|

|

市場調査レポート

商品コード

1122089

世界と中国のニードルコークス産業の分析 (2022年~2027年)Global and China Needle Coke Industry Report, 2022-2027 |

||||||

| 世界と中国のニードルコークス産業の分析 (2022年~2027年) |

|

出版日: 2022年08月25日

発行: ResearchInChina

ページ情報: 英文 124 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

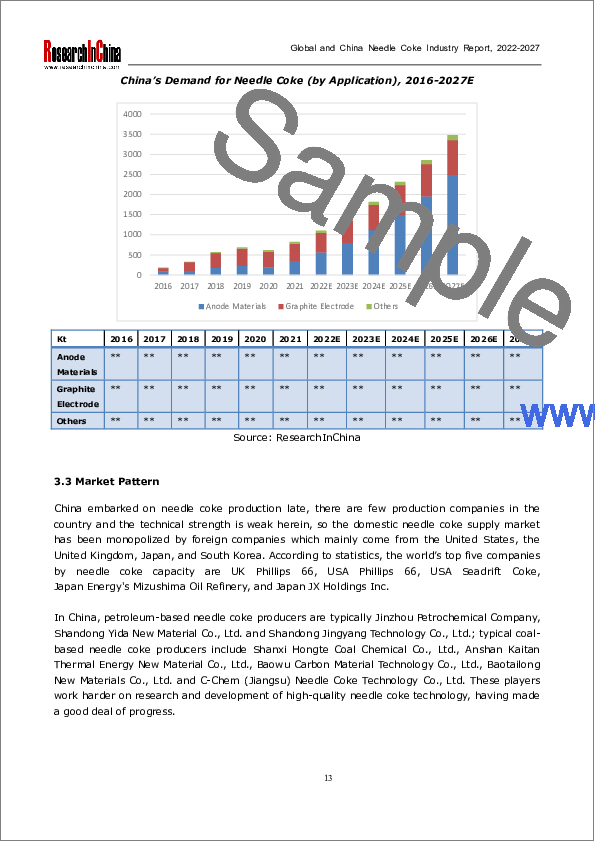

低抵抗で耐衝撃性、耐酸化性に優れたニードルコークスは、超高出力黒鉛電極、原子炉減速材、リチウム電池負極材などに広く利用されています。近年、中国政府が鉄スクラップの活用を強化した結果、新エネルギー車のブームや電炉設備の増加により、ニードルコークスの需要や生産が大きく伸びています。中国のニードルコークス生産能力は、2014年の160 kt/aから2021年には2,180 kt/aに拡大し、生産量は2016年の80 ktから2021年には762 ktに倍増しました。世界と中国の新エネルギー自動車産業は、今後5年間も勢いを増すと思われます。中国の良心的な資源リサイクル政策により、電炉設備の開発は引き続き促進されます。2027年の中国のニードルコークス生産量は3,458 ktで、2021年から2027年にかけて28.7%のCAGRを維持することが考えられます。

ニードルコークスには、石炭系と石油系があります。欧米では石油系ニードルコークス、アジアでは石炭系ニードルコークスの生産が盛んです。原料の供給が制約されているため、近年、中国では石炭系ニードルコークスの急速な発展がもたらされました。2021年、中国の石炭系ニードルコークス生産能力は1,000kt/aに達し、生産量は261kt、石油系ニードルコークス生産能力は1,180kt/aで、生産量は501ktでした。

リチウム電池負極材の主原料であるニードルコークスは、リチウム電池の需要に大きく影響されます。2020年、中国における負極材用ニードルコークスの需要は190ktに達し、2026年には1,900ktに達すると予測されています。

当レポートでは、世界と中国のニードルコークス産業について分析し、成員の定義や分類、世界の産業構造・動向 (需給構造、技術情勢、競合パターンほか)、中国国内の産業動向 (発展環境、需給動向、競合パターン、輸出入動向ほか)、主な下流工程市場 (黒鉛電極など) の構造・動向、世界・中国の主なニードルコークスメーカーのプロファイル (経営状況、収益構造、ニードルコークス事業ほか)、といった情報を取りまとめてお届けいたします。

