|

|

市場調査レポート

商品コード

1170391

遠隔操作式無人銃架・砲塔の世界市場-2031年までの市場・技術予測Remotely Operated Weapon Stations - Market and Technology Forecast to 2031 |

||||||

| 遠隔操作式無人銃架・砲塔の世界市場-2031年までの市場・技術予測 |

|

出版日: 2022年12月12日

発行: Market Forecast

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートでは、世界の遠隔操作式無人銃架・砲塔市場について調査分析し、市場概要、市場分析、影響分析、主要企業など、体系的な情報を提供しています。

目次

第1章 イントロダクション

- 範囲

- 定義

- 調査手法

- 本調査の対象読者

第2章 エグゼクティブサマリー

- 動向と洞察

- 主な結果

- 主な結論

- 機能と技術ベース

- 産業および市場ベース

- 重要な表と図

第3章 技術と開発

- 技術概要

- 遠隔操作式無人銃架・砲塔の基本コンポーネント

- 遠隔操作式無人銃架・砲塔の設計と運用における重要な要素

- 安定

- センサー

- 防火ユニット

- 銃、武器、弾薬

- プラットフォーム上での遠隔操作式無人銃架・砲塔の統合

- 遠隔操作式無人銃架・砲塔と有人タレット

- 遠隔操作式無人銃架・砲塔-利点と制限

- 遠隔操作式無人銃架・砲塔のタイプ

- 陸上プラットフォーム

- 装輪車と装軌車

- ケーススタディ-英国陸軍打撃旅団

- ケーススタディ-フランス陸軍スコーピオンプログラム

- ケーススタディ-欧州の米国軍

- 遠隔操作式無人銃架・砲塔を備えた無人プラットフォーム

- C-UAVの遠隔操作式無人銃架・砲塔

- 遠隔操作式無人銃架・砲塔を備えた海軍プラットフォーム

- 固定遠隔操作式無人銃架・砲塔

- 空中遠隔操作式無人銃架・砲塔

- 遠隔操作式無人銃架・砲塔市場でのトレーニングとシミュレーション

第4章 市場概要

- イントロダクション

- 遠隔操作式無人銃架・砲塔市場の性質

- 競合情勢

- 会社概要

- 危険因子

第5章 市場分析と予測要因

- 市場セグメンテーション

- 促進要因

- 防衛予算

- 永続的なISRの要件

- 非対称の脅威

- 沿岸海域でますます活動する海軍

- 国土安全保障機関の重要性

- 搭乗員の生存性

- レガシープラットフォームのアップグレードの必要性

- 市街戦

- 動向

- 装輪装甲車の増加傾向

- 土着の防衛産業能力の開発

- エンゲージメントと精度の向上

- 複合機能

- 電力と署名の管理

- UGVとUUVの拡散

- 技術的イネーブラー

- 非殺傷兵器を使用した遠隔操作式無人銃架・砲塔

- 機会

- EO/IR技術開発

- 遠隔操作式無人銃架・砲塔のコスト可用性

- 無人システムのテストと評価の改善

- 有人無人チーミングの改善

- マーケティングの改善およびメッセージの付加価値

- プラットフォームの寿命と機能を拡張する方法の開発

- 1つの遠隔操作式無人銃架・砲塔別複数の効果

- 国土安全保障用途に適応可能な遠隔操作式無人銃架・砲塔

- システムとしての遠隔操作式無人銃架・砲塔

- シミュレーターと仮想環境に必要な遠隔操作式無人銃架・砲塔ドライブのトレーニング

- スペアパーツのフィールド付加製造

- 課題

- 実証済みの運用コンセプトの欠如

- 有人ソリューションへの信頼

- 防衛予算

- 人工知能と倫理

- 交戦規則と国際法

- 防衛における輸出規制

第6章 国別分析

- 米国

- 欧州

- 英国

- フランス

- ポーランド

- イスラエル

- オーストラリア

第7章 世界および地域市場の予測(~2031年)

- イントロダクション

- 遠隔操作式無人銃架・砲塔市場:地域別

- 遠隔操作式無人銃架・砲塔市場予測:用途別

- 北米の遠隔操作式無人銃架・砲塔市場:用途別

- 欧州の遠隔操作式無人銃架・砲塔市場:用途別

- アジア太平洋の遠隔操作式無人銃架・砲塔市場:用途別

- 中東およびアフリカの遠隔操作式無人銃架・砲塔市場:用途別

- 遠隔操作式無人銃架・砲塔市場:最終用途別

- 北米の遠隔操作式無人銃架・砲塔市場:最終用途別

- 欧州の遠隔操作式無人銃架・砲塔市場:最終用途別

- アジア太平洋の遠隔操作式無人銃架・砲塔市場:最終用途別

- 中東およびアフリカの遠隔操作式無人銃架・砲塔市場:最終用途別

第8章 用途市場予測(~2031年)

- イントロダクション

- 遠隔操作式無人銃架・砲塔市場概要:用途別

- 総遠隔操作式無人銃架・砲塔市場:用途別

- HLS遠隔操作式無人銃架・砲塔市場:用途別

- 軍用遠隔操作式無人銃架・砲塔市場:用途別

- 総陸上遠隔操作式無人銃架・砲塔市場:用途別

- 総海軍遠隔操作式無人銃架・砲塔市場:用途別

第9章 エンドユーザー市場予測(~2031年)

- イントロダクション

- 防衛およびHLSセクターの遠隔操作式無人銃架・砲塔

- 精度の向上

- 火力の向上

- システムのシステム

- 遠隔操作式無人銃架・砲塔と新規プラットフォーム

- 遠隔操作式無人銃架・砲塔とレガシープラットフォーム

- 遠隔操作式無人銃架・砲塔と無人プラットフォーム

- 重要インフラの保護

- 世界遠隔操作式無人銃架・砲塔市場概要:最終用途別

- HLS遠隔操作式無人銃架・砲塔市場:地域別

- 世界の軍事用遠隔操作式無人銃架・砲塔市場:地域別

- HLS遠隔操作式無人銃架・砲塔市場:用途別

- 軍用遠隔操作式無人銃架・砲塔市場:用途別

第10章 影響分析

- イントロダクション

- 予測要因と市場への影響

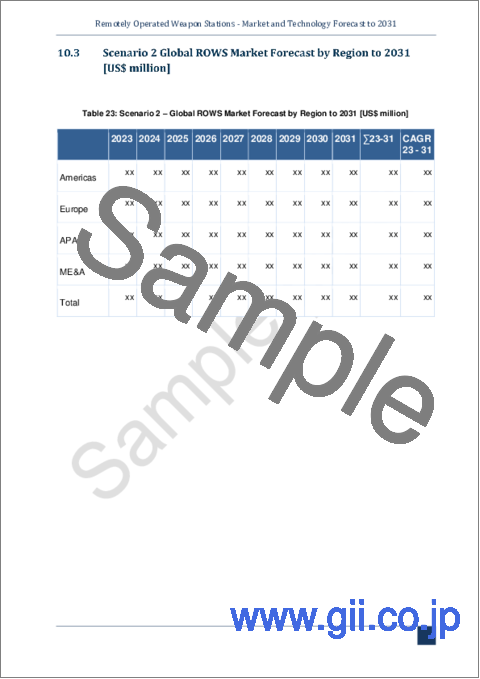

- シナリオ2-世界の遠隔操作式無人銃架・砲塔市場予測[100万米ドル](~2031年):地域別

- シナリオ2-世界の遠隔操作式無人銃架・砲塔市場予測[100万米ドル](~2031年):用途別

第11章 主要企業

- ASELSAN Elektronik Sanayi ve Ticater A.S.

- BAE Systems

- Elbit Systems

- EOS (Electro-Optic Systems) Australia

- FN Herstal

- General Dynamics

- John Cockerill

- Kongsberg

- KMW GmbH (KNDS)

- Leonardo S.p.A.

- MSI Defence Systems Ltd.

- Nexter (KNDS)

- Rafael Advanced Defense Systems

- Rheinmetall AG

- SAAB

第12章 結果と結論

第13章 市場予測について

- 全般的

- お問い合わせ

- 免責事項

- ライセンス

付録A:言及された企業

付録B:略語

After more than 20 years of use in the field, Remotely Operated Weapon Stations have become a well-established market. The advantages they offer are significant, including crew protection, increased accuracy, first-round hit probability, target recognition and identification, low production, integration, and operational cost. Most importantly they can significantly increase the firepower of smaller and legacy platforms, thus increasing their range of capabilities or extending their utility in the modern battlefield.

The outbreak of the war in Ukraine has shown that a confrontation between peer or near-peer competitors is not a possibility that could happen in the distant future, but a highly like scenario. In such confrontations, firepower, long-range fires and ISR are elements that play a key role. However, the defence industries were unprepared for the requirements of a high-intensity warfare, and they have been struggling to deliver the required capabilities. That is an issue further exacerbated by the risks posed by the current economic and political climate which impacts defence budgets and supply chains.

In such a tight framework ROWS can deliver significant capabilities to new and legacy platforms in a timely and affordable manner. There is also an important development in the ROWS market that no one should disregard, as they are expected to change the conduct of combat operations. Just as radio brought a small revolution in technical and military affairs when it was used as a medium to guide weapons, ROWS will bring a similar change, not only as standalone systems but also as part of a networked environment and on top of unmanned ground or surface vehicles.

The current global security environment poses many challenges either in the form of low-intensity conflicts too. With major forces around the globe being in need of fielding disruptive technologies with fire delivery capabilities, platforms or unmanned systems with ROWS, interconnected through IoMT over a C2 backbone, will serve that goal effectively and affordably.

Recognizing that potential of the market, a significant number of manufacturers around the world are positioning themselves by developing their own ROWS. That creates a highly competitive environment for businesses, which will be better served through the creation of economies of scale.

Market Forecast provides a detailed analysis of the Remotely Operated Weapon Stations (ROWS) market up to 2031 in terms of technologies, end-users and platforms, acquisition programs, leading companies, and opportunities for manufacturers. The report also provides the case studies that would help readers better understand the nature of the market and the underlying factors affecting the procurement of ROWS.

Covered in this report:

- Global market share assessments for all types in numbers delivered and value up to 2031.

- Market share assessments per segments and regions up to 2031.

- Snapshot on global security issues, defence budgets, spending patterns and how these affect the procurement of ROWS systems.

- Focus on US, European, Asian-Pacific and Middle East procurement programmes.

- Case studies with some of the world's biggest acquisition programs that have ROWS an integral part of the equation.

- Market Dynamics: An insight on the latest technological developments in the ROWS market and which countries are changing their preferences, are in position to absorb the new technology and adapt their modus operandi.

- Roles for all types: Insight on how ROWS fit into a military or security concept of operations and how they form a revolution in military affairs.

- Main military ROWS technological trends.

- Market Trends: Drivers, Trends, Opportunities and Risks for the stakeholders that want to stay ahead of the competition.

- Profiles for the leading companies.

Segmentation

We have segmented the market by Region, Application (domain), and End-Use.

Region

- Americas

- Europe

- APAC

- Middle East & Africa

Application

- Land domain

- Naval domain

End-Use

- Defence

- Security

Reasons to buy this study:

- The report "Remotely Operated Weapon Stations - Market and Technology Forecast to 2031" will be of help to existing companies and new market entrants in this sector.

- The "Market Analysis and Forecast Factors' helps to understand how the market will evolve

- The "Technologies and Developments" chapter helps companies with investment choices.

- Strategy formulation teams can use the market forecast chapter to understand the future market potential, this would help them to converge their efforts to specific segment.

- The sales team can use the market forecast chapter to plan their sales campaigns and focus areas.

- Scenarios with potential and unpredictable factors are identified in the Impact Analysis Chapter

- The Opportunity Analysis chapter shows the market growth for the segments.

- The company profiles chapter contains financial information, products, recent contract, and a SWOT analysis

Who is This Report For?

This report is a must, particularly if you are one of the following:

- Business Leaders & Business Developers

- Market Analysts

- Government and Military decision-makers

- Component manufacturers

Companies Listed:

|

|

Table of Contents

1. Introduction

- 1.1. Scope

- 1.2. Definitions

- 1.3. Methodology

- 1.4. Who will benefit from this study?

2. Executive Summary

- 2.1. Trends and Insights

- 2.2. Main Findings

- 2.3. Key Conclusions

- 2.3.1. Capabilities and technology-based

- 2.3.2. Industrial and market-based

- 2.4. Important Tables and Figures

3. Technologies and Developments

- 3.1. Technology overview

- 3.2. ROWS' Basic Components

- 3.3. Important Elements in ROWS' Design and Operation

- 3.3.1. Stabilization

- 3.3.2. Sensors

- 3.3.3. Fire Control Unit

- 3.3.4. Guns, Weapons and Ammunition

- 3.3.5. ROWS' Integration on Platforms

- 3.4. ROWS vs Manned Turrets

- 3.4.1. ROWS - Advantages and Limitations

- 3.5. Types of ROWS

- 3.5.1. Land Platforms

- 3.5.2. Wheeled vs Tracked Vehicles

- 3.5.3. Case Study - British Army Strike Brigades

- 3.5.4. Case Study - French Army Scorpion Programme

- 3.5.5. Case Study - US Army Forces in Europe

- 3.5.6. Unmanned Platforms with ROWS

- 3.5.7. ROWS for C-UAV

- 3.5.8. Naval Platforms with ROWS

- 3.5.9. Static ROWS

- 3.5.10. Airborne ROWS

- 3.6. Training and Simulation in the ROWS Market

4. Market Overview

- 4.1. Introduction

- 4.2. The Nature of the ROWS Market

- 4.3. Competitive landscape

- 4.4. Overview of companies

- 4.5. Risk factors

5. Market Analysis and Forecast Factors

- 5.1. Market Segmentation

- 5.2. Drivers

- 5.2.1. Defence budgets

- 5.2.2. Requirement for persistent ISR

- 5.2.3. Asymmetric threats

- 5.2.4. Navies to increasingly operate in the littoral waters

- 5.2.5. Importance of homeland security agencies

- 5.2.6. Crew survivability

- 5.2.7. Need to upgrade legacy platforms

- 5.2.8. Urban warfare

- 5.3. Trends

- 5.3.1. Increase trend for wheeled armoured vehicles

- 5.3.2. Development of the indigenous defence industrial capabilities

- 5.3.3. Increased range of engagements and accuracy

- 5.3.4. Combined capabilities

- 5.3.5. Power and signature management

- 5.3.6. Proliferation of UGVs and UUVs

- 5.3.7. Technological enablers

- 5.3.8. ROWS with non-lethal weapons

- 5.4. Opportunities

- 5.4.1. EO/IR technology developments

- 5.4.2. ROWS' cost availability

- 5.4.3. Improving unmanned systems testing and evaluation

- 5.4.4. Improving Manned-Unmanned Teaming

- 5.4.5. Improving marketing and value-added messages

- 5.4.6. Developing ways to extend the lifespan and capabilities of platforms

- 5.4.7. Multiple effects by a single ROWS

- 5.4.8. ROWS adaptable for homeland security use

- 5.4.9. The ROWS as systems

- 5.4.10. Training for ROWS drives need for simulators and virtual environment

- 5.4.11. Field additive manufacturing of spare parts

- 5.5. Challenges

- 5.5.1. Lack of proven concept of operations

- 5.5.2. Trust in manned solutions

- 5.5.3. Defence budgets

- 5.5.4. Artificial intelligence and ethics

- 5.5.5. Rules of engagement and international law

- 5.5.6. Export controls in defence

6. Country Analysis

- 6.1. USA

- 6.2. Europe

- 6.2.1. UK

- 6.2.2. France

- 6.2.3. Poland

- 6.3. Israel

- 6.4. Australia

7. Global and Regional Market Forecast to 2031

- 7.1. Introduction

- 7.2. ROWS market by region

- 7.3. ROWS Market Forecast by Application

- 7.3.1. Americas' ROWS market by Application

- 7.3.2. Europe's ROWS market by Application

- 7.3.3. Asian-Pacific ROWS Market by Application

- 7.3.4. Middle East and African ROWS Market by Application

- 7.4. ROWS market Regions by End-Use

- 7.4.1. America's ROWS market by End-Use

- 7.4.2. Europe ROWS market by End-Use

- 7.4.3. Asian-Pacific ROWS market by End-Use

- 7.4.4. Middle East and Africa Analytics market by End-Use

8. Application Market Forecast to 2031

- 8.1. Introduction

- 8.2. ROWS market by application overview

- 8.3. Total ROWS Market by Application

- 8.3.1. HLS ROWS Market by Application

- 8.3.2. Military ROWS Market by Application

- 8.3.3. Total Land ROWS Market

- 8.3.4. Total Naval ROWS by End-Use

9. End-Users Market Forecast to 2031

- 9.1. Introduction

- 9.2. ROWS for the Defence and HLS Sectors

- 9.2.1. Improved accuracy

- 9.2.2. Improved firepower

- 9.2.3. A system of systems

- 9.2.4. ROWS and new platforms

- 9.2.5. ROWS and legacy platforms

- 9.2.6. ROWS and unmanned platforms

- 9.2.7. Protecting critical infrastructure

- 9.3. Global ROWS market by End-Use overview

- 9.4. HLS ROWS market by Region

- 9.4.1. Global Military ROWS market by Region

- 9.4.2. HLS ROWS market by Application

- 9.4.3. Military ROWS Market by Application

10. Impact Analysis

- 10.1. Introduction

- 10.2. Forecast factors and Market Impact

- 10.3. Scenario 2 Global ROWS Market Forecast by Region to 2031 [US$ million]

- 10.4. Scenario 2 - Global ROWS Market Forecast to 2031 by Application [US$ Million]

11. Leading Companies

- 11.1. ASELSAN Elektronik Sanayi ve Ticater A.S.

- 11.1.1. Introduction

- 11.1.2. ROWS Products and Services

- 11.1.3. Recent Developments and Contracts

- 11.1.4. Recent Projects Completed

- 11.1.5. Strategic Alliances

- 11.1.6. SWOT Analysis

- 11.2. BAE Systems

- 11.2.1. Introduction

- 11.2.2. ROWS Products and Services

- 11.2.3. Recent Developments and Contracts

- 11.2.4. Strategic Alliances

- 11.2.5. SWOT Analysis

- 11.3. Elbit Systems

- 11.3.1. Introduction

- 11.3.2. ROWS Products and Services

- 11.3.3. Other Products & Services

- 11.3.4. Recent Developments and Contracts

- 11.3.5. Strategic Alliances

- 11.3.6. SWOT Analysis

- 11.4. EOS (Electro-Optic Systems) Australia

- 11.4.1. Introduction

- 11.4.2. ROWS Products and Services

- 11.4.3. Other Products & Services

- 11.4.4. Recent Developments and Contracts

- 11.4.5. Strategic Alliances

- 11.4.6. SWOT Analysis

- 11.5. FN Herstal

- 11.5.1. Introduction

- 11.5.2. ROWS Products and Services

- 11.5.3. Other Products & Services

- 11.5.4. Recent Developments and Contracts

- 11.5.5. Strategic Alliances

- 11.5.6. SWOT Analysis

- 11.6. General Dynamics

- 11.6.1. Introduction

- 11.6.2. ROWS Products and Services

- 11.6.3. Other Products & Services

- 11.6.4. Recent Developments and Contracts

- 11.6.5. SWOT Analysis

- 11.7. John Cockerill

- 11.7.1. Introduction

- 11.7.2. ROWS Products and Services

- 11.7.3. Other Products & Services

- 11.7.4. Strategic Alliances

- 11.7.5. SWOT Analysis

- 11.8. Kongsberg

- 11.8.1. Introduction

- 11.8.2. ROWS Products and Services

- 11.8.3. Other Products & Services

- 11.8.4. Recent Developments and Contracts

- 11.8.5. Strategic Alliances

- 11.8.6. SWOT Analysis

- 11.9. KMW GmbH (KNDS)

- 11.9.1. Introduction

- 11.9.2. ROWS Products and Services

- 11.9.3. Other Products & Services

- 11.9.4. Recent Developments and Contracts

- 11.9.5. Strategic Alliances

- 11.9.6. SWOT Analysis

- 11.10. Leonardo S.p.A.

- 11.10.1. Introduction

- 11.10.2. ROWS Products and Services

- 11.10.3. Other Products & Services

- 11.10.4. Recent Developments and Contracts

- 11.10.5. SWOT Analysis

- 11.11. MSI Defence Systems Ltd.

- 11.11.1. Introduction

- 11.11.2. ROWS Products and Services

- 11.11.3. Other Products & Services

- 11.11.4. Recent Developments and Contracts

- 11.11.5. SWOT Analysis

- 11.12. Nexter (KNDS)

- 11.12.1. Introduction

- 11.12.2. ROWS Products and Services

- 11.12.3. Other Products & Services

- 11.12.4. Recent Developments and Contracts

- 11.12.5. Strategic Alliances

- 11.12.6. SWOT Analysis

- 11.13. Rafael Advanced Defense Systems

- 11.13.1. Introduction

- 11.13.2. ROWS Products and Services

- 11.13.3. Other Products & Services

- 11.13.4. Recent Developments and Contracts

- 11.13.5. Strategic Alliances

- 11.13.6. SWOT Analysis

- 11.14. Rheinmetall AG

- 11.14.1. Introduction

- 11.14.2. ROWS Products and Services

- 11.14.3. Other Products & Services

- 11.14.4. Recent Developments and Contracts

- 11.14.5. Strategic Alliances

- 11.14.6. SWOT Analysis

- 11.15. SAAB

- 11.15.1. Introduction

- 11.15.2. ROWS Products and Services

- 11.15.3. Recent Developments and Contracts

- 11.15.4. SWOT Analysis

12. Results and Conclusions

13. About Market Forecast

- 13.1. General

- 13.2. Contact us

- 13.3. Disclaimer

- 13.4. License

Appendix A: Companies Mentioned

Appendix B: Abbreviations

List of figures

- Figure 1: Global ROWS Market Forecast to 2031 by Region [US$ million]

- Figure 2: Global ROWS Market Forecast to 2031 by Application [US$ million]

- Figure 3: Global ROWS Market Forecast to 2031 by End-Use [US$ million]

- Figure 4: A photo of all the parts comprising a Kongsberg Protector M153 CROWS II.

- Figure 5: A picture of a gunner's position, with the FCU and CG units, inside a Humvee vehicle. Also note on the top the large diameter opening required to install a pintle.

- Figure 6: A Norwegian Army Protector ROWS lifted by a crane. Note the small circumference of the base attached to a vehicle, requiring only minimal penetration.

- Figure 7: Milrem's Nordic Robotic Wingman UGV with a Kongsberg RT40 (30mm) ROW turret.

- Figure 8: GDSL Stryker IM-SHORAD

- Figure 9: The MSI Defence Seahawk remote weapon station, with a 30mm gun and Thales' LMM (Lightweight Multirole Missile) aboard a Type 23 frigate. The position of the station shows the easiness of integration aboard existing and future platforms.

- Figure 10: Elbit Systems' Seagull USV with a ROWS

- Figure 11: The Remote Guardian System stowed and deployed, with the EO/IR gimbal on the left of each picture and the weapon station to the right.

- Figure 12: A JLTV vehicle with a Protector ROWS as shown in BIS' training software.

- Figure 13: ROWS Market Segmentation and Sub Segmentation

- Figure 14: Global ROWS Market Forecast to 2031 by Region [US$ million]

- Figure 15: Global ROWS Market by Region [%] - 2023, 2027 and 2031

- Figure 16: Americas' ROWS Market Forecast to 2031 by Application [US$ million]

- Figure 17: Americas Market Forecast to 2031 by Application [%]

- Figure 18: Europe's ROWS Market Forecast to 2031 by Application [US$ million]

- Figure 19: Europe's Market Forecast to 2031 by Application [%]

- Figure 20: Asian-Pacific ROWS Market Forecast to 2030 by Application [US$ million]

- Figure 21: Asian-Pacific ROWS Market Forecast to 2031 by Application [US$ million]

- Figure 22: Asian-Pacific's Market Forecast to 2031 by Application [%]

- Figure 23: Middle East & African ROWS Market Forecast to 2030 by Application [US$ million]

- Figure 24: Middle East & African ROWS Market Forecast to 2030 by Application [US$ million]

- Figure 25: America's ROWS market to 2031 by End-Use [US$ million]

- Figure 26: Americas ROWS Market Forecast to 2031 by End-Use [%]

- Figure 27: Europe's ROWS market to 2031 by End-Use [US$ million]

- Figure 28: Europe ROWS Market Forecast to 2031 by End-Use [%]

- Figure 29: APAC ROWS market to 2031 by End-Use [US$ million]

- Figure 30: APAC ROWS Market Forecast to 2031 by End-Use [%]

- Figure 31: ME&A ROWS market to 2031 by End-Use [US$ million]

- Figure 32: ME&A ROWS Market Forecast to 2031 by End-Use [%]

- Figure 37: Total ROWS Market to 2031 by Application [US$ million]

- Figure 38: Total ROWS Market to 2031 by Application [%]

- Figure 39: HLS ROWS Market to 2031 by Application [US$ million]

- Figure 40: HLS ROWS Market to 2031 by Application [%]

- Figure 41: Military ROWS Market to 2031 by Application [US$ million]

- Figure 42: Military ROWS Market to 2031 by Application [%]

- Figure 43: Land ROWS Market to 2031 by End-Use [US$ million]

- Figure 44: Land ROWS Market to 2031 by End-Use [%]

- Figure 45: Naval ROWS Market to 2031 by Application [US$ million]

- Figure 46: Global ROWS Market to 2031 by End-Use [US$ million]

- Figure 47: Global ROWS Market to 2031 by End-Use [%]

- Figure 48: Global HLS ROWS market to 2031 by Region [US$ million]

- Figure 49: HLS ROWS Market Forecast to 2031 by Region [%]

- Figure 50: Global Military ROWS market to 2031 by Region [US$ million]

- Figure 51: Military ROWS Market Forecast to 2031 by Region [%]

- Figure 52: Global HLS ROWS market to 2031 by Application [US$ million]

- Figure 53: HLS ROWS Market Forecast to 2031 by Application [%]

- Figure 54: Global Military ROWS market to 2031 by Application [US$ million]

- Figure 55: Military ROWS Market Forecast to 2031 by Application [%]

- Figure 56: Scenario 1 vs Scenario 2 - Global ROWS Market Forecast to 2031 [US$ million]

- Figure 57: Scenario 2 - Global ROWS Market Forecast by Region to 2031 [US$ million]

- Figure 58: Scenario 2 - Total ROWS Market Forecast to 2031 by End-Use [US$ million]

- Figure 59: Scenario 2 - Total ROWS Market Forecast to 2031 by Application [US$ million]

List of tables

- Table 1: Global ROWS Market Forecast to 2031 by Region [US$ million]

- Table 2: Global ROWS Market Forecast to 2031 by Application [US$ million]

- Table 3: Global ROWS Market Forecast to 2031 by End-Use [US$ million]

- Table 4: Recent collaborations in the ROWS market

- Table 5: Global ROWS Market Forecast to 2031 by Region [US$ million]

- Table 6: European Market Forecast to 2030 by Application [US$ million]

- Table 7: America's ROWS market to 2031 by End-Use [US$ million]

- Table 8: Europe's ROWS market to 2031 by End-Use [US$ million]

- Table 9: APAC ROWS market to 2031 by End-Use [US$ million]

- Table 10: ME&A ROWS market to 2031 by End-Use [US$ million]

- Table 11: Total ROWS Market to 2031 by Application [US$ million]

- Table 12: HLS ROWS Market to 2031 by Application [US$ million]

- Table 13: Military ROWS Market to 2031 by Application [US$ million]

- Table 14: Land ROWS Market to 2031 by End-Use [US$ million]

- Table 15: Naval ROWS Market to 2031 by End-Use [US$ million]

- Table 16: Naval ROWS Market to 2031 by Application [%]

- Table 17: Global ROWS Market to 2031 by End-Use [US$ million]

- Table 18: Global HLS ROWS market to 2031 by Region [US$ million]

- Table 19: Global Military ROWS market to 2031 by Region [US$ million]

- Table 20: Global HLS ROWS market to 2031 by Application [US$ million]

- Table 21: Global Military ROWS market to 2031 by Application [US$ million]

- Table 22: Scenario 1 vs Scenario 2 - Global ROWS Market Forecast to 2031 [US$ million]

- Table 23: Scenario 2 - Global ROWS Market Forecast by Region to 2031 [US$ million]

- Table 24: Scenario 2 - Total ROWS Market Forecast to 2031 by End-Use [US$ million]

- Table 25: Scenario 2 - Total ROWS Market Forecast to 2031 by Application [US$ million]

- Table 26: Aselsan Company SWOT Analysis

- Table 27: BAE Systems Company SWOT Analysis

- Table 28: Elbit Systems Company SWOT Analysis

- Table 29: EOS Australia Company SWOT Analysis

- Table 30: FN Herstal Company SWOT Analysis

- Table 31: General Dynamics Company SWOT Analysis

- Table 32: John Cockerill Company SWOT Analysis

- Table 33: Kongsberg Company SWOT Analysis

- Table 34: KMW Company SWOT Analysis

- Table 35: Leonardo Company SWOT Analysis

- Table 36: MSI Defence Company SWOT Analysis

- Table 37: MSI Defence Company SWOT Analysis

- Table 38: Rafael Company SWOT Analysis

- Table 39: Rafael Company SWOT Analysis

- Table 40: Saab Company SWOT Analysis