- SFMAP Technology

- Leador

- Momenta

- HERE

- 4 HERE HD Live Map

- TomTom

第6章 HDマップ関連技術の企業

- Mobileye

- Nvidia

- Bosch

- DMP

- Carmera

- Kuandeng Technology

- DeepMotion

- Dilu Technology

- その他

HD maps have been applied on a large scale, spreading from freeways to cities

According to ResearchInChina, more than 100,000 Chinese passenger cars were equipped with HD maps by OEMs in the first half of 2022. OEMs will constantly speed up the installation of HD maps. HD maps were mainly regarded as an option in the past, but now they have been gradually included in the standard configuration of vehicles, such as Li L9, NIO ET7, HiPhi, etc.

From the perspective of the layout of OEMs, advanced driver assistance in urban scenarios has become a new hot spot in intelligent field. At present, there are three technical routes for advanced driver assistance in cities:

- (1) Pure vision: Companies represented by Tesla mainly rely on cameras, super powerful algorithms, etc. to realize assisted driving in cities. It is reported that Tesla may introduce FSD Beta to Chinese market.

- (2) Perception + map: The solution does not depend heavily on pre-made HD maps. It builds real-time HD maps through vision systems in places where there are no HD maps. For example, the LiDAR version of WEY Mocha released by Great Wall in August 2022 adopts Haomo.AI's urban NOH technology with a weak HD map, which require fewer lane-level attributes than regular HD maps.

- (3) Multi-sensor fusion + HD map: Companies represented by NIO, Li Auto and Xpeng enhance the intelligent driving experience by making use of HD maps and LiDAR to make up the insufficient computing power.

Xpeng expects to gradually introduce urban NGP functions to users in Guangzhou, Shenzhen, Beijing, Shanghai, Hangzhou and other cities since 2022.

After the launch of urban NGP by Xpeng, the point-to-point autonomous driving has been realized to some extent (except that drivers cannot take their hands off the steering wheel), covering more than 90% of daily driving scenarios including parking lots, cities and freeways.

NIO plans to make urban assisted driving possible on models such as ET7 and ET5 equipped with NAD system in 2022. When the driver sets a destination on the navigator, the IVI map shows the start and end sections of NOP. When the vehicle enters the sections, the driver can turn on or off the NOP function through the "Pilot Assist" in the lower left corner of the navigator.

Li L9 equipped with intelligent driving system "Li AD Max" can see navigation and assisted driving in all scenarios.

With the computing power as high as 400TOPS, Avatr 11 equipped with Huawei ADS can secure high-level intelligent driving functions at freeways, urban areas and parking.

BAIC ARCFOX αS HI Advance equipped with Huawei ADS can accomplish autonomous driving on freeways, high-level autonomous driving in urban areas, AVP and other functions.

In terms of mainstream solutions, OEMs except Tesla basically adopt the sensor + map solution, but they have different requirements for map accuracy. As per the development progress of HD maps, urban HD maps face long mileage, surveying and mapping restrictions and update challenges. Therefore, some OEMs consider using SD pro maps for urban assisted driving to avoid HD map elements as much as possible.

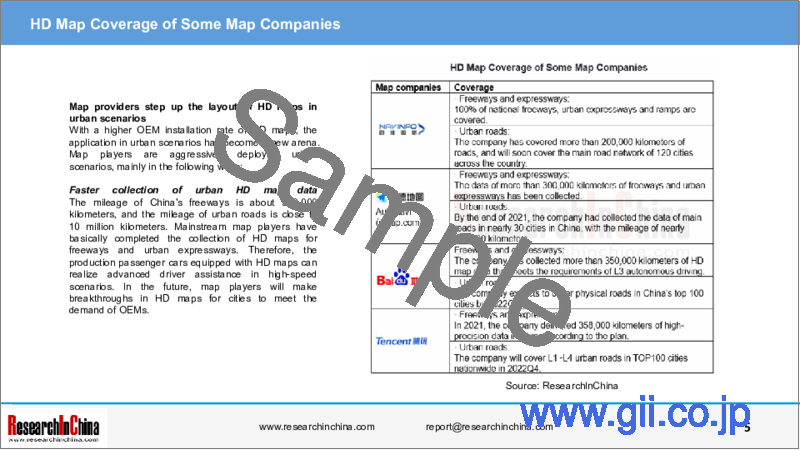

Map providers step up the layout of HD maps in urban scenarios

With a higher OEM installation rate of HD maps, the application in urban scenarios has become a new arena. Map players are aggressively deploying urban scenarios, mainly in the following ways:

Faster collection of urban HD map data

The mileage of China's freeways is about 300,000 kilometers, and the mileage of urban roads is close to 10 million kilometers. Mainstream map players have basically completed the collection of HD maps for freeways and urban expressways. Therefore, the production passenger cars equipped with HD maps can realize advanced driver assistance in high-speed scenarios. In the future, map players will make breakthroughs in HD maps for cities to meet the demand of OEMs.

