|

市場調査レポート

商品コード

1273334

食品用潤滑油市場- 成長、動向、予測(2023年-2028年)Food Grade Lubricants Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 食品用潤滑油市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

食品用潤滑油の市場は、予測期間中に世界全体で5%以上のCAGRで推移すると予想されています。

COVID-19の流行は、食品用潤滑油の市場にマイナスの影響を与えました。生産施設の閉鎖と一時的な停止により、いくつかのアプリケーションにかなりの被害が発生し、食品用潤滑油の使用量が減少しました。しかし、2020年以降は、主要なエンドユーザーカテゴリーにおける継続的な取り組みにより、市場は緩やかに成長しました。

主なハイライト

- 市場調査の主な促進要因は、食品安全規制の強化です。また、加工食品需要の増加も市場を前進させると予想されます。

- 逆に、製造業者の認識不足とトレーニング不足が市場の成長を妨げています。

- 飲食品の安全性に対する関心の高まりは、予測期間中、チャンスとなりそうです。

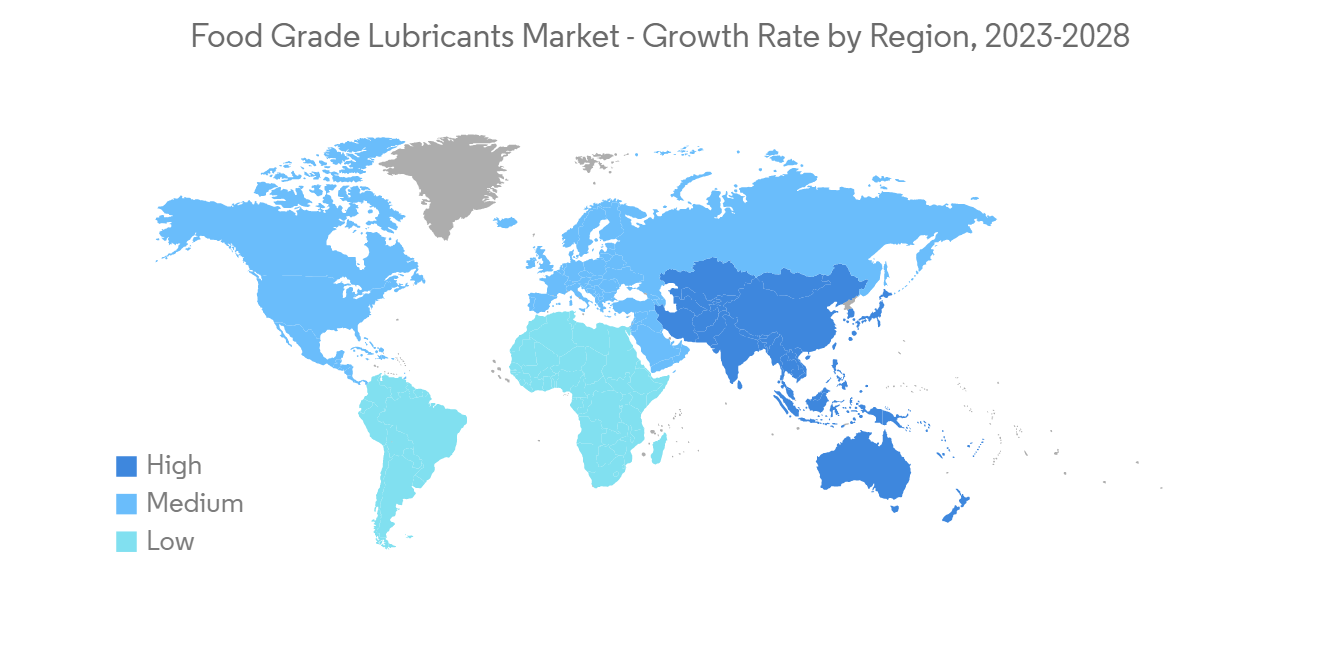

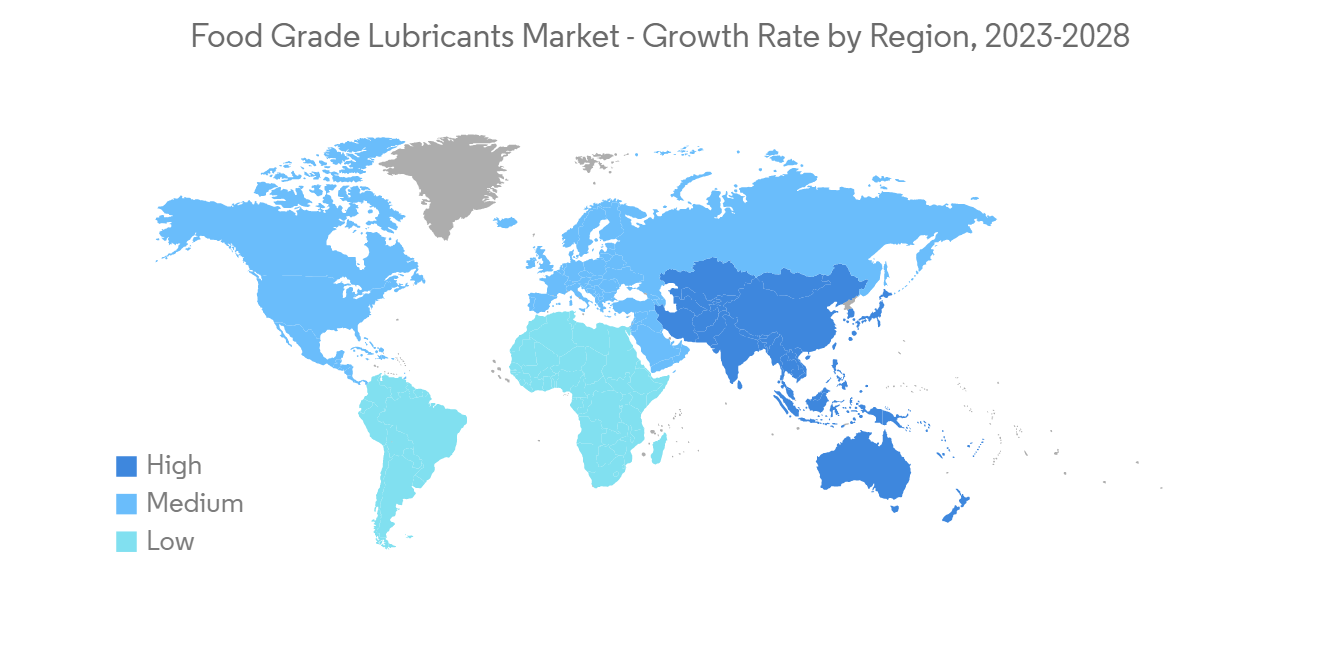

- 欧州は、ドイツ、英国、フランスなどの国々から最も多くの消費があり、世界市場を独占すると予想されます。

食品用潤滑油の市場動向

飲食品産業での用途拡大

- 食品と潤滑油の偶発的な接触が起こりうる産業機械用に特別に作られた合成潤滑油は、食品用潤滑油として知られています。

- これらのオイルは生理学的に不活性で、無味、無臭であり、国際的に認められています。また、食品、健康、安全に関する要件にも適合しています。

- 潤滑油の漏れや溢れ、あるいは潤滑の不具合により、潤滑油が機械から発生する飲食品に誤って触れてしまう可能性があります。そこで重要な役割を果たすのが、中立的な品質を持つ食品用潤滑油です。

