|

|

市場調査レポート

商品コード

1130744

中国の自動車用ビジョン産業の分析 (2022年)China Automotive Vision Industry Report, 2022 |

||||||

| 中国の自動車用ビジョン産業の分析 (2022年) |

|

出版日: 2022年09月26日

発行: ResearchInChina

ページ情報: 英文 350 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

中国国内で2022年上半期に新車に搭載されたカメラの台数は2,062万4,000台で、前年同期比で11.8%増となっています。市場セグメント別では、フロントビューカメラが前年比20.4%増の349万9,000台、サラウンドビューカメラは同22.7%増の1073万5,000台、リアビューカメラは同18.8%減の452万台、DMSカメラは同141.8%増の38万4,000台、ドライブレコーダーは同39.7%増の148万6,000台でした。

2025年には、全体で7,540万台が設置される見込みです。その要因として、政府の対応策強化や、L2+機能を搭載した自動車の増加、車載カメラの高画素化 (800万画素以上)、3Dセンシング技術の進歩、DMS/OMS (ドライバー/乗員監視システム) の普及などが挙げられます。

当レポートでは、中国国内の自動車用ビジョン (視覚装置) 産業について分析し、技術・製品の概略や業界の基本構造、中国国内の市場規模と傾向 (製品セグメント別)、主要企業のプロファイルなどを調査しております。

目次

第1章 自動車用ビジョン産業の概要

- ADASの概略

- ADAS機能の分類

- ADASにおける自動車用カメラ:主な適用シナリオ

- 自動車用カメラの分類

- 自動車用カメラの動作原理と構造

- 自動車用カメラのコスト構造

- 自動車用カメラの産業チェーン

- 自動車用カメラの産業チェーン:企業のレイアウト

第2章 中国の自動車用ビジョン市場と動向

- 市場概要

- 中国の乗用車のカメラ構成 (2022年上半期)

- 中国の合弁系ブランドの乗用車カメラ構成

- 中国の独立系ブランドの乗用車カメラ構成

- フロントビューシステム

- フロントビューカメラの設置 (価格別・ブランド別・モデル別)

- フロントビューカメラの設置:合弁系ブランド (2022年上半期)

- フロントビューカメラの設置:独立系ブランド (2022年上半期)

- サラウンドビューシステム

- DMS (ドライバー監視システム)

- リアビューシステム

- ドライブレコーダー

- フロントビューシステムの主要サプライヤー

- 中国のビジョン企業のレイアウト分析

- 中国のビジョン市場の発展動向

第3章 中国のモノビジョン企業

- MINIEYE

- Suzhou INNO

- JIMU intelligent

- MAXIEYE

- Autocruis

- Freetech

- Tsingtech Microvision

- CalmCar

- Jingwei Hirain Technologies

- OFILM

- Streamax Technology

- Anzhi-Auto

第4章 中国の立体ビジョン企業

- Smarter Eye

- Metoak Technology

- Huawei

- DJI

- Huaruijie Technology

- Jianzhi Technology

第5章 その他のビジョン企業

- Neusoft Reach

- Hikvision

- Desay SV

- Zongmu Technology

- oToBrite

- Hefei Softec Auto Electronic

China automotive vision research: DMS is booming, with the installations soaring 141.8% year-on-year

1. China will install 75.4 million cameras in 2025

According to ResearchInChina, China installed 20.624 million cameras in new cars in 2022H1, a year-on-year increase of 11.8%. By market segments, the installations of front view cameras increased by 20.4% year-on-year to 3.499 million units in 2022H1; the installations of surround view cameras jumped by 22.7% year-on-year to 10.735 million units; the installations of rear view cameras decreased by 18.8% year-on-year to 4.52 million units; the installations of DMS cameras swelled by 141.8% year-on-year to 384,000 units; the installations of driving recorders ascended by 39.7% year-on-year to 1.486 million units.

China will install 75.4 million cameras in 2025 under the impulse of following factors:

1) Policies

The state and cities have actively launched policies related to autonomous driving in order to promote development and commercialization of autonomous driving industry. On March 1, 2022, China officially implemented "Autonomous Driving Classification" as a new national standard. On August 1, Shenzhen officially enforced "Regulations on Administration of Intelligent Connected Vehicles in Shenzhen Special Economic Zone", allowing fully autonomous vehicles to hit the road. On September 5, Shanghai issued "Implementation Plan for Accelerating Innovation and Development of Intelligent Connected Vehicles in Shanghai", stipulating that Shanghai should initially build a leading domestic innovation and development system for intelligent connected vehicles by 2025.

