|

|

市場調査レポート

商品コード

1190281

化学機械研磨(CMP)スラリー市場- 成長、動向、予測(2023年-2028年)Chemical Mechanical Planarization (CMP) Slurry Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 化学機械研磨(CMP)スラリー市場- 成長、動向、予測(2023年-2028年) |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

化学機械研磨(CMP)スラリー市場は、予測期間中に6.4%のCAGRで推移すると予想されます。

主に半導体の性能を向上させるための製造および半導体プロセスにおける技術的進歩の高まりが、予測期間中、世界のCMP(化学機械研磨)スラリー市場を牽引すると予想されます。また、メーカーによる製品イノベーションのための半導体ウエハー製造用材料への投資の増加も、市場の成長を後押ししています。

主なハイライト

- 日本、中国、韓国、シンガポール、米国は主要な半導体チップメーカーであり、消費と投資の面で市場の拡大に大きく貢献しています。CMPは、半導体企業が集積回路(IC)やメモリーディスクを製造する際に利用する標準的な製造方法として発展してきました。その結果、IoT、自動車、5Gなどの分野でこれらの部品の使用量が増加していることが、予測期間中のCMPスラリーの需要を押し上げる可能性があります。

- CMPは、新世代のチップを構築するためのトランジスタ、およびその他の相互接続デバイスの最小化において重要な役割を担っています。トランジスタの採用が進み、14nmノードから5nmノードに至るまで継続的に産業が発展していることも、市場ベンダーに大きなビジネスチャンスをもたらしています。

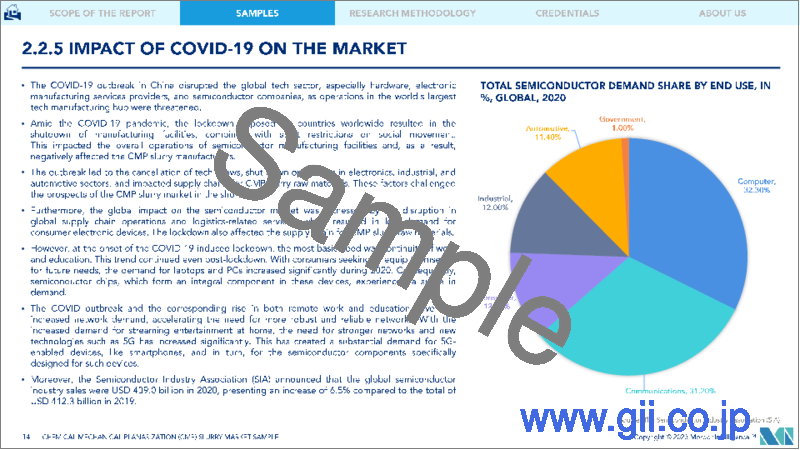

- COVID-19の流行は、世界中の中小企業や大企業に経済的な大混乱をもたらしました。このウイルスは、各国の封鎖によりスマートデバイスの需要にも影響を与え、これらのデバイスの生産とサプライチェーンに大きな打撃を与えました。今後、電子機器の生産が再開され、ウイルスの拡散が抑えられれば、電子機器の需要が急激に増加し、CMPスラリーは世界的に大きな市場機会を迎えると予想されています。

- アジア諸国、特に中国は、市場拡大において重要な役割を担っています。中国は、2025年までに製品の16%から70%に国産半導体を利用する国産チッププログラムも確立しています。最近のCOVID-19の発生は、この分野への長期的な投資により、業界のサプライチェーンに影響を与える可能性がありますが、業界は急速に回復すると予想されます。

主な市場動向

メモリが市場で大きなシェアを占める

- 大容量ストレージを必要とするスマートフォンの普及に伴い、フラッシュメモリが大きな推進力となっています。不揮発性メモリは、通常のNANDよりも高速かつ長寿命であり、メモリの成長を促進すると予想されます。このような改善により、CMPプロセスはCMPスラリー市場の成長を促進するために不可欠であることが証明されるかもしれません。

- PCやスマートフォンの普及に伴い、NANDフラッシュメモリの消費量は飛躍的に増加しており、その要因としてスマートフォンの平均容量が増加していることが挙げられます。このことが、CMPスラリーの需要を押し上げると予想されます。

- 例えば、GSMAによると、2021年時点で北米のスマートフォン普及率は82%と最も高く、2022年末には85%に上昇する可能性があります。スマートフォンの普及が進むことで、CMPスラリー市場を牽引する可能性があります。

- NAND技術が2Dから3Dに進化するにつれ、チャネルポリCMPや階段CMPなど、追加のCMPステージが導入されました。チャネルポリCMPの目的は、SiN、酸化膜、poly-Siなど、多くの材料を同時に研磨することです。そのため、最終的な形状に合わせて材料ごとにレートを調整する必要があり、CMPスラリーの需要を高めています。

- フラッシュメモリーストレージは、コンテンツ制作の増加に伴いストレージへのニーズが高まり続ける消費者や、BoM(Bill of Materials)コストの観点からOEMにとって、スマートフォンの重要な要素となっています。NANDフラッシュの需要は、主にスマートフォンの平均容量の伸びによって、指数関数的に増加しています。5G対応スマートフォンの人気の高まりは、2022年までの市場成長を牽引すると予測されます。

台湾は市場の主要地域として台頭する見込み

- 台湾では、半導体製造の拡大により、CMPスラリーの使用量が増加しています。台湾政府は、サプライチェーンから中国を完全に切り離すための堅実な措置を講じています。2022年1月、台湾はマイクロチップを生産するために2億米ドルの投資を発表しました。また、リトアニアと台湾の企業間のプロジェクトに焦点を当てた10億米ドルの投資も開始されました。

- 世界市場で50%以上のシェアを持つ世界最大の受託チップメーカーである台湾のTSMCも、CMPスラリーの需要を大きく創出します。5Gと自動車産業のため、通信産業の成長の進歩は、同社の製品需要を促進し、それゆえ、市場ベンダーのための範囲を開発しています。

- 例えば、Huaweiは、5Gインフラストラクチャのために台湾の機器を購入しています。同社の5G基地局には、ほとんどがTSMCの半導体が提供されています。TSMCは、市場の重要なベンダーの1つであるCabot Microelectronicsの消費者でもあります。

- しかし、米国との貿易摩擦の中で、半導体生産の自給自足を目指す中国の野望によって、同社は困難に直面しています。米国政府も多数の台湾企業に対して、中国やHuaweiへの半導体出荷を減らすように働きかけています。

- 台湾は5G展開の戦略で5Gに投資しています。半導体製造業が主にこの取り組みを推進しているため、5G向けの各種デジタルシグナルプロセッサやその高周波無線モデム回路など、IC設計顧客の期待に応えることが期待されます。この動向は、市場の成長を後押しすると予想されます。

競合情勢

化学機械研磨(CMP)スラリー市場は比較的集約されており、トップ企業が50%以上のシェアを占めています。市場ベンダーは、市場での開拓を推進するために、コラボレーション戦略や製品の進化を採用しています。最近の市場開拓は以下の通りです。

- 2021年12月-EntegrisがCMC Materialsを65億米ドルで買収し、電子材料のリーダーとなることで合意しました。CMC Materialsは、特に半導体分野で革新的な材料を提供する重要な企業です。CMC Materialsの主要なCMPポートフォリオを取得することで、エンターグリスのソリューションセットが広がり、包括的な電子材料が提供できるようになる可能性があります。両社の技術基盤の相互補完性により、Entegrisはより幅広い革新的で高価値のソリューションをより速いペースで市場に投入することができるかもしれません。

- 2021年10月-BASFとEntegrisは、BASFの精密マイクロ化学品事業を9000万米ドルでEntegrisに売却する契約を締結しました。2021年末までに、取引には技術、知的財産、商標が含まれます。精密マイクロ化学品事業は、BASFのコーティング部門の表面処理ビジネスユニットの一部であり、電子材料の機械加工や表面調整に採用されている洗浄化学品やCMPスラリーも含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査対象範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 マーケットインサイト

