|

市場調査レポート

商品コード

1273507

テトラヒドロフラン(THF)市場 - 成長、動向、予測(2023年-2028年)Tetrahydrofuran (THF) Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

価格

| テトラヒドロフラン(THF)市場 - 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年04月14日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

ご注意事項 :

本レポートは最新情報反映のため適宜更新し、内容構成変更を行う場合があります。ご検討の際はお問い合わせください。

- 全表示

- 概要

- 目次

概要

テトラヒドロフラン(THF)市場は予測期間中に6%のCAGRで推移すると予測されています。

主なハイライト

- COVID-19が2020年の市場にマイナスの影響を与えました。コロナウイルス関連の集団検疫は、ポリマー、繊維、塗料、コーティングの各業界に悪影響を及ぼしました。その間に有益な影響を受けたのは、医薬品事業だけでした。それにもかかわらず、THF市場は最近成長を始めており、予測期間中も同じ軌道で拡大すると予測されます。

- 中期的には、繊維産業からのスパンデックスの需要増とポリ塩化ビニル製造の需要増が、市場を牽引する大きな要因となっています。一方、近い代替品があること、THFの危険な特性(非常に燃えやすい、健康被害がある)が市場拡大の妨げになっています。

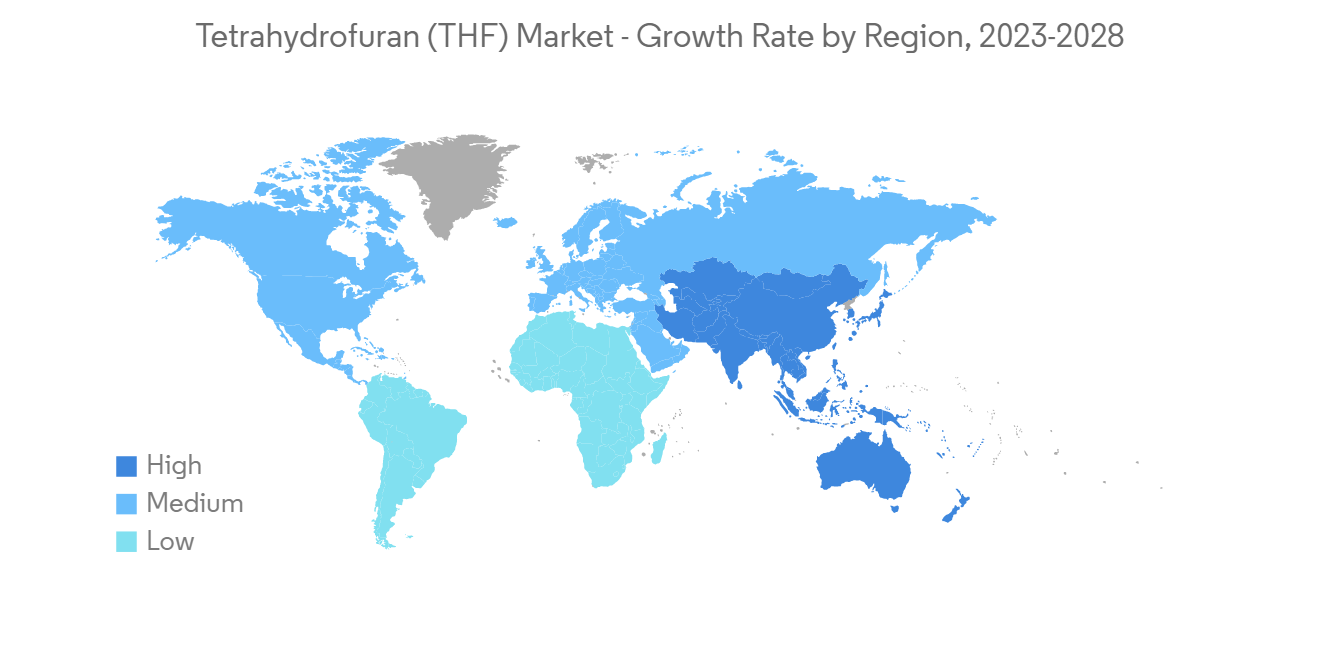

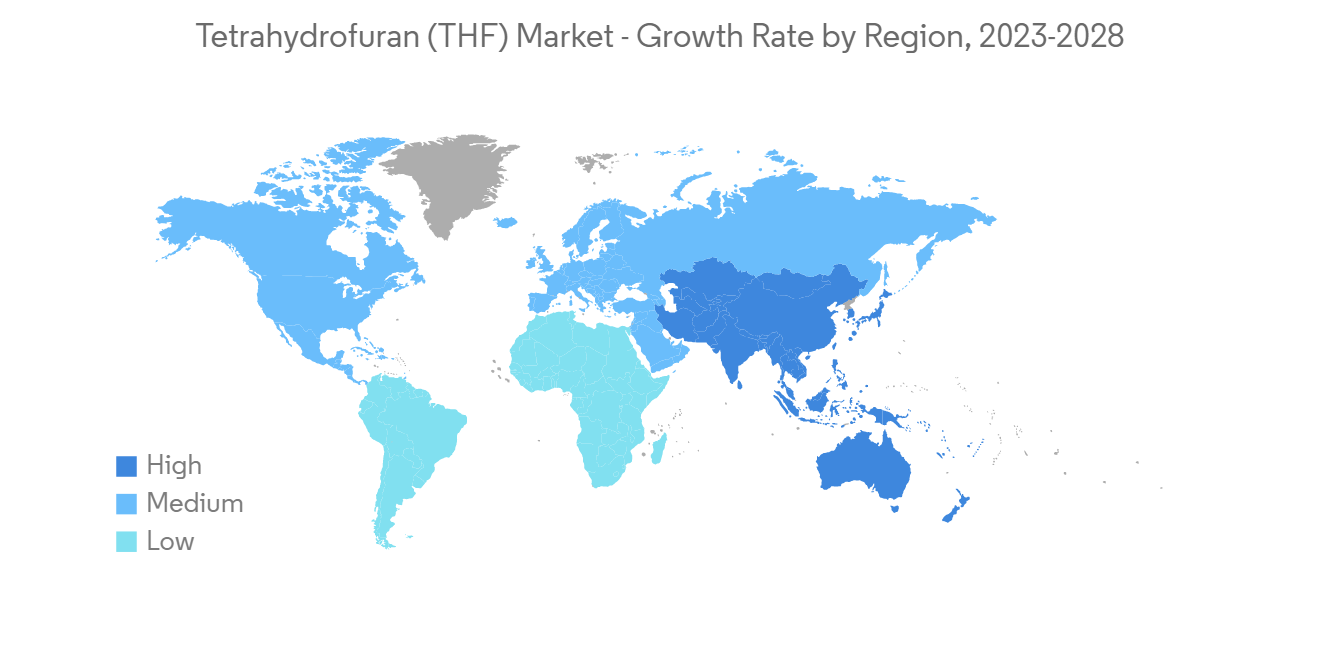

- バイオベースのTHFに関する最近の技術革新は、調査した市場にとって好機として作用すると思われます。アジア太平洋地域は、中国、インド、日本などの国からの消費が最も多く、世界的に市場を独占すると予想されます。

テトラヒドロフラン(THF)の市場動向

塗料・コーティング業界からの需要増加

- テトラヒドロフラン(THF)は、そのユニークな特性により、塗料・コーティング産業においてさまざまな用途に使用されています。例えば、接着剤、特殊塗料、コーティング、繊維の調製、特定の活性物質の抽出、特定の化合物の再結晶など、化学工業におけるさまざまな合成のための溶剤、反応媒体、出発物質として一般的に使用されています。

- 均一な塗膜厚と迅速な乾燥を実現し、高い固形分と実用的な作業粘度の溶液を形成し、良好な粘度とレオロジーコントロールを提供し、その結果、スミアを減らすことができます。

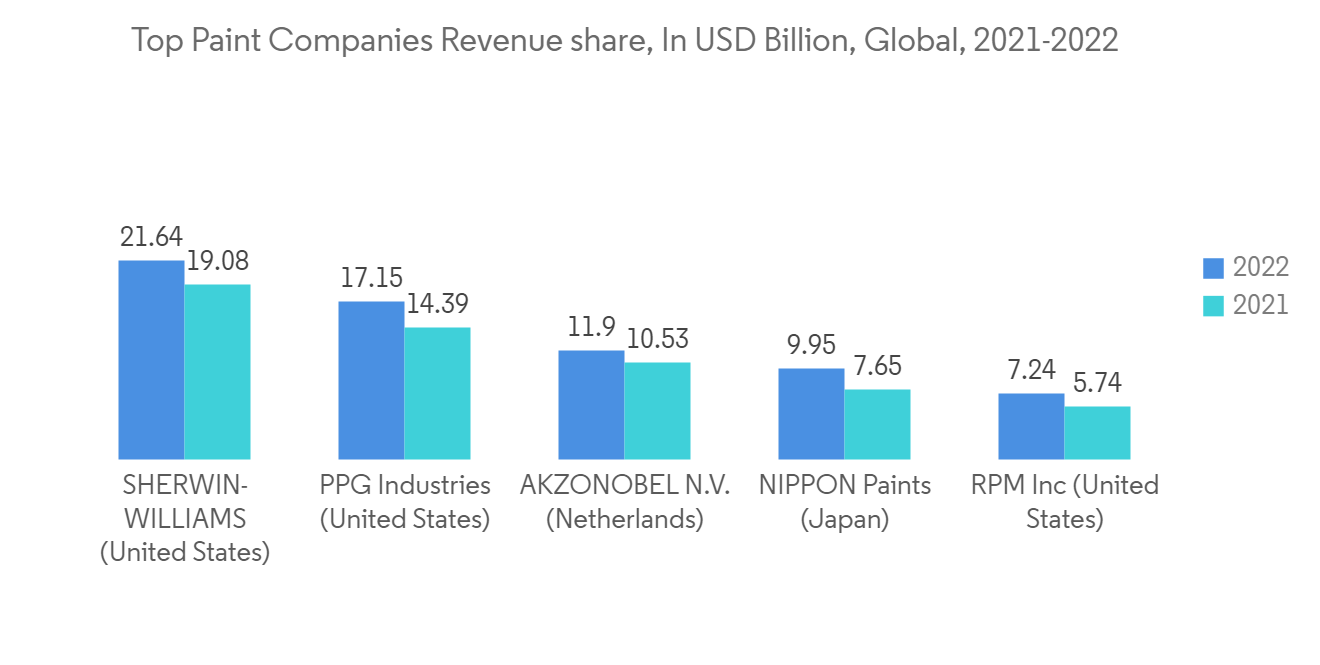

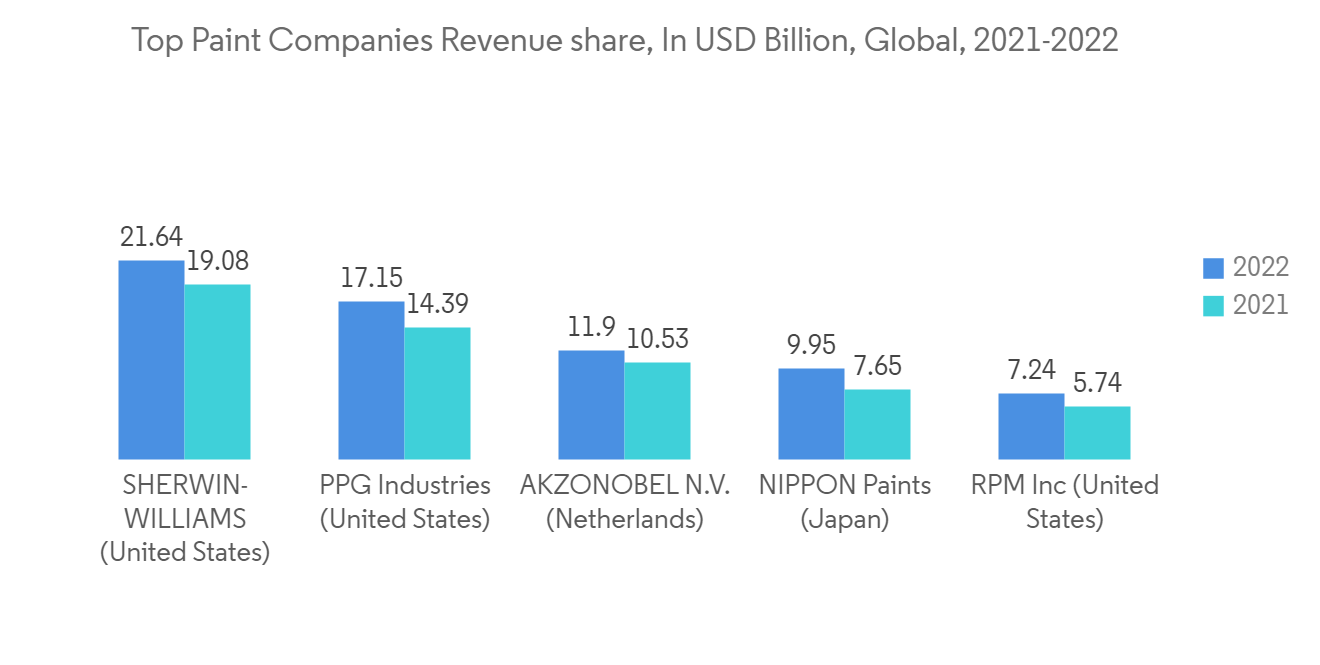

- Worlds Paint and Coatings Industry Association(WPCIA)によると、2022年の塗料とコーティングの世界売上高は約1,800億米ドルでした。2027年には、塗料・コーティング産業は約3%の年間平均成長率(CAGR)を記録すると予測されています。また、同協会の年次報告書によると、2022年の北米市場は339億2,000万米ドル、欧州市場は423億7,000万米ドルの規模であることが明らかになっています。これらの個別地域の拡大は、カナダ、ドイツ、米国で国内のリフォームプロジェクトが活発化していることに起因しています。

- 多くの産業で塗料やコーティングの消費が急速に伸びています。塗料は、自動車、建設、製造業などで広く使用されています。例えば、世界の建物建設市場は、2019年の6兆6,000億米ドルから2022年には8兆4,000億米ドルに増加しました。同様に、世界の運輸製造市場は、2019年の6兆米ドルから2022年には7兆8,000億米ドルに増加します。

- 装飾用塗料とコーティングは建物や建設に広く使用されているのに対し、保護用塗料とコーティングは自動車、主要家電、産業機器産業と密接に関連しています。したがって、エンドユーザー産業の成長が、予測期間中の塗料・コーティング市場を牽引すると予想されます。

- これらの要因により、さまざまな産業への投資が増加し、世界中の塗料やコーティングの需要が増加し、テトラヒドロフランの市場にプラスの影響を与えるでしょう。

アジア太平洋地域が市場を独占する

- アジア太平洋地域は、中国、インド、日本などの国々からの需要の増加により、予測期間中、テトラヒドロフランの市場を独占すると予想されます。塗料・コーティングの今後の需要は、中国、インド、新興諸国を中心とした発展途上国における産業およびインフラ建設の増加によって牽引されると予想されます。

- 2022年、アジア太平洋の塗料・コーティング産業は630億米ドルの規模になりました。現在、中国がこの地域の市場を独占しており、年間平均成長率(CAGR)5.8%で成長しています。2022年、中国市場の成長率は5.7%でした。現在の動向によると、中国の塗料・コーティングの総売上高は、2022年に450億米ドルを超えます。東アジアでは、同国の市場シェアが78%と最も大きいです。

- テトラヒドロフランは、製薬業界では咳止め、リファマイシン、プロゲステロンなどのホルモン剤の製造や、グリニャール合成過程の反応媒体として使用されています。インドの医薬品事業は、世界の供給量の20%を占め、生産量では第3位となっています。テトラヒドロフランの市場は、需要の高まりと製薬ビジネスの拡大によって牽引されると考えられます。

- 健康情報技術と臨床研究の複合産業を提供する米国の多国籍企業IQVIAの予測によると、世界第2位の医薬品支出国である中国は、5年間で同セグメントの数量が8%増加する一方、支出は19%増加し、以前より遅いペースではあるもの、革新的な医薬品へのアクセス拡大に焦点を当てたものになるとされています。

- インド政府によると、インドの医薬品セクターの市場規模は2030年までに1,300億米ドルに達するとされています。さらに、インドは200カ国以上に医薬品を供給しており、今後も供給し続ける予定です。2021年時点では、ワクチン生産量全体の60%を占める世界最大のワクチン生産国であり、医薬品製造量では第3位となっています。