Integration of SD maps and HD maps

In high-speed scenarios, map companies can post-match SD maps with HD maps, with a high accuracy rate. However, in urban scenarios, SD maps and HD maps can't be associated in the later stage due to different production processes. Therefore, in order to facilitate advanced driver assistance in cities, map companies have begun to actively deploy the integrated production of SD maps and HD maps.

Baidu has developed SD-HD integrated AI map production platform, which integrates various data production structures and technological processes via a system. It satisfies the standardized and unified model expression of map data with different accuracy levels, thus solving the consistency problem.

For Here, different maps share the same map data, the same specification, and the same database. Here produces three modes of maps - SD, ADAS and HDML with the same standard, production environment and production process, so that they are interrelated by sharing and the same data and standard.

Strict supervision amid pilot application of HD maps

Six cities start HD map pilot application projects

In August, 2022, the General Office of the Ministry of Natural Resources of China issued the "Notice on HD Map Pilot Application Projects of Intelligent Connected Vehicles". The pilot projects will stage in six cities including Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chongqing.

The Notice requires the provincial natural resources authorities in these pilot cities to work out pilot implementation plans, timetables and roadmaps in accordance with the deployment of the State Council and the national laws, regulations and policies on surveying, mapping, geographic information management and data security. Besides, they should rationally delineate the pilot scope according to the specific application scenarios of autonomous driving map data.

In August 2022, the Ministry of Transport of China issued "Opinions on HD map construction and other pilot projects of Beijing Baidu Netcom Science Technology Co., Ltd. for the purpose of building a transportation powerhouse". Baidu plans to provide centimeter-level HD map services on freeways and typical urban roads in three to five years, and make its integrated mobility service platform available in about 10 cities.

Strict supervision in HD map field

As China continues to strengthen the security management of geographic information, the Ministry of Natural Resources is intensifying the supervision over the HD map market while opening up pilot cities for application of intelligent connected vehicles.

Tightened supervision on surveying and mapping qualification: by the end of 2021, a total of 31 companies were approved for a-level electronic navigation map qualification, which is valid for 5 years, many enterprises need to re-apply for A-level electronic navigation map qualification in 2022, and there are 19 companies of A-level mapping qualification for navigation electronic map production that completed the re-examination and renewal in 2022.

Subjects of surveying and mapping: In August 2022, the Ministry of Natural Resources clearly pointed out that the following activities should be subject to the "Surveying and Mapping Law of the People's Republic of China": The intelligent connected vehicles installed or integrated with sensors such as satellite navigation and positioning modules, inertial measurement units, cameras and LiDAR collect, store, transmit and process spatial coordinates, images, point clouds, attributes and the like of vehicles and surrounding road facilities during operation, service and road testing.

China's first road HD electronic navigation map quality standard was officially established.

In September 2022, the Road HD Electronic Navigation Maps Quality Specification, recommended by Department of Land and Mapping of the Ministry of Natural Resources and led by Baidu, was officially approved by National Geographic Information Standardization Technical Committee, which is also the first industry standard for road HD electronic navigation map quality specification approved in China. It will solve "What to inspect, how to inspect, how to analyze and evaluate the inspection results, and how to compile the quality report", which are concerned by map and car companies.

“Global and China HD Industry Report, 2022” highlights the following:

- Policies, regulations, standards and compliance about HD maps;

- HD map market size, market structure, business models, etc.

- HD map production technology, update technology, data distribution and fusion technology; the fusion application of HD maps and V2X; the application of HD maps in lane-level positioning, etc.

- Main application scenarios of HD maps, such as autonomous passenger cars, automated parking of passenger cars, passenger and cargo transportation by autonomous driving, etc.;

- HD map production and update technology, main products and application scenarios of major map companies at home and abroad;

- HD map business layout and main technologies of major HD map technology providers at home and abroad.

