|

|

市場調査レポート

商品コード

1275651

自動車用センサーチップ業界(2023年)Automotive Sensor Chip Industry Report, 2023 |

||||||

| 自動車用センサーチップ業界(2023年) |

|

出版日: 2023年05月09日

発行: ResearchInChina

ページ情報: 英文 360 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

センサーチップ業界調査:「知覚の比重を高める」路線で、センサーチップは急速な反復進化の新段階に突入しています.

2023年上海モーターショーでは、OEMやTier1サプライヤーの「more weight on perception, less weight on maps」、「urban NOA」、「BEV+Transformer」などが多く見られた大手メーカーは、都市型NOAのレイアウトを加速させ、HD地図への依存を解消するために、「知覚重視、地図軽視」の技術路線に舵を切ったことがわかりかます。

「知覚の比重を高める」技術路線に牽引され、自動車用センサーはより重要な役割を果たすようになりましたLiDAR、4Dイメージングレーダー、8MP CMOSイメージセンサー(CIS)などの新製品が急速に自動車に搭載され、センサーチップの需要を押し上げています。車載用センサーとチップの技術は、急速な反復進化と迅速なコスト削減という新しいステージに突入しています。

レーダーチップ:中国ベンダーが躍進し、海外独占を打破

自動車用レーダーチップ市場は、NXP、Infineon、TIなどの企業が独占しています。中国ベンダーの中でも、Calterah Semiconductorは、早くから自動車メーカー20社以上と提携し、70以上の乗用車モデルの指定プロジェクトで、合計300万個以上を出荷し、そのうち3分の1は海外顧客向けになっています。

4Dレーダーは、中・上級モデルや自律走行モデルにも急速に浸透しています。BMWやGMなどのOEM、ContinentalやZFなどのTier1サプライヤーは、この分野でのレイアウトを完成させました。李汽車、長安、BYD、テスラ、吉利などの中国ブランドは、4Dレーダーを指定したり、誕生させたりして適用しています。4Dイメージングレーダー「Phoenix」を搭載したテスラの次世代自律走行プラットフォーム「HW4.0」は、市場の転換点となっています。

従来のレーダーチップの分野では、InfineonとNXPがほぼ独占的な立場にあります。レーダーの主な開発方向として、4G画像レーダーは、都市のNOAなどの高度な自律走行機能によりよく対応することができます。中国メーカーも4Dレーダーチップのレイアウトを加速しています。

カルテラ:2022年12月、4Dイメージングレーダー機能を実現し、L3+自律走行の発展を促進する次世代新レーダーSoCファミリー「Andes」を発表しました。同シリーズは以下の主な特徴を持ちます:

- 22nmプロセスを採用した4T4R SoC

- DSP(デジタル・シグナル・プロセッサ)、RSP(レーダー・シグナル・プロセッサ)を含むマルチコアCPUを搭載

- RGMII/SMGII別ギガビット・イーサネット

- 柔軟なカスケード接続に対応

- ASIL-B & AEC-Q100 Grade 1の要件に従う

Muye Microelectronics:4Dレーダーのスタートアップで、4D高精度イメージングレーダーに特化しています。2022年12月、初の77Gレーダーチップの開発に成功、2023年3月、「1S0-26262 ASL-D機能安全認証」に合格、2023年4月、プレA資金ラウンドを終了して1億元を調達、チップ製品化、アルファ顧客への生産・配送に費やします。

LiDARチップ:SoC統合に向けて発展

2022年以降、はるかに多くのLiDARが自動車に使用され、中国では約16万4千台の乗用車にLiDARが搭載されています。LiDARはL2+++の乗用車(高速道路+都市部のNOA機能付き)に多く採用されており、そのほとんどは25万元以上のハイエンド新エネルギー車です。2026年には、中国の乗用車に366万6千個のLiDARが搭載されると推定されています。15万人乗りの乗用車にLiDARを搭載する場合、より大きなコストダウンが必要になりますこれは短期的には実現が難しいかもしれません。

2023年、LiDARの価格競争が始まり、出荷価格は500米ドル程度に低迷しているが、4Dレーダーの価格(200~300米ドル)に比べればまだ比較的高いSoCをベースに、LiDARはさらに集積化され、安価になっていくでしょう。

(1) トランシーバーチップとの統合

LiDARを自動車に広く普及させるためには、まずコスト管理が必要です。LiDARの開発ルートがメーカーごとに異なるため、コストに差が生じます。しかし、トランシーバーチップはコストの中心的な要素ですトランシーバーチップとの統合は、LiDARのコストを削減するための有効な手段です。

- トランスミッターチップ:ディスクリートモジュールを統合モジュールに置き換えることで、材料費とデバッグ費用を70%以上削減することができます;

- レシーバーチップ:SPADソリューションのサイズが小さいため、読み出し回路との統合が有利であり、さらにコストを削減することができます。

LiDARチップは海外メーカーが得意とする技術だが、近年は中国ベンダーも関連技術の開発に取り組んでいます。送信チップの場合、中国メーカーは上流のVCSELチップ設計に着手しています受信チップに関しては、中国の新興企業がSPADとSiPMチップに進出しており、中でもQuantaEyeとFortSenseはSPAD/SiPMの研究開発に力を注いでいます。

FortSense:2019年からSPAD LiDARチップの研究開発を展開し始めた2021年にテープアウトし、2022年9月に車載認証に合格しました。5社以上の自動車メーカーの指定LiDARサプライヤーに支持されています。2022年12月、C資金調達ラウンドを終了し、調達した資金はLiDARチップの開発に使用される予定です。

Hesai Technology:近年、LiDARチップの開発に力を注いでいます。Hesai Technologyは2018年からLiDAR SoCの開発を開始し、複数世代のチップ型トランシーバー(V1.0、V1.5、V2.0、V3.0など)を開発する戦略を立てています。ここで、V2.0については、CMOS技術の下で検出器と回路機能モジュールを統合するために、受信端をSiPMからSPADアレイにアップグレードし、V3.0アーキテクチャについては、VCSELエリアアレイ 促進要因チップとSPAD検出器に基づくエリアアレイSoCの開発を完了すると予想されます。

Hesaiの長距離半固体LiDAR AT128:自社開発の車載用チップを搭載しています。チップベースのソリッドステート電子スキャンのための128のスキャンチャンネルを1つの回路基板に統合しています。