目次

第1章 ニードルコークスの概要

- 製品概略

- 分類と用途

- 産業チェーン

第2章 世界のニードルコークス産業の発展

- 概要

- 需給

- 供給

- 需要

- 技術状況

- 市場パターン

- 米国

- 日本

- 英国

第3章 中国のニードルコークス産業の発展

- 開発環境

- 政策環境

- 技術環境

- 貿易環境

- 需給

- 供給

- 需要

- 市場パターン

- 輸入

- 石油性ニードルコークス

- 石炭系ニードルコークス

- 価格動向

第4章 中国の黒鉛電極産業の発展

- 需給

- 概要

- 供給

- 需要

- 輸出・輸入

- 競合情勢

- 企業間の競合

- 地域間の競合

- 価格動向

- ニードルコークスの需要

第5章 中国のリチウムイオン電池負極材料の市場

- 需給

- 供給

- 需要

- 競合情勢

- 企業間の競合

- 地域間の競合

- 価格動向

- ニードルコークスの需要

第6章 世界の主要ニードルコークス企業

- Phillips 66

- プロファイル

- 経営状況

- ニードルコークス事業

- Nippon Steel Chemical & Material (NSCM)

- GrafTech International

- Mitsubishi Chemical

- ENEOS

- Petrocokes Japan Limited

- Posco Chemtech

第7章 中国の主要なニードルコークス企業

- Fangda Carbon New Material Technology Co.、Ltd.

- プロファイル

- 経営状況

- 収益構造

- 研究開発

- ニードルコークス事業

- Qitaihe Baotailong Coal&Coal Chemicals Public Co., Ltd.

- Shandong Yida New Material Co., Ltd.

- Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

- Jinzhou Petrochemical Co., Ltd.

- Baowu Carbon

- Bora Bioenergy

- Shandong Jingyang Technology Co., Ltd.

- Risun Holdings

- Henan Baoshun Fine Chemical Co., Ltd.

- TSDR New Energy Materials Co., Ltd.

- Zaozhuang Zhenxing Carbon Material Technology Co., Ltd.

- Anhui MaSteel Chemical Energy Technology Co., Ltd.

- Shanxi Hongte Coal Chemical Industry Co., Ltd.

