|

|

市場調査レポート

商品コード

1223943

自動車用ステアリングシステムの世界市場:技術・EPSの種類別・ピニオン別・メカニズム別・コンポーネント別 ・車種別・地域別の将来予測 (2027年まで)Automotive Steering System Market by Technology (HPS, EHPS, EPS), EPS Type (R-EPS, C-EPS, P-EPS), Pinion (Single, Dual), Mechanism (Collapsible, Rigid), Components (OE, Aftermarket), Vehicle (PC, LCV, HCV, EV, OHV) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用ステアリングシステムの世界市場:技術・EPSの種類別・ピニオン別・メカニズム別・コンポーネント別 ・車種別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月14日

発行: MarketsandMarkets

ページ情報: 英文 292 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用ステアリングシステムの市場規模は、2022年の353億米ドルから2027年には395億米ドルへと、予測期間中に2.3%のCAGRで成長すると予測されています。

電気自動車 (EV) の採用拡大や乗用車の普及、自動車生産台数の全体的な増加などが、今後数年間、ステアリングシステム、特にEPS (電動パワーステアリング) システムの需要に拍車をかけると思われます。また、自律走行車の進化もステアリング・バイ・ワイヤ・システムの需要を押し上げると予想されます。

欧州の自動車生産台数は17.1%で、アジア太平洋に次いで2番目に大きな市場シェアを有しています。同地域では、乗用車へのEPSの導入が飽和状態に達する一方、LCVやHCVへのEPS採用が進み、先進ステアリングシステムの需要がさらに高まると予想されます。

当レポートでは、世界の自動車用ステアリングシステムの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、セグメント別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 貿易分析

- ポーターのファイブフォース分析

- 景気後退の経済への影響

- 自動車セクターへの景気後退の影響

- バリューチェーン:自動車用ステアリングシステム市場

- サプライチェーン分析

- 自動車用ステアリングシステム市場のエコシステム

- 自動車用ステアリングシステム市場のエコシステムにおける企業の役割

- 平均販売価格の傾向

- 特許分析

- 自動車ステアリングシステムメーカーの収益シフト

- 技術分析

- ケーススタディ分析

- 主な会議とイベント (2023年)

第6章 MarketsandMarketsの提言

第7章 自動車用ステアリングシステム市場:技術別

- イントロダクション

- 油圧パワーステアリング (HPS)

- 電動アシスト油圧パワーステアリング (EHPS)

- 電動パワーステアリング (EPS)

第8章 自動車用ステアリングシステム市場:車種別

- イントロダクション

- 乗用車

- 小型商用車 (LCV)

- 大型商用車 (HCV)

第9章 オフハイウェイ車 (OHV) 用ステアリングシステム市場:装置の種類別

- イントロダクション

- 農業用トラクター

- 建設機械

第10章 自動車用ステアリングシステム市場:コンポーネント別

- イントロダクション

- 油圧ポンプ

- ステアリングコラム

- ステアリング角度センサー

- トルクセンサー

- 電子制御ユニット

- 電気モーター

- 機械式ラック&ピニオン

- ベアリング

第11章 電動パワーステアリング (EPS) 市場:種類別

- イントロダクション

- コラムEPS (C-EPS)

- ピニオンEPS (P-EPS)

- ラックEPS (R-EPS)

第12章 電動パワーステアリング市場:電気自動車 (EV) の種類別

- イントロダクション

- アジア太平洋地域

- 欧州

- 北米

- バッテリー式電気自動車 (BEV)

- プラグインハイブリッド車 (PHEV)

- 燃料電池車 (FCEV)

第13章 自動車用ステアリングシステム市場:電気モーターの種類別

- イントロダクション

- ブラシ付きDCモーター

- ブラシレスDCモーター

第14章 自動車用ステアリングシステム市場:メカニズム別

- イントロダクション

- 衝撃吸収型 (コラプス) EPS

- 衝撃耐久型 (リジッド) EPS

第15章 自動車用ステアリングシステム市場:ピニオンの種類別

- イントロダクション

- シングルピニオン

- デュアルピニオン

第16章 自動車用ステアリングシステムのアフターマーケット:コンポーネント別

- イントロダクション

- 油圧ポンプ

- ステアリングコラム

- 電気モーター

第17章 自動車用ステアリングシステム市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- トルコ

- 北米

- 米国

- カナダ

- メキシコ

- 他の国々 (RoW)

- ブラジル

- ロシア

- 南アフリカ

第18章 競合情勢

- 概要

- 自動車用ステアリングシステムの市場シェア分析 (2021年)

- ステアリングシステム・コンポーネントの市場シェア分析

- 自動車用ステアリングシステムの市場シェア分析 (2021年)

- ステアリングコラム/シャフト

- ステアリングナックル

- ステアリングホイール

- 企業評価クアドラント

- 競合シナリオ

- 新製品の発売

- 資本取引

- その他の動向 (2019年~2022年)

- 有力企業

- 競合ベンチマーキング

第19章 企業プロファイル

- 主要企業

- JTEKT CORPORATION

- NEXTEER AUTOMOTIVE

- ZF FRIEDRICHSHAFEN AG

- ROBERT BOSCH

- NSK LTD.

- HYUNDAI MOBIS

- HITACHI ASTEMO

- THYSSENKRUPP

- MITSUBISHI ELECTRIC

- KYB CORPORATION

- MANDO CORPORATION

- HYCET TECHNOLOGY CO., LTD.

- その他の企業

- MAVAL INDUSTRIES

- TENNECO

- GSS STEERING SYSTEMS LLC

- HELLA GMBH & CO. KGAA

- YUBEI POWER STEERING SYSTEM CO., LTD.

- HUHEI HENGLONG AUTO SYSTEM GROUP

- BORGWARNER

- DENSO CORPORATION

第20章 付録

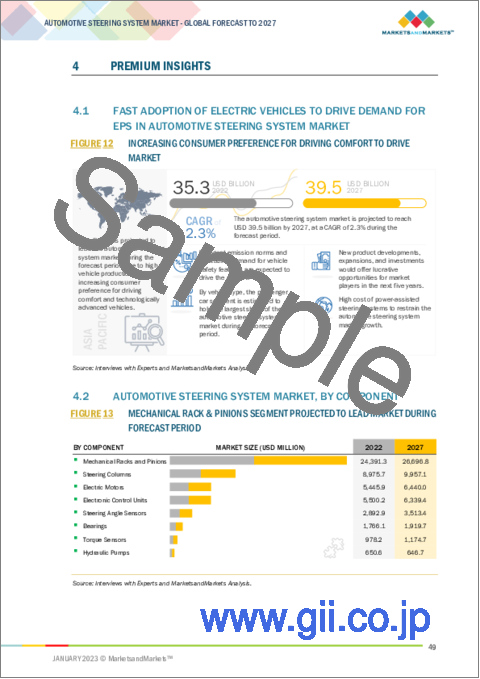

The Automotive Steering System market is projected to grow from USD 35.3 Billion in 2022 to USD 39.5 Billion by 2027, at a CAGR of 2.3% over the forecast period.

Growing adoption of EVs, penetration of passenger cars, and an overall increase in vehicle production would fuel the demand for steering systems, especially EPS systems, in the coming years. Also, advancements in autonomous vehicles is expected to drive the demand for Steer-by-Wire Systems.

BEVs hold the largest share of the electric vehicle steering systems market.

With growing investments in EV infrastructure and government subsidies, the demand for EVs is growing. EV sales have increased by almost 100% from 2020 to 2021, reaching 6.6 million units worldwide, which are expected to grow by ~71% in 2023. BEVs contribute to the largest, ~70%, of all EV types. All the BEVs, including commercial trucks and buses, are equipped with EPS as it is easier to draw the required power from the enormous battery packs of EVs. The BEV sales are expected to grow at a CAGR of ~23% from 2022 to 2027, and the demand for steering systems, especially EPS, would grow. As a result of this gain in market share by EVs, the demand for Hydraulic Power Steering (HPS) is decreasing. Owing to the faster adoption of EVs, where the BEVs dominate the market, BEVs are expected to be the largest market segment by EV type for the automotive steering system market.

Europe is the second largest market for the automotive steering system market

Europe holds the second largest market share in vehicle production at 17.1% after Asia Pacific. Luxury vehicles and SUVs are in high demand in this region. The SUV market is expected to grow by CAGR of 4.7% in the region. Amongst vehicle segments, Multi-purpose Vehicles (MPVs) are in higher share in this region than other regions, with ~9% growth expected for this vehicle segment. Luxury vehicles in the region are expected to have growth rates ranging from 8% to 14%. This increase in demand for luxury vehicles will drive the demand for EPS and advanced features such as ADAS-integrated EPS. Commercial vehicle OEMs such as Scania, Volvo, and MAN have introduced Electrically assisted Hydraulic Power Steering (EHPS) in heavy trucks and buses. These OEMs are also, to course, to launch hybrid and all-electric trucks and buses, for example, the Volvo FH, FM, and FMX series, with which the demand for EPS in the commercial vehicle segment will increase. The European market has reached saturation for EPS adoption in the passenger cars segment. The region has moved to adopt EPS in LCVs and HCVs, which will further boost the demand for advanced steering systems in the region.

The breakup of primary respondents

- By Stakeholders: Demand Side - 20%, Supply Side - 80%

- By Designation: Directors/VPs Level - 30%, C level executives - 10%, Others - 60%

- By Region: Asia Oceania - 60%, Europe - 20%, North America - 20%

The Automotive Steering System Market is consolidated, with the presence of five major players JTEKT Corporation (Japan), Nexteer (US), Robert Bosch (Germany), Hyundai Mobis (South Korea), and NSK Ltd. (Japan). The study includes an in-depth competitive analysis of these key players in the automotive steering system market with their company profiles, MnM view of the top five companies, recent developments, and key market strategies.

Research Coverage

The study's primary objective is to define, describe, and forecast the automotive steering system market by value and volume. The study segments the automotive steering system market Component (Steering Columns, Sensors, Steering Gears, Mechanical Rack & Pinions, Electronic Control Units, Electric Motors, Bearings, & Hydraulic Pumps), Electric motor type (Brushed DC motor, & Brushless DC motor), Application (Passenger Cars, Light Commercial Vehicles & Heavy Commercial Vehicles), EPS Type (C-EPS, P-EPS, & R-EPS), EPS Mechanism (Collapsible-EPS, & Rigid-EPS), Pinion type (Single Pinion & Double Pinion), By Technology (Hydraulic Power Steering (HPS), Electrically Assisted Hydraulic Power Steering (E-HPS), & Electric Power Steering (EPS)), Aftermarket, By Component (Hydraulic Pumps, Steering Columns, & Electric Motors), Electric vehicle type (BEV, PHEV, & FCEV), Off-highway vehicle (Agricultural Equipment, & Construction Equipment), By Region - Asia Pacific (China, India, Japan, & South Korea), Europe (Germany, UK, France, Spain, Italy, Russia), North America (US, Canada, and Mexico), and the Rest of the World (Brazil, South Africa).

Key Benefits of Buying the Report:

The report will help the market leaders with information on the closest approximations of the revenue numbers for the Automotive Steering System Market and the sub-segments. The study will also help the key players identify the highest potential region and design its product portfolio per market requirements. Detailed research on different Automotive Steering System types and their application is expected to help manufacturers to understand the potential market for these equipment types and which technologies are predominant in the respective equipment. This report includes various analyses like supply chain, average selling price analysis, patent analysis, revenue shift analysis, case study analysis, and porter's analysis. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION: AUTOMOTIVE STEERING SYSTEM MARKET

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 SUMMARY OF CHANGES

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE STEERING SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.2 SECONDARY DATA

- 2.2.1 LIST OF KEY SECONDARY SOURCES

- 2.2.1.1 List of key secondary sources to estimate vehicle production

- 2.2.1.2 List of key secondary sources to estimate automotive steering system market

- 2.2.2 KEY DATA FROM SECONDARY SOURCES

- 2.2.1 LIST OF KEY SECONDARY SOURCES

- 2.3 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.3.1 LIST OF PRIMARY PARTICIPANTS

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 6 AUTOMOTIVE STEERING SYSTEM MARKET: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 AUTOMOTIVE STEERING SYSTEM MARKET BY TYPE: TOP-DOWN APPROACH

- FIGURE 8 AUTOMOTIVE STEERING SYSTEM MARKET: RESEARCH DESIGN AND METHODOLOGY

- 2.4.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.4.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 DATA TRIANGULATION

- FIGURE 9 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 PRE- & POST-RECESSION SCENARIO: AUTOMOTIVE STEERING SYSTEM MARKET, 2018-2027 (USD MILLION)

- 3.1 REPORT SUMMARY

- FIGURE 11 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 FAST ADOPTION OF ELECTRIC VEHICLES TO DRIVE DEMAND FOR EPS IN AUTOMOTIVE STEERING SYSTEM MARKET

- FIGURE 12 INCREASING CONSUMER PREFERENCE FOR DRIVING COMFORT TO DRIVE MARKET

- 4.2 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT

- FIGURE 13 MECHANICAL RACK & PINIONS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY

- FIGURE 14 EPS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.4 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE

- FIGURE 15 PASSENGER CARS TO SHOWCASE LARGEST DEMAND FOR STEERING SYSTEMS OVER NEXT FIVE YEARS

- 4.5 AUTOMOTIVE STEERING SYSTEM MARKET, BY TYPE

- FIGURE 16 C-EPS SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT

- FIGURE 17 ELECTRIC MOTORS SEGMENT TO LEAD AUTOMOTIVE STEERING SYSTEM AFTERMARKET DURING FORECAST PERIOD

- 4.7 AUTOMOTIVE STEERING SYSTEM MARKET, BY MOTOR TYPE

- FIGURE 18 BRUSHLESS DC MOTOR OFFERS SIGNIFICANTLY HIGHER EFFICIENCY AND BETTER PERFORMANCE THAN BRUSHED DC MOTOR

- 4.8 AUTOMOTIVE STEERING SYSTEM MARKET, BY MECHANISM

- FIGURE 19 INCREASING FOCUS ON DRIVER SAFETY LEADS TO INCREASED DEMAND FOR COLLAPSIBLE EPS

- 4.9 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE

- FIGURE 20 DUAL PINION STEERING SYSTEMS OFFER OPTIMIZED DRIVING EXPERIENCE AND DESIGN FLEXIBILITY

- 4.10 AUTOMOTIVE STEERING SYSTEM MARKET, BY EV TYPE

- FIGURE 21 INCREASING EV SALES TO DRIVE DEMAND FOR EPS BY EV TYPE

- 4.11 AUTOMOTIVE STEERING SYSTEM MARKET, BY OFF-HIGHWAY

- FIGURE 22 HYDRAULIC STEERING INCREASES FUEL EFFICIENCY IN OFF-HIGHWAY SEGMENT

- 4.12 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION

- FIGURE 23 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 AUTOMOTIVE STEERING SYSTEM MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent fuel emission norms and demand for lightweight systems

- FIGURE 25 GLOBAL EMISSION REGULATIONS FOR LIGHT DUTY VEHICLES, BY COUNTRY, 2014-2025

- 5.2.1.2 Increasing demand for driving comfort in commercial vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited load-bearing capacity of EPS systems

- TABLE 1 STEERING RACK FORCE LIMIT, BY PASSENGER CAR SEGMENT

- 5.2.2.2 Lack of electrically assisted power steering for construction and mining equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of steer-by-wire technology

- FIGURE 26 ILLUSTRATIVE MODEL OF STEER-BY-WIRE TECHNOLOGY

- FIGURE 27 PROS AND CONS OF STEER-BY-WIRE SYSTEMS

- 5.2.3.2 Integrating EPS with ADAS

- 5.2.4 CHALLENGES

- 5.2.4.1 Cybersecurity concerns in EPS for connected cars

- 5.2.4.2 Low customer confidence in adopting steer-by-wire technology for autonomous mobility

- 5.3 TRADE ANALYSIS

- 5.3.1 IMPORT DATA

- 5.3.1.1 US

- TABLE 2 US: IMPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.1.2 Germany

- TABLE 3 GERMANY: IMPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.1.3 Mexico

- TABLE 4 MEXICO: IMPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.1.4 UK

- TABLE 5 UK: IMPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.1.5 China

- TABLE 6 CHINA: IMPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.2 EXPORT DATA

- 5.3.2.1 UK

- TABLE 7 UK: EXPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.2.2 China

- TABLE 8 CHINA: EXPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.2.3 Canada

- TABLE 9 CANADA: EXPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.2.4 US

- TABLE 10 US: EXPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.2.5 Germany

- TABLE 11 GERMANY: EXPORT SHARE, BY COUNTRY, VALUE (%)

- 5.3.1 IMPORT DATA

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS: PRESENCE OF ESTABLISHED GLOBAL PLAYERS INCREASES DEGREE OF COMPETITION

- 5.4.1 THREAT OF SUBSTITUTES

- 5.4.2 THREAT OF NEW ENTRANTS

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4.6 PORTER'S FIVE FORCES ANALYSIS

- 5.5 RECESSION IMPACT ON ECONOMY

- 5.5.1 INTRODUCTION

- 5.5.2 REGIONAL MACRO-ECONOMIC OVERVIEW

- 5.5.3 ANALYSIS OF KEY ECONOMIC INDICATORS

- TABLE 12 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021-2022

- 5.5.4 ECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION

- 5.5.4.1 Europe

- TABLE 13 EUROPE: KEY ECONOMIC INDICATORS, 2021-2023

- 5.5.4.2 Asia Pacific

- TABLE 14 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021-2023

- 5.5.4.3 Americas

- TABLE 15 AMERICAS: KEY ECONOMIC INDICATORS, 2021-2023

- 5.5.5 ECONOMIC OUTLOOK/PROJECTIONS

- TABLE 16 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024-2027 (% GROWTH)

- 5.6 RECESSION IMPACT ON AUTOMOTIVE SECTOR

- 5.6.1 ANALYSIS OF AUTOMOTIVE VEHICLE SALES

- 5.6.1.1 Europe

- FIGURE 29 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022 (UNITS)

- 5.6.1.2 Asia Pacific

- FIGURE 30 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022 (UNITS)

- 5.6.1.3 Americas

- FIGURE 31 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021-2022 (UNITS)

- 5.6.2 AUTOMOTIVE SALES OUTLOOK

- FIGURE 32 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 ('000 UNITS)

- FIGURE 33 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 ('000 UNITS)

- FIGURE 34 NORTH AMERICA: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2027 ('000 UNITS)

- 5.6.1 ANALYSIS OF AUTOMOTIVE VEHICLE SALES

- 5.7 VALUE CHAIN: AUTOMOTIVE STEERING SYSTEM MARKET

- FIGURE 35 VALUE CHAIN: AUTOMOTIVE STEERING SYSTEM MARKET

- 5.8 SUPPLY CHAIN ANALYSIS

- 5.9 AUTOMOTIVE STEERING SYSTEM MARKET ECOSYSTEM

- FIGURE 36 AUTOMOTIVE STEERING SYSTEM MARKET: ECOSYSTEM

- 5.10 ROLE OF COMPANIES IN AUTOMOTIVE STEERING SYSTEM MARKET ECOSYSTEM

- 5.10.1 AUTOMOTIVE STEERING SYSTEM MARKET: SUPPLY CHAIN

- 5.11 AVERAGE SELLING PRICE TREND

- TABLE 17 AVERAGE REGIONAL PRICE TREND: AUTOMOTIVE STEERING SYSTEM MARKET (USD/UNIT), 2022

- TABLE 18 AVERAGE GLOBAL PRICE TREND: AUTOMOTIVE STEERING SYSTEM MARKET, BY TYPE (USD/UNIT), 2022

- 5.12 PATENT ANALYSIS

- 5.12.1 APPLICATIONS AND PATENTS GRANTED, 2019-2022

- 5.13 REVENUE SHIFT FOR AUTOMOTIVE STEERING SYSTEM MANUFACTURERS

- FIGURE 37 SHIFT OF FOCUS TOWARD ELECTRICALLY ASSISTED STEERING SYSTEMS

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 STOWABLE COLUMNS FOR AUTOMATED DRIVING AND ADDITIONAL COMFORT

- 5.14.2 NEW STEERING TECHNOLOGY PROVIDING INTUITIVE DRIVING

- 5.14.3 ADVANCED STEERING TECHNOLOGIES FOR SOFTWARE-DEFINED VEHICLES

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 FUTURE-PROOFING VEHICLE STEERING SYSTEMS

- 5.15.2 PREDICT IN-VEHICLE E-POWER STEERING SOUND & VIBRATION PERFORMANCE

- 5.16 KEY CONFERENCES AND EVENTS IN 2023

- 5.16.1 BUYING CRITERIA

- FIGURE 38 KEY BUYING CRITERIA FOR DIFFERENT STEERING SYSTEM TECHNOLOGIES

- TABLE 19 KEY BUYING CRITERIA FOR STEERING SYSTEM TECHNOLOGIES

- 5.16.2 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR AUTOMOTIVE STEERING SYSTEM TECHNOLOGIES (%)

6 RECOMMENDATIONS BY MARKETSANDMARKETS

- 6.1 ASIA PACIFIC TO BE KEY MARKET FOR AUTOMOTIVE STEERING SYSTEMS

- 6.2 ELECTRICALLY ASSISTED POWER STEERING FOR HEAVY COMMERCIAL VEHICLES - KEY FOCUS AREA

- 6.3 CONCLUSION

7 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS

- FIGURE 39 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- TABLE 21 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 22 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 23 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 24 AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

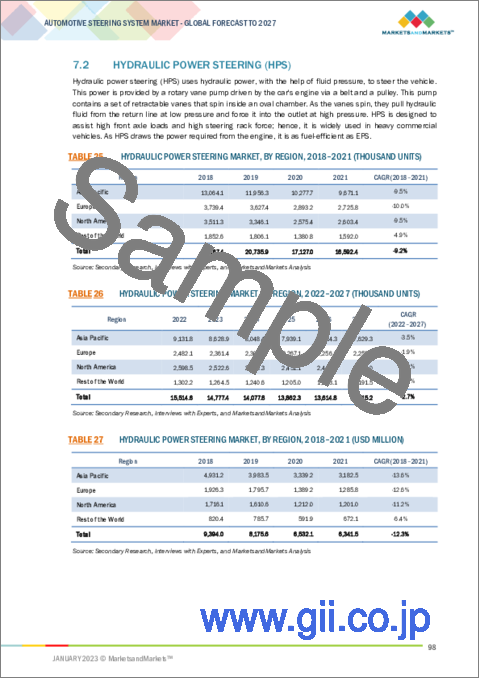

- 7.2 HYDRAULIC POWER STEERING (HPS)

- TABLE 25 HYDRAULIC POWER STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 26 HYDRAULIC POWER STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 27 HYDRAULIC POWER STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 HYDRAULIC POWER STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING (EHPS)

- TABLE 29 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 30 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 31 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 ELECTRICALLY ASSISTED HYDRAULIC POWER STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 ELECTRIC POWER STEERING (EPS)

- TABLE 33 ELECTRIC POWER STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 34 ELECTRIC POWER STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 35 ELECTRIC POWER STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 ELECTRIC POWER STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

8 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 INDUSTRY INSIGHTS

- 8.1.3 ASSUMPTIONS

- FIGURE 40 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 37 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 38 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 39 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 40 AUTOMOTIVE STEERING SYSTEM MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 8.2 PASSENGER CARS

- TABLE 41 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 42 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 43 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 PASSENGER CARS STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 LIGHT COMMERCIAL VEHICLES (LCVS)

- TABLE 45 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 46 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 47 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 LIGHT COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 HEAVY COMMERCIAL VEHICLES (HCVS)

- TABLE 49 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 50 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 51 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 52 HEAVY COMMERCIAL VEHICLES STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

9 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE

- Note - The chapter is further segmented by technology type. Technology considered are Manual Steering and HPS.

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 PRIMARY INDUSTRY INSIGHTS

- 9.1.3 ASSUMPTIONS

- FIGURE 41 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 53 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 54 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 55 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2018-2021 (USD MILLION)

- TABLE 56 OFF-HIGHWAY STEERING SYSTEM MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 9.2 AGRICULTURAL TRACTORS

- TABLE 57 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 58 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 59 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 60 AGRICULTURAL TRACTORS: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 9.3 CONSTRUCTION EQUIPMENT

- TABLE 61 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 62 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 63 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 64 CONSTRUCTION EQUIPMENT: STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

10 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS

- FIGURE 42 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- TABLE 65 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT, 2018-2021 (THOUSAND UNITS)

- TABLE 66 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT, 2022-2027 (THOUSAND UNITS)

- TABLE 67 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 68 AUTOMOTIVE STEERING SYSTEM MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 10.2 HYDRAULIC PUMPS

- 10.2.1 HYDRAULIC PUMPS TO WITNESS DECLINING DEMAND OWING TO WIDER EPS ADOPTION

- TABLE 69 HYDRAULIC PUMPS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 70 HYDRAULIC PUMPS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 71 HYDRAULIC PUMPS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 HYDRAULIC PUMPS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 STEERING COLUMNS

- 10.3.1 ASIA PACIFIC TO BE LARGEST MARKET DUE TO INCREASED POWER STEERING ADOPTION

- TABLE 73 STEERING COLUMNS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 74 STEERING COLUMNS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 75 STEERING COLUMNS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 STEERING COLUMNS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 STEERING ANGLE SENSORS

- 10.4.1 GROWING ADOPTION OF EHPS AND EPS TO DRIVE STEERING ANGLE SENSOR DEMAND

- TABLE 77 STEERING ANGLE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 78 STEERING ANGLE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 79 STEERING ANGLE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 STEERING ANGLE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 TORQUE SENSORS

- 10.5.1 GROWING PREMIUM VEHICLE SEGMENT TO DRIVE TORQUE SENSOR DEMAND

- TABLE 81 TORQUE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 82 TORQUE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 83 TORQUE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 84 TORQUE SENSORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 ELECTRONIC CONTROL UNITS

- 10.6.1 RAPID ADOPTION OF ELECTRIC POWER STEERING TO DRIVE DEMAND FOR ELECTRONIC CONTROL UNITS

- TABLE 85 ELECTRONIC CONTROL UNITS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 86 ELECTRONIC CONTROL UNITS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 87 ELECTRONIC CONTROL UNITS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 ELECTRONIC CONTROL UNITS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 ELECTRIC MOTORS

- 10.7.1 ELECTRIFICATION OF STEERING SYSTEMS TO DRIVE DEMAND FOR ELECTRIC MOTORS

- TABLE 89 ELECTRIC MOTORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 90 ELECTRIC MOTORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 91 ELECTRIC MOTORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 92 ELECTRIC MOTORS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 MECHANICAL RACKS AND PINIONS

- 10.8.1 EUROPE TO BE SECOND-LARGEST MARKET FOR STEERING RACK AND PINION ASSEMBLY

- TABLE 93 MECHANICAL RACKS AND PINIONS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 94 MECHANICAL RACKS AND PINIONS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 95 MECHANICAL RACKS AND PINIONS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 MECHANICAL RACKS AND PINIONS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.9 BEARINGS

- 10.9.1 DEMAND FOR BEARINGS TO BE HIGHEST IN ASIA PACIFIC

- TABLE 97 BEARINGS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 98 BEARINGS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 99 BEARINGS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 BEARINGS: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

11 ELECTRIC POWER STEERING MARKET, BY TYPE

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 11.1 INTRODUCTION

- 11.1.1 RESEARCH METHODOLOGY

- 11.1.2 ASSUMPTIONS

- 11.1.3 INDUSTRY INSIGHTS

- FIGURE 43 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 101 ELECTRIC POWER STEERING MARKET, BY TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 102 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 103 ELECTRIC POWER STEERING MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 104 ELECTRIC POWER STEERING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2 COLUMN-EPS (C-EPS)

- TABLE 105 COLUMN-EPS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 106 COLUMN-EPS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 107 COLUMN-EPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 108 COLUMN-EPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 PINION-EPS (P-EPS)

- TABLE 109 PINION-EPS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 110 PINION-EPS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 111 PINION-EPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 112 PINION-EPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 RACK-EPS (R-EPS)

- TABLE 113 RACK-EPS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 114 RACK-EPS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 115 RACK-EPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 116 RACK-EPS MARKET, BY REGION, 2022-2027 (USD MILLION)

12 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 12.1 INTRODUCTION

- 12.1.1 RESEARCH METHODOLOGY

- 12.1.2 PRIMARY INDUSTRY INSIGHTS

- 12.1.3 ASSUMPTIONS

- 12.2 ASIA PACIFIC

- 12.3 EUROPE

- 12.4 NORTH AMERICA

- FIGURE 44 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 117 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 118 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 119 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 120 ELECTRIC POWER STEERING MARKET, BY ELECTRIC VEHICLE TYPE, 2022-2027 (USD MILLION)

- 12.5 BATTERY ELECTRIC VEHICLE (BEV)

- TABLE 121 BEV STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 122 BEV STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 123 BEV STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 124 BEV STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.6 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- TABLE 125 PHEV STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 126 PHEV STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 127 PHEV STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 128 PHEV STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.7 FUEL CELL ELECTRIC VEHICLE (FCEV)

- TABLE 129 FCEV STEERING MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 130 FCEV STEERING MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 131 FCEV STEERING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 132 FCEV STEERING MARKET, BY REGION, 2022-2027 (USD MILLION)

13 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 13.1 INTRODUCTION

- 13.1.1 RESEARCH METHODOLOGY

- 13.1.2 ASSUMPTIONS

- FIGURE 45 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 133 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 134 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 135 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE, 2018-2021 (USD MILLION)

- TABLE 136 AUTOMOTIVE STEERING SYSTEM MARKET, BY ELECTRIC MOTOR TYPE, 2022-2027 (USD MILLION)

- 13.2 BRUSHED DC MOTOR

- TABLE 137 BRUSHED DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 138 BRUSHED DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 139 BRUSHED DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 140 BRUSHED DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.3 BRUSHLESS DC MOTOR

- TABLE 141 BRUSHLESS DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 142 BRUSHLESS DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 143 BRUSHLESS DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 144 BRUSHLESS DC MOTOR: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

14 AUTOMOTIVE STEERING SYSTEM MARKET, BY MECHANISM

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 14.1 INTRODUCTION

- 14.1.1 RESEARCH METHODOLOGY

- 14.1.2 ASSUMPTIONS

- 14.1.3 INDUSTRY INSIGHTS

- FIGURE 46 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022 VS. 2027 (USD MILLION)

- TABLE 145 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2018-2021 (THOUSAND UNITS)

- TABLE 146 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022-2027 (THOUSAND UNITS)

- TABLE 147 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2018-2021 (USD MILLION)

- TABLE 148 ELECTRIC POWER STEERING SYSTEM MARKET, BY MECHANISM, 2022-2027 (USD MILLION)

- 14.2 COLLAPSIBLE EPS

- TABLE 149 COLLAPSIBLE EPS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 150 COLLAPSIBLE EPS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 151 COLLAPSIBLE EPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 152 COLLAPSIBLE EPS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.3 RIGID EPS

- TABLE 153 RIGID EPS MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 154 RIGID EPS MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 155 RIGID EPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 156 RIGID EPS MARKET, BY REGION, 2022-2027 (USD MILLION)

15 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 15.1 INTRODUCTION

- 15.1.1 RESEARCH METHODOLOGY

- 15.1.2 ASSUMPTIONS

- 15.1.3 INDUSTRY INSIGHTS

- FIGURE 47 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 157 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE, 2018-2021 (THOUSAND UNITS)

- TABLE 158 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE, 2022-2027 (THOUSAND UNITS)

- TABLE 159 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE, 2018-2021 (USD MILLION)

- TABLE 160 AUTOMOTIVE STEERING SYSTEM MARKET, BY PINION TYPE, 2022-2027 (USD MILLION)

- 15.2 SINGLE PINION

- TABLE 161 SINGLE PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 162 SINGLE PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 163 SINGLE PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 164 SINGLE PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 15.3 DUAL PINION

- TABLE 165 DUAL PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 166 DUAL PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 167 DUAL PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 168 DUAL PINION: AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

16 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT

- Note - The chapter is further segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America, and Rest of the World

- 16.1 INTRODUCTION

- 16.1.1 RESEARCH METHODOLOGY

- 16.1.2 ASSUMPTIONS

- 16.1.3 INDUSTRY INSIGHTS

- FIGURE 48 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022 VS. 2027 (USD MILLION)

- TABLE 169 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2018-2021 (MILLION UNITS)

- TABLE 170 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022-2027 (MILLION UNITS)

- TABLE 171 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2018-2021 (USD MILLION)

- TABLE 172 AUTOMOTIVE STEERING SYSTEM AFTERMARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 16.2 HYDRAULIC PUMPS

- TABLE 173 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 174 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 175 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 176 HYDRAULIC PUMPS AFTERMARKET, BY REGION, 2022-2027 (USD MILLION)

- 16.3 STEERING COLUMNS

- TABLE 177 STEERING COLUMNS AFTERMARKET, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 178 STEERING COLUMNS AFTERMARKET, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 179 STEERING COLUMNS AFTERMARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 180 STEERING COLUMNS AFTERMARKET, BY REGION, 2022-2027 (USD MILLION)

- 16.4 ELECTRIC MOTORS

- TABLE 181 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2018-2021 (MILLION UNITS)

- TABLE 182 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2022-2027 (MILLION UNITS)

- TABLE 183 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 184 ELECTRIC MOTORS AFTERMARKET, BY REGION, 2022-2027 (USD MILLION)

17 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION

- Note - In this chapter each country is further segment by technology type. Technologies considered are HPS, EHPS, and EPS

- 17.1 RESEARCH METHODOLOGY

- 17.1.1 ASSUMPTIONS

- 17.1.2 INDUSTRY INSIGHTS

- 17.2 INTRODUCTION

- FIGURE 49 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022 (USD MILLION)

- TABLE 185 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (THOUSAND UNITS)

- TABLE 186 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (THOUSAND UNITS)

- TABLE 187 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 188 AUTOMOTIVE STEERING SYSTEM MARKET, BY REGION, 2022-2027 (USD MILLION)

- 17.3 ASIA PACIFIC

- 17.3.1 RECESSION IMPACT

- FIGURE 50 ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET SNAPSHOT

- TABLE 189 ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 190 ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 191 ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 192 ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 17.3.2 CHINA

- 17.3.2.1 Rapid adoption of EVs to boost demand for EPS and EHPS across vehicle segments

- TABLE 193 CHINA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 194 CHINA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 195 CHINA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 196 CHINA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.3.3 INDIA

- 17.3.3.1 EPS to be dominant technology in passenger cars

- TABLE 197 INDIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 198 INDIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 199 INDIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 200 INDIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.3.4 JAPAN

- 17.3.4.1 Electrification of automotive vehicles to increase demand for EPS and EHPS systems

- TABLE 201 JAPAN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 202 JAPAN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 203 JAPAN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 204 JAPAN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.3.5 SOUTH KOREA

- 17.3.5.1 Growing electric vehicle sales in mid-level segment to drive demand for EPS technology

- TABLE 205 SOUTH KOREA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 206 SOUTH KOREA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 207 SOUTH KOREA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 208 SOUTH KOREA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.3.6 REST OF ASIA PACIFIC

- TABLE 209 REST OF ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 210 REST OF ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 211 REST OF ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4 EUROPE

- 17.4.1 RECESSION IMPACT

- FIGURE 51 EUROPE: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 213 EUROPE: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 214 EUROPE: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 215 EUROPE: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 216 EUROPE: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 17.4.2 GERMANY

- 17.4.2.1 EPS to be standard steering technology across passenger car segment

- TABLE 217 GERMANY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 218 GERMANY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 219 GERMANY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 220 GERMANY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4.3 FRANCE

- 17.4.3.1 Increased penetration of luxury MPVs to drive demand for EPS technology

- TABLE 221 FRANCE: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 222 FRANCE: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 223 FRANCE: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 224 FRANCE: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4.4 UK

- 17.4.4.1 Growing EV sales to drive demand for EHPS and EPS systems

- TABLE 225 UK: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 226 UK: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 227 UK: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 228 UK: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4.5 ITALY

- 17.4.5.1 Increased manufacturing of premium and luxury vehicles to boost demand for EHPS and EPS systems

- TABLE 229 ITALY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 230 ITALY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 231 ITALY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 232 ITALY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4.6 SPAIN

- 17.4.6.1 Growing LCV and MPV sales to drive demand for EPS technology

- TABLE 233 SPAIN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 234 SPAIN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 235 SPAIN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 236 SPAIN: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.4.7 TURKEY

- 17.4.7.1 Growing LCV sales to drive demand for EHPS systems

- TABLE 237 TURKEY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 238 TURKEY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 239 TURKEY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 240 TURKEY: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.5 NORTH AMERICA

- 17.5.1 RECESSION IMPACT

- FIGURE 52 NORTH AMERICA: AUTOMOTIVE STEERING SYSTEM MARKET SNAPSHOT

- TABLE 241 NORTH AMERICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 242 NORTH AMERICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 243 NORTH AMERICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 244 NORTH AMERICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 17.5.2 US

- 17.5.2.1 Ease in steering effort to drive EPS demand in LCVs and HCVs

- TABLE 245 US: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 246 US: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 247 US: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 248 US: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.5.3 CANADA

- 17.5.3.1 LCVs to shift from EHPS to EPS technology in Canada

- TABLE 249 CANADA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 250 CANADA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 251 CANADA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 252 CANADA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.5.4 MEXICO

- 17.5.4.1 Growing economy and rising income levels to drive demand for EPS technology

- TABLE 253 MEXICO: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 254 MEXICO: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 255 MEXICO: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 256 MEXICO: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.6 REST OF THE WORLD

- 17.6.1 RECESSION IMPACT

- TABLE 257 REST OF THE WORLD: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (THOUSAND UNITS)

- TABLE 258 REST OF THE WORLD: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (THOUSAND UNITS)

- TABLE 259 REST OF THE WORLD: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 260 REST OF THE WORLD: AUTOMOTIVE STEERING SYSTEM MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 17.6.2 BRAZIL

- 17.6.2.1 Fuel efficiency to drive demand for EPS in passenger cars

- TABLE 261 BRAZIL: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 262 BRAZIL: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 263 BRAZIL: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 264 BRAZIL: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.6.3 RUSSIA

- 17.6.3.1 HPS to witness slower demand from passenger car segment

- TABLE 265 RUSSIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 266 RUSSIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 267 RUSSIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 268 RUSSIA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 17.6.4 SOUTH AFRICA

- 17.6.4.1 EPS to be fastest-growing steering technology in South Africa

- TABLE 269 SOUTH AFRICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (THOUSAND UNITS)

- TABLE 270 SOUTH AFRICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (THOUSAND UNITS)

- TABLE 271 SOUTH AFRICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 272 SOUTH AFRICA: AUTOMOTIVE STEERING SYSTEM MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

18 COMPETITIVE LANDSCAPE

- 18.1 OVERVIEW

- 18.2 AUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021

- TABLE 273 MARKET SHARE ANALYSIS, 2021

- FIGURE 53 AUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021

- FIGURE 54 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 18.3 MARKET SHARE ANALYSIS OF STEERING SYSTEM COMPONENTS

- 18.3.1 AUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021

- 18.3.1.1 Japan: Steering system market share analysis, 2021

- 18.3.1.2 China: Steering system market share analysis, 2021

- 18.3.1.3 Americas: Steering system market share analysis, 2021

- 18.3.1.4 ASEAN, India, South Korea: Steering system market share analysis, 2021

- 18.3.2 STEERING COLUMNS/SHAFTS

- 18.3.2.1 Japan: Steering columns/shafts market share analysis, 2021

- 18.3.2.2 ASEAN, India, South Korea: Steering columns/shafts market share analysis, 2021

- 18.3.3 STEERING KNUCKLES

- 18.3.3.1 Japan: Steering knuckles market share analysis, 2021

- 18.3.3.2 Thailand: Steering knuckles market share analysis, 2021

- 18.3.4 STEERING WHEELS

- 18.3.4.1 Global: Steering wheels market share analysis, 2021

- 18.3.1 AUTOMOTIVE STEERING SYSTEM MARKET SHARE ANALYSIS, 2021

- 18.4 COMPANY EVALUATION QUADRANT

- 18.4.1 STARS

- 18.4.2 EMERGING LEADERS

- 18.4.3 PERVASIVE PLAYERS

- 18.4.4 PARTICIPANTS

- FIGURE 55 COMPETITIVE EVALUATION MATRIX (AUTOMOTIVE STEERING SYSTEM MANUFACTURERS), 2021

- TABLE 274 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS AND EXPANSIONS AS KEY GROWTH STRATEGIES, 2019-2022

- 18.5 COMPETITIVE SCENARIO

- 18.5.1 NEW PRODUCT LAUNCHES

- TABLE 275 PRODUCT LAUNCHES, 2019-2022

- 18.5.2 DEALS

- TABLE 276 DEALS, 2019-2022

- 18.5.3 OTHER DEVELOPMENTS, 2019-2022

- TABLE 277 OTHER DEVELOPMENTS, 2019-2022

- 18.6 RIGHT TO WIN

- TABLE 278 COMPANIES ADOPTED NEW PRODUCT DEVELOPMENTS, PARTNERSHIPS, AND SUPPLY CONTRACTS AS KEY GROWTH STRATEGIES FROM 2019 TO 2022

- 18.7 COMPETITIVE BENCHMARKING

- TABLE 279 AUTOMOTIVE STEERING SYSTEM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 280 AUTOMOTIVE STEERING SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

19 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 19.1 KEY PLAYERS

- 19.1.1 JTEKT CORPORATION

- TABLE 281 JTEKT CORPORATION: BUSINESS OVERVIEW

- FIGURE 56 COMPANY SNAPSHOT: JTEKT CORPORATION

- TABLE 282 JTEKT CORPORATION: PRODUCTS OFFERED

- TABLE 283 JTEKT CORPORATION: DEALS

- TABLE 284 JTEKT CORPORATION: OTHER DEVELOPMENTS

- 19.1.2 NEXTEER AUTOMOTIVE

- TABLE 285 NEXTEER AUTOMOTIVE: BUSINESS OVERVIEW

- FIGURE 57 COMPANY SNAPSHOT: NEXTEER AUTOMOTIVE

- TABLE 286 NEXTEER AUTOMOTIVE: PRODUCTS OFFERED

- TABLE 287 NEXTEER AUTOMOTIVE: NEW PRODUCT DEVELOPMENTS

- TABLE 288 NEXTEER AUTOMOTIVE: OTHER DEVELOPMENTS

- 19.1.3 ZF FRIEDRICHSHAFEN AG

- TABLE 289 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

- FIGURE 58 COMPANY SNAPSHOT: ZF FRIEDRICHSHAFEN AG

- TABLE 290 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 291 ZF FRIEDRICHSHAFEN AG: DEALS

- 19.1.4 ROBERT BOSCH

- TABLE 292 ROBERT BOSCH: BUSINESS OVERVIEW

- FIGURE 59 COMPANY SNAPSHOT: ROBERT BOSCH

- TABLE 293 ROBERT BOSCH: PRODUCTS OFFERED

- 19.1.5 NSK LTD.

- TABLE 294 NSK LTD.: BUSINESS OVERVIEW

- FIGURE 60 COMPANY SNAPSHOT: NSK LTD.

- TABLE 295 NSK LTD.: PRODUCTS OFFERED

- TABLE 296 NSK LTD.: NEW PRODUCT DEVELOPMENTS

- TABLE 297 NSK LTD.: DEALS

- 19.1.6 HYUNDAI MOBIS

- TABLE 298 HYUNDAI MOBIS: BUSINESS OVERVIEW

- FIGURE 61 COMPANY SNAPSHOT: HYUNDAI MOBIS

- TABLE 299 HYUNDAI MOBIS: PRODUCTS OFFERED

- TABLE 300 HYUNDAI MOBIS: NEW PRODUCT DEVELOPMENTS

- TABLE 301 HYUNDAI MOBIS: DEALS

- 19.1.7 HITACHI ASTEMO

- TABLE 302 HITACHI ASTEMO: BUSINESS OVERVIEW

- FIGURE 62 COMPANY SNAPSHOT: HITACHI ASTEMO

- TABLE 303 HITACHI ASTEMO: PRODUCTS OFFERED

- 19.1.8 THYSSENKRUPP

- TABLE 304 THYSSENKRUPP: BUSINESS OVERVIEW

- FIGURE 63 COMPANY SNAPSHOT: THYSSENKRUPP

- TABLE 305 THYSSENKRUPP: PRODUCTS OFFERED

- TABLE 306 THYSSENKRUPP: OTHER DEVELOPMENTS

- 19.1.9 MITSUBISHI ELECTRIC

- TABLE 307 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 64 COMPANY SNAPSHOT: MITSUBISHI ELECTRIC

- TABLE 308 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- 19.1.10 KYB CORPORATION

- TABLE 309 KYB CORPORATION: BUSINESS OVERVIEW

- FIGURE 65 COMPANY SNAPSHOT: KYB CORPORATION

- TABLE 310 KYB CORPORATION: PRODUCTS OFFERED

- 19.1.11 MANDO CORPORATION

- TABLE 311 MANDO CORPORATION: BUSINESS OVERVIEW

- FIGURE 66 COMPANY SNAPSHOT: MANDO CORPORATION

- TABLE 312 MANDO CORPORATION: PRODUCTS OFFERED

- TABLE 313 MANDO CORPORATION: DEALS

- TABLE 314 MANDO CORPORATION: OTHER DEVELOPMENTS

- 19.1.12 HYCET TECHNOLOGY CO., LTD.

- TABLE 315 HYCET TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- TABLE 316 HYCET TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- 19.2 OTHER PLAYERS

- 19.2.1 MAVAL INDUSTRIES

- TABLE 317 MAVAL INDUSTRIES: BUSINESS OVERVIEW

- 19.2.2 TENNECO

- TABLE 318 TENNECO: BUSINESS OVERVIEW

- 19.2.3 GSS STEERING SYSTEMS LLC

- TABLE 319 GSS STEERING SYSTEMS LLC: BUSINESS OVERVIEW

- 19.2.4 HELLA GMBH & CO. KGAA

- TABLE 320 HELLA GMBH & CO. KGAA: BUSINESS OVERVIEW

- 19.2.5 YUBEI POWER STEERING SYSTEM CO., LTD.

- TABLE 321 YUBEI POWER STEERING SYSTEM CO., LTD.: BUSINESS OVERVIEW

- 19.2.6 HUHEI HENGLONG AUTO SYSTEM GROUP

- TABLE 322 HUHEI HENGLONG AUTO SYSTEM GROUP: BUSINESS OVERVIEW

- 19.2.7 BORGWARNER

- TABLE 323 BORGWARNER: BUSINESS OVERVIEW

- 19.2.8 DENSO CORPORATION

- TABLE 324 DENSO CORPORATION: BUSINESS OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 CUSTOMIZATION OPTIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS