|

|

市場調査レポート

商品コード

1132597

食品産業向け工業用バッチミキサーの世界市場:せん断タイプ別(高せん断ミキサー、低せん断ミキサー)、バッチ容量別(10,000リットル以上)、用途別(乳児用調製粉乳・栄養補助食品、スープ・ソース)、地域別の予測(~2029年)Industrial Batch Mixers Market for Food Industry by Shear Type (High-shear Mixers, Low-shear Mixers), Batch Capacity (Above 10,000 Liters), Application (Infant Formula & Nutritional Supplement, Soup & Sauce), and Geography - Global Forecast to 2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 食品産業向け工業用バッチミキサーの世界市場:せん断タイプ別(高せん断ミキサー、低せん断ミキサー)、バッチ容量別(10,000リットル以上)、用途別(乳児用調製粉乳・栄養補助食品、スープ・ソース)、地域別の予測(~2029年) |

|

出版日: 2022年06月10日

発行: Meticulous Research

ページ情報: 英文 249 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

世界の食品産業向け工業用バッチミキサーの市場規模は、2022年から2029年の予測期間中に5.9%のCAGRで成長し、2029年までに9億7,410万米ドルに達すると予測されています。市場の成長を後押しする主な要因には、食品加工機器の開発に向けた投資の増加、食品安全のための動的規制基準、新興国での食品加工機器に対する需要の高まりなどが挙げられます。一方で、メーカーに対するコスト面でのプレッシャーなどが、市場の成長を抑制する可能性があります。

当レポートでは、世界の食品産業向け工業用バッチミキサー市場を調査しており、市場の概要、市場規模や予測、動向、促進要因・抑制要因、競合情勢、せん断タイプ別・バッチ容量別・用途別・地域別の分析、および企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

- 市場の定義

- 市場エコシステム

- 通貨と制限

- 通貨

- 制限事項

- 主な利害関係者

第2章 調査手法

- 調査アプローチ

- データ収集と検証

- 2次調査

- 1次調査

- 市場評価

- 市場規模予測

- ボトムアップアプローチ

- トップダウンアプローチ

- 成長予測

- 調査の前提条件

第3章 エグゼクティブサマリー

- 市場分析、用途別

- 市場分析、食品混合用別

- 市場分析、食品加工用別

- 市場分析、せん断タイプ別

- 市場分析、バッチ容量別

- 市場分析、地域別

- 競合分析

第4章 市場の洞察

- イントロダクション

- 世界の食品産業向け工業用バッチミキサー市場:市場促進要因の影響分析(2022年~2029年)

- 食品加工業界における産業用バッチミキサーの需要の高まり

- 食品安全のための動的規制基準

- 食品加工機器の開発への投資増加

- 世界の食品産業向け工業用バッチミキサー市場:市場抑制要因の影響分析(2022年~2029年)

- コスト圧力と、効率的で正確なクライアント固有のソリューションの開発

- 世界の食品産業向け工業用バッチミキサー市場:市場機会の影響分析(2022年~2029年)

- 高度な技術と食品加工機器の統合

- 新興諸国における食品加工機器の需要の高まり

- 世界の食品産業向け工業用バッチミキサー市場:市場動向の影響分析(2022年~2029年)

- 食品加工機器のカスタマイズ

- エネルギー効率が改善された工業用バッチミキサーの利用可能性の拡大

第5章 世界の食品産業向け工業用バッチミキサー市場:用途別

- 食品混合用

- 市場の主要企業とその製品のリスト

- 乳児用調製粉乳・栄養補助食品

- スープ・ソース

- デザート・プリン・カスタード

- コールドエマルジョン

- 果物加工

- その他

- 食品加工用

- 市場の主要企業とその製品のリスト

- 乳児用調製粉乳・栄養補助食品

- スープ・ソース

- デザート・プリン・カスタード

- コールドエマルジョン

- 果物加工

- その他

第6章 世界の食品産業向け工業用バッチミキサー市場:せん断タイプ別

- イントロダクション

- 高せん断ミキサー

- 中せん断ミキサー

- 低せん断ミキサー

第7章 世界の食品産業向け工業用バッチミキサー市場:バッチ容量別

- イントロダクション

- 10,000リットル以上

- 2,001リットル~10,000リットル

- 501リットル~2,000リットル

- 500リットル以下

第8章 世界の食品産業向けの工業用バッチミキサー市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- その他のアジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- オランダ

- スイス

- その他の欧州

- 北米

- 米国

- カナダ

- 中東・アフリカ

- イスラエル

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第9章 競合情勢

- イントロダクション

- 主要な成長戦略

- 市場の差別化要因

- 相乗効果分析:主要取引と戦略的提携

- 競合ダッシュボード

- 業界のリーダー

- 市場の差別化要因

- 先駆者

- 新興企業

- ベンダー市場のポジショニング

- 市場ランキング(2021年)

第10章 企業プロファイル(事業概要、財務概要、製品ポートフォリオ、および戦略的開発)

- Frain Industries, Inc.

- Admix, Inc.

- Proxes GmbH

- GEA Group Aktiengesellschaft

- Silverson

- Arde Barinco, Inc.

- amixon GmbH

- Hosokawa Micron B.V.

- Charles Ross & Son Company

- BHS-Sonthofen GmbH

- Gericke AG

- Tetra Pak

- Kady International

- PerMix North America

- Eriez Manufacturing Co.

第11章 付録

List of Tables

- Table 1 Currency Conversion Rate (2018-2022)

- Table 2 Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 3 Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 4 Food Mixing Applications Market, by Country, 2020-2029 (USD Million)

- Table 5 Food Mixing Applications Market Volume, by Country, 2020-2029 (Units)

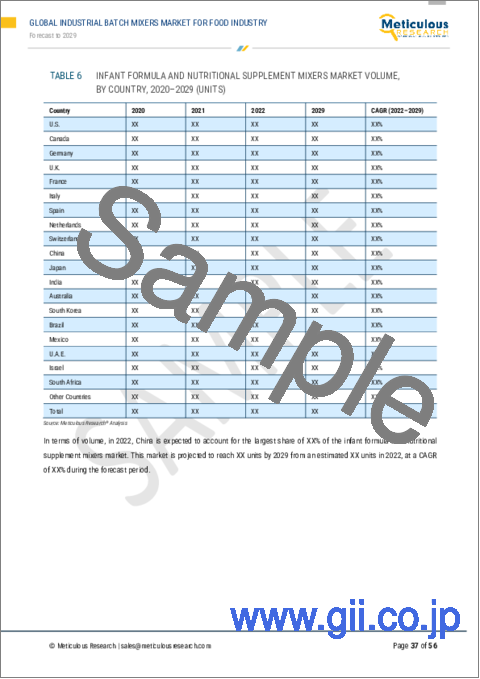

- Table 6 Infant Formula and Nutritional Supplement Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 7 Infant Formula and Nutritional Supplement Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 8 Soup & Sauce Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 9 Soup & Sauce Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 10 Dessert, Pudding, and Custard Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 11 Dessert, Pudding, and Custard Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 12 Cold Emulsion Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 13 Cold Emulsion Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 14 Fruit Preparation Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 15 Fruit Preparation Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 16 Other Food Mixing Application Mixers Market Size, by Country, 2020-2029 (USD Million)

- Table 17 Other Food Mixing Application Mixers Market Volume, by Country, 2020-2029 (Units)

- Table 18 Food Processing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 19 Food Processing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 20 Food Processing Applications Market, by Country, 2020-2029 (USD Million)

- Table 21 Food Processing Applications Market Volume, by Country, 2020-2029 (Units)

- Table 22 Infant Formula & Nutritional Supplement Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 23 Infant Formula & Nutritional Supplement Processors Market Volume, by Country, 2020-2029 (Units)

- Table 24 Soup & Sauce Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 25 Soup & Sauce Processors Market Volume, by Country, 2020-2029 (Units)

- Table 26 Dessert, Pudding, and Custard Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 27 Dessert, Pudding, and Custard Processors Market Volume, by Country, 2020-2029 (Units)

- Table 28 Cold Emulsion Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 29 Cold Emulsion Processors Market Volume, by Country, 2020-2029 (Units)

- Table 30 Fruit Preparation Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 31 Fruit Preparation Processors Market Volume, by Country, 2020-2029 (Units)

- Table 32 Other Food Processing Application Processors Market Size, by Country, 2020-2029 (USD Million)

- Table 33 Other Food Processing Application Processors Market Volume, by Country, 2020-2029 (Units)

- Table 34 Global Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 35 Global Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 36 High-shear Type Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 37 High-shear Type Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 38 Mid-shear Type Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 39 Mid-shear Type Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 40 Low-shear Type Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 41 Low-shear Type Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 42 Global Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 43 Global Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 44 Above 10,000 Liters Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 45 Above 10,000 Liters Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 46 2,001 Liters to 10,000 Liters Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 47 2,001 Liters to 10,000 Liters Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 48 501 Liters to 2,000 Liters Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 49 501 Liters to 2,000 Liters Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 50 Up to 500 Liters Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 51 Up to 500 Liters Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 52 Global Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 53 Global Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 54 Asia-Pacific: Industrial Batch Mixers Market Size for Food Industry, by Country/Region, 2020-2029 (USD Million)

- Table 55 Asia-Pacific: Industrial Batch Mixers Market Volume for Food Industry, by Country/Region, 2020-2029 (Units)

- Table 56 Asia-Pacific: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 57 Asia-Pacific: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 58 Asia-Pacific: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 59 Asia-Pacific: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 60 Asia-Pacific: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 61 Asia-Pacific: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 62 China: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 63 China: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 64 China: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 65 China: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 66 China: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 67 China: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 68 India: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 69 India: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 70 India: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 71 India: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 72 India: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 73 India: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 74 Japan: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 75 Japan: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 76 Japan: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 77 Japan: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 78 Japan: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 79 Japan: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 80 South Korea: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 81 South Korea: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 82 South Korea: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 83 South Korea: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 84 South Korea: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 85 South Korea: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 86 Australia: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 87 Australia: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 88 Australia: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 89 Australia: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 90 Australia: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 91 Australia: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 92 Rest of Asia-Pacific: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 93 Rest of Asia-Pacific: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 94 Rest of Asia-Pacific: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 95 Rest of Asia-Pacific: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 96 Rest of Asia-Pacific: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 97 Rest of Asia-Pacific: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 98 Europe: Industrial Batch Mixers Market Size for Food Industry, by Country/Region, 2020-2029 (USD Million)

- Table 99 Europe: Industrial Batch Mixers Market Volume for Food Industry, by Country/Region, 2020-2029 (Units)

- Table 100 Europe: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 101 Europe: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 102 Europe: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 103 Europe: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 104 Europe: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 105 Europe: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 106 Germany: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 107 Germany: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 108 Germany: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 109 Germany: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 110 Germany: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 111 Germany: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 112 U.K.: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 113 U.K.: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 114 U.K.: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 115 U.K.: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 116 U.K.: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 117 U.K.: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 118 France: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 119 France: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 120 France: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 121 France: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 122 France: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 123 France: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 124 Italy: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 125 Italy: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 126 Italy: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 127 Italy: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 128 Italy: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 129 Italy: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 130 Spain: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 131 Spain: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 132 Spain: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 133 Spain: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 134 Spain: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 135 Spain: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 136 Netherlands: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 137 Netherlands: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 138 Netherlands: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 139 Netherlands: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 140 Netherlands: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 141 Netherlands: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 142 Switzerland: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 143 Switzerland: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 144 Switzerland: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 145 Switzerland: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 146 Switzerland: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 147 Switzerland: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 148 Rest of Europe: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 149 Rest of Europe: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 150 Rest of Europe: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 151 Rest of Europe: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 152 Rest of Europe: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 153 Rest of Europe: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 154 North America: Industrial Batch Mixers Market Size for Food Industry, by Country, 2020-2029 (USD Million)

- Table 155 North America: Industrial Batch Mixers Market Volume for Food Industry, by Country, 2020-2029 (Units)

- Table 156 North America: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 157 North America: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 158 North America: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 159 North America: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 160 North America: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 161 North America: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 162 U.S.: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 163 U.S.: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 164 U.S.: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 165 U.S.: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 166 U.S.: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 167 U.S.: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 168 Canada: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 169 Canada: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 170 Canada: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 171 Canada: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 172 Canada: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 173 Canada: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 174 Middle East & Africa: Industrial Batch Mixers Market Size for Food Industry, by Country/Region, 2020-2029 (USD Million)

- Table 175 Middle East & Africa: Industrial Batch Mixers Market Volume for Food Industry, by Country/Region, 2020-2029 (Units)

- Table 176 Middle East & Africa: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 177 Middle East & Africa: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 178 Middle East & Africa: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 179 Middle East & Africa: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 180 Middle East & Africa: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 181 Middle East & Africa: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 182 Israel: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 183 Israel: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 184 Israel: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 185 Israel: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 186 Israel: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 187 Israel: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 188 UAE: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 189 UAE: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 190 UAE: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 191 UAE: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 192 UAE: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 193 UAE: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 194 South Africa: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 195 South Africa: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 196 South Africa: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 197 South Africa: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 198 South Africa: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 199 South Africa: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 200 Rest of Middle East & Africa: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 201 Rest of Middle East & Africa: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 202 Rest of Middle East & Africa: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 203 Rest of Middle East & Africa: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 204 Rest of Middle East & Africa: Industrial Bath Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 205 Rest of Middle East & Africa: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 206 Latin America: Industrial Batch Mixers Market Size for Food Industry, by Country/Region, 2020-2029 (USD Million)

- Table 207 Latin America: Industrial Batch Mixers Market Volume for Food Industry, by Country/Region, 2020-2029 (Units)

- Table 208 Latin America: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 209 Latin America: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 210 Latin America: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 211 Latin America: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 212 Latin America: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 213 Latin America: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 214 Brazil: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 215 Brazil: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 216 Brazil: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 217 Brazil: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 218 Brazil: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 219 Brazil: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 220 Mexico: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 221 Mexico: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 222 Mexico: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 223 Mexico: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 224 Mexico: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 225 Mexico: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 226 Rest of Latin America: Food Mixing Applications Market Size, by Food Type, 2020-2029 (USD Million)

- Table 227 Rest of Latin America: Food Mixing Applications Market Volume, by Food Type, 2020-2029 (Units)

- Table 228 Rest of Latin America: Industrial Batch Mixers Market Size for Food Industry, by Shear Type, 2020-2029 (USD Million)

- Table 229 Rest of Latin America: Industrial Batch Mixers Market Volume for Food Industry, by Shear Type, 2020-2029 (Units)

- Table 230 Rest of Latin America: Industrial Batch Mixers Market Size for Food Industry, by Batch Capacity, 2020-2029 (USD Million)

- Table 231 Rest of Latin America: Industrial Batch Mixers Market Volume for Food Industry, by Batch Capacity, 2020-2029 (Units)

- Table 232 Vendor Market Positioning Analysis (2019-2022)

List of Figures

- Figure 1 Research Process

- Figure 2 Primary Research Techniques

- Figure 3 Key Executives Interviewed

- Figure 4 Breakdown of Primary Interviews (Supply Side & Demand Side)

- Figure 5 Market Sizing and Growth Forecast Approach

- Figure 6 Key Insights

- Figure 7 Based on Value, Food Mixing Application Market (USD Million)

- Figure 8 Based on Volume, Food Mixing Application Market (Units)

- Figure 9 Based on Value, Food Processing Application Market (USD Million)

- Figure 10 Based on Volume, Food Processing Application Market (Units)

- Figure 11 Based on Value, the High-shear Type Segment to Dominate the Market (USD Million)

- Figure 12 Based on Volume, the High-shear Type Segment to Dominate the Market (Units)

- Figure 13 Based on Value, the Above 10,000 Liters Segment is Expected to Account for the Largest Share of the Market(USD Million)

- Figure 14 Based on Volume, the Above 10,000 Liters Segment is Expected to Account for the Largest Share of the Market (Units)

- Figure 15 Based on Value, Asia-Pacific to Dominate the Global Industrial Batch Mixers Market for Food Industry

- Figure 16 Based on Volume, Asia-Pacific to Dominate the Global Industrial Batch Mixers Market for Food Industry

- Figure 17 Market Dynamics

- Figure 18 The Infant Formula & Nutritional Supplement Segment to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (USD Million)

- Figure 19 The Infant Formula & Nutritional Supplement Segment to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (Units)

- Figure 20 The Infant Formula & Nutritional Supplement Segment to Account for the Largest Share of the Food Processing Applications Market (USD Million)

- Figure 21 The Infant Formula & Nutritional Supplement Segment to Account for the Largest Share of the Food Processing Applications Market (Units)

- Figure 22 The High-shear Type Segment is Expected to Dominate the Industrial Batch Mixers Market for Food Industry (USD Million)

- Figure 23 The High-shear Type Segment is Expected to Dominate the Industrial Batch Mixers Market for Food Industry (Units)

- Figure 24 The Above 10,000 Liters Segment is Expected to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (USD Million)

- Figure 25 The Above 10,000 Liters Segment is Expected to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (Units)

- Figure 26 The Asia-Pacific Segment to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (USD Million)

- Figure 27 The Asia-Pacific Segment to Account for the Largest Share of the Industrial Batch Mixers Market for Food Industry (Units)

- Figure 28 Geographic Snapshot: Asia-Pacific Industrial Batch Mixers Market for Food Industry

- Figure 29 Geographic Snapshot: Europe Industrial Batch Mixers Market for Food Industry

- Figure 30 Geographic Snapshot: North America Industrial Batch Mixers Market for Food Industry

- Figure 31 Geographic Snapshot: Middle East & Africa Industrial Batch Mixers Market for Food Industry

- Figure 32 Geographic Snapshot: Latin America Industrial Batch Mixers Market for Food Industry

- Figure 33 Competitive Dashboard: Industrial Batch Mixers Market for Food Indus

- Figure 34 GEA Group Aktiengesellschaft: Financial Overview (2019-2021)

- Figure 35 Hosokawa Micron Corporation: Financial Overview (2019-2021)

Industrial Batch Mixers Market for the Food Industry by Shear Type (High-shear Mixers, Low-shear Mixers), Batch Capacity (Above 10,000 Liters), Application (Infant Formula & Nutritional Supplement, Soup & Sauce), and Geography - Global Forecast to 2029

The research report titled, 'Industrial Batch Mixers Market for the Food Industry by Shear Type (High-shear Mixers, Low-shear Mixers), Batch Capacity (Above 10,000 Liters), Application (Infant Formula & Nutritional Supplement, Soup & Sauce), and Geography - Global Forecast to 2029,' provides an in-depth analysis of industrial batch mixers market for the food industry across five major geographies and emphasizes on the current market trends, market sizes, market shares, recent developments, and forecasts till 2029.

The industrial batch mixers market for the food industry is expected to reach $974.1 million by 2029, growing at a CAGR of 5.9% during the forecast period of 2022-2029.

Increasing investments in the development of food processing equipment and dynamic regulatory standards for food safety are the major factors driving the growth of this market. Furthermore, the growing demand for food processing equipment in developing countries is expected to offer significant opportunities for the growth of this market. However, cost pressures on manufacturers and the challenges in developing efficient & accurate client-specific solutions restrain the growth of this market to a notable extent.

Based on shear type, the industrial batch mixers market for the food industry is segmented into low-shear mixers, mid-shear mixers, and high-shear mixers. In 2022, the high-shear mixers segment is expected to account for the largest share of the industrial batch mixers market for the food industry. The large market share of this segment is attributed to the rising demand for high-quality emulsions and solutions production and the growing requirement for industrial mixers with less mixing and processing time. Furthermore, the high-shear mixers segment is slated to register the highest CAGR during the forecast period.

Based on application, the industrial batch mixers market is segmented into infant formula & nutritional supplement; soup & sauce; dessert, pudding, and custard; cold emulsion; fruit preparation; and other food applications. In 2022, the infant formula & nutritional supplement segment is expected to account for the share of the industrial batch mixers market for the food industry and grow at the highest CAGR during the forecast period. The growth of this segment is attributed to stringent safety, hygiene, and nutritional regulations in the food industry and the high demand for nutritional supplements in food products.

Geographic Review:

Based on geography, the industrial batch mixers market for the food industry is segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. In 2022, Asia-Pacific is expected to account for the largest share of the industrial batch mixers market for the food industry. Asia-Pacific's food processing sector contributes significantly to the economy and is undergoing a rapid transformation. The market growth in Asia-Pacific is attributed to the growing adoption of disruptive technologies in the food industry across the region, the rising demand for industrial mixers for manufacturing processed food, and the increasing government investments in the food processing sector in the region.

The key players operating in the industrial batch mixers market for the food industry include ProXES GmbH (Germany), GEA Group Aktiengesellschaft (Germany), ARDE Barinco, Inc. (U.S.), Silverson (U.S.), Amixon GmbH (Germany), HOSOKAWA MICRON B.V. (Netherlands), Charles Ross & Son Company (U.S.), BHS-Sonthofen GmbH (Germany), Gericke AG (Switzerland), Admix Inc. (U.K.), and Frain Industries, Inc. (U.S.).

Key questions answered in the report:

- Which are the high-growth market segments in terms of shear type, batch capacity, application, and country?

- What is the historical market for industrial batch mixers in the food industry across the globe?

- What are the market forecasts and estimates for 2022-2029?

- What are the major drivers, restraints, and opportunities in the industrial batch mixers market for the food industry?

- Who are the major players in the industrial batch mixers market for the food industry, and what are their market shares?

- Who are the major players in various countries, and what are their market shares?

- How is the competitive landscape?

- What are the recent developments in the industrial batch mixers market for the food industry?

- What are the different strategies adopted by the major players in the industrial batch mixers market for the food industry?

- What are the geographical trends and high-growth countries?

- Who are the local emerging players in the industrial batch mixers market for the food industry and how do they compete with the other players?

Scope of the Report:

Industrial Batch Mixers Market for the Food Industry, by Shear Type

- Low-shear Mixers

- Mid-shear Mixers

- High-shear Mixers

Industrial Batch Mixers Market for the Food Industry, by Batch Capacity

- Up to 500 liters

- 501 liters to 2,000 liters

- 2,001 liters to 10,000 liters

- Above 10,000 liters

Industrial Batch Mixers Market for the Food Industry, by Application

- Infant Formula & Nutritional Supplement

- Soup & Sauce

- Dessert, Pudding, and Custard

- Cold Emulsion

- Fruit Preparation

- Other Food Applications

Industrial Batch Mixers Market for the Food Industry, by Geography

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Israel

- UAE

- South Africa

- Rest of Middle East & Africa

TABLE OF CONTENTS

1. Introduction

- 1.1. Market Definition

- 1.2. Market Ecosystem

- 1.3. Currency and Limitations

- 1.3.1. Currency

- 1.3.2. Limitations

- 1.4. Key Stakeholders

2. Research Methodology

- 2.1. Research Approach

- 2.2. Data Collection & Validation

- 2.2.1. Secondary Research

- 2.2.2. Primary Research

- 2.3. Market Assessment

- 2.3.1. Market Size Estimation

- 2.3.2. Bottom-up Approach

- 2.3.3. Top-down Approach

- 2.3.4. Growth Forecast

- 2.4. Assumptions for the Study

3. Executive Summary

- 3.1. Market Analysis, by Application

- 3.1.1. Market Analysis, by Food Mixing Application

- 3.1.2. Market Analysis, by Food Processing Application

- 3.2. Market Analysis, by Shear Type

- 3.3. Market Analysis, by Batch Capacity

- 3.4. Market Analysis, by Geography

- 3.5. Competitive Analysis

4. Market Insights

- 4.1. Introduction

- 4.2. Global Industrial Batch Mixers Market for Food Industry: Impact Analysis of Market Drivers (2022-2029)

- 4.2.1. Growing Demand for Industrial Batch Mixers Among Food Processing Industries

- 4.2.2. Dynamic Regulatory Standards for Food Safety

- 4.2.3. Increasing Investments in the Development of Food Processing Equipment

- 4.3. Global Industrial Batch Mixers Market for Food Industry: Impact Analysis of Market Challenges (2022-2029)

- 4.3.1. Cost Pressures and the Development of Efficient & Accurate Client-specific Solutions

- 4.4. Global Industrial Batch Mixers Market for Food Industry: Impact Analysis of Market Opportunities (2022-2029)

- 4.4.1. Integration of Advanced Technologies With Food Processing Equipment

- 4.4.2. Growing Demand for Food Processing Equipment in Developing Countries

- 4.5. Global Industrial Batch Mixers Market for Food Industry: Impact Analysis of Market Trends (2022-2029)

- 4.5.1. Customization of Food Processing Equipment

- 4.5.2. Growing Availability of Industrial Batch Mixers With Improved Energy Efficiency

5. Global Industrial Batch Mixers Market for Food Industry, by Application

- 5.1. Food Mixing Applications

- 5.1.1. List of Key Players in the Market & Their Product Offerings

- 5.1.1.1. Product Portfolio

- 5.1.2. Infant Formula & Nutritional Supplement

- 5.1.3. Soup & Sauce

- 5.1.4. Dessert, Pudding, and Custard

- 5.1.5. Cold Emulsion

- 5.1.6. Fruit Preparation

- 5.1.7. Other Food Mixing Applications

- 5.1.1. List of Key Players in the Market & Their Product Offerings

- 5.2. Food Processing Applications

- 5.2.1. List of Key Players in the Market & their Product Offerings

- 5.2.1.1. Product Portfolio

- 5.2.2. Infant Formula & Nutritional Supplement

- 5.2.3. Soup & Sauce

- 5.2.4. Dessert, Pudding, and Custard

- 5.2.5. Cold Emulsion

- 5.2.6. Fruit Preparation

- 5.2.7. Other Food Processing Applications

- 5.2.1. List of Key Players in the Market & their Product Offerings

6. Global Industrial Batch Mixers Market for Food Industry, by Shear Type

- 6.1. Introduction

- 6.2. High-shear Mixers

- 6.3. Mid-shear Mixers

- 6.4. Low-shear Mixers

7. Global Industrial Batch Mixers Market for Food Industry, by Batch Capacity

- 7.1. Introduction

- 7.2. Above 10,000 Liters

- 7.3. 2,001 Liters to 10,000 Liters

- 7.4. 501 Liters to 2,000 Liters

- 7.5. Up to 500 Liters

8. Global Industrial Batch Mixers Market for Food Industry, by Geography

- 8.1. Introduction

- 8.2. Asia-Pacific

- 8.2.1. China

- 8.2.2. India

- 8.2.3. Japan

- 8.2.4. South Korea

- 8.2.5. Australia

- 8.2.6. Rest of Asia-Pacific

- 8.3. Europe

- 8.3.1. Germany

- 8.3.2. U.K.

- 8.3.3. France

- 8.3.4. Italy

- 8.3.5. Spain

- 8.3.6. Netherlands

- 8.3.7. Switzerland

- 8.3.8. Rest of Europe (RoE)

- 8.4. North America

- 8.4.1. U.S.

- 8.4.2. Canada

- 8.5. Middle East & Africa

- 8.5.1. Israel

- 8.5.2. UAE

- 8.5.3. South Africa

- 8.5.4. Rest of Middle East & Africa

- 8.6. Latin America

- 8.6.1. Brazil

- 8.6.2. Mexico

- 8.6.3. Rest of Latin America (RoLATM)

9. Competitive Landscape

- 9.1. Introduction

- 9.2. Key Growth Strategies

- 9.2.1. Market Differentiators

- 9.2.2. Synergy Analysis: Major Deals & Strategic Alliances

- 9.3. Competitive Dashboard

- 9.3.1. Industry Leaders

- 9.3.2. Market Differentiators

- 9.3.3. Vanguards

- 9.3.4. Emerging Companies

- 9.4. Vendor Market Positioning

- 9.5. Market Ranking (2021)

10. Company Profiles (Business Overview, Financial Overview, Product Portfolio, and Strategic Developments)

- 10.1. Frain Industries, Inc.

- 10.2. Admix, Inc.

- 10.3. Proxes GmbH

- 10.4. GEA Group Aktiengesellschaft

- 10.5. Silverson

- 10.6. Arde Barinco, Inc.

- 10.7. amixon GmbH

- 10.8. Hosokawa Micron B.V.

- 10.9. Charles Ross & Son Company

- 10.10. BHS-Sonthofen GmbH

- 10.11. Gericke AG

- 10.12. Tetra Pak

- 10.13. Kady International

- 10.14. PerMix North America

- 10.15. Eriez Manufacturing Co.

11. Appendix

- 11.1. Questionnaire

- 11.2. Available Customization