|

|

市場調査レポート

商品コード

1437958

UV LED:市場シェア分析、業界動向と統計、成長予測(2024~2029年)UV LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| UV LED:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

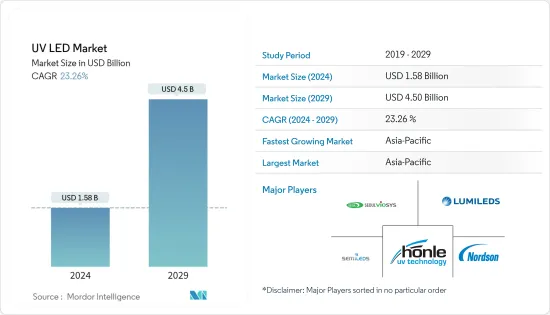

UV LED市場規模は2024年に15億8,000万米ドルと推定され、2029年までに45億米ドルに達すると予想されており、予測期間(2024年から2029年)中に23.26%のCAGRで成長します。

UV LED照明は寿命が長く、信頼性が高く、サイズが小さいため、システム設計者は設計の自由度を最大限に高めることができます。 180~280 nmの波長の放射線はUV-Cと呼ばれ、これは除染、消毒、滅菌に効果的に使用するために必要な範囲です。

主なハイライト

- UV LEDがUVランプに比べて持つ重要な利点は、UVランプと比較して帯域が狭いことです。間違った波長にさらされるリスクが大幅に軽減されます。印刷や医療業務などのアプリケーションは、最初の数年間で最も恩恵を受けました。

- 印刷ソリューション市場は、市場におけるパートナーシップやイノベーションなどの絶え間ない発展により、大幅な需要の増加が見込まれています。 2021年 1月、RMGTはGEWとのUV LED提携を発表しました。 RMGTは、数か月にわたるすべての主要なUV LEDメーカーの評価を経て、継続的な技術改善における決定的な新しいソリューションとして高性能GEW製品を採用しました。

- UV LED照明は、よりエネルギー効率が高く環境に優しいソリューションをユーザーに提供します。メンテナンスの軽減、小型コンパクトなサイズ、予熱の必要がないため、よりコスト効率が高く便利なオプションです。 UV-C LED照明は従来のものよりも持続可能で、均一に分散された熱、瞬間的な予熱、集中した光源、耐久性のあるハウジングを提供します。このような柔軟でユーザーフレンドリーな実装により、さまざまなシステムに統合でき、消毒プロセスの効率を向上させることができます。

- さらに、電気からUV-Cへの変換効率はすでに水銀ランプよりも低くなります。消費電力が大幅に低いため、UV LEDのエネルギー効率が向上します。 UV LEDは瞬時にオン/オフすることもできますが、水銀管はフルパワーに達する前にウォームアップ期間があるため、エネルギー消費の制御が難しくなります。

- 新型コロナウイルス感染症(COVID-19)の発生により、殺菌特性と表面の消毒の急速な使用により、紫外線LED市場の需要が大幅に増加しています。中国や米国などのいくつかの国では、表面をきれいにし、人々の感染を防ぐために紫外線ランプを使用しています。 Photonics Mediaによると、パンデミックにより、空間を消毒する紫外線LEDの需要が増加しました。

紫外線(UV)LED市場動向

滅菌が大きな市場シェアを握る

- 世界中で安全な飲料水を提供する最も安価な方法であることが証明されているため、UV LEDの適用範囲は滅菌用途に豊富になってきています。これにより、消費量が増加し、プレーヤーに金銭的利益も提供されます。

- 先進国と発展途上国で水の純度に対する関心が高まっていることは、住宅と商業部門の両方で紫外線LEDが消費者に採用される大きな成長の機会をもたらしています。世界人口の増加と純水の不足により、多くのUV LEDメーカーが未開発の水浄化アプリケーション市場に注目しています。

- (IUVA)(国際紫外線協会)によると、水中および空気中の細菌に対して効果的に作用する紫外線スペクトルの範囲は200nm~300nmです。これはUV-B範囲(多くの場合UV-C)に相当し、殺菌紫外線と呼ばれることもあります。このような範囲内では、紫外線が微生物の細胞を透過してDNAを破壊し、増殖して病気を引き起こす能力を排除することができます。

- UV殺菌照射は、何十年もの間、除染および消毒産業において不可欠なプロセスの1つと考えられてきました。このプロセスでは、100~280 nmの短波長UV-C光を利用して微生物を死滅させますが、除染に有効な波長範囲は250~260 nmです。

- UV LEDは世界中で安全な飲料水を提供する最も安価な方法と考えられているため、殺菌用途での使用が大幅に増加しています。この製品は企業に金銭的なメリットをもたらし、消費を増加させると思われます。

- 滅菌分野への多額の投資が市場の成長にさらに貢献しています。世界のヘルスケアのパイオニアであるGERMITECは、2022年5月に、医療従事者の時間業務、安全性、責任を本質的に簡素化する超音波プローブ用の高レベルUV-C消毒システムを商品化および開発し、1,100万ユーロの資金調達ラウンドの完了を発表しました。

アジア太平洋は大きな成長を遂げる

- アジア太平洋は、予測期間中に大幅な市場の成長が見込まれると予想されます。日本と中国に拠点を置くいくつかのベンダーは、UV LEDの用途拡大に多額の投資を行っています。

- 中国で事業を展開している著名なインクメーカー(東洋インキ、DIC株式会社、中国に事業を展開している日本の化学会社など)は、環境上の利点と硬化速度の速さにより、紫外線インクの需要が高まっていることを強調しました。たとえば、紫外線LEDの用途は、ワインやタバコなどのエンドユーザー産業における材料(アルミ箔、紙、プラスチックなど)のパッケージ印刷です。

- 中国中央政府は、中国の自動車生産が2025年までに3,500万台に達すると予測しています。自動車生産の増加に伴い、塗装などへの紫外線応用により紫外線LEDのニーズが高まると予想されています。逆に紫外線LEDの方が寿命が長いのです。 10倍以上長く、10,000時間以上の寿命があります。これは、UV LED除染を一晩実行して、より持続的な病原体を除染できることを意味します。

- 日本は技術進歩の広大な拠点とみなされており、効率的で新しいUV硬化型接着剤の活発な研究開発拠点があります。最近、新しいUV硬化型接着剤製品が、この国の電気、包装、自動車分野での用途を見出しています。

- 日本を拠点とするいくつかのベンダーは、拡大活動に加えて、殺菌や消毒などの紫外線LEDの用途拡大に多額の投資を行っています。

- 韓国ではUV硬化型樹脂の消費レベルが比較的低く、生産段階では依然として顕著です。韓国を拠点とするLEDベンダーは、近日中に新しいシリーズのUV-C LED製品を発売すると予想されています。 UV-C LEDは技術的に製造が難しいため、アジア太平洋地域の市場成長に大きく貢献すると期待されています。

紫外線(UV)LED業界の概要

UV LED市場は本質的に競争が激しいです。市場は非常に細分化されています。市場の重要なプレーヤーには、Lumileds Holding BV、Signify Holding、Nordson Corporation、GEW(EC)Limited、Seoul Viosys、日亜化学工業株式会社などがあります。

- 2022年 3月-Signifyは、植物育成ライトに関してPerfect Plantsと協力しました。 2つの新しい気候セルには、調光可能なPhilips GreenPower LEDトップライトと、成長照明にコンパクトなPhilips GrowWise制御システムが装備されており、あらゆる成長段階で効果的かつ効率的に使用できる照明システムを提供します。同社は大麻の合法栽培に関するオランダのライセンスを争っており、最近では調査と生産のための施設に投資しています。 Signifyは、柔軟なGreenPower LEDシステムと専門知識を提供します。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

- COVID-19によるUV LED市場への影響

第5章 市場力学

- 市場促進要因

- 環境に優しいUV LEDの構成

- UV硬化市場の採用の増加

- 低い総所有コストによる適応性の向上

- 市場抑制要因

- UV LEDチップの製造増加

第6章 市場セグメンテーション

- 技術別

- UV-A

- UV-B

- UV-C

- 用途別

- 光学センサーと計測器

- 偽造品の検出

- 殺菌

- UV硬化

- 医療光療法

- その他の用途

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- チリ

- メキシコ

- その他ラテンアメリカ

- 中東とアフリカ

- アラブ首長国連邦

- 南アフリカ

- その他中東とアフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Lumileds Holding BV

- Koninklijke Philips NV

- Nordson Corporation

- Honle UV America Inc.

- Seoul Viosys Co. Ltd

- Nichia Corporation

- Semileds Corporation

- EPIGAP Optronic GmbH

- CRYSTAL IS Inc.(Asahi Kasei Corporation)

- Heraeus Holding GmbH

- FUJIFILM Business Innovation Corporation

第8章 投資分析

第9章 市場の将来

The UV LED Market size is estimated at USD 1.58 billion in 2024, and is expected to reach USD 4.5 billion by 2029, growing at a CAGR of 23.26% during the forecast period (2024-2029).

UV LED lighting offers longer lifetimes, greater reliability, and smaller sizes, enabling system designers maximum design freedom. Radiations with wavelengths from 180 to 280 nm are referred to as UV-C, and this is the range needed to be used effectively in decontamination, disinfection, and sterilization.

Key Highlights

- The critical advantage UV LEDs have over UV lamps is that they have a narrow band compared to UV lamps. The risk of exposure to the wrong wavelength gets reduced significantly. The applications, such as printing and medical operations, benefitted the most during the initial years.

- The printing solution market is expected to witness a considerable increase in demand, owing to constant developments such as partnerships and innovations in the market. In January 2021, RMGT announced a UV LED partnership with GEW. RMGT adopted the high-performance GEW product as its definitive new solution in the ongoing technology improvement after months of evaluating all significant UV LED manufacturers.

- UV LED lighting provides the user with a much more energy-efficient and environmentally friendly solution. With reduced maintenance, small compact sizing, and no preheating requirement, it is a more cost-effective and convenient option. UV-C LED lighting is more sustainable than traditional, providing evenly dispersed heat, instantaneous preheating, a concentrated light source, and durable housing. With such a flexible, user-friendly implementation, they can be integrated into various systems and improve the efficiency of the disinfection process.

- Additionally, the electrical-to-UV-C conversion efficiency is already lower than that of mercury lamps. They consume substantially low power, making UV LEDs more energy efficient. UV LEDs can also be turned on and off instantly, whereas mercury tubes have a warm-up period before they reach full power, which means their energy consumption is less controllable.

- With the COVID-19 outbreak, the ultraviolet LED market is witnessing significant growth in demand due to the rapid usage of germ-killing properties and disinfecting surfaces. Several countries, such as China and the United States, use ultraviolet lamps to clean surfaces and prevent people from getting infected. According to Photonics Media, the pandemic has increased the demand for ultraviolet LEDs that disinfect spaces.

Ultravoilet (UV) LED Market Trends

Sterilization to Hold Significant Market Share

- The scope for a UV LED is becoming abundant in sterilization applications, as it is being proved to be the cheapest way to provide safe drinking water across the globe. This also offers monetary benefits to the players with increasing consumption.

- The growing concern for water purity in developed and developing nations presents a substantial growth opportunity for ultraviolet LEDs to be adopted by consumers in both residential and commercial sectors. The rise in the world population and the scarcity of pure water have attracted many UV LED manufacturers toward the untapped water purification application market.

- According to (IUVA) (International Ultraviolet Association), the portion of the ultraviolet spectrum that effectively works against germs in the water and air ranges between 200nm-300nm. This corresponds to the UV-B range, often to UV-C, and is sometimes termed germicidal ultraviolet light. Within such a range, ultraviolet light can penetrate the cells of microorganisms and disrupt the DNA, eliminating the ability to multiply and cause diseases.

- UV germicidal irradiation has been considered one of the essential processes in the decontamination and disinfectant industry for decades. This process utilizes short-wavelength UV-C light to kill the microbes from 100 to 280 nm, but the effective wavelength range for decontamination is between 250-260 nm.

- UV LED is increasing significantly for sterilization applications, as it is considered of the cheapest ways to provide safe drinking water globally. The products would offer monetary advantages to companies and increase consumption.

- The considerable investments in the sterilization sector further contribute to the market growth. GERMITEC, a global healthcare pioneer, in May 2022, commercialized and created high-level UV-C disinfection systems for ultrasound probes that essentially simplified health providers' time tasks, safety, and responsibilities and announced the completion of a EURO 11 Million fundraising round.

Asia-Pacific to Witness Significant Growth

- The Asia-Pacific is expected to witness significant market growth over the forecast period. Several vendors based in Japan and China are making considerable investments in the expanding applications of UV LEDs.

- The prominent ink manufacturers operating in China (like Toyo Ink Co. Ltd, DIC Corporation, and Japanese chemical companies operating in China) highlighted the increasing demand for ultraviolet inks, owing to the environmental advantages and the faster curing rates. For instance, the application of ultraviolet LEDs are materials (such as aluminum foil, paper, and plastic) package printing in end-user industries, such as wine and cigarette)

- The Chinese central government expects China's automobile production to reach 35 Million units by 2025. With the increasing growth in automobile production, the need for ultraviolet LED is expected to increase owing to ultraviolet applications in painting, etc. On the contrary, ultraviolet LEDs last more than ten times longer, with lifespans of over 10,000 hours. This means UV LED decontamination can be run overnight to decontaminate more persistent pathogens.

- Japan is considered a vast hub for technological advancements and hosts an active research and development base for efficient and newer UV-curable adhesives. Recently, novel UV-curable adhesive products are finding applications in the country's electrical, packaging, and automotive sectors.

- Several vendors based out of Japan are making considerable investments in the expanding applications of ultraviolet LEDs, like sterilization and disinfection, in addition to the expansion activities.

- South Korea has comparatively low consumption levels of UV-curable resins, which is still prominent in the production phase. LED vendors based out of South Korea are expected to launch new series of UV-C LED products shortly. UV-C LEDs, which are challenging to manufacture technologically, are expected to significantly contribute to the market's growth in the Asia-Pacific region.

Ultravoilet (UV) LED Industry Overview

The UV LED Market is competitive in nature. The market is highly fragmented. Some of the significant players in the market are Lumileds Holding B.V, Signify Holding, Nordson Corporation, GEW (EC) Limited, Seoul Viosys Co. Ltd, and Nichia Corporation.

- March 2022 - Signify collaborated with Perfect Plants on grow lights. Two new climate cells are equipped with dimmable Philips GreenPower LED toplighting compact to grow lights and the Philips GrowWise Control System, providing a light system that can be used effectively and efficiently in every growth phase. The company is competing for a Dutch license for the legal cultivation of cannabis and recently invested in facilities for research and production. Signify supplies flexible GreenPower LED systems and specialist knowledge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the UV LED Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Eco-friendly Composition of UV LED

- 5.1.2 Rising Adoption of the UV Curing Market

- 5.1.3 Increasing Adaptability Fueled by Low Total Cost of Ownership

- 5.2 Market Restraints

- 5.2.1 Increasing Manufacturing of UV LED Chips

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 UV-A

- 6.1.2 UV-B

- 6.1.3 UV-C

- 6.2 By Application

- 6.2.1 Optical Sensors and Instrumentation

- 6.2.2 Counterfeit Detection

- 6.2.3 Sterilization

- 6.2.4 UV Curing

- 6.2.5 Medical Light Therapy

- 6.2.6 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Chile

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 South Africa

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Lumileds Holding BV

- 7.1.2 Koninklijke Philips NV

- 7.1.3 Nordson Corporation

- 7.1.4 Honle UV America Inc.

- 7.1.5 Seoul Viosys Co. Ltd

- 7.1.6 Nichia Corporation

- 7.1.7 Semileds Corporation

- 7.1.8 EPIGAP Optronic GmbH

- 7.1.9 CRYSTAL IS Inc. (Asahi Kasei Corporation)

- 7.1.10 Heraeus Holding GmbH

- 7.1.11 FUJIFILM Business Innovation Corporation