|

市場調査レポート

商品コード

1444345

航空宇宙および防衛における3Dプリンティング - 市場シェア分析、業界動向と統計、成長予測(2024年~2029年)3D Printing In Aerospace And Defense - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。

| 航空宇宙および防衛における3Dプリンティング - 市場シェア分析、業界動向と統計、成長予測(2024年~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 122 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

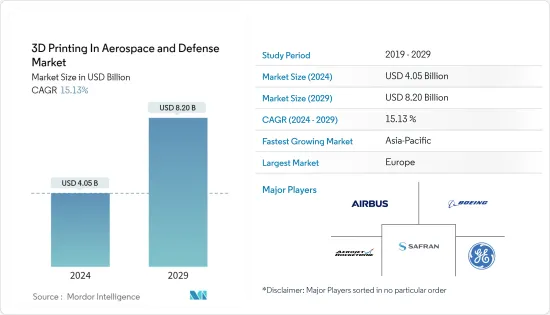

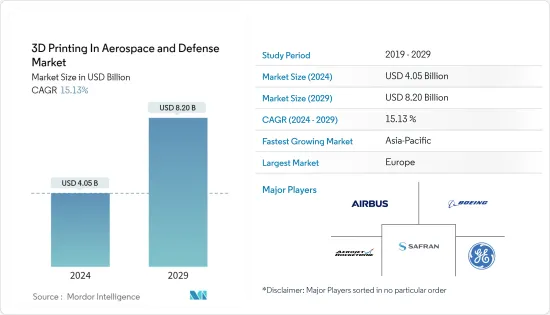

航空宇宙および防衛における3Dプリンティングの市場規模は、2024年に40億5,000万米ドルと推定され、2029年までに82億米ドルに達すると予測されており、予測期間(2024年から2029年)中に15.13%のCAGRで成長します。

2020年、COVID-19のパンデミックは航空業界に影響を及ぼしました。そのため、航空会社はコスト削減策として古い航空機の退役を加速することを選択し、現在、比較的軽量で燃料効率の高い新世代の航空機に置き換えることを計画しています。いくつかの航空宇宙OEM企業は、新世代航空機での3Dプリント部品やコンポーネントの使用を強化するための大規模な調査プロジェクトに投資しています。さらに、アフターマーケット分野では3Dプリント部品の使用が増加しており、そのような部品は従来のサプライチェーンへの圧力を軽減する可能性があります。

3Dプリンティングによってもたらされる利点により、航空宇宙分野での採用が普及しました。 3Dプリンティングは、より短いリードタイムと、よりデジタル的に柔軟な設計および開発方法により、部品を低コストで生産します。 3Dプリンティングは、ユーザーとメーカーにとって大幅なコスト削減にもつながります。

A&D部門では3Dプリンティングの採用が増加していますが、現在、大量採用に向けた進歩を遅らせている重大な課題があります。それにもかかわらず、3Dプリンティング技術や材料科学を含む進歩により、これらの制限のほとんどが解決される可能性があり、それによって今後数年間で航空業界での3Dプリンティングの採用が促進されるでしょう。

航空宇宙および防衛における3Dプリンティング市場の動向

航空機セグメントは予測期間中に最高の成長を示すと予想される

航空機セグメントは、予測期間中に顕著な成長を示すでしょう。この成長は、民間航空機の注文と納入数の増加と、航空機製造における先進技術の導入の増加によるものと考えられます。 3Dプリンティングは航空機製造業界に革命をもたらし、積層造形が民間航空機や軍用航空機の部品を低コストで、より短いリードタイムで、よりデジタル的に柔軟な設計と開発で製造する従来の方法に取って代わることができるユースケースの数が大幅に拡大しています。方法。 B777X航空機は、GE9Xエンジンが燃料ノズル、温度センサー、熱交換器、低圧タービンブレードを含む300個の3Dプリント部品で作られているため、積層造形の応用の顕著な例です。

航空機OEMと3Dプリンティング会社は、スペアパーツの大量在庫を維持する代わりに、在庫コストと保管要件を大幅に削減するために協力しています。メーカーは必要に応じてそれらを生産できるため、リードタイムとサプライチェーンの複雑さが軽減されます。たとえば、2023年 1月、レオナルドは、ハイエンド 3Dプリンティングアプリケーションのイタリアの主要サービス局であるBEAMITグループと、レオナルド航空機モデルに搭載する部品を開発および認定するための5年契約を締結しました。 2017年以来、両社は協力してM345、M346、およびC27J航空機モデルに100以上の部品を認定し搭載してきました。このような発展は、今後数年間の市場の成長を促進すると予想されます。

アジア太平洋は予測期間中に市場の大幅な成長が見込まれる

アジア太平洋では、予測期間中に航空宇宙および防衛市場における3Dプリンティングが顕著な成長を示すと予想されます。この成長は、航空部門の急速な拡大と、中国、インド、韓国などの国からの防衛支出の増加によるものと予想されます。国際航空運送協会(IATA)によると、中国は2020年半ばに座席数の点で最大の航空市場となった。 2021年2月に発表された計画によると、中国は2035年末までに民間輸送空港を400か所設ける計画です。

中国製造2025基本計画に基づき、中国政府は航空宇宙機器と3Dプリンティングの開発を中国の製造業の主要な成長原動力として位置付けています。中国のメーカーは、旅客機の重量を軽減し、安全性を高めるために、3Dプリントされたチタン部品、28個の客室ドア部品、2個のファン入口構造部品を使用してC919狭胴航空機を開発しました。また、中国の航空業界は新世代戦闘機で3Dプリント技術の利用を開始しており、3Dプリントされた部品は新しく開発された航空機で広く使用されています。 3Dプリンティング技術は、中国の航空業界の主要な航空機製造工場で導入されています。 3Dプリント部品には、高い構造強度と長い耐用年数に加え、軽量、低コスト、より迅速な製造など、多くの利点があります。

さらに、インドは3Dプリンティング技術の利用に関して徐々に成長しており、バンガロール、チェンナイ、ムンバイ、ヴィシャカパトナムなどの都市で、航空宇宙および防衛分野に不可欠な部品を製造するスタートアップ企業が誕生しています。顧客には、インド海軍、空軍、インド宇宙調査機関(ISRO)、ヒンドゥスタン航空会社(HAL)が含まれます。たとえば、2022年 11月、インド軍はラダック東部の実効支配線に沿って3Dプリントによるバンカーまたは恒久的な防衛施設を建設しました。軍事工学サービス(MES)と新興企業は、さまざまなサイズと機能の3Dプリント構造を開発しました。 MESは、2023年の初めからシッキム、ラダック、アルナーチャル・プラデーシュ州から砂漠地帯までの実際の管理ラインと国際国境に沿って、バンカーや住宅などの常設の3Dプリントシェルターを配備する計画を立てています。したがって、航空宇宙および防衛分野での3Dプリンティングの採用の増加により、この地域全体の市場の成長が促進されます。

航空宇宙および防衛における3Dプリンティング産業の概要

航空宇宙および防衛分野の3Dプリンティング市場は、航空宇宙および防衛産業をサポートするTier-1およびTier-2メーカーに加え、航空機OEMおよび宇宙船メーカーの存在により細分化されています。市場における著名なプレーヤーとしては、ゼネラル・エレクトリック社、エアバス SE、サフランSA、エアロジェットロケットダインホールディングス、ボーイング社などがあります。軽量コンポーネントやより燃料効率の高い航空機搭載プラットフォームへの需要が高まる中、両社は成長する機会をつかむために既存の積層造形能力の拡大に積極的に投資しています。

これに関連して、2021年 7月、Burloak Technologiesはカリフォルニア州カマリロに2番目の積層造形センターを開設すると発表しました。新しい施設は、オンタリオ州の付加製造センター・オブ・エクセレンスを強化することが期待されています。航空機OEMも、3Dプリント部品の需要の高まりに伴い、積層造形市場への進出を拡大しています。また、従来のサブトラクティブ製造法と比較して、宇宙分野における3Dプリントコンポーネントの経済的利点により、NASAやESAなどの宇宙機関は現在、3Dプリントコンポーネントを使用して宇宙船の部品を製造することを検討しています。この要因により、今後数年間に新しい企業が市場に参入し、競合が激化すると予想されます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 用途

- 航空機

- 無人航空機

- 宇宙船

- 材料

- 合金

- 特殊金属

- その他の素材

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- その他のアジア太平洋

- ラテンアメリカ

- メキシコ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- ベンダーの市場シェア

- 企業プロファイル

- Aerojet Rocketdyne Holdings Inc.

- MTU Aero Engines AG

- Moog Inc.

- Safran SA

- General Electric Company

- The Boeing Company

- Airbus SE

- Samuel, Son &Co.

- Raytheon Technologies Corporation

- Honeywell International Inc.

- American Additive Manufacturing LLC

- Lockheed Martin Corporation

第7章 市場機会と将来の動向

The 3D Printing In Aerospace And Defense Market size is estimated at USD 4.05 billion in 2024, and is expected to reach USD 8.20 billion by 2029, growing at a CAGR of 15.13% during the forecast period (2024-2029).

The COVID-19 pandemic affected the aviation industry in 2020. Thus, airlines have opted to accelerate the retirement of older aircraft as a cost-cutting measure and are now planning to replace them with newer generation aircraft that are comparatively lightweight and more fuel-efficient. Several aerospace OEMs are investing in large-scale research projects to enhance the use of 3D-printed parts and components in newer-generation aircraft. Furthermore, the use of 3D-printed parts is increasing in the aftermarket space, as such parts may reduce the pressure on traditional supply chains.

The benefits offered by 3D printing have popularized its adoption in the aerospace sector. 3D printing produces parts at lower costs with faster lead times and more digitally flexible design and development methods. 3D printing also results in significant cost savings for users and manufacturers.

Although the adoption of 3D printing is increasing in the A&D sector, there are significant challenges that are currently delaying its progress toward mass adoption. Nevertheless, the advancements, including 3D printing technology and material sciences, are likely to address most of these limitations, thereby driving the adoption of 3D printing in the aviation industry in the coming years.

3D Printing in Aerospace and Defense Market Trends

Aircraft Segment is Expected to Show Highest Growth During the Forecast Period

The aircraft segment will showcase remarkable growth during the forecast period. The growth would be due to the increasing number of commercial aircraft orders and deliveries, as well as the rising adoption of advanced technologies in aircraft manufacturing. 3D printing has revolutionized the aircraft manufacturing industry, and there is a massive expansion in the number of use cases where additive manufacturing can replace conventional methods of manufacturing commercial and military aircraft parts at lower costs, faster lead times, and more digitally flexible design and development methods. The B777X aircraft is a prominent example of the application of additive manufacturing as its GE9X engines are made of 300 3D printed parts, including fuel nozzles, temperature sensors, heat exchanges, and low-pressure turbine blades.

Aircraft OEMs and 3D printing firms are collaborating to significantly reduce inventory costs and storage requirements instead of maintaining large stocks of spare parts. Manufacturers can produce them as needed, reducing lead times and supply chain complexities. For instance, in January 2023, Leonardo signed a five-year deal with BEAMIT Group, an Italian premier service bureau for high-end 3D printing applications, to develop and qualify parts for installation onboard Leonardo aircraft models. Since 2017, the two firms have collaborated to qualify and install over 100 parts onboard the M345, M346, and C27J aircraft models. Such developments are expected to drive the market growth in coming years.

Asia-Pacific is Expected to Project Significant Growth in the Market During the Forecast Period

Asia-Pacific is anticipated to show remarkable growth in 3D printing in the aerospace and defense market during the forecast period. The growth is expected to be due to the rapid expansion of the aviation sector and increasing defense expenditure from countries such as China, India, and South Korea. According to the International Air Transport Association (IATA), China became the largest aviation market in terms of seating capacity in mid-2020. According to plans released in February 2021, China is planning to have 400 civilian transport airports by the end of 2035.

Under the country's Made in China 2025 master plan, the Chinese government has earmarked the development of aerospace equipment and 3D printing as key growth drivers of Chinese manufacturing industries. A Chinese manufacturer developed the C919 narrow-body aircraft using 3D printed titanium parts, 28 cabin door parts, and two fan inlet structural parts to reduce the airliner's weight and increase its safety. Also, China's aviation industry has started using 3D printing technologies on new-generation warplanes, with 3D printed parts widely used on newly developed aircraft. 3D printing technologies have been implemented in the major aircraft manufacturing factories of the Chinese aviation industry. 3D printed parts provide numerous advantages such as high structural strength and long service life, as well as being lightweight, low cost, and quicker to manufacture.

Furthermore, India is gradually growing concerning its utilization of 3D printing technology, with startups springing up in cities like Bangalore, Chennai, Mumbai, Visakhapatnam, etc., to produce essential parts for the aerospace and defense sector. The clientele includes the Indian Navy, Air Force, Indian Space Research Organization (ISRO), and Hindustan Aeronautics Limited (HAL). For instance, in November 2022, the Indian Army constructed 3D printed bunkers or permanent defenses along the Line of Actual Control in eastern Ladakh. Military Engineering Services (MES) and start-ups have developed 3D printed structures of varying sizes and capabilities. The MES is planning to deploy permanent 3D printed shelters, such as bunkers and houses, from the beginning of 2023 along the Line of Actual Control and International Border, from Sikkim, Ladakh, and Arunachal Pradesh to desert regions. Thus, growing adoption of 3D printing in aerospace and defense boosts the market growth across the region.

3D Printing in Aerospace and Defense Industry Overview

The market for 3D printing in aerospace and defense is fragmented with the presence of aircraft OEMs and spacecraft manufacturers, along with Tier-1 and Tier-2 manufacturers that support the aerospace and defense industry. Some of the prominent players in the market are General Electric Company, Airbus SE, Safran SA, Aerojet Rocketdyne Holdings Inc., and The Boeing Company. With the increasing demand for lightweight components and more fuel-efficient airborne platforms, the companies are robustly investing in expanding their existing additive manufacturing capabilities to seize the growing opportunities.

On this note, in July 2021, Burloak Technologies announced the opening of its second additive manufacturing center in Camarillo, California. The new facility is expected to reinforce its Additive Manufacturing Center of Excellence in Ontario. Aircraft OEMs are also increasing their footprint in the additive manufacturing market with the increasing requirement for 3D printed components. Also, due to the economic advantage of 3D printing components in the space sector compared to the traditional subtractive manufacturing methods, space agencies like NASA and ESA are currently looking to manufacture spacecraft parts using 3D printed components. This factor is expected to allow new companies to venture into the market in the coming years, increasing competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Aircraft

- 5.1.2 Unmanned Aerial Vehicles

- 5.1.3 Spacecraft

- 5.2 Material

- 5.2.1 Alloys

- 5.2.2 Special Metals

- 5.2.3 Other Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Mexico

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Aerojet Rocketdyne Holdings Inc.

- 6.2.2 MTU Aero Engines AG

- 6.2.3 Moog Inc.

- 6.2.4 Safran SA

- 6.2.5 General Electric Company

- 6.2.6 The Boeing Company

- 6.2.7 Airbus SE

- 6.2.8 Samuel, Son & Co.

- 6.2.9 Raytheon Technologies Corporation

- 6.2.10 Honeywell International Inc.

- 6.2.11 American Additive Manufacturing LLC

- 6.2.12 Lockheed Martin Corporation