2) OEMs

In 2022H1, 2.877 million vehicles boasted L2+ functions, accounting for 32.4% which jumped 12.6 percentage points year-on-year. In particular, the installation rate of L2.5 and L2.9 ticked up dramatically. Many OEMs are deploying L3 and higher-level autonomous driving. In the later stage, autonomous driving above L2.9 will become standard.

Traditional OEMs deploy autonomous driving by partnering with technology companies or launching new brands. For example, BYD teamed up with NVIDIA and Baidu in February and March 2022 respectively. NVIDIA will provide intelligent driving technology, and Baidu will offer a complete solution for L3 intelligent driving. In March 2022, GAC released its new electric brand "e:NP" and the first battery-electric vehicle "e:NP1" under the brand to embody "electrification". The vehicle enables L3 intelligent driving.

Emerging automakers focus on independent development. NIO, Li Auto and Xpeng have successively embarked on full-stack self-research of software and algorithms. Xpeng's full-stack self-developed XPilot driving assistance system has continuously upgraded. Currently, XPilot 3.5 can make L3 autonomous driving possible. XPilot 4 is now available on G9, and it is scheduled to complete the transition to autonomous driving in 2026.

2. 2022H1, Bosch, Denso, and Aptiv enjoyed 52.28% share of the front view camera market, and Chinese local player Jingwei Hirain Technologies was shortlisted in the top ten

In 2022H1, Chinese front view camera market for new passenger cars was mainly occupied by foreign suppliers like Bosch, Denso, and Aptiv. Bosch grasped the market share of 25.12% by serving BYD, Honda, BMW, Changan, etc. Denso secured the market share of 19.09% as a partner of Toyota. The market share of Aptiv whose main customers included Volvo, GAC, SAIC, etc. hit 8.27%.

Jingwei Hirain Technologies is the only Chinese local company that ranked among the top 10 front view camera suppliers for new passenger cars in China. Established in 2003, Jingwei Hirain Technologies entered ADAS field in 2016, mainly serving OEMs such as SAIC, FAW, Geely, etc.. Its main products include ADCU, ADAS, LMU, DMS, T-BOX, GW, etc., among which ADAS cameras have evolved to the fifth generation. In the future, a new generation of super-high-computing-power intelligent driving domain controllers, intelligent cockpit perception controllers, 3D cameras and other new products will be developed for domestic chips or foreign higher-computing-power chips, ISP technology, and in-cockpit three-dimensional perception technology.

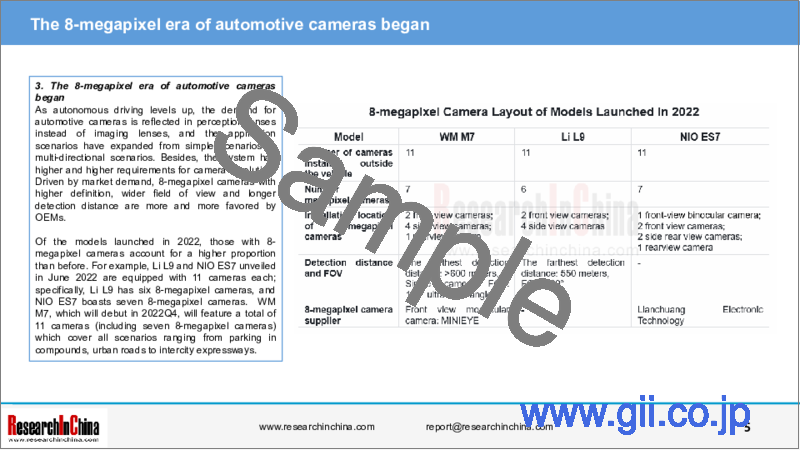

3. The 8-megapixel era of automotive cameras began

As autonomous driving levels up, the demand for automotive cameras is reflected in perception lenses instead of imaging lenses, and the application scenarios have expanded from simple scenarios to multi-directional scenarios. Besides, the system has higher and higher requirements for camera resolution. Driven by market demand, 8-megapixel cameras with higher definition, wider field of view and longer detection distance are more and more favored by OEMs.