Selected Charts

Physical Needle Coke

Needle Coke Industry Chain

Global Needle Coke Capacity, 2013-2021

Global Needle Coke Capacity Structure (by Product), 2010-2021

Global Needle Coke Output, 2011-2021

Shipment of Global Lithium Battery Anode Materials, 2016-2026E

Global Coal Based Needle Coke Production Process and Its Characteristics

Needle Coke Production Process by Different Raw Materials

Capacity of Major Global Needle Coke Manufacturers, 2021

Capacity and Production Base of U.S. Needle Coke Manufacturers, 2021

Capacity and Product Type of Major Japanese Needle Coke Manufacturers, 2021

Capacity and Production Base of British Needle Coke Manufacturers, 2021

Needle Coke-related Policies in China, 2016-2020

Process of Needle Coke Technology in China

China's Tentative Tax Rate for Imported Carbon Goods, 2021

New Needle Coke Capacity of Some Chinese Companies, 2022

China's Needle Coke Capacity, 2014-2021

China's Needle Coke Output, 2016-2027E

China's Needle Coke Output by Product, 2017-2027E

China's Demand for Needle Coke, 2016-2027E

China's Demand for Needle Coke (by Application), 2016-2027E

Distribution of Needle Coke Capacity in China by Enterprise, 2022

Distribution of New Needle Choke Capacity in China by Enterprise, 2022-2024

Monthly Import Volume of Oil-based Needle Coke, 2019-2021

Oil-based Needle Coke Import Unit Price by Country, 2019-2021

Monthly Import Volume of Coal-based Needle Coke, 2019-2021

Coal-based Needle Coke Import Unit Price by Country, 2019-2021

Needle Coke Price in China by Product, 2020-2021

Factors Affecting Supply and Demand of Graphite Electrode

China's Graphite Electrode Output, 2017-2027E

China's Graphite Electrode Output (by Product), 2013-2021

Downstream Structure of Graphite Electrode in China

Policies on Electric Furnace Steel in China, 2016-2021

Operating Rate of 71 Independent Electric Arc Furnaces in China, 2019-2021

Capacity Utilization of 71 Independent Electric Arc Furnaces in China, 2019-2021

Electric Furnace Steel Output and Ratio to Crude Steel in China, 2017-2027E

China's Export Volume of Graphite Electrode, 2016-2021

Main Export Destinations of China's Graphite Electrodes, 2021

China's Graphite Electrode Export Breakdown by Country, 2021

Capacity of Major Chinese Graphite Electrode Companies, 2021

Capacity Expansion Plans of Major Chinese Graphite Electrode Companies, 2020-2022

Top5 Enterprises by Graphite Electrode Sales in China, 2021

Top5 Enterprises by Ultra-high-power Graphite Electrode Output in China, 2021

Regional Graphite Electrode Capacity Layout, 2021

Price Trend of Graphite Electrode in China, 2021

Applications of Needle Coke to Graphite Electrode

Demand for Needle Coke from Graphite Electrode in China, 2017-2027E

Output of Lithium-ion Battery Anode Materials in China, 2015-2027E

Performance Comparison of Main Anode Materials

Output of Lithium-ion Battery Anode Materials (By Product) in China, 2017-2027E

Cost Structure of Lithium Battery

China's Output of Power Lithium Battery, 2016-2027E

Output and Sales of New Energy Vehicle in China, 2017-2027E

Capacity Distribution of Major Anode Material Producers in China, 2021

Anode Material Sales Volume of Key Producers in China, 2021

Anode Materials Capacity Expansion Plans of Main Companies, 2022

Geographical Distribution of Anode Materials Output in China, 2016-2021

Regional Anode Material Capacity Layout of China,2021

Price Trend of Anode Materials in China, 2014-2021

Demand for Needle Coke Used in Lithium Battery Anode Materials in China, 2016-2026E

Main Business of Phillips 66

Revenue and Net Income of Phillips66, 2019-2021

Sales and Other Operating Revenues by Business of Phillips66, 2019-2021

Net Income (Loss) by Business of Phillips66, 2019-2021

Sales and Other Operating Revenues by Region of Phillips66, 2019-2021

Needle Coke Capacity of Phillips66, 2021

Profile of NSCM

Needle Coke Industry Chain of NSCM

Coke Production Layout of NSCM

Coke Products Portfolio of NSCM

Needle Coke Performance Index of NSCM

Global Network of Production and Sales of GrafTech

Revenue and Net Income of GrafTech, 2019-2021

Revenue Structure of GrafTech by End Market, 2021

Revenue Structure of GrafTech by Region, 2020-2021

GrafTech Industry Chain

Characteristics of Seadrift SSP™ Senior Petroleum Coke and Seadrift SSP™ Ordinary Petroleum Coke

Sales and Production Volume of GraTech's Graphite Electrode,2020-2021

Key Business of Mitsubishi Chemical

Sale Revenue and Operating Income of Mitsubishi Chemical, FY2017-FY2021

Revenue Structure of Mitsubishi Chemical, FY2021

Needle Coke Production Process of Mitsubishi Chemical

Key Facts of ENEOS Holdings

Business Segments of ENEOS

Revenue and Net Income of ENEOS Holdings, FY2017-FY2021

Revenue Structure of ENEOS Holdings (by Division), FY2021

Key Product of ENEOS Corporation

Needle Coke Production Bases and Capacity of ENEOS Holdings, 2021

Posco Chemtech's Sales, Operating Income and Net Income, 2018-2021

Revenue and Gross Margin of Posco Chemtech, 2019-2021

Sales of PMC Tech, 2019-2021

Equity Structure of Fangda Carbon, 2022

Revenue and Net Income of Fangda Carbon, 2012-2021

Gross Margin of Fangda Carbon (by product), 2015-2021

Revenue Structure of Fangda Carbon (by product), 2015-2021

Revenue Structure of Fangda Carbon (by region), 2015-2021

R&D Investment and % in Revenue of Fangda Carbon, 2015-2021

Equity Structure of C-Chem (Jiangsu)

