|

市場調査レポート

商品コード

1437967

RF GaN:市場シェア分析、業界動向と統計、成長予測(2024~2029年)RF GaN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| RF GaN:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 127 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

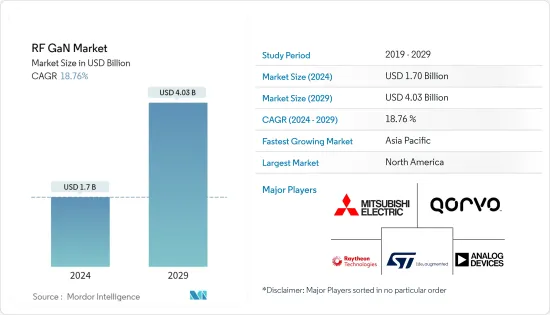

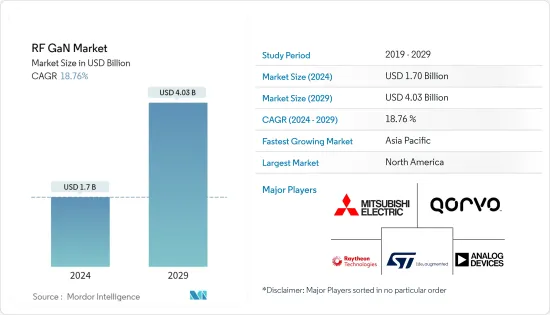

RF GaN市場規模は2024年に17億米ドルと推定され、2029年までに40億3,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に18.76%のCAGRで成長します。

リアルタイムにリンクされた幅広いデバイスやアプリケーションにわたるRF GaNの使用の利点により、より多くの業界がモノのインターネット(IoT)テクノロジーを使用すると予想され、市場の成長を促進すると予想されます。継続的に進化するGaNテクノロジーにより、GaNは、フェーズドアレイ、レーダー、ケーブルTV(CATV)用の基地送受信局、超小型開口端末(VSAT)、防衛通信など、より複雑なアプリケーションでのより高い周波数を可能にします。

主なハイライト

- RF GaNはワイヤレスインフラストラクチャで重要な役割を果たし、効率を向上させ、帯域幅を拡大して、増加し続けるデータ伝送速度をサポートします。 RF GaN市場は主に5Gの導入増加と無線通信の進歩によって牽引されています。通信事業者も、GaNパワートランジスタの使用が増えることで恩恵を受ける可能性があります。

- 電気自動車におけるRF GaNの採用の増加も、この市場の需要を促進する主要な要因の1つです。炭化ケイ素デバイスは、電気バス、タクシー、トラック、乗用車の車載バッテリー充電器に使用されています。さらに、電気自動車市場に有利な政府法の増加により、RF GaN市場の需要が刺激されています。

- 自動運転車やドローンの開発に必要なインフラストラクチャも、RF GaNテクノロジーの需要を高めるもう1つの要因です。したがって、さまざまな用途、特に軍事および防衛向けの自動運転車やドローンの採用と開発の増加により、予測期間中にRF GaNデバイスの採用がさらに増加すると予想されます。

- GaNに固有の材料上の利点には、コストやデバイスの処理とパッケージングの最適化など、関連する製造上の課題がいくつか伴います。その他の問題としては、電荷トラップや電流崩壊などがあり、これらのデバイスの採用を増やすためには解決する必要があります。 RF GaNベースのデバイス(性能と歩留まり)は大幅に改善されましたが、窒化ガリウム/炭化ケイ素(GaN-on-SiC)が主流のアプリケーション(無線通信基地局など)に導入されるのを妨げる障壁がまだいくつかあります。

- 新型コロナウイルス感染症(COVID-19)のパンデミックは、供給ラインと通信業界に影響を与えました。これは通信分野における5Gの普及を大きく妨げました。この危機的な状況において、消費者は今後も携帯電話を使用し続けることが期待されますが、ほとんどの消費者はまだ初期段階にあるテクノロジーにこれ以上投資できない可能性があります。

- データ消費量の急速な増加により商用ネットワークが成長し、ネットワークプロバイダーが4Gや5Gなどの次世代ネットワークを採用することが奨励されています。 Cisco Visual Networking Indexによると、世界のモバイルデータトラフィックは46%のCAGRを記録し、2022年までに月間77.5エクサバイトに達すると予想されています。