Of the models launched in 2022, those with 8-megapixel cameras account for a higher proportion than before. For example, Li L9 and NIO ES7 unveiled in June 2022 are equipped with 11 cameras each; specifically, Li L9 has six 8-megapixel cameras, and NIO ES7 boasts seven 8-megapixel cameras. WM M7, which will debut in 2022Q4, will feature a total of 11 cameras (including seven 8-megapixel cameras) which cover all scenarios ranging from parking in compounds, urban roads to intercity expressways.

With the support of OEMs for assisted driving functions, suppliers have begun to vigorously deploy R&D and production of high-resolution camera modules. For example, the third-generation front view camera FVC3 released by Freetech in August 2022 has 8 megapixels, the farthest vehicle detection distance of 250 meters, and the farthest pedestrian detection distance of 120 meters. It bolsters Navigate on Autopilot (NOA) on expressways and recognition of Chinese traffic signs and scenarios.

4. 3D Sensing Technology

3D sensing is a depth sensing technology that can measure and collect the height, depth and shape of objects. Compared to traditional solutions, 3D ToF can capture depth and infrared images under harsh lighting conditions with a higher lens frame, which is more suitable for dynamic scenarios. At present, 3D sensing technology is mainly used in the interior of the cockpit, such as DMS.

As the mainstream technical solutions of 3D sensing, structured light and ToF technology have become the hotspots of major automotive lens vendors for technical breakthrough. OFILM is currently the main supplier of 3D sensing modules in China. In 2017, OFILM made a layout in this field, and developed structured light and ToF solutions simultaneously. It took the lead in the mass production of automotive ToF visual perception modules for AITO M5 released in March 2022 as a pioneer in the automotive industry.

ArcSoft's latest 3D ToF gesture interaction technology debuted on Li L9 in June 2022.

Oradar will release its 3D ToF smart cockpit solution in September 2022.

5. As an important part of smart cockpit, DMS/OMS will see a surge in installations

In 2022H1, DMS installations swelled by 141.8% year-on-year to 384,000 units. The current mainstream DMS solutions can be divided into cockpit integrated solutions and independent hardware solutions. Integrated cockpit solutions offer rich functions and mobile phone interconnection in terms of entertainment functions and social media functions. Independent hardware solutions can meet the requirements of L2+ and L3 autonomous driving in view of functional safety level, and effectively monitor the state of human-machine co-driving.

Mainstream providers of independent hardware solutions include Neusoft Reach, Suzhou INVO, OFILM, and Hikvision. In particular, Neusoft Reach's independent hardware DMS solution has conducted functional safety development in accordance with ISO2 6262 ASIL-B in terms of system, hardware and software, and has realized deployment of full-chain information security modules on controller, vehicle, cloud, and mobile phone. Combined with L3 intelligent driving domain controller of vehicle, it has been mounted on mainstream models of many automakers.

In the future, when autonomous driving technology enters an advanced stage and people need not act as drivers, the scenario application of smart cockpit will become more important. The key to the perfect user experience depends on cockpit-driving integration. Therefore, a number of domestic vision suppliers have launched solutions that integrate the interior and exterior of the cockpit.

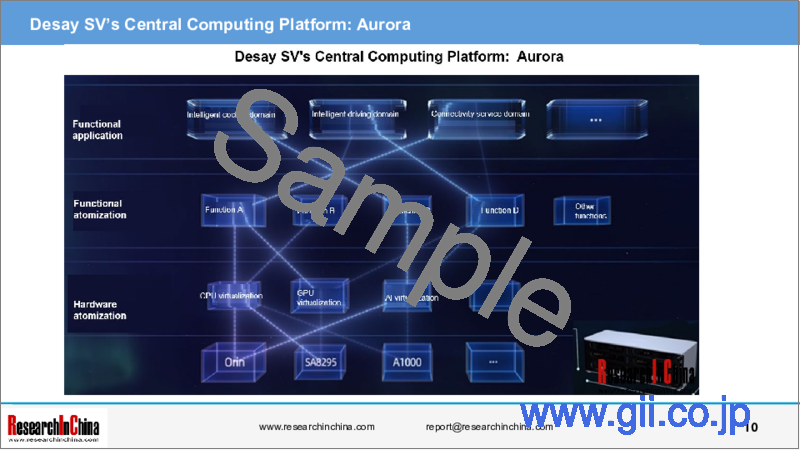

In April 2022, Desay SV released automotive intelligent computer "Aurora", marking the company's leap from a domain controller to a central computing platform. This cockpit-driving fusion solution, based on multiple SoCs, integrates multiple functional domains such as intelligent cockpit, intelligent driving, and connected services at the functional level.