Revenue and Net Income of C-Chem (Jiangsu), 2017-2021

Fangda Carbon's Payment for Its Procurement of Raw Materials like Needle Coke from Associate Companies, 2018-2021

Equity Structure of Baotailong, 2019

Revenue and Net Income of Baotailong, 2014-2021

Revenue of Baotailong (by Product), 2019-2020

Operating Revenue of Baotailong (by Region), 2014-2021

Technical Parameters of Non-calcined Needle Coke of Baotailong New Materials

Technical Parameters of Calcined Needle Coke of Baotailong New Materials

Baotailong's Needle Coke Capacity and Capacity Utilization, 2016-2021

Baotailong's Needle Coke Output, Sales and Inventory, 2018-2021

Baotailong's Needle Coke Revenue, Operating Cost and Gross Margin, 2021

Main Financial Data of Kaifeng Pingmei New Carbon Materials Technology, 2019-2021

Domestic Customers of Kaifeng Pingmei New Carbon Materials Technology

Needle Coke Performance Indicators of Anshan Zhongte New Material Technology

Development History of Anshan Zhongte New Material Technology's Needle Coke

Revenue and Net Income of Baowu Carbon, 2019-2021

Revenue of Baowu Carbon by Product, 2019-2021

Revenue of Baowu Carbon by Region, 2019-2021

Technical Indicators of Baowu Carbon's Coal-based Needle Coke

Technical Indicators of Baowu Carbon's Coke for Anode Materials

Needle Coke Capacity and Output of Baowu Carbon, 2019-2022

Asset Restructuring Progress of Baowu Carbon, 2020-2022

List of Fundraising Projects of Baowu Carbon, 2022

Typical Needle Coke Products of Bora Bioenergy

Milestones of Shandong Jingyang

Major Customers of Shandong Jingyang

Needle Coke Technical Index of Shandong Jingyang Technology Co., Ltd.

Sales Network of Shandong Jingyang

Revenue and Net Income of Risun Holdings, 2016-2021

Revenue Structure of Risun Holdings, 2021

Major Products' Production Volume of Risun Holdings, 2021

Technical Specifications of TSDR New Energy's Graphite Electrode

Schematic Diagram of TSDR New Energy's Needle Coke Technology

Schematic Diagram of TSDR New Energy's Ultra-high Power Graphite Electrode Technology

Equity Structure of Zhenxing Carbon

Technical Indicators of Zaozhuang Zhenxing Carbon Material Technology's Needle Coke (Green Coke)

Technical Indicators of Zaozhuang Zhenxing Carbon Material Technology's Needle Coke (Calcined Coke)

Needle Coke Capacity of Zaozhuang Zhenxing Carbon Material Technology, 2020-2024

Assets and Net Income of MaSteel Chemical

Needle Coke Performance Index of Shanxi Hongte

Sales Network of Hongte

Needle coke that features low resistivity and strong resistance to impact and oxidation has found broad application in ultra-high-power graphite electrodes, nuclear reactor moderating materials and lithium battery anode materials among others. In recent years, the boom of new energy vehicles and the increase of electric furnace equipment, a result of China government's greater efforts to make use of steel scraps have given a big boost to the demand for needle coke and the production. China's needle coke production capacity was expanded from 160 kt/a in 2014 to 2,180 kt/a in 2021, and the production multiplied from 80 kt in 2016 to 762 kt in 2021. The global and Chinese new energy vehicle industries will still gain momentum in the next five years. China's benign resource recycling policies will continue to expedite the development of electric furnace equipment. It is conceivable that China will produce 3,458 kt needle coke in 2027, sustaining CAGRs of 28.7% during 2021-2027.

Needle coke falls into coal-based and petroleum-based types. Needle coke made from petroleum residue is petroleum-based needle coke; that produced from coal tar pitch and fractions is coal-based needle coke. European and American producers concentrate on producing petroleum-based needle coke, while their Asian peers are engaged in coal-based needle coke. The constrained supply of raw materials brought about the rapid development of coal-based needle coke in China in recent years. In 2021, China's coal-based needle coke capacity reached 1,000kt/a, and the output was 261 kt; the petroleum-based needle coke capacity was 1,180 kt/a, and the output was 501 kt.

In terms of competitive landscape, global needle coke producers cluster in the US, Japan and China. Among them, Phillips 66, a spin-off from ConocoPhillips, is the world's largest producer of petroleum-based needle coke, with production capacity of about 450 kt/a; Shandong Yida New Material Co., Ltd. and Shandong Jingyang Technology Co., Ltd. have seen surging capacity in recent years, each with 180 kt/a, tied for the second largest needle coke producer in the world; Shanxi Hongte Coal Chemical Industry Co., Ltd. and Shandong Yiwei New Materials Co., Ltd. surpassed Nippon Steel Chemical (formerly C-Chem) and became the world's largest (joint) coal-based needle coke producer, with capacity of 150 kt/a. In addition to the above-mentioned producers, other Chinese players have also increased their investments in recent years. The capacity of Tangshan Dongri New Energy Materials Co., Ltd., Zaozhuang Zhenxing Carbon Material Technology Co., Ltd., and Kaifeng Pingmei New Carbon Materials Technology Co., Ltd. and more has increased significantly in recent years.

Needle coke, the main raw material for lithium battery anode materials, is greatly affected by the demand for lithium batteries. In 2020, the demand for needle coke for anode materials in China reached 190 kt, a figure projected to hit 1,900 kt in 2026.

“Global and China Needle Coke Industry Report, 2022-2027” highlights the following:

- Needle coke (definition, classification, main models, development history, etc.);

- Global needle coke industry (supply and demand, technology, competitive pattern, etc.);

- China needle coke industry (development environment, supply and demand, competitive pattern, import and export, etc.);

- Main downstream sectors (graphite electrode) of needle coke (production, demand, market pattern, etc.);

- 7 global and 16 Chinese needle coke producers (operation, revenue structure, needle coke business, etc.).

Table of Contents

1. Overview of Needle Coke

- 1.1 Product Introduction

- 1.2 Classification and Application

- 1.3 Industry Chain

2. Development of Global Needle Coke Industry

- 2.1 Overview

- 2.2 Supply & Demand

- 2.2.1 Supply

- 2.2.2 Demand

- 2.3 Technical Status

- 2.4 Market Pattern

- 2.4.1 USA

- 2.4.2 Japan

- 2.4.3 UK

3. Development of Needle Coke Industry in China

- 3.1 Development Environment

- 3.1.1 Policy Environment

- 3.1.2 Technical Environment

- 3.1.3 Trade Environment

- 3.2 Supply & Demand

- 3.2.1 Supply

- 3.2.2 Demand

- 3.3 Market Pattern

- 3.4 Import

- 3.4.1 Oil-based Needle Coke

- 3.4.2 Coal-based Needle Coke

- 3.5 Price Trend

4. China Graphite Electrode Industry Development

- 4.1 Supply & Demand

- 4.1.1 Overview

- 4.1.2 Supply

- 4.1.3 Demand

- 4.1.4 Import & Export

- 4.2 Competitive Landscape

- 4.2.1 Enterprise Competition

- 4.2.2 Regional Competition

- 4.3 Price Trend

- 4.4 Needle Coke Demand

5. China Lithium-ion Battery Anode Materials Market

- 5.1 Supply & Demand

- 5.1.1 Supply

- 5.1.2 Demand

- 5.2 Competitive Landscape

- 5.2.1 Enterprise Competition

- 5.2.2 Regional Competition

- 5.3 Price Trend

- 5.4 Needle Coke Demand

6. Major Needle Coke Companies Worldwide

- 6.1 Phillips 66

- 6.1.1 Profile

- 6.1.2 Operation

- 6.1.3 Needle Coke Business

- 6.2 Nippon Steel Chemical & Material (NSCM)

- 6.2.1 Profile

- 6.2.2 Needle Coke Business

- 6.3 GrafTech International

- 6.3.1 Profile

- 6.3.2 Operation

- 6.3.3 Needle Coke Business

- 6.4 Mitsubishi Chemical

- 6.4.1 Profile

- 6.4.2 Operation

- 6.4.3 Needle Coke Business

- 6.5 ENEOS

- 6.5.1 Profile

- 6.5.2 Operation

- 6.5.3 Needle Coke Business

- 6.6 Petrocokes Japan Limited

- 6.6.1 Profile

- 6.6.2 Needle Coke Business

- 6.7 Posco Chemtech

- 6.7.1 Profile

- 6.7.2 Operation

- 6.7.3 Needle Coke Business

7. Major Needle Coke Companies in China

- 7.1 Fangda Carbon New Material Technology Co., Ltd.

- 7.1.1 Profile

- 7.1.2 Operation

- 7.1.3 Revenue Structure

- 7.1.4 R&D

- 7.1.5 Needle Coke Business

- 7.2 Qitaihe Baotailong Coal&Coal Chemicals Public Co., Ltd.

- 7.2.1 Profile

- 7.2.2 Operation

- 7.2.3 Revenue Structure

- 7.2.4 Needle Coke Business

- 7.3 Shandong Yida New Material Co., Ltd.

- 7.3.1 Profile

- 7.3.2 Needle Coke Business

- 7.4 Kaifeng Pingmei New Carbon Materials Technology Co., Ltd.

- 7.4.1 Profile

- 7.4.2 Operation

- 7.4.3 Key Customers

- 7.4.3 Anshan Zhongte New Material Technology Co., Ltd.

- 7.4.4 Henan Shoucheng Technology New Material Co., Ltd.

- 7.5 Jinzhou Petrochemical Co., Ltd.

- 7.5.1 Profile

- 7.5.2 Needle Coke Business

- 7.6 Baowu Carbon

- 7.6.1 Profile

- 7.6.2 Operation

- 7.6.2 Needle Coke Business

- 7.6.4 Latest Developments

- 7.7 Bora Bioenergy

- 7.7.1 Profile

- 7.7.2 Needle Coke Business

- 7.8 Shandong Jingyang Technology Co., Ltd.

- 7.8.1 Profile

- 7.8.2 Needle Coke Business

- 7.8.3 Latest Developments

- 7.9 Risun Holdings

- 7.9.1 Profile

- 7.9.2 Operation

- 7.9.3 Revenue Structure

- 7.9.4 Pingdingshan Xuyang Xingyu New Materials Co., Ltd.

- 7.10 Henan Baoshun Fine Chemical Co., Ltd.

- 7.10.1 Profile

- 7.10.2 Needle Coke Business

- 7.11 TSDR New Energy Materials Co., Ltd.

- 7.11.1 Profile

- 7.11.2 Needle Coke Business

- 7.11.3 Main Process

- 7.12 Zaozhuang Zhenxing Carbon Material Technology Co., Ltd.

- 7.12.1 Profile

- 7.12.2 Needle Coke Business

- 7.13 Anhui MaSteel Chemical Energy Technology Co., Ltd.

- 7.13.1 Profile

- 7.13.2 Needle Coke Business

- 7.14 Shanxi Hongte Coal Chemical Industry Co., Ltd.

- 7.14.1 Profile

- 7.14.2 Needle Coke Business