|

|

市場調査レポート

商品コード

1128172

医療用電源の世界市場:コンバータタイプ別(AC-DC、DC-DC)、用途別(MRI、ECG、EEG、PET、CTスキャン、超音波、X線、RFマンモグラフィー、手術機器、歯科機器)、製造タイプ別 - 2027年までの予測Medical Power Supply Market by Converter Type (AC-DC, DC-DC), Application (MRI, ECG, EEG, PET, CT Scan, Ultrasound, X-ray, RF Mammography, Surgical Equipment, Dental Equipment), Manufacturing Type - Global Forecasts to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 医療用電源の世界市場:コンバータタイプ別(AC-DC、DC-DC)、用途別(MRI、ECG、EEG、PET、CTスキャン、超音波、X線、RFマンモグラフィー、手術機器、歯科機器)、製造タイプ別 - 2027年までの予測 |

|

出版日: 2022年09月15日

発行: MarketsandMarkets

ページ情報: 英文 289 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の医療用電源の市場規模は、2022年の15億米ドルから2027年には19億米ドルに達すると予測され、2022年から2027年までのCAGRは6.5%となります。

医療機器用電源の進歩、エネルギー効率の高いAC/DC/DC電源の需要の増加、効果的な大気・水質汚染の監視と制御に対する政府の支持的規制、クリーンルームと製造に対する支持的規制と基準、食品の品質に対する注目の高まり、技術の進歩&新製品投入が世界的に市場の成長を促進するものと思われます。しかし、パーティクルカウンターの高コストと技術的な限界が、この市場の成長に悪影響を及ぼしています。

"2022年、AC-DC電源セグメントが最大シェアを占める"

医療用電源の世界市場は、コンバータタイプに基づき、AC-DC電源とDC-DC電源に区分されます。2022年の医療用電源の世界市場では、AC-DC電源分野が最大のシェアを占めると予想されます。AC-DC電源は、MRIやX線システムなど、さまざまな画像診断機器と互換性があります。したがって、病院、診断センター、ASC、その他のヘルスケア施設におけるこうしたシステムの採用が拡大しており、市場の成長を支えるものと期待されています。

"外部電源部門は予測期間中に最高のCAGRを記録すると予測される"

医療用電源の世界市場は、アーキテクチャに基づき、密閉型、オープンフレーム型、外部型、Uブラケット型、コンフィギュラブル、カプセル型電源に区分されます。外部電源セグメントは、2022年から2027年の予測期間において、最も高いCAGRを記録すると予測されています。ホームヘルスケア用途での外部電源の採用が拡大していることが、同分野の成長を促進すると予想されます。

"用途別では、2021年に患者監視装置分野が最大のシェアを占めた"

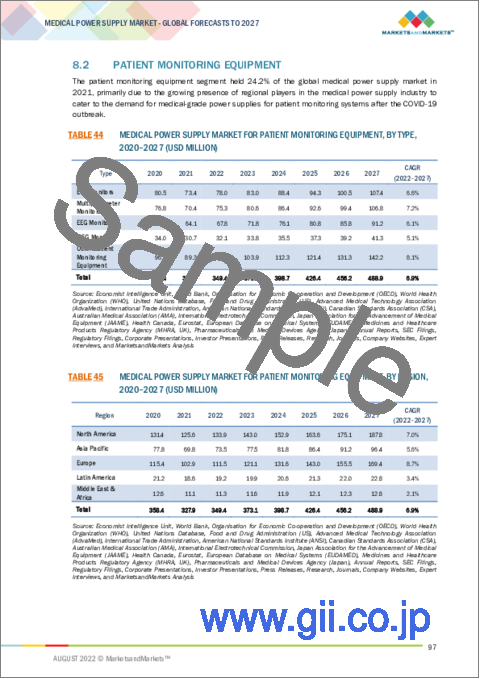

医療用電源市場は、用途別に画像診断システム、患者モニタリング機器、家庭用・ウェアラブル医療機器、埋め込み型医療機器、歯科用機器、外科用機器、その他医療機器に分類されます。患者モニタリング機器分野は、2021年の世界の医療用電源市場で最大のシェアを占めており、これは主に、新興国における医療インフラの開拓と、高度な患者モニタリング機器の設置に向けた官民の資金調達が増加していることに起因しています。

"アジア太平洋市場は、予測期間中に最も高い成長を遂げると予想される"

アジア太平洋には、最も人口の多い7カ国があり、世界人口の60%以上を占めています。人口の多さと強力な経済指標が相まって、この地域には大きな可能性が生まれています。そのため、世界中の医療機器メーカーがAPACへの参入と拡大に注力しています。ヘルスケアサービスの需要が高まる中、医療機器は市場全体において重要な役割を担っています。診断ラボの開拓、先進的な医療インフラ、医療用電源に関する厳しい規制(日本、中国、インドなど)が、同地域の市場を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 規制分析

- エコシステム分析

- バリューチェーン分析

- 特許分析

- 貿易分析

- 主な会議とイベント(2022-2024)

- ケーススタディ

第6章 コンバータタイプ別:医療用電源市場

- イントロダクション

- AC-DC電源

- 用途別:AC-DC医療用電源市場

- アーキテクチャ別:AC-DC医療用電源市場

- 製造タイプ別:AC-DC医療用電源市場

- 200W以下

- 201~500W

- 501~1,000W

- 1,001~3,000W

- 3,001W以上

- DC-DC電源

- 用途別:DC-DC医療用電源市場

- アーキテクチャ別:DC-DC医療用電源市場

- 製造タイプ別:DC-DC医療用電源市場

- 30W以下

- 31~60W

- 61W以上

第7章 アーキテクチャ別:医療用電源市場

- イントロダクション

- 密閉型電源

- オープンフレーム電源

- 外部電源

- カプセル化電源

- Uブラケット電源

- 設定可能な電源

第8章 用途別:医療用電源市場

- イントロダクション

- 患者モニタリング機器

- 心電図モニター

- マルチパラメータモニター

- 脳波モニター

- メグモニター

- その他の患者モニタリング機器

- 画像診断システム

- MRIシステム

- CTスキャナー

- X線システム

- 超音波システム

- マンモグラフィーシステム

- ペットシステム

- その他の画像診断システム

- 家庭用・ウェアラブル機器

- 手術機器

- 美的レーザーシステム

- 眼科レーザー装置

- 光およびレーザーベースのアブレーションシステム

- RFベースのアブレーションシステム

- 電気およびエレクトロポレーションアブレーションシステム

- その他

- 歯科機器

- 埋め込み型医療機器

- その他の医療機器

第9章 製造タイプ別:医療用電源市場

- イントロダクション

- 標準電源

- CF定格電源

- カスタマム電源

第10章 地域別:医療用電源市場

- イントロダクション

- 北米

- 米国

- カナダ

- アジア太平洋

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他アジア太平洋

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業の戦略

- 収益シェア分析

- 市場シェア分析

- 主要企業の企業評価クアドラント(2021)

- スタートアップ/中小企業の企業評価クアドラント(2021)

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- ADVANCED ENERGY INDUSTRIES

- TDK-LAMBDA CORPORATION

- DELTA ELECTRONICS INC.

- SL POWER ELECTRONICS

- XP POWER

- BEL FUSE

- その他の企業

- COSEL CO. LTD.

- FRIWO GERATEBAU GMBH

- SYNQOR

- GLOBTEK, INC.

- MEAN WELL ENTERPRISES

- SPELLMAN HIGH VOLTAGE ELECTRONICS CORPORATION

- ASTRODYNE TDI

- INVENTUS POWER

- WALL INDUSTRIES INC.

- その他

第13章 付録

The global medical power supply market is projected to reach USD 1.9 Billion by 2027 from USD 1.5 Billion in 2022, at a CAGR of 6.5% from 2022 to 2027. Advances in power supplies for medical equipment, increasing demand for energy-efficient AC/DC-DC/DC power supplies, and Supportive government regulations for effective air and water pollution monitoring and control, supportive regulations and standards for cleanrooms and manufacturing, growing focus on the quality of food products, and technological advancement & new product launch to drive the growth of the market globally. However, the high cost and technical limitations of particle counters are adversely impacting the growth of this market.

"The AC-DC power supply segment to hold the largest share of the market in 2022"

Based on the converter type, the global medical power supply market is segmented into AC-DC and DC-DC power supplies. The AC-DC power supply segment to hold the largest share of the global medical power supply market in 2022. AC-DC power supplies are compatible with various diagnostic imaging devices, such as MRI and X-ray systems. Thus, the growing adoption of such systems in hospitals, diagnostics centers, ASCs, and other healthcare facilities is expected to support market growth.

"The external power supply segment is projected to register the highest CAGR during the forecast period"

Based on architecture, the global medical power supply market is segmented into enclosed, open-frame, external, U-bracket, configurable, and encapsulated power supply. The external power supply segment is projected to register the highest CAGR during the forecast period of 2022 to 2027. The growing adoption of external power supplies for home healthcare applications is expected to drive the growth of the segment.

"In terms of application, patient monitoring equipment segment held the largest share of the market in 2021"

Based on the application, the medical power supply market is segmented into diagnostic imaging systems, patient monitoring equipment, home use and wearable medical equipment, implantable medical devices, dental equipment, surgical equipment, and other medical devices. The patient monitoring equipment segment held the largest share of the global medical power supply market in 2021, primarily due to the developing healthcare infrastructure in developing countries and increasing public-private funding for installing advanced patient monitoring equipment.

"The market in the APAC region is expected to witness the highest growth during the forecast period."

The APAC is home to seven of the most populous countries and over 60% of the global population. The sheer magnitude of the population coupled with strong economic indicators has created massive potential in the region. Thus, medical device companies across the globe are focusing on entering and expanding in the APAC. With the escalating demand for healthcare services, medical devices play a key role in the overall market. Development of diagnostic labs, advanced healthcare infrastructure, and strict regulations for medical power supply (in countries like Japan, China, and India) to drive market in the region.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-48%, Tier 2-36%, and Tier 3- 16%

- By Designation: C-level-10%, Director-level-14%, and Others-76%

- By Region: North America-40%, Europe-32%, Asia Pacific-20%, Latin America-5%, and the Middle East & Africa-3%

The prominent players in the medical power supply market are: Advanced Energy Industries, Inc (US), TDK Corporation (Japan), Delta Electronics, Inc. (Taiwan), SL Power Electronics (US), XP Power (Singapore), Bel Fuse Inc. (US), COSEL Co. Ltd. (Japan), FRIWO Geratebau GmbH (Germany), SynQor, Inc. (US), GlobTek, Inc. (US), MEAN WELL Enterprises Co. Ltd. (Taiwan), Spellman High Voltage Electronics Corporation (US), and Astrodyne TDI (US), among others.

Research Coverage

This report studies the medical power supply market based on converter type, application, architecture, manufacturing type and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the medical power supply market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the medical power supply market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the medical power supply market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MEDICAL POWER SUPPLY MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Customer-based market estimation

- FIGURE 5 BOTTOM-UP APPROACH FOR MARKET SIZE ESTIMATION

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- FIGURE 6 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

- 2.3 DATA TRIANGULATION APPROACH

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 APAC TO SHOW HIGHEST GROWTH DURING 2022-2027

4 PREMIUM INSIGHTS

- 4.1 MEDICAL POWER SUPPLY MARKET OVERVIEW

- FIGURE 12 HEALTHCARE INFRASTRUCTURAL DEVELOPMENT INITIATIVES TO DRIVE MARKET GROWTH

- 4.2 AC-DC MEDICAL POWER SUPPLY MARKET SHARE, BY POWER RANGE, 2022 VS. 2027

- FIGURE 13 201W-500W POWER RANGE TO REGISTER SIGNIFICANT GROWTH DUE TO TECHNOLOGICAL ADVANCEMENTS

- 4.3 APAC MEDICAL POWER SUPPLY MARKET, BY COUNTRY AND ARCHITECTURE

- FIGURE 14 JAPAN HOLDS LARGEST SHARE OF APAC MEDICAL POWER SUPPLY MARKET

- 4.4 NORTH AMERICA MEDICAL POWER SUPPLY MARKET, BY APPLICATION

- FIGURE 15 PATIENT MONITORING EQUIPMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- 4.5 GEOGRAPHICAL SNAPSHOT

- FIGURE 16 MARKET IN CHINA TO REGISTER HIGHEST CAGR

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 MEDICAL POWER SUPPLIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased market penetration of portable and integrated medical devices

- 5.2.1.2 Growing adoption of home-use healthcare products

- 5.2.1.3 Increased research spending on energy-efficient power supplies

- 5.2.1.4 Technology evolution in power supplies and ecosystem

- 5.2.1.4.1 ZVS circuit

- 5.2.1.4.2 PC Board Core Transformers

- 5.2.1.4.3 Digital control and fan-less medical power supplies

- 5.2.1.4.4 Emergence of gallium nitride-based semiconductors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulatory compliance and safety standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Economic development and increased healthcare expenditure in emerging countries

- 5.2.3.2 Emerging high-voltage DC power sources

- 5.2.3.3 Increasing accessibility of products

- 5.2.4 CHALLENGES

- 5.2.4.1 Grey market for low-quality products

- 5.2.4.2 Difficult adaption of device system interface

- 5.2.4.3 Technical limitations of power supply

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 MEDICAL POWER SUPPLY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 DEGREE OF COMPETITION

- 5.4 REGULATORY ANALYSIS

- TABLE 2 KEY REGULATORY BODIES AND GOVERNMENT AGENCIES

- 5.4.1 KEY REGULATORY GUIDELINES

- 5.4.1.1 US

- 5.4.1.2 Europe

- 5.4.1.3 Japan

- 5.4.1.4 China

- TABLE 3 OTHER REGULATORY COMPLIANCE AND SAFETY STANDARDS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 R&D

- 5.6.2 PROCUREMENT AND PRODUCT DEVELOPMENT

- 5.6.3 MARKETING, SALES, DISTRIBUTION, AND POST-SALES SERVICES

- FIGURE 18 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- 5.7 PATENT ANALYSIS

- FIGURE 19 PATENT DETAILS FOR MEDICAL POWER SUPPLIES (JANUARY 2012- JULY 2022)

- 5.8 TRADE ANALYSIS

- TABLE 4 IMPORT DATA FOR POWER SUPPLIES (HS CODE 850431), BY COUNTRY, 2017-2021 (UNITS/TONS)

- TABLE 5 EXPORT DATA FOR POWER SUPPLIES (HS CODE 850431), BY COUNTRY, 2017-2021 (UNITS/TONS)

- 5.9 KEY CONFERENCES AND EVENTS (2022-2024)

- TABLE 6 MEDICAL POWER SUPPLY MARKET: DETAILED LIST OF MAJOR CONFERENCES AND EVENTS

- 5.10 CASE STUDIES

- 5.10.1 DELIVERY OF ADVANCED POWER SOLUTIONS

- TABLE 7 CASE-1: PROVIDE SMALLER MULTI-FUNCTIONAL SYSTEMS WITH MIXED TECHNOLOGIES

- 5.10.2 COMPACT POWER SUPPLIES

- TABLE 8 CASE-2: DESIGN AND DELIVER COMPACT CONTROLLERS AND PANEL METERS

6 MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE

- 6.1 INTRODUCTION

- TABLE 9 MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- 6.2 AC-DC POWER SUPPLY

- TABLE 10 AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 11 AC-DC MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.1 AC-DC MEDICAL POWER SUPPLY MARKET, BY APPLICATION

- TABLE 12 AC-DC MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.2 AC-DC MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE

- TABLE 13 AC-DC MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- 6.2.3 AC-DC MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE

- TABLE 14 AC-DC MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 6.2.4 200W AND LESS

- 6.2.4.1 Growing usage of AC-DC power supplies in wearable medical devices to boost demand

- TABLE 15 200W AND LESS MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.4.2 200W and less medical power supply market, by application

- TABLE 16 200W AND LESS MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.5 201-500W

- 6.2.5.1 Technological evolution to boost demand for 201-500W units

- TABLE 17 201-500W MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.5.2 201-500W medical power supply market, by application

- TABLE 18 201-500W MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.6 501-1,000W

- 6.2.6.1 Availability of power units with natural convection cooling operation drives market growth

- TABLE 19 501-1,000W MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.6.2 501-1,000W medical power supply market, by application

- TABLE 20 501-1,000W MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.7 1,001-3,000W

- 6.2.7.1 Introduction of high-voltage AC-DC units to drive segment growth

- TABLE 21 1,000-3,000W MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.7.2 1,000-3,000W medical power supply market, by application

- TABLE 22 1,000-3,000W MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.2.8 3,001W AND ABOVE

- 6.2.8.1 Emergence of programmable AC-DC power supply for high power ranges to drive segment growth

- TABLE 23 3,001W AND ABOVE MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.2.8.2 3,001W and above medical power supply market, by application

- TABLE 24 3,001W AND ABOVE MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3 DC-DC POWER SUPPLY

- TABLE 25 DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 26 DC-DC MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.1 DC-DC MEDICAL POWER SUPPLY MARKET, BY APPLICATION

- TABLE 27 DC-DC MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.2 DC-DC MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE

- TABLE 28 DC-DC MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- 6.3.3 DC-DC MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE

- TABLE 29 DC-DC MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 6.3.4 30W AND LESS

- 6.3.4.1 Growing preference for high-voltage and low-power DC-DC converters to drive segment growth

- TABLE 30 30W AND LESS MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.4.2 30W and less medical power supply market, by application

- TABLE 31 30W AND LESS MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.5 31-60W

- 6.3.5.1 Availability of custom-designed DC power supplies for medical & healthcare devices to drive market growth

- TABLE 32 31-60W MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.5.2 31-60W medical power supply market, by application

- TABLE 33 31-60W MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 6.3.6 61W AND ABOVE

- 6.3.6.1 Growing usage of 61W and above power range in mobile medical devices to propel growth

- TABLE 34 61W AND ABOVE MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3.6.2 61W and above medical power supply market, by application

- TABLE 35 61W AND ABOVE MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

7 MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE

- 7.1 INTRODUCTION

- TABLE 36 MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- 7.2 ENCLOSED POWER SUPPLY

- 7.2.1 AVAILABILITY OF ENCLOSED SOLUTIONS FOR VAST POWER AND VOLTAGE SPECTRUM TO DRIVE MARKET GROWTH

- TABLE 37 ENCLOSED POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 OPEN-FRAME POWER SUPPLY

- 7.3.1 OPEN-FRAME ARCHITECTURE IS USED IN TEMPERATURE-SENSITIVE MEDICAL INSTRUMENTS

- TABLE 38 OPEN-FRAME POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.4 EXTERNAL POWER SUPPLY

- 7.4.1 HIGH DEMAND FOR PORTABLE MEDICAL DEVICES TO DRIVE MARKET GROWTH

- TABLE 39 EXTERNAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.5 ENCAPSULATED POWER SUPPLY

- 7.5.1 DEVELOPMENT OF COMPACT ENCAPSULATED POWER SUPPLIES TO DRIVE SEGMENT GROWTH

- TABLE 40 ENCAPSULATED POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.6 U-BRACKET POWER SUPPLY

- 7.6.1 EASE OF INSTALLATION TO DRIVE END-USER DEMAND

- TABLE 41 U-BRACKET POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.7 CONFIGURABLE POWER SUPPLY

- 7.7.1 INTRODUCTION OF PROGRAMMABLE POWER UNITS TO INCREASE DEMAND FOR CONFIGURABLE POWER SUPPLY

- TABLE 42 CONFIGURABLE POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

8 MEDICAL POWER SUPPLY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 43 MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- 8.2 PATIENT MONITORING EQUIPMENT

- TABLE 44 MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 45 MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.2.1 ECG MONITORS

- 8.2.1.1 Low cost and minimal power requirement of ECG devices to drive market growth

- TABLE 46 MEDICAL POWER SUPPLY MARKET FOR ECG MONITORS, BY REGION, 2020-2027 (USD MILLION)

- 8.2.2 MULTIPARAMETER MONITORS

- 8.2.2.1 Rising production volume of multiparameter monitors to drive market growth

- TABLE 47 MEDICAL POWER SUPPLY MARKET FOR MULTIPARAMETER MONITORS, BY REGION, 2020-2027 (USD MILLION)

- 8.2.3 EEG MONITORS

- 8.2.3.1 Growing usage of external AC-DC power supplies drives market growth

- TABLE 48 MEDICAL POWER SUPPLY MARKET FOR EEG MONITORS, BY REGION, 2020-2027 (USD MILLION)

- 8.2.4 MEG MONITORS

- 8.2.4.1 Declining MEG procurement likely to hinder segment growth

- TABLE 49 MEDICAL POWER SUPPLY MARKET FOR MEG MONITORS, BY REGION, 2020-2027 (USD MILLION)

- 8.2.5 OTHER PATIENT MONITORING EQUIPMENT

- TABLE 50 MEDICAL POWER SUPPLY MARKET FOR OTHER PATIENT MONITORING EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.3 DIAGNOSTIC IMAGING SYSTEMS

- TABLE 51 MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 52 MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.1 MRI SYSTEMS

- 8.3.1.1 Innovation and advancements in MRI applications support demand for power supply units

- TABLE 53 MEDICAL POWER SUPPLY MARKET FOR MRI SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.2 CT SCANNERS

- 8.3.2.1 Growing emphasis on maintaining patient safety to drive demand for customized medical-grade power supply units

- TABLE 54 MEDICAL POWER SUPPLY MARKET FOR CT SCANNERS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.3 X-RAY SYSTEMS

- 8.3.3.1 Availability of refurbished devices drives power supply component adoption in emerging markets

- TABLE 55 MEDICAL POWER SUPPLY MARKET FOR X-RAY SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.4 ULTRASOUND SYSTEMS

- 8.3.4.1 Increasing demand for small power supply units for portable ultrasound devices to drive market growth

- TABLE 56 MEDICAL POWER SUPPLY MARKET FOR ULTRASOUND SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.5 MAMMOGRAPHY SYSTEMS

- 8.3.5.1 Mammography systems segment to grow at high CAGR

- TABLE 57 MEDICAL POWER SUPPLY MARKET FOR MAMMOGRAPHY SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.6 PET SYSTEMS

- 8.3.6.1 High cost of PET and its components hinders market growth

- TABLE 58 MEDICAL POWER SUPPLY MARKET FOR PET SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.3.7 OTHER DIAGNOSTIC IMAGING SYSTEMS

- TABLE 59 MEDICAL POWER SUPPLY MARKET FOR OTHER DIAGNOSTIC IMAGING SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.4 HOME USE & WEARABLE EQUIPMENT

- 8.4.1 THREAT OF PANDEMICS SUCH AS COVID-19 DRIVES DEMAND FOR POWER SUPPLY UNITS FOR HOME MEDICAL EQUIPMENT

- TABLE 60 MEDICAL POWER SUPPLY MARKET FOR HOME USE & WEARABLE EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.5 SURGICAL EQUIPMENT

- TABLE 61 MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 62 MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.5.1 AESTHETIC LASER SYSTEMS

- 8.5.1.1 Increasing acceptance of aesthetic procedures to fuel power supply demands

- TABLE 63 POWER RANGE FOR AESTHETIC LASER SYSTEMS

- TABLE 64 MEDICAL POWER SUPPLY MARKET FOR AESTHETIC LASER SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.5.2 OPHTHALMOLOGY LASER DEVICES

- 8.5.2.1 Implementation of modular DC power supply in ophthalmology laser devices to fuel market growth

- TABLE 65 POWER RANGE FOR OPHTHALMIC LASERS

- TABLE 66 MEDICAL POWER SUPPLY MARKET FOR OPHTHALMOLOGY LASER DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 8.5.3 LIGHT & LASER-BASED ABLATION SYSTEMS

- 8.5.3.1 Rapid regulatory approval process to drive technology adoption and market growth

- TABLE 67 MEDICAL POWER SUPPLY MARKET FOR LIGHT & LASER-BASED ABLATION SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.5.4 RF-BASED ABLATION SYSTEMS

- 8.5.4.1 Increased demand for RF ablation to drive market for medical power supplies

- TABLE 68 MEDICAL POWER SUPPLY MARKET FOR RF-BASED ABLATION SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.5.5 ELECTRIC & ELECTROPORATION ABLATION SYSTEMS

- 8.5.5.1 High success rate of electric & electroporation power units to drive market growth

- TABLE 69 MEDICAL POWER SUPPLY MARKET FOR ELECTRIC & ELECTROPORATION ABLATION SYSTEMS, BY REGION, 2020-2027 (USD MILLION)

- 8.5.6 OTHER SURGICAL EQUIPMENT

- TABLE 70 MEDICAL POWER SUPPLY MARKET FOR OTHER SURGICAL EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.6 DENTAL EQUIPMENT

- 8.6.1 DEMAND FOR INBUILT POWER UNITS IN DENTAL EQUIPMENT TO DRIVE GROWTH IN THIS MARKET

- TABLE 71 MEDICAL POWER SUPPLY MARKET FOR DENTAL EQUIPMENT, BY REGION, 2020-2027 (USD MILLION)

- 8.7 IMPLANTABLE MEDICAL DEVICES

- 8.7.1 HIGH COST AND LIMITED APPLICATIONS LIMIT SEGMENT GROWTH

- TABLE 72 MEDICAL POWER SUPPLY MARKET FOR IMPLANTABLE MEDICAL DEVICES, BY REGION, 2020-2027 (USD MILLION)

- 8.8 OTHER MEDICAL DEVICES

- TABLE 73 POWER RANGE FOR DIFFERENT ANALYTICAL INSTRUMENTS

- TABLE 74 MEDICAL POWER SUPPLY MARKET FOR OTHER MEDICAL DEVICES, BY REGION, 2020-2027 (USD MILLION)

9 MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE

- 9.1 INTRODUCTION

- TABLE 75 MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 9.2 STANDARD POWER SUPPLY

- 9.2.1 GROWING NUMBER OF STANDARD POWER SUPPLY VENDORS TO BOOST MARKET GROWTH

- TABLE 76 STANDARD POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.3 CF RATING POWER SUPPLY

- 9.3.1 RISING INSTALLATION BASE FOR CARDIAC DEVICES TO BOOST MARKET

- TABLE 77 CF RATING POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 9.4 CUSTOMIZED POWER SUPPLY

- 9.4.1 DEMAND FOR CUSTOM SUPPLIES HAS RISEN IN RECENT YEARS

- TABLE 78 CUSTOMIZED POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

10 MEDICAL POWER SUPPLY MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 79 MEDICAL POWER SUPPLY MARKET, BY REGION, 2020-2027 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 20 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET SNAPSHOT

- TABLE 80 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 82 NORTH AMERICA: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Expansion and advancement in medical equipment industry to drive market growth

- TABLE 90 US: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 91 US: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 92 US: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Rising installation of medical devices to drive Canadian market

- TABLE 93 CANADA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 94 CANADA: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 95 CANADA: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3 ASIA PACIFIC

- FIGURE 21 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET SNAPSHOT

- TABLE 96 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 98 ASIA PACIFIC: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 99 ASIA PACIFIC: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 100 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 101 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 10.3.1 JAPAN

- 10.3.1.1 Japan dominates APAC medical power supply market

- TABLE 106 JAPAN: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 107 JAPAN: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 108 JAPAN: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3.2 CHINA

- 10.3.2.1 Stringent regulations for high-pollution sectors to drive market growth

- TABLE 109 CHINA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 110 CHINA: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 111 CHINA: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3.3 INDIA

- 10.3.3.1 Government initiatives and increased manufacturing activity in healthcare sector to drive market

- TABLE 112 INDIA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 113 INDIA: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 114 INDIA: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Increasing production of medical devices by local manufacturers to fuel medical power supply market

- TABLE 115 SOUTH KOREA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 116 SOUTH KOREA: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 117 SOUTH KOREA: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3.5 AUSTRALIA

- 10.3.5.1 Australia witnessing rising demand for power supplies in medical laboratories

- TABLE 118 AUSTRALIA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 119 AUSTRALIA: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 120 AUSTRALIA: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.3.6 REST OF ASIA PACIFIC

- TABLE 121 ROAPAC: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 122 ROAPAC: AC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 123 ROAPAC: DC-DC POWER SUPPLY MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4 EUROPE

- TABLE 124 EUROPE: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 125 EUROPE: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 126 EUROPE: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 127 EUROPE: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 128 EUROPE: MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 129 EUROPE: MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 130 EUROPE: MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 131 EUROPE: MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 132 EUROPE: MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- TABLE 133 EUROPE: MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 10.4.1 GERMANY

- 10.4.1.1 Germany dominates European medical power supply market

- TABLE 134 GERMANY: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 135 GERMANY: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 136 GERMANY: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4.2 UK

- 10.4.2.1 Expansion of power supply vendors driving market growth

- TABLE 137 UK: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 138 UK: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 139 UK: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Growing demand for medical power supplies to boost market growth

- TABLE 140 FRANCE: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 141 FRANCE: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 142 FRANCE: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4.4 ITALY

- 10.4.4.1 Increasing government investments in medical devices contribute to market growth

- TABLE 143 ITALY: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 144 ITALY: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 145 ITALY: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4.5 SPAIN

- 10.4.5.1 Focus on early disease diagnostics supports medical device adoption in Spain

- TABLE 146 SPAIN: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 147 SPAIN: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 148 SPAIN: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.4.6 REST OF EUROPE

- TABLE 149 ROE: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 150 ROE: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 151 ROE: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 152 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- TABLE 153 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 154 LATIN AMERICA: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 155 LATIN AMERICA: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 156 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 157 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 158 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 159 LATIN AMERICA: AL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 160 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- TABLE 161 LATIN AMERICA: MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

- 10.5.1 BRAZIL

- 10.5.1.1 Stringent regulations to monitor medical & healthcare devices likely to drive market growth

- TABLE 162 BRAZIL: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 163 BRAZIL: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 164 BRAZIL: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Increasing expenditure on healthcare to fuel market growth

- TABLE 165 MEXICO: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 166 MEXICO: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 167 MEXICO: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.5.3 REST OF LATIN AMERICA

- TABLE 168 ROLATAM: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 169 ROLATAM: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 170 ROLATAM: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INFRASTRUCTURAL IMPROVEMENTS, GROWING INVESTMENTS IN HEALTHCARE SUPPORT MARKET GROWTH

- TABLE 171 MEA: MEDICAL POWER SUPPLY MARKET, BY CONVERTER TYPE, 2020-2027 (USD MILLION)

- TABLE 172 MEA: AC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 173 MEA: DC-DC MEDICAL POWER SUPPLY MARKET, BY POWER RANGE, 2020-2027 (USD MILLION)

- TABLE 174 MEA: MEDICAL POWER SUPPLY MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 175 MEA: MEDICAL POWER SUPPLY MARKET FOR SURGICAL EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 176 MEA: MEDICAL POWER SUPPLY MARKET FOR DIAGNOSTIC IMAGING SYSTEMS, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 177 MEA: MEDICAL POWER SUPPLY MARKET FOR PATIENT MONITORING EQUIPMENT, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 178 MEA: MEDICAL POWER SUPPLY MARKET, BY ARCHITECTURE, 2020-2027 (USD MILLION)

- TABLE 179 MEA: MEDICAL POWER SUPPLY MARKET, BY MANUFACTURING TYPE, 2020-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 22 REVENUE SHARE ANALYSIS OF TOP FIVE PLAYERS IN MEDICAL POWER SUPPLY MARKET (2019-2021)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 23 MEDICAL POWER SUPPLY MARKET SHARE BY KEY PLAYER, 2021

- TABLE 180 MEDICAL POWER SUPPLY MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT FOR MAJOR PLAYERS (2021)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 24 MEDICAL POWER SUPPLY MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

- 11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES (2021)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 25 MEDICAL POWER SUPPLY MARKET: COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 181 OVERALL FOOTPRINT ANALYSIS

- TABLE 182 PRODUCT FOOTPRINT ANALYSIS

- TABLE 183 REGIONAL FOOTPRINT ANALYSIS

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES AND APPROVALS

- 11.8.2 DEALS

- 11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 ADVANCED ENERGY INDUSTRIES

- TABLE 184 ADVANCED ENERGY INDUSTRIES: COMPANY OVERVIEW

- FIGURE 26 ADVANCED ENERGY INDUSTRIES: COMPANY SNAPSHOT (2021)

- 12.1.2 TDK-LAMBDA CORPORATION

- TABLE 185 TDK CORPORATION: COMPANY OVERVIEW

- FIGURE 27 TDK CORPORATION: COMPANY SNAPSHOT (2021)

- 12.1.3 DELTA ELECTRONICS INC.

- TABLE 186 DELTA ELECTRONICS: COMPANY OVERVIEW

- FIGURE 28 DELTA ELECTRONICS: COMPANY SNAPSHOT (2021)

- 12.1.3.2 Products/services/solutions offered

- 12.1.4 SL POWER ELECTRONICS

- TABLE 187 SL POWER ELECTRONICS: COMPANY OVERVIEW

- 12.1.5 XP POWER

- TABLE 188 XP POWER: COMPANY OVERVIEW

- FIGURE 29 XP POWER: COMPANY SNAPSHOT (2021)

- 12.1.6 BEL FUSE

- TABLE 189 BEL FUSE: COMPANY OVERVIEW

- FIGURE 30 BEL FUSE: COMPANY SNAPSHOT (2021)

- 12.2 OTHER PLAYERS

- 12.2.1 COSEL CO. LTD.

- TABLE 190 COSEL CO. LTD.: COMPANY OVERVIEW

- FIGURE 31 COSEL CO. LTD.: COMPANY SNAPSHOT (2021)

- 12.2.2 FRIWO GERATEBAU GMBH

- TABLE 191 FRIWO GERATEBAU GMBH: COMPANY OVERVIEW

- FIGURE 32 FRIWO GROUP: COMPANY SNAPSHOT (2021)

- 12.2.3 SYNQOR

- TABLE 192 SYNQOR: COMPANY OVERVIEW

- 12.2.4 GLOBTEK, INC.

- TABLE 193 GLOBTEK INC.: COMPANY OVERVIEW

- 12.2.5 MEAN WELL ENTERPRISES

- TABLE 194 MEAN WELL ENTERPRISES: COMPANY OVERVIEW

- 12.2.6 SPELLMAN HIGH VOLTAGE ELECTRONICS CORPORATION

- TABLE 195 SPELLMAN HIGH VOLTAGE ELECTRONICS CORPORATION: COMPANY OVERVIEW

- 12.2.7 ASTRODYNE TDI

- TABLE 196 ASTRODYNE TDI: COMPANY OVERVIEW

- 12.2.8 INVENTUS POWER

- TABLE 197 INVENTUS POWER: COMPANY OVERVIEW

- 12.2.9 WALL INDUSTRIES INC.

- 12.2.10 OTHER COMPANIES

- 12.2.10.1 Traco Electronic AG

- 12.2.10.2 Cincon Electronics

- 12.2.10.3 FSP Group

- 12.2.10.4 Murata Manufacturing Co., Ltd.

- 12.2.10.5 RECOM Power GmbH

- 12.2.10.6 FranMar International Inc.

- 12.2.10.7 HDP Power (SEACOMP)

- 12.2.10.8 TRI-MAG, LLC

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS