|

|

市場調査レポート

商品コード

1190667

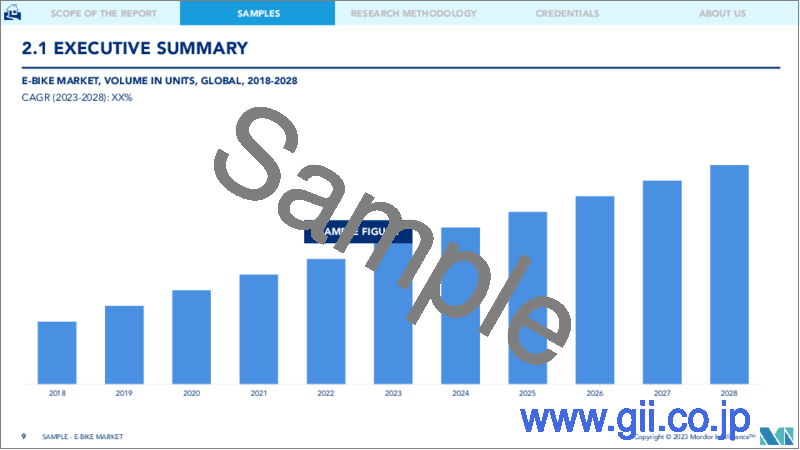

E-Bike市場- 成長、動向、予測(2023年~2028年)E-Bike Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| E-Bike市場- 成長、動向、予測(2023年~2028年) |

|

出版日: 2023年01月18日

発行: Mordor Intelligence

ページ情報: 英文 155 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界のE-Bike市場は、2020年のCOVID-19の大流行により、製造施設の閉鎖や停止、サプライチェーンの混乱など、大きな影響を受けました。

しかし、規制が解除されて以来、同分野は順調に回復しています。住宅販売の増加、新規プロジェクトの立ち上げ、E-Bikeの需要増が、ここ2年間の市場回復を牽引しています。

中期的には、政府の規制と政策が良好であることに加え、成人、特に若者の間でフィットネスやレクリエーションとしてのサイクリングへの関心が高まっていることが、市場の需要を促進すると予想されます。このほか、主要OEMメーカーによる世界の主要国での投資や製品発売の増加、サプライチェーン施設のローカライズへの注力も、市場の明るい見通しを生み出しています。

電動バイクやスクーターは、通常の二輪車に比べて購入費用が高いと言われていますが、燃料費の上昇を抑えることができるため、物流、食品、配送、観光などの分野に携わる複数の企業が参入しています。したがって、これらの企業は電動二輪車の調達に投資し、市場の他の競合他社に対する顕著な優位性を得るために、これらの車両製造会社と戦略的な契約を締結しています。例えば、以下のようなことです。

主なハイライト

- 一部の旅行会社は、「サイクリング・ホリデー」と呼ばれるパッケージを独占的に提供しています。欧州には数多くの旅行先があるため、ホリデーシーズンには毎年数百万人の観光客が訪れます。観光客もこの新しい体験に魅了され、著名な観光地や田舎を回るためにE-Bikeを選ぶケースもあるようです。

市場シェアは欧州が大きく、次いでアジア太平洋、北米の順と予想されます。政府の取り組みやインセンティブの高まり、公害を制限する必要性などが、欧州とアジア太平洋地域の電動二輪車セクターの拡大を後押ししています。これらの地域の主要都市では、国レベル、都市レベルなどで、E-Bikeの急速な普及を支援するために自転車専用レーンを増設しています。例えば

主なハイライト

- 2020年12月、ニューヨークでは、ビル・デ・ブラシオ市長が、ニューヨーク市交通局(DOT)が2020年に5つの区すべてで過去最高の28.6レーンマイルの保護自転車レーンを新設すると発表しました。この発表の後、市の自転車レーンネットワークは合計1,375レーンマイルに達し、545マイルの保護レーン、そのうち約170マイルが路上に設置されました。

E-Bikeの市場動向

ペダルアシスト式電動アシスト自転車の需要拡大が予想される

電動自転車のペダルアシストモードは、従来の自転車とほぼ同じ仕組みで、車輪を回転させるためにライダーが手動で操作しなければならないペダルを備えています。しかし、電動自転車の種類によっては、前輪または後輪に搭載されたバッテリー駆動のモーターによって、さらなる動力が供給されます。電池寿命の長さ、メンテナンスの必要性の低さ、モデルによって3~5種類のペダルアシストモードを選択できるなどの利点が、新規ユーザーを獲得し、予測期間中の市場全体の発展に貢献するものと思われます。

また、若者の間で上り坂のサイクリングなどのスポーツ活動への関心が高まっていることや、健康的で健康的なライフスタイルへの意識が高まっていることも、市場の需要をさらに押し上げると予想されます。一貫した技術の進歩に伴い、ペデレックメーカーは、ライダーのスマートフォンと統合できるペデレックを設計・開発し、ライダーに速度やバッテリーの状態に関するリアルタイムの情報を提供することで、全体的なユーザーインターフェースの強化に注力しています。

さらに、スポーツイベントや関連活動の高まりと相まって、継続的な製品のアップグレードや新モデルの発売が既存および新規のプレイヤーを後押しし、その他のプレイヤーも市場に参入する可能性が高いです。例えば、次のようなことです。

- 2022年2月、Ninety-One Cyclesは最新の電動自転車「Meraki S7」の発売を発表しました。この自転車には、Shimano Tourney 7-Speed Gearset, 5-Mode Pedal Assist, and the smart LCD with speed indicationが搭載されています。Meraki S7は、初代Merakiの機能をそのままに、Shimano Tourney 7-Speed Gearset, 5-Mode Pedal Assist,スピード表示機能付きスマートLCDを搭載した自転車です。

- 2021年6月、世界的に高い評価を得ている子供用自転車メーカーwoomは、米国で初めて子供用電動自転車(E-bike)を発売しました。250Wのプレミアムドライブシステム「FAZUA」は、カスタマイズ可能な3つの設定で、最大時速12マイルのペダルアシストを可能にします。ライダーは、無料のFazua Riderアプリをダウンロードし、パワーモードの微調整、モーターのデータ(出力、残り距離など)の監視、距離、速度、標高など、走行中のすべての統計情報を柔軟に記録することが可能です。

ペダル式E-Bikeは、低価格であることが好まれ、また、継続的な体の動きが要求されるため、健康愛好家に好まれています。また、新世代のペダルアシスト式E-Bikeには、フィットネスやGPSトラッキング、速度、バッテリー状態などの機能が搭載されています。このような市場の新興国動向は、今後5年間の市場全体の需要を高めると予想されます。

予測期間中、欧州が市場で重要な役割を果たすと予想される

欧州の電動自転車市場は、ドイツ、フランス、イタリアが中心となっています。E-Bikeの販売を促進する主な要因としては、製品の革新性、バッテリーとドライブの完全統合、魅力的なデザイン、高品質な素材の使用などが挙げられます。

- 欧州市場はドイツが牽引し、2021年には市場の約40%を占めました。次いで、オランダ、フランスがそれぞれ全体の11%以上のシェアを獲得しています。欧州委員会による中国製E-Bikeに対する反ダンピングおよび反補助金制裁は、2018年以降の市場の成長に大きく寄与しています。

ドイツのE-Bikeと自転車産業は近年すでに急速な発展を遂げており、2020年は最も高い数量拡大率と収益成長率を記録しました。

- ドイツの業界団体Zweirad-Industrie-Verband(ZIV2020)の市場データによると、2020年のE-Bikeの販売台数は43%増の200万台となりました。しかし、2021年の市場は様々な要因で若干減少しました。その背景にはCOVID-19があり、2020年から多数の工場が閉鎖され、生産の遅れが続いています。2021年の業界全体のE-Bikeの販売台数は約200万台を記録しました。これは、およそ2.6%の減少を意味します。

フランスでもE-Bikeの需要がかつてないほど高まっており、メーカー、小売店ともに在庫が急速に枯渇する事態に陥っています。パリでは、自転車通行量の増加に対応するため、50kmの自転車専用道路が整備され、Boltなどのe-mobility新興企業が市場の成長をさらに後押ししています。レジャー用から日常的な長距離走行用へと移行する人が増えたため、E-Bikeの販売台数は通常の自転車の販売台数を上回っています。

E-Bike市場の競合分析

E-Bike市場は、競争が激しく、すべての主要地域で世界および国内プレーヤーが活発に活動しているため、非常に断片的な市場です。このため、著名なプレーヤーは、市場で他のプレーヤーに対する競争力を得るために成長戦略の設計に継続的に焦点を当てています。さらに、E-Bikeメーカーは、予測期間中に製品の発売、拡張、コラボレーション、買収などの彼らの戦略的な開発を拡大することを意図しています。例えば、以下の通りです。

- 2021年4月、The Yamaha Motor Corporation USAは、Yamaha PWX-2モーター、500 Whバッテリー、160 mmトラベル、27.5インチホイールを搭載した、同社初の完全フルサスペンションeMTB、2021 YDX Moro Proを発売しました。

- 2021年1月、フォード、トレック、ボッシュは、Bicycle-To-Vehicle(B2V)通信安全ソフトウェアの開発で提携しました。このソフトウェアは、マイクロモビリティが近くの車両と通信できるようにし、大都市や渋滞地帯の促進要因が視界の外にいるライダーをより認識しやすくする可能性があります。また、自動車が近づきすぎた場合、目に見える形で警告を発することができるようになるかもしれません。

- 2021年1月、メリダは、250Whのバッテリーを搭載し、出力250W、トルク40NmのMahle ebikemotion X35+リアハブ電気モーターを搭載した、ドロップバーロード、フラットバーハイブリッド、グラベルバイク「eScultura」の3つの新しい電動バイクを発表しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場促進要因

- 市場抑制要因

- 産業の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場セグメンテーション(金額ベース、数量ベースの市場規模)

- 推進タイプ別

- ペダルアシスト

- スロットルアシスト(パワーオンデマンド)

- 用途別

- 都市・市街地

- トレッキング(E-Mountain Bike/E-MTB)

- カーゴ

- 電池種類別

- リチウムイオン電池

- 鉛蓄電池

- 出力別

- 250W未満および同程度

- 250W以上

- 地域別内訳

- 北米

- 米国

- メキシコ

- カナダ

- その他北米地域

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 世界のその他の地域

- 南米

- 中東・アフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Giant Bicycles Co. Ltd

- Merida Industry Co. Ltd

- Riese & Muller

- Fritzmeier Systems GmbH & Co. KG(M1 Sporttechnik)

- Yamaha Bicycles

- Trek Bicycle Corporation

- Cannondale Bicycle Corporation

- Kalkhoff Werke GmbH

- VanMoof BV

- Pedego Electric Bikes

- Accell Group

- Merida Industry Co. Ltd

- Desiknio Cycles SL

- Ampler Bikes

- Pon Bicycle Holding BV

第7章 市場機会と今後の動向

The e-bike market was valued at USD 35,408.58 million, and it is expected to reach USD 61,869.48 million after five years, registering a CAGR of 6.96% over the next five years.

The global e-bike market was severely affected by the COVID-19 pandemic during the 2020 lockdowns and shutdown of manufacturing facilities and supply chain disruptions. However, the sector has been recovering well since restrictions were lifted. An increase in house sales, new project launches, and increasing demand for e-bikes have been leading the market recovery over the last two years.

Over the medium term, favorable government regulations and policies coupled with increasing interest among adults, especially youth, in cycling as a fitness and recreational activity are expected to drive demand in the market. Besides these, rising investments and product launches by major OEMs in major countries globally and their focus on localizing supply chain facilities create a positive outlook in the market.

While electric bikes and scooters are said to be more expensive to purchase compared to regular two-wheelers, the amount of money saved with respect to rising fuel costs is encouraging several players across the logistics, food, delivery, tourism, etc., sectors. Accordingly, the companies are investing in procuring these electric two-wheelers and are entering strategic agreements with these vehicle manufacturing companies to gain a notable edge over other competitors in the market. For instance,

Key Highlights

- Some tourism companies are exclusively offering packages termed as 'Cycling Holidays.' As Europe is home to numerous travel destinations, millions of visitors flock to the country yearly during the holiday seasons. Even tourists are wooed by this new and different experience and are opting for e-bikes to tour prominent sites as well as the country-side in some cases.

Europe is expected to hold a significant market share, followed by Asia-Pacific and North America. The rising government efforts and incentives and the need to limit pollution are driving the expansion of Europe and Asia-Pacific electric-two-wheeler sector. Major cities in these regions are adding bike lanes to support the rapid adoption of e-bikes at the country level, city level, etc. For instance,

Key Highlights

- In December 2020, in New York, Mayor Bill de Blasio announced that the New York City Department of Transportation (DOT) constructed a record 28.6 lane miles of new protected bike lanes across all five boroughs in 2020. After this announcement, the city's total bike lane network reached 1,375 lane miles, 545 protected miles, including nearly 170 miles on the street.

E Bike Market Trends

Pedal - Assisted E-bikes Expected to Gain Significant demand in the Market

The pedal-assisted mode of an electric bike works much like a traditional bicycle, with pedals that the rider must manually operate to turn the wheels. However, additional power is supplied by a battery-powered motor mounted on the front or back wheel, depending on the type of bike. The advantages like better battery life, lower servicing needs, and the ability for users to choose from the three to five modes of pedal assist depending on the model, etc. are anticipated to attract new users and are likely to contribute to enhancing the overall development of the market during the forecast period.

In addition, increasing interest among youth towards sports activities like uphill cycling, etc., and the rising awareness towards healthy and fit lifestyles are expected to further propel demand in the market. With the consistent technological advancements, pedelec manufacturers are focusing on enhancing the overall user interface by designing and developing pedelecs that can be integrated with the rider's smartphones and provide them with real-time information on the speed and battery status of their vehicles.

Moreover, continuous product upgrades and new model launches coupled with rising sports events and associated activities encourage existing and new players and are likely to encourage other players in the market. For instance,

- In February 2022, Ninety-One Cycles announced the launch of their latest electric bike, the Meraki S7. The bike comes equipped with a Shimano Tourney 7-Speed Gearset, 5-Mode Pedal Assist, and a smart LCD with speed indication. The bike has all the features of the original Meraki and additionally comes equipped with a Shimano Tourney 7-Speed Gearset, 5-Mode Pedal Assist, and a smart LCD with speed indication.

- In June 2021, woom, a globally-acclaimed kids' bicycle company, launched its first electric bike (e-bike) for kids in United States. The premium 250-watt FAZUA drive system enables pedal assist in three customizable settings, up to 12 mph. Riders could download the free Fazua Rider app, which could give the flexibility to fine-tune the power modes, monitor the motor's data (power output, remaining range, etc.), and record all the stats during a ride, including distance, speed, and elevation.

Pedelec e-bikes are being preferred for their lower prices and are also a preferred choice for health enthusiasts as they demand continuous body motion. Newer generation pedal-assisted e-bikes also incorporate features like fitness and GPS tracking, speed, and battery status, among others. Such developments and trends in the market anticipated to enhance overall demand in the market over the next five years.

Europe is Expected to Play a Prominent Role in the Market During the Forecast Period

The European e-bike market is dominated by Germany, France, and Italy. Some of the major factors driving the sales of e-bikes are the innovative nature of the product, fully-integrated batteries and drives, appealing designs, and the use of high-quality materials.

- Germany led the European market, accounting for approximately 40% of the market in 2021. It was followed by the Netherlands and France, each of which captured more than 11% of the overall market share. The European Commission's anti-dumping and anti-subsidy sanctions against Chinese e-bikes have contributed significantly to the market's growth since 2018.

Germany's e-bike and bicycle industries have already experienced rapid development in recent years, while 2020 recorded the highest volume expansion and revenue growth.

- According to the German industry group Zweirad-Industrie-Verband (ZIV2020 )'s market data, e-bike sales in 2020 increased by 43% to two million units. However, the market declined slightly in 2021, owing to many factors. The backdrop to this was COVID-19, with numerous factories shutting and output delays continuing from 2020. The industry recorded sales of around two million e-bikes in total in 2021. This would imply a drop of roughly 2.6%.

France has also been facing unprecedented growth in demand for e-bikes, and both manufacturers and retailers have been struggling to keep up with the rapidly depleting inventory. Paris added 50 kilometers of bicycle lanes to cater to the increasing cycle traffic, and e-mobility startups, such as Bolt, have been further propelling the market's growth. The e-bike sales outnumbered the regular bicycle sales as more people moved from leisure buying to long-distance everyday use of e-bikes.

E Bike Market Competitive Analysis

The e-bike market is highly fragmented market as the market is competitive and has an active engagement of both global and domestic players across all major regions i.e., though many key companies are operating in this industry, none of them have enough market share to influence prices, production, investment, and their competition. Owing to this, prominent players are continuously focusing on designing growth strategies to gain a competitive edge over other players in the market. Furthermore, e-bike manufacturers are intended on expanding their strategic developments such as product launches, expansion, collaborations, acquisitions, etc. over the forecast period. For instance,

- In April 2021, The Yamaha Motor Corporation USA launched their first complete full-suspension eMTB, the 2021 YDX Moro Pro, equipped with the Yamaha PWX-2 motor, a 500 Wh battery, 160 mm travel, and 27.5" wheels.

- In January 2021, Ford, Trek, and Bosch partnered to develop Bicycle-To-Vehicle(B2V) Communication safety software that may allow forms of micro-mobility to communicate with nearby vehicles so that drivers in big cities and congested areas are more aware of riders out of their line of sight. It could also trigger visible alerts on bicycles when cars get too close.

- In January 2021, Merida announced three new electric bikes: the eScultura drop-bar road, eSpeeder flat-bar hybrid, and eSilex gravel bike, which are equipped with 250Wh battery and powered by the Mahle ebikemotion X35+ rear hub electric motor, which offers 250 watts of output and 40Nm of torque.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value and Volume)

- 5.1 By Propulsion Type

- 5.1.1 Pedal Assisted

- 5.1.2 Throttle-assisted (Power-on-demand)

- 5.2 By Application

- 5.2.1 City/Urban

- 5.2.2 Trekking (E-mountain Bikes/E-MTB)

- 5.2.3 Cargo

- 5.3 By Battery Type

- 5.3.1 Lithium-ion Battery

- 5.3.2 Lead-acid Battery

- 5.4 By Power

- 5.4.1 Less than and Equal to 250W

- 5.4.2 Above 250W

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Mexico

- 5.5.1.3 Canada

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Giant Bicycles Co. Ltd

- 6.2.2 Merida Industry Co. Ltd

- 6.2.3 Riese & Muller

- 6.2.4 Fritzmeier Systems GmbH & Co. KG (M1 Sporttechnik)

- 6.2.5 Yamaha Bicycles

- 6.2.6 Trek Bicycle Corporation

- 6.2.7 Cannondale Bicycle Corporation

- 6.2.8 Kalkhoff Werke GmbH

- 6.2.9 VanMoof BV

- 6.2.10 Pedego Electric Bikes

- 6.2.11 Accell Group

- 6.2.12 Merida Industry Co. Ltd

- 6.2.13 Desiknio Cycles SL

- 6.2.14 Ampler Bikes

- 6.2.15 Pon Bicycle Holding BV