ヘサイの新世代全固体ギャップフィラーレーダーFT120:1つのチップに数万個のレーザー受信チャンネルからなるエリアアレイを集積し、チップ内を完全にレーザー発光・受信します。従来のLiDARよりはるかに少ない部品点数で、ATファミリーに比べてコストパフォーマンスに優れています。

(2) シングルチップLiDARソリューション

LiDARのコストダウンには、様々な光電子デバイスを統合するフォトニックインテグレーションプロセスを利用する必要があります異種材料統合からシングルチップ統合へと進化しています。このプロセスは、準備したシリコンウエハを単結晶シリコン基板にスロットインし、単結晶シリコン基板上にIII-V族材料をエピタキシヤルで成長するプロセス難易度は高いが、このプロセスには、低損失、パッケージングの容易さ、高信頼性、高集積化といったメリットがあります。

2023年初頭、Mobileye社は次世代FMCW LiDARのデモを初めて行っています。正確には、波長1320nmのLiDAR SoCです。インテルのチップ型シリコンフォトニクスプロセスをベースに、距離と速度を同時に計測できる製品です。

チップベースのシリコンフォトニクスFMCW固体LiDAR技術ルートは、FMCW、固体分散走査、シリコンフォトニクスなどの主要技術を含む、将来のLiDAR開発における好ましい方向となる可能性があります。新しい技術ルートとして、FMCW LiDARはまだ多くの技術的課題を抱えていますMobileye、Aeva、Auroraといった海外メーカーのほか、Inxuntech、LuminWaveといった中国ベンダーも導入しています。

ビジョンセンサーチップ:各社が8MPの製品を並べる競争

車載カメラのハードウェアには、レンズ、CIS、画像信号処理装置(ISP)が含まれます。そのため、参入障壁の高い車載用CISは、オン・セミコンダクター、オムニビジョン、ソニーなどの寡占的な市場となっています。今後、製品の高画素化、HDR(High Dynamic Range)化が進むと思われます従来のISPだけでなく、現在のISP統合ソリューションでは、CISやSOCにISPを統合しています。

CISは高画素化に向けて発展

高度な自律走行の実現に伴い、車載カメラの高画質化が求められています。一般的に、カメラの画素数が高いほど、画質は向上し、自動車メーカーや自律走行プロバイダーはより有益な情報を得ることができます。8MPカメラの車載化が加速します2023年初頭に発売されたXpeng P7iは、インテリジェント運転支援ソリューション用に8MPカメラを搭載しています。

フロントビューは、8MP高解像度カメラの必要性が最も高いアプリケーションシナリオです。現在、主要な自動車用CISサプライヤーは、8MP CIS製品の展開に成功しています。

SmartSens:2022年11月にSC850ATを発表しました。このセンサー製品は8.3MP解像度をサポートし、SmartSens SmartClarity?-2革新的なイメージング技術アーキテクチャとアップグレードされた自社開発のRawドメインアルゴリズムを採用し、画像の詳細を効果的に保護し、全体の画像効果を向上させることができます。Staggered HDRに加え、SmartSens独自のPixGain HDR?技術をサポートし、140dBのHDRを実現し、より正確な画像情報を取得できるため、複雑な照明条件下でも明るさや暗さの詳細を正確に捉える能力を確保します。

なお、このチップの量産は2023年第2四半期に予定されています。

ISP:統合に向けて進化

ISPソリューションには、独立型と統合型の2種類があります。独立型ISPは強力だがコストが高く、統合型ISPは低コスト、小面積、低消費電力というメリットがあるが、処理能力は比較的弱いというところです。近年、大手ベンダーは、ISP内蔵CISに加え、ISP内蔵SOCを精力的に展開しています。

ISP統合型CIS:ISPをCISに統合することで、省スペースと消費電力削減の目的を達成することができます。主に一部のCISのリーダーが関連ソリューションを導入しています。2023年1月、オムニビジョンは車載用360度サラウンドビューシステム(SVS)とリアビューカメラ(RVC)向けの新しい130万画素(MP)OX01E20システムオンチップ(SoC)を発表しました。OX01E20は、LEDフリッカーミティゲーション(LFM)と140dbハイダイナミックレンジ(HDR)機能を搭載した最高級の製品です。3ミクロンイメージセンサー、先進の画像信号処理プロセッサ(ISP)、フル機能の歪み補正/遠近補正(DC/PC)、オンスクリーンディスプレイ(OSD)を備えています。

ISP統合SOC:ISPをCISから外し、自律走行用のメイン制御SoCに直接統合する方法は、知覚ハードウェアのコストを大幅に削減することができ、カメラからISPを外すことは、高画素カメラによる放熱の深刻な問題を解決するだけでなく、車載カメラの回路基板サイズと消費電力の一層の削減に貢献しますほぼすべての自律走行領域制御SoCは、ISPモジュールを統合しています。

" 車載用センサーチップ産業レポート、2023年 "は、以下の点を強調しています:

- 自動車用センサーチップ産業(概要、産業政策・規格の策定、市場規模など);

- 車載用センサーチップ業界の主要セグメント(車載用カメラチップ、レーダーチップ、LiDARチップなど)(製品構造、技術動向、市場規模、市場パターン、など)

- 主な車載用レーダーチップのサプライヤー(製品ラインのレイアウト、主要製品の性能、新製品の開発、製品の応用など);

- 主な車載用LiDARチップのサプライヤー(製品ラインのレイアウト、主要製品の性能、新製品の開発、製品アプリケーションなど);

- 主な車載用ビジョンセンサーチップサプライヤー(製品ラインアップ、主要製品の性能、新製品開発、製品アプリケーションなど)

当レポートでは、自動車用センサーチップ業界について調査分析し、市場規模と予測、技術動向、主なサプライヤーのプロファイルなどを提供しています。

目次

第1章 自動運転向けセンサーチップ業界の概要

- 自動車用自動運転センサーチップの概要

- 産業政策と規格

第2章 レーダーチップ業界

- レーダー業界の概要

- レーダーの構造

- レーダーチップの応用動向

- 4Dレーダーチップの応用動向

- レーダーチップの市場規模とパターン

第3章 LiDARチップ業界

- LiDAR業界の概要

- LiDAR製品とコスト構造

- LiDARチップの技術動向

- LiDARチップの市場規模とパターン

第4章 ビジョンセンサーチップ業界

- 自動車用カメラ業界の概要

- ビジョンチップ

- 自動車用カメラCISチップ

- 自動車用カメラISP

第5章 レーダーチップのサプライヤー

- Infineon

- NXP

- STMicroelectronics

- TI

- ADI

- Vayyar

- Uhnder

- Arbe

- Calterah Semiconductor

- Andar Technologies

- SGR Semiconductors

- Runchip

- その他

第6章 LiDARチップのサプライヤー

- LeddarTech

- Ouster

- Lumentum

- Mobileye

- Lumotive

- LuminWave

- visionICs

- Xilight

- ABAX Sensing

- Vertilite

- Hesai Technology

- China Science Photon Chip

- Fortsense

- DAO Sensing

- その他

第7章 ビジョンセンサーチップのサプライヤー

- ON Semiconductor

- Samsung Electronics

- Sony

- NXP

- Nextchip

- OmniVision Technology

- SmartSens

- GalaxyCore

- Metoak

- Rockchip

- Fullhan Microelectronics

- その他

Sensor chip industry research: driven by the "more weight on perception" route, sensor chips are entering a new stage of rapid iterative evolution.

At the Auto Shanghai 2023, "more weight on perception, less weight on maps", "urban NOA", and "BEV+Transformer" abounded of OEMs and Tier 1 suppliers. It can be seen that major manufacturers have turned to the technology route of "more weight on perception, less weight maps", to speed up their layout of urban NOA and break their dependence on HD maps.

Driven by the "more weight on perception" technology route, automotive sensors play a more important role. New products like LiDAR, 4D imaging radar, and 8MP CMOS image sensor (CIS) are quickly applied in vehicles, pushing up the demand for sensor chips. Automotive sensor and chip technologies are entering a new stage of rapid iterative evolution and fast cost reduction.

Radar chip: Chinese vendors have made breakthroughs and broken overseas monopoly.

The automotive radar chip market is dominated by such companies as NXP, Infineon, and TI; among Chinese vendors, Calterah Semiconductor as an early starter has forged partnerships with more than 20 automotive OEMs, on designated projects for over 70 passenger car models, and has shipped a total of over 3 million pieces, one third of which were to overseas customers.

4D radars rapidly penetrate into mid- and high-end models and autonomous models. OEMs such as BMW and GM, and Tier 1 suppliers like Continental and ZF have completed the layout in this field. Quite a few Chinese brands including Li Auto, Changan, BYD, Tesla and Geely have designated or spawned and applied 4D radars. HW4.0, Tesla's next-generation autonomous driving platform equipped with a "Phoenix" 4D imaging radar, has become a tipping point in market.

In the field of conventional radar chips, Infineon and NXP are almost in a monopoly position. As the main development direction of radars, 4G imaging radars can better serve advanced autonomous driving functions such as urban NOA. Chinese manufacturers are also expediting layout of 4D radar chips.

Calterah: in December 2022, announced Andes, its next-generation new radar SoC family that enables 4D imaging radar functions and promotes the development of L3+ autonomous driving, with the following key features:

- 4T4R SoC using 22nm process

- Multi-core CPU, including DSP (digital signal processor) and RSP (radar signal processor)

- Gigabit Ethernet with RGMII/SGMII

- Support for flexible cascading

- Subject to ASIL-B & AEC-Q100 Grade 1 requirements

Muye Microelectronics: a 4D radar start-up specializes in 4D high-precision imaging radars. In December 2022, it successfully developed the first 77G radar chip; in March 2023, passed the "1S0-26262 ASL-D functional safety certification"; in April 2023, closed the Pre-A funding round and raised RMB100 million, which is spent for chip productization, and production and delivery to Alpha customers.

LiDAR chip: develop towards SoC integration.

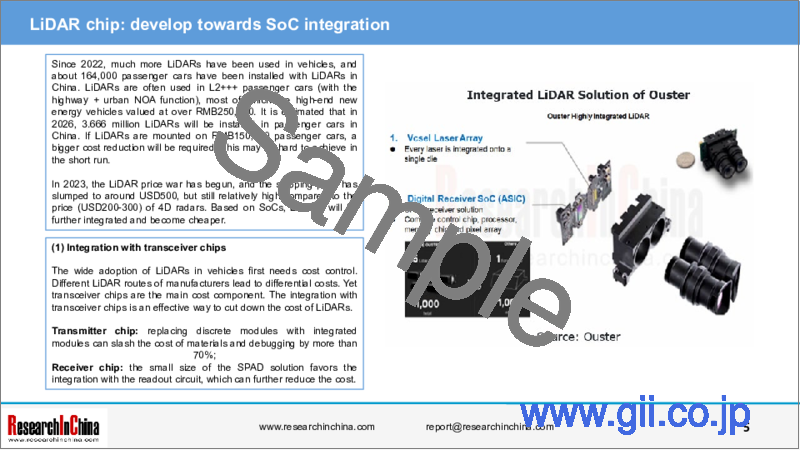

Since 2022, much more LiDARs have been used in vehicles, and about 164,000 passenger cars have been installed with LiDARs in China. LiDARs are often used in L2+++ passenger cars (with the highway + urban NOA function), most of which are high-end new energy vehicles valued at over RMB250,000. It is estimated that in 2026, 3.666 million LiDARs will be installed in passenger cars in China. If LiDARs are mounted on RMB150,000 passenger cars, a bigger cost reduction will be required. This may be hard to achieve in the short run.

In 2023, the LiDAR price war has begun, and the shipping price has slumped to around USD500, but still relatively high compared to the price (USD200-300) of 4D radars. Based on SoCs, LiDARs will be further integrated and become cheaper.

(1) Integration with transceiver chips

The wide adoption of LiDARs in vehicles first needs cost control. Different LiDAR routes of manufacturers lead to differential costs. Yet transceiver chips are the main cost component. The integration with transceiver chips is an effective way to cut down the cost of LiDARs.

- Transmitter chip: replacing discrete modules with integrated modules can slash the cost of materials and debugging by more than 70%;

- Receiver chip: the small size of the SPAD solution favors the integration with the readout circuit, which can further reduce the cost.

LiDAR chip technique is mastered by foreign manufacturers, but Chinese vendors have also worked to develop related technologies in recent years. In the case of transmitter chips, Chinese manufacturers have begun to step into upstream VCSEL chip design; as concerns receiver chips, Chinese start-ups march into SPAD and SiPM chips, among which QuantaEye and FortSense concentrate their efforts on SPAD/SiPM R&D.

FortSense: it has started deploying SPAD LiDAR chip R&D from 2019. It taped out in 2021, and passed automotive certification in September 2022. It has been favored by designated LiDAR suppliers of over 5 automakers. In December 2022, it closed the C funding round, with the raised funds to be used to develop LiDAR chips.

Hesai Technology: in recent years, it has been committed to developing LiDAR chips. Hesai Technology has started developing LiDAR SoCs since 2018, and has made the strategy for developing multiple generations of chip-based transceivers (V1.0, V1.5, V2.0, V3.0, etc.). Wherein, for V2.0, the receiving end is upgraded from SiPM to SPAD array for integration of detectors and circuit function modules under the CMOS technology; as for the V3.0 architecture, it is expected to complete the development of the VCSEL area array driver chip and the area array SoC based on SPAD detector.

Hesai's long-range semi-solid-state LiDAR AT128: it is equipped with a self-developed automotive chip. A single circuit board integrates 128 scanning channels for chip-based solid-state electronic scanning.

Hesai's new-generation all-solid-state gap filler radar FT120: a single chip integrates an area array composed of tens of thousands of laser receiving channels for laser emission and reception completely through the chip. With much fewer components than conventional LiDARs, it is more cost-effective than the AT family.

(2) Single-chip LiDAR solution

LiDAR cost reduction needs to use the photonic integration process to integrate various optoelectronic devices, which is evolving from heterogeneous materials integration to single-chip integration, a process to slot the prepared silicon wafer to the monocrystalline silicon substrate, and then grow the group III-V materials on the monocrystalline silicon substrate in an epitaxial way. Despite high difficulty, the process offers benefits of low loss, easy to package, high reliability, and high integration.

In early 2023, Mobileye demonstrated its next-generation FMCW LiDAR for the first time. To be precise, it is a LiDAR SoC with a wavelength of 1320nm. Based on Intel's chip-level silicon photonics process, this product can measure distance and speed at the same time.

The chip-based silicon photonics FMCW solid-state LiDAR technology route may become a preferred direction in future LiDAR development, involving such key technologies as FMCW, solid-state dispersion scanning and silicon photonics. As a new technology route, FMCW LiDAR still poses a lot of technical challenges. In addition to foreign manufacturers like Mobileye, Aeva and Aurora, Chinese vendors such as Inxuntech and LuminWave have also made deployments.

Vision sensor chips: giants race to lay out 8MP products.

Automotive camera hardware includes lens, CIS and image signal processor (ISP). Thereof, automotive CIS with a high entry threshold is an oligopolistic market in which dominant competitors include ON Semiconductor, OmniVision and Sony. In the future the products will tend to have high pixel and high dynamic range (HDR). As well as conventional ISPs, the current ISP integrated solutions also integrate ISP into CIS or SOC.

CIS develops towards high pixel.

The development of high-level autonomous driving requires increasingly high imaging quality of automotive cameras. Generally speaking, the higher the pixel of cameras, the better the imaging quality and the more useful information automakers/autonomous driving providers can get. The pace of using 8MP cameras in vehicles quickens. Xpeng P7i launched in early 2023 packs an 8MP camera for intelligent driving assistance solutions.

Front view is the application scenario with the most urgent need for 8MP high-resolution cameras. Currently, mainstream automotive CIS suppliers have successfully deployed 8MP CIS products.

SmartSens: it announced SC850AT in November 2022. This sensor product supports 8.3MP resolution, and adopts SmartSens SmartClarity®-2 innovative imaging technology architecture and the upgraded self-developed Raw domain algorithms that can effectively protect image details and improve overall image effects. In addition to Staggered HDR, it also supports SmartSens' unique PixGain HDR® technology to achieve 140dB HDR, and can capture more accurate image information, ensuring its ability to accurately capture details in brightness and darkness in complex lighting conditions.

The volume production of the chip is scheduled in the second quarter of 2023.

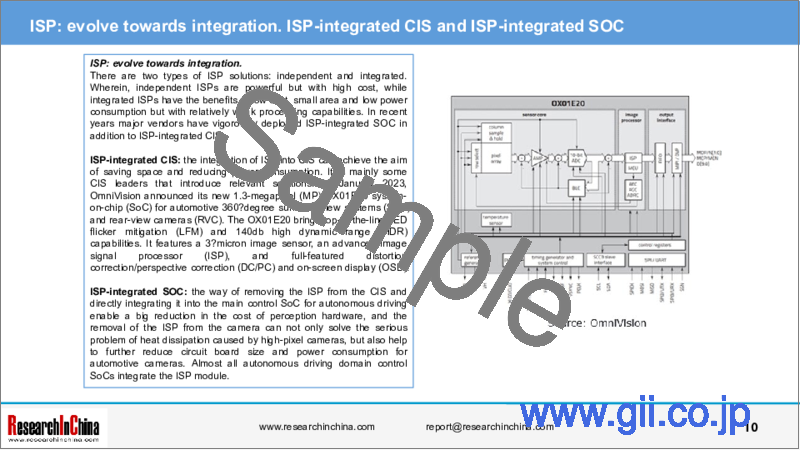

ISP: evolve towards integration.

There are two types of ISP solutions: independent and integrated. Wherein, independent ISPs are powerful but with high cost, while integrated ISPs have the benefits of low cost, small area and low power consumption but with relatively weak processing capabilities. In recent years major vendors have vigorously deployed ISP-integrated SOC in addition to ISP-integrated CIS.

ISP-integrated CIS: the integration of ISP into CIS can achieve the aim of saving space and reducing power consumption. It is mainly some CIS leaders that introduce relevant solutions. In January 2023, OmniVision announced its new 1.3-megapixel (MP) OX01E20 system-on-chip (SoC) for automotive 360-degree surround view systems (SVS) and rear-view cameras (RVC). The OX01E20 brings top-of-the-line LED flicker mitigation (LFM) and 140db high dynamic range (HDR) capabilities. It features a 3-micron image sensor, an advanced image signal processor (ISP), and full-featured distortion correction/perspective correction (DC/PC) and on-screen display (OSD).

ISP-integrated SOC: the way of removing the ISP from the CIS and directly integrating it into the main control SoC for autonomous driving enable a big reduction in the cost of perception hardware, and the removal of the ISP from the camera can not only solve the serious problem of heat dissipation caused by high-pixel cameras, but also help to further reduce circuit board size and power consumption for automotive cameras. Almost all autonomous driving domain control SoCs integrate the ISP module.

“ Automotive Sensor Chip Industry Report, 2023” highlights the following:

- Automotive sensor chip industry (overview, formulation of industrial policies and standards, market size, etc.);

- Main automotive sensor chip industry segments (automotive camera chip, radar chip, LiDAR chip, etc.) (product structure, technology trends, market size, market pattern, etc.)

- Main automotive radar chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

- Main automotive LiDAR chip suppliers (product line layout, performance of main products, development of new products, product application, etc.);

- Main automotive vision sensor chip suppliers (product line layout, performance of main products, development of new products, product application, etc.).

Table of Contents

1 Overview of Autonomous Driving Sensor Chip Industry

- 1.1 Overview of Automotive Autonomous Driving Sensor Chips

- 1.1.1 Types of Autonomous Driving Sensor Chips

- 1.1.2 Process of Applying Autonomous Driving Sensor Chips in Vehicles

- 1.1.3 Installation Scale of Autonomous Driving Sensor Chips in Vehicles

- 1.2 Industrial Policies and Standards

- 1.2.1 The Latest Standard Dynamics during 2022-2023: "Guidelines for the Construction of the National Automotive Chip Standard System (2023)" (1)

- 1.2.2 The Latest Standard Dynamics during 2022-2023: "Guidelines for the Construction of the National Automotive Chip Standard System (2023)" (2)

- 1.2.3 Certification Thresholds for Automotive Chips

2 Radar Chip Industry

- 2.1 Overview of Radar Industry

- 2.1.1 Workflow of Automotive Radar

- 2.1.2 Implementation Mode 1 of Radars in Vehicles: OEMs That Rely on External Integration Continue Their Close Coupling Relationships with Chip Vendors

- 2.1.3 Implementation Mode 2 of Radars in Vehicles: Mighty Automakers Directly Procure Hardware and Outsource the Assembly

- 2.1.4 Major OEMs in Automotive Radar Industry Chain (1)

- 2.1.5 Major OEMs in Automotive Radar Industry Chain (2)

- 2.2 Radar Structure

- 2.2.1 Structure Diagram of Automotive Radar

- 2.2.2 Cost Structure of Automotive Radar

- 2.2.3 Price of Automotive Radar Chip (MICC)

- 2.2.4 Autonomous Driving Sensor Chip Industry Chain: Radar Chip

- 2.3 Application Trends of Radar Chips

- 2.3.1 Intelligent Driving Market Provides A Big Boost to the Demand for Radars and Chips

- 2.3.2 Technical Requirements for Radar Chips: High Precision, High Power, High Sensitivity

- 2.3.3 Development Directions of Automotive Radar Chips

- 2.3.4 Development Direction 1 of Automotive Radar Chips: Chip Integration

- 2.3.5 Development Direction 2 of Automotive Radar Chips: Policies Facilitate the Development of High-frequency Radar Chips

- 2.3.6 Development Direction 3 of Automotive Radar Chips: 4D radar

- 2.3.7 Development Direction 4 of Automotive Radar Chips: Production Process Upgrade (1)

- 2.3.8 Development Direction 4 of Automotive Radar Chips: Production Process Upgrade (2)

- 2.4 Application Trends of 4D Radar Chips

- 2.4.1 Automotive 4D Radar Chip Technology Route

- 2.4.2 Automotive 4D Radar Chip Packaging and Testing Schemes

- 2.4.3 Technology Trends of Automotive 4D Radar Chips

- 2.4.4 4D Radar Chip Installation Scheme 1: Cascading (1)

- 2.4.5 4D Radar Chip Installation Scheme 1: Cascading (2)

- 2.4.6 4D Radar Chip Installation Scheme 2: Single-chip Integration

- 2.4.7 4D Radar Chip Installation Scheme 3: Software Algorithm Support

- 2.4.8 Comparison between 4D Radar Chip Installation Schemes

- 2.4.9 Mainstream Automotive 4D Radar Chip Suppliers (1)

- 2.4.10 Mainstream Automotive 4D Radar Chip Suppliers (2)

- 2.4.11 Mainstream Automotive 4D Radar Chip Suppliers (3)

- 2.5 Radar Chip Market Size and Pattern

- 2.5.1 China's Demand for Passenger Car Radars, 2021-2026E

- 2.5.2 China's Passenger Car Radar Chip Market Size, 2021-2026E

- 2.5.3 China's Passenger Car Radar Chip Market Size, 2021-2026E - Attached Table (1)

- 2.5.4 China's Passenger Car Radar Chip Market Size, 2021-2026E - Attached Table (2)

- 2.5.5 Automotive Radar Chip Market Structure

- 2.5.6 Automotive Radar Chip Market Structure: Suppliers Accelerate the Pace of Localization

- 2.5.7 Automotive Radar Chip Market Structure: Chinese Suppliers (1)

- 2.5.8 Automotive Radar Chip Market Structure: Chinese Suppliers (2)

3 LiDAR Chip Industry

- 3.1 Overview of LiDAR Industry

- 3.1.1 Workflow of LiDAR

- 3.1.2 LiDAR Industry Chain

- 3.1.3 LiDAR OEM Model

- 3.1.4 LiDAR OEM: MEMS Galvanometer OEM

- 3.1.5 Major OEMs in LiDAR Industry Chain (1)

- 3.1.6 Major OEMs in LiDAR Industry Chain (2)

- 3.2 LiDAR Products and Cost Structure

- 3.2.1 Structure Diagram of Automotive LiDAR

- 3.2.2 Main Components of Automotive LiDAR (1)

- 3.2.3 Main Components of Automotive LiDAR (2)

- 3.2.4 Major Players in LiDAR Transmitter VCSEL Chip Market

- 3.2.5 Major Players in LiDAR Receiver SPAD/SiPM Chip Market

- 3.2.6 Cost Structure of Automotive LiDAR

- 3.2.7 Automotive LiDAR Chip Industry Chain

- 3.3 Technology Trends of LiDAR Chips

- 3.3.1 LiDAR Development Technology Route

- 3.3.2 Development Directions of LiDAR Chips

- 3.3.3 LiDAR Transmitter Chip Technology Trend 1: Develop from EEL to VCSEL Chip

- 3.3.4 LiDAR Transmitter Chip Technology Trend 2: 905nm Is Favored again Due to Its Cost Advantage (1)

- 3.3.5 LiDAR Transmitter Chip Technology Trend 2: 905nm Is Favored again Due to Its Cost Advantage (2)

- 3.3.6 LiDAR Transmitter Chip Technology Trend 3: FMCW Ranging Method Rises Rapidly (1)

- 3.3.7 LiDAR Transmitter Chip Technology Trend 3: FMCW Ranging Method Rises Rapidly (2)

- 3.3.8 LiDAR Receiver Chip Technology Trends: SPAD/SiPM Can Replace APD in the Future (1)

- 3.3.9 LiDAR Receiver Chip Technology Trends: SPAD/SiPM Can Replace APD in the Future (2)

- 3.3.10 LiDAR Development Trend 1: Integration with Transceiver Chip Favors Cost Reduction (1)

- 3.3.11 LiDAR Development Trend 1: Integration with Transceiver Chip Favors Cost Reduction (2)

- 3.3.12 LiDAR Development Trend 1: Integration with Transceiver Chip Favors Cost Reduction (3)

- 3.3.13 LiDAR Development Trend 2: Single-chip Silicon Photonics Integration (1)

- 3.3.14 LiDAR Development Trend 2: Single-chip Silicon Photonics Integration (2)

- 3.3.15 LiDAR Development Trend 2: Single-chip Silicon Photonics Integration (3)

- 3.3.16 Single-chip LiDAR Layout Case 1 of Suppliers: Hesai Technology

- 3.3.17 Single-chip LiDAR Layout Case 2 of Suppliers: Ouster

- 3.4 LiDAR Chip Market Size and Pattern

- 3.4.1 China's Demand for Passenger Car LiDARs, 2021-2026E

- 3.4.2 China's Passenger Car LiDAR Chip Market Size, 2021-2026E

- 3.4.3 China's Passenger Car LiDAR Chip Market Size, 2021-2026E - Attached Table (2)

- 3.4.4 Competitive Pattern of LiDAR Chip Market

- 3.4.5 Mainstream Automotive LiDAR Chip Suppliers (1)

- 3.4.6 Mainstream Automotive LiDAR Chip Suppliers (2)

- 3.4.7 Layout of Chinese Suppliers in Laser Sensor Chips: Stepping into the Upstream End of VCSEL Chips

- 3.4.8 Layout of Chinese Suppliers in Laser Sensor Chips: Marching into SPAD and SiPM Chips

4 Vision Sensor Chip Industry

- 4.1 Overview of Automotive Camera Industry

- 4.1.1 Structure of Automotive Camera

- 4.1.2 Implementation Mode of Cameras in Vehicles

- 4.1.3 Major OEMs in Automotive Camera Industry Chain (1)

- 4.1.4 Major OEMs in Automotive Camera Industry Chain (2)

- 4.1.5 Autonomous Driving Sensor Chip Industry Chain: Types of

- Vision Chips

- 4.1.6 Cost Structure of Automotive Camera

- 4.1.7 China's Demand for Passenger Car Cameras, 2021-2026E

- 4.1.8 China's Passenger Car Camera Chipset Market Size, 2021-2026E

- 4.1.9 China's Passenger Car Camera Chipset Market Size, 2021-2026E - Attached Table (1)

- 4.1.10 China's Passenger Car Camera Chipset Market Size, 2021-2026E - Attached Table (2)

- 4.2 Automotive Camera CIS Chip

- 4.2.1 Demand for Automotive Camera CIS Keeps Increasing

- 4.2.2 Automotive CIS Shipment Structure

- 4.2.3 Automotive CIS Market Features High Entry Threshold and Oligarchic Competition

- 4.2.4 Automotive CIS Market Pattern (1)

- 4.2.5 Automotive CIS Market Pattern (2)

- 4.2.6 Automotive CIS Market Pattern (3)

- 4.2.7 Automotive CIS Market Pattern: Chinese Manufacturers Accelerate Product Layout

- 4.2.8 Comparison between Main Automotive CIS Products

- 4.2.9 Development Directions of Automotive CIS Technology

- 4.2.10 Development Direction 1 of Automotive CIS Technology: Higher Resolution (1)

- 4.2.11 Development Direction 1 of Automotive CIS Technology: Higher Resolution (2)

- 4.2.12 Development Direction 2 of Automotive CIS Technology: Higher Dynamic Range

- 4.3 Automotive Camera ISP

- 4.3.1 Automotive ISP Fusion Modes

- 4.3.2 Competition Pattern of Automotive ISP Market

- 4.3.3 Development Directions of Automotive ISP

- 4.3.4 Development Direction 1 of Automotive ISP: Introduction of AI Algorithms

- 4.3.5 Development Direction 2 of Automotive ISP: Integration of ISP into SoC

- 4.3.6 Case 1 of Automotive ISP Integrated into Autonomous Driving SOC: TI

- 4.3.7 Case 2 of Automotive ISP Integrated into Autonomous Driving SOC: Mobileye

- 4.3.8 Case 3 of Automotive ISP Integrated into Autonomous Driving SOC: Black Sesame Technologies

- 4.3.9 Case 4 of Automotive ISP Integrated into Autonomous Driving SOC: Horizon Robotics

- 4.3.10 Case 5 of Automotive ISP Integrated into Autonomous Driving SOC: Ambarella

5 Radar Chip Suppliers

- 5.1 Infineon

- 5.1.1 Autonomous Driving Sensor Chip Product Line

- 5.1.2 Radar Chips

- 5.1.3 24GHz Radar Chips: BGT24XX Series (1)

- 5.1.4 24GHz Radar Chips: BGT24XX Series (2)

- 5.1.5 77GHz Radar Chips

- 5.1.6 77GHz Radar Microcontroller

- 5.2 NXP

- 5.2.1 Autonomous Driving Sensor Chip Product Line

- 5.2.2 Radar Chip Business

- 5.2.3 4D Imaging Radar Chip: S32R45

- 5.2.4 77GHz Radar Transceiver Chips: TEF82xx

- 5.2.5 77GHz Radar Transceiver Chips: TEF810X

- 5.2.6 77GHz Radar Transceiver Chips: MR3003

- 5.2.7 Radar Solutions

- 5.2.8 Application of Autonomous Driving Sensor Chips: Continental's 4-cascade Radar

- 5.3 STMicroelectronics

- 5.3.1 Autonomous Driving Sensor Chip Product Line

- 5.3.2 24GHz Radar Chips

- 5.3.3 77GHz Radar Chip: STRADA770M

- 5.4 TI

- 5.4.1 Autonomous Driving Sensor Chip Product Line (1)

- 5.4.2 Autonomous Driving Sensor Chip Product Line (2)

- 5.4.3 Radar Chip System

- 5.4.4 Parameters of Radar Chips

- 5.4.5 77GHz Radar Chips: AWR1243

- 4.5.6 77GHz Radar Chips: AWR2243

- 5.4.7 77GHz Radar Chips: AWR2944

- 5.4.8 Integrated Radar Chip: AWR1843AoP

- 5.5 ADI

- 5.5.1 Autonomous Driving Sensor Chip Product Line

- 5.5.2 24GHz Radar Chips

- 5.5.3 Intelligent Transportation Solution Based on 24GHz Radar Demonstration Platform

- 5.6 Vayyar

- 5.6.1 Autonomous Driving Sensor Chip Product Line

- 5.6.2 Comparison between Radar Products and Alternative Products

- 5.6.3 Radar SOC

- 5.6.4 4D Radars and Chips

- 5.6.5 60GHz Radar Chips

- 5.7 Uhnder

- 5.7.1 Imaging Radar Chips

- 5.7.2 Application of Radar Chips

- 5.8 Arbe

- 5.8.1 Imaging Radar Chipset Solutions (1)

- 5.8.2 Imaging Radar Chipset Solutions (2)

- 5.8.3 Imaging Radar Chipset Application 1: In-house Phoenix Perception Radar

- 5.8.4 Imaging Radar Chipset Application 2: In-house Lynx Surround Imaging Radar

- 5.8.5 Imaging Radar Chipset Application 3: In-house 360° Surround Radar

- 5.8.6 Imaging Radar Chipset Application 4: Cooperation (1)

- 5.8.7 Imaging Radar Chipset Application 4: Cooperation (2)

- 5.9 Calterah Semiconductor

- 5.9.1 Profile

- 5.9.2 Platformization and Serialization of Radar Chips Have Been Realized

- 5.9.3 Automotive Radar Chip Product Line

- 5.9.4 Radar Chip Products: Alps-Pro Series

- 5.9.5 Radar Chip Products: Andes Series

- 5.9.6 Radar Chip Products: ALPS Series

- 5.9.7 Radar Chip Products: Alps-Mini Series

- 5.9.8 Application Scenarios of Radar Chips

- 5.10 Andar Technologies

- 5.10.1 Profile

- 5.10.2 77/79GHz Radar Chips: ADT2011

- 5.10.3 77/79GHz Radar Chips: ADT2001

- 5.10.4 77/79GHz Radar Chips: ADT3102

- 5.10.5 77/79GHz Radar Chips: ADT3101

- 5.11 SGR Semiconductors

- 5.11.1 Profile

- 5.11.2 24GHz Automotive Radar Chip Products

- 5.11.3 Application of Radar Chips

- 5.12 Runchip

- 5.12.1 77GHz Radar Chips

- 5.12.2 Domestic Radar Chip Localization Capability

- 5.13 Others

- 5.13.1 76-81GHz Radar Chips of Radaric (Beijing) Technology

- 5.13.2 77GHz Radar Chips of Citta Microelectronics

6 LiDAR Chip Suppliers

- 6.1 LeddarTech

- 6.1.1 Profile

- 6.1.2 Global Network

- 6.1.3 Automotive LiDAR Technology (1)

- 6.1.4 Automotive LiDAR Technology (2)

- 6.1.5 LeddarCore SoCs: LCA2 & LCA3

- 6.1.6 Products (1): Vu8 Solid State LiDAR Module

- 6.1.7 Products (2): M16 Solid State LiDAR Module

- 6.1.8 Products (3): LeddarVision & LeddarSteer

- 6.1.9 Cooperation Mode

- 6.1.10 Partners

- 6.1.11 Partners

- 6.2 Ouster

- 6.2.1 Profile

- 6.2.2 LiDAR Chip Products (1)

- 6.2.3 LiDAR Chip Products (2)

- 6.3 Lumentum

- 6.3.1 Automotive Business Layout

- 6.3.2 LiDAR Chips

- 6.4 Mobileye

- 6.4.1 LiDAR Chip Layout

- 6.4.2 Benefit from Intel's Silicon Photonics Manufacturing Technology

- 6.5 Lumotive

- 6.5.1 Profile

- 6.5.2 LiDAR Chip Technology

- 6.6 LuminWave

- 6.6.1 LiDAR Chip Technology

- 6.6.2 LiDAR Chip Technology Upgrade

- 6.7 visionICs

- 6.7.1 Profile

- 6.7.2 Autonomous Driving Sensor Chip Product Line

- 6.7.3 Main LiDAR Chip Products (1)

- 6.7.4 Main LiDAR Chip Products (2)

- 6.8 Xilight

- 6.8.1 Profile

- 6.8.2 Autonomous Driving Sensor Chip Product Line

- 6.8.3 Main LiDAR Chip Products (1): Detection Chip

- 6.8.4 Main LiDAR Chip Products (2): Signal Receiving SiPM Chip

- 6.8.5 Main LiDAR Chip Products (3): Digital Conversion Chip - XTD50

- 6.8.6 Product R&D Dynamics

- 6.9 ABAX Sensing

- 6.9.1 Profile

- 6.9.2 LiDAR Chips

- 6.9.3 Parameters of LiDAR Products

- 6.9.4 Development Dynamics

- 6.10 Vertilite

- 6.10.1 Profile

- 6.10.2 LiDAR Chips: CAC940K010

- 6.10.3 LiDAR Chips: CAC940F005

- 6.11 Hesai Technology

- 6.11.1 Self-developed Chip Planning

- 6.11.2 Self-developed Chip Planning: Work to Lay out Single-chip Solutions

- 6.11.3 Scope of Self-developed Chips

- 6.11.4 Scope of Self-developed Chips

- 6.11.5 Application of Self-developed Chips

- 6.12 China Science Photon Chip

- 6.12.1 Profile

- 6.12.2 LiDAR Chip Layout

- 6.13 Fortsense

- 6.13.1 Profile

- 6.13.2 LiDAR Chip Business

- 6.14 DAO Sensing

- 6.14.1 LiDAR Chip Planning (1)

- 6.14.2 LiDAR Chip Planning (1)

- 6.15 Others

- 6.15.1 LiDAR Chip Business of Sophoton

- 6.15.2 LiDAR Chip Layout of Huawei

- 6.15.3 LiDAR Chip Business of Luminar

- 6.15.4 Automotive LiDAR Chip Business of Berxel Photonics

- 6.15.5 LiDAR Business of Dibotics

7 Vision Sensor Chip Suppliers

- 7.1 ON Semiconductor

- 7.1.1 Profile

- 7.1.2 Market & Product Layout (1)

- 7.1.3 Market & Product Layout (2)

- 7.1.4 Classification of Products

- 7.1.5 Automotive CIS Products

- 7.1.6 Automotive ISP Products

- 7.1.7 CIS Products - Front View CIS (1)

- 7.1.8 CIS Products - Front View CIS (2)

- 7.1.9 CIS Products - Cockpit CIS (1)

- 7.1.10 CIS Products - Cockpit CIS (2)

- 7.1.11 CIS Products - Cockpit CIS (3)

- 7.1.12 CIS Products - Cockpit CIS (4)

- 7.1.13 CIS Products - Surround/Back View CIS

- 7.1.14 ISP Products - ISP (1)

- 7.1.15 ISP Products - ISP (2)

- 7.1.16 CIS Technology

- 7.1.17 LiDAR Chip Technology

- 7.1.18 Market Share and Customers of ON Semiconductor's Automotive Image Sensors

- 7.1.19 Autonomous Driving Ecosystem Partners (1)

- 7.1.20 Autonomous Driving Ecosystem Partners (2)

- 7.2 Samsung Electronics

- 7.2.1 Automotive Image Sensors: ISOCELL Auto

- 7.2.2 Automotive Image Sensors: ISOCELL Auto 4AC

- 7.2.3 Features of Automotive Image Sensors

- 7.3 Sony

- 7.3.1 Profile

- 7.3.2 CIS Market Layout

- 7.3.3 Development History of CIS

- 7.3.4 Classification of Semiconductor Products

- 7.3.5 Autonomous Driving Sensor Chip Product Line

- 7.3.6 CIS Technology

- 7.3.7 Automotive CIS Products (1)

- 7.3.8 Automotive CIS Products (2)

- 7.3.9 Automotive CIS Products (3)

- 7.3.10 Application of Autonomous Driving Sensor Chips (1)

- 7.3.11 Application of Autonomous Driving Sensor Chips (2)

- 7.4 NXP

- 7.4.1 Profile

- 7.4.2 Classification of Products

- 7.4.3 Automotive ISP Products - ISP-integrated Vision Processing Unit (1)

- 7.4.4 Automotive ISP Products - ISP-integrated Vision Processing Unit (2)

- 7.4.5 Automotive ISP Products - ISP-integrated Vision Processing Unit (3)

- 7.4.6 Automotive ISP Products - ISP-integrated Autonomous Driving SoC (1)

- 7.4.7 Automotive ISP Products - ISP-integrated Autonomous Driving SoC (2)

- 7.4.8 Automotive ISP Products - ISP-integrated Autonomous Driving SoC (3)

- 7.4.9 Automotive ISP Products - ISP-integrated Autonomous Driving SoC (4)

- 7.4.10 Summary of Automotive ISP Products

- 7.4.11 ISP Software Training Partners

- 7.5 Nextchip

- 7.5.1 Profile & Classification of Products

- 7.5.2 Development History and Market Layout

- 7.5.3 Core Technologies

- 7.5.4 Products - ISP (1)

- 7.5.5 Products - ISP (2)

- 7.5.6 Products - ISP (3)

- 7.5.7 Products - ISP (4)

- 7.5.8 Products - ISP-integrated Autonomous Driving SoC (1)

- 7.5.9 Products - ISP-integrated Autonomous Driving SoC (2)

- 7.5.10 Products - ISP-integrated Autonomous Driving SoC (3)

- 7.5.11 Summary of Products (1)

- 7.5.12 Summary of Products (2)

- 7.5.13 Customers and Partners

- 7.6 OmniVision Technology

- 7.6.1 Profile

- 7.6.2 Market Layout (1)

- 7.6.3 Market layout (2)

- 7.6.4 Technologies (1)

- 7.6.5 Technologies (2)

- 7.6.6 Classification of Products

- 7.6.7 Products - ISP-integrated Video Processing Unit (1)

- 7.6.8 Products - ISP-integrated Video Processing Unit (2)

- 7.6.9 Products - ISP-integrated Video Processing Unit (3)

- 7.6.10 Products - ISP-integrated Video Processing Unit (4)

- 7.6.11 Products - ISP

- 7.6.12 Products - ISP-integrated CIS (1)

- 7.6.13 Products - ISP-integrated CIS (2)

- 7.6.14 Products - ISP-integrated CIS (3)

- 7.6.15 Products - ISP-integrated CIS (4)

- 7.6.16 Products - Non-ISP CIS

- 7.6.17 Summary of Products (1)

- 7.6.18 Summary of Products (2)

- 7.6.19 Comparison of Some CIS Products between OmniVision and ON Semiconductor

- 7.7 SmartSens

- 7.7.1 Profile

- 7.7.2 Classification of Products

- 7.7.3 Automotive CIS Business

- 7.7.4 Products - ISP-integrated CIS (1)

- 7.7.5 Products - ISP-integrated CIS (2)

- 7.7.6 Products - ISP-integrated CIS (3)

- 7.7.7 Products - ISP-integrated CIS (4)

- 7.7.8 Products - ISP-integrated CIS (5)

- 7.7.9 Products - ISP-integrated CIS (6)

- 7.7.10 Summary of ISP-integrated CIS Products

- 7.7.11 Automotive CIS Product Layout (1)

- 7.7.12 Automotive CIS Product Layout (2)

- 7.7.13 Market Layout (1)

- 7.7.14 Market Layout (2)

- 7.7.15 Product R&D Layout

- 7.8 GalaxyCore

- 7.8.1 Profile

- 7.8.2 CMOS Image Sensor Business

- 7.9 Metoak

- 7.9.1 Profile

- 7.9.2 Product Lines

- 7.9.3 Stereo Vision Chips

- 7.10 Rockchip

- 7.10.1 Panoramic View Chip - RK3588M

- 7.10.2 Architecture of RK3588M SoC

- 7.11 Fullhan Microelectronics

- 7.11.1 Profile

- 7.11.2 Classification of Products

- 7.11.3 Products - ISP (1)

- 7.11.4 Products - ISP (2)

- 7.11.5 Products & Summary of Products

- 7.11.6 ISP Tuning & Image Tuning Lab

- 7.11.7 ISP Product Layout & Market Layout

- 7.11.8 Customers & Partners

- 7.12 Others

- 7.12.1 GPU Products of ARM

- 7.12.2 Vision Chip Products of NST Technology