- 世界中の組織が新製品を革新し、ビジネスを拡大しています。たとえば、革新的なRFおよびマイクロ波電力ソリューションのプロバイダーであるIntegraは、2022年 6月に、画期的な100V RF GaNテクノロジーを米国と欧州の顧客に出荷し始めたと発表しました。同社はまた、アビオニクス、指向性エネルギー、電子戦、レーダー、科学市場分野向けに単一トランジスタで最大5kWの電力レベルを実現する7つの新製品を発売することにより、100V RF GaN製品ポートフォリオを拡大することも発表しました。

高周波窒化ガリウムの市場動向

5G導入の進展により通信インフラ分野からの強い需要が牽引

- 電気通信業界は、世界のデジタル化の主な推進力であり、市場環境の包括的な変化が起こっている業界として、デジタル変革テクノロジーの主要なユーザーとみなされています。電気通信業界の相互運用性とテクノロジーへの投資は、世界経済全体にわたる資本と情報の流れのパラダイムシフトを促進し、業界全体にまったく新しいビジネスモデルの出現のための基礎を提供しました。

- 5Gテクノロジーは、さまざまなブロードバンドサービスの領域に革命をもたらし、さまざまなエンドユーザーの業種にわたる接続を可能にすることが期待されています。 GaNの市場シェアを押し上げる主な要因は、モバイル契約の増加、オンラインビデオコンテンツのストリーミング、5Gインフラ、5Gを使用したさまざまなIoTアプリケーションです。 5Gは、複数のシナリオにわたってさまざまなサービスと関連するサービス要件をサポートすると予想されます。

- 現在、5Gモバイルの加入数は42万件と評価されており、2022年までに4億件に達すると予想されています。世界の5Gテクノロジーの展開の大幅な増加に伴い、RF GaNテクノロジーの需要は増加すると予想されます。

- 2022年5月、STマイクロエレクトロニクス(ST)と通信、産業、防衛、データセンター業界向けの半導体製品サプライヤーであるMACOMテクノロジーソリューションズホールディングス(MACOM)は、RF GaNオンシリコン(RF Gan-on-Si)の生産を発表しました。プロトタイプ。この成功により、STとMACOMは今後も協力し、関係を拡大していきます。 STとMACOMが開発中のGaN-on-Si技術は、標準的な半導体プロセスフローに統合することで、競争力のある性能と大幅な規模の経済性を実現すると期待されています。

- Qorvoは、2G、3G、および4G基地局メーカーへのRFソリューションのサプライヤーの1つです。サブ 6 GHzおよびcmWave/mmWaveワイヤレスインフラストラクチャの開発をサポートする市場で独自の地位を確立しています。 Qorvoは、主に5Gを実現するために、3.5、4.8、28、および39GHzなどの関連する5G帯域をカバーする製品ソリューションに投資して市場にサービスを提供してきました。

- 5Gインフラストラクチャでは高密度で小規模なアンテナアレイが必要になるため、無線周波数(RF)システムの電力と熱の管理に重要な課題が生じます。広帯域性能、効率、電力密度が向上したGaNデバイスは、これらの課題に対処できる、よりコンパクトなソリューションの可能性をもたらします。

アジア太平洋は大幅な成長が見込まれる

- アジア太平洋地域のディスクリート半導体産業は、中国、日本、台湾、韓国によって牽引されており、世界のディスクリート半導体市場の約65%を占めています。対照的に、ベトナム、タイ、マレーシア、シンガポールなどは、この地域の市場支配に貢献しています。

- インド電子半導体協会によると、インドの半導体部品市場は10.1%のCAGR(2018~2025年)を記録し、2025年までに323億5,000万米ドルに達すると予想されています。この国は、世界の研究開発センターにとって重要な目的地です。したがって、インド政府が現在進めている「Make in India」構想は、半導体市場への多額の投資をもたらすことが予想されます。インド政府によるこのような取り組みは、RF GaN市場を活用することになります。

- 2022年 2月、GaN集積回路(IC)プロバイダーであるNavitas Semiconductorは、中国国際資本有限公司(CICC)投資家会議への参加を発表しました。同社独自のGaNパワーICは、GaNパワーとGaNの駆動、制御、保護を単一のSMTパッケージに統合しています。このような参加により、この地域のGaN市場が活用されることになります。

- 5Gテクノロジーをサポートするインフラストラクチャの開発に対する投資家の関心の高まりにより、APAC地域全体のRF GaNの需要が増加すると予想されます。たとえば、GSMAによると、アジア太平洋の携帯電話会社は2025年までに4,000億米ドル以上を支出すると予想されており、そのうち3,310億米ドルは5Gの展開に費やされる予定です。

- 中国におけるRF GaN企業の成長は、同国が製造業経済からイノベーション主導型経済に移行する広範な傾向の一部です。中国市場では商用無線通信アプリケーションの需要が急増しており、中国企業はすでに次世代通信ネットワークの開発を進めています。

- さらに、2021年12月、インドのカンプール工科大学の研究者らは、アルミニウムGaN(AlGaN)高電子移動度トランジスタ(HEMT)の高性能業界標準モデルを開発しました。このモデルは、高出力RF回路の製造に使用できるシンプルな設計方法を提供します。 RF回路には、無線伝送に使用されるアンプやスイッチが含まれており、航空宇宙および防衛用途で役立ちます。研究者による絶え間ないイノベーションが、この地域のRF GaN市場の成長を促進するでしょう。

高周波窒化ガリウム業界の概要

RF GaN市場におけるプレーヤー間の競争企業間の敵対関係は、特にレイセオンテクノロジーズ、STMマイクロエレクトロニクスなどのいくつかの主要企業の存在により激しいです。自社の製品を継続的に革新する能力により、他のプレーヤーに対して競争上の優位性を得ることができました。これらの企業は、研究開発、戦略的パートナーシップ、合併と買収を通じて、市場で強力な足場を築くことができました。

2022年 6月、世界を接続する革新的なRFソリューションの著名なプロバイダーであるQorvoは、米国国防総省(DoD)によって、国内最先端技術向けの高度な統合相互接続と製造の成長(SOTA)を進める対象に選ばれました。RF GaNプログラムは、STARRY NITEとしても知られており、国防次官調査工学部(OUSD R&E)のマイクロエレクトロニクスロードマップの一部です。このプログラムは、国防総省の先進パッケージングエコシステムと連携して、国内のオープンなSOTA RF GaNファウンドリを開発し、成熟させることを目指しています。

2022年5月、STマイクロエレクトロニクスと、産業、通信、防衛、データセンター業界向けの半導体製品の主要サプライヤーであるMACOM Technology Solutions Holdings Inc.は、RF Gan on Silicon(RF Gan-on-Si)プロトタイプの製造に成功したと発表しました。この成果により、STとMACOMは今後も協力し、関係を強化していきます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界のバリューチェーン分析

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

- テクノロジーのスナップショット

- COVID-19感染症が業界に与える影響の評価

第5章 市場力学

- 市場促進要因

- 5G導入の進展により通信インフラ分野からの強い需要が牽引

- 高性能、小型フォームファクターなどの有利な特性

- 市場抑制要因

- コストと運用上の課題

第6章 市場セグメンテーション

- 用途別

- 軍隊

- 通信インフラストラクチャ(バックホール、RRH、Massive MIMO、スモールセル)

- 衛星通信

- 有線ブロードバンド

- 商用レーダーとアビオニクス

- RFエネルギー

- 材料タイプ別

- GaN-on-Si

- GaN-on-SiC

- その他の材料タイプ(GaN-on-GaN、GaN-on-Diamond)

- 地域別

- 北米

- 欧州

- アジア太平洋地域

- 中東とアフリカ

第7章 競合情勢

- 企業プロファイル

- Aethercomm Inc.

- Analog Devices Inc.

- Wolfspeed Inc.(Cree Inc.)

- Integra Technologies Inc.

- MACOM Technology Solutions Holdings Inc.

- Microsemi Corporation(Microchip Technology Incorporated)

- Mitsubishi Electric Corporation

- NXP Semiconductors NV

- Qorvo Inc.

- STMicroelectronics NV

- Sumitomo Electric Device Innovations Inc.

- HRL Laboratories

- Raytheon Technologies

- Mercury Systems, Inc

第8章 投資分析

第9章 市場機会と将来の動向

The RF GaN Market size is estimated at USD 1.7 billion in 2024, and is expected to reach USD 4.03 billion by 2029, growing at a CAGR of 18.76% during the forecast period (2024-2029).

Due to the benefits of RF GaN usage across a wide range of real-time linked devices and applications, more industries are expected to use the Internet of Things (IoT) technology, which is expected to drive market growth. With the continuously evolving GaN technology, GaN enables higher frequencies in more complex applications, such as phased arrays, radar, and base transceiver stations for cable TV (CATV), very small aperture terminal (VSAT), and defense communications.

Key Highlights

- RF GaN plays a key role in wireless infrastructure, improving efficiency and expanding bandwidth to support ever-increasing data transmission speeds. The market for RF GaN is primarily driven by increasing 5G adoption and advances in wireless communications. Telecom operators could also benefit from increased use of GaN power transistors.

- The increasing adoption of RF GaN in electric automotive is also one of the major factors driving demand in this market. Silicon carbide devices are used in the onboard battery chargers of electric buses, taxis, lorries, and passenger cars. Further, increasing government laws favoring the electric vehicles market stimulates demand in the RF GaN market.

- The infrastructure needed to create autonomous vehicles and drones is another factor that increases demand for RF GaN technologies. Hence, growth in the adoption and development of autonomous vehicles and drones for various applications, especially military and defense, is expected to increase further the adoption of RF GaN devices over the forecast period.

- The inherent material advantages of GaN come with some associated manufacturing challenges that include the cost and optimization of device processing and packaging. Other issues include charge trapping and current collapse, which need to be resolved for increased adoption of these devices. Although significant improvements have been made in RF GaN-based devices (performance and yields), there are still some barriers preventing the gallium nitride on silicon carbide (GaN-on-SiC) from entering mainstream applications (i.e., in wireless telecom base-stations or CATV).

- The COVID-19 pandemic impacted supply lines and the telecoms industry. It considerably hindered the penetration of 5G in the telecommunications sector. In this critical situation, consumers are expected to continue using mobile phones, but most of them may not be able to invest more in a technology that is still in a nascent stage.

- Rapidly increasing data consumption has resulted in the growth of commercial networks and is encouraging network providers to adopt next-generation networks, such as 4G and 5G. According to the Cisco Visual Networking Index, global mobile data traffic is expected to register a CAGR of 46%, reaching 77.5 exabytes per month by 2022.

- Organizations across the world are innovating new products and expanding their business. For instance, in June 2022, Integra, a provider of innovative RF and microwave power solutions, announced that it had begun shipping its breakthrough 100V RF GaN technology to customers in the United States and Europe. The company also announced the expansion of its 100V RF GaN product portfolio with the launch of seven new products for the avionics, directed energy, electronic warfare, radar, and scientific market segments, delivering power levels of up to 5kW in a single transistor.

Radiofrequency Gallium Nitride Market Trends

Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- As a primary driver of global digitization and an industry undergoing comprehensive changes in the market environment, the telecommunications industry is regarded as a major user of digital transformation technologies. The telecommunications industry's investment in interoperability and technology has facilitated a paradigm shift in the flow of capital and information throughout the global economy, providing the building blocks for the emergence of entirely new business models across the industry.

- The 5G technology is expected to revolutionize the domain of various broadband services and empower connectivity across different end-user verticals. The major factors boosting the market share of GaN are increasing mobile subscriptions, streaming of online video content, 5G infrastructure, and various IoT applications using 5G. 5G is anticipated to support different services and associated service requirements across multiple scenarios.

- Currently, the number of 5G mobile subscriptions is valued at 0.42 million, and it is expected to reach 400 million subscriptions by 2022. With the substantial growth in the rollouts of 5G technology globally, the demand for RF GaN technology is expected to increase.

- In May 2022, STMicroelectronics (ST) and MACOM Technology Solutions Holdings (MACOM), a supplier of semiconductor products for the telecommunications, industrial, defense, and data center industries, announced the production of RF GaN on silicon (RF Gan-on-Si) prototypes. With this success, ST and MACOM will continue to work together and expand their relationship. GaN-on-Si technology under development by ST and MACOM is anticipated to offer competitive performance and significant economies of scale enabled by integration into standard semiconductor process flows.

- Qorvo is one of the suppliers of RF solutions to the 2G, 3G, and 4G base station manufacturers. It is uniquely positioned in the market to support the development of sub-6 GHz and cmWave/mmWave wireless infrastructure. Qorvo has been investing in product solutions covering relevant 5G bands, such as 3.5, 4.8 and 28, and 39GHz, to service the market, mainly to enable 5G.

- The need for dense, small-scale antenna arrays in 5G infrastructure results in key challenges with power and thermal management in radio frequency (RF) systems. With their improved wideband performance, efficiency, and power density, GaN devices offer the potential for more compact solutions that can address these challenges.

Asia-Pacific is Expected to Experience Significant Growth

- The Asia-Pacific region's discrete semiconductor industry is driven by China, Japan, Taiwan, and South Korea, constituting around 65% of the global discrete semiconductor market. In contrast, others, like Vietnam, Thailand, Malaysia, and Singapore, contribute to the region's dominance in the market.

- According to the Electronics and Semiconductors Association of India,the Indian market for semiconductor components would register a 10.1% CAGR (2018-2025) to reach USD 32.35 billion by 2025. The country is a vital destination for global research and development centers. Therefore, the ongoing 'Make in India' initiative by the Government of India is expected to result in significant investment in the semiconductor market. Such initiatives by the government of India will leverage the RF GaN market.

- In February 2022, Navitas Semiconductor, a provider of GaN integrated circuits (ICs), announced its participation in the China International Capital Corporation Limited (CICC) Investor Conference. The company's proprietary GaN power IC integrates GaN power and GaN drive, control, and protection in a single SMT package. Such participation will leverage the GaN market in the region.

- Demand for RF GaN across the APAC region is expected to increase due to growing investor interest in developing infrastructure to support 5G technology. For instance, according to the GSMA, the Asia-Pacific mobile operator is expected to spend more than USD 400 billion by 2025, of which USD 331 billion will be expended on 5G deployments.

- The growth of RF GaN companies in China is part of a broader trend as the nation shifts from a manufacturing- to an innovation-driven economy. The Chinese market is witnessing an exploding demand for commercial wireless telecom applications, and Chinese companies are already developing next-gen telecom networks.

- Moreover, in December 2021, researchers from IIT Kanpur in India developed a high-performance, industry-standard model of aluminum GaN (AlGaN) high electron mobility transistor (HEMT). This model provides a simple design method that can be used to manufacture high-power RF circuits. RF circuits include amplifiers and switches used in wireless transmissions and are useful in aerospace and defense applications. Constant innovations by researchers will drive the market growth of RF GaN in the region.

Radiofrequency Gallium Nitride Industry Overview

The competitive rivalry among the players in the RF GaN market is high owing to the presence of some key players such as Raytheon Technologies, STM microelectronics, amongst others. Their ability to continually innovate their offerings has allowed them to gain a competitive advantage over other players. Through research and development, strategic partnerships, and mergers and acquisitions, these players have been able to gain a strong foothold in the market.

In June 2022, Qorvo, a prominent provider of innovative RF solutions that connect the world, was selected by the US Department of Defense (DoD) to proceed with the Advanced Integration Interconnection and Fabrication Growth for Domestic State-of-the-Art (SOTA) RF GaN program, also known as STARRY NITE, as part of the Office of Undersecretary of Defense Research & Engineering's (OUSD R&E) microelectronics roadmap. The program seeks to develop and mature domestic, open SOTA RF GaN foundries in alignment with the DoD's advanced packaging ecosystem.

In May 2022, STMicroelectronics and MACOM Technology Solutions Holdings Inc., a significant supplier of semiconductor products for the industrial, telecommunications, defense, and data center industries, announced the successful production of RF Gan on Silicon (RF Gan-on-Si) prototypes. With this achievement, ST and MACOM would continue to work together and enhance their relationship.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Demand from Telecom Infrastructure Segment Driven by Advancements in 5G Implementation

- 5.1.2 Favorable Attributes Such As High-performance and Small Form Factor to

- 5.2 Market Restraints

- 5.2.1 Cost & Operational Challenges

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Military

- 6.1.2 Telecom Infrastructure (Backhaul, RRH, Massive MIMO, Small Cells)

- 6.1.3 Satellite Communication

- 6.1.4 Wired Broadband

- 6.1.5 Commercial Radar and Avionics

- 6.1.6 RF Energy

- 6.2 By Material Type

- 6.2.1 GaN-on-Si

- 6.2.2 GaN-on-SiC

- 6.2.3 Other Material Types (GaN-on-GaN, GaN-on-Diamond)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aethercomm Inc.

- 7.1.2 Analog Devices Inc.

- 7.1.3 Wolfspeed Inc. (Cree Inc.)

- 7.1.4 Integra Technologies Inc.

- 7.1.5 MACOM Technology Solutions Holdings Inc.

- 7.1.6 Microsemi Corporation (Microchip Technology Incorporated)

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 NXP Semiconductors NV

- 7.1.9 Qorvo Inc.

- 7.1.10 STMicroelectronics NV

- 7.1.11 Sumitomo Electric Device Innovations Inc.

- 7.1.12 HRL Laboratories

- 7.1.13 Raytheon Technologies

- 7.1.14 Mercury Systems, Inc