|

市場調査レポート

商品コード

1433757

アナログ集積回路(IC):市場シェア分析、産業動向・統計、成長予測(2024~2029年)Analog Integrated Circuit (IC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| アナログ集積回路(IC):市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 192 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

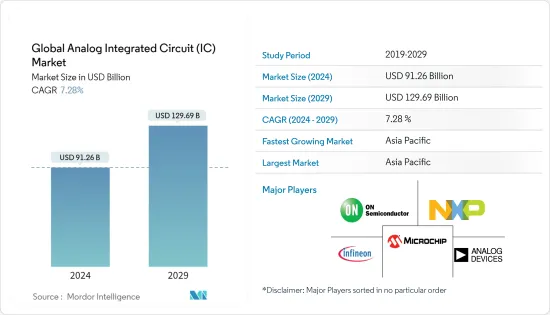

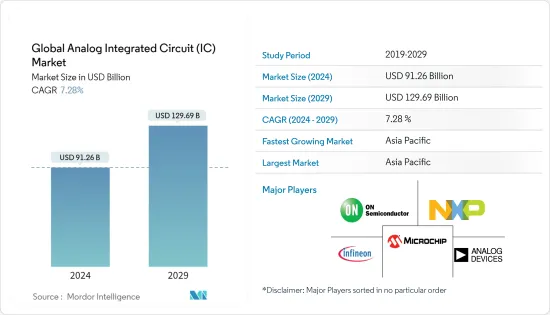

世界のアナログ集積回路(IC)の市場規模は、2024年に912億6,000万米ドルに達し、2024~2029年の予測期間中にCAGR 7.28%で成長し、2029年までに1,296億9,000万米ドルに達すると予測されております。

主なハイライト

- アナログ集積回路(IC)は、半導体材料の単一ウエハー上に製造された、相互接続されたコンポーネントのネットワークです。これらのコンポーネントは、2つの入力および出力電圧レベルのみを使用するデジタル対応コンポーネントとは対照的に、連続範囲の入力信号にわたって動作します。これらの回路は、デバイスの動作中に複数のエネルギー出力レベルを処理、受信、生成します。発振器、DCアンプ、マルチバイブレータ、オーディオアンプなどのコンポーネントを使用する電子機器は、出力と入力のレベルを等しく保つアナログ回路を利用しています。

- モノのインターネット(IoT)などの新興技術のイントロダクションと採用は、かなりの範囲のリアルタイム接続デバイスおよびアプリケーションにわたるアナログ ICの明らかな利点により、市場の成長を推進すると予想されます。高速接続の可用性の向上、クラウドの採用の増加、データ処理と分析の使用の増加により、モノのインターネット(IoT)の採用は着実に増加しています。たとえば、エリクソンによれば、2022年には世界中で19億のセルラーIoT接続があり、2027年には55億に増加すると予想されており、この期間で19%のCAGRを記録します。

- さらに、スマートフォン、家庭用電化製品、コンピュータ、ストレージデバイスの普及や電気自動車の販売増加により、アナログICの採用が近年急増しています。スマートフォンに使用されるさまざまなICには、充電IC、ディスプレイPMIC、SoC PMIC、カメラPMICなどがあります。 Apple、Qualcomm、Intel、Samsung S.LSIなどの主要企業がこの市場を独占しています。その結果、先進技術を搭載したスマートフォンの生産と販売の増加、および5Gと6Gの統合の増加により、アナログIC市場は世界的に大きな牽引力を得ることが予想されます。

- しかし、インフレの進行、個人消費の減少、消費者見通しの低迷により、世界のスマートフォン需要は2022年と比較して2023年に減少すると予測されています。この減少はアナログIC市場を一時的に妨げると予想されます。それにも関わらず、5Gスマートフォンの需要の高まりと、特に5Gおよび折りたたみ式スマートフォンの普及拡大による世界の5Gネットワーク接続の拡大により、市場は2024年度には若干回復すると予測されています。たとえば、GSMAによると、2025年までに5Gネットワークは世界人口の3分の1をカバーする可能性があります。

- 産業における熟練したアナログチップ設計エンジニアの確保に大きく依存しています。しかし、半導体産業ではそのようなスキルが必要とされています。インテルの人事、人材計画、買収担当のCindi Harper氏によると、産業における人材の需要は供給を上回っています。同様に、シーメンスEDAのカントリーマネージャーであるルチル・ディクシット氏は、米国では今後5年間で25万人の半導体エンジニアが不足すると予想していると述べた。中国と台湾では、それぞれ30万人と5万人のエンジニアが不足すると予想されています。このような動向は市場の成長を妨げます。

- さらに、ロシア・ウクライナの間の紛争は、エレクトロニクス産業などのいくつかの産業に大きな影響を与えることが予想されます。この紛争はすでに半導体サプライチェーンの問題とチップ不足を悪化させており、しばらくの間産業に影響を与えています。この混乱により、ニッケル、パラジウム、銅、シリコン、ゲルマニウム、インジウムガリウムヒ素リン、チタン、アルミニウム、鉄鉱石などの重要な原材料の価格が不安定になり、材料不足が発生しました。さらに、SEMIによれば、ロシアはパラジウムの45~50%の世界の供給国です。半導体パッケージ用のボンディングワイヤー、リードフレーム、電極、めっき、コーティングなどの形成に使用されます。したがって、各国がロシアとの貿易を閉鎖する中、半導体メーカーは代替原材料の供給にますます注力しており、市場で必要とされる半導体の生産はさらに遅れています。

アナログ集積回路(IC)市場動向

通信分野では携帯電話が大きなシェアを握る

- このセグメントには、音声通信が依然として主要な機能である携帯電話および多機能(音声/Web/電子メール)ハンドヘルドデバイス向けに設計され、使用されるアプリケーション固有のアナログ ICが含まれます。これらの電話機は、2G、3G、Wimaxなどの広域セルラーネットワーク向けに設計されており、CDMA、GSM、およびそれらのアップグレードバージョンなどの包括的な伝送フォーマットを採用しています。

- 特に発展途上国でのスマートフォン普及率の上昇は、これらの地域での人口増加と都市化の増加によって加速されています。たとえば、エリクソンの予測では、世界のモバイル契約数は2022年までに約84億件に達すると予想されており、継続的な増加傾向を示しています。

- 5G技術の出現により、5Gスマートフォンの普及が加速しています。 2022年 11月のEricsson Mobility Reportによると、5Gモバイルの契約数は2028年末までに50億に達すると予想されています。特に、5Gネットワークは人口の85%をカバーし、モバイルトラフィックの約70%を処理すると予想されています。

- 多くの産業プレーヤーによる5Gスマートフォン向けに調整されたチップセットのイントロダクションは、市場の成長に大きく貢献しています。たとえば、Googleはインドの5Gネットワークをサポートするために、2022年にPixel 6a、Pixel 7、Pixel 7 Proを発表しました。 Pixel 6aは19の5Gバンドをサポートし、Pixel 7と7 Proは22の5Gバンドをサポートします。

- Consumer Technology Association(CTA)と米国国勢調査局の報告書では、米国のスマートフォン販売額が2021年の730億米ドルから2022年には747億米ドルに増加すると予測しています。さらに、GSMAは北米でのスマートフォン加入者の増加を予測しています。 2025年までに3億2,800万人に増加し、携帯電話加入者(86%)とインターネットユーザー(80%)の普及率も増加します。

- Ericsson Mobility Reportは、中東およびアフリカ(MEA)地域では2024年までに6,000万人の5Gサービス加入者がいる可能性があり、これは全モバイル加入者の約3%を占める可能性があると示唆しています。 GSMAは、MENA全体で約5,000万接続の5G接続があり、2025年までにアラブ諸国だけでも2,000万接続になる可能性があると推定しています。これらの統計は、調査対象市場を推進するモバイル導入の急速なペースを裏付けています。

中国はアジア太平洋で最も急速に成長する市場になると予想されている

- 中国は、大手半導体メーカーの存在、急速な工業化、巨大な家庭用電化製品市場により、アナログ IC市場で支配的なプレーヤーとして浮上すると予想されています。この地域は、半導体の大量生産と、家庭用電化製品、自動車、通信などのさまざまな産業におけるアナログ ICの採用で有名です。これらの要因は、調査対象となっている国内市場の成長を促進すると予想され、それによって市場関係者に有利な機会がもたらされます。

- さらに、この国ではITおよびデータセンター産業が繁栄しており、これは毎年生成されるデータ量の増加に起因すると考えられます。世界の技術分野における支配力としての中国の目覚ましい躍進は、主にその繁栄したデータセンターエコシステムによって支えられています。中国のインターネットデータセンター市場は、世界中で最も技術的に進んだ市場の1つとして際立っており、数多くの組織がデジタルプラットフォームを通じて運営されています。

- さらに、データセンターへの投資の増加とインターネットの普及の増加により、これらのデバイスの多くに、物理世界と対話するセンサーを組み込む需要が生じ、アナログからデジタルへの変換のためのアナログ処理が必要になることが予想されます。これらの機能をデジタル技術と組み合わせることで、コスト効率が高く、低消費電力で信頼性の高いソリューションが実現します。結果として、これらの要因は、予測期間中に世界のアナログIC市場の成長を促進すると予想されます。

- さらに、5Gネットワーキング機能の増加により、アナログ ICモジュールに対する膨大な需要が生じることが予想されます。中国は、5G基地局の大幅な配備により、5G分野で著名なプレーヤーとして浮上しています。 MIITが発表したデータによると、中国には2022年末までに231万の5G基地局があった。同国のインフラへの巨額投資と野心的な導入戦略により、広範な5Gカバレッジの達成が可能になった。専門家は、中国の5G基地局は2024年までに600万局を超えると予測しています。

- さらに、中国情報通信技術研究院(CAICT)によると、2022年7月の中国における5Gスマートフォンの出荷台数は1,470万台に達し、スマートフォン総出荷台数の73%以上を占めました。さらに、同月の中国の全携帯電話出荷台数の74 %を5Gスマートフォンが占めました。 2022年の5Gスマートフォン出荷台数は年初から累計1億2,400万台に達しました。さらに、中国は同年に121の新しい5G携帯電話モデルを発売しました。 5Gスマートフォンの普及の高まりにより、アナログICの需要が高まると考えられます。

- ITAによると、中国は年間販売台数と製造台数において依然として世界の自動車市場をリードしています。国内生産台数は2025年までに3,500万台に達すると予測されています。さらに、中国の自動車産業は今年、世界への進出を強化しており、輸出台数は前年比81%増の176万台と目覚ましい伸びを見せています。中国自動車工業協会(CAAM)が開示したデータによると、2023年の最初の5か月。自動車製造におけるこのような重要な機能は、現代の自動車における幅広い用途について、調査対象の産業市場に大きな需要を生み出すことが予想されます。

アナログ集積回路(IC)産業の概要

アナログ集積回路(IC)市場の予測は、半統合的な情勢を示しています。メーカーは製品革新と技術差別化を駆使して熾烈な競合を繰り広げています。多くの企業は、先行者利益を確保し、競争力を維持するために、アナログ ICの開発に戦略的に投資しています。この分野の注目すべきプレーヤーには、Analog Devices Inc.、Infineon Technologies AG、Microchip Technology Inc.、NXP Semiconductors NV、およびON Semiconductorが含まれます。

2023年 2月、Analog Devices Inc.とMarvell Technology Inc.は、オープンRANサポートを統合した、最先端の5G大規模MIMO(mMIMO)リファレンス設計プラットフォームを発表しました。この先駆的なプラットフォームは、ADIの最先端RadioVerseトランシーバーSoCとマーベルのOCTEON 10 Fusion 5Gベースバンドプロセッサを組み合わせ、産業をリードする5G向け5 nmデジタルビームフォーミングソリューションを提供します。この高度な技術を活用することで、このプラットフォームは高度なmMIMO無線ユニットとO-RANサポートの市場投入までの時間を大幅に短縮し、最大40%のエネルギー消費の削減、サイズの縮小、軽量化を実現します。

2023年 1月、Microchip Technologyは、耐放射線ポートフォリオへの最新製品であるMIC69303RT 3A低ドロップアウト(LDO)電圧レギュレータを発表しました。この商用既製(COTS)パワーデバイスは、耐放射線技術の範囲を拡大するマイクロチップ社の大きな進歩を表しています。このCOTS耐放射線電源管理ソリューションのイントロダクションは、Microchip社のアナログパワーおよびインターフェイスビジネスユニット内の宇宙アプリケーションで新たな設計の機会を開拓することを目的としています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 産業の魅力度 - ポーターのファイブフォース分析

- 新規参入業者の脅威

- 消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- サプライチェーン分析

- マクロ経済要因とCOVID-19の影響

第5章 市場力学

- 市場促進要因

- スマートフォン、フィーチャーフォン、タブレット端末の普及率上昇

- 市場の課題

- アナログ集積回路(IC)の設計複雑化

第6章 市場セグメンテーション

- タイプ別

- 汎用IC

- インターフェース

- 電源管理

- 信号変換

- アンプ/コンパレータ(シグナルコンディショニング)

- 用途 - 特定IC

- コンシューマー

- オーディオ/ビデオ

- デジタルスチルカメラ/ビデオカメラ

- その他のコンシューマー

- 自動車

- インフォテインメント

- その他のインフォテインメント

- 通信機器

- 携帯電話

- インフラ

- 有線通信

- 近距離通信

- その他の無線通信

- コンピューター

- コンピュータシステム・ディスプレイ

- コンピュータ周辺機器

- ストレージ

- その他のコンピュータ

- 産業用・その他

- 汎用IC

- 地域別

- 南北アメリカ

- 欧州

- 日本

- 中国

- その他の地域

第7章 ベンダー市場シェア分析

第8章 競合情勢

- 企業プロファイル

- Analog Devices Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor

- Richtek Technology Corporation(MediaTek Inc.)

- Skyworks Solutions Inc.

- STMicroelectronics NV

- Renesas Electronics Corporation

- Texas Instruments Inc.

- Qorvo Inc.

第9章 アナログ集積回路(IC)市場の価格分析

第10章 投資分析

第11章 市場の将来

The Global Analog Integrated Circuit Market size is estimated at USD 91.26 billion in 2024, and is expected to reach USD 129.69 billion by 2029, growing at a CAGR of 7.28% during the forecast period (2024-2029).

Key Highlights

- An analog integrated circuit (IC) is a network of interconnected components manufactured on a single wafer of semiconducting material. These components operate across a continuous range of input signals, contrasting with their digital counterparts, which utilize only two input and output voltage levels. These circuits process, receive, and generate multiple energy output levels during device operation. Electronic devices employing components such as oscillators, DC amplifiers, multi-vibrators, and audio amplifiers utilize analog circuits, which maintain equal output and input levels.

- The introduction and adoption of emerging technologies such as the Internet of Things (IoT) are expected to propel the market growth owing to the evident benefits of analog ICs across a considerable range of real-time connected devices and applications. Owing to the increasing availability of high-speed connectivity, rising cloud adoption, and increasing use of data processing and analytics, the adoption of the Internet of Things (IoT) is growing steadily. For instance, as per Ericsson, there were 1.9 billion cellular IoT connections in the world in 2022, which is expected to grow to 5.5 billion in 2027, registering a CAGR of 19% over the period.

- Furthermore, the adoption of analog ICs has surged in recent years due to the proliferation of smartphones, consumer electronics, computers, and storage devices, as well as the increased sales of electric vehicles. Various ICs used in smartphones include charge ICs, display PMICs, SoC PMICs, and Camera PMICs. Key players such as Apple, Qualcomm, Intel, and Samsung S.LSI dominate this market. Consequently, with the growing production and sales of smartphones featuring advanced technologies and the increasing integration of 5G and 6G, the analog IC market is anticipated to gain substantial traction globally.

- However, global smartphone demand is projected to decline in 2023 compared to 2022 due to ongoing inflation, reduced consumer spending, and a weaker consumer outlook. This decline is expected to temporarily hamper the Analog IC market. Nevertheless, the market is predicted to recover slightly in FY 2024 owing to heightened demand for 5G smartphones and the expanding 5G network connectivity worldwide, particularly driven by the increased proliferation of 5G and foldable smartphones. For instance, as per GSMA, by 2025, 5G networks will likely cover one-third of the world's population.

- There is a significant dependency on the availability of skilled analog chip design engineers in the industry. However, there is a need for such skills within the semiconductor industry. According to Cindi Harper, Human Resources, Talent Planning, and Acquisition at Intel, the demand for talent in the industry surpasses the supply. Similarly, Ruchir Dixit, country manager at Siemens EDA, has stated that the US expects a shortage of 250,000 semiconductor engineers over the next five years. China and Taiwan anticipate shortages of 300,000 and 50,000 engineers, respectively. Such trends hinder the market's growth.

- Moreover, the conflict between Russia and Ukraine is expected to significantly impact several industries like the electronics industry. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have impacted the industry for some time. The disruption caused volatile pricing for critical raw materials like nickel, palladium, copper, silicon, Germanium, Indium Gallium Arsenide Phosphide, titanium, aluminum, and iron ore, resulting in material shortages. Further, according to SEMI, Russia is a global supplier of 45-50% of palladium. The material is used to form bonding wires, lead frames, electrodes, plating, and coating for semiconductor packaging. Therefore, with every country shutting doors for trading with Russia, the semiconductor manufacturers' focus is increasing on alternative raw material supplies, further delaying the production of semiconductors required in the market.

Analog Integrated Circuit (IC) Market Trends

Cell Phone within Communication Segment to Hold Major Share

- This segment encompasses application-specific analog ICs designed for and used in cellular phones and multifunction (voice/web/email) handheld devices, where voice communication remains a primary function. These phones are intended for wide-area cellular networks such as 2G, 3G, and Wimax, employing comprehensive transmission formats like CDMA, GSM, and their upgraded versions.

- The escalating rates of smartphone adoption, particularly in developing nations, are fueled by increasing population growth and urbanization in these regions. For instance, Ericsson forecasts predict that global mobile subscriptions are expected to reach approximately 8.4 billion by 2022, indicating a continuous upward trend.

- The advent of 5G technology is fostering a surge in 5G smartphone penetration. As per the November 2022 Ericsson Mobility Report, it's anticipated that 5G mobile subscriptions will reach 5 billion by the end of 2028. Notably, 5G networks are expected to cover 85% of the population and handle around 70% of mobile traffic.

- The introduction of chipsets tailored for 5G smartphones by numerous industry players is contributing significantly to the market's growth. For example, Google unveiled the Pixel 6a, Pixel 7, and Pixel 7 Pro in 2022 to support India's 5G network. The Pixel 6a supports 19 5G bands, while Pixel 7 and 7 Pro support 22.

- Reports from the Consumer Technology Association (CTA) and the US Census Bureau project an increase in smartphone sales value in the United States from USD 73 billion in 2021 to USD 74.7 billion in 2022. Additionally, GSMA estimates a rise in smartphone subscribers in North America to 328 million by 2025, along with increased penetration rates for mobile subscribers (86%) and Internet users (80%).

- The Ericsson Mobility Report suggests that the Middle East & Africa (MEA) region may have 60 million 5G service subscribers by 2024, accounting for approximately 3% of all mobile subscriptions. GSMA estimates around 50 million 5G connections across MENA, with potentially 20 million connections in the Arab States alone by 2025. These statistics underscore the swift pace of mobile adoption driving the studied market

China is Expected to be the Fastest Growing Market in the Asia Pacific Region

- China is anticipated to emerge as a dominant player in the analog IC market, owing to the presence of major semiconductor manufacturers, rapid industrialization, and a vast consumer electronics market. The region is renowned for its high-volume production of semiconductors and the adoption of analog IC across diverse industries, such as consumer electronics, automotive, and telecommunications. These factors are expected to fuel the growth of the studied market in the country, thereby presenting lucrative opportunities for market players.

- In addition, the country is experiencing a thriving IT and data center industry, which is attributed to the increasing volume of data generated annually. China's remarkable ascent as a dominant force in the global technology sector is primarily bolstered by its flourishing data center ecosystem. The Chinese market for Internet data centers stands out as one of the most technologically advanced markets worldwide, with numerous organizations operating through digital platforms.

- Furthermore, it is expected that the rising investments in data centers and the increasing internet penetration is expected to create the demand for many of these devices to incorporate sensors that interact with the physical world, requiring analog processing for analog to digital conversion. By combining these functions with digital technology, a cost-effective, low-power, and reliable solution is achieved. As a result, these factors are expected to drive the growth of the global analog IC market during the forecast period.

- Moreover, the increasing 5G networking capabilities are expected to create a massive demand for analog IC modules. China has emerged as a prominent player in the 5G arena with a substantial deployment of 5G base stations. As per the data released by MIIT, China had 2.31 million 5G base stations by the end of 2022. The country's massive investment in infrastructure and ambitious rollout strategies have enabled it to achieve extensive 5G coverage. Experts predict that the 5G base stations in China will surpass six million by 2024.

- Furthermore, according to China Academy of Information and Communications Technology (CAICT), In July 2022, the shipment volume of 5G smartphones in China amounted to 14.7 million units, representing over 73 % of the total smartphone shipments. Additionally, 5G smartphones accounted for 74 % of all mobile phone shipments in China during that month. The year-to-date total for 5G smartphone shipments in 2022 reached 124 million units. Furthermore, China released 121 new 5G mobile phone models in the same year. The rising 5G smartphone penetration will likely drive the demand for analog IC.

- China remains the leading global vehicle market in annual sales and manufacturing output, per ITA. The domestic production is projected to touch 35 million vehicles by 2025. Additionally, the automotive industry in China has intensified its global outreach in the current year, with exports witnessing a remarkable surge of 81% year-on-year to 1.76 million vehicles in the first five months of 2023, as per the data disclosed by the China Association of Automobile Manufacturers (CAAM). Such significant capabilities in manufacturing automobiles are expected to create a significant demand for the studied market in the industry for their wide range of applications in modern cars.

Analog Integrated Circuit (IC) Industry Overview

The forecast for the Analog Integrated Circuit (IC) Market indicates a semi-consolidated landscape. Manufacturers are engaged in fierce competition, leveraging product innovation and technological differentiation. Many companies are strategically investing in the development of analog ICs to secure a first-mover advantage and maintain competitiveness. Notable players in this arena include Analog Devices Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors NV, and ON Semiconductor.

In February 2023, Analog Devices Inc. and Marvell Technology Inc. introduced their cutting-edge 5G massive MIMO (mMIMO) reference design platform, integrating Open RAN support. This pioneering platform combines ADI's state-of-the-art RadioVerse Transceiver SoC with Marvell's OCTEON 10 Fusion 5G baseband processor, delivering an industry-leading 5 nm digital beamforming solution for 5G. By harnessing this advanced technology, the platform significantly accelerates the time-to-market for advanced mMIMO radio units and O-RAN support, achieving up to 40% lower energy consumption, reduced size, and lighter weight.

In January 2023, Microchip Technology unveiled its latest addition to the radiation-tolerant portfolio, the MIC69303RT 3A Low-Dropout (LDO) Voltage Regulator. This commercial-off-the-shelf (COTS) power device represents a significant stride for Microchip as it expands its range in radiation-tolerant technology. The introduction of this COTS rad-tolerant power management solution aims to unlock new design opportunities in space applications within Microchip's analog power and interface business unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Impact of Macroeconomic Factors and COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphones, Feature Phones, and Tablets

- 5.2 Market Challenges

- 5.2.1 Increasing Design Complexity of Analog IC

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General-Purpose IC

- 6.1.1.1 Interface

- 6.1.1.2 Power Management

- 6.1.1.3 Signal Conversion

- 6.1.1.4 Amplifiers/Comparators (Signal Conditioning)

- 6.1.2 Application-Specific IC

- 6.1.2.1 Consumer

- 6.1.2.1.1 Audio/Video

- 6.1.2.1.2 Digital Still Camera and Camcorder

- 6.1.2.1.3 Other Consumers

- 6.1.2.2 Automotive

- 6.1.2.2.1 Infotainment

- 6.1.2.2.2 Other Infotainment

- 6.1.2.3 Communication

- 6.1.2.3.1 Cell Phone

- 6.1.2.3.2 Infrastructure

- 6.1.2.3.3 Wired Communication

- 6.1.2.3.4 Short Range

- 6.1.2.3.5 Other Wireless

- 6.1.2.4 Computer

- 6.1.2.4.1 Computer System and Display

- 6.1.2.4.2 Computer Periphery

- 6.1.2.4.3 Storage

- 6.1.2.4.4 Other Computers

- 6.1.2.5 Industrial and Others

- 6.1.1 General-Purpose IC

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Rest of the World

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Analog Devices Inc.

- 8.1.2 Infineon Technologies AG

- 8.1.3 Microchip Technology Inc.

- 8.1.4 NXP Semiconductors NV

- 8.1.5 ON Semiconductor

- 8.1.6 Richtek Technology Corporation (MediaTek Inc.)

- 8.1.7 Skyworks Solutions Inc.

- 8.1.8 STMicroelectronics NV

- 8.1.9 Renesas Electronics Corporation

- 8.1.10 Texas Instruments Inc.

- 8.1.11 Qorvo Inc.