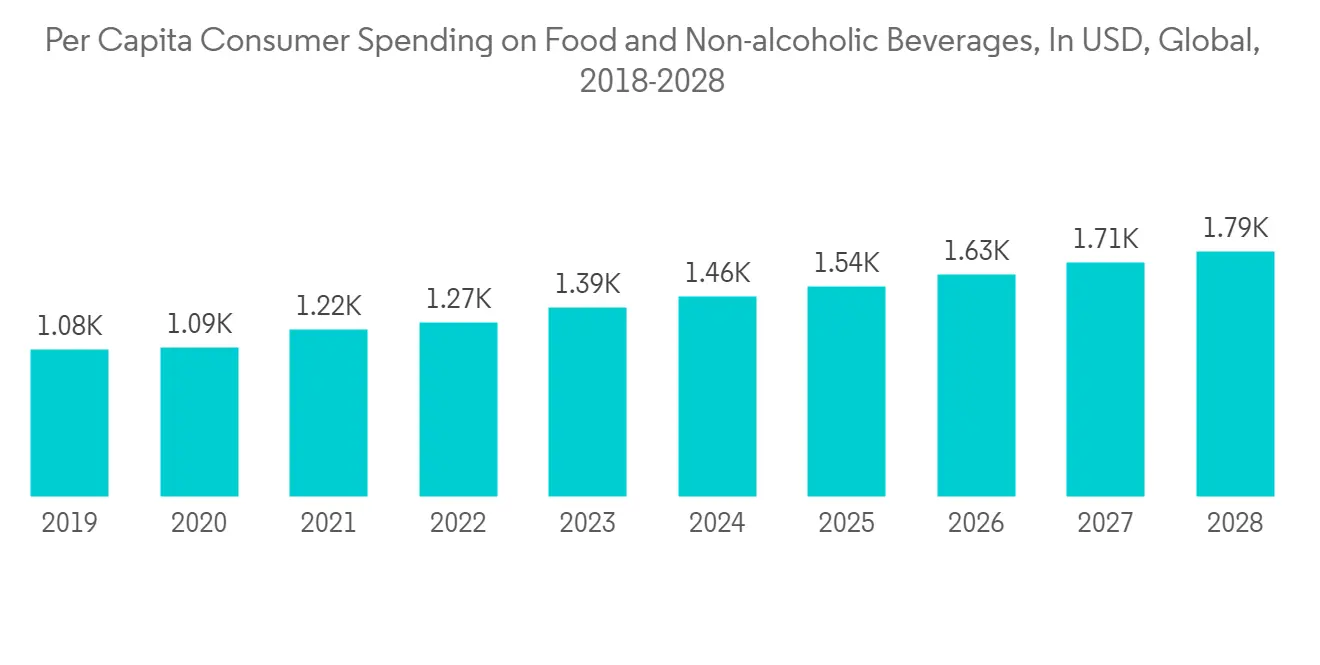

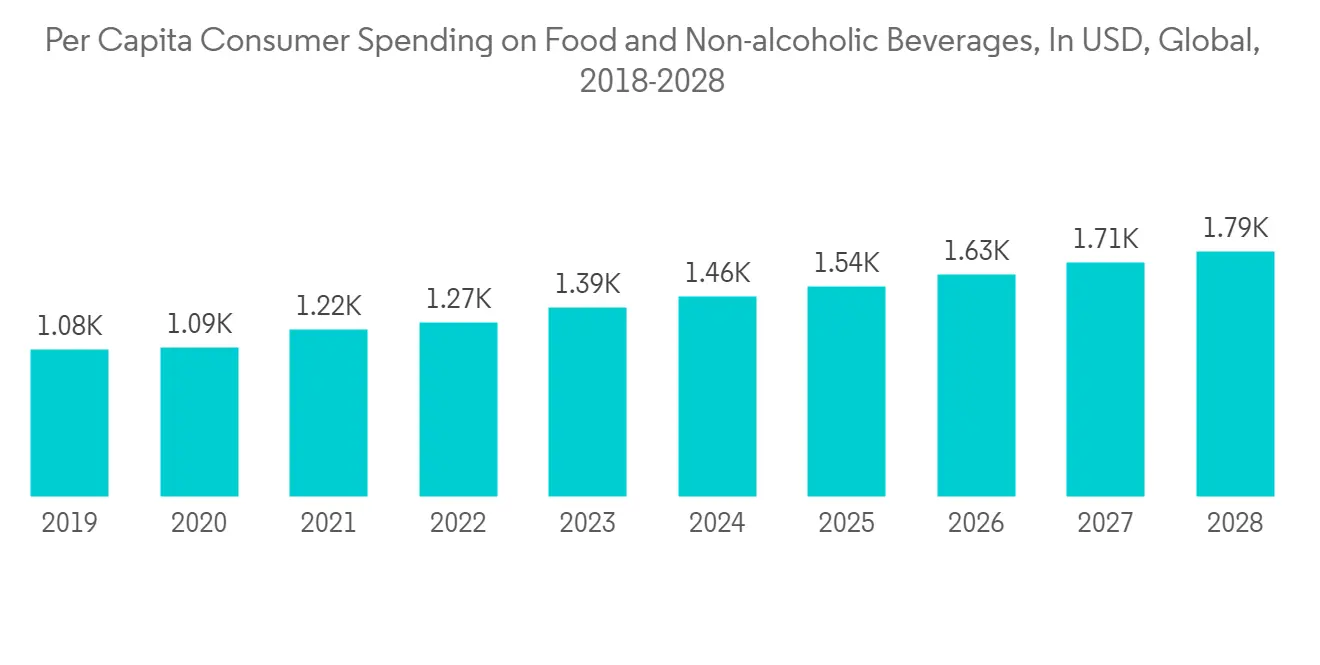

- Statistaは、2022年の世界の飲食品事業の売上が7,400億米ドルに達すると予測しています。2022年から2027年にかけてはCAGR7.14%で拡大し、その年の市場規模は11億米ドルになると予測されています。

- 経済分析局によると、2022年第1~3四半期における米国の飲食品部門の貢献額は約9,676億米ドルで、昨年の同時期を1.3%上回っています。

- 2022年に欧州で最も重要な製造業の1つである飲食品産業は、約460万人を雇用し、1兆1,000億ユーロ(1兆1,590億米ドル)の収益をもたらし、2,300億ユーロ(2,423億7,000万米ドル)の価値を付加しました。そのため、この地域の飲食品部門を後押ししています。

- インド・ブランド・エクイティ財団はさらに、2025年までにインドの加工食品部門は4,700億米ドルに達すると予測していると述べています。2022-23年度の連邦予算によると、飲食品・公共配給省は、拡大する食品・飲料部門を考慮して、215 960クロー(278億2,000万米ドル)の予算を獲得しています。

- したがって、特にアジア太平洋地域と欧州地域における食品・飲料製造の拡大により、食品用潤滑油の需要は予測期間中に増加すると予想されます。

欧州地域が市場を独占する

- 予測期間中、欧州が食品用潤滑油の市場を独占すると予想されます。ドイツ、英国、フランスなどの国々からのアプリケーションの需要が高いため、食品用潤滑油の市場は成長しています。

- 欧州は、食品用潤滑油が最も広範囲に使用されている地域です。欧州では、CONDAT Group、Matrix Specialty Lubricants、Dow、およびClearco Products Co.Inc.が食品用潤滑油のトップメーカーです。

- 2022年に欧州最大の製造業の1つである飲食品事業は、金額で2,300億ユーロ(2,423億7,000万米ドル)を加え、約460万人を雇用し、1兆1,000億ユーロ(1兆1,590億米ドル)の所得を生み出しています。そのため、現地の飲食品業界を強化しています。

- Cosmetics Europeによると、2021年の欧州の化粧品・パーソナルケア市場は約800億ユーロ(~940億米ドル)であると推定されます。欧州内の化粧品およびパーソナルケア製品の最大の国別市場は、ドイツ(136億ユーロ(~160億米ドル))、フランス(120億ユーロ(~140億米ドル))、イタリア(106億ユーロ(~122億米ドル))、英国(99億ユーロ(~118億米ドル))、スペイン(70億ユーロ(~80億米ドル))。

- 欧州では、スキンケア(232億ユーロ(~270億米ドル))とトイレタリー(206億ユーロ(~240億米ドル))が最も大きなシェアを占めており、ヘアケア製品、フレグランス/香水、装飾用化粧品と続いています。

- 上記の要因や政府の支援は、予測期間中の食品用潤滑油市場の需要増加に寄与すると思われます。

食品用潤滑油の産業概要

食品用潤滑油市場は断片的であり、プレーヤーが占める市場シェアはわずかです。重要な企業には、Dow、The Chemours Company、The Lubrizol Corporation、CONDAT Group、Matrix Specialty Lubricantsなどがある(順不同)。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 本調査の対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 食品安全規制の強化

- 加工食品への需要の増加

- 抑制要因

- 認識不足とトレーニング不足

- その他の抑制要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

第5章 市場セグメンテーション

- 食品グレード

- H1

- H2

- H3

- 製品タイプ

- グリース

- 油圧作動油

- ギアオイル

- その他の製品タイプ

- エンドユーザー産業

- 飲食品

- 化粧品

- 食用油

- その他エンドユーザー産業

- 地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東およびアフリカ

- サウジアラビア

- 南アフリカ

- その他中東とアフリカ

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約など

- 市場シェア(%)/ランキング分析

- 主要企業が採用した戦略

- 企業プロファイル

- Calumet Specialty Products Partners, L.P.

- CITGO Petroleum Corporation

- Clearco Products Co., Inc.

- CONDAT Group

- Dow

- Elba Lubes

- Engen Petroleum Ltd

- Lubrication Engineers

- Matrix Specialty Lubricants

- Petrelplus Inc.

- Suncor Energy Inc.(Petro Canada)

- The Chemours Company

- The Lubrizol Corporation

- Ultrachem Inc.

第7章 市場機会および将来動向

- 飲食品産業における用途の拡大

The market for food-grade lubricants is expected to register a CAGR of over 5% globally during the forecast period.

The COVID-19 epidemic negatively impacted the market for food-grade lubricants. The lockdown and temporary suspensions in production facilities caused considerable damage to several applications, reducing food-grade lubricants' usage. Yet, beyond 2020, the market grew moderately due to ongoing initiatives in the main end-user categories.

Key Highlights

- The primary factor driving the market studied is increasing food safety regulations. Also, the increased processed food demand is expected to drive the market forward.

- Conversely, awareness shortage and lack of training among manufacturers are hindering the market's growth.

- The increasing concern over food and beverage safety will likely be an opportunity during the forecast period.

- Europe is expected to dominate the global market with the most substantial consumption from countries such as Germany, the United Kingdom, and France.

Food Grade Lubricants Market Trends

Increasing Application in Food and Beverage Industry

- Synthetic lubricants created explicitly for industrial machinery where accidental contact between food and lubricants may occur are known as food-grade lubricants.

- These oils are physiologically inert, tasteless, odorless, and accepted internationally. They also adhere to food/health/safety requirements.

- Following a leak, overflow, or lubrication malfunction, the lubricants are prone to coming into touch accidentally with the food and beverages generated by the machinery. It is where these food-grade lubricants serve a crucial role, thanks to their neutral quality.

- Statista projects that the global food and beverage business will bring in USD 740 billion in revenue in 2022. The market is anticipated to expand at a CAGR of 7.14% between 2022 and 2027, with a projected market size of USD 1.10 billion by that year.

- According to the Bureau of Economic Analysis, the value contributed by the food and beverage sector in the United States during the first three quarters of 2022 was around USD 967.6 billion, 1.3% more than it was during the same time last year.

- One of Europe's most significant manufacturing sectors in 2022, the food and beverage industry employed almost 4.6 million people, brought in EUR 1.1 trillion (USD 1.159 trillion) in revenue, and added EUR 230 billion (USD 242.37 billion) in value. It is, thus, boosting the food and beverage sector in the area.

- The India Brand Equity Foundation further stated that by 2025, India's processed food sector is anticipated to reach USD 470 billion. According to the Union Budget for FY 2022-23, the Department of Food and Public Distribution has received a budget of INR 215 960 crores (USD 27.82 billion) considering the expanding food and beverage sector.

- Hence, due to the growing food and beverage manufacturing, especially in the Asia-Pacific and European regions, the demand for food-grade lubricants is expected to increase over the forecast period.

Europe Region to Dominate the Market

- Europe is expected to dominate the market for food-grade lubricants during the forecast period. Due to the high demand for applications from countries like Germany, the United Kingdom, and France, the market for food-grade lubricants is growing.

- Europe is where food-grade lubricants are used most extensively. In Europe, the CONDAT Group, Matrix Specialty Lubricants, Dow, and Clearco Products Co. Inc. are some of the top producers of food-grade lubricants.

- The food and beverage business, one of the largest manufacturing industries in Europe in 2022, added EUR 230 billion (USD 242.37 billion) in value, employed about 4.6 million people, and generated EUR 1.1 trillion (USD 1.159 trillion) in income. It is, thus, enhancing the local food and beverage industry.

- Cosmetics Europe said the European cosmetics and personal care market was valued at about EUR 80 billion (~USD 94 billion) in 2021. The largest national markets for cosmetics and personal care products within Europe are Germany (EUR 13.6 billion (~USD 16 billion)), France (EUR 12.0 billion (~USD 14 billion)), Italy (EUR 10.6 billion (~USD 12.2 billion)), the UK (EUR 9.9 billion (~USD 11.8 billion)) and Spain (EUR 7 billion (~USD 8 billion)).

- Skincare (EUR 23.2 billion (~USD 27 billion)) and toiletries (EUR 20.6 billion (~USD 24 billion)) include the most significant market share in Europe, followed by hair-care products, fragrances/perfumes, and decorative cosmetics.

- The abovementioned factors and government support will likely contribute to the increasing demand for the food-grade lubricants market during the forecast period.

Food Grade Lubricants Industry Overview

The food-grade lubricants market is fragmented, with players accounting for a marginal market share. Some of the significant companies include (not in any particular order) Dow, The Chemours Company, The Lubrizol Corporation, CONDAT Group, and Matrix Specialty Lubricants, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Food Safety Regulations

- 4.1.2 Increase in Demand for Processed Food

- 4.2 Restraints

- 4.2.1 Lack of Awareness and Shortage of Training

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Food Grade

- 5.1.1 H1

- 5.1.2 H2

- 5.1.3 H3

- 5.2 Product Type

- 5.2.1 Grease

- 5.2.2 Hydraulic Fluid

- 5.2.3 Gear Oil

- 5.2.4 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Food & Beverage

- 5.3.2 Cosmetics

- 5.3.3 Edible Oil

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Calumet Specialty Products Partners, L.P.

- 6.4.2 CITGO Petroleum Corporation

- 6.4.3 Clearco Products Co., Inc.

- 6.4.4 CONDAT Group

- 6.4.5 Dow

- 6.4.6 Elba Lubes

- 6.4.7 Engen Petroleum Ltd

- 6.4.8 Lubrication Engineers

- 6.4.9 Matrix Specialty Lubricants

- 6.4.10 Petrelplus Inc.

- 6.4.11 Suncor Energy Inc. (Petro Canada)

- 6.4.12 The Chemours Company

- 6.4.13 The Lubrizol Corporation

- 6.4.14 Ultrachem Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in the Food and Beverage Industry