- インドでは、一人当たりの所得の上昇、良好な人口動態、ブランド製品への嗜好の変化が繊維産業の需要を押し上げるため、調査した市場を後押ししています。インド・ブランド・エクイティ財団(IBEF)によると、インドの繊維産業は2025年までに約2,200億米ドルに達すると推定されています。

- このような背景と、政府の支援、世界の投資や事業拡大が、アジア太平洋地域におけるテトラヒドロフランの需要拡大を後押ししています。

テトラヒドロフラン(THF)産業の概要

世界のテトラヒドロフラン市場は、部分的に断片化されており、大手企業が市場のわずかなシェアを占めています。数社には、Ashland、BASF SE、三菱化学株式会社、DCC、Banner Chemicals Limitedが含まれます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 本調査の対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 繊維産業におけるスパンデックスの需要拡大

- PVC製造の需要増加

- 阻害要因

- 近い代替品の入手可能性

- THFの危険性(高可燃性、健康被害)

- 産業バリューチェーン分析

- ファイブフォース分析(Porter's Five Forces)分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の度合い

第5章 市場セグメンテーション(金額ベース市場規模)

- 用途

- ポリテトラメチレンエーテルグリコール(PTMEG)

- 溶媒

- その他の用途

- エンドユーザー産業

- ポリマー材料

- 繊維

- 医薬

- 塗料・コーティング

- その他のエンドユーザー産業

- 地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- M&A、ジョイントベンチャー、コラボレーション、契約など

- 市場シェア(%)**/ランキング分析

- 主要企業が採用した戦略

- 企業プロファイル

- Ashland

- Banner Chemicals Limited

- BASF SE

- BHAGWATI CHEMICALS

- DCC

- Hefei TNJ Chemical Industry Co.,Ltd.

- Henan GP Chemicals Co., Ltd

- Mitsubishi Chemical Corporation

- NASIT PHARMACHEM

- REE ATHARVA LIFESCIENCE PVT. LTD

- Riddhi Siddhi Industries

- Shenyang East Chemical Science-Tech Co., Ltd.

- Sipchem Company

第7章 市場機会および将来動向

- バイオベースのテトラヒドロフラン(THF)開発における技術革新

- その他のビジネスチャンス

目次

Product Code: 69066

The tetrahydrofuran (THF) market is projected to register a CAGR of 6% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. The coronavirus-related mass quarantines negatively affected the polymer, textile, paints, and coatings industries. The pharmaceutical business was the only one to have a beneficial impact during that time. Nonetheless, the THF market has started to grow in the recent past and is predicted to expand with the same trajectory over the forecast years.

- In the medium term, growing demand for spandex from the textile industry and increasing demand for polyvinyl chloride manufacturing are the major factors driving the market. On the other hand, the availability of close replacements and THF's hazardous characteristics (very flammable and health hazards) are impeding the market's expansion.

- The recent innovations in bio-based THF will likely act as an opportunity for the market studied. The Asia-Pacific region is expected to dominate the market across the world, with the largest consumption from countries such as China, India, and Japan.

Tetrahydrofuran (THF) Market Trends

Increasing Demand from the Paints and Coatings Industry

- Tetrahydrofuran (THF) serves a variety of purposes in the paints and coatings industry due to its unique properties. It is commonly used as a solvent, reaction medium, and starting material for various syntheses in the chemical industry, for example, for preparing adhesives, special paints, coatings, and fibers, and in the extraction of specific active substances, for the recrystallization of certain compounds.

- It provides uniform coating thickness and rapid drying, forms a solution with high solids and practical working viscosities, and provides good viscosity and rheology control, which in turn helps reduce smearing.

- According to Worlds Paint and Coatings Industry Association (WPCIA), global sales of paints and coatings were around USD 180 billion in 2022. By 2027, the paints and coatings industry is predicted to have a compound annual growth rate (CAGR) of around 3%. The annual report by the association also stated that in 2022, the North American market was worth USD 33.92 billion, while the European market was worth USD 42.37 billion. The expansion of these individual regions is ascribed to an uptick in domestic remodeling projects in Canada, Germany, and the United States.

- There is a rapid growth in the consumption of paints and coatings in many industries. Paints and coatings are widely used in the automotive, construction, and manufacturing industries. For instance, the global buildings construction market increased from USD 6.6 trillion in 2019 to USD 8.4 trillion in 2022. Similarly, the global transportation manufacturing market is increased from USD 6 trillion in 2019 to USD 7.8 trillion in 2022.

- Decorative paints and coatings are widely used in buildings and construction whereas protective paints and coatings are linked closely to the automotive, major appliance, and industrial equipment industries. Therefore, growth in end-user industries is expected to drive the paints and coatings market during the forecast period..

- Owing to all these factors, the rising investments in different industries will increase the demand for paints and coatings from all around the world and thus positively influence the market of tetrahydrofuran

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for tetrahydrofuran during the forecast period due to an increase in demand from countries like China, India, and Japan. The future demand for paints and coatings is expected to be driven by rising industrial and infrastructure construction in developing countries, particularly China, India, and ASEAN countries.

- In 2022, the Asia-Pacific paints and coatings industry was worth USD 63 billion. China now dominates the region's market, which is growing at a compound annual growth rate (CAGR) of 5.8%. In 2022, the Chinese market grew by 5.7%. According to current trends, China's total paints and coatings sales exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share at 78%.

- Tetrahydrofuran is used in the pharmaceutical industry to make cough serum, rifamycin, progesterone, and other hormone medicines, as well as a reaction medium in the Grignard synthesis process. India's pharmaceutical business accounts for 20% of global supply by volume and ranks third in terms of production volume. The market for tetrahydrofuran is likely to be driven by rising demand and the expansion of pharmaceutical businesses.

- According to the estimations by IQVIA, a US multinational company serving the combined industries of health information technology and clinical research, China, the world's second-largest pharmaceutical spending country, will increase the volume of the segment by 8% over five years while spending will increase by 19%, a slower rate than in previous years but still at a focus on extending access to innovative drugs.

- According to the Government of India, the Indian pharmaceutical sector market will be worth USD 130 billion by 2030. Furthermore, India has supplied pharmaceutical products to over 200 countries and will continue to do so in the future. As of 2021, the country was the world's largest producer of vaccines, accounting for 60% of overall vaccine production, and ranked third in pharmaceutical manufacturing by volume.

- In India, the rising per capita income, favorable demographics, and a shift in preference for branded products boost the demand for the textile industry, thus, boosting the market studied. According to the India Brand Equity Foundation (IBEF), the textile industry in India is estimated to reach about USD 220 billion by 2025.

- The aforementioned causes, together with government backing and global investments and expansions in the region, are driving growing demand for tetrahydrofuran in Asia-Pacific.

Tetrahydrofuran (THF) Industry Overview

The global tetrahydrofuran market is partially fragmented, with major players accounting for a marginal share of the market. A few companies include Ashland, BASF SE, Mitsubishi Chemical Corporation, DCC, and Banner Chemicals Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Spandex from the Textile Industry

- 4.1.2 Increasing Demand for PVC Manufacturing

- 4.2 Restraints

- 4.2.1 Availability of Close Substitutes

- 4.2.2 Hazardous Nature (Highly Flammable and Health Hazard) of THF

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Polytetramethylene Ether Glycol (PTMEG)

- 5.1.2 Solvent

- 5.1.3 Other Applications

- 5.2 End-User Industry

- 5.2.1 Polymer

- 5.2.2 Textile

- 5.2.3 Pharmaceutical

- 5.2.4 Paints and Coatings

- 5.2.5 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ashland

- 6.4.2 Banner Chemicals Limited

- 6.4.3 BASF SE

- 6.4.4 BHAGWATI CHEMICALS

- 6.4.5 DCC

- 6.4.6 Hefei TNJ Chemical Industry Co.,Ltd.

- 6.4.7 Henan GP Chemicals Co., Ltd

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 NASIT PHARMACHEM

- 6.4.10 REE ATHARVA LIFESCIENCE PVT. LTD

- 6.4.11 Riddhi Siddhi Industries

- 6.4.12 Shenyang East Chemical Science-Tech Co., Ltd.

- 6.4.13 Sipchem Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Development of Bio-based Tetrahydrofuran (THF)

- 7.2 Other Opportunities

お電話でのお問い合わせ

044-952-0102

( 土日・祝日を除く )