|

市場調査レポート

商品コード

1065083

コンステレーションの市場評価:SATCOMおよびEO(第4版)Constellations Market Assessment: SATCOM & EO, 4th Edition |

|||||||

| コンステレーションの市場評価:SATCOMおよびEO(第4版) |

|

出版日: 2022年03月16日

発行: Northern Sky Research, LLC

ページ情報: 英文

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

今後3~5年の間に、多くのコンステレーションプレーヤーが開発段階を越えて成長段階に入り、エコシステム全体の業界収益機会に影響を及ぼすと予想されています。

主な特徴

当レポートの分析対象企業

Airbus, Amazon, Ariane Space, Astrocast, Atlas, Ball Aerospace, BlackSky, Boeing, Bridge Comm, Capella Space, CASC, CNSA, Collins Aerospace, Earthi, Fleet Space, Gilat, Hiber, ICEYE, Infostellar, Iridium, Isotropic Systems, ISRO, Kepler, KSAT, Kymeta, Maxar Technologies, OneWeb, Phasor, Planet, RBC Signals, Rocket Labs, Satellogic, SatixFY, SES, Spire, Starlink, SSC, Swarm, Telesat, Thales Alenia Space, and ThinKom

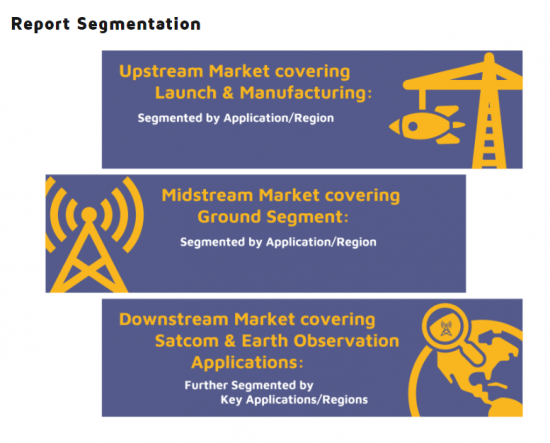

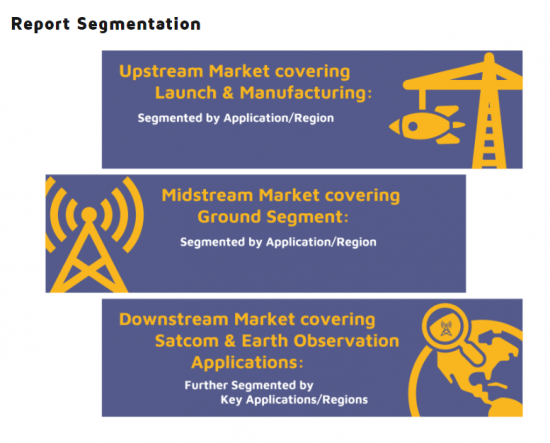

当レポートは、SATCOMおよびEOの各セグメントにおける用途、地域、業界のバリューチェーンにまたがる機会創出についての360度評価、および事業者からエンドユーザーまで、上流、中流、下流それぞれの市場力学の中核的理解に基づき、CAPEXや競合他社の強みなどの情報を提供しています。

目次

定義

第1章 エグゼクティブサマリー

- 市場の概要

- 地域の見通し

- 業界のバリューチェーン

- 主要動向と成功要因

第2章 世界の分析

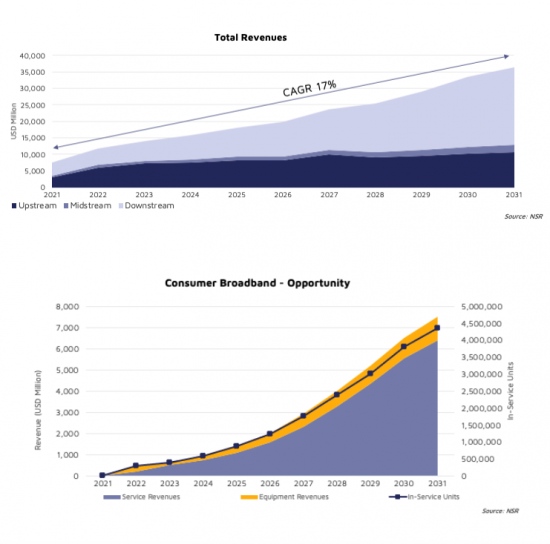

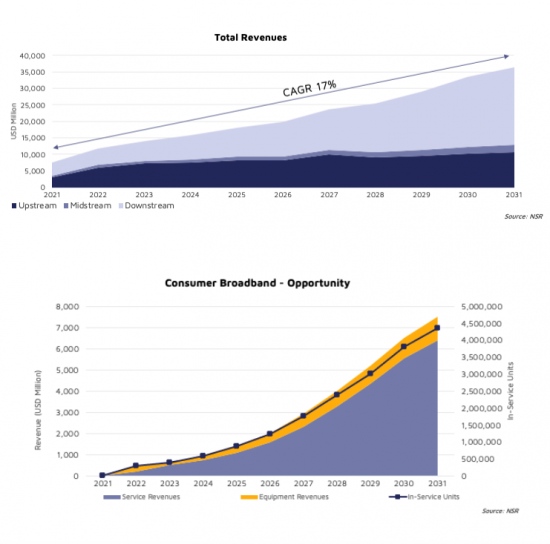

- 総収益

- 衛星通信市場

- スターリンク - ビジネスキャンバス/ケーススタディ

- OneWeb - ビジネスキャンバス/ケーススタディ

- ケーススタディ - Telesat, Kuiper & mPower

- 地球観測市場

- ケーススタディ - EO市場

- 上流市場

- 中流市場

- ケーススタディ - 地上セグメントの革新

- 下流市場

- 下流市場:用途別

- 結論

第3章 北米市場

- 総収益

- 上流市場

- 中流市場

- 下流市場

- 結論

第4章 ラテンアメリカ市場

- 総収益

- 上流市場・中流市場

- 下流市場

- 結論

第5章 欧州市場

- 総収益

- 上流市場

- 中流市場

- 下流市場

第6章 中東・アフリカ市場

- 総収益

- 上流市場・中流市場

- 下流市場

- 結論

第7章 アジア市場

- 総収益

- 上流市場

- 中流市場

- 下流市場

- 結論

付録

- 調査手法

Report Summary:

NSR's latest report, “Constellations Market Assessment: SATCOM & EO, 4th Edition (CMA4) ” , (formerly NSR's HTS Satellite Constellations, A Critical Analysis) is the industry's leading resource for evaluating the rapidly emerging satellite constellations sector. The report offers a 360° assessment of opportunity generation across applications, regions, and industry value chain within the Satcom and Earth Observation segments.

NEW in this Edition:

|

Constellation players, in the last decade, have faced multiple challenges including funding, technology, and Chapter 11 filings. In the next 3-5 years, many constellation players are expected to cross the development phase and enter the growth phase, impacting industry revenue opportunities across the ecosystem. Building on a core understanding of market dynamics both upstream, midstream and downstream, from operator to end user, the report objectively analyzes the market landscape including CAPEX and Competitive Strengths.

Who Should Purchase this Report :

- Investors/VCs/Finance Professionals - to identify the right investment opportunity

- Constellation Owners and Satellite Operators - for a competitive assessment

- Service Providers and Distribution Partners - to assess the future of capacity supply and pricing dynamics

- Manufacturers and Launch Providers

- Insurance Companies

- Ground Segment and User Antenna/Modem Providers

Key Features:

Covered in this Report:

- NEW in this Edition-End-to-End market assessment

- NEW in this Edition-Total and Segmented constellations market opportunities (Y-on-Y forecast, 2021-2031)

- NEW in this Edition-Top target markets by application and region

- NEW in this Edition-Major drivers and challenges

- NEW in this Edition-Key players by target application and their product/services positioning

- NEW in this Edition-Case Studies of major constellation players - Progression in 2021 and future trajectory/plans

- NEW in this Edition-Strategic Imperatives across value chain

- Comprehensive Y-on-Y Forecasting of Total and Segmented Constellation Market Opportunities

- Details Top Target markets by Application and Region

- Examines major drivers and challenges for Strategic Imperatives across the value chain

- Identifies Key players by target application and their product/service positioning

- Case Studies of major constellation players - Progression in 2021 and future trajectory/plans

- Cumulative Opportunity assessment for Constellations across each market vertical

Companies Included in this Report

Airbus, Amazon, Ariane Space, Astrocast, Atlas, Ball Aerospace, BlackSky, Boeing, Bridge Comm, Capella Space, CASC, CNSA, Collins Aerospace, Earthi, Fleet Space, Gilat, Hiber, ICEYE, Infostellar, Iridium, Isotropic Systems, ISRO, Kepler, KSAT, Kymeta, Maxar Technologies, OneWeb, Phasor, Planet, RBC Signals, Rocket Labs, Satellogic, SatixFY, SES, Spire, Starlink, SSC, Swarm, Telesat, Thales Alenia Space, and ThinKom.

Table of Contents

Definitions

1. Executive Summary

- 1.1 Market Summary

- 1.2 Regional Outlook

- 1.3 Industry Value Chain

- 1.4 Top trends & Success factors

2. Global Analysis

- 2.1 Total Revenues

- 2.2 Satellite Communications Market

- 2.3 Starlink - Business Canvas / Case Study

- 2.4 OneWeb - Business Canvas / Case Study

- 2.5 Case Study - Telesat, Kuiper & mPower

- 2.6 Earth Observation Market

- 2.7 Case Studies - EO Market

- 2.8 Upstream Market

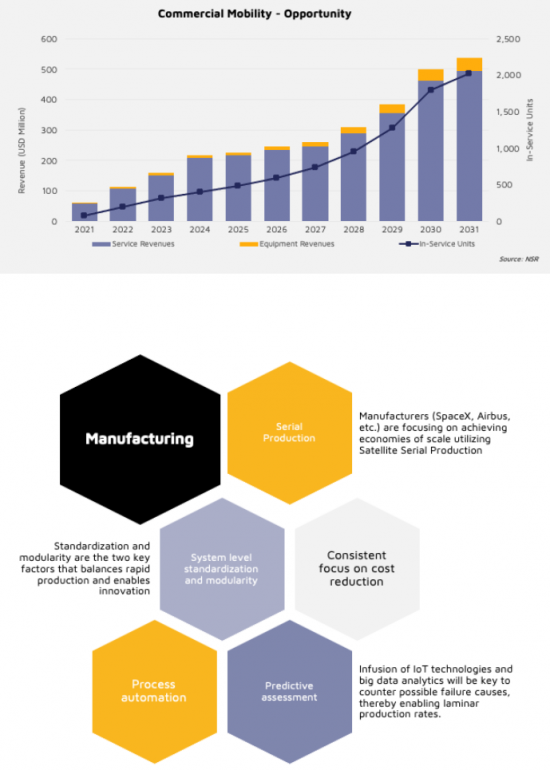

- 2.9 Midstream Market

- 2.10 Case Study - Ground Segment Innovation

- 2.11 Downstream Market

- 2.12 Downstream Market by Application

- 2.13 Bottom Line

3. North America Market

- 3.1 Total Revenues

- 3.2 Upstream Market

- 3.3 Midstream Market

- 3.4 Downstream Market

- 3.5 Bottom Line

4. Latin America Market

- 4.1 Total Revenues

- 4.2 Upstream & Midstream Market

- 4.3 Downstream Market

- 4.4 Bottom Line

5. Europe Market

- 5.1 Total Revenues

- 5.2 Upstream Market

- 5.3 Midstream Market

- 5.4 Downstream

6. Middle East and Africa Market

- 6.1 Total Revenues

- 6.2 Upstream & Midstream Market

- 6.3 Downstream Market

- 6.4 Bottom Line

7. Asia Market

- 7.1 Total Revenues

- 7.2 Upstream Market

- 7.3 Midstream Market

- 7.4 Downstream Market

- 7.5 Bottom Line

Annex

- Research Methodology

List of Exhibits

1. Executive Summary

- 1.1 Global Upstream Revenues

- 1.2 Global Midstream Revenues

- 1.3 Global Downstream Revenues

- 1.4 Global Revenues

- 1.5 Global Revenues - Contributions

2. Global Analysis

- 2.1 Global Revenues

- 2.2 Global Revenues - Contribution

- 2.3 SATCOM Revenues

- 2.4 SATCOM Revenues - Cumulative

- 2.5 SATCOM In-Service Units

- 2.6 EO Revenues

- 2.7 EO Revenues - Cumulative

- 2.8 Upstream Revenues

- 2.9 Upstream Market - No. of Satellites

- 2.10 Midstream Revenues

- 2.11 Midstream Revenues - SATCOM

- 2.12 Downstream Revenues

- 2.13 Downstream Revenues - SATCOM

- 2.14 SATCOM - In-Service Units

- 2.15 Backhaul & Trunking - Opportunity

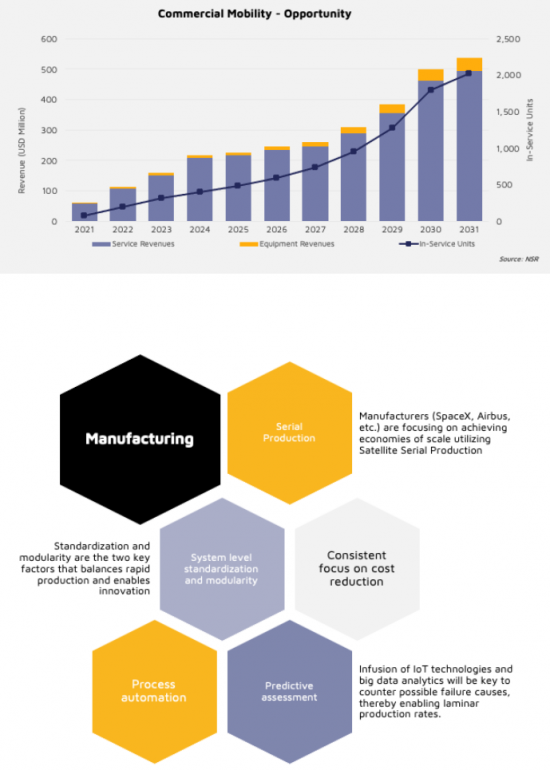

- 2.16 Commercial Mobility - Opportunity

- 2.17 Consumer Broadband - Opportunity

- 2.18 Enterprise VSAT - Opportunity

- 2.19 Gov/Mil - Opportunity

- 2.20 IoT/M2M - Opportunity

- 2.21 Earth Observation - Opportunity

3. North America Market

- 3.1 Total Revenues

- 3.2 Total Revenues - Cumulative

- 3.3 Upstream Revenues

- 3.4 Upstream Market - No. of Satellites

- 3.5 Midstream Revenues

- 3.6 Midstream Revenues - SATCOM

- 3.7 Downstream Revenues

- 3.8 Downstream Revenues - SATCOM

- 3.9 Downstream Revenues - EO

4. Latin America Market

- 4.1 Total Revenues

- 4.2 Total Revenues - Cumulative

- 4.3 Upstream Market - No. of Satellites

- 4.4 Midstream Revenues

- 4.5 Midstream Revenues - SATCOM

- 4.6 Downstream Revenues

- 4.7 Downstream Revenues - SATCOM

- 4.8 Downstream Revenues - EO

5. Europe Market

- 5.1 Total Revenues

- 5.2 Total Revenues - Cumulative

- 5.3 Upstream Revenues

- 5.4 Upstream Market - No. of Satellites

- 5.5 Midstream Revenues

- 5.6 Midstream Revenues - SATCOM

- 5.7 Downstream Revenues

- 5.8 Downstream Revenues - SATCOM

- 5.9 Downstream Revenues - EO

6. Middle East and Africa Market

- 6.1 Total Revenues

- 6.2 Total Revenues - Cumulative

- 6.3 Upstream Revenues

- 6.4 Midstream Revenues

- 6.5 Midstream Revenues - SATCOM

- 6.6 Downstream Revenues

- 6.7 Downstream Revenues - SATCOM

- 6.8 Downstream Revenues - EO

7. ASIA Market

- 7.1 Total Revenues

- 7.2 Total Revenues - Cumulative

- 7.3 Upstream Revenues

- 7.4 Upstream Market - No. of Satellites

- 7.5 Midstream Revenues

- 7.6 Midstream Revenues - SATCOM

- 7.7 Downstream Revenues

- 7.8 Downstream Revenues - SATCOM

- 7.9 Downstream Revenues - EO