|

市場調査レポート

商品コード

1437960

屋内農業:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Indoor Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 屋内農業:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 156 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

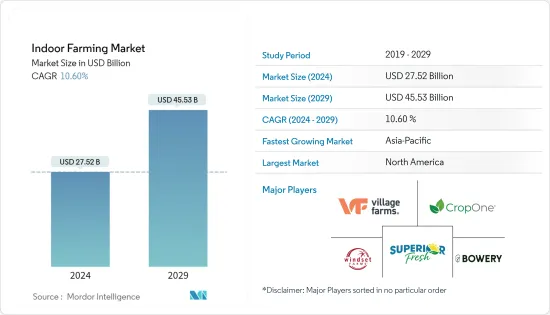

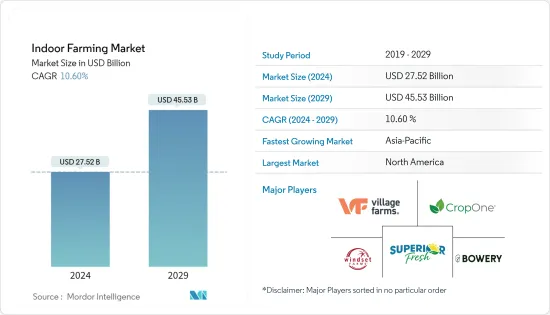

屋内農業市場の規模は、2024年に275億2,000万米ドルと推定され、2029年までに455億3,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に10.60%のCAGRで成長します。

主なハイライト

- 健康意識の高まりと残留物を含まない食品の消費により、屋内農業などの高度な技術の利用への道が開かれました。人々は害虫のない食べ物を得るために必要な作物を自宅で小規模に栽培しており、その結果、収量が増加しています。

- さまざまな栽培タイプの中で、土壌ベースの屋内農業が市場を独占しています。従来の農業と比較して、植物の収穫サイクルを向上させる能力が市場の成長を推進しています。施設タイプ別では、ガラスまたはポリ温室がより大きな市場シェアを占めていますが、屋内深水養殖システムは予測期間中に最も高いCAGRを示すと予想されます。中東では持続可能な食料生産への需要が高まっており、これは農業に屋内垂直農法技術を導入することで実現可能です。

- 2021年には北米が最大の市場シェアを占めました。この地域のシェアに大きく貢献しているのは米国で、カナダ、メキシコがそれに続きます。屋内農業が大きな注目を集めている主な理由の1つは、より少ないリソースでより多くの生産が可能であるためです。たとえば、米国農務省(USDA)によると、従来のレタス栽培の平均収量は、垂直農法で栽培すると2倍になりました。アジア太平洋地域の屋内農業市場は、政府の政策の恩恵を受けて急速に成長しています。

屋内農業市場の動向

気候条件が生産に及ぼす影響

欧州委員会によると、農業目的で使用される土地の量は、2017年の現在のレベルである1億7,600万ヘクタールから2030年には1億7,200万ヘクタールに減少する可能性があり、これに対応してEUの耕地レベルも2017年の1億650万ヘクタールから2030年には1億400万ヘクタールに低下する可能性があります。

世界銀行の統計によると、南アジアは全土地に占める耕地の割合が2017年の43.2%から2020年の43%に減少しました。したがって、南アジアの新興諸国では耕地の減少と汚染の増加が予想されます。屋内農業を含む代替栽培の需要を高めるため。

一人当たりの農地利用可能量は減少し続けているため、生産性を向上させることが解決策となっています。したがって、生産量を損なうことなく農地不足の問題を解決でき、屋内農業によって達成できる高収量作物が求められています。農地の減少は主に、都市化、道路、工業、住宅などの非農業目的への転用と、さまざまな新興諸国における土壌浸食と汚染が原因です。中国には約3億3,400万エーカーの耕地があり、そのうち約3,700万エーカーは耕作不可能であり、人口増加が大きな脅威となっています。より多くの耕地を造成する代わりに、耕作地の収量と生産性を向上させることが考えられます。これらの技術には、高収量品種、肥料と農薬の管理、機械化、灌漑管理、屋内農業などの新しい農業技術の採用が含まれます。

耕作可能な土地が世界的に減少しているため、屋内農業は、水耕栽培と人工照明を使用して、屋外で栽培する場合のみ植物に栄養と光を提供することで、生産量の増加に役立つ可能性があります。したがって、屋内農業用機器の需要は予測期間中に増加する可能性があります。

北米が市場を独占

北米は、 2021年に世界の屋内農業市場で最も高いシェアを占めました。高効率LED照明と強化された屋内管理慣行の助けを借りて、米国の栽培者は大規模な屋内農業を採用しました。このような実践により、照明エネルギーのコストが約50%削減され、環境管理された農業の二酸化炭素排出量が削減されると期待されています。米国農務省(USDA)によると、垂直農法で栽培した場合、従来のレタス栽培の平均収量は2倍になりました。現在、米国の屋内農業産業は温室作物生産が大部分を占めています。ニューヨーク、シカゴ、ミルウォーキーなどの都市全体で都市人口の住居が始まり、脱線した空き倉庫、廃墟となった建物、高層ビルの改修などの活動により屋内農業の環境が推進され、その結果、生鮮食品の生産量が全体的に増加します。米国における温室トマトの需要が、水耕栽培の市場需要を押し上げています。屋内農業は、米国で最も急速に成長している産業の1つです。

国連食糧農業機関によると、メキシコの乾燥地は約1億150万ヘクタールの土地を占めており、そのため屋内農業の必要性が高まっています。カナダもプラスの成長傾向にあり、水耕栽培トマトの世界輸出に大きく貢献しています。この地域の水耕栽培および空気栽培システムの成長は、主に収量を向上させるための革新的で効率的な技術の導入に注目が集まっているため、屋内農業市場全体を牽引しています。北米諸国では、葉物野菜、ハーブ、果物、マイクログリーン、花など、さまざまな作物が屋内農業で栽培されています。屋内垂直農業システムは有機食品を提供しており、北米の消費者の間で農薬や除草剤を使用していない食品に対する需要が高まるとともに、有機食品が屋内垂直農業の主な原動力となっています。

屋内農業産業の概要

屋内農業の市場は非常に細分化されており、主要企業は少数のシェアを占めており、他の小規模企業が市場で大きなシェアを占めています。

市場は非常に細分化されており、特に、Village Farms International Inc.、Superior Fresh、Crop One Holdings、Windest Farms、Bowery Incなどの主要収益企業が市場シェアの一部を占めています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 成長システム

- エアロポニックス

- 水耕栽培

- アクアポニックス

- 土壌ベース

- ハイブリッド

- 施設タイプ

- ガラスまたはポリ温室

- 屋内垂直農場

- コンテナファーム

- 屋内DWCシステム

- その他の施設タイプ

- 作物タイプ

- 果物と野菜

- 葉物野菜

- レタス

- ケール

- ほうれん草

- その他の葉物野菜

- トマト

- いちご

- ナス

- その他の果物と野菜

- ハーブとマイクログリーン

- バジル

- ハーブ

- タラゴン

- ウィートグラス

- その他のハーブとマイクログリーン

- 花と観賞用植物

- 多年草

- 一年生植物

- 観賞用

- その他の花と観賞植物

- その他の作物タイプ

- 果物と野菜

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 北米のその他の地域

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- シンガポール

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 市場シェア分析

- 企業プロファイル

- AeroFarms

- Bright Farms Inc.

- Bowery Inc.

- Crop One Holdings

- Metropolis Farms Inc.

- Garden Fresh Farms

- Village Farms International Inc.

- Green Sense Farms LLC

- Sky Greens(Sky Urban Solutions)

- Superior Fresh Farms

- Windset Farms

- Gotham Greens

第7章 市場機会と将来の動向

The Indoor Farming Market size is estimated at USD 27.52 billion in 2024, and is expected to reach USD 45.53 billion by 2029, growing at a CAGR of 10.60% during the forecast period (2024-2029).

Key Highlights

- An increase in health consciousness and consumption of residue-free food has paved the way for the usage of advanced techniques, like indoor farming. People are growing the necessary crops in their own houses on a small scale to have food free from pests, resulting in a higher yield.

- Among the various growing types, soil-based indoor farming dominates the market. Its ability to enhance the harvesting cycle of plants, when compared to traditional farming, is driving its market growth. By facility type, glass or poly greenhouses occupy a larger market share, while the indoor deep-water culture system is anticipated to witness the highest CAGR during the forecast period. There is an increase in the demand for sustainable food production in the Middle East, which is achievable by adopting indoor vertical farming technologies in agriculture.

- North America accounted for the largest market share in 2021. The US is a major contributor to the region's share, followed by Canada and Mexico. One of the primary reasons indoor farming has been gaining significant traction is because of its ability to produce more with fewer resources. For example, as per the US Department of Agriculture (USDA), the average yield of conventional lettuce farming doubled twofold when cultivated through vertical farming. The indoor farming market in the Asia-Pacific region is growing rapidly, with the industry benefiting from government policies.

Indoor Farming Market Trends

Effect of Climate Conditions on Production

According to the European Commission, the amount of land used for agricultural purposes may fall to 172 million ha in 2030 from the current level of 176 million ha in 2017, with a corresponding decline in the level of EU arable land, from 106.5 million hectares in 2017 to 104 million hectares in 2030.

According to the World Bank statistics, South Asia declined the arable land percentage of the total land from 43.2% in 2017 to 43% in 2020. Thus, a reduction in arable land and an increase in pollution in the developing countries of Southern Asia are expected to increase the demand for alternative cultivation, including indoor farming.

Due to the continuous decline in the per capita availability of farmland, the practice of increasing productivity is a way out. Thus, there is a need for high-yielding crops, which can solve the problem of farmland scarcity without compromising production volumes, which can be attained through indoor farming. The decline in agricultural land has been mainly due to diversion for non-agricultural purposes, such as urbanization, roads, industries, and housing, and soil erosion and pollution in various developing countries. In China, there are approximately 334 million acres of arable land, of which around 37 million acres are non-cultivable, and the growing population poses a major threat. The alternative to creating more arable land is to enhance the yield and productivity of cultivated land. These technologies include high-yielding varieties, the management of fertilizers and pesticides, mechanization, irrigation management, and employing new farming techniques, such as indoor farming.

As the cultivable land is decreasing globally, indoor farming may help increase production by using hydroponics and artificial lighting to provide plants with nutrients and light, as they would only receive when grown outdoors. Thus, the demand for equipment for indoor farming may increase during the forecast period.

North America Dominates the Market

North America accounted for the highest global indoor farming market share in 2021. With the help of high-efficiency LED lights and enhanced indoor management practices, US growers have adopted large-scale indoor farming. Such practices are expected to reduce energy lighting costs by about 50%, thus, reducing the carbon footprint of controlled environment agriculture. As per the US Department of Agriculture (USDA), the average yield of conventional lettuce farming doubled twofold when cultivated through vertical farming. Currently, the indoor farming industry in the US is predominantly dominated by greenhouse crop production. The onset of urban population dwellings across cities, such as New York, Chicago, and Milwaukee, has propelled the environment for indoor farming with activities such as revamping derailed vacant warehouses, derelict buildings, and high rises, which has, in turn, led to an increase in the production of fresh grown foods altogether. The demand for greenhouse tomatoes in the United States is driving the market demand for hydroponic operations. Indoor farming is one of the fastest-growing industries in the United States.

According to the UN Food and Agriculture Organization, drylands in Mexico occupy approximately 101.5 million hectares of land, thereby boosting the need for indoor farming practices. Canada has also seen a positive growth trend, contributing significantly to the world exports of hydroponically grown tomatoes. The region's growth of hydroponics and aeroponics systems is driving the overall indoor farming market, mainly due to the increasing focus on adopting innovative and efficient technologies to improve yields. A wide variety of crops, such as leafy vegetables, herbs, fruits, micro greens, and flowers, are grown through indoor farming in the countries of North America. Indoor vertical farming systems have provided organic food, which has become the major driving force for indoor vertical farming along with the increasing demand for pesticide- and herbicide-free food among the consumers of North America.

Indoor Farming Industry Overview

The market for indoor farming is highly fragmented, with the top players accounting for a minor share and the other small companies capturing a major share in the market.

The market is highly fragmented, with major revenue-generating companies, which are Village Farms International Inc., Superior Fresh, Crop One Holdings, Windest Farms, and Bowery Inc, among others, cornering some parts of the market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Growing System

- 5.1.1 Aeroponics

- 5.1.2 Hydroponics

- 5.1.3 Aquaponics

- 5.1.4 Soil-based

- 5.1.5 Hybrid

- 5.2 Facility Type

- 5.2.1 Glass or Poly Greenhouses

- 5.2.2 Indoor Vertical Farms

- 5.2.3 Container Farms

- 5.2.4 Indoor Deep Water Culture Systems

- 5.2.5 Other Facility Types

- 5.3 Crop Type

- 5.3.1 Fruits and Vegetables

- 5.3.1.1 Leafy Vegetables

- 5.3.1.1.1 Lettuce

- 5.3.1.1.2 Kale

- 5.3.1.1.3 Spinach

- 5.3.1.1.4 Other Leafy Vegetables

- 5.3.1.2 Tomato

- 5.3.1.3 Strawberry

- 5.3.1.4 Eggplant

- 5.3.1.5 Other Fruits and Vegetables

- 5.3.2 Herbs and Microgreens

- 5.3.2.1 Basil

- 5.3.2.2 Herbs

- 5.3.2.3 Tarragon

- 5.3.2.4 Wheatgrass

- 5.3.2.5 Other Herbs and Microgreens

- 5.3.3 Flowers and Ornamentals

- 5.3.3.1 Perennials

- 5.3.3.2 Annuals

- 5.3.3.3 Ornamentals

- 5.3.3.4 Other Flowers and Ornamentals

- 5.3.4 Other Crop Types

- 5.3.1 Fruits and Vegetables

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Singapore

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AeroFarms

- 6.3.2 Bright Farms Inc.

- 6.3.3 Bowery Inc.

- 6.3.4 Crop One Holdings

- 6.3.5 Metropolis Farms Inc.

- 6.3.6 Garden Fresh Farms

- 6.3.7 Village Farms International Inc.

- 6.3.8 Green Sense Farms LLC

- 6.3.9 Sky Greens (Sky Urban Solutions)

- 6.3.10 Superior Fresh Farms

- 6.3.11 Windset Farms

- 6.3.12 Gotham Greens