- 市場概要

- 産業の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

- アプリケーション- 銅およびバリア、コバルト、タングステン、酸化物、セリア、およびその他のアプリケーション

- COVID-19の市場への影響度評価

第5章 市場力学

- 市場促進要因

- ICの3D構造化の進展とCMP技術の重要性の高まり

- 市場の課題

- CMP技術に関する技術的課題

第6章 市場セグメンテーション

- デバイスタイプ別

- メモリ

- ロジック

- 国別

- 韓国

- 台湾

- 米国

- 日本

- 欧州

- 中国

- 世界のその他の地域

第7章 競合情勢

- ベンダーランキング分析

- 企業プロファイル

- Cabot Microelectronics Corporation

- Showa Denko Materials Co. Ltd

- Hitachi Chemical Co. Ltd

- Fujifilm Corporation

- Fujimi Corporation

- Dow Inc.

- Merck KGaA(Including Versum Materials)

- Saint-Gobain Ceramics & Plastics Inc.

- BASF

第8章 投資分析

第9章 市場の展望と機会

The chemical mechanical planarization (CMP) slurry market is expected to register a CAGR of 6.4% during the forecast period. The growing technological advancements in fabrication and semiconductor processes, mainly to enhance the performance of the semiconductor, are expected to drive the worldwide market for chemical mechanical planarization (CMP) slurry over the forecast period. Manufacturers' increasing investment in semiconductor wafer fabrication materials for product innovation also drives the market's growth.

Key Highlights

- Japan, China, Korea, Singapore, and United States are significant semiconductor chip makers, contributing considerably to the market expansion in terms of consumption and investment. CMP has evolved into a standardized manufacturing method utilized by semiconductor firms to manufacture integrated circuits (IC) and memory disks. As a result, increasing usage of these components in areas such as IoT, automotive, and 5G may drive the demand for CMP slurries during the forecast period.

- CMP has played a significant role in minimizing transistors, and other interconnect devices for building a new generation of chips. The increase in adoption of transistors and continuous industrial development, down to the 5nm node from the 14nm node, also offers massive opportunities for market vendors.

- The COVID-19 outbreak caused economic havoc in small, medium, and large-scale companies worldwide. The virus also impacted demand for smart devices owing to national lockdowns, which substantially affected the production and supply chain of these devices. Furthermore, with the resumption of production of these gadgets and the lowering of virus propagation, an exponential surge in demand for electronic devices is predicted to open up numerous market opportunities for the CMP slurry on a global scale.

- Asian countries, particularly China, play a vital role in market expansion. China is also establishing a homegrown chip program to utilize local semiconductors in 70% of its products by 2025, up from 16%. Even though the recent COVID-19 outbreak may impact the industry's supply chain due to longer-term investment in the sector, the industry is anticipated to recover fast.

Key Market Trends

Memory Occupies a Significant Share in the Market

- Due to the increasing popularity of smartphones with large storage requirements, flash memory has been a significant driving factor. Emerging technologies like non-volatile memory, which provides faster and longer-lasting performance than regular NAND, are anticipated to drive memory growth. With such improvements, the CMP process may prove to be vital in driving the CMP slurry market's growth.

- With the growing adoption of PCs and smartphones, NAND flash consumption is dramatically increasing, much of which is attributable to the increase in average smartphone capacity. This factor is anticipated to boost the demand for CMP slurry.

- For instance, according to GSMA, as of 2021, North America had the highest smartphone adoption rate, at 82%, which may increase to 85% by the end of 2022. The increasing adoption of smartphones may drive the CMP slurry market.

- As NAND technology evolved from 2D to 3D, additional CMP stages were introduced, such as channel poly CMP and staircase CMP. The purpose of channel poly CMP is to polish many materials simultaneously, such as SiN, oxide, and poly-Si. As a result, individual material rate tunability is required to match the final topographical requirement, thus boosting the demand for CMP slurry.

- Flash memory storage has become a key component in smartphones for consumers whose need for storage continues to grow as content creation increases and for OEMs in terms of bill of materials (BoM) cost. The NAND flash demand has been increasing exponentially, primarily driven by the growth of the average capacity of smartphones. The rising popularity of 5G-enabled smartphones is projected to drive the market's growth through 2022.

Taiwan is Expected to Emerge as a Major Region in the Market

- The country's expanding semiconductor manufacturing is primarily driving the usage of CMP slurry. The Taiwanese government is taking solid steps to cut China from the supply chain entirely. In January 2022, Taiwan announced an investment of USD 200 million to produce microchips. An investment of USD 1 billion was also launched to focus on projects between Lithuanian and Taiwanese companies.

- Taiwan-based TSMC, the world's largest contract chipmaker with more than 50% share in the global market, also significantly creates demand for CMP slurries. Due to 5G and the automotive industry, the growing advancements in the telecom industry are fuelling the company's product demand, hence developing the scope for the market vendors.

- For instance, Huawei purchases Taiwanese equipment for 5G infrastructure. The company's 5G base stations are mostly provided with TSMC semiconductors. TSMC is also a consumer of Cabot Microelectronics, one of the significant vendors in the market.

- However, the company is facing difficulties due to China's ambition to become more self-sufficient in semiconductor production amid its trade battle with United States. The US government is also pushing numerous Taiwanese firms to reduce semiconductor shipments to China or Huawei.

- Taiwan is investing in 5G with its strategy for a 5G rollout. As the semiconductor manufacturing industry is primarily driving the effort, it is expected to meet the expectations of its IC design customers for various digital signal processors for 5G and its high-frequency radio modem circuits. This trend is anticipated to boost the market's growth.

Competitive Landscape

The chemical mechanical planarization (CMP) slurry market is relatively consolidated, with top players accounting for more than 50% of the market share. The market vendors are adopting collaboration strategies and product advancements to drive development in the market. Some recent market developments include.

- December 2021 - Entegris agreed to acquire CMC Materials for USD 6.5 billion to become a leader in electronic materials. CMC Materials is a significant provider of innovative materials, particularly in the semiconductor sector. The acquisition of CMC Materials' leading CMP portfolio may broaden Entegris' solution set, providing a comprehensive electronic materials offering. The complementary nature of the company's technological platforms may allow Entegris to bring a wider range of innovative and high-value solutions to market at a faster pace.

- October 2021 - BASF and Entegris signed an agreement for the sale of BASF's Precision Microchemicals business to Entegris for USD 90 million. By the end of 2021, the transaction included technologies, intellectual property, and trademarks. The Precision Microchemicals business is part of the Surface Treatment business unit of BASF's Coatings division, which also includes cleaning chemistries and CMP slurries employed in the machining and surface conditioning of electronic materials.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Applications - Copper and Barrier, Cobalt, Tungsten, Oxide, Ceria, and Other Applications

- 4.5 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Use of 3D Structures in ICs and Growing Importance of CMP Technology

- 5.2 Market Challenges

- 5.2.1 Technical Challenges Pertaining to CMP Technique

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Memory

- 6.1.2 Logic

- 6.2 By Country

- 6.2.1 South Korea

- 6.2.2 Taiwan

- 6.2.3 United States

- 6.2.4 Japan

- 6.2.5 Europe

- 6.2.6 China

- 6.2.7 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Ranking Analysis

- 7.2 Company Profiles

- 7.2.1 Cabot Microelectronics Corporation

- 7.2.2 Showa Denko Materials Co. Ltd

- 7.2.3 Hitachi Chemical Co. Ltd

- 7.2.4 Fujifilm Corporation

- 7.2.5 Fujimi Corporation

- 7.2.6 Dow Inc.

- 7.2.7 Merck KGaA (Including Versum Materials)

- 7.2.8 Saint-Gobain Ceramics & Plastics Inc.

- 7.2.9 BASF