Table of Contents

1 HD Map Policies, Standards and Regulations

- 1.1 Policies Related to HD Maps

- 1.1.1 Latest Policy in 2022: Carry Out the Pilot Application of HD Maps for Intelligent Connected Vehicles

- 1.1.2 Latest Policy in 2022: Ministry of Transport Approves Baidu to Conduct HD Map Pilot

- 1.1.3 Latest Policy in 2022: Shanghai Accelerates the Innovation and Development of Intelligent Connected Vehicles

- 1.2 Regulations Related to HD Maps

- 1.2.1 Foreign Regulations Related to HD Maps

- 1.2.2 Domestic Regulations Related to HD Maps

- 1.2.3 Latest Regulation in 2022: Review of Mapping Qualifications for HD Maps Gradually Tightened (1)

- 1.2.4 Latest Regulation in 2022: Review of Mapping Qualifications for HD Maps Gradually Tightened (2)

- 1.2.5 Latest Regulation in 2022: Ministry of Natural Resources Clarifies that Automotive Sensors and Intelligent Connected Vehicle Manufacturing are Illegal Mapping Activities (3)

- 1.2.6 Latest Regulation in 2022: Chongqing Issued HD Map Management Measures for Intelligent Connected Vehicles (4)

- 1.3 Standards Related to HD Maps

- 1.3.1 Foreign Map Standard Ecology: Europe (1)

- 1.3.2 Foreign Map Standard Ecology: Japan (2)

- 1.3.3 Status Quo of Foreign HD Map Standard Development

- 1.3.4 Status Quo of China HD Map Standard Customization (Published)

- 1.3.5 Status Quo of China HD Map Standard Customization (Pre-research)

- 1.3.6 Progress of China's HD Map Standard: Crowdsourcing Update Standard Gradually Improved

- 1.3.7 Latest Standard in 2022: "General Specifications for Traffic Information Holographic Acquisition System of Road Intersections" Group Standard Officially Released (1)

- 1.3.8 Latest Standard in 2022: First Domestic Road HD Electronic Navigation Maps Quality Specification Industry Standard Approved (2)

- 1.3.9 Latest Standard in 2022: Domestic Autonomous Parking Map Standard Coming Soon (3)

- 1.3.10 Latest Standard in 2022: First Provincial Local Standard Focusing on Intelligent Connected Vehicle Maps Launched (4)

- 1.4 Compliance of HD Map

- 1.4.1 State Increases Automotive Data Security Control

- 1.4.2 HD Map Data Compliance Production Process

- 1.4.3 HD Map Compliance Data Service

- 1.4.4 HD Map Compliance Development Path: Building a HD Dynamic Map Basic Platform

2 HD Map Market Size and Competitive Pattern

- 2.1 HD Map Market Size

- 2.1.1 Estimated Installations of HD Maps in Autonomous Vehicles in China in 2022

- 2.1.2 Market Size of OEM HD Maps for Passenger Cars in China (1)

- 2.1.3 Market Size of OEM HD Maps for Passenger Cars in China (2)

- 2.2 Competitive Landscape of HD Map Market

- 2.2.1 HD Map Market Pattern

- 2.2.2 HD Map Market Players (1): Top 10 Domestic Traditional Map Suppliers (1)

- 2.2.3 HD Map Market Players (1): Top 10 Domestic Traditional Map Suppliers (2)

- 2.2.4 HD Map Market Players (1): Product Comparison between Major Map Companies

- 2.2.5 HD Map Market Players (I): Comparison between Three Major Map Producers

- 2.2.6 HD Map Market Players (2): HD Map Layout of OEMs

- 2.2.7 HD Map Market Players (2): OEMs Tend to Self-develop HD Maps Instead of Outsourcing

- 2.2.8 HD Map Market Players (2): The OEMs That Develop Their Own HD Maps Are Facing Difficulties

- 2.2.9 HD Map Market Players (2): HD Map Layout Cases of OEMs (1)

- 2.2.10 HD Map Market Players (2): HD Map Layout Cases of OEMs (2)

- 2.2.11 HD Map Market Players (3): Foreign Map Companies

- 2.3 HD Map Business Models

- 2.3.1 Scenarios where HD maps have been commercialized

- 2.3.2 HD Map Business Model 1: Autonomous Driving

- 2.3.3 HD Map Business Model 2: Parking Lots

- 2.3.4 Classification of HD Map Profit Models

- 2.3.5 Summary of HD Map Business Models: Domestic Map Companies (1)

- 2.3.6 Summary of HD Map Business Models: Domestic Map Companies (2)

- 2.3.7 Summary of HD Map Business Models: Foreign Map Companies (1)

- 2.3.8 Summary of HD Map Business Models: Foreign Map Companies (2)

- 2.3.9 Cases of HD Map Profit Models: Cloud SaaS Service Model

3 Key Technologies for HD Map Mass Production

- 3.1 HD Map Production

- 3.1.1 HD Map Production Flow

- 3.1.2 HD Map Production Flow (I): Hard to Collect HD Maps of Urban Roads

- 3.1.3 HD Map Production Flow (II): Point Cloud HD Map Generation

- 3.1.4 HD Map Production Flow (II): Visual Fusion Point Cloud Mapping

- 3.1.5 HD Map Production Flow (II): LIDAR Point Cloud Mapping

- 3.1.6 HD Map Production Flow (III): Feature Extraction

- 3.1.7 HD Map Production Tools: Open Source Architecture Lanelet2

- 3.1.8 HD Map Production Tools: Open Source Architecture OpenDRIVE

- 3.1.9 HD Map Production Cases (I): Baidu

- 3.1.10 HD Map Production Cases (II): NavInfo's Automatic Map Production Line

- 3.1.11 HD Map Production Cases (II): NavInfo's New Automated Mapping Technology

- 3.1.12 Weak HD Map Production Flow

- 3.1.13 Weak HD Map Production Flow (I): Spatial Fusion of Different Sensors

- 3.1.14 Weak HD Map Production Flow (II): Environment Modeling

- 3.1.15 Weak HD Map Production Flow (III): Realize Online HD Vector Map Reconstruction

- 3.1.16 HD Map Production Technology Trend: SD/HD Map Integrated Production

- 3.2 HD Map Update

- 3.2.1 HD Map Update Trends: from Professional Collection to Crowdsourcing Update

- 3.2.2 HD Map Crowdsourcing Update Method

- 3.2.3 Challenges to HD Map Crowdsourcing Update (I)

- 3.2.4 Challenges to HD Map Crowdsourcing Update (II)

- 3.2.5 HD Map Crowdsourcing Update Solutions (I): Low-cost Collection + SLAM Algorithm

- 3.2.6 HD Map Crowdsourcing Update Solutions (II): Vision-only + Deep Learning + SLAM Algorithm (1)

- 3.2.7 HD Map Crowdsourcing Update Solutions (II): Vision-only + Deep Learning + SLAM Algorithm (2)

- 3.2.8 HD Map Crowdsourcing Update Solutions (II): Vision-only + Deep Learning + SLAM Algorithm (3)

- 3.2.9 HD Map Crowdsourcing Update Solutions (III): Cloud + Terminal Form An Update Closed Loop

- 3.2.10 HD Map Update Subjects (I): OEM'S Crowdsourcing Update Solutions (1)

- 3.2.11 HD Map Update Subjects (I): OEM'S Crowdsourcing Update Solutions (2)

- 3.2.12 HD Map Update Subjects (II): Technology Providers' Crowdsourcing Update Solutions

- 3.2.13 HD Map Crowdsourcing Update Cases (I): NavInfo's New Map Learning Platform (1)

- 3.2.14 HD Map Crowdsourcing Update Cases (I): NavInfo's New Map Learning Platform (2)

- 3.2.15 HD Map Crowdsourcing Update Cases (I): NavInfo's New Map Learning Platform (3)

- 3.2.16 HD Map Crowdsourcing Update Cases (I): NavInfo's Proprietary Data Processing Platform

- 3.2.17 HD Map Crowdsourcing Update Cases (II): TomTom Completes Crowdsourced Data Fusion over Cloud

- 3.3 HD Map Data Distribution and Fusion

- 3.3.1 HD Map Data Distribution and Fusion Process

- 3.3.2 Process 1: HD Map Data Distribution Engine Architecture

- 3.3.3 Process 1: Road Network Model of HD Map Data Distribution Engine

- 3.3.4 Process 1: Integration Forms of HD Map Data Distribution Engine

- 3.3.5 Process 1: HD Map Box in Integration Forms of HD Map Data Distribution Engine

- 3.3.6 Process 1: Major HD Data Distribution Engine Providers

- 3.3.7 Process 2: HD Map Data Format Conversion (1)

- 3.3.8 Process 2: HD Map Data Format Conversion (2)

- 3.3.9 Process 3: Interaction between HD Map Data Distribution and Receiving Terminals

- 3.3.10 Process 4: HD Map Data Fusion

- 3.3.11 Process 4: Integration of HD Map Data Distribution and ADAS

- 3.3.12 Process 4: Relationship between HD Map Data Distribution and ADAS Applications

- 3.3.13 HD Map Data Distribution and Fusion Cases (I): NavInfo's Cross-correlation Layer

- 3.3.14 HD Map Data Distribution and Fusion Cases (II): Amap's Data Fusion and Application Methods

- 3.3.15 HD Map Data Distribution and Fusion Trend: Centralized Processing in the Central Domain Controller

- 3.4 Fusion Application of HD Map and V2X Technology

- 3.4.1 Roles of HD Map in V2X (I): Infrastructure

- 3.4.2 Roles of HD Map in V2X (II): Data Support

- 3.4.3 Roles of HD Map in V2X (III): Helping to Achieve High-Precision Positioning

- 3.4.4 Roles of V2X in HD Map (I): Data Storage

- 3.4.5 Roles of V2X in HD Map (II): Data Distribution (1)

- 3.4.6 Roles of V2X in HD Map (II): Data Distribution (2)

- 3.4.7 Roles of V2X in HD Map (III): map Data Update

- 3.4.8 HD Map and V2X Fusion Application Case: Traffic Lights Prompt

- 3.5 HD Map Applied to Lane-Level Positioning

- 3.5.1 Structure of HD Map Based Lane-Level Positioning Solutions

- 3.5.2 Map Matching Technologies in Lane-Level Positioning Solutions (I): Map Matching Based on Point Cloud

- 3.5.3 Map Matching Technologies in Lane-Level Positioning Solutions (I): Map Matching Algorithms Based on Point Cloud (1)

- 3.5.4 Map Matching Technologies in Lane-Level Positioning Solutions (I): Map Matching Algorithms Based on Point Cloud (2)

- 3.5.5 Map Matching Technologies in Lane-Level Positioning Solutions (II): Map Matching Based on Deep Learning (1)

- 3.5.6 Map Matching Technologies in Lane-Level Positioning Solutions (II): Map Matching Based on Deep Learning (2)

- 3.5.7 Providers of Lane-Level Positioning Solutions Based on HD Maps

- 3.5.8 Application Cases (I): Mxnavi's Lane-Level Positioning Solutions Based on HD Maps

- 3.5.9 Application Cases (II): Voyah's Urban Road HD Positioning Solutions Based on Weak HD Maps

4 Application Scenario for HD Map Mass Production

- 4.1 HD Map Demand for Different Autonomous Driving Levels

- 4.1.1 HD Map Road Element Demand for Different Autonomous Driving Level

- 4.1.2 Requirements of Autonomous Driving for HD Map Elements: L2 NOA

- 4.1.3 Requirements of Autonomous Driving for HD Map Elements: L2 Hands Free

- 4.1.4 Requirements of Autonomous Driving for HD Map Elements: L3

- 4.1.5 Requirements of Autonomous Driving for HD Map Elements: L4 (1)

- 4.1.6 Requirements of Autonomous Driving for HD Map Elements: L4 (2)

- 4.1.7 Autonomous Driving Development Stage : Human-car Co-Driving

- 4.1.8 HD Map Framework in the Human-car Co-driving Stage

- 4.1.9 Challenges of Human-car Co-driving Stage to HD Map Industry

- 4.2 HD Map Application Scenario 1: Highway Autonomous Driving for Passenger Cars

- 4.2.1 HD Map Installation of Independent Brand Mass-produced Passenger Cars (1)

- 4.2.2 HD Map Installation of Independent Brand Mass-produced Passenger Cars (2)

- 4.2.3 HD Map Installation of Independent Brand Mass-produced Passenger Cars (3)

- 4.2.4 HD Map Installation of Independent Brand Mass-produced Passenger Cars (4)

- 4.2.5 HD Map Installation of Independent Brand Mass-produced Passenger Cars (5)

- 4.2.6 HD Map Installation of Joint Venture Brand Mass-produced Passenger Cars

- 4.2.7 Mass Production Case 1: GAC Aion HD Map Installation Demand

- 4.2.8 Mass Production Case 1: GAC Aion HD Map Solution

- 4.2.9 Mass Production Case 1: GAC Aion EHP

- 4.2.10 Mass Production Case 1: GAC Aion HD Map Curvature and Slope

- 4.2.11 Mass Production Case 2: Xpeng HD Map Installation Solution

- 4.2.12 Mass Production Case 2: Functions of XPeng P7 HD Map

- 4.2.13 Mass Production Case 2: XPeng Enables Urban Assisted Driving Based on HD Map

- 4.2.14 Mass Production Case 3: GWM WEY Realizes Point-to-Point Autonomous Driving with HD Map

- 4.2.15 Mass Production Case 4: GM HD Map Installation Solution

- 4.2.16 Mass Production Case 5: Li Auto HD Map Installation

- 4.2.17 Mass Production Case 6: NIO Introduces HD Map from 2020

- 4.2.18 Mass Production Case 6: NIO NOP Integrated with HD Map

- 4.2.19 Mass Production Case 7: SAIC IM Autonomous Driving Hardware Solution

- 4.2.20 Mass Production Case 8: SAIC MAXUS MIFA 9

- 4.2.21 Mass Production Case 9: Geely ZEEKR 001

- 4.2.22 Mass Production Case 10: AVATR 11 with Highway + Urban Scenario Assisted Driving

- 4.2.23 Mass Production Plan 1: BMW HD map Installation Requirement and Solution (1)

- 4.2.24 Mass Production Plan 1: BMW HD Map Installation Demand and Solution (2)

- 4.2.25 Mass Production Plan 1: BMW HD Map Mass Production Function

- 4.2.26 New Battlefield for Passenger Car Autonomous Driving: Urban Scenarios

- 4.2.27 HD Map solution for Autonomous Driving in Urban Scenarios: SD Pro Map

- 4.2.28 Urban Autonomous Driving Passenger Car HD Map Installation Solution 1: Multi-sensor Fusion + HD map

- 4.2.29 Urban Autonomous Driving Passenger Car HD Map Installation Solution 2: Heavy on Perception + Light on Map

- 4.2.30 Heavy on Perception + Light on Map Application Case 1: IDRIVERPLUS

- 4.2.31 Heavy on Perception + Light on Map Application Case 2: Haomo AI

- 4.3 HD Map Application Scenario 2: Low-speed Autonomous Parking for Passenger Cars

- 4.3.1 AVP Map Type 1: HD Map

- 4.3.2 AVP Map Type 1: SLAM Real-time map

- 4.3.3 Top Five HD Map Suppliers for Parking Lots

- 4.3.4 Application Case 1: Roadgrids Parking Lot HD Map Building System

- 4.3.5 Application Case 2: ZongMu Technology HD Map-based Parking Product

- 4.3.6 Autonomous Parking Map Development Trend: One Map of Vehicle / Field / Cloud / APP

- 4.4 HD Map Application Scenario 3: Autonomous Driving for Cargo

- 4.4.1 Importance of HD Maps for Low-speed Autonomous Driving

- 4.4.2 HD Map Building Method for Low-speed Autonomous Driving: SLAM

- 4.4.3 HD Map Supplier Pattern of Autonomous Driving for Cargo (1)

- 4.4.4 HD Map Supplier Pattern of Autonomous Driving for Cargo (2)

- 4.4.5 Application Case 1 of Autonomous Driving for Cargo: Meituan Autonomous Delivery Vehicle

- 4.4.6 Application Case 1 of Autonomous Driving for Cargo: JD Autonomous Delivery Vehicle

- 4.5 HD Map Application Scenario 4: Autonomous Driving for People

- 4.5.1 HD Maps are a Must for High-level Autonomous Driving

- 4.5.2 Application Case 1 of Autonomous Driving for People: Autonomous Robotaxi HD Map Application

- 4.5.3 Application Case 1 of Autonomous Driving for People: Robobus HD Map Application

- 4.5.4 Application Case of Autonomous Driving for People: PIX Moving Autonomous Minibus

5 Chinese and Foreign HD Map Providers

- 5.1 Baidu Map

- 5.1.1 "Vehicle-Road-Cloud-Map" Coordinated Development

- 5.1.2 HD Map Product System

- 5.1.3 Human-Computer Co-Driving Map

- 5.1.4 Advantages of HD Map Products (I): SD/HD Map Integrated Production

- 5.1.5 Advantages of HD Map Products (II): Strong Data Closed-Loop Update Capability

- 5.1.6 Advantages of HD Map Products (III): High Update Frequency

- 5.1.7 Advantages of HD Map Products (IV): Wide Coverage

- 5.1.8 Advantages of HD Map Products (V): Verify Map Accuracy via Cockpit APP

- 5.1.9 Advantages of HD Map Products (VI): Support Rapid Mass Production

- 5.1.10 Advantages of HD Map Products (VII): Deep integration of Cockpit, Driving and Map

- 5.1.11 HD Map Product Planning

- 5.1.12 AVP HD Maps Are Collected in Real Time Using Machine Vision

- 5.1.13 Integrate HD Map and Autonomous Driving (I)

- 5.1.14 Integrate HD Map and Autonomous Driving (II)

- 5.1.15 HD Map Ecosystem and Partners

- 5.2 NavInfo

- 5.2.1 Advantages in HD Map Market (I): Provide All-scenario HD Map Products

- 5.2.2 Advantages in HD Map Market (II): Build Third-party HD Map Platforms

- 5.2.3 In-depth Layout of Software and Hardware Integrated Solutions with HD Maps as the Core

- 5.2.4 Build Barriers in the Key Link "Base Map-Update-Positioning"

- 5.2.5 Major HD Map Products

- 5.2.6 The HD Map Capability Has Exceeded L2+

- 5.2.7 AVP Map

- 5.2.8 HD Map Engine

- 5.2.9 HD Map Update Technologies: UGC

- 5.2.10 HD Map Update Technologies: Algorithms & Tools

- 5.2.11 Data-Driven Open Platform for L5

- 5.2.12 HD Map Quality Control System

- 5.2.13 Partners Cover Automakers and Tier 1 Suppliers

- 5.3 eMapgo

- 5.3.1 Profile

- 5.3.2 eMapgo and Luokung Technology Cooperated to Build A HD Map Platform Provider

- 5.3.3 HD Map Products

- 5.3.4 HD Map Update

- 5.3.5 eHorizon (I)

- 5.3.6 eHorizon (II)

- 5.3.7 Parking Lot HD Map (I)

- 5.3.8 Parking Lot HD Map (II)

- 5.3.9 HD Map Cloud Platform

- 5.4 Amap

- 5.4.1 Profile

- 5.4.2 Map Data Collection and Production

- 5.4.3 Integrated Solutions Based on HD Map and High-Precision Positioning

- 5.4.4 Third-generation Map Navigation for Vehicles

- 5.4.5 HD Map and SD Map Matching

- 5.5 Tencent

- 5.5.1 Profile

- 5.5.2 HD Map Solution

- 5.5.3 HD Map Update

- 5.5.4 Intelligent Driving Map for Human-Computer Co-Driving

- 5.5.5 "Vehicle-Cloud Integration" Strategic Layout

- 5.6 ECARX

- 5.6.1 Financing

- 5.6.2 HD Map Business

- 5.7 BrightMap

- 5.7.1 Profile

- 5.7.2 Advantages of Parking Lot HD Map Products

- 5.7.3 AVP HD Map

- 5.7.4 AVP HD Map Data Delivery and Update

- 5.7.5 Parking Navigation HD Map

- 5.7.6 Secured Mass Production Orders for Parking Lot HD Maps

- 5.8 Mxnavi

- 5.8.1 Business Layout

- 5.8.2 Full-link HD Map Service Capabilities

- 5.8.3 HD Map Fusion Platform

- 5.8.4 HD Map Crowdsourced Production Solution

- 5.9 Huawei

- 5.9.1 HD Map Layout

- 5.9.2 Autonomous Driving Map Data System

- 5.9.3 HD Map Cloud Services

- 5.9.4 Huawei Accomplishes Crowdsourced Updates of HD Maps Based on the Open Autonomous Driving Platform

- 5.9.5 HD Map Application: Holographic Intersections

- 5.9.6 HD Map Application: Advanced Autonomous Driving System (ADS)

- 5.10 Heading Data Intelligence

- 5.10.1 Profile

- 5.10.2 HD Map Business

- 5.10.3 HD Map Updates

- 5.10.4 HD Map Engines

- 5.10.5 HD Map Application Scenarios: Parking

- 5.10.6 HD Map Application Scenarios: Freeways/Urban Areas

- 5.10.7 Products Based on HD Maps

- 5.10.8 Listing and Trading of HD Electronic Map Data Products

- 5.11 JD.com

- 5.11.1 HD Map Business

- 5.11.2 HD Map Application Scenarios

- 5.12 SFMAP Technology

- 5.12.1 HD Map Business

- 5.13 Leador

- 5.13.1 Profile

- 5.13.2 Autonomous Driving Technology Based on HD Maps (1)

- 5.13.3 Autonomous Driving Technology Based on HD Maps (2)

- 5.13.4 Indoor Map Construction Based on SLAM Algorithms

- 5.13.5 HD Maps for Parking Lots

- 5.13.6 HD Map Application Scenarios

- 5.14 Momenta

- 5.14.1 Profile

- 5.14.2 HD Map Technology Route

- 5.14.3 The Role of HD Maps in Mpilot Parking

- 5.15 HERE

- 5.15.1 Profile

- 5.15.2 Map Evolution Mode

- 5.15.3 HD Map Business

- 5.15. 4 HERE HD Live Map

- 5.15.5 HD Map Data Updates

- 5.15.6 HD Map Layout in China

- 5.15.7 HERE Supports China's Automobile Brands to "Go Out"

- 5.16 TomTom

- 5.16.1 Profile

- 5.16.2 HD Map Business

- 5.16.3 TomTom AutoStream Delivery Service

- 5.16.4 HD Map Collection and Drawing

- 5.16.5 Crowdsourced Updates of HD Maps

- 5.16.6 integrated ADAS Software Based on Maps

- 5.16.7 Cooperation between TomTom and EB

6 HD Map-related Technology Companies

- 6.1 Mobileye

- 6.1.1 HD Map Business

- 6.1.2 Map Data Coverage of Mobileye REM

- 6.1.3 Mobileye REM Technology Realizes Crowdsourced Updates

- 6.1.4 REM Reduces Map Production and Maintenance Cost

- 6.1.5 Functions Achieved by Mobileye REM

- 6.1.6 REM-based Map Extension Service of Mobileye

- 6.1.7 Progress of REM in the World

- 6.1.8 Mobileye Encounters Obstacles in the Chinese Market

- 6.1.9 Mobileye Updates ZEEKR's Assisted Driving Functions via OTA

- 6.2 Nvidia

- 6.2.1 Nvidia acquired DeepMap to deploy HD maps

- 6.2.2 Nvidia's DRIVE Map for Autonomous Vehicles (1)

- 6.2.3 Nvidia's DRIVE Map for Autonomous Vehicles (2)

- 6.2.4 DeepMap's Crowdsourced Update Solution (1)

- 6.2.5 DeepMap's Crowdsourced Update Solution (2)

- 6.3 Bosch

- 6.3.1 Bosch Acquired Atlatec for HD Map Layout

- 6.3.2 Bosch's Low-cost and Easy-to-deploy Mapping Solution

- 6.4 DMP

- 6.4.1 Profile

- 6.4.2 DMP's Dynamic Map

- 6.5 Carmera

- 6.5.1 Toyota Acquired Carmera

- 6.5.2 Carmera's Autonomous Driving 3D Map Solution

- 6.5.3 Carmera's Map Data Collection Mode

- 6.6 Kuandeng Technology

- 6.6.1 Kuandeng Technology's HD Map Technology Solution

- 6.6.2 Kuandeng Technology's HD Map Quality Evaluation System

- 6.7 DeepMotion

- 6.7.1 DeepMotion Was Acquired by Xiaomi

- 6.7.2 DeepMotion's HD Map Technology Solution

- 6.7.3 Features of DeepMotion's HD Maps

- 6.8 Dilu Technology

- 6.8.1 Profile

- 6.8.2 HD map solutions

- 6.8.3 Production Process of Dilu Technology's HD Maps (1)

- 6.8.4 Production Process of Dilu Technology's HD Maps (2)

- 6.9 Others

- 6.9.1 HD Map Update Solutions of Horizon Robotics

- 6.9.2 Mapbox's HD Map Services

- 6.9.3 Mapper.ai