|

|

市場調査レポート

商品コード

1120745

ナッツ製品の世界市場:製品タイプ(ナッツバター、ナッツペースト/マジパンペースト/ペルシパンペースト、ココア入りナッツフィリング、ココアなしナッツフィリング、キャラメルナッツ、ナッツ粉末)、ナッツタイプ、用途、品質、カテゴリー、地域別 - 2027年までの予測Nut Products Market by Product Type (Nut Butter, Nut Paste/Marzipan Paste/Persipan Paste, Nut Fillings with Cocoa, Nut Fillings without Cocoa, Caramelized Nuts, & Nut Flour), Nut Type, Application, Quality, Category and Region - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ナッツ製品の世界市場:製品タイプ(ナッツバター、ナッツペースト/マジパンペースト/ペルシパンペースト、ココア入りナッツフィリング、ココアなしナッツフィリング、キャラメルナッツ、ナッツ粉末)、ナッツタイプ、用途、品質、カテゴリー、地域別 - 2027年までの予測 |

|

出版日: 2022年08月22日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

MarketsandMarketsによると、世界のナッツ製品市場規模は、2022年に67億米ドルと推定されます。

2027年には89億米ドルに達すると予測され、金額ベースで5.9%のCAGRを記録しています。ライフスタイルの変化、強化食品に対する需要の増加、健康意識の高まり、乳糖およびグルテンアレルギーの事例の増加、アプリケーション分野の拡大などが、ナッツ製品の成長を促進する要因となっています。本調査では、ナッツ製品市場を製品タイプ、用途、ナッツの種類、品質、カテゴリー、地域に基づいて分類しています。製品タイプには、ナッツバター、ナッツペースト、ココア入りナッツフィリング、ココアなしナッツフィリング、ナッツ粉が含まれます。ナッツタイプは、アーモンド、ヘーゼルナッツ、カシューナッツ、クルミ、ピーナッツ、ピスタチオ、マカダミア、ピーカン、松の実、ブラジルナッツに分類されます。

"製品タイプ別では、ナッツバター部門が予測期間中に2番目に大きな市場シェアを占めると予測される"

製品タイプ別では、ナッツバターセグメントが予測期間中に2番目に大きな市場であると予測されています。ナッツバターは、一般的にパンに塗る自然なスプレッドとして消費されます。これとは別に、トッピング、増粘剤、結合成分としても使用されます。甘くクリーミーでナッツのような風味があり、ベジタブルバーガー、クッキー、スムージーなど様々な食品に使用され、ビーガン消費者に好まれている食品です。ナッツバターは、タンパク質、銅、オメガ6必須脂肪酸、繊維、一価不飽和脂肪、マンガン、マグネシウム、リン、モリブデン、ビタミンなどの栄養素が豊富に含まれています。

"ナッツの種類別では、クルミのセグメントが2番目に大きな市場になると予測されています。"

食品メーカーは焼き菓子や製菓、スナック、乳製品といった高品質な製品の原料としてクルミを使用しています。シリアルバー、ヨーグルト、食事、バター、チーズなどに使用され、人気を博しています。中国は世界最大のクルミの生産国であり消費国であり、米国がそれに続いています。総生産量の75%近くを中国が占めています。中国はクルミの最大の生産国ですが、中国国内での需要も増えてきています。そのため、中国は消費者の需要を満たすためにクルミの大部分を輸入しています。

"用途別では、工業用食品メーカー分野がナッツ製品市場で最大のシェアを占めると予測される"

セイボリー製品に使用されるナッツはまだ初期段階です。ナッツは油分と食物繊維を含むため、食品に満腹感を与え、風味を与えながら水分バランスを整え、他の香ばしい風味を運ぶのに役立っています。ナッツ類を風味付けに使用する食品加工業者の多くは、ローストしたヘーゼルナッツを製品に使用しており、より歯ごたえとナッツの風味を付与しています。例えば、ローストミールはパンやスナックに、ヘーゼルナッツバターはソースに使用することができ、風味とコクを加え、タンパク質を増加させることができます。

"品質別では、標準品質分野がレビュー期間中に最大の市場シェアを占めると予測される"

各国が策定したナッツ/ナッツ製品の商業品質基準は、国際貿易の円滑化、高品質生産の奨励、収益性の向上、消費者の利益の保護に役立っています。例えば、ピーナッツバターなどのナッツ製品には、異臭がしない、腐敗しない、カビが生えない、虫がつかないなどの最低基準が設定されています。また、特にアレルギーに関連する問題については、木の実の真偽表示が義務づけられています。例えば、ヘーゼルナッツペースト(ヌテラ)は、菓子類や直接食用に供される食材です。ペーストに含まれるヘーゼルナッツの数が多いと、品質に重大な問題が生じたり、人工化合物や他の成分で置き換えられ、ナッツ製品の品質が阻害される可能性があります。

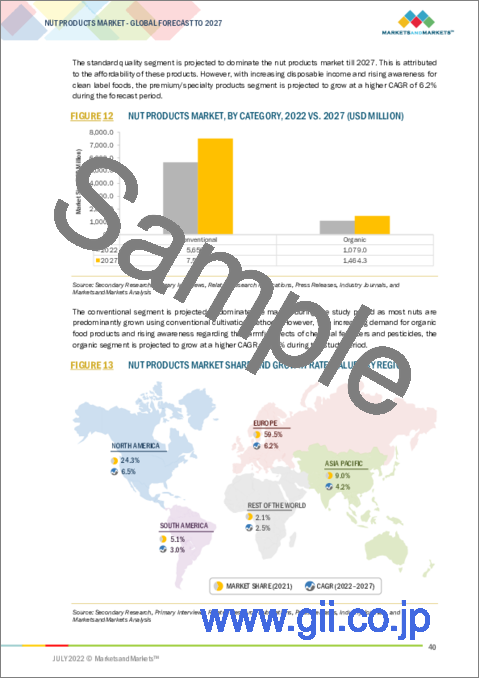

"カテゴリー別では、慣行栽培のセグメントが最大の市場シェアを占めると予測されている"