In June 2022, Jidu Auto launched a "robot" concept car. Based on self-developed SOA cockpit-driving fusion technology architecture, it allows computing power sharing, perception sharing, and service sharing. The intelligent cockpit domain controller can support system-level security redundancy when the intelligent driving system fails, and the intelligent driving domain controller enables AI interaction of intelligent cockpit 3D human-machine co-driving map.

Table of Contents

1 Overview of Automotive Vision Industry

- 1.1 Basic Introduction to ADAS

- 1.2 Classification of ADAS functions

- 1.3 Main Application Scenarios of Automotive Cameras in ADAS

- 1.4 Classification of Automotive Cameras

- 1.5 Working Principle and Structure of Automotive Cameras

- 1.6 Cost Structure of Automotive Cameras

- 1.7 Automotive Camera Industry Chain

- 1.8 Layout of Automotive Camera Industry Chain Companies

2 Chinese Automotive Vision Market and Trends

- 2.1 Market Overview

- 2.1.1 China's Passenger Car Camera Configurations, 2022H1

- 2.1.2 China's Passenger Car Camera Configuration of Joint Venture Brands

- 2.1.3 China's Passenger Car Camera Configuration of Independent Brands

- 2.2 Front View System

- 2.2.1 Installation of Front-view Camera (Price/Brand/Model)

- 2.2.2 Installation of Front-view Camera--Joint Venture Brands in 2022H1

- 2.2.3 Installation of Front-view Camera--Independent Brands in 2022H1

- 2.3 Surround View System

- 2.3.1 Installation of Surround View Camera (Price/Brand/Model)

- 2.3.2 Installation of Surround View Camera --Joint Venture Brands in 2022H1

- 2.3.3 Installation of Surround View Camera --Independent Brands in 2022H1

- 2.4 DMS

- 2.4.1 DMS Camera Installation (Price/Brand/Model)

- 2.4.2 DMS Camera Installation --Joint Venture Brands in 2022H1

- 2.4.3 DMS Camera Installation --Independent Brands in 2022H1

- 2.5 Rearview System

- 2.5.1 Installation of Rearview Camera (Price/Brand/Model)

- 2.5.2 Installation of Rearview Camera --Joint Venture Brands in 2022H1

- 2.5.3 Installation of Rearview Camera--Independent Brands in 2022H1

- 2.6 Driving Recorder

- 2.6.1 Driving Recorder Camera Installation(Price/Brand/Model)

- 2.6.2 Installation of Driving Recorder Camera--Joint Venture Brands in 2022H1

- 2.6.3Installation of Driving Recorder Camera--Independent Brands in 2022H1

- 2.7 Main Front View System Suppliers

- 2.7.1 China's New Passenger Car Front View System Suppliers and Market Share

- 2.8 Analysis of Layout of Chinese Vision Enterprises

- 2.9 Development Trend of China's Vision Market

- 2.9.1 Trend 1

- 2.9.2 Trend 2

- 2.9.3 Trend 3

- 2.9.4 Trend 4

- 2.9.5 Trend 5

- 2.9.6 Trend 6

- 2.9.7 Trend 7

- 2.9.8 Trend 8

- 2.9.9 Trend 9

- 2.9.10 Trend.....

3 Chinese Monocular Vision Enterprises

- 3.1 MINIEYE

- 3.1.1 Profile

- 3.1.2 Four Major Product Matrices

- 3.1.3 Introduction of Intelligent Pilot Assistance Solution --iPilot

- 3.1.4 ADAS Product Introduction

- 3.1.5 Smart Cockpit Perception and Interaction Solution

- 3.1.6 Technology

- 3.1.7 Cooperation Dynamics, Customers and Future Development Directions

- 3.1.8 Product Summary

- 3.2 Suzhou INNO

- 3.2.1 Profile

- 3.2.2 Product Lineup

- 3.2.3 Intelligent Driving System

- 3.2.4 Development of Intelligent Driving System

- 3.2.5 Introduction of Intelligent Parking System

- 3.2.6 Development of Intelligent Parking System

- 3.2.7 Product History of Intelligent Cockpit Monitoring System

- 3.2.8 Intelligent Gateway System

- 3.2.9 Technology Development Direction and Active Safety Solutions

- 3.2.10 Partners and Future Development

- 3.2.11 Summary

- 3.3 JIMU intelligent

- 3.3.1 Profile

- 3.3.2 Core Technologies

- 3.3.3 Products

- 3.3.4 Post-installed ADAS solutions

- 3.3.5 Front-mounted Driver Assistance Solutions

- 3.3.6 Industry Driver Assistance Solutions

- 3.3.7 L2 Intelligent Driving Solution

- 3.3.8 L2 + Commercial Vehicle Video Domain Control Solution

- 3.3.9 JMFeelt

- 3.3.10 Achievements

- 3.3.11 Cooperation Dynamics and Future Development

- 3.4 MAXIEYE

- 3.4.1 Profile

- 3.4.2 Product Lineup

- 3.4.3 Product History of Intelligent Visual Perception System

- 3.4.4 Intelligent Driving System

- 3.4.5 Intelligent Driving Solutions for Commercial Vehicles and Passenger Cars

- 3.4.6 Cooperation Dynamics

- 3.4.7 Achievements and Future Development

- 3.4.8 Intelligent Visual Perception System and Solutions

- 3.4.8 Summary of Intelligent Driving System

- 3.5 Autocruis

- 3.5.1 Profile

- 3.5.2 Six Major Technologies

- 3.5.3 Products

- 3.5.4 Forward ADAS System

- 3.5.5 Intelligent Blind Area Management System

- 3.5.6 Intelligent Panoramic Image System, Driver Monitoring System

- 3.5.7 Commercial Vehicle Solutions

- 3.5.8 Cooperation Dynamics and Partners

- 3.5.9 Summary

- 3.6 Freetech

- 3.6.1 Profile

- 3.6.2 Product Lineup

- 3.6.3 Vision Camera Products

- 3.6.4 ADAS Solution Products

- 3.6.4 Comparison of Configurations of Second Generation ADAS Solutions

- 3.6.5 Autonomous Driving Solutions

- 3.6.5 Composition and Function of Autonomous Driving Solutions

- 3.6.5 Navigation Assisted Driving Solution: ADC20 Version

- 3.6.5 Advanced Autonomous Driving Solution Enhancement: ADC30 Edition

- 3.6.6 Cooperation Dynamics

- 3.6.7 Achievements and Future Development

- 3.6.8 Summary

- 3.7 Tsingtech Microvision

- 3.7.1 Profile

- 3.7.2 Technology

- 3.7.3 Products

- 3.7.4 CTO Bus Passenger Flow Monitoring System-TM-CTO

- 3.7.4 Intelligent Interactive Driver Assistance System-TM-T1A

- 3.7.4 360 ° Panoramic Surround View System

- 3.7.4 Binocular Stereo Vision Warning System

- 3.7.4 Integrated Autonomous Parking System

- 3.7.5 Intelligent Driving Solutions for Passenger Cars

- 3.7.5 Commercial Vehicle Intelligent Driving Solutions

- 3.7.5 L2 + Autonomous Driving Solution for Commercial Vehicles

- 3.7.6 Product Summary

- 3.7.6 Solution Summary

- 3.8 CalmCar

- 3.8.1 Profile

- 3.8.2 Core products

- 3.8.3 Surround Perception

- 3.8.3 Smart Parking, AVM System

- 3.8.3 Low Speed Valet Parking System

- 3.8.4 Camera Module

- 3.8.5 Intelligent Cockpit System

- 3.8.6 Partners

- 3.9 Jingwei Hirain Technologies

- 3.9.1 Profile

- 3.9.2 History and Revenue

- 3.9.3 Business

- 3.9.4 Automotive Electronics Products

- 3.9.5 Vehicle Camera

- 3.9.5 ADAS

- 3.9.5 DMS

- 3.9.5 APA

- 3.9.6 Smart Cockpit Sensing System (SCSS)

- 3.9.7 Cooperation Dynamics and Future Development

- 3.9.8 Summary

- 3.10 OFILM

- 3.10.1 Profile

- 3.10.2 Business Layout and Revenue

- 3.10.3 Intelligent Vehicle Layout

- 3.10.4 Vehicle Lens and Camera

- 3.10.5 Intelligent Front-view System, Vehicle Rear-view Camera, AVM, Electronic Rear-view Mirror

- 3.10.6 Parking System

- 3.10.7 Full Stack Autonomous Driving Solution

- 3.11 Streamax Technology

- 3.11.1 Profile

- 3.11.2 Revenue in 2021

- 3.11.3 Business Layout

- 3.11.4 Camera Products

- 3.11.5 AI Technology

- 3.11.6 Active Safety Solutions

- 3.11.7 Vehicle Camera Summary

- 3.11.7 Solution Summary

- 3.12 Anzhi-Auto

- 3.12.1 Profile

- 3.12.2 Product Matrix

- 3.12.3 Multifunctional Monocular Camera

- 3.12.3 "Human Eye-like" Camera

- 3.12.4 Sensor Fusion System

4 Chinese Binocular Vision Enterprises

- 4.1 Smarter Eye

- 4.1.1 Profile

- 4.1.2 Vision Products and Core Technologies

- 4.1.3 Stereo Vision Products - SE1

- 4.1.3 Stereo Vision Products - S1

- 4.1.3 Stereo Vision Products - S2

- 4.1.3 Development of Stereo Vision Products

- 4.1.4 Passenger car AEB active safety system

- 4.1.4 Truck AEB Active Safety System

- 4.1.4 Fire truck AEB active safety system

- 4.1.4 Bus AEB active safety system, vehicle height limit detection system

- 4.1.4 Development of AEB System

- 4.1.5 Recent Cooperation and Customers

- 4.1.6 Summary

- 4.2 Metoak Technology

- 4.2.1 Profile

- 4.2.2 Product Overview

- 4.2.3 Vehicle-grade Binocular Stereo Vision Products

- 4.2.4 Cooperate with Baolong Technology to develop a Binocular Road Previewing System

- 4.3 Huawei

- 4.3.1 Introduction to Huawei Smart Vehicle Solutions BU

- 4.3.2 Huawei Camera and Solution Camera Configuration

- 4.3.3 AVATRANS Intelligent Pilot System

- 4.4 DJI

- 4.4.1 Profile

- 4.4.2 Product Layout

- 4.4.3 Binocular Vision Perception Technology

- 4.4.4 Visual Perception Sensor Product

- 4.4.5 Intelligent Driving Solutions

- 4.4.5 Intelligent Driving Function Configuration and Application

- 4.4.6 Intelligent Parking

- 4.4.7 Summary

- 4.5 Huaruijie Technology

- 4.5.1 Profile

- 4.5.2 Core Technology

- 4.5.3 Product Matrix

- 4.5.4 Passenger Car Vision products - DMS Cameras, Front-view Binocular Cameras

- 4.5.4 Passenger Car Vision Products - Blind Spot, Surround View Camera

- 4.5.5 Application of Passenger Car Vision products

- 4.5.6 Commercial Vehicle Vision Products

- 4.5.6 Commercial Vehicle Vision Products - In-Vehicle Monitoring

- 4.5.7 Smart Vehicle Commercial Vehicle Solutions

- 4.5.8 Summary

- 4.6 Jianzhi Technology

- 4.6.1 Profile

- 4.6.2 Core Technology

- 4.6.3 Product Layout - Visual Radar

- 4.6.3 Product Layout - Autonomous Driving Solutions

- 4.6.4 L2 ++ Autonomous Driving Mass Production Solution

- 4.6.5 Cooperation Dynamics and Development Plan

5 Other Visual Enterprises

- 5.1 Neusoft Reach

- 5.1.1 Profile

- 5.1.2 Autonomous Driving Products

- 5.1.3 Basic Software Platform Product NeuSAR

- 5.2 Hikvision

- 5.2.1 Profile

- 5.2.2 Passenger Cars -OEM and AM Products

- 5.2.3 Commercial Vehicles - Technology and Solutions

- 5.3 Desay SV

- 5.3.1 Profile

- 5.3.2 Development History and Business

- 5.3.3 Development of Smart Cockpit

- 5.3.4 Development and Aapplication of Intelligent Driving

- 5.3.5 Recent Cooperation and Major Customers

- 5.4 Zongmu Technology

- 5.4.1 Profile

- 5.4.2 Products

- 5.4.3 Products - Cameras

- 5.4.4 Driving and Parking Integrated Products

- 5.4.5 Cooperation, Achievements and Development

- 5.4.6 Summary

- 5.5 oToBrite

- 5.5.1 Profile

- 5.5.2 Core technologies

- 5.5.3 ADAS technology

- 5.5.4 Camera

- 5.5.5 Parking System

- 5.5.6 Future Planning and Cooperative Customers

- 5.6 Hefei Softec Auto Electronic

- 5.6.1 Profile

- 5.6.2 Camera Products

- 5.6.3 Cooperative Customers and Future Plans