アジア太平洋、南米、アフリカの発展途上地域を中心に、生産性の向上、有機農業への移行に必要な知識不足、有機農業認証の取得に伴うお役所仕事などの理由から、様々なナッツが慣行農法で栽培されています。

"予測期間中、欧州がナッツ製品市場で最大の市場シェアを占めると予測される"

欧州では、ヘーゼルナッツ、クルミ、アーモンドなどが菓子類やベーカリー用途で使用される人気のナッツ類です。ヘーゼルナッツバターやアーモンドバターなどのナッツ類は、フィリングとして使用されています。ナッツは粉、ペースト、バター、オイルなど様々な形態があるため、製品開発者の間では常に技術革新が行われています。カリフォルニア州アーモンド協会(ABC)によると、アーモンドは汎用性が高く、クリーンラベルや植物由来の食品などの動向を取り入れることができるため、主に人気があるとのことです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- 価格分析:タイプ別のナッツ製品市場

- エコシステムマップ

- バイヤーに影響を与える動向/ディスラプション

- 技術分析

- 特許分析

- 貿易分析

- ポーターのファイブフォース分析

- ケーススタディ

- 2022年から2023年の主な会議とイベント

- 主な利害関係者と購入基準

第7章 ナッツ製品に関する主な規制

- 米国

- 関税と規制状況

第8章 ナッツ製品市場:製品タイプ別

- イントロダクション

- ナッツバター

- ナッツペースト/マジパンペースト/ペルシパンペースト

- ココア入りナッツフィリング

- ココアなしのナッツフィリング

- キャラメルナッツ

- ナッツ粉末

第9章 ナッツ製品市場:ナッツタイプ別

- イントロダクション

- アーモンド

- ヘーゼルナッツ

- クルミ

- カシューナッツ

- ピスタチオ

- ピーナッツ

- マカダミア

- ピーカン

- 松の実

- ブラジルナッツ

第10章 ナッツ製品市場:用途別

- イントロダクション

- 工業用食品メーカー

- チョコレート菓子類製品

- ベーカリー製品

- アイスクリーム・フローズンデザート

- シリアル・スナックバー

- 飲料

- セイボリー製品

- フードサービス・ベーカリー

- ベーカリーショップ

- フードサービス

第11章 ナッツ製品市場:品質別

- イントロダクション

- 標準品質

- プレミアム/特殊製品

第12章 ナッツ製品市場:カテゴリー別

- イントロダクション

- 従来型

- オーガニック

第13章 ナッツ製品市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- スペイン

- フランス

- イタリア

- ベルギー

- 英国

- トルコ

- その他

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリアとニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 南アフリカ

- 中東

- その他アフリカ

第14章 競合情勢

- 概要

- 市場シェア分析(2021)

- 主要業の戦略

- 主要企の収益シェア分析

- 会社評価クアドラント(主要企業)

- 製品タイプフットプリント

- スタートアップ/中小企業の評価クアドラント(その他の企業)

- 競合シナリオ

- 新製品の発売

- お買い得

- その他

第15章 企業プロファイル

- 主要企業

- OLAM INTERNATIONAL

- BARRY CALLEBAUT

- BLUE DIAMOND GROWERS

- SUCREST GMBH(SUBSIDIARY OF KERRY GROUP)

- ZENTIS GMBH & CO. KG

- MOUNT FRANKLIN FOODS

- MANDELIN, INC

- BAZZINI

- BESANA

- LUBECA

- PURATOS

- GEORG LEMKE GMBH & CO. KG

- ALMENDRAS LLOPIS S.A.U.

- KANEGRADE

- MOLL MARZIPAN GMBH

- KONDIMA

- CSM

- TREEHOUSE ALMONDS

- ROYAL NUT COMPANY

- STELLIFERI & ITAVEX S.P.A(ACQUIRER:FERRERO INTERNATIONAL SA)

第16章 隣接および関連市場

- イントロダクション

- 制限事項

- アーモンド原料市場

- 製パン原料市場

- ナッツ原料市場

第17章 付録

According to MarketsandMarkets, the global nut products market size is estimated to be valued at USD 6.7 Billion in 2022. It is projected to reach USD 8.9 Billion by 2027, recording a CAGR of 5.9% in terms of value. Changing lifestyles, increasing demand for fortified food products, growing health awareness, increasing instances of lactose and gluten allergies, and rising application sectors are some factors driving the growth of nut products. In this study, the nut products market has been categorized based on product type, application, nut type, quality, category, and region. Product types include nut butter, nut pastes, nut fillings with cocoa, nut fillings without cocoa, and nut flour. The nut type segment is classified into almonds, hazelnuts, cashews, walnuts, peanuts, pistachios, macadamias, pecans, pine nuts, and Brazil nuts.

"By product type, the nut butter segment is projected to account for the second largest market share during the forecast period."

Based on product type, the nut butter segment is projected to be the second largest market during the forecast period. Nut butter is generally consumed as a natural spread on bread; apart from this, it is also used as a topping, thickener, and binding ingredient. It is sweet, creamy, nutty, and gritty and a preferred choice by vegan consumers in various foods, such as veggie burgers, cookies, and smoothies. Nut butter is rich in nutrients, such as proteins, copper, omega-6 essential fatty acids, fibers, monounsaturated fats, manganese, magnesium, phosphorus, molybdenum, and vitamins.

"By nut type, the walnut segment is forecasted to be the second largest market."

Food manufacturers use walnuts as an ingredient for high-quality products, such as baked goods or confectionaries, snacks, or dairy products. It is gaining traction owing to its application in cereal bars, yogurts, meals, butter, and cheese. China is the world's biggest producer and consumer of walnuts, followed by the US. They account for nearly 75% of the total production. Although China is the largest producer of walnuts, there is an increasing demand in China. Therefore, China imports a large share of walnuts to meet consumer demand.

"By application, the industrial food manufacturers segment is forecasted to account for the largest market share in the nut products market."

Nuts used in savory products are still in the nascent stage. Because of the oil and fiber content, they add satiety value to foods, help balance the moisture content while lending their flavor, and help carry other savory flavors. Most food processors that use nuts in savory applications opt for roasted hazelnuts in their products as they impart a crunchier and nuttier flavor. For instance, roasted meals can be used in bread and snacks, while hazelnut butter can be used in sauces, adding flavor, richness, and increased protein content.

"By quality, the standard quality segment is forecasted to account largest market share during the review period."

Commercial quality standards developed by every country for nuts/nut products help facilitate international trade, encourage high-quality production, improve profitability, and protect consumer interests. For instance, minimum standards set for nut products, such as peanut butter, are free from foreign smell, free of rancidity, free from mold, and free from insects. The authenticity label for tree nuts is also a mandatory indication, particularly for problems linked to allergies. For instance, hazelnut paste (Nutella) is an ingredient for confectionery and direct consumption. The number of hazelnuts present in the paste can cause a critical quality issue or replacement with artificial compounds or other ingredients, which may hamper the quality of the nut product.

"By category, the conventional segment is forecasted to account for the largest market share."

Various nuts are grown through conventional farming due to increased productivity, lack of knowledge required to shift to organic farming, and red tape involved in acquiring organic farming certifications, mainly in developing regions of Asia Pacific, South America, and Africa.

"Europe is projected to account for the largest market share in the nut products market during the forecast period."

In Europe, hazelnuts, walnuts, and almonds are some popular nuts used in confectionery and bakery applications. Nut products such as hazelnut and almond butter are used as fillings. As nuts are available in different forms - flour, paste, butter, and oil, innovations are constant among product developers. According to the Almond Board of California (ABC), almonds are popular mainly due to their versatility and ability to tap into trends, including clean label and plant-based foods.

Break-up of Primaries

- By Company Type: Tier 1 - 30%, Tier 2 - 25% and Tier 3 - 45%

- By Designation: Manager- 25%, CXOs- 40%, and Executives - 35%

- By Region: Asia Pacific - 40%, Europe - 30%, North America- 16%, and RoW- 14%

Leading players profiled in this report include the following:

- Olam International (Singapore)

- Barry Callebaut (Switzerland)

- Blue Diamond Growers (US)

- Kerry Group (Ireland)

- Zentis GmbH & Co. KG. (Germany)

- Mount Franklin Foods (US)

- Mandelin, Inc (US)

- Besana (Italy)

- Bazzini (US)

- Lubeca (Denmark)

- Puratos (Belgium)

- Georg Lemke Gmbh & Co. Kg (Germany)

- Almendras Llopis S.A.U. (Spain)

- Stelliferi & Itavex S.P.A. (Italy)

- Kanegrade (UK)

- Kondima (Germany)

- Royal Nut Company (US)

- Moll Marzipan GMBH (Germany)

- CSM (US)

- Treehouse Almonds (US)

Research Coverage

This report segments the nut products market on the basis of product types, nut types, application, quality, category, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, pricing insights, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the nut products market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the nut products market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and the key strategies adopted by them

- To gain insights into the major countries/regions in which the nut products market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- FIGURE 1 NUT PRODUCTS MARKET SEGMENTATION

- 1.3.1 GEOGRAPHIC SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NUT PRODUCTS MARKET: RESEARCH DESIGN CHART

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 3 EXPERT INSIGHTS

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY VALUE CHAIN, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 2 NUT PRODUCTS MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 8 NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 NUT PRODUCTS MARKET, BY NUT TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 NUT PRODUCTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 NUT PRODUCTS MARKET, BY QUALITY, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 NUT PRODUCTS MARKET, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 NUT PRODUCTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN NUT PRODUCTS MARKET

- FIGURE 14 INCREASING DEMAND FOR PLANT-BASED FOOD TO DRIVE MARKET FOR NUT PRODUCTS

- 4.2 EUROPE: NUT PRODUCTS MARKET, BY PRODUCT TYPE AND COUNTRY

- FIGURE 15 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT AND GERMANY TO ACCOUNT FOR LARGEST SHARES IN EUROPE IN 2022

- 4.3 NUT PRODUCTS MARKET, BY PRODUCT TYPE

- FIGURE 16 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT TO DOMINATE DURING FORECAST PERIOD

- 4.4 NUT PRODUCTS MARKET, BY PRODUCT TYPE AND REGION

- FIGURE 17 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES SEGMENT AND EUROPE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- 4.5 NUT PRODUCTS MARKET, BY NUT TYPE

- FIGURE 18 HAZELNUTS TO DOMINATE DURING FORECAST PERIOD

- 4.6 NUT PRODUCTS MARKET, BY QUALITY

- FIGURE 19 STANDARD QUALITY TO DOMINATE DURING FORECAST PERIOD

- 4.7 NUT PRODUCTS MARKET, BY CATEGORY

- FIGURE 20 CONVENTIONAL SEGMENT TO DOMINATE DURING FORECAST PERIOD

- 4.8 NUT PRODUCTS MARKET, BY APPLICATION

- FIGURE 21 INDUSTRIAL FOOD MANUFACTURERS TO DOMINATE DURING FORECAST PERIOD

- FIGURE 22 US ACCOUNTED FOR LARGEST SHARE IN 2021

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 NUT PRODUCTS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising health awareness leading to evolving dietary patterns

- TABLE 3 AMINO ACID PROFILE OF WALNUTS

- TABLE 4 NUTRITIONAL PROFILE OF DIFFERENT NUTS PER 100 GRAMS

- 5.2.1.2 Robust growth projections for bakery and confectionery sectors

- FIGURE 24 ESTIMATED CONFECTIONERY SALES, BY REGION, 2018-2020 (USD BILLION)

- 5.2.1.3 Preventive healthcare - emerging dietary approach to address lifestyle diseases

- TABLE 5 SCIENTIFIC EVIDENCE HIGHLIGHTING DISEASE PREVENTION ABILITIES OF NUTS

- 5.2.1.4 Nuts as major ingredients in new product development

- FIGURE 25 NEW PRODUCT LAUNCHES WITH NUTS AS KEY INGREDIENT, 2015-2020

- 5.2.1.5 Vegan food products - nuts as key ingredient - their strategic positioning

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability and fluctuating costs for nuts as raw material

- 5.2.2.2 Allergy concerns for nut-based ingredients

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding application spectrum for nuts and derivatives

- 5.2.3.2 Emerging economies as global hotspots for investments

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain management intricacies and quality of nut products

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 26 NUT PRODUCTS: VALUE CHAIN ANALYSIS

- 6.2.1 GROWERS & SMALL-SCALE PRODUCERS

- 6.2.2 SUPPLIERS/TRADERS

- 6.2.3 PROCESSORS & PACKERS

- 6.2.4 BRANDING, MARKETING & SALES

- 6.2.5 LOGISTICS & DISTRIBUTION

- 6.2.6 END USERS

- 6.3 PRICING ANALYSIS: NUT PRODUCTS MARKET, BY TYPE

- TABLE 6 GLOBAL ASP: PRICING ANALYSIS OF NUT PRODUCT TYPES, 2020 ('000 USD/TONNES)

- FIGURE 27 GLOBAL PRICING TREND OF NUT-BASED SEMI-FINISHED PRODUCTS, BY KEY NUT TYPE, 2019-2021 ('000 USD/TONNES)

- 6.4 ECOSYSTEM MAP

- 6.4.1 NUT PRODUCTS MARKET: ECOSYSTEM VIEW

- TABLE 7 NUT PRODUCTS MARKET: ECOSYSTEM

- 6.4.2 NUT PRODUCTS MARKET MAP

- 6.4.2.1 Upstream

- 6.4.2.1.1 Raw material suppliers

- 6.4.2.1.2 Ingredient manufacturers

- 6.4.2.2 Downstream

- 6.4.2.2.1 Testing, Inspection & Certification (TIC) Service Providers and Regulatory bodies

- 6.4.2.1 Upstream

- 6.5 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 28 REVENUE SHIFT FOR NUT PRODUCTS MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 PATENT ANALYSIS

- FIGURE 29 PATENTS GRANTED FOR NUT PRODUCTS MARKET, 2011-2021

- FIGURE 30 REGIONAL ANALYSIS OF PATENT GRANTED, 2011-2021

- TABLE 8 KEY PATENTS PERTAINING TO NUT PRODUCTS MARKET, 2020-2021

- 6.8 TRADE ANALYSIS

- TABLE 9 TOP TEN IMPORTERS AND EXPORTERS OF NUTS, 2021 (KT)

- TABLE 10 TOP TEN IMPORTERS AND EXPORTERS OF EDIBLE NUTS, 2021 (KT)

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 NUT PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 DEGREE OF COMPETITION

- 6.9.2 BARGAINING POWER OF SUPPLIERS

- 6.9.3 BARGAINING POWER OF BUYERS

- 6.9.4 THREAT OF SUBSTITUTES

- 6.9.5 THREAT OF NEW ENTRANTS

- 6.10 CASE STUDIES

- 6.10.1 IMPROVISING TEXTURAL ATTRIBUTES OF NUT BUTTERS AND FACILITATING THEIR INCORPORATION

- 6.10.2 CRUNCHY ATTRIBUTE OF NUTS AMONG END-USE INDUSTRIES

- 6.10.3 NUT-BASED DERIVATIVE PRODUCTS - COMPOSITION AND KEY REQUISITES

- 6.10.4 IMPROVISING COMPOSITION AND NUTRITIONAL PROFILE OF NUT-BASED CONFECTIONS

- 6.11 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 12 NUT PRODUCTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2022-2023

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 13 INFLUENCE OF STAKEHOLDERS IN BUYING DIFFERENT QUALITY NUTS

- 6.12.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR NUT PRODUCTS IN INDUSTRIAL FOOD APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR NUT PRODUCTS IN INDUSTRIAL FOOD APPLICATIONS

7 KEY REGULATIONS FOR NUT PRODUCTS

- 7.1 US

- 7.1.1 US FOOD AND DRUG ADMINISTRATION

- 7.1.2 ELECTRONIC CODE OF FEDERAL REGULATIONS

- 7.1.3 EUROPEAN UNION REGULATIONS

- 7.2 TARIFF AND REGULATORY LANDSCAPE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 NUT PRODUCTS MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 32 NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 19 NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 20 NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- 8.1.1 NUT BUTTER

- 8.1.1.1 Snacking to be potential growth market for nut spreads

- TABLE 21 NUT BUTTER: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 22 NUT BUTTER: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 8.1.2 NUT PASTES/MARZIPAN PASTES/PERSIPAN PASTES

- 8.1.2.1 Rising consumption of healthy bakery products to boost nut pastes segment

- TABLE 23 NUT PASTES: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 24 NUT PASTES: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 8.1.3 NUT FILLINGS WITH COCOA

- 8.1.3.1 Increased usage of almond flavor in confectionery and baked foods to drive market

- TABLE 25 NUT FILLINGS WITH COCOA: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 26 NUT FILLINGS WITH COCOA: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 8.1.4 NUT FILLINGS WITHOUT COCOA

- 8.1.4.1 Application of pralines in various foods to drive market

- TABLE 27 NUT FILLINGS WITHOUT COCOA: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 28 NUT FILLINGS WITHOUT COCOA: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 8.1.5 CARAMELIZED NUTS

- 8.1.5.1 Companies to invest in product innovations in this segment

- TABLE 29 CARAMELIZED NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 30 CARAMELIZED NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 8.1.6 NUT FLOUR

- 8.1.6.1 Premium range of almond flour to drive this segment

- TABLE 31 NUT FLOUR: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 32 NUT FLOUR: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

9 NUT PRODUCTS MARKET, BY NUT TYPE

- 9.1 INTRODUCTION

- FIGURE 33 WORLD TREE NUT PRODUCTION, KERNEL BASIS, 2021-2022

- FIGURE 34 NUT PRODUCTS MARKET, BY NUT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 33 NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 34 NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- 9.2 ALMONDS

- 9.2.1 ALMONDS RANK HIGHEST IN TERMS OF USAGE IN FOOD INDUSTRY

- FIGURE 35 CALIFORNIAN ALMOND PRODUCTION, 2015-2019 (MILLION POUNDS)

- TABLE 35 ALMONDS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 36 ALMONDS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.3 HAZELNUTS

- 9.3.1 HAZELNUTS LARGELY PREFERRED IN NORTH AMERICAN AND EUROPEAN CONFECTIONERY INDUSTRIES

- FIGURE 36 WORLD HAZELNUT PRODUCTION, KERNEL BASIS, 2016-2021 (METRIC TONS)

- TABLE 37 HAZELNUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 38 HAZELNUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.4 WALNUTS

- 9.4.1 CHINESE WALNUTS TO HAVE GREAT DEMAND WORLDWIDE

- FIGURE 37 WALNUT PRODUCTION, KERNEL BASIS, 2020-2021

- TABLE 39 WALNUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 40 WALNUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.5 CASHEWS

- 9.5.1 ASIA PACIFIC TO CONTINUE TO BE LARGE CONSUMER OF CASHEWS

- TABLE 41 CASHEWS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 42 CASHEWS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.6 PISTACHIOS

- 9.6.1 PISTACHIOS TO BE INCREASINGLY POPULAR IN CHINA

- FIGURE 38 PISTACHIO PRODUCTION, IN-SHELL BASIS, 2021-2022

- TABLE 43 PISTACHIOS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 44 PISTACHIOS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.7 PEANUTS

- 9.7.1 PEANUT BUTTER TO BE MAJORLY CONSUMED NUT BUTTER WORLDWIDE

- FIGURE 39 ESTIMATED PEANUT PRODUCTION, IN-SHELL BASIS, 2021-2022

- TABLE 45 PEANUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 46 PEANUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.8 MACADAMIAS

- 9.8.1 MACADAMIA NUTS TO BE INCLUDED IN CEREALS, PROTEIN BARS, AND ICE-CREAM TOPPINGS

- FIGURE 40 MACADAMIA PRODUCTION, KERNEL BASIS, 2021

- TABLE 47 MACADAMIAS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 48 MACADAMIAS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.9 PECANS

- 9.9.1 PECANS EXPORTED FROM US AND MEXICO ACCOUNTED FOR 98% OF GLOBAL SHARE

- FIGURE 41 PECAN PRODUCTION, KERNEL BASIS, 2021-2022

- TABLE 49 PECANS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 50 PECANS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.10 PINE NUTS

- 9.10.1 INCREASE IN MEDITERRANEAN COOKING TO DRIVE MARKET

- TABLE 51 PINE NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 52 PINE NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 9.11 BRAZIL NUTS

- 9.11.1 BOLIVIA TO BE LARGEST PRODUCER OF BRAZIL NUTS

- TABLE 53 BRAZIL NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 54 BRAZIL NUTS: NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

10 NUT PRODUCTS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 42 NUT PRODUCTS MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 55 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 56 FOODSERVICE & BAKERIES: NUT PRODUCTS MARKET, BY APPLICATION, 2019-2027 (USD MILLION)

- 10.2 INDUSTRIAL FOOD MANUFACTURERS

- 10.2.1 CHOCOLATE CONFECTIONERY PRODUCTS

- 10.2.1.1 Increasing demand for chocolate confections with almond inclusions to drive market

- TABLE 57 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR CHOCOLATE CONFECTIONERY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.2.2 BAKERY PRODUCTS

- 10.2.2.1 Almond flour widely used in bakery sector

- TABLE 58 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR BAKERY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.2.3 ICE CREAM & FROZEN DESSERTS

- 10.2.3.1 Premium ice creams with nut inclusions to drive market

- TABLE 59 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR ICE CREAM & FROZEN DESSERTS, BY REGION, 2019-2027 (USD MILLION)

- 10.2.4 CEREALS & SNACK BARS

- 10.2.4.1 Nut snack bars to gain popularity in US

- TABLE 60 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR CEREALS & SNACK BARS, BY REGION, 2019-2027 (USD MILLION)

- 10.2.5 BEVERAGES

- 10.2.5.1 Demand for milk substitutes to create demand for nut-based beverages

- TABLE 61 INDUSTRY FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR BEVERAGES, BY REGION, 2019-2027 (USD MILLION)

- 10.2.6 SAVORY PRODUCTS

- 10.2.6.1 Nut inclusions in savory products building slowly with increasing demand for protein-rich foods

- TABLE 62 INDUSTRIAL FOOD MANUFACTURERS: NUT PRODUCTS MARKET FOR SAVORY PRODUCTS, BY REGION, 2019-2027 (USD MILLION)

- 10.2.1 CHOCOLATE CONFECTIONERY PRODUCTS

- 10.3 FOODSERVICE AND BAKERIES

- 10.3.1 BAKERY SHOPS

- 10.3.1.1 Traditional delicacies require more nut products

- TABLE 63 FOODSERVICE AND BAKERIES: NUT PRODUCTS MARKET FOR BAKERY SHOPS (INCLUDING ARTISANAL BAKERIES), BY REGION, 2019-2027 (USD MILLION)

- 10.3.2 FOODSERVICE

- 10.3.2.1 Demand for natural ingredients to drive market

- TABLE 64 FOODSERVICE AND BAKERIES: NUT PRODUCTS MARKET FOR FOODSERVICE (RESTAURANTS, CAFES, AND HOTELS), BY REGION, 2019-2027 (USD MILLION)

- 10.3.1 BAKERY SHOPS

11 NUT PRODUCTS MARKET, BY QUALITY

- 11.1 INTRODUCTION

- FIGURE 43 NUT PRODUCTS MARKET, BY QUALITY, 2022 VS. 2027 (USD MILLION)

- TABLE 65 NUT PRODUCTS MARKET, BY QUALITY, 2019-2027 (USD MILLION)

- 11.2 STANDARD QUALITY

- TABLE 66 STANDARD QUALITY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- 11.3 PREMIUM/SPECIALTY PRODUCTS

- TABLE 67 PREMIUM/SPECIALTY PRODUCTS: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

12 NUT PRODUCTS MARKET, BY CATEGORY

- 12.1 INTRODUCTION

- FIGURE 44 NUT PRODUCTS MARKET, BY CATEGORY, 2022 VS. 2027 (USD MILLION)

- TABLE 68 NUT PRODUCTS MARKET, BY CATEGORY, 2019-2027 (USD MILLION)

- 12.2 CONVENTIONAL

- TABLE 69 CONVENTIONAL: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- 12.3 ORGANIC

- TABLE 70 ORGANIC: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

13 NUT PRODUCTS MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 45 ITALY TO RECORD HIGHEST CAGR FROM 2022 TO 2027

- TABLE 71 NUT PRODUCTS MARKET, BY REGION, 2019-2027 (USD MILLION)

- TABLE 72 NUT PRODUCTS MARKET, BY REGION, 2019-2027 (KT)

- 13.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: NUT PRODUCTS MARKET SNAPSHOT

- FIGURE 47 NORTH AMERICA: PECAN IMPORTS, 2020 (SHELLED BASIS)

- TABLE 73 NORTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 75 NORTH AMERICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 77 NORTH AMERICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- TABLE 79 NORTH AMERICA: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 80 NORTH AMERICA: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019-2027 (USD MILLION)

- 13.2.1 US

- 13.2.1.1 Almonds to lead tree nut consumption in US

- FIGURE 48 ALMOND CONSUMPTION IN US, 2016-2020 (METRIC TONS)

- TABLE 81 US: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 82 US: NUT PRODUCTS MARKET SIZE, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.2.2 CANADA

- 13.2.2.1 Growing interest in low-calorie snacks to drive market in Canada

- TABLE 83 CANADA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 84 CANADA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.2.3 MEXICO

- 13.2.3.1 Foodservice industry to dominate nut products in Mexico

- TABLE 85 MEXICO: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 86 MEXICO: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3 EUROPE

- FIGURE 49 TREE NUT PRODUCTION IN EUROPE, 2019-2020 (METRIC TONS)

- FIGURE 50 EUROPE: NUT PRODUCTS MARKET SNAPSHOT

- TABLE 87 EUROPE: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 88 EUROPE: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 89 EUROPE: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 90 EUROPE: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 91 EUROPE: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 92 EUROPE: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- TABLE 93 EUROPE: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 94 EUROPE: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019-2027 (USD MILLION)

- 13.3.1 GERMANY

- 13.3.1.1 Inclination toward healthy foods to increase demand for snacks

- FIGURE 51 ALMOND IMPORTS IN GERMANY, 2016-2020 (METRIC TONS)

- TABLE 95 GERMANY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 96 GERMANY: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.2 SPAIN

- 13.3.2.1 Spanish confectionery and snack industries use various nut products

- TABLE 97 SPAIN: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 98 SPAIN: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.3 FRANCE

- 13.3.3.1 Investor-friendly policies and free-trade agreements to drive market

- TABLE 99 FRANCE: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 100 FRANCE: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.4 ITALY

- 13.3.4.1 Rising demand for Italian cuisines to drive market

- TABLE 101 ITALY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 102 ITALY: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.5 BELGIUM

- 13.3.5.1 Huge demand from consumers for chocolates creates growth opportunities for nut product manufacturers

- TABLE 103 BELGIUM: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 104 BELGIUM: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.6 UK

- 13.3.6.1 Increasing preference for functional foods to boost market

- TABLE 105 UK: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 106 UK: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.7 TURKEY

- 13.3.7.1 Increase in hazelnut exports to cater to different food industries

- FIGURE 52 WORLD HAZELNUT EXPORTS, 2020 (SHELLED)

- TABLE 107 TURKEY: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 108 TURKEY: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.3.8 REST OF EUROPE

- 13.3.8.1 Rising health concerns and increase in vegan population to drive market

- TABLE 109 REST OF EUROPE: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 110 REST OF EUROPE: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- TABLE 111 ASIA PACIFIC: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 112 ASIA PACIFIC: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 113 ASIA PACIFIC: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 114 ASIA PACIFIC: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 115 ASIA PACIFIC: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 116 ASIA PACIFIC: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- TABLE 117 ASIA PACIFIC: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 118 ASIA PACIFIC: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019-2027 (USD MILLION)

- 13.4.1 CHINA

- 13.4.1.1 Increasing shift to premium food products to boost market

- TABLE 119 CHINA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 120 CHINA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4.2 INDIA

- 13.4.2.1 Increasing demand for plant-based foods leading to nut products market growth

- TABLE 121 INDIA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 122 INDIA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4.3 JAPAN

- 13.4.3.1 Growth in "guilt-free" food to pave way for nut products

- TABLE 123 JAPAN: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 124 JAPAN: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Imported nuts account for over 90% of tree nut consumption

- FIGURE 53 MARKET SHARE OF NUT TYPES IN SOUTH KOREA, 2019

- TABLE 125 SOUTH KOREA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 126 SOUTH KOREA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4.5 AUSTRALIA & NEW ZEALAND

- 13.4.5.1 Urge to consume healthy food products to drive market

- TABLE 127 AUSTRALIA & NEW ZEALAND: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 128 AUSTRALIA & NEW ZEALAND: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.4.6 REST OF ASIA PACIFIC

- 13.4.6.1 Increasing demand for high-value products to lead to market growth

- TABLE 129 REST OF ASIA PACIFIC: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 130 REST OF ASIA PACIFIC: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.5 SOUTH AMERICA

- FIGURE 54 BRAZIL NUT PRODUCTION, 2021-2022 (KERNEL BASIS)

- TABLE 131 SOUTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

- TABLE 132 SOUTH AMERICA: NUT PRODUCTS MARKET, BY COUNTRY, 2019-2027 (KT)

- TABLE 133 SOUTH AMERICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 134 SOUTH AMERICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 135 SOUTH AMERICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 136 SOUTH AMERICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- TABLE 137 SOUTH AMERICA: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 138 SOUTH AMERICA: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019-2027 (USD MILLION)

- 13.5.1 BRAZIL

- 13.5.1.1 Brazil nuts have high demand due to their nutritional content

- TABLE 139 BRAZIL: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 140 BRAZIL: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.5.2 ARGENTINA

- 13.5.2.1 Rising health-related problems to drive market growth

- TABLE 141 ARGENTINA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 142 ARGENTINA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.3.1 Entry of new market players to boost market growth

- TABLE 143 REST OF SOUTH AMERICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 144 REST OF SOUTH AMERICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.6 REST OF THE WORLD

- TABLE 145 REST OF THE WORLD: NUT PRODUCTS MARKET, BY COUNTRY/REGION, 2019-2027 (USD MILLION)

- TABLE 146 REST OF THE WORLD: NUT PRODUCTS MARKET, BY COUNTRY/REGION, 2019-2027 (KT)

- TABLE 147 REST OF THE WORLD: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

- TABLE 148 REST OF THE WORLD: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 149 REST OF THE WORLD: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- TABLE 150 REST OF THE WORLD: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (KT)

- TABLE 151 REST OF THE WORLD: NUT PRODUCTS MARKET FOR INDUSTRIAL FOOD MANUFACTURERS, BY APPLICATION, 2019-2027 (USD MILLION)

- TABLE 152 REST OF THE WORLD: NUT PRODUCTS MARKET FOR FOODSERVICE & BAKERIES, BY APPLICATION, 2019-2027 (USD MILLION)

- 13.6.1 SOUTH AFRICA

- 13.6.1.1 Key players expanding their business in South Africa

- TABLE 153 SOUTH AFRICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 154 SOUTH AFRICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.6.2 MIDDLE EAST

- 13.6.2.1 High consumption of traditional flavors to drive demand for nut products

- TABLE 155 MIDDLE EAST: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 156 MIDDLE EAST: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

- 13.6.3 OTHER COUNTRIES IN AFRICA

- 13.6.3.1 Commodities are grown in line with ongoing trend of healthy food consumption

- TABLE 157 OTHER COUNTRIES IN AFRICA: NUT PRODUCTS MARKET, BY PRODUCT TYPE, 2019-2027 (KT)

- TABLE 158 OTHER COUNTRIES IN AFRICA: NUT PRODUCTS MARKET, BY NUT TYPE, 2019-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 MARKET SHARE ANALYSIS, 2021

- TABLE 159 NUT PRODUCTS MARKET: DEGREE OF COMPETITION

- 14.3 KEY PLAYER STRATEGIES

- 14.4 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 55 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN NUT PRODUCTS MARKET, 2019-2021 (USD BILLION)

- 14.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 56 NUT PRODUCTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 14.6 PRODUCT TYPE FOOTPRINT

- TABLE 160 COMPANY, BY PRODUCT TYPE FOOTPRINT

- TABLE 161 COMPANY PRODUCT FOOTPRINT, BY APPLICATION

- TABLE 162 COMPANY, BY REGIONAL FOOTPRINT

- TABLE 163 COMPANY PRODUCT FOOTPRINT: OVERALL FOOTPRINT

- 14.7 START-UP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 STARTING BLOCKS

- 14.7.3 RESPONSIVE COMPANIES

- 14.7.4 DYNAMIC COMPANIES

- TABLE 164 NUT PRODUCTS: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- FIGURE 57 NUT PRODUCTS MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 NEW PRODUCT LAUNCHES

- TABLE 165 NUT PRODUCTS MARKET: NEW PRODUCT LAUNCHES, 2018-2022

- 14.8.2 DEALS

- TABLE 166 NUT PRODUCTS MARKET: DEALS, 2018-2022

- 14.8.3 OTHERS

- TABLE 167 NUT PRODUCTS MARKET: EXPANSIONS, 2019 - 2022

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- (Business Overview, Products offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 15.1.1 OLAM INTERNATIONAL

- TABLE 168 OLAM INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 58 OLAM INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 169 OLAM INTERNATIONAL: PRODUCTS OFFERED

- 15.1.2 BARRY CALLEBAUT

- TABLE 170 BARRY CALLEBAUT: BUSINESS OVERVIEW

- FIGURE 59 BARRY CALLEBAUT: COMPANY SNAPSHOT

- TABLE 171 BARRY CALLEBAUT: PRODUCTS OFFERED

- 15.1.3 BLUE DIAMOND GROWERS

- TABLE 172 BLUE DIAMOND GROWERS: BUSINESS OVERVIEW

- FIGURE 60 BLUE DIAMOND GROWERS: COMPANY SNAPSHOT

- TABLE 173 BLUE DIAMOND GROWERS: PRODUCTS OFFERED

- 15.1.4 SUCREST GMBH (SUBSIDIARY OF KERRY GROUP)

- TABLE 174 SUCREST GMBH: BUSINESS OVERVIEW

- FIGURE 61 KERRY GROUP: COMPANY SNAPSHOT

- TABLE 175 KERRY GROUP: PRODUCTS OFFERED

- 15.1.5 ZENTIS GMBH & CO. KG

- TABLE 176 ZENTIS GMBH & CO. KG: BUSINESS OVERVIEW

- FIGURE 62 ZENTIS GMBH & CO. KG: COMPANY SNAPSHOT

- TABLE 177 ZENTIS GMBH & CO. KG: PRODUCTS OFFERED

- 15.1.6 MOUNT FRANKLIN FOODS

- TABLE 178 MOUNT FRANKLIN FOODS: BUSINESS OVERVIEW

- TABLE 179 MOUNT FRANKLIN FOODS: PRODUCTS OFFERED

- 15.1.7 MANDELIN, INC

- TABLE 180 MANDELIN, INC: BUSINESS OVERVIEW

- TABLE 181 MANDELIN, INC: PRODUCTS OFFERED

- 15.1.8 BAZZINI

- TABLE 182 BAZZINI: BUSINESS OVERVIEW

- TABLE 183 BAZZINI: PRODUCTS OFFERED

- 15.1.9 BESANA

- TABLE 184 BESANA: BUSINESS OVERVIEW

- TABLE 185 BESANA: PRODUCTS OFFERED

- 15.1.10 LUBECA

- TABLE 186 LUBECA: BUSINESS OVERVIEW

- TABLE 187 LUBECA: PRODUCTS OFFERED

- 15.1.11 PURATOS

- TABLE 188 PURATOS: BUSINESS OVERVIEW

- TABLE 189 PURATOS: PRODUCTS OFFERED

- 15.1.12 GEORG LEMKE GMBH & CO. KG

- TABLE 190 GEORG LEMKE GMBH & CO. KG: BUSINESS OVERVIEW

- TABLE 191 GEORG LEMKE GMBH & CO. KG: PRODUCTS OFFERED

- 15.1.13 ALMENDRAS LLOPIS S.A.U.

- TABLE 192 ALMENDRAS LLOPIS S.A.U.: BUSINESS OVERVIEW

- TABLE 193 ALMENDRAS LLOPIS S.A.U.: PRODUCTS OFFERED

- 15.1.14 KANEGRADE

- TABLE 194 KANEGRADE: BUSINESS OVERVIEW

- TABLE 195 KANEGRADE: PRODUCTS OFFERED

- 15.1.15 MOLL MARZIPAN GMBH

- TABLE 196 MOLL MARZIPAN GMBH: BUSINESS OVERVIEW

- TABLE 197 MOLL MARZIPAN GMBH: PRODUCTS OFFERED

- 15.1.16 KONDIMA

- 15.1.17 CSM

- 15.1.18 TREEHOUSE ALMONDS

- 15.1.19 ROYAL NUT COMPANY

- TABLE 198 ROYAL NUT COMPANY: BUSINESS OVERVIEW

- 15.1.20 STELLIFERI & ITAVEX S.P.A (ACQUIRER: FERRERO INTERNATIONAL SA)

- *Details on Business Overview, Products offered, Recent Developments, MnM view, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- TABLE 199 ADJACENT MARKETS TO NUT PRODUCTS MARKET

- 16.2 LIMITATIONS

- 16.3 ALMOND INGREDIENTS MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- TABLE 200 ALMOND INGREDIENTS MARKET, BY TYPE, 2018-2025 (USD MILLION)

- 16.4 BAKING INGREDIENTS MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

- TABLE 201 BAKING INGREDIENTS MARKET, BY APPLICATION, 2019-2026 (USD MILLION)

- 16.5 NUT INGREDIENTS MARKET

- 16.5.1 MARKET DEFINITION

- 16.5.2 MARKET OVERVIEW

- TABLE 202 NUT INGREDIENTS MARKET, BY FORM, 2012-2019 